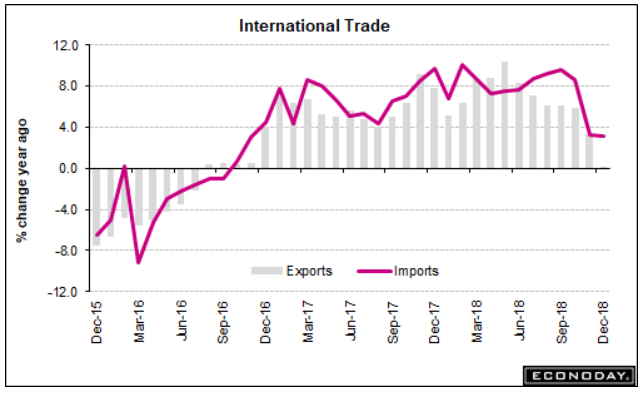

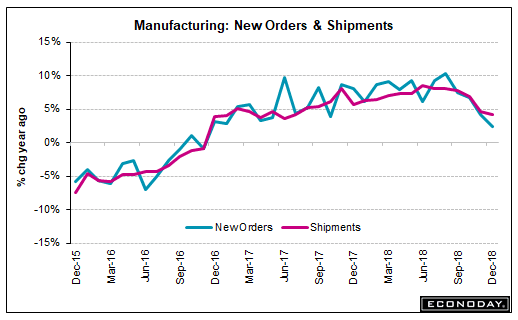

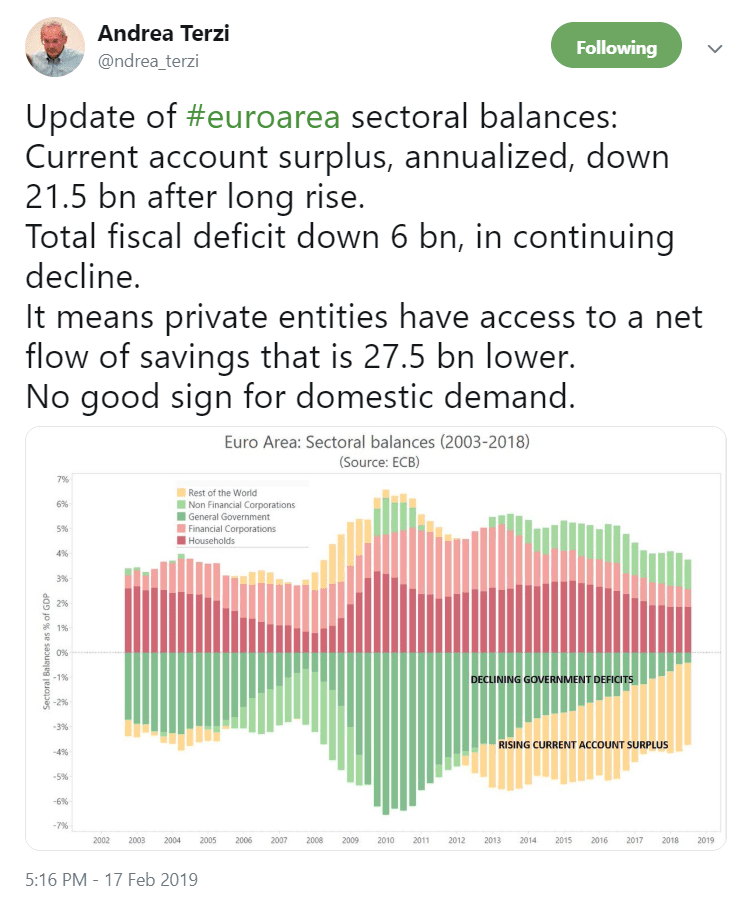

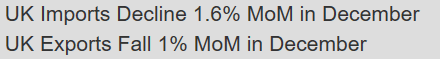

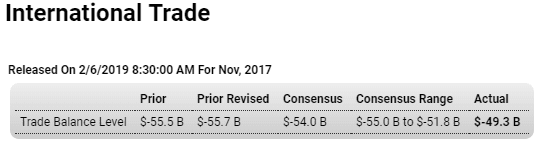

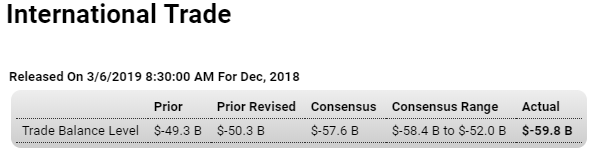

Downward revisions for q4 GDP. And not how both imports and exports are down for the last 6 months or so as global trade decelerates:

Highlights

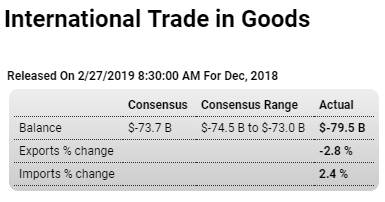

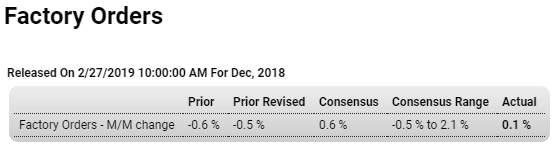

Revision estimates for fourth-quarter GDP will be coming down following an unexpectedly deep $59.8 billion trade deficit in December. Not helping the quarterly deficit are downward revisions to November and October that deepened the net deficit in those two months by $1.6 billion.

The trouble is equally severe on both sides of the report as exports in December fell 2.8 percent to $205.1 billion and imports rose 2.4 percent to $264.9 billion.

Food is the standout negative with imports at a record $12.6 billion in the month and exports, at $9.6 billion, the lowest monthly total since August 2010. This looks like a smoking gun over tariff tensions with China which may well have cut back its U.S. purchases.

The bilateral trade deficit with China for full year 2018 came in at just over $419 billion, which is much deeper than deficits of $375 and $347 billion in the prior two years.

Exports of services failed to help out December, unchanged at a still very strong $69.5 billion with imports of services, however, rising 1.0 percent in the month to $47.7 billion. Turning back to goods trade, vehicles are another major weakness with monthly exports at $12.3 billion for a second month and the lowest since September 2017 with imports of $32.1 billion at a record high.

Today’s headline $59.8 billion deficit is the deepest of the expansion, since October 2008. It is also $1.4 billion beneath Econoday’s consensus range and $2.2 billion deeper than the consensus. Net exports had only been a small drag in last week’s initial estimate for fourth-quarter GDP but today’s report is pointing to a more significant one. One final detail, the nation’s total trade gap in 2018 came to $621.0 billion, 12.4 percent deeper than $552.3 in 2017 and the deepest since 2008.