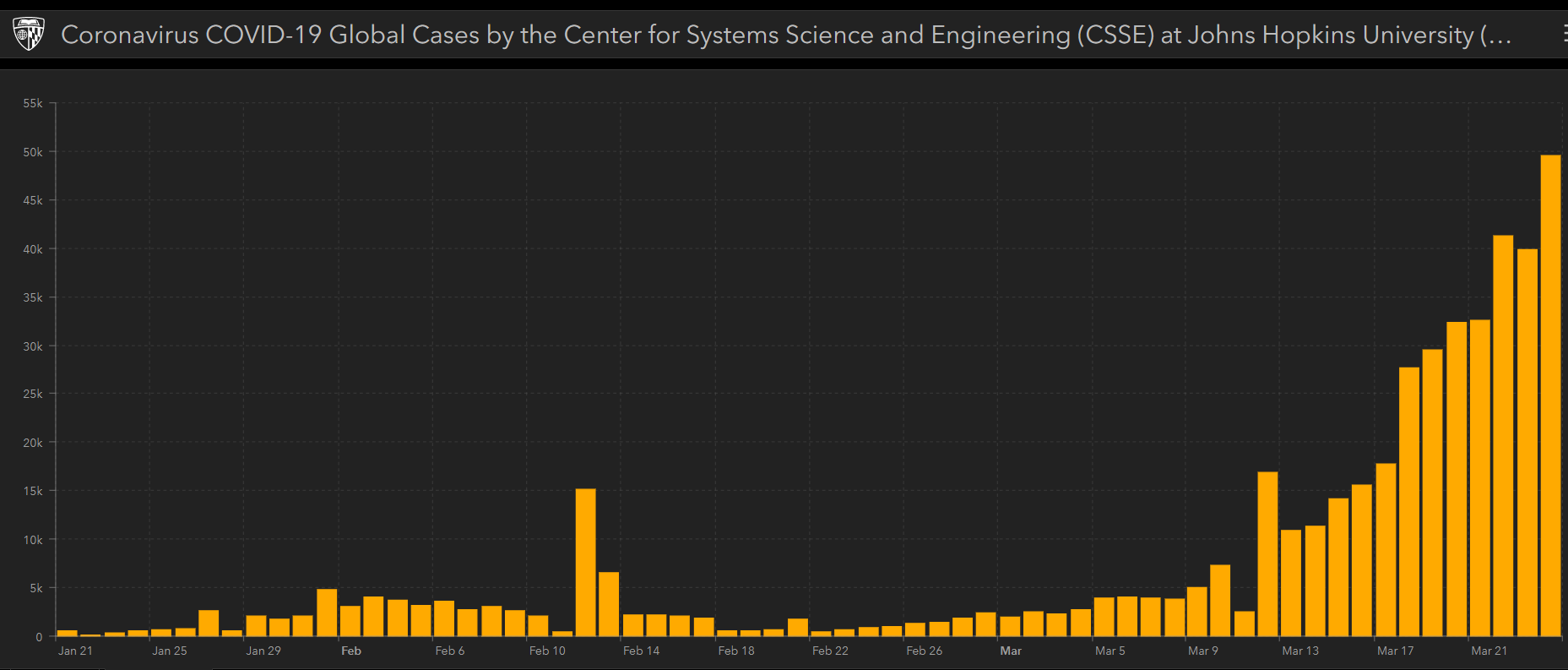

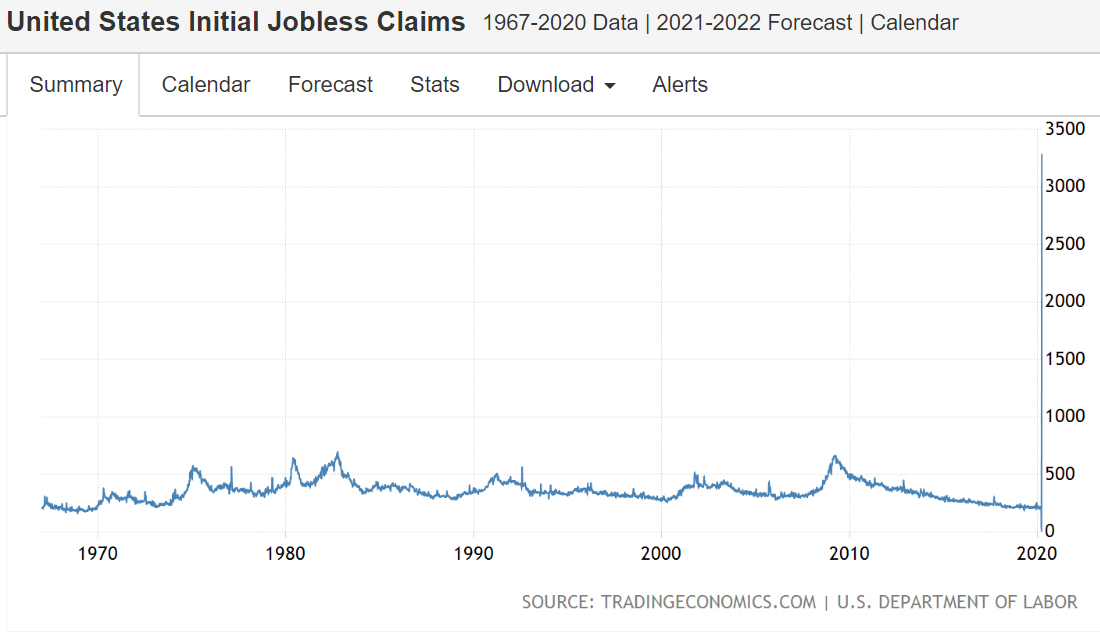

Big spike up:

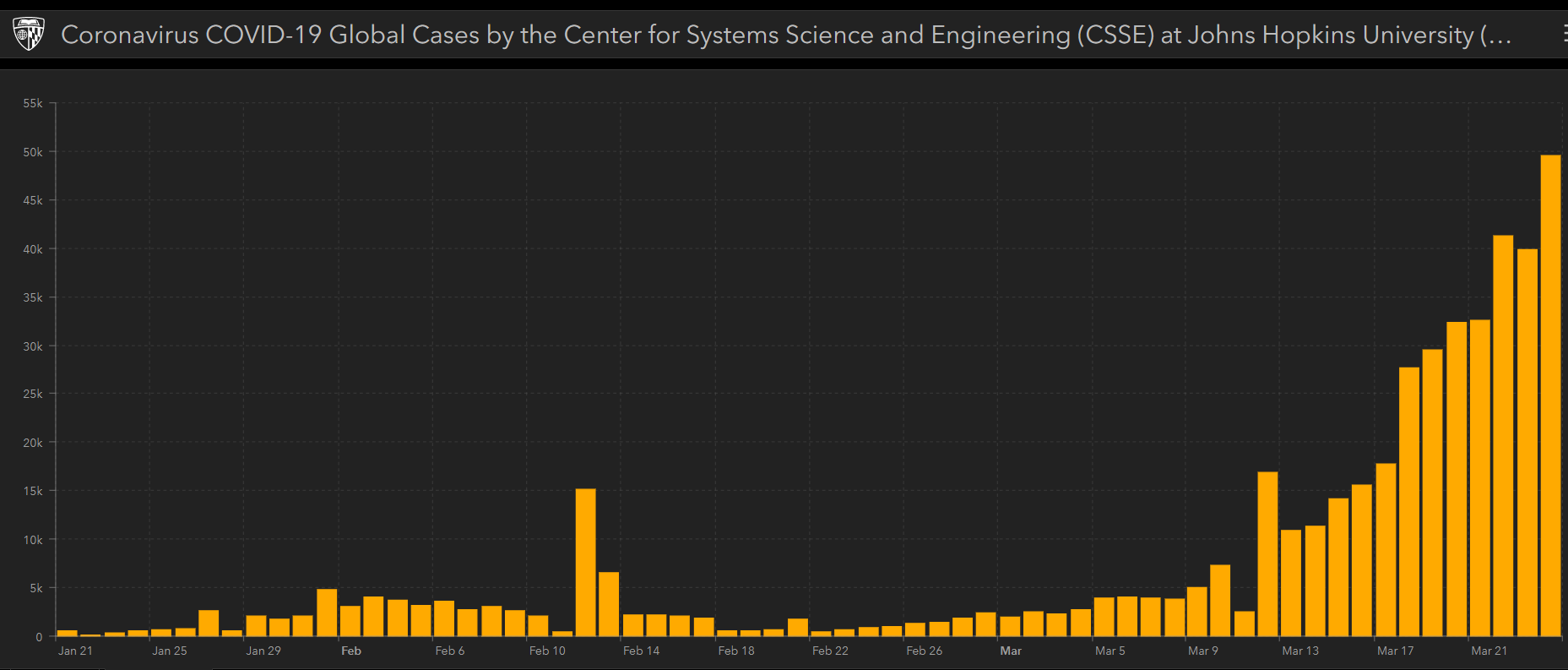

New daily global confirmed cases growing:

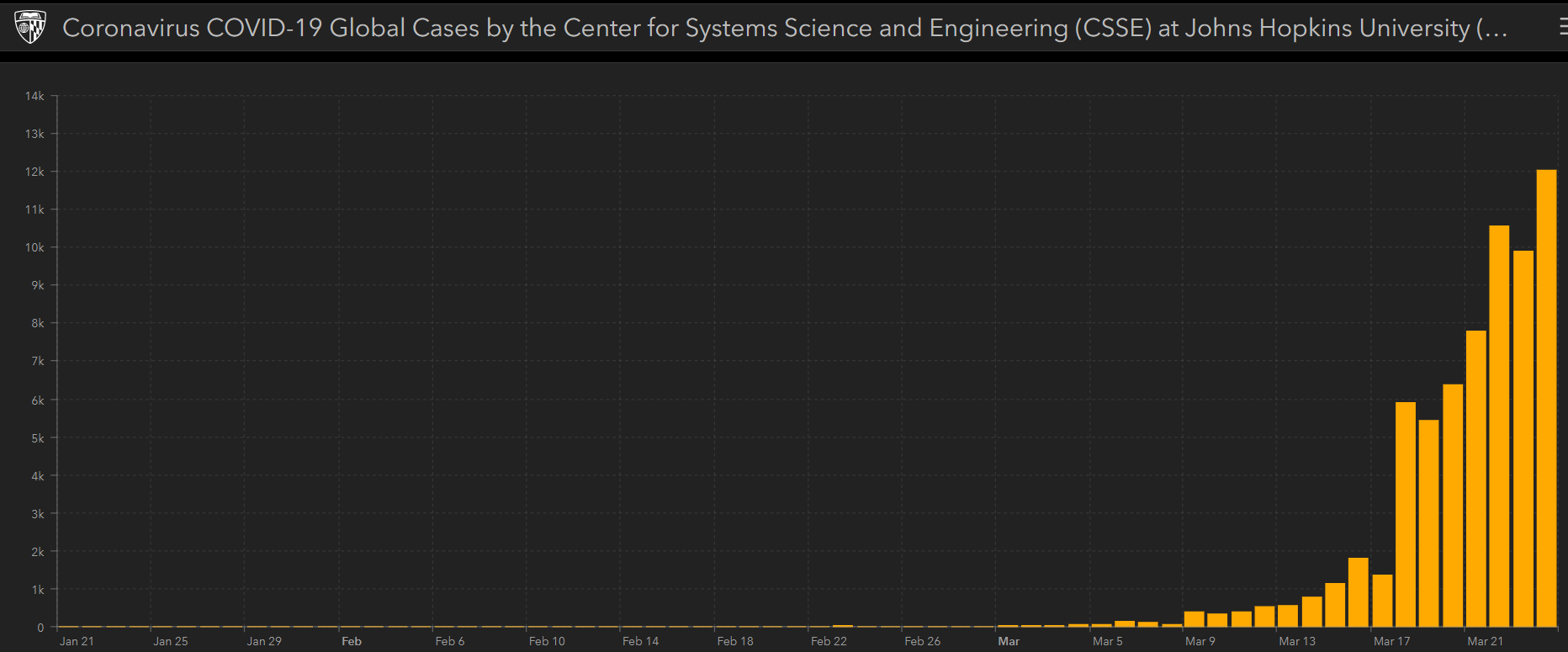

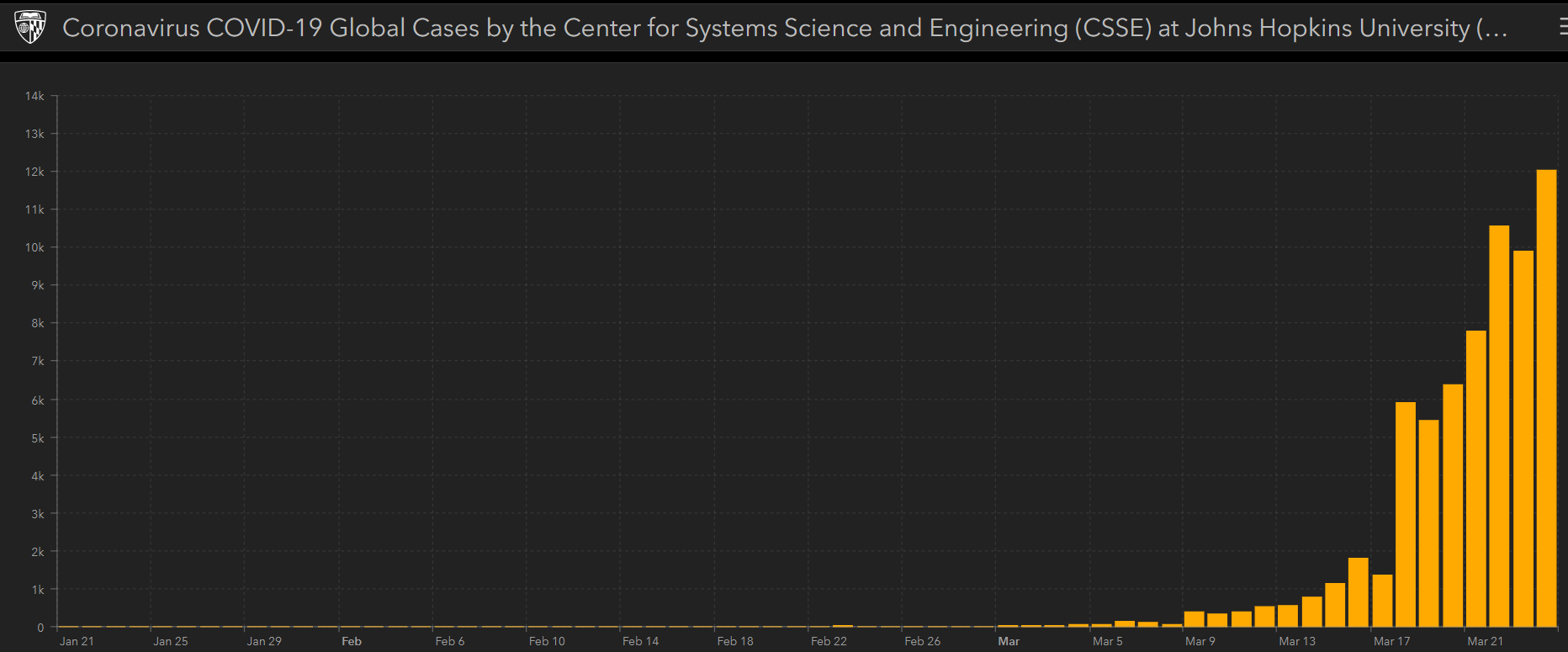

US cases growing rapidly and soon to surpass Italy and China to take the lead globally:

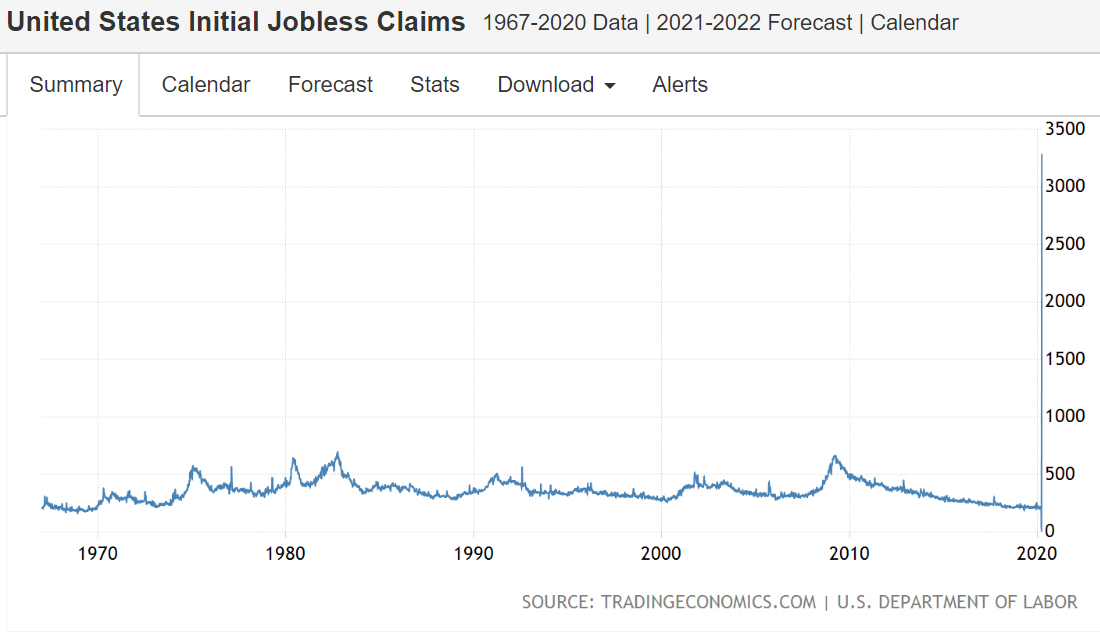

Big spike up:

New daily global confirmed cases growing:

US cases growing rapidly and soon to surpass Italy and China to take the lead globally:

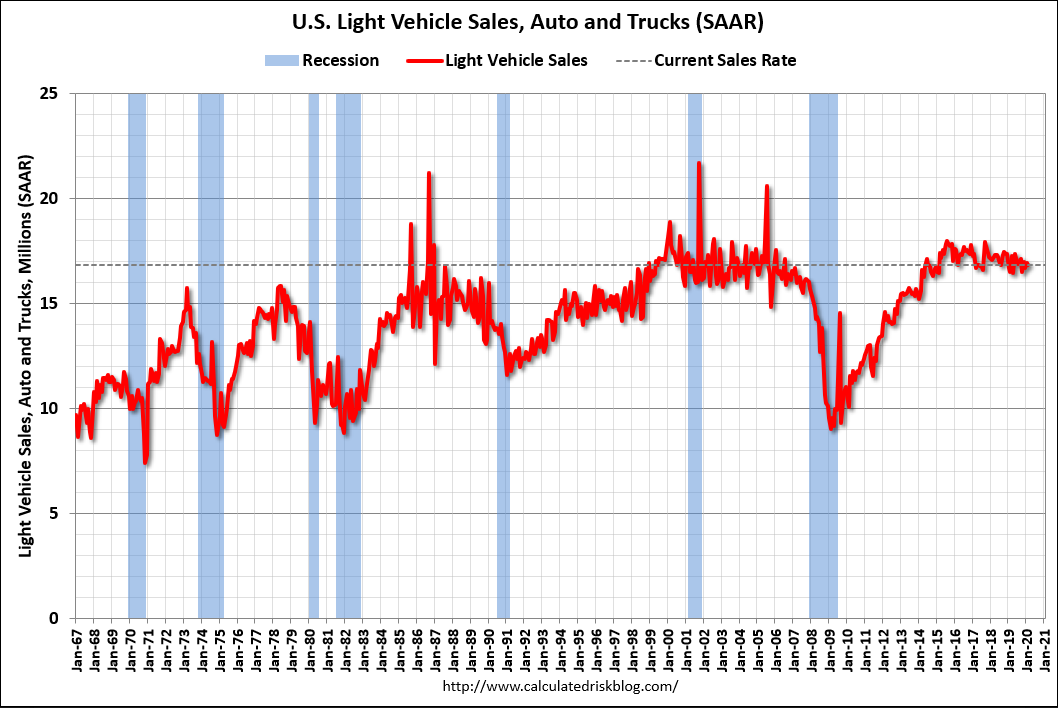

Effects of virus starting to hit US economy:

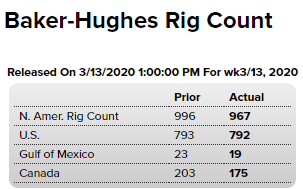

As expected, the lower price of oil will cut capital expenditures and eventually output:

The mini spike in real estate lending from the drop in rates is already fading:

The Japanese economy shrank 7.1 percent on an annualized basis in the fourth quarter of 2019, worse than an initial estimate of a 6.6 percent contraction and following a downwardly revised 0.1 percent growth in the previous three-month period. That was the biggest slump in GDP since the second quarter of 2014 as private consumption dropped 10.6 percent as a sales tax hike in October weighed on spending. Also, business spending declined by 17.3 percent, the most since the first quarter of 2009. Japan GDP Growth Annualized – data, historical chart, forecasts and calendar of releases – was last updated on March of 2020.

I suspect these numbers will be subject to large downward revisions, particularly today’s release, and the downtrend will continue. This is much like the other indicators that had recently blipped up and then reversed:

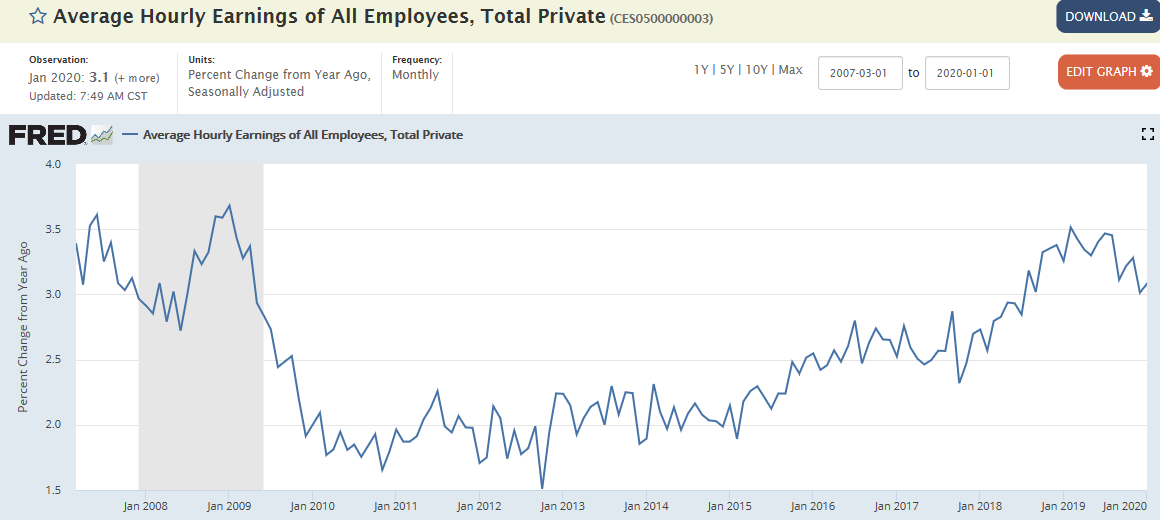

Wage growth, for example, has been decelerating, while the narrative is that everyone is working and there are no people left to employ:

The number of persons working part time for economic reasons increased in February to 4.318 million from 4.182 million in January.

The number of persons working part time for economic reason has been generally trending down.

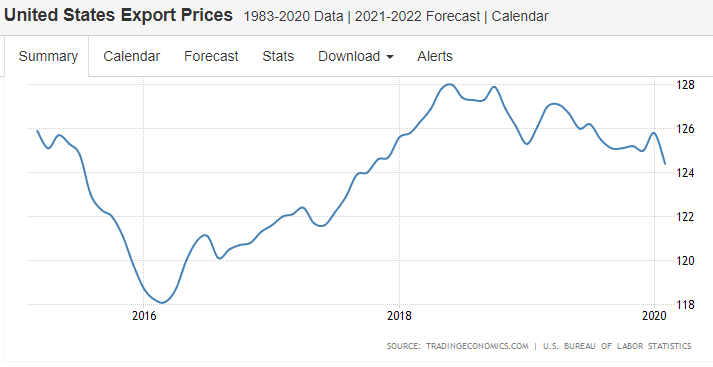

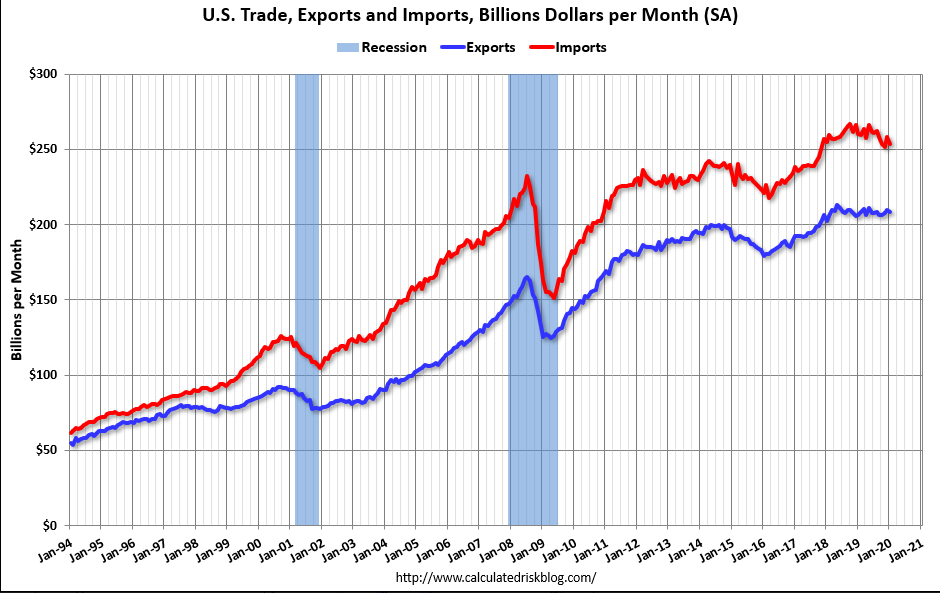

Not good when imports and exports are both working their way lower:

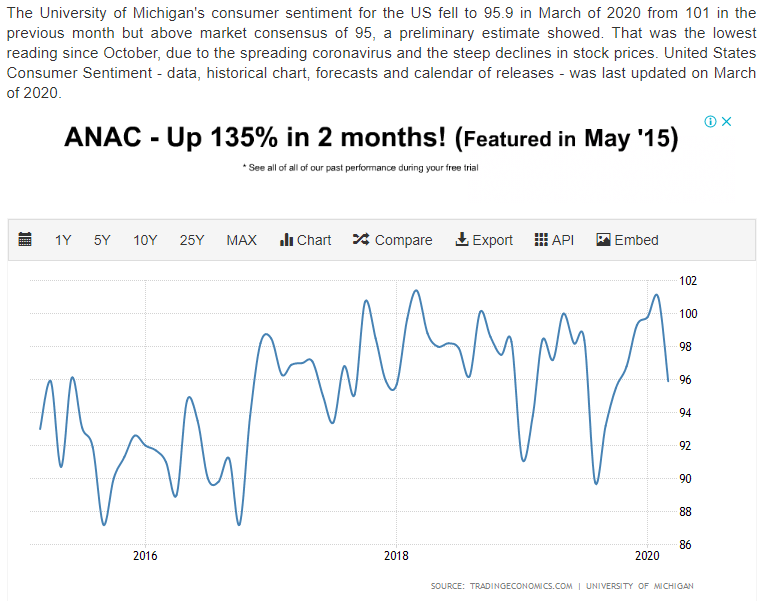

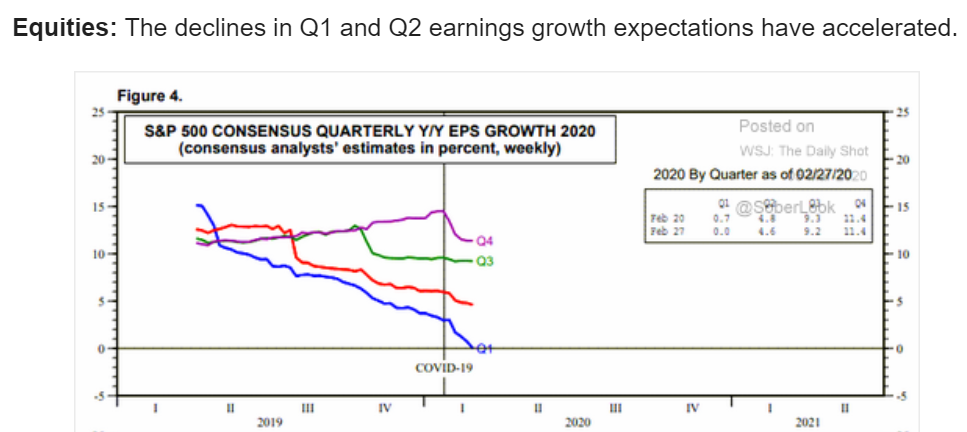

Expectations down further with the virus:

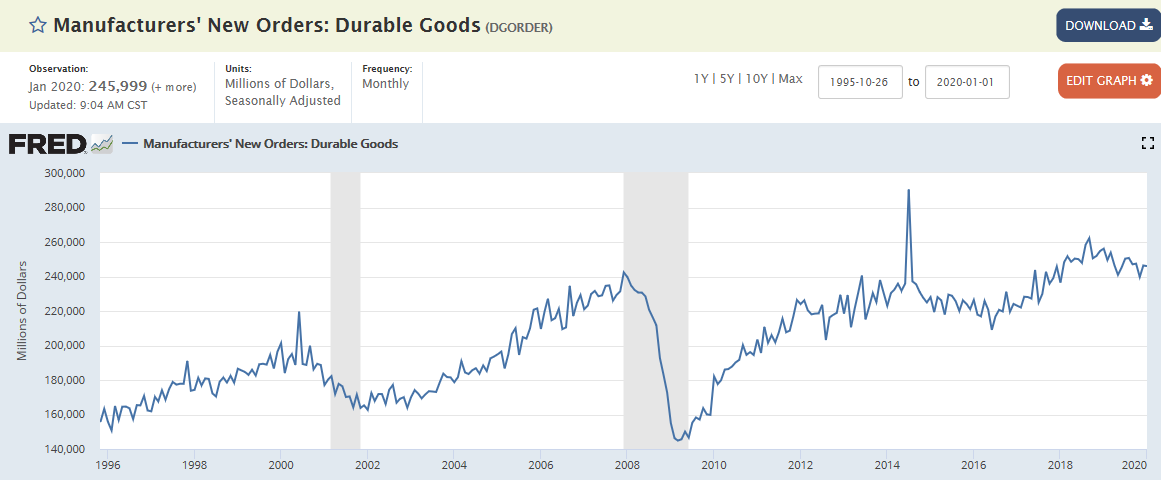

Just updated for January, well before the virus, and already trending lower:

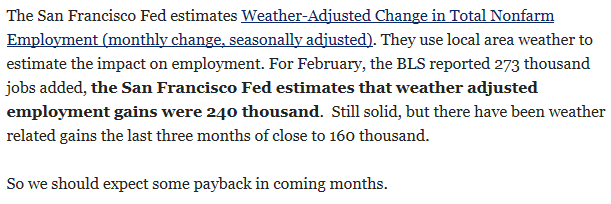

Monthly employment report tomorrow. It’s been decelerating for quite a while and looks to slow further:

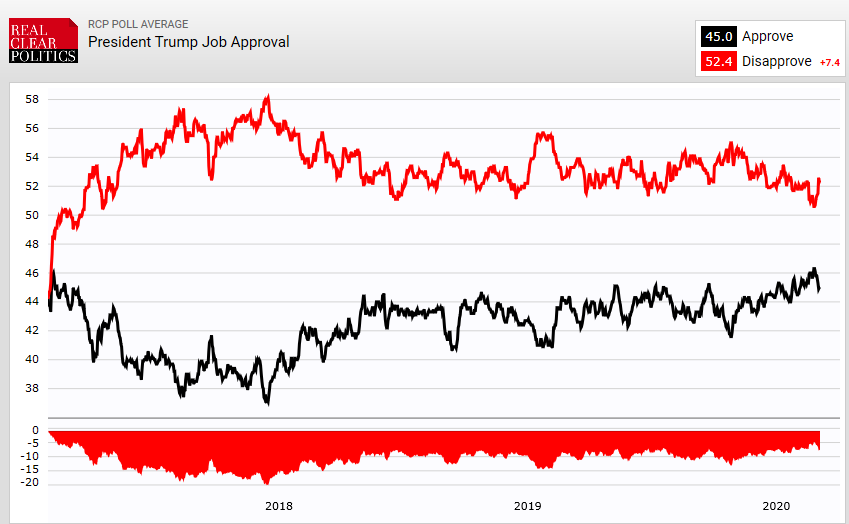

Trump seems to be losing support during the last week or so?

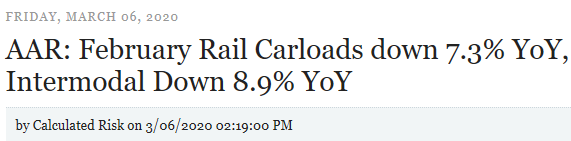

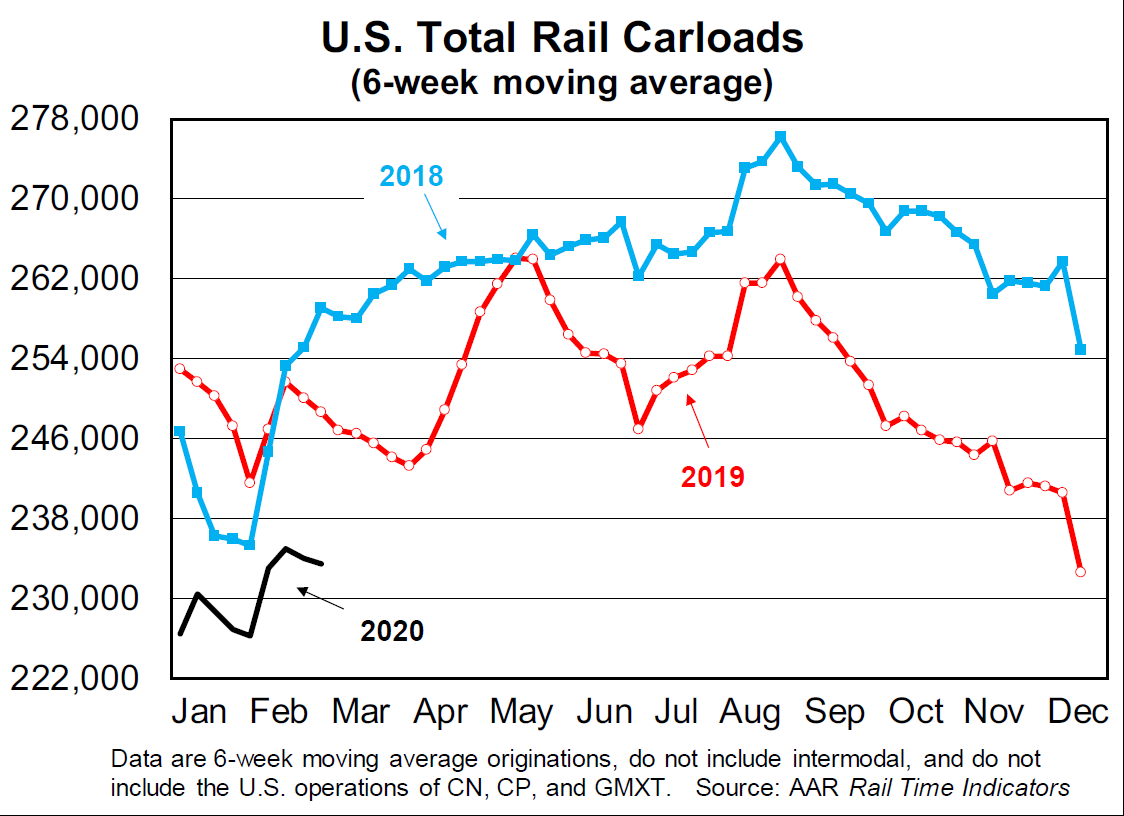

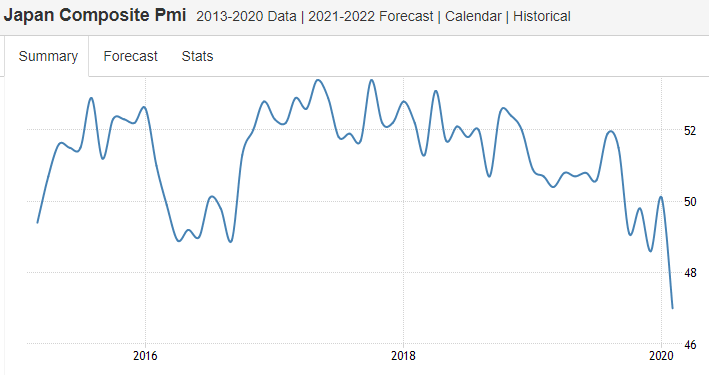

Beat down by the tariffs, virus effects soon to come:

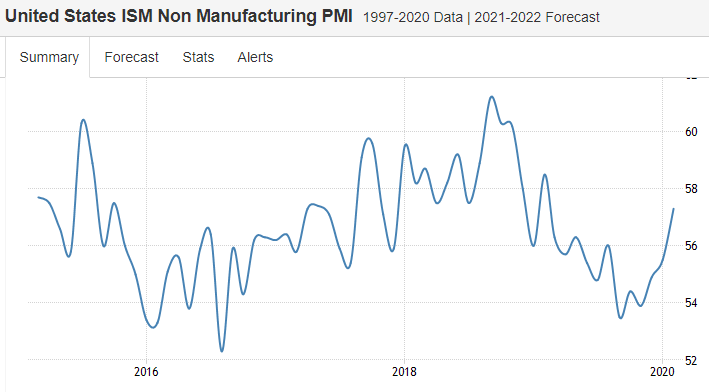

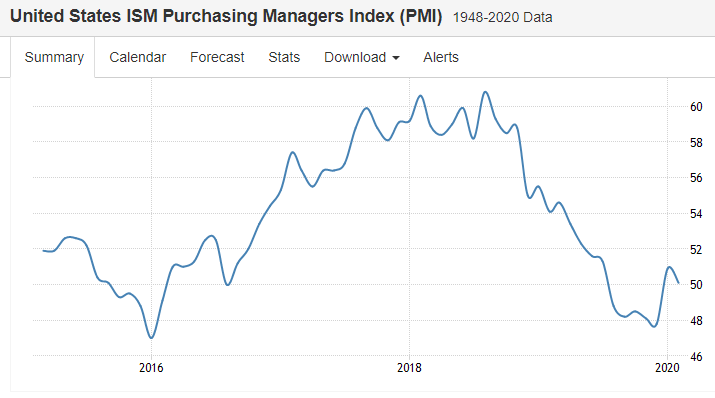

Nice move up against the trend. We’ll see if it reverses like the Markit survey has:

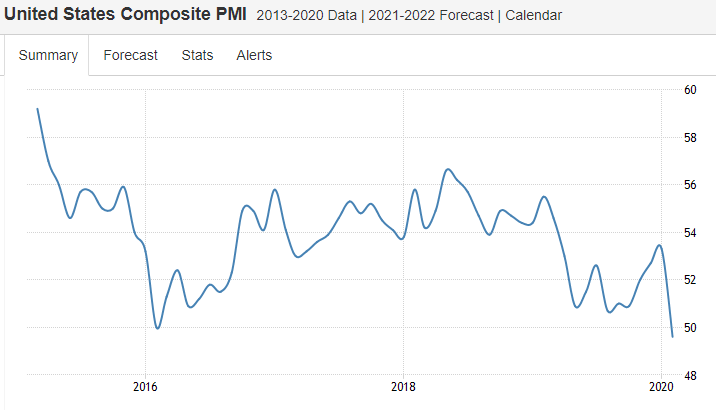

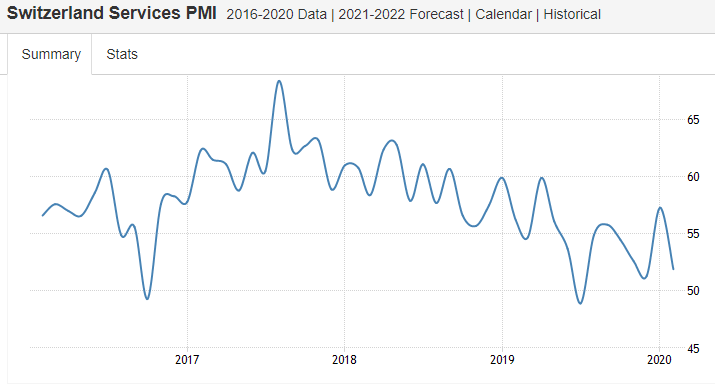

Examples of a recent reversals:

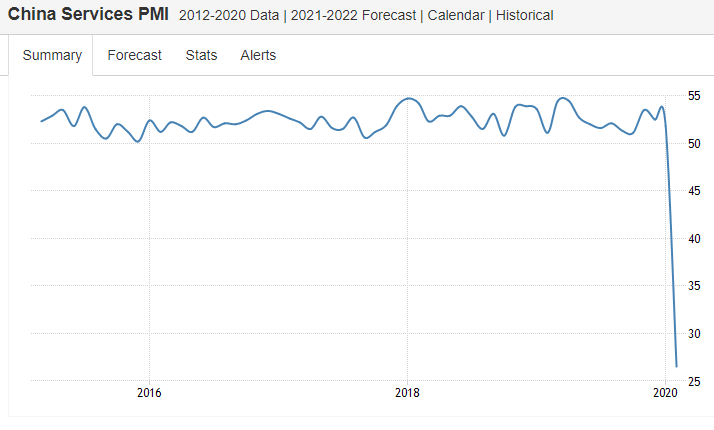

Bit of a move down here as the virus slows things down in China:

Still decelerating:

Another one of those brief moves up after the long slide seems to be reversing:

The ISM Manufacturing PMI for the US declined to 50.1 in February of 2020 from 50.9 in January and below market expectations of 50.5. New orders contracted (49.8 from 52), production slowed (50.3 from 54.3) and both employment (46.9 from 46.6) and inventories (46.5 from 48.8) continued to fall. Also, price pressures declined (45.9 from 53.3). Global supply chains are impacting most, if not all, of the manufacturing industry sectors.

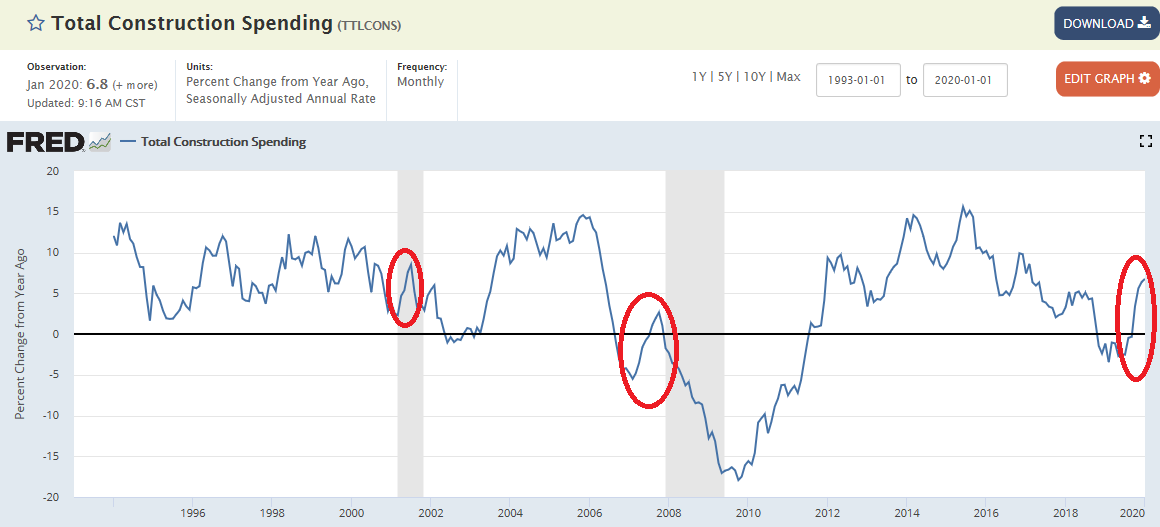

Construction spending mover up a bit, but that was January with its warmer than average weather immediately after rates fell and pre virus. And note similar moves up in prior cycles:

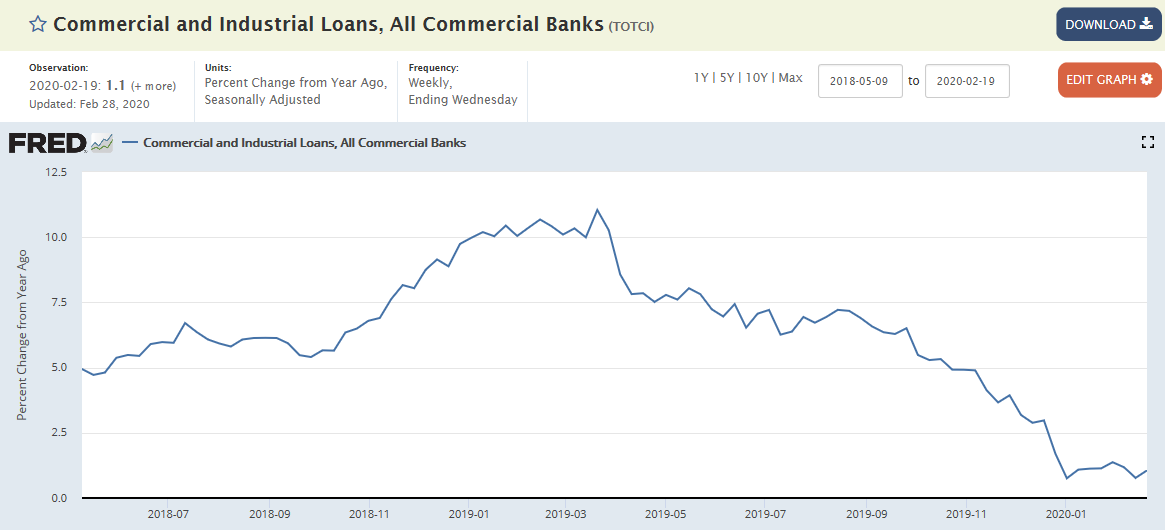

Commercial and industrial loan growth remains depressed at near 0:

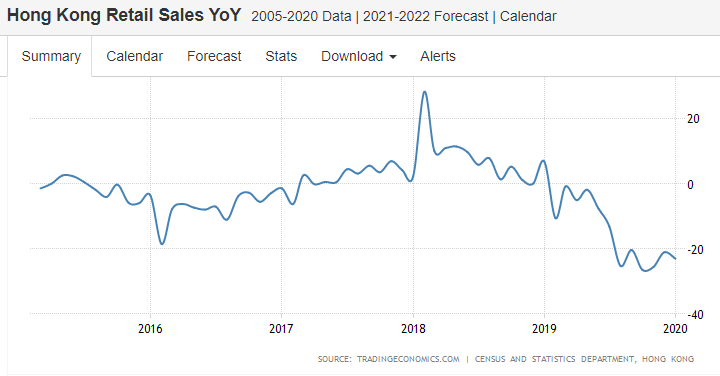

Glimpse into China:

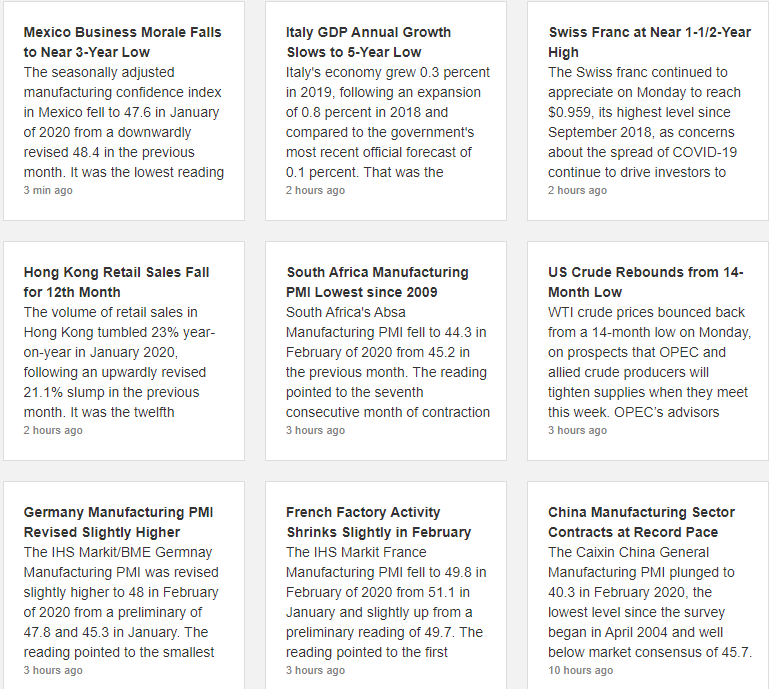

Headline snapshot:

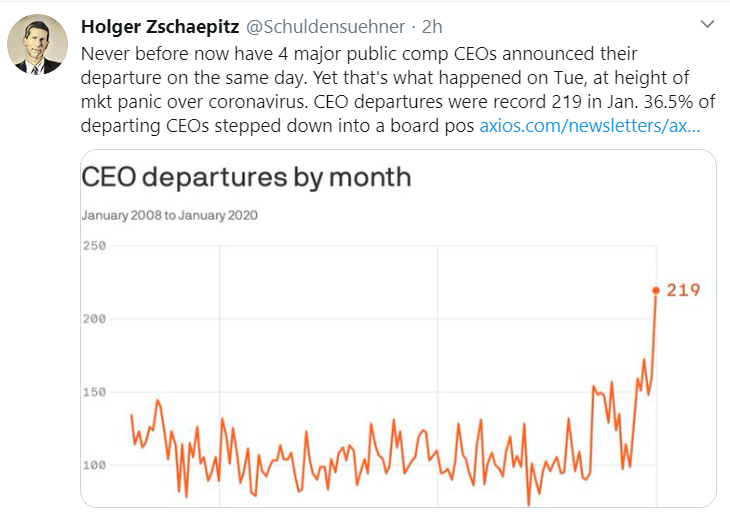

Not a good sign: