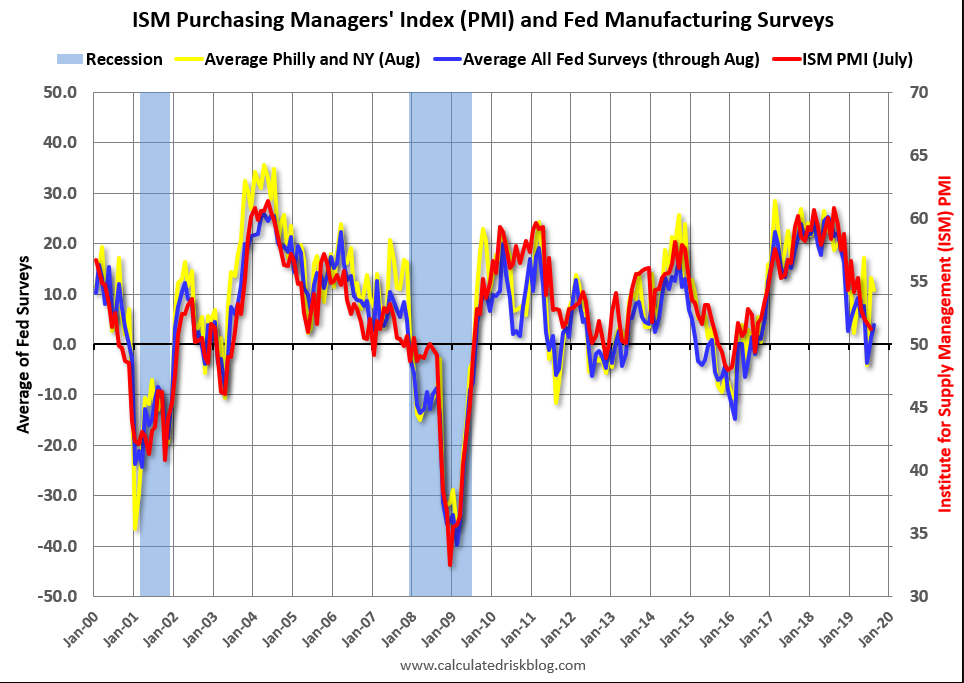

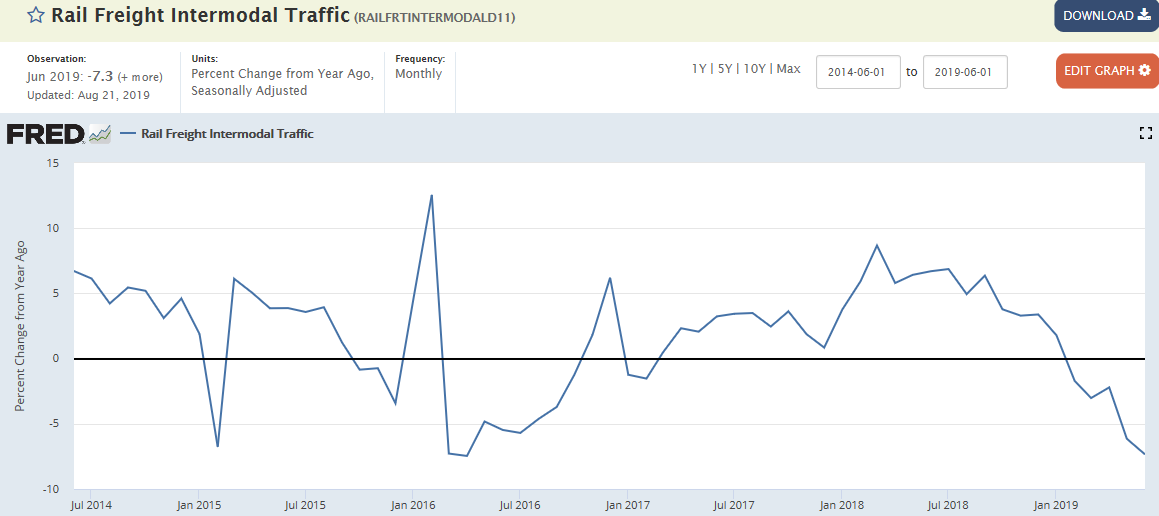

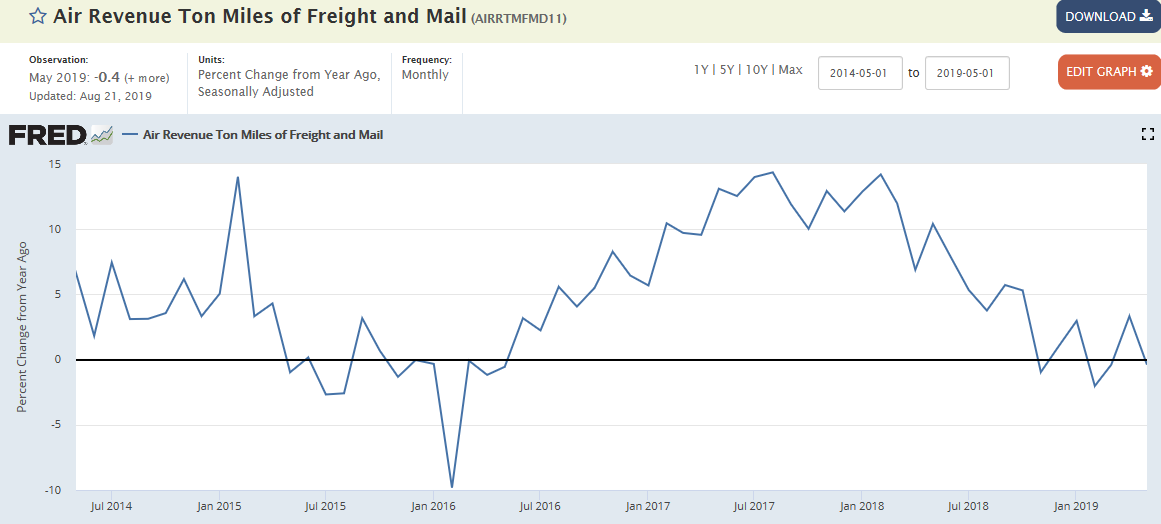

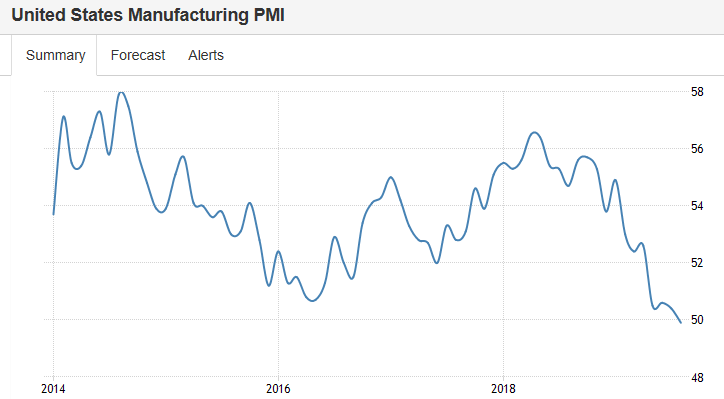

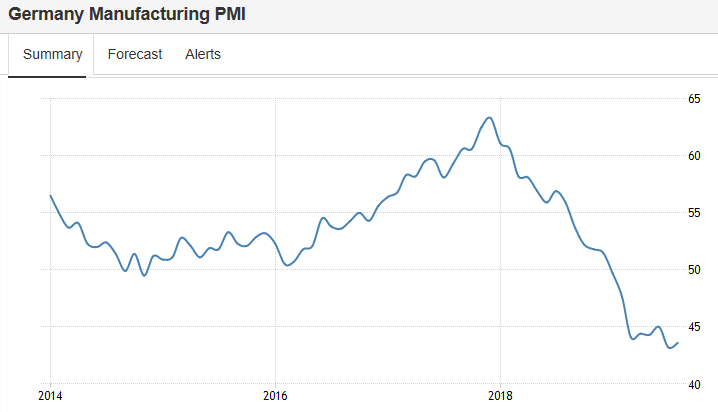

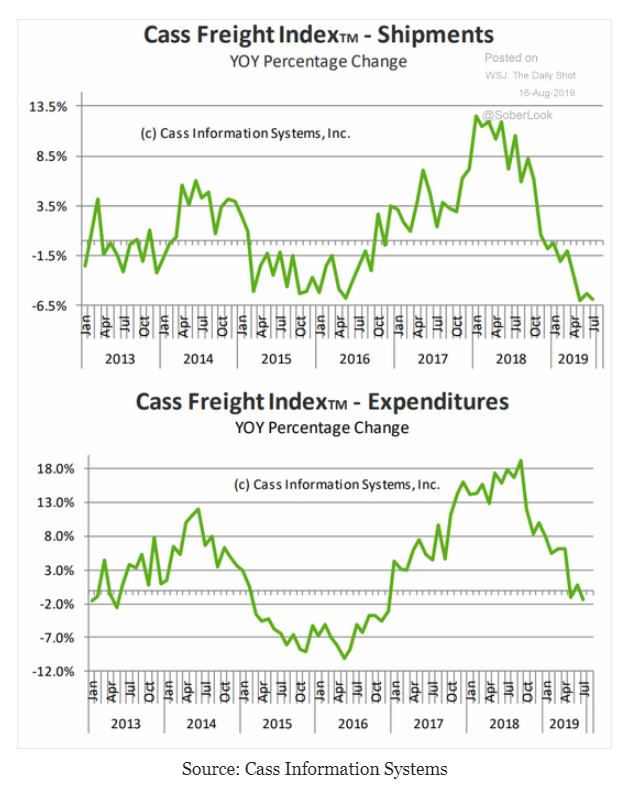

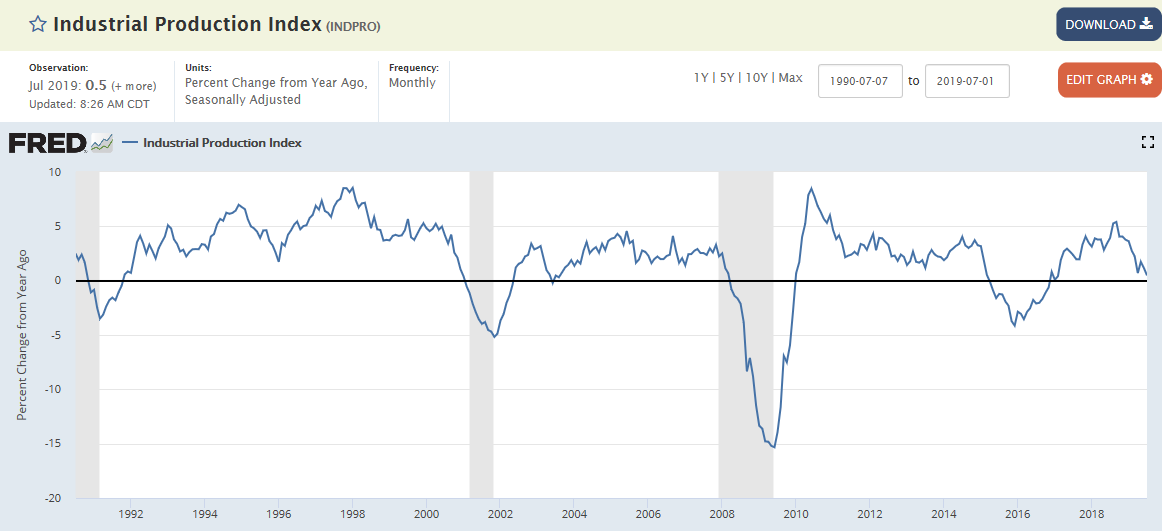

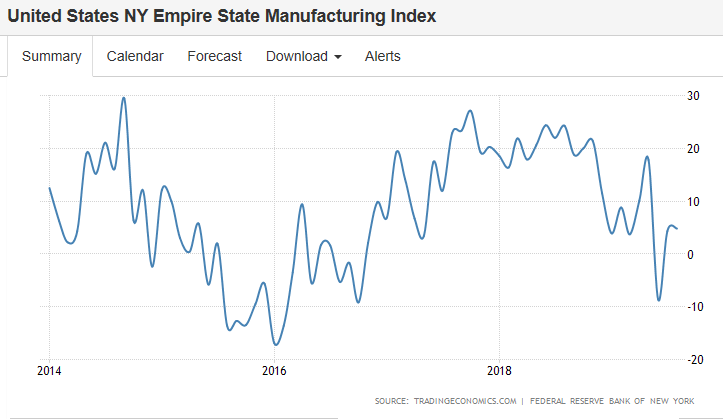

Tariffs doing their thing to the US economy:

Highlights

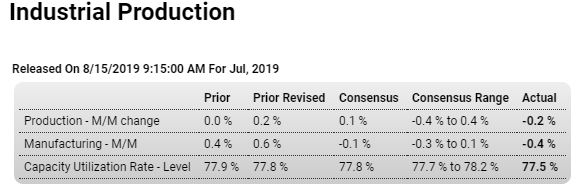

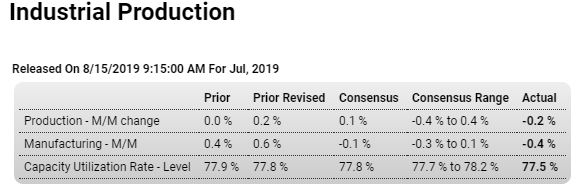

A jump in utility output couldn’t save industrial production in July which, pressured by contraction in both manufacturing and also mining, came in near the low end of Econoday’s consensus range with a 0.2 percent decline. Utilities, where production is affected by the weather and where results are often volatile, jumped 3.1 percent in the month following a 3.3 percent June decline. Outside of this component, however, positives in the July report are scarce.

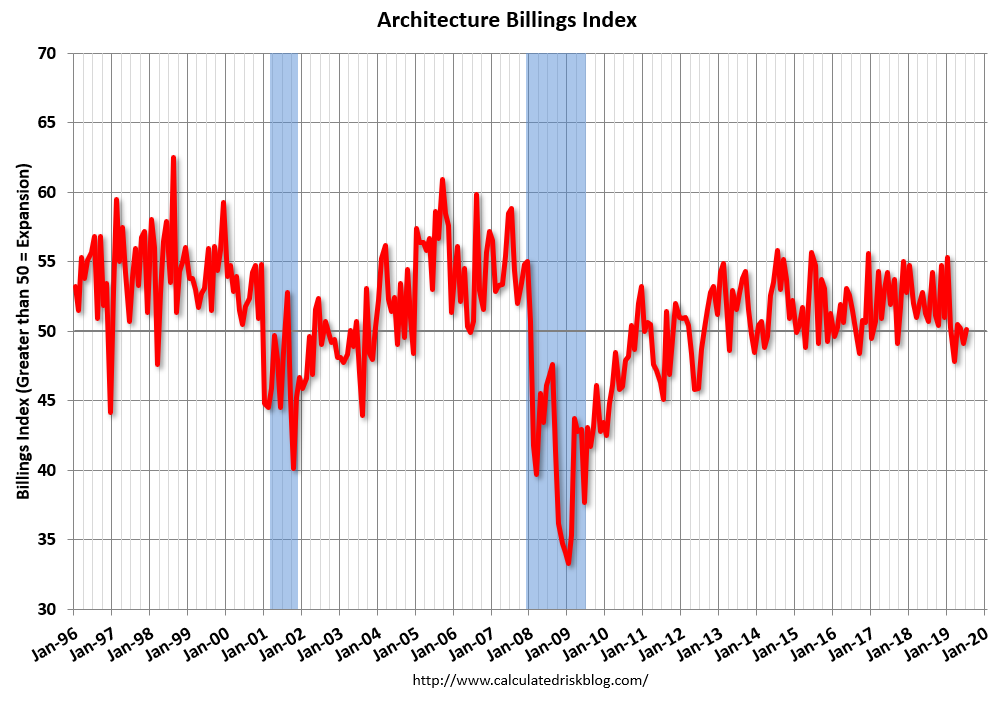

Manufacturing production fell 0.4 percent in the month to miss the low end of the consensus range. Construction supplies fell 1.0 percent in the latest uneven indication for this sector while motor vehicles, where production had been on the rise, edged back 0.2 percent. Business equipment, an area of particular concern for the Federal Reserve, fell 0.4 percent in the month. Mining, which along with manufacturing and utilities is the third major component in the report, has been contributing strongly to total growth for the past couple of years but not in July as output fell 1.8 percent.

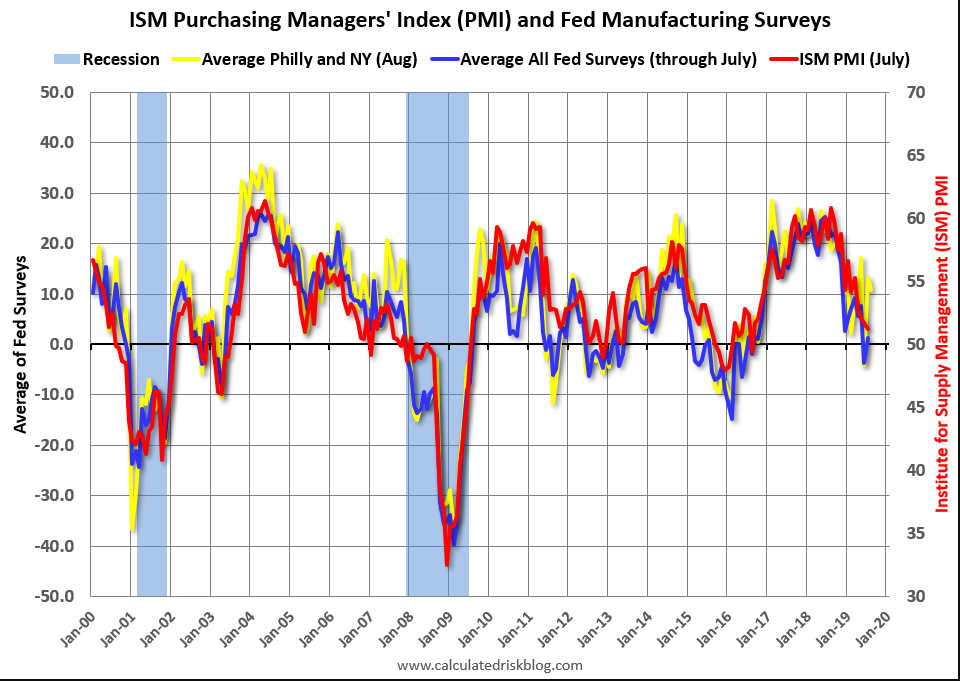

The weakness in this report was signaled by declines in hours worked in the July employment report, yet the results are more negative than expected and will boost arguments at the Federal Reserve for further interest rate cuts. The Fed is especially focused on manufacturing, a sector that is directly exposed to global slowing and global trade tensions and which is structurally considered to account for most of the domestic economy’s cyclical variation.

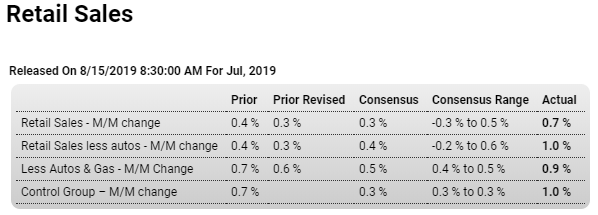

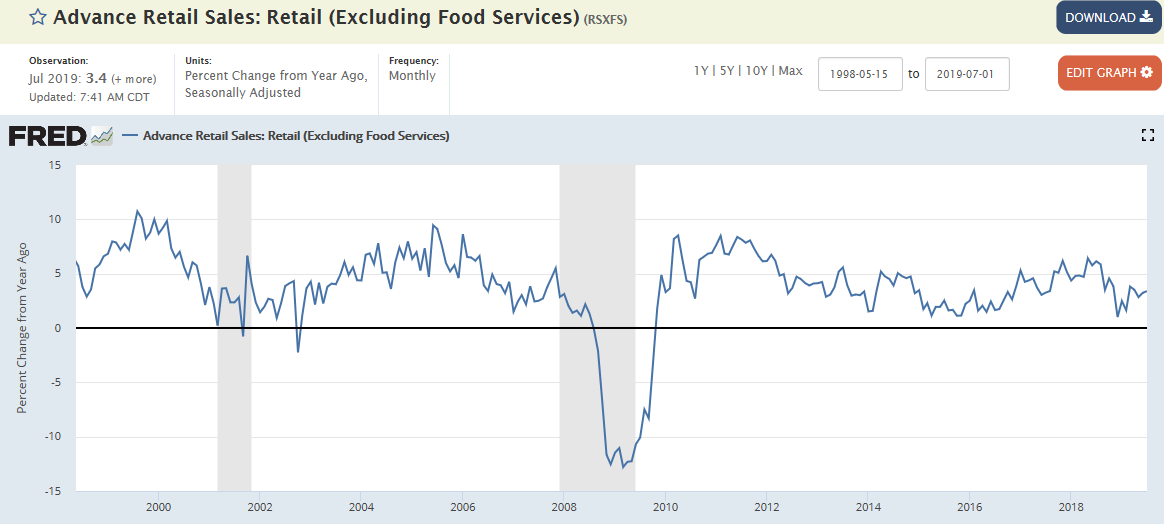

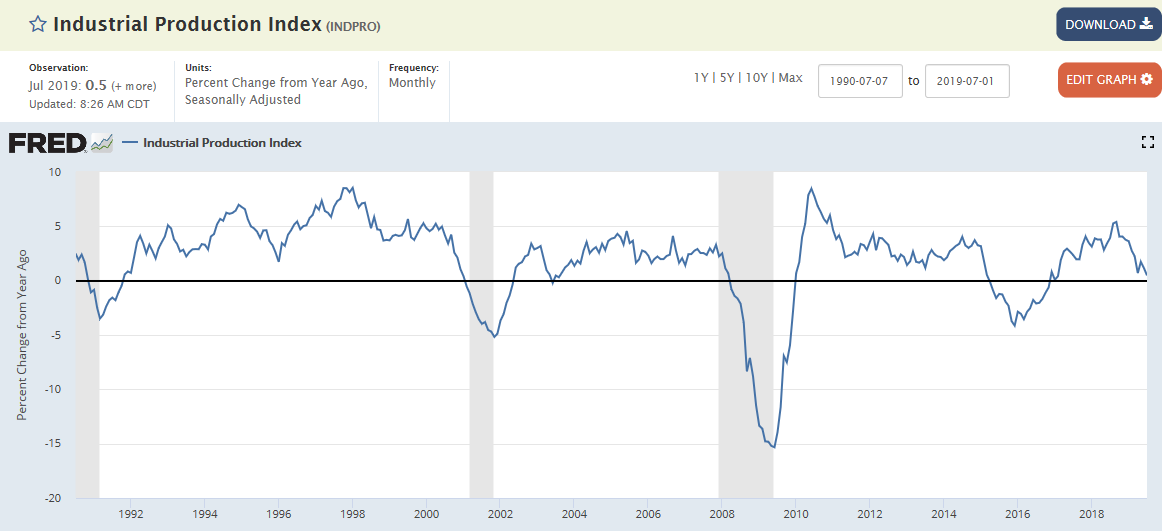

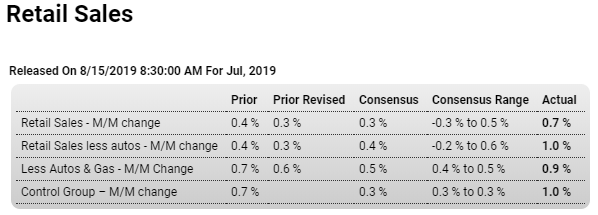

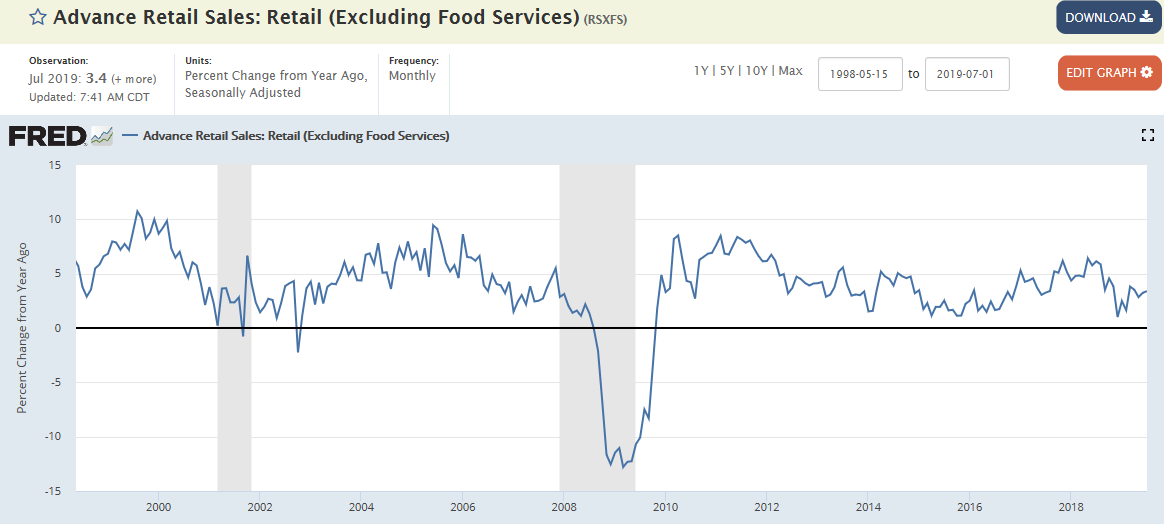

Strong report, subject to revision, and in any case on a year over year basis the gains are still working their way lower:

Highlights

Unexpected strength has not been an overstatement in recent retail sales reports including July’s where all major readings easily surpass Econoday’s consensus range. Total sales rose 0.7 percent, ex-auto up 1.0 percent, ex-auto ex-gas up 0.9 percent, and the control group up 1.0 percent.

Where to start? First the few weaknesses including auto sales which, as indicated by a dip in previously released unit sales, fell 0.6 percent in the month to extend an uneven run for this component. Sporting goods, a small category, also fell while health & personal care stores, a large category, slipped slightly.

Now let’s turn to acceleration and it’s led once again by non-stores, where monthly sales jumped 2.8 percent following gains of 1.9 and 2.3 percent in the two prior months. This component is dominated by e-commerce which is making increasingly greater gains at the expense of brick-and-mortar stores. Department stores have been one of the victims but not in July with a 1.2 percent sales jump. Electronics & appliance stores posted a 0.9 percent gain with clothing stores up 0.8 percent and food & beverage up 0.6 percent. Gasoline stations, benefiting from higher prices, had a strong month with a 1.8 percent gain. Building materials posted a small contribution.

But punctuating the strength and speaking to the underlying discretionary power of the consumer is yet another very strong gain for restaurants, up 1.1 percent following four prior monthly gains of 0.7, 1.1, and 0.7 percent.

The consumer held up second-quarter GDP posting robust and inflation-adjusted annual spending growth of 4.3 percent, a mark that would be difficult to match let alone exceed but that’s a possibility given the strong jump out of the gate for July retail sales.

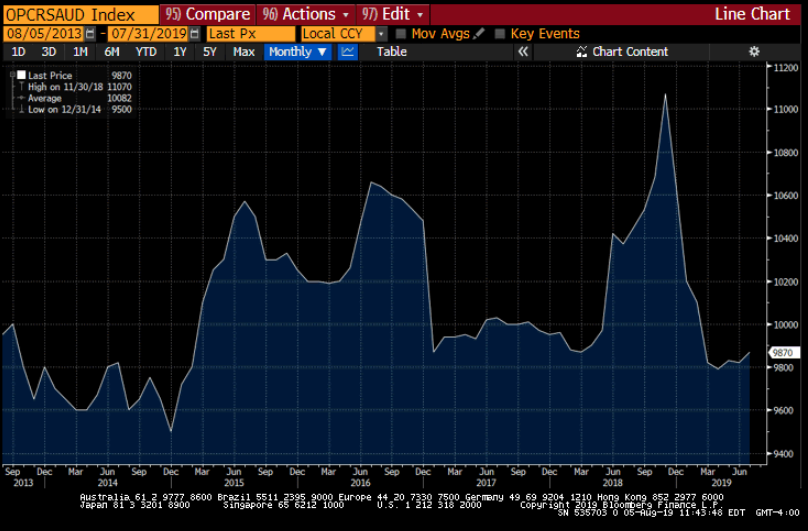

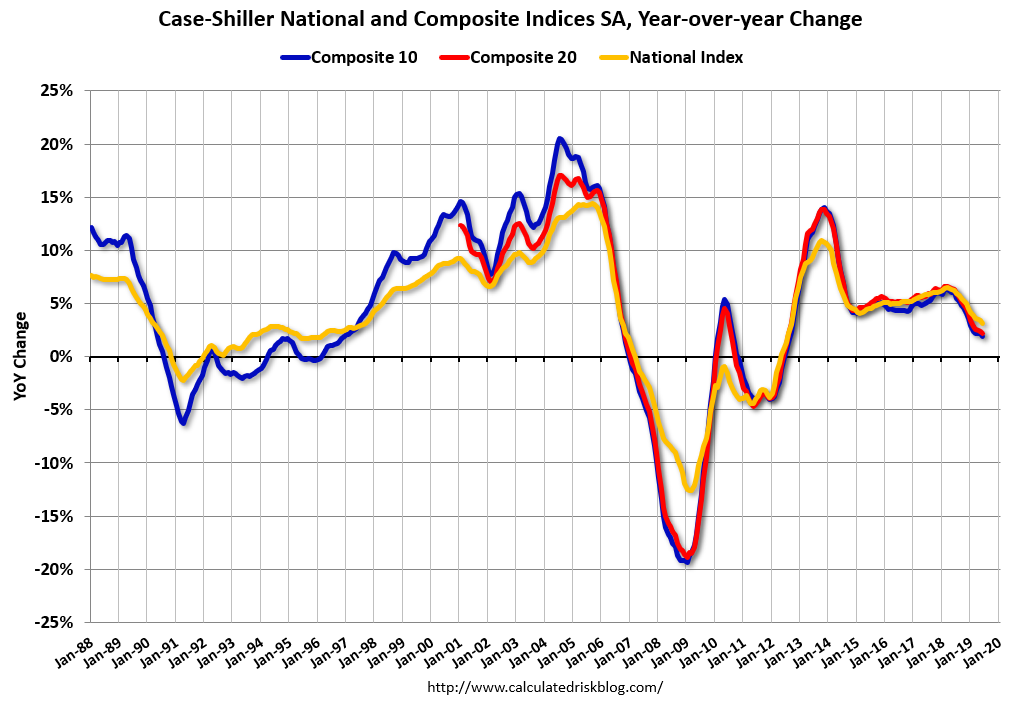

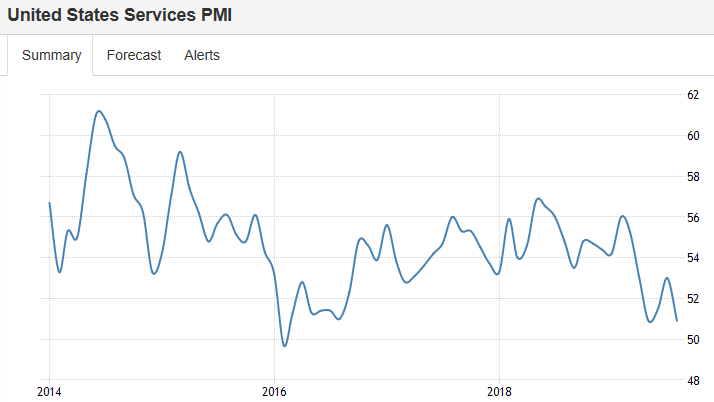

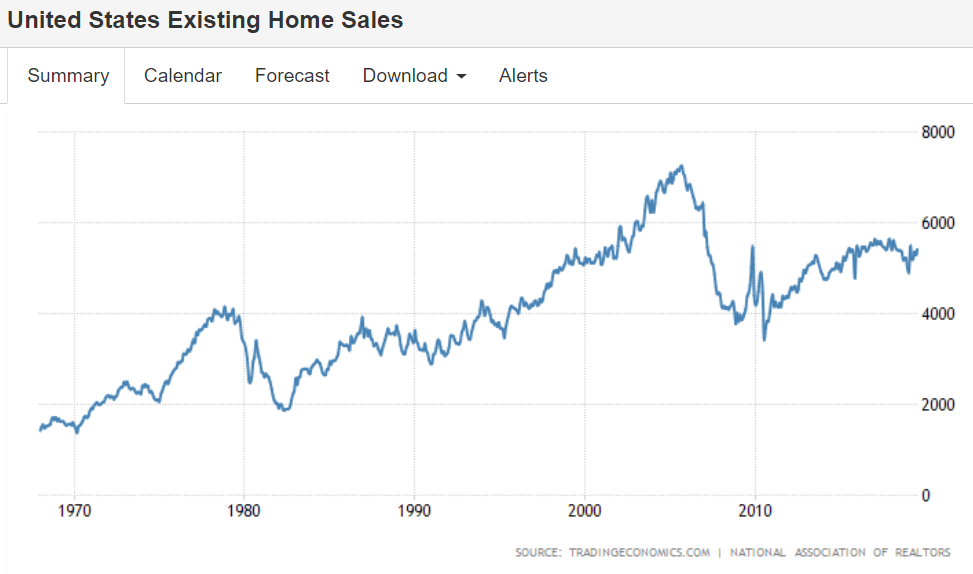

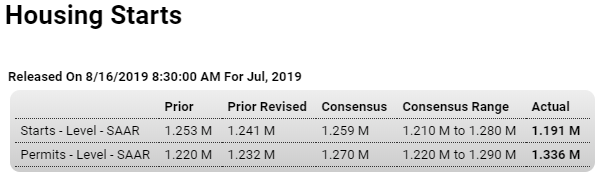

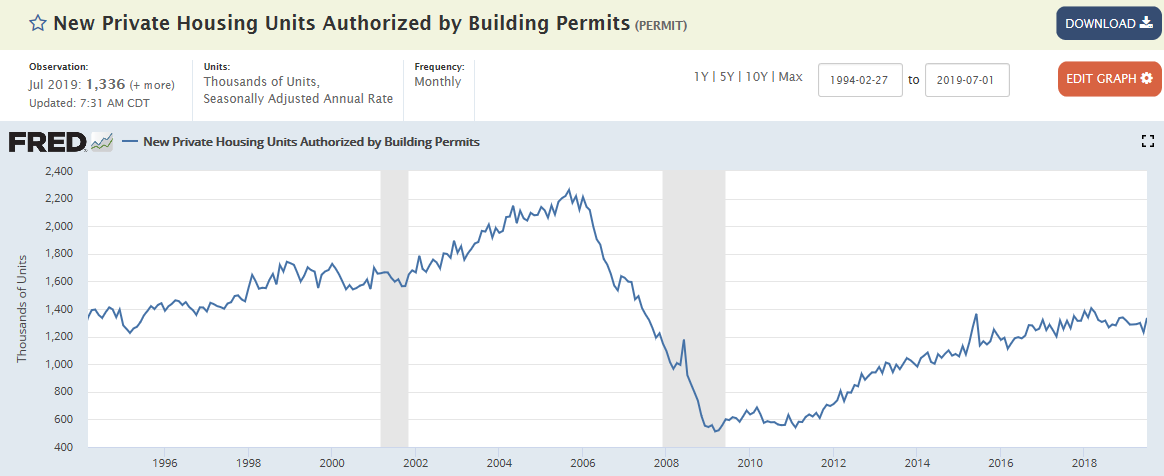

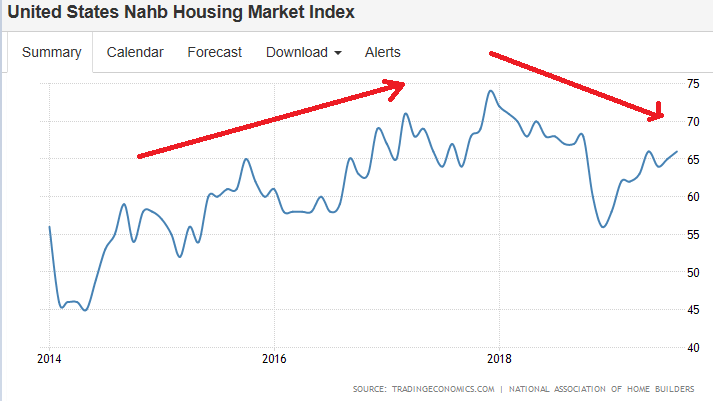

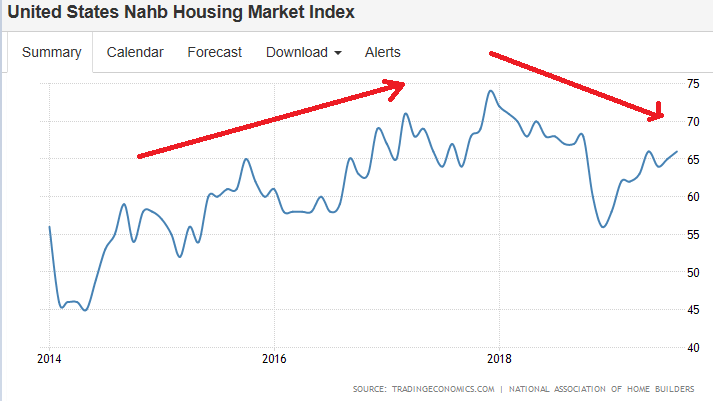

Up a bit but still looking like it peaked about a year and a half ago:

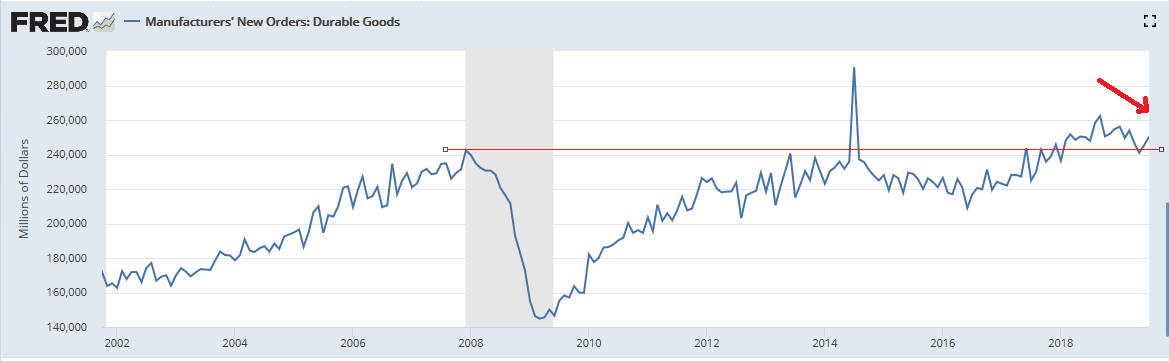

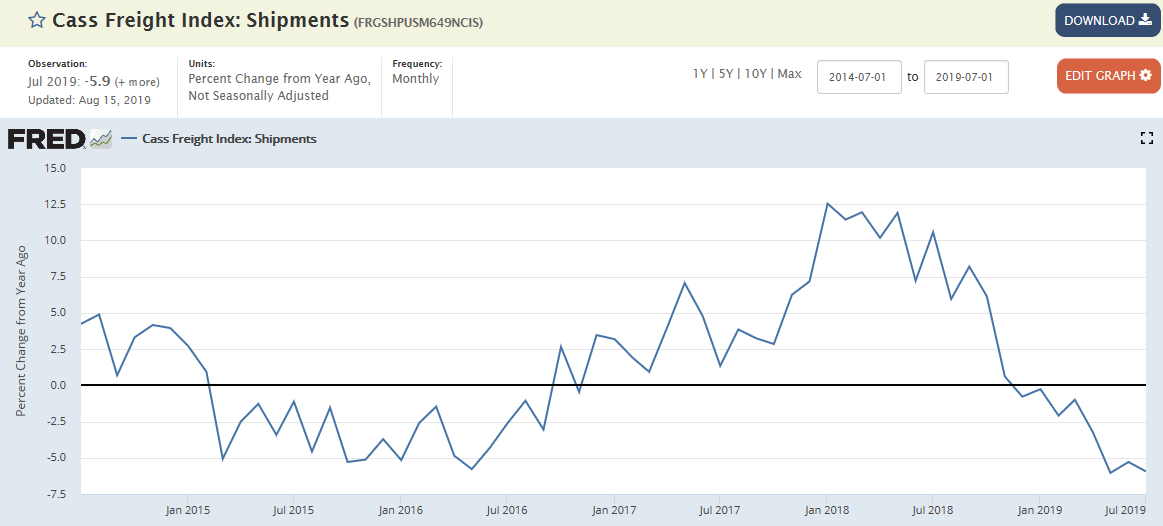

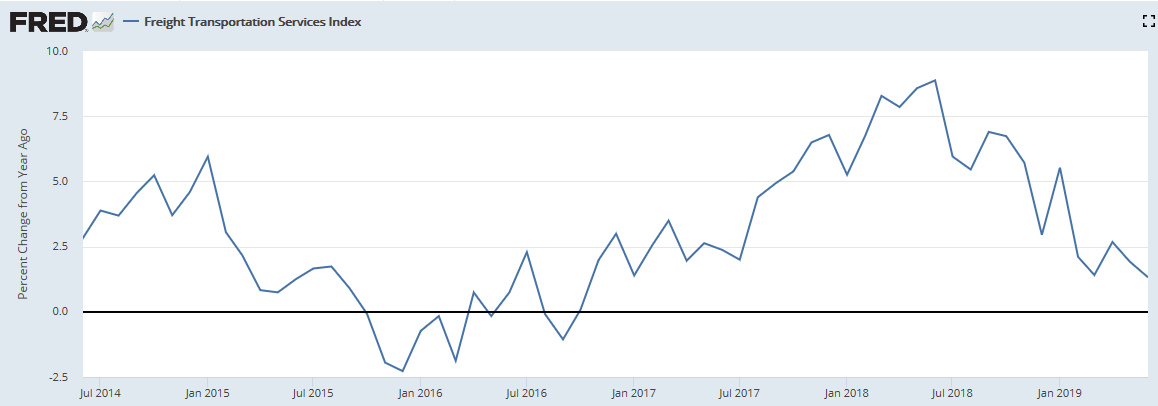

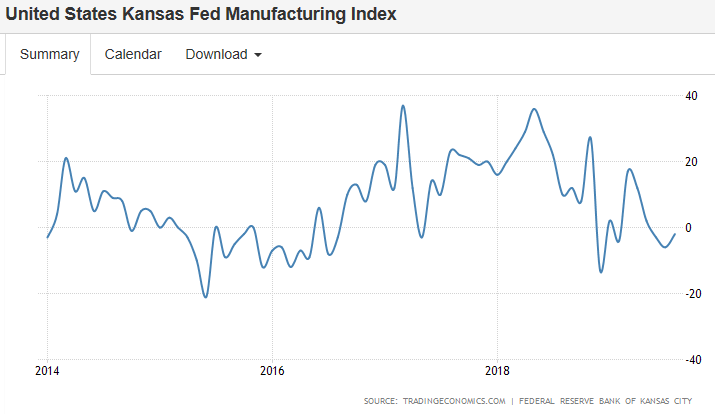

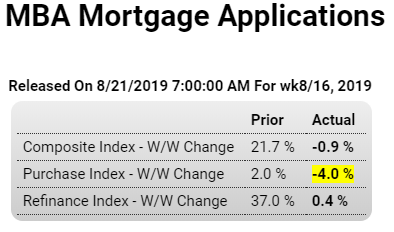

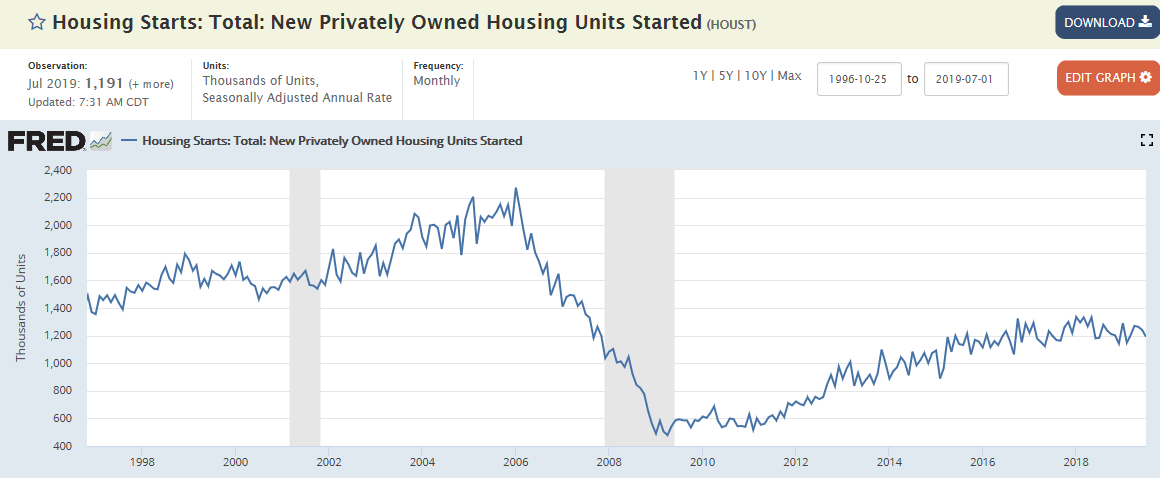

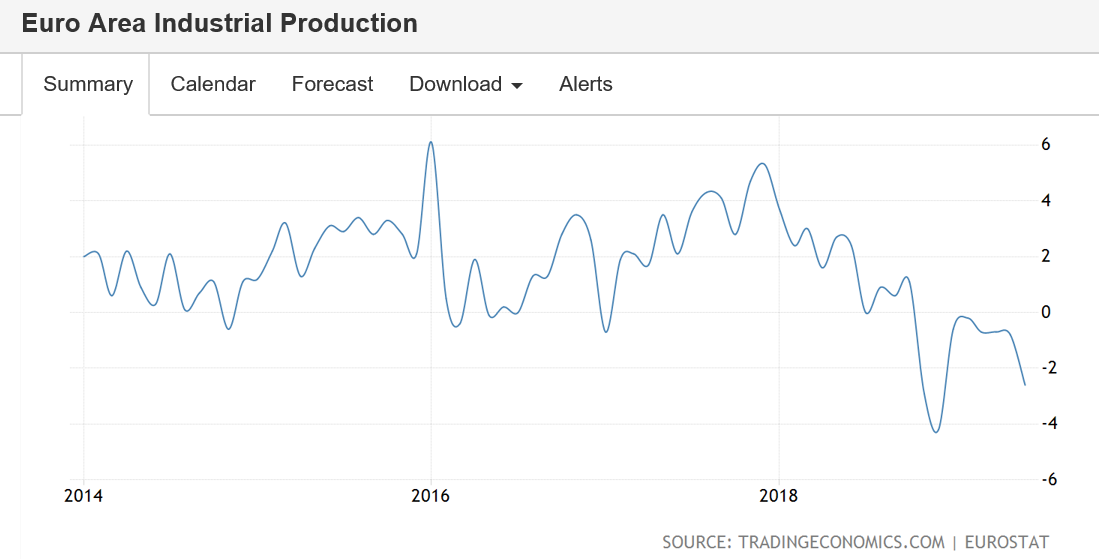

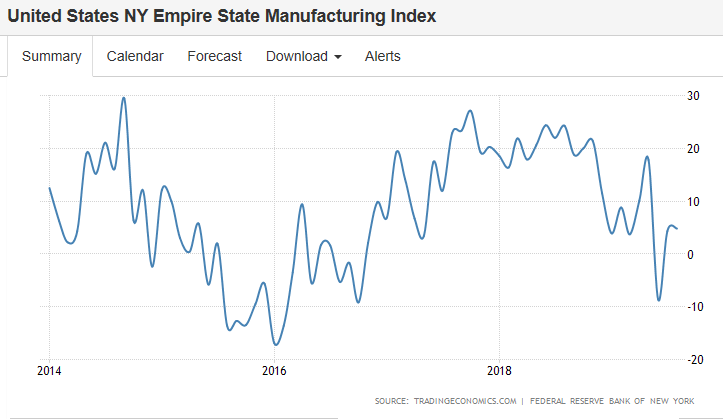

Volatile but also still looks to be working its way lower:

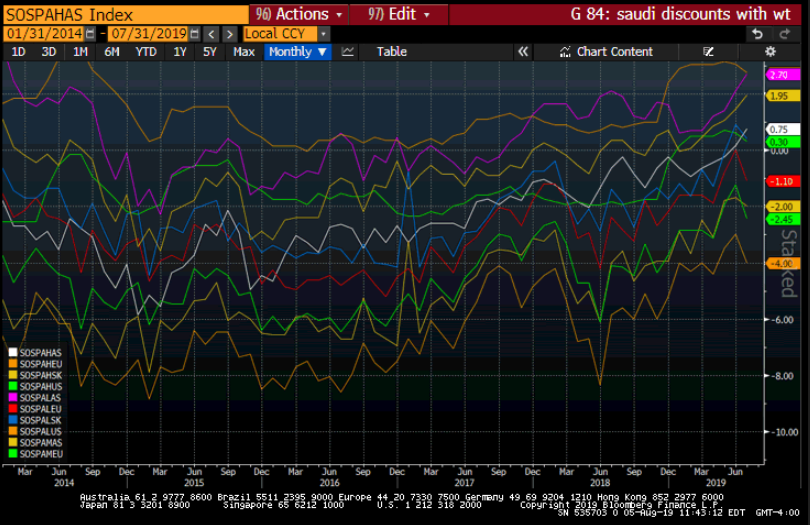

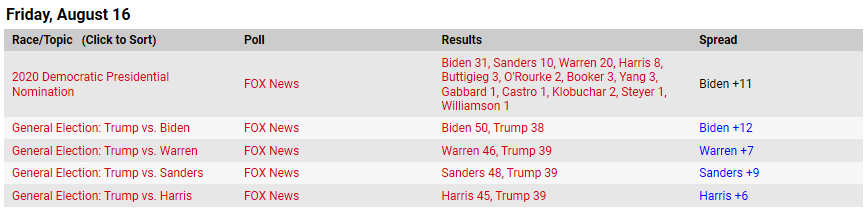

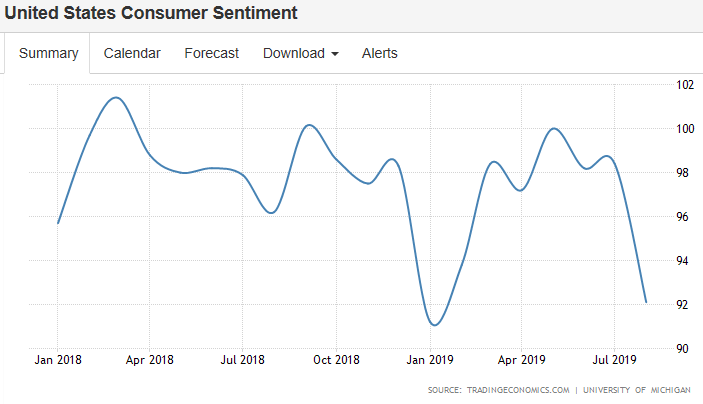

The latest from our ‘shoot first and ask questions later’ President: