By Bill McBride

From the NAR: Pending Home Sales Slip in June

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.1 percent to 102.7 in June from 103.8 in May, and is 7.3 percent below June 2013 (110.8). Despite June’s decrease, the index is above 100 – considered an average level of contract activity – for the second consecutive month after failing to reach the mark since November 2013 (100.7).

The PHSI in the Northeast fell 2.9 percent to 83.8 in June, and is 3.2 percent below a year ago. In the Midwest the index rose 1.1 percent to 106.6, but remains 5.5 percent below June 2013.

Pending home sales in the South dipped 2.4 percent to an index of 113.8 in June, and is 4.3 percent below a year ago. The index in the West inched 0.2 percent in June to 95.7, but remains 16.7 percent below June 2013.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

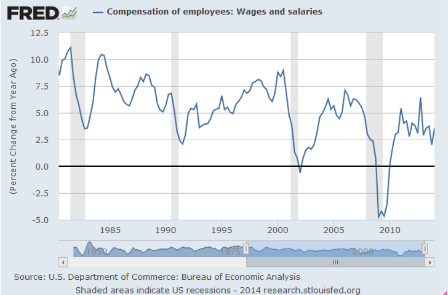

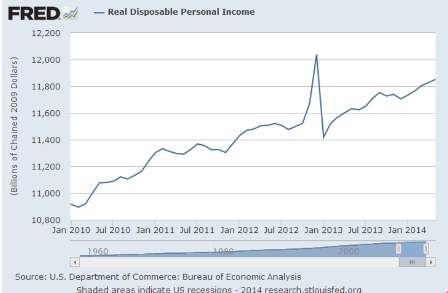

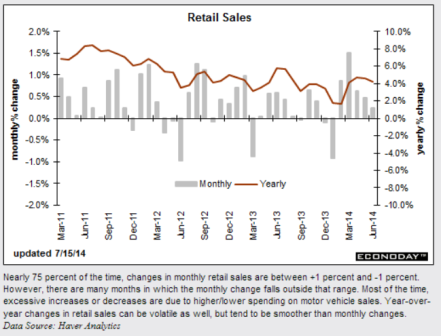

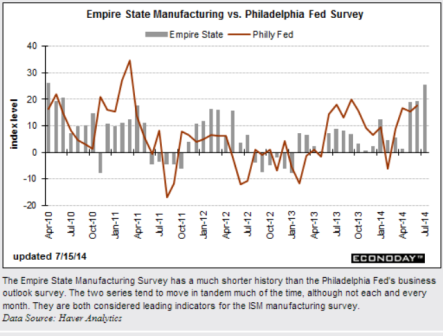

So manufacturing is chugging along at it’s usual 4% rate of growth, jobs are chugging along at a 1.9% rate of growth, and for the most part all the surveys are looking pretty good.

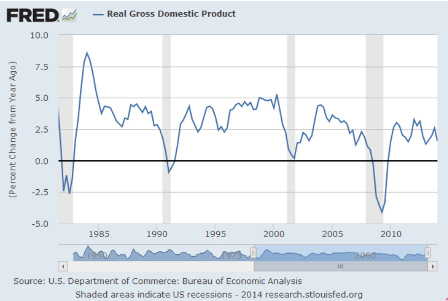

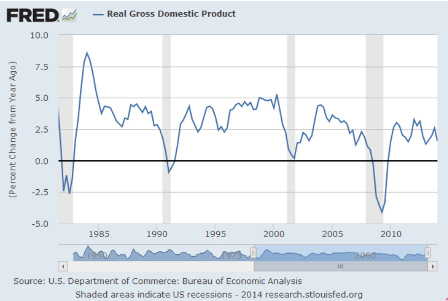

Yet GDP year over year looks to be trending down, with the consensus 2014 forecast now down less then 2%.

Full size image

Full size image

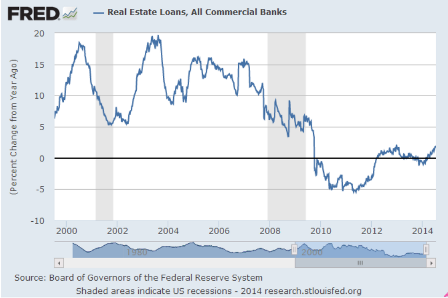

So why does housing matter?

Can’t spending simply go elsewhere?

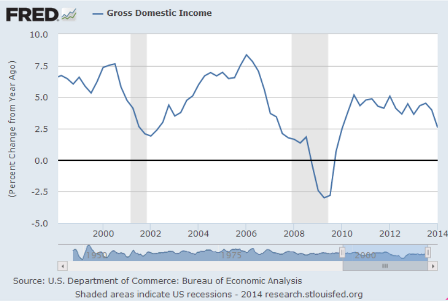

The problem is the oldest of all macro constraints-

If any agent spends less than his income, another must spend more than his income for all of the output to get sold.

It’s also been expressed as ‘the paradox of thrift’- decisions to not spend income and to instead ‘save’ cause sales and income to fall with no increase in net savings.

And it shows up in this discussion- ‘if the banks charge interest, where does the economy get the money to pay it?’ With the response ‘the banks spend the interest income’.

And if the banks don’t spend their income it’s the same unspent income problem as with any unspent income.

Unspent income is also known as a demand leakage.

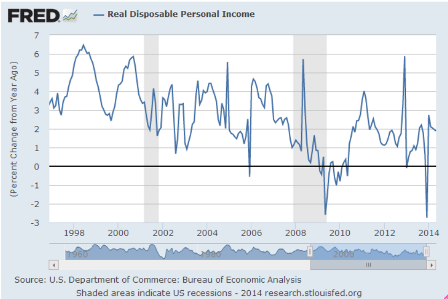

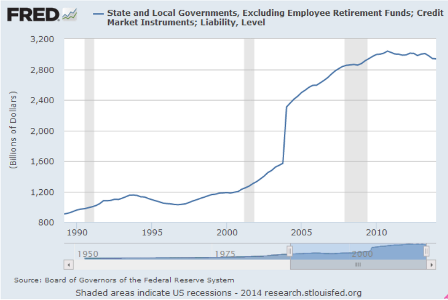

And in the normal course of business, the US has all kinds of demand leakages going on, many due to tax advantages, including pension contributions (and pension fund earnings), additions to IRA’s, insurance reserves, bank reserves, foreign central bank dollar reserves,

etc. etc. etc.

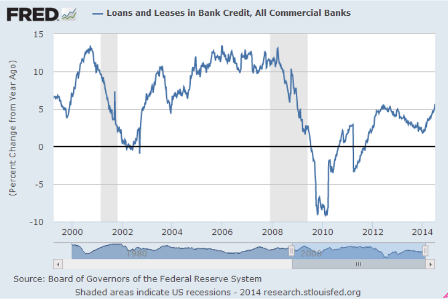

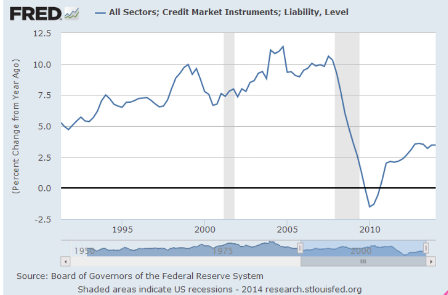

This means that much output won’t get sold unless other agents spend more than their incomes. This includes the US govt spending more than its income (the dreaded deficit), as well as corporations spending more than their earnings, and consumers borrowing to spend more than their incomes.

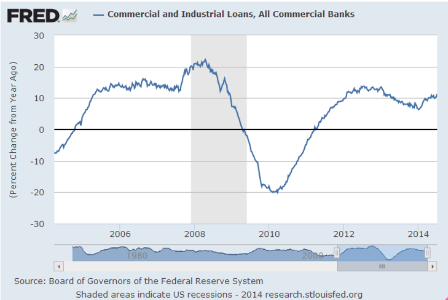

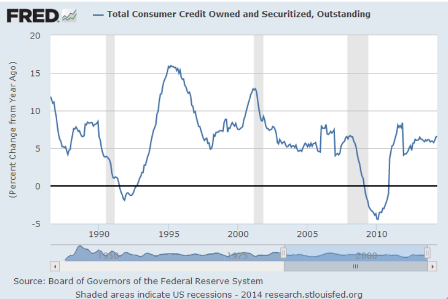

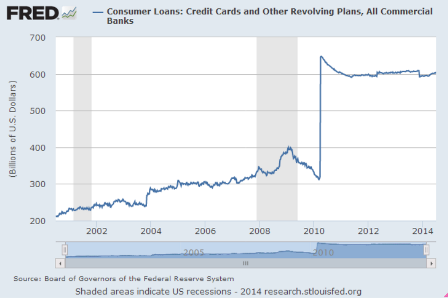

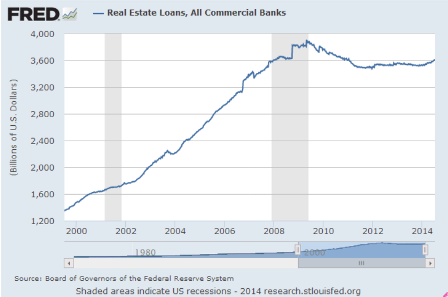

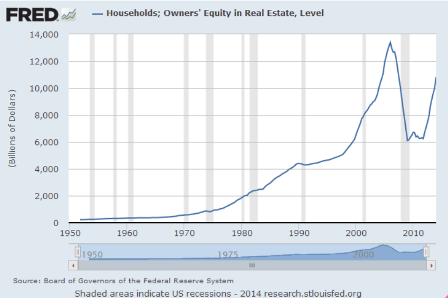

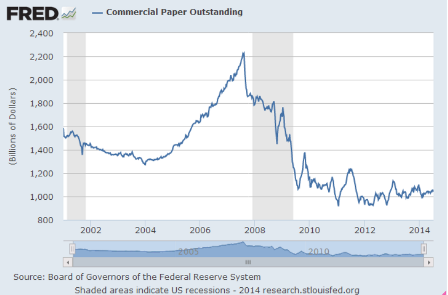

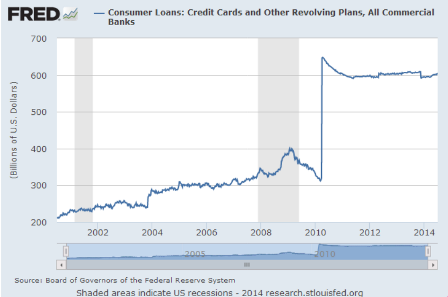

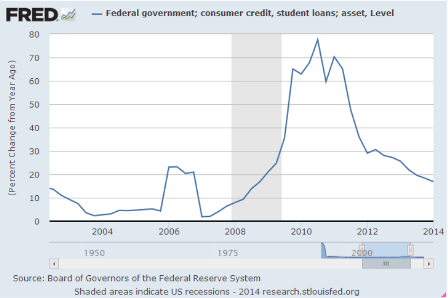

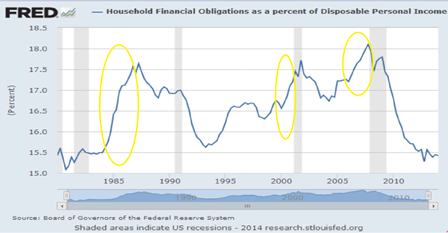

Which is where housing comes in. Historically it’s been the engine of ‘borrowing to spend’ to offset the demand leakages, driving the economy even as the automatic fiscal stabilizers work to bring down the govt’s deficit spending. This includes the borrowing to spend that turned into the sub prime fiasco, the Clinton housing boom that combined with the .com and y2k borrowing to spend, and the $1 trillion+ S and L financing/fraud that drove the Reagan years back when that was a lot of money.

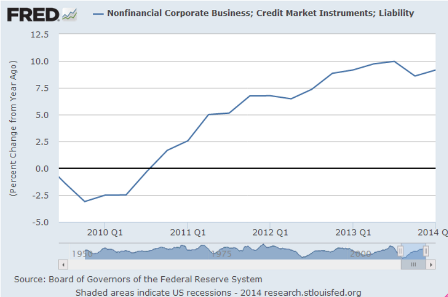

Yes, the business sector can materially borrow to spend to close the output gap. It falls under ‘investment’, including construction, and many would argue it’s the preferred way to go. And this would include new equity issues as well as borrowings ‘further up the credit stack’, as long as it’s ‘borrowing to spend’ on real goods and services- the output- GDP. So yes, there’s some of that going on, which is encouraging, but not nearly enough to overcome the demand leakages they way it did in the late 90’s.

So again, historically, it’s been new housing that has been the prime channel for private sector agents to spend more than their incomes.

Yes, they can spend on other things, but it’s highly problematic for that spending to result in anything near the mortgage debt of prior cycles.

That is, instead of a 200,000 mortgage on a house, the same family would have to borrow 200,000 to spend elsewhere to similarly support the economy/accommodate the savings desires of those wishing to spend less then their incomes. Buying a car does some of that, and maybe a few appliances, or a student loan.

But overall, seems to me that kind of thing can’t ever be enough to ‘close the output gap.’

And with the politicians measuring success by their deficit reduction efforts, the macro constraint of unspent income only gets worse.

So housing matters a lot as it looks to be the only available avenue for the economy to spend more than its income in sufficient quantities to overcome the demand leakages.