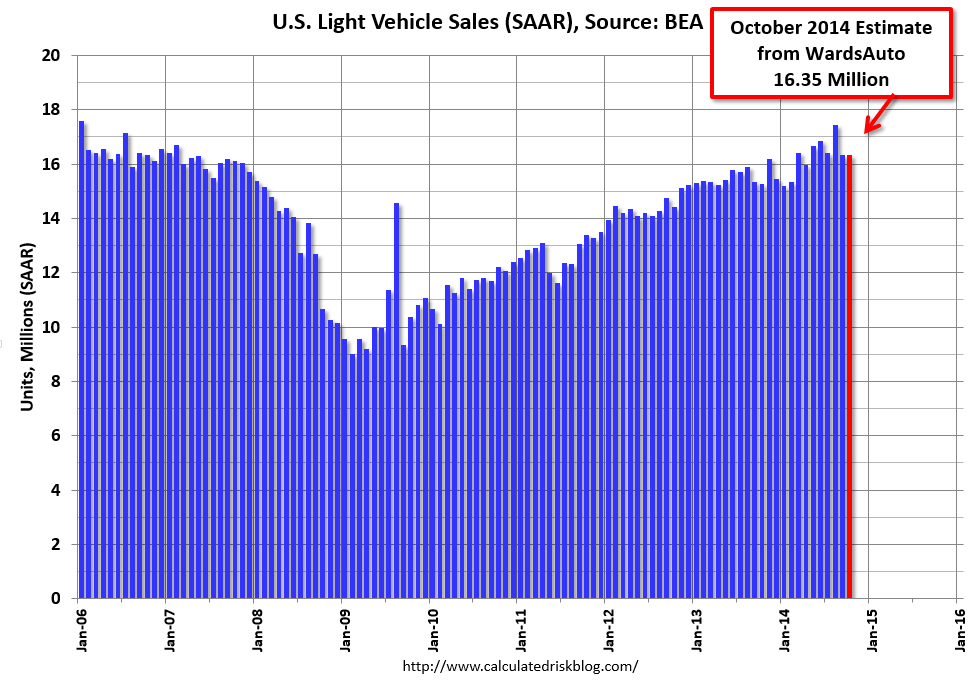

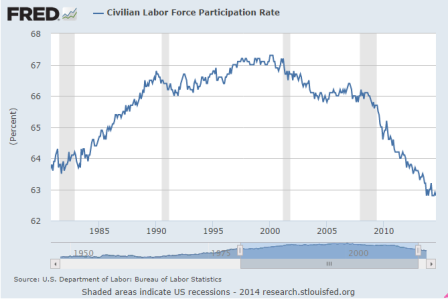

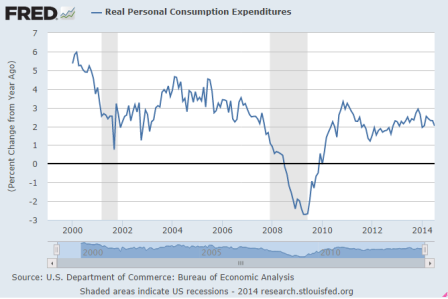

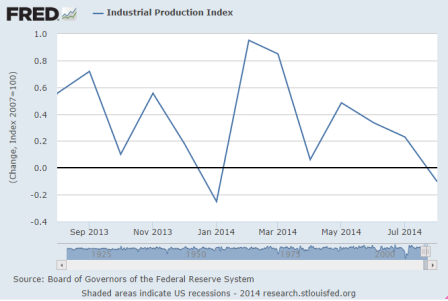

First construction spending was revised down/less than expected which lowered Q3 GDP forecasts, and then car sales were less than expected as well.

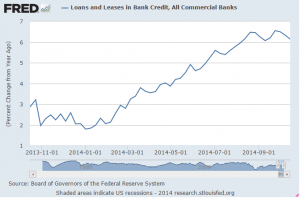

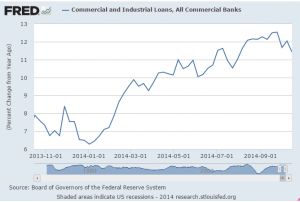

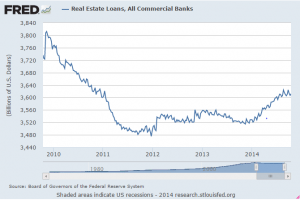

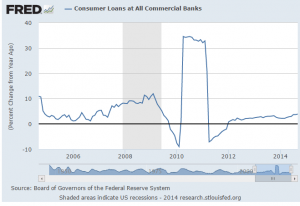

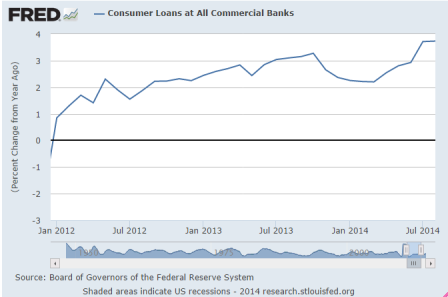

Together they are a large factor in consumer ‘borrowing to spend’ which is necessary to offset the demand leakages- those agents spending less than their incomes.

This doesn’t bode well for Q4, which is already at risk for little or no growth as previously discussed.