So back to basics

For 16t in output to get sold there must have been 16t in spending, which also translates into 16t in some agent’s income.

And (apart from unsold inventory growth), for all practical purposes nominal GDP growth is another way to say sales growth.

To state the obvious, sales = spending, income = expense, etc. Working against growth is ‘unspent income’, also called ‘demand leakages’. Those include pension contributions, insurance reserves, retained earnings, foreign CB fx purchases, cash hoards, etc. etc. etc. And for every agent that spent less than his income, some other agent spent more than his income, to the tune of the 16t GDP.

And GDP growth is a function of that much more of same.

Well, the 2% or so growth we’ve been getting once included the govt spending maybe 10% more than its income to keep sales growing more than the demand leakages were working against sales growth. And with growth, the so called automatic fiscal STABILIZERS work to temper that growth, as growth causes govt revenues to increase and govt transfer payments to decline.

You can think of this as institutional structure that causes the economy to have to go uphill to grow. That’s because as the economy grows, the growth of govt net spending is ‘automatically’ reduced.

So after a couple of years growth the govt went from spending maybe 10% more than its income to something under 6% of its income, which translated into about 2% real growth, and about 3.5% nominal growth.

Well, to keep this going in the face of the demand leakages, some other agents were picking up the slack.

Looking at the charts it seems to me it was the home buyers and car buyers who were consistently spending more than their incomes, driving the nominal GDP growth.

But then on Jan 1 fica taxes went up as did some income tax rates, by about 3.5 billion/week, removing that much income from potential spenders. And a few months later the sequesters hit, both reducing GDP by the amount of those spending cuts and reducing income by about another 1.5 billion per week.

In other words, the govt suddenly reduced the amount it was spending beyond its income by about 1.5% of GDP, which had been working along with the domestic credit expansion to outpace the demand leakages.

So how has domestic credit managed to expand to fill that spending gap caused by the already retreating govt deficit spending proactively dropping another 1.5%?

With great difficulty!

Since January, after climbing steadily, car sales look to have gone sideways. And looks to me like the rate of domestic deficit spending on housing has declined as well. In any case there hasn’t been an the increase these ‘credit expansion engines’ needed to fill the spending gap from the proactive drop in govt deficit spending. And add to that decelerating person income stats (and remember, the pay for additional jobs comes from someone else’s income, and hopefully income spent on output).

And in any case to keep growing at about 2% credit expansion has to overcome the demand leakages and climb the hill of the automatic fiscal stabilizers as with the current institutional structure nominal growth automatically reduces the contribution of govt deficit spending, which is now maybe down to 4% of GDP. Note that with forecasts of 2% growth the forecast for the govt deficit spending falls to only 2% of GDP, implying far more rapid increases of ‘borrowing to spend’ in the domestic sector. And if that net new borrowing doesn’t materialize, the sales don’t either.

Is it possible for housing related credit expansion to suddenly accelerate? Sure, but is it likely, especially in the face of the drag the govt layoffs and tax increases that made the hill the domestic credit expansion needs to climb that much steeper? And sure, the foreign sector could suddenly spend that much more of its income in the US, but is a US export boom likely in the current anemic global economy? I wouldn’t bet on it.

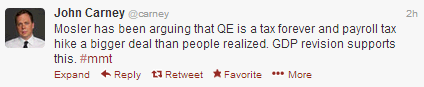

Now add this to the taper nonsense.

As previously discussed, QE is at best a placebo, and more likely a negative as it removes interest income from the economy.

But with none of the name institutions of higher learning teaching this, today’s portfolio managers think it’s somehow a ‘stimulus’ and act accordingly, driving up stock prices globally, supporting global ‘confidence’, even as growth and earnings show signs of fading. And then when the Fed even discusses the possibility of reducing the volume of QE, they all stampede the other way, with bonds reacting to the same misguided QE logic as well. But in any case, these are misguided, one time portfolio shifts, that tend to reverse with time as the reality of the underlying economy/earnings eventuates, refudiating the presumed effects of QE… :)

To conclude, I just don’t see the source of the credit expansion needed for anything more than modest nominal growth, which has now continued to decelerate to maybe 3% of GDP, and a real risk that the domestic credit expansion can’t even keep up with the demand leakages, and real GDP goes negative, along with top line growth and earnings growth.

In fact, with annual population growth running at about 1.25%, per capita GDP is already only about equal to productivity growth, as the labor force participation rate hovers at multi decade lows.

Have a nice weekend!

Ciao!