Larger than expected:

Highlights

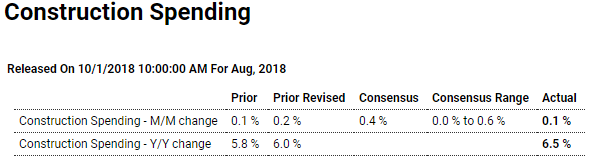

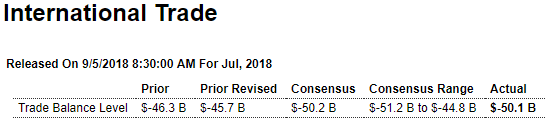

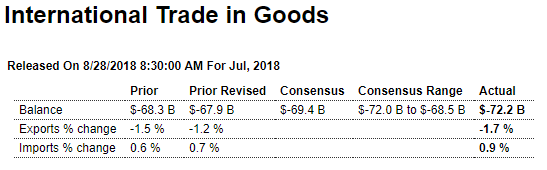

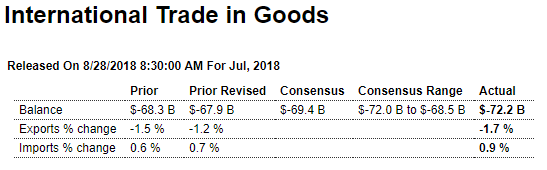

In some of the early data coming out in this period of trade disputes, the goods deficit of the July trade report totaled a much deeper-than-expected $72.2 billion. Exports of goods fell 1.7 percent in the month to $140.0 billion showing a very steep 6.7 percent month-to-month decline in food & feeds together with a 2.5 percent dip in exports of consumer goods and a 1.7 percent decline in the nation’s largest export, that of capital goods.

Imports also added to the widening of the deficit in July, up 0.9 percent compared to June to $212.2 billion with foods & feeds up 2.1 percent, vehicles up 1.6 percent, and industrial supplies, which include petroleum products, up 0.9 percent. The nation’s largest import category is consumer goods which was the only category to fall on the import side of the data, down 1.5 percent in the month.

July’s $72.2 billion goods deficit compares with a monthly average of $66.7 billion in the second quarter which was a very good quarter for trade, representing 1.1 percentage points of the quarter’s 4.1 percent pace. Today’s results, however, pose a very slow start for the third quarter.

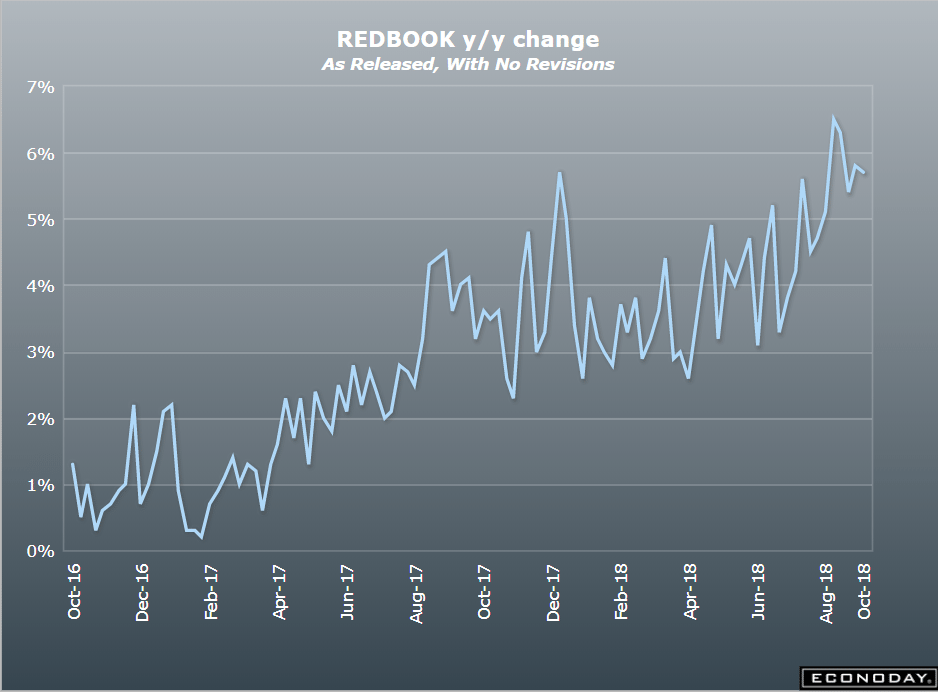

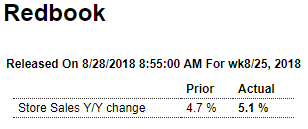

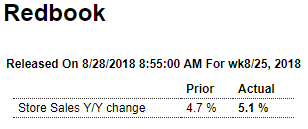

Same store retail sales seem to be growing nicely, now that the number of stores has been reduced:

Highlights

Same store sales were up 5.1 percent year-on-year in the August 25 week, accelerating by 0.4 percentage points to the third fastest growth pace of the year. Month-to-date sales versus the prior month were up 0.4 percent, while the full month year-on-year gain widened by 0.2 percentage points to 4.8 percent, the second strongest reading for this comparison this year. Redbook’s same store sales point to continued robust strength in ex-auto ex-gas retail sales.

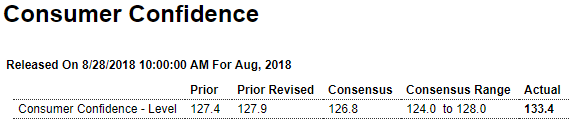

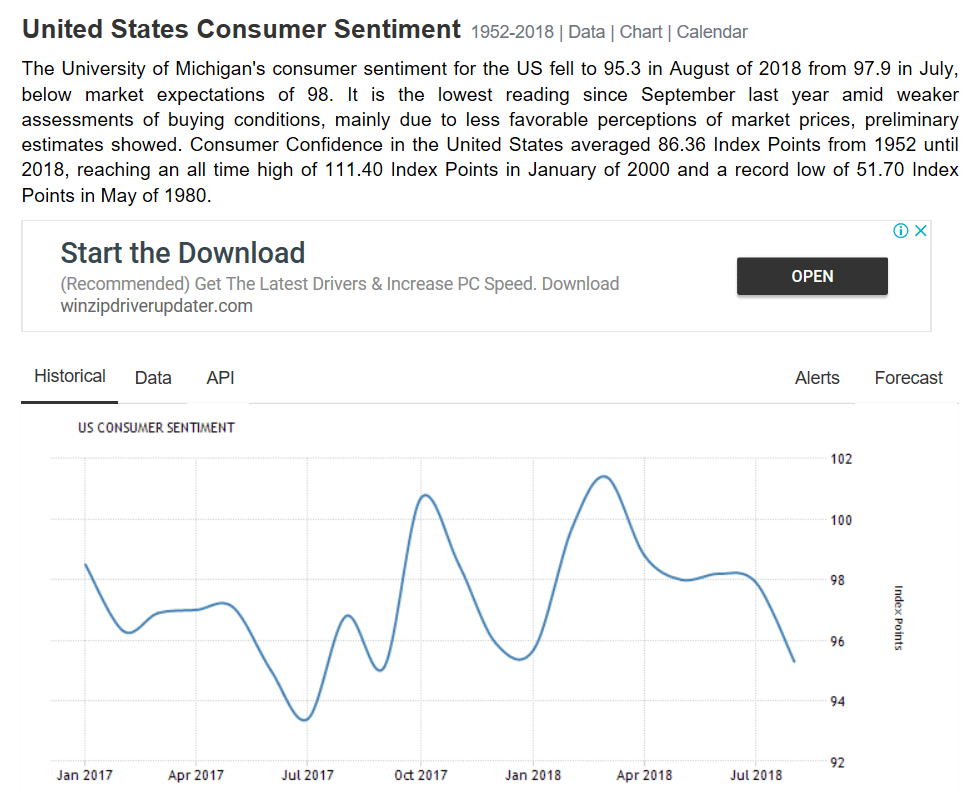

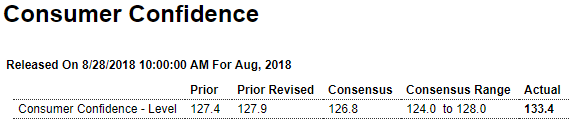

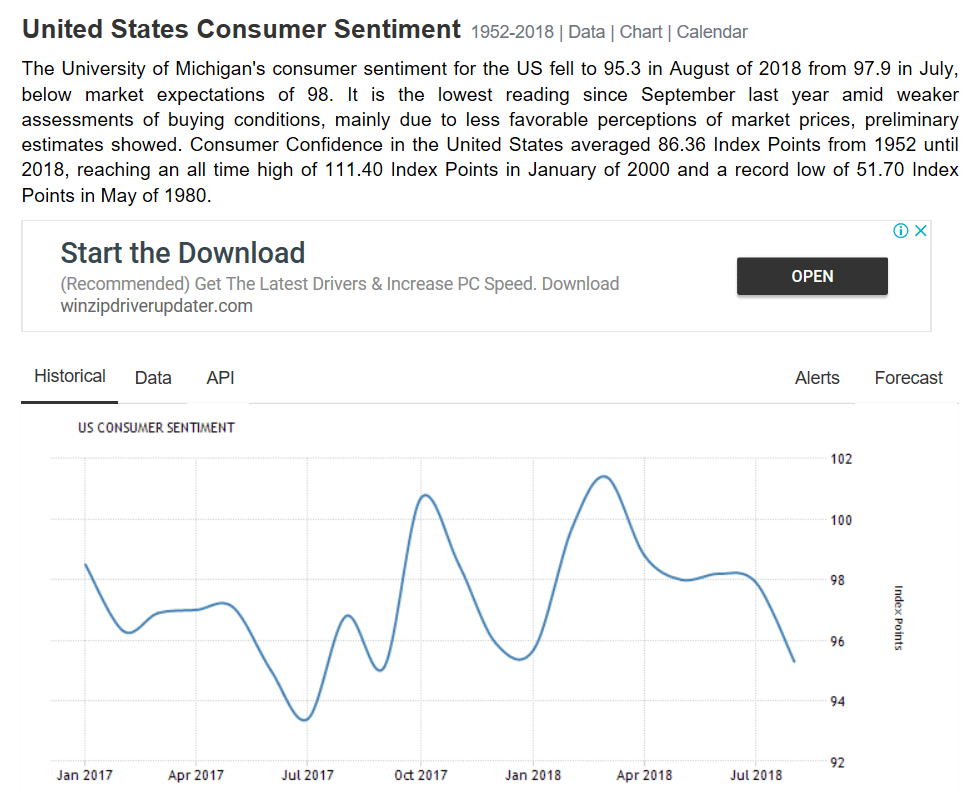

Consumer confidence looking strong, in line with the stock market, while consumer sentiment fell:

Highlights

The consumer sentiment index at mid-month came in much weaker than expected in complete contrast to today’s consumer confidence index which easily tops expectations, at 133.4 for August vs Econoday’s high forecast for 128.0 and median consensus for 126.8. This is the strongest result since the dotcom fever of October 2000. July is revised 5 tenths higher to 127.9.

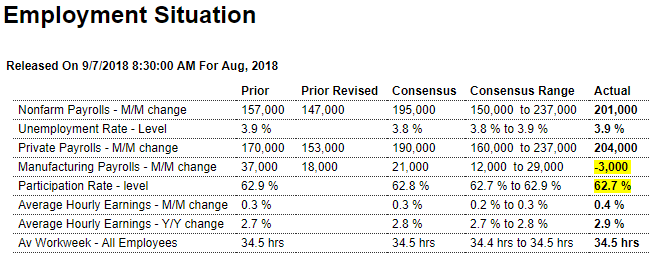

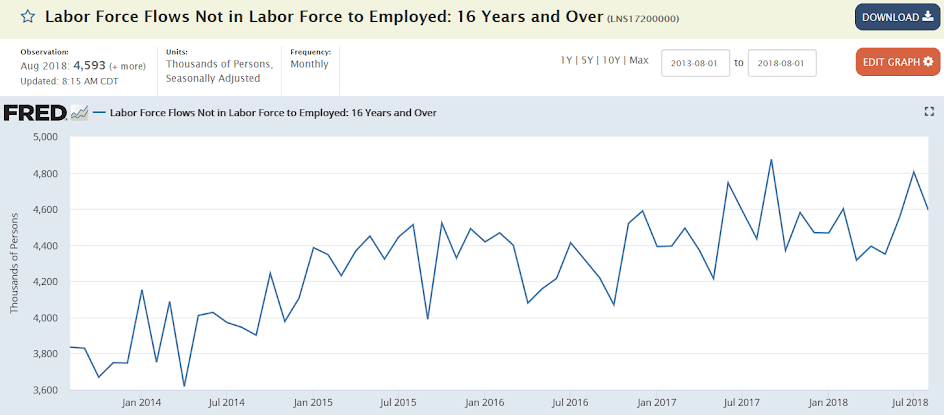

The most important detail in the August report is a notable decline in those saying jobs are currently hard to get which is down very steeply from an already thin 14.8 percent to 12.7 percent. This is extremely favorable for this reading and is certain to raise expectations for a very healthy monthly employment report for August.

A second detail that speaks to impressive strength is the outlook on income. Optimists here rose a very sharp 5.1 percentage points to 25.5 percent with pessimists shrinking 2.4 points to 7.0 percent. The gain here not only reflects the strength of the labor market but also the strength of the stock market.

Boosted by jobs hard to get, the present situation index rose from 166.1 to 172.2 while the expectations index, boosted by income prospects, increased from 102.4 last month to 107.6 this month.

Another positive in the report, at least for Federal Reserve policy makers who are concerned that inflation doesn’t overshoot their target, is a 2 tenths dip in year-ahead inflation expectations to 4.8 percent which for this reading is nevertheless elevated.

Bulls are dominating stock market sentiment, at 39.4 percent for a 2.2 point gain from July with bears at 24.5 percent and down 4.1 points. Most see interest rates moving higher, at 69.4 percent vs 71.4 percent in July.

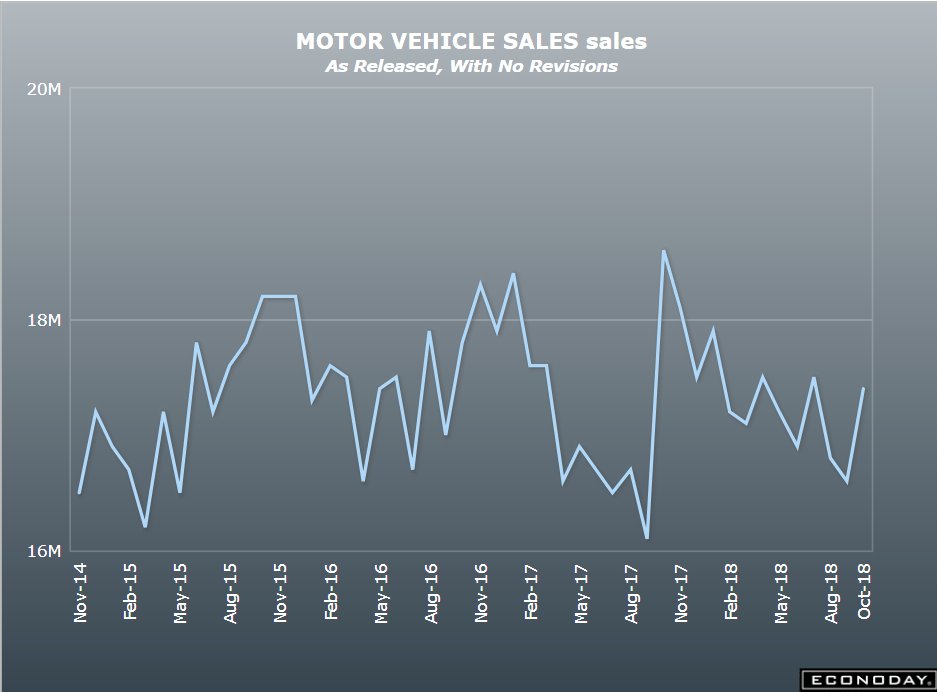

Buying plans are yet another major positive showing strong gains across the board: autos, homes, and major appliances. This report points to a noticeable upward revision in Friday’s consumer sentiment report and more importantly hints at building consumer momentum for third-quarter GDP.

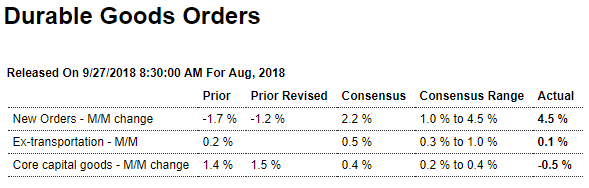

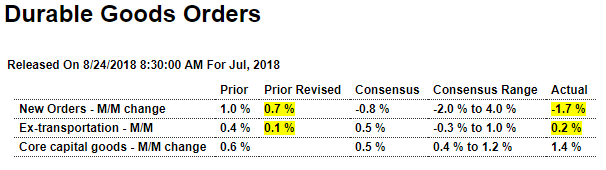

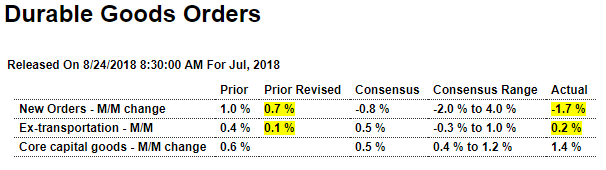

Weak apart from ‘core capital goods’ but best to wait until next month’s revisions before passing judgement:

Highlights

A stunning showing for core capital goods orders steals the show in what looks on the surface, based on the 1.7 percent headline drop, to be a weak durable goods report for July. Orders for core capital goods (nondefense ex-aircraft) surged 1.4 percent to easily beat Econoday’s consensus for a 0.5 percent gain and also top Econoday’s high forecast for 1.2 percent. Computers & electronics as well as machinery were positive contributors for the capital goods group where July’s strength points to further acceleration for what has already been very strong growth in business investment.

The headline weakness is tied to the always volatile commercial aircraft component where orders come in big batches, and July does not include one of those big batches as orders fell 35.4 percent. Orders for defense aircraft were also weak and together with commercial aircraft skew the transportation reading to a 5.3 percent decline. This decline masks another strong positive in today’s report and that’s a 3.5 percent jump in motor vehicle orders. Excluding all transportation equipment, orders inched 0.2 percent ahead in July.

Turning back to core capital goods, the surge in orders will feed into shipments which is what the GDP account for business investment specifically tracks. Shipments here are up 0.9 percent following a 2 tenths upward revised gain of also 0.9 percent in June. The July gain marks a fast start for third-quarter nonresidential fixed investment while the upward revision to June will give a small boost to revision estimates for second-quarter GDP.

Other details include a very large 1.3 percent build in durable inventories which had looked too lean going into the third quarter. Large builds for commercial aircraft equipment as well as continuing builds for primary metals and fabrications, both affected by tariffs, gave inventories a boost, one that will also be a plus for third-quarter GDP. Shipments of durables slipped 0.2 percent in the month and may reflect stubborn shortages of truck drivers in the transportation sector. Unfilled orders, which had been on the climb, were unchanged.

Durable goods are one of the most volatile indicators on the economic calendar and today’s results further cement this reputation. But looking past the headline and at the strength of computers and machinery and vehicles, the factory sector continues to be the headline strength of the 2018 economy.

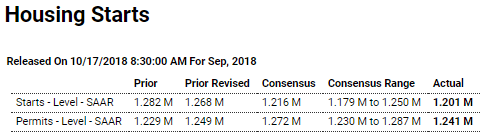

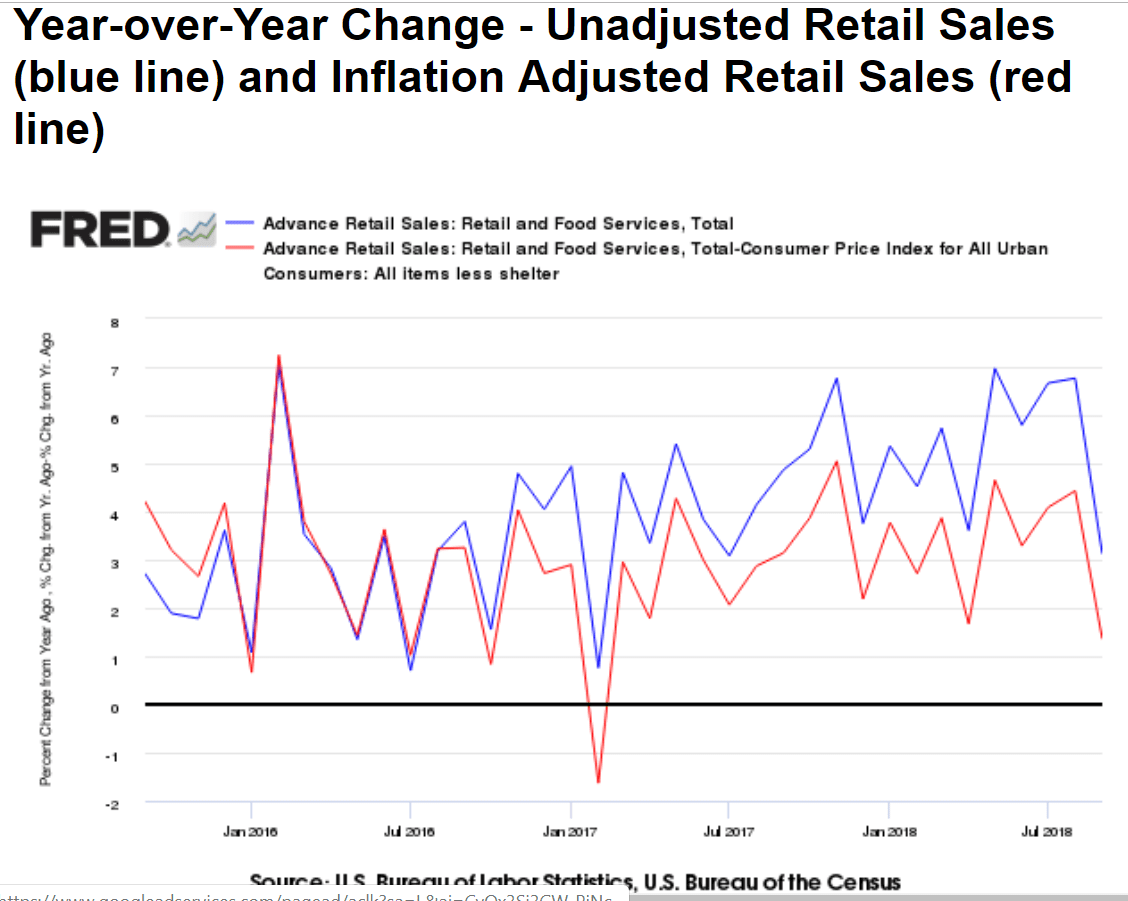

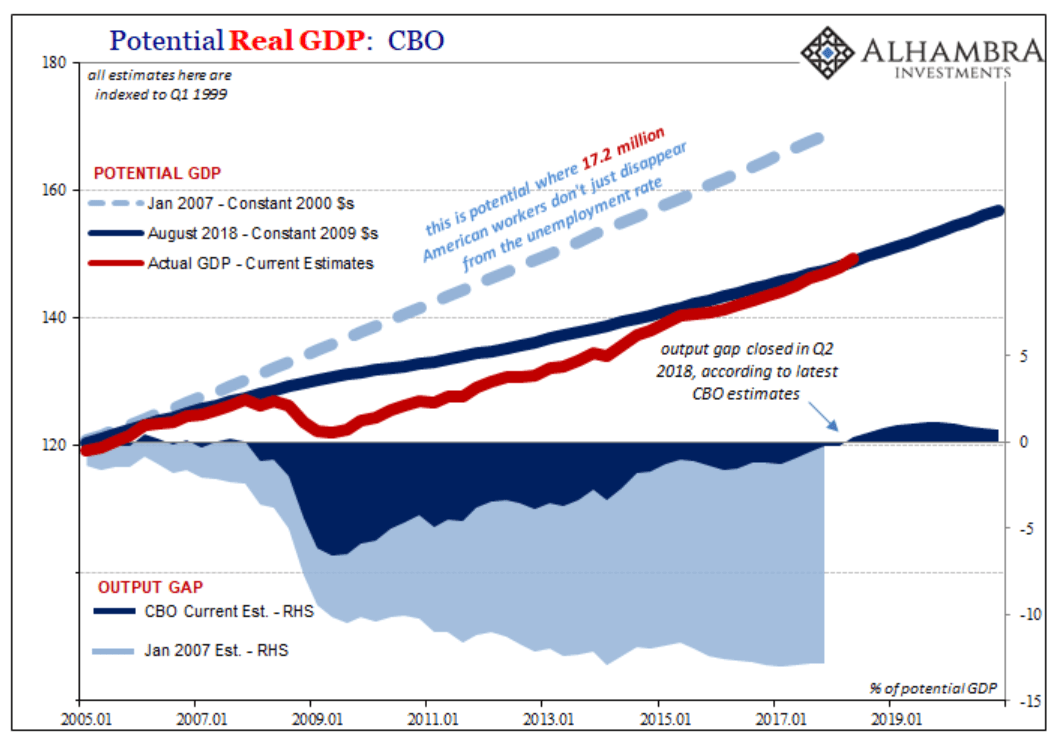

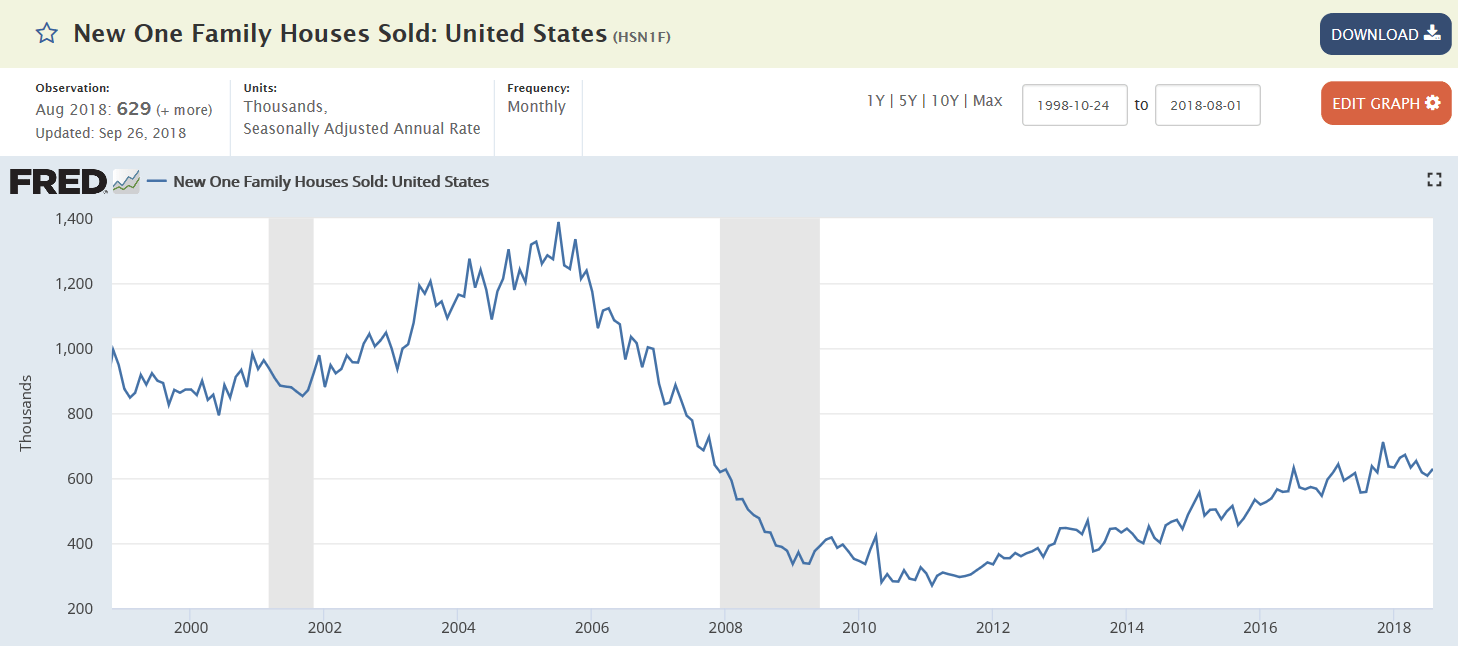

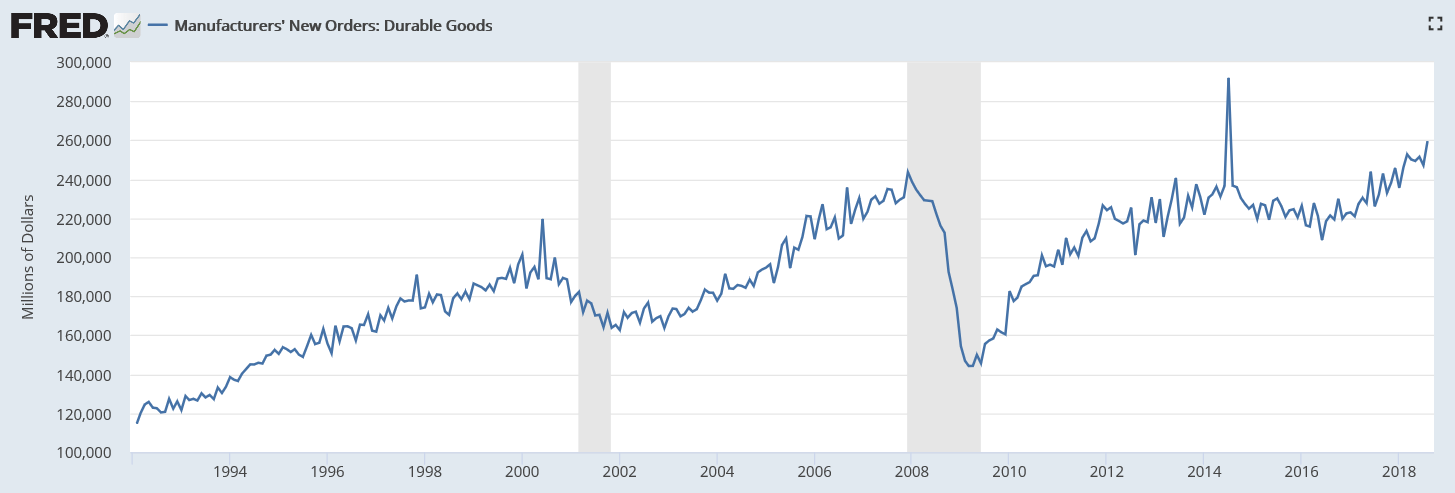

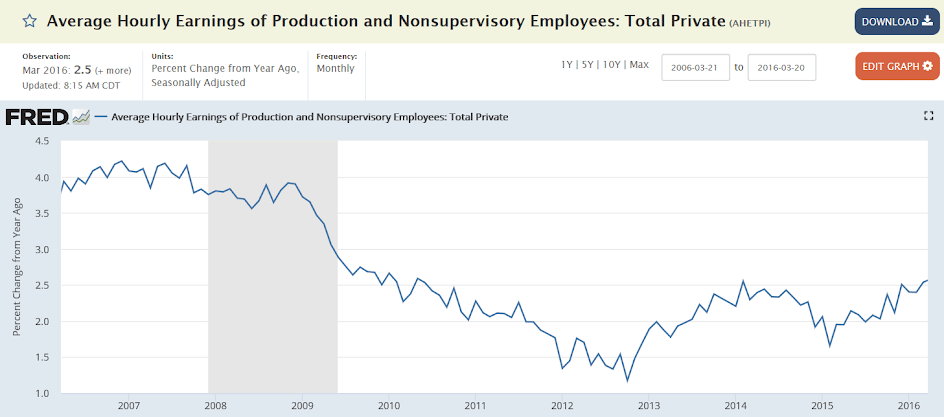

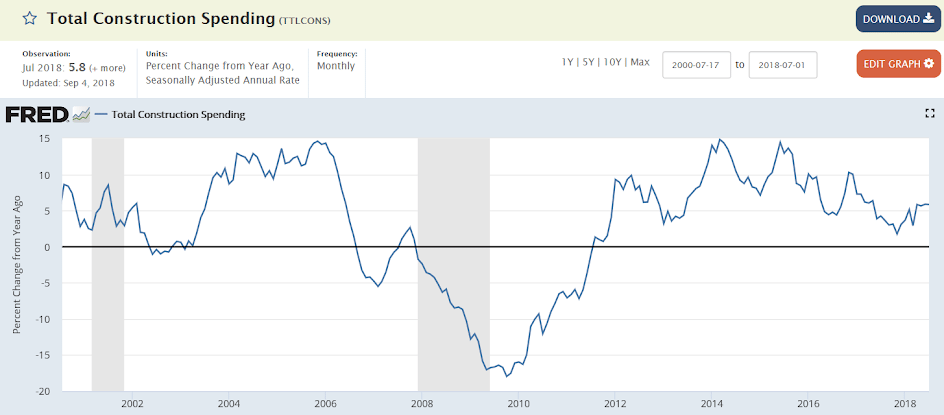

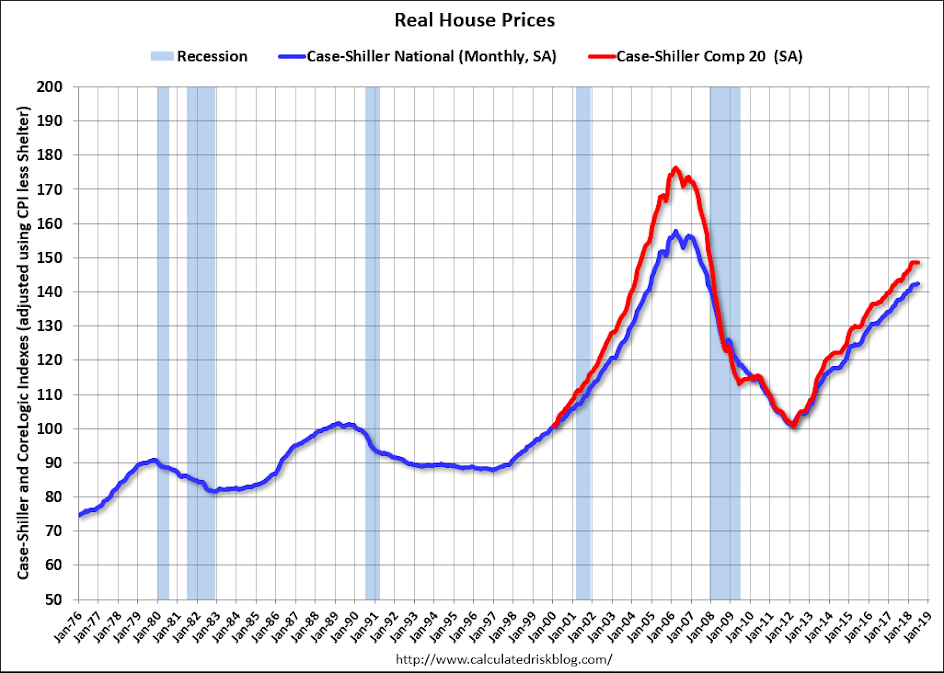

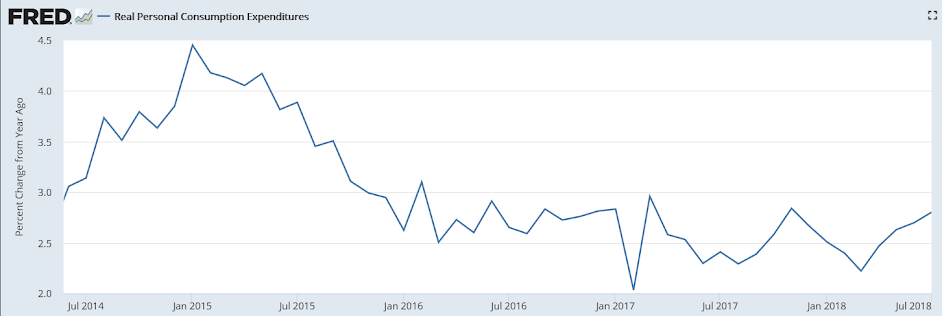

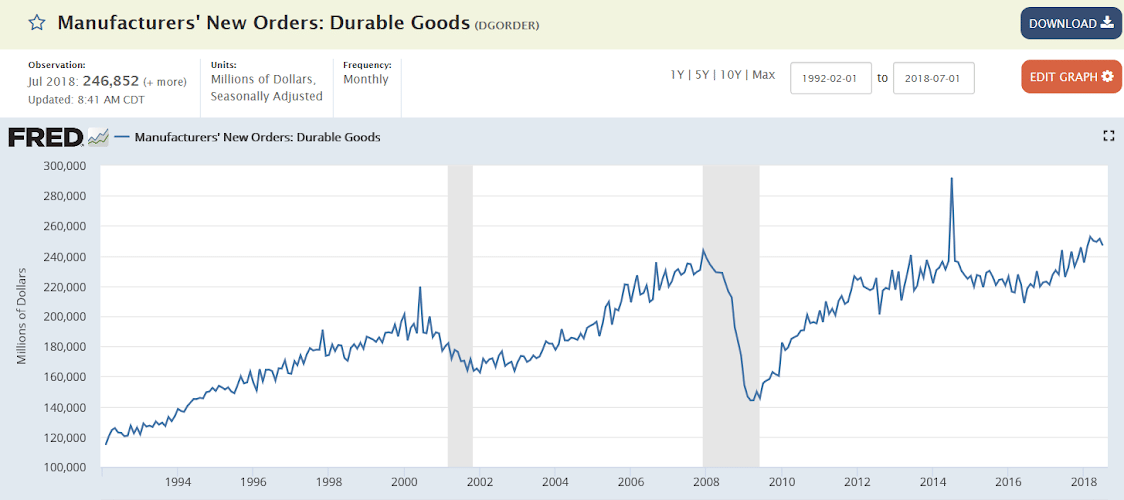

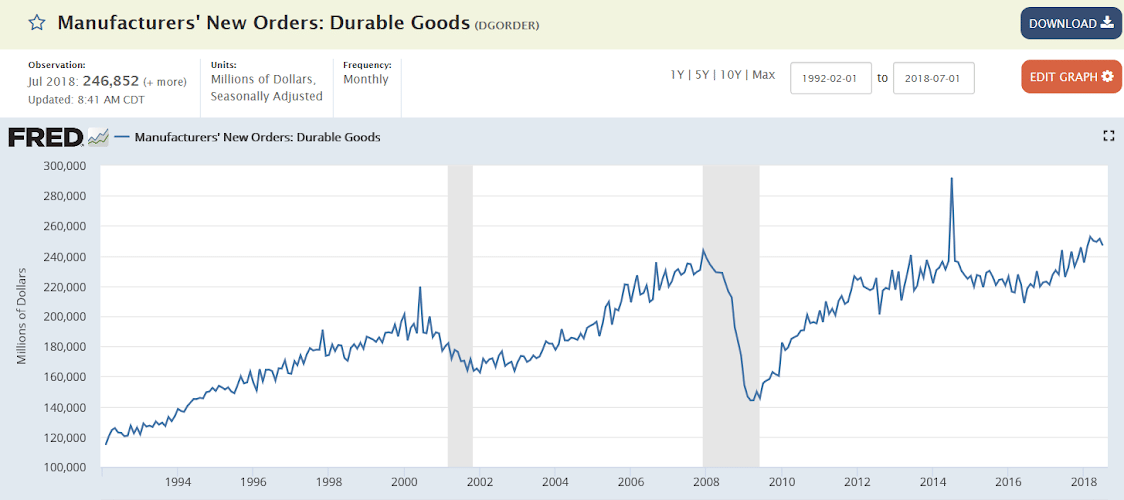

These numbers are not adjusted for inflation, so on an inflation adjusted basis we remain well below the highs of 10 years ago and well below the highs of 20+ years ago as well:

(Reuters) China will keep hitting back at Washington as more U.S. trade tariffs are imposed, but its counter-strikes will remain as targeted as possible to avoid harming businesses in China – whether Chinese or foreign, Finance Minister Liu Kun said. There are three things China needs to do well – lowering taxes and cutting fees, preserving the intensity of its fiscal spending so that its effect can be better felt, and supporting the real economy and lightening the burdens of companies, he said.

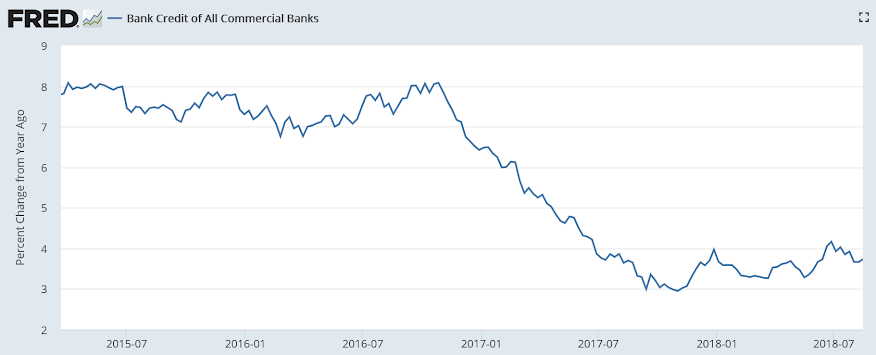

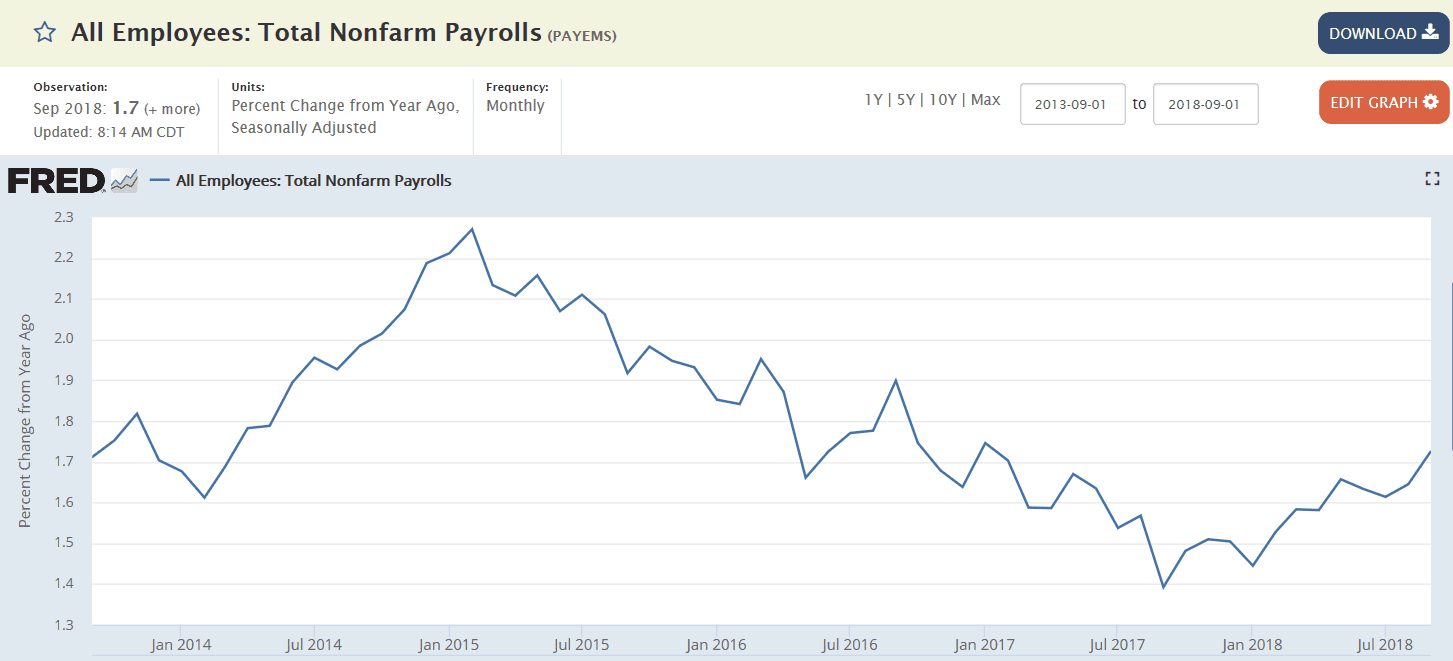

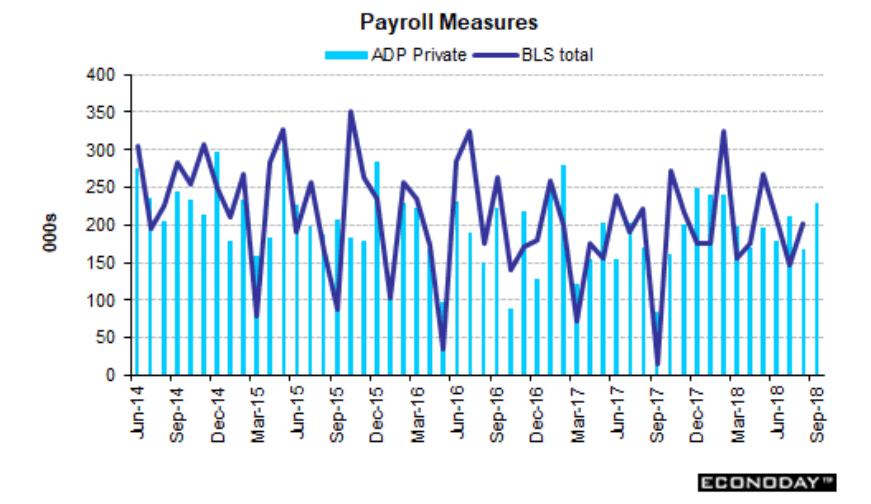

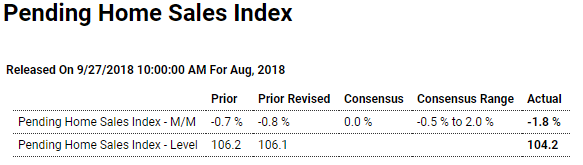

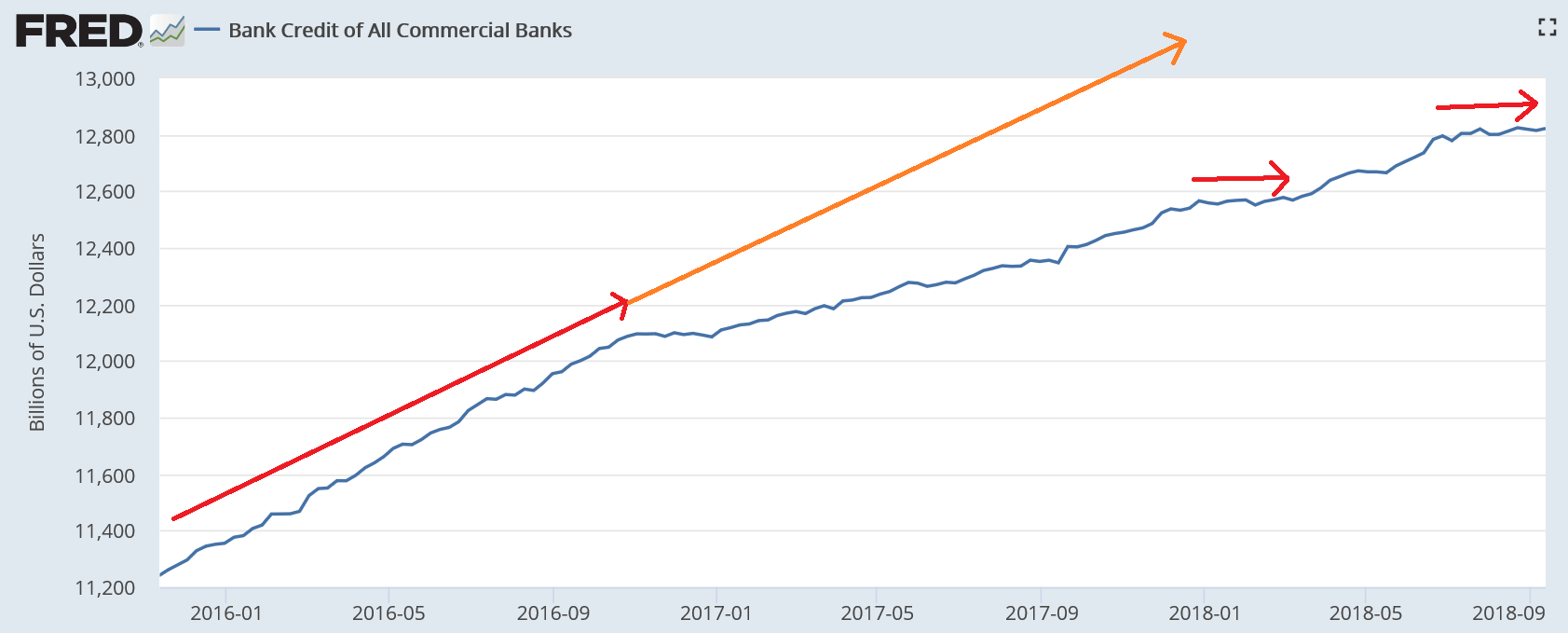

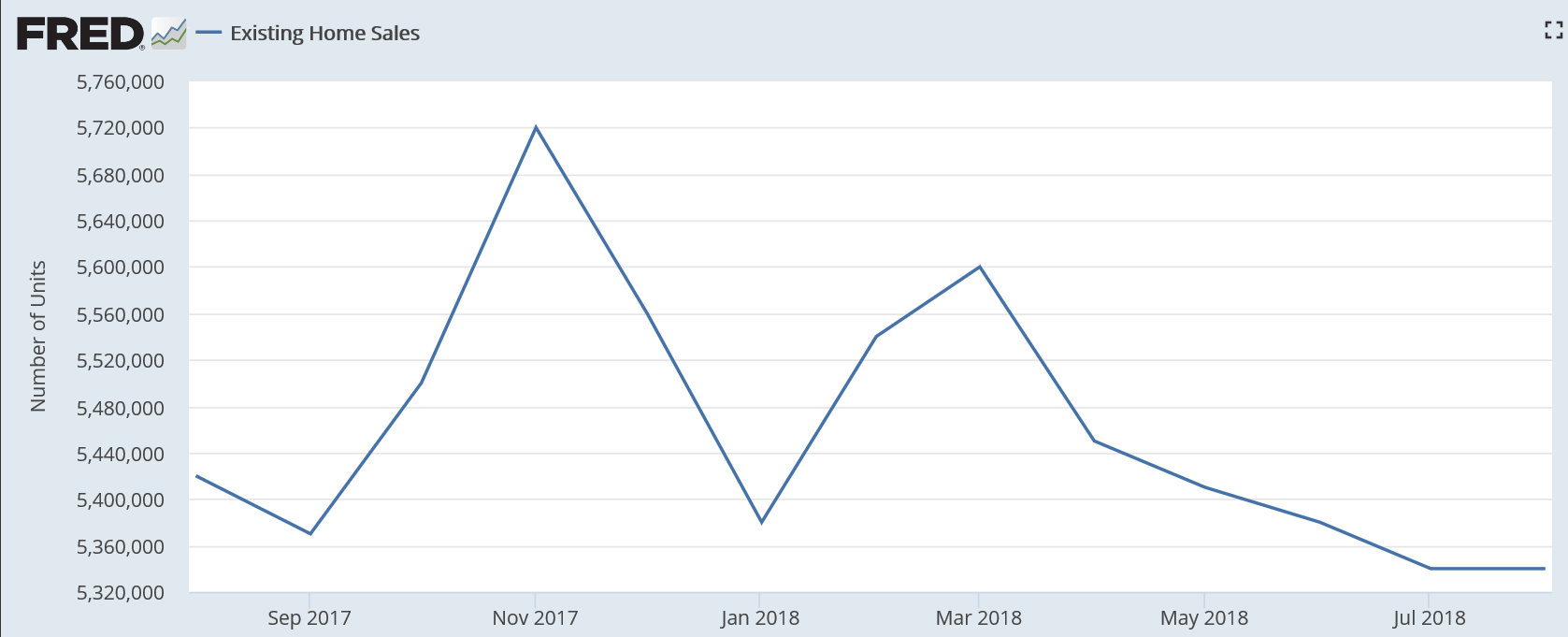

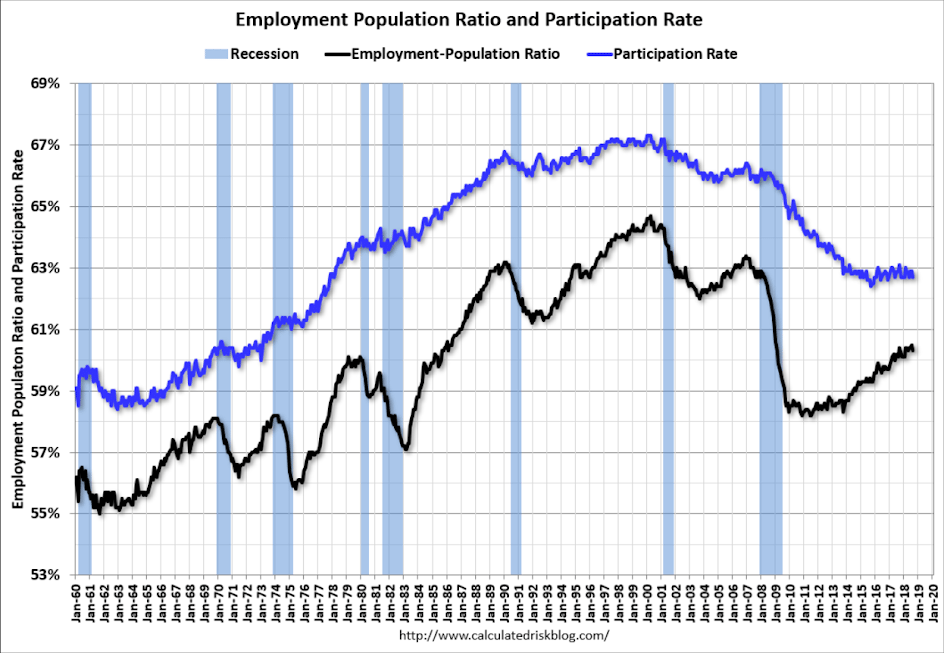

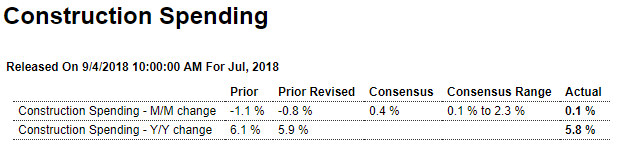

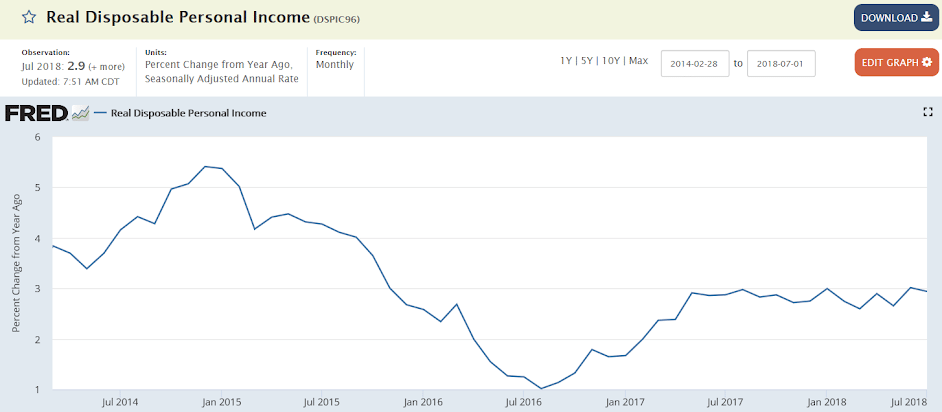

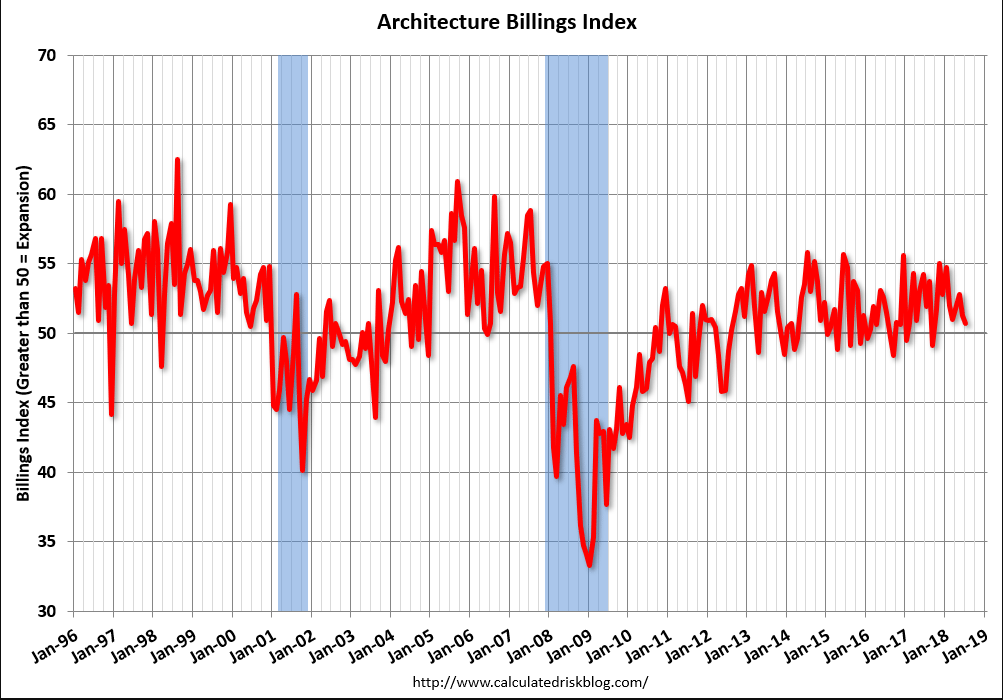

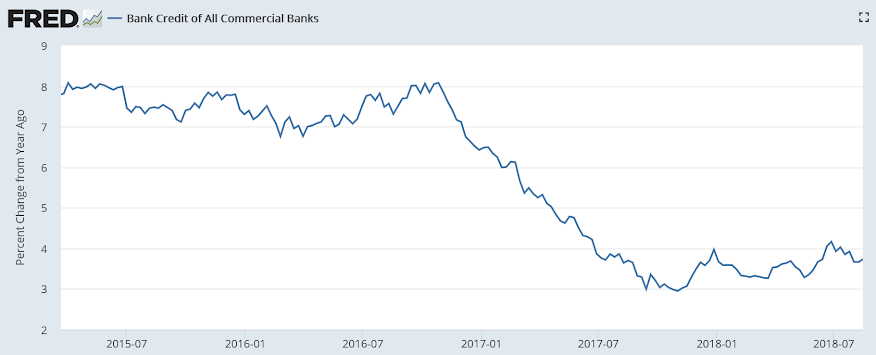

Going nowhere: