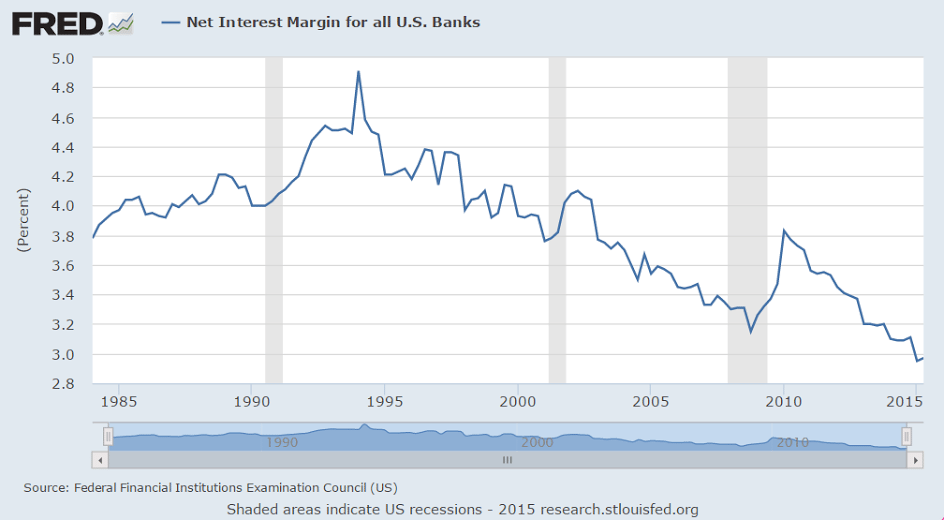

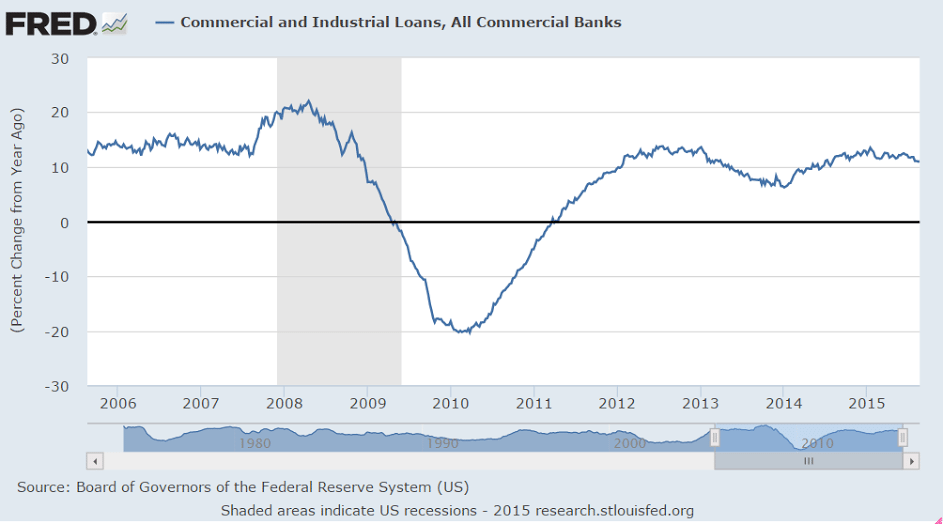

This monetarist stuff doesn’t work:

China removes regulation on loan-to-deposit ratio

Aug 28 (Xinhua) — China’s top legislature on Saturday adopted an amendment to the Law on Commercial Banks, removing a 75-percent loan-to-deposit ratio stipulation. China has kept the 75-percent ratio since the law was enacted and put into effect in 1995. “The ratio was set to prevent overly quick expansion of commercial banks’ credit scale and control liquidity risk, but it has become improper for current needs,” said Shang Fulin, chairman of the China Banking Regulatory Commission. Such an outdated ratio is now hindering the already market-oriented banks to better support the real economy, Shang said.

And this kind of stuff will further slow things down:

Obama

By Carlos Tejada

Aug 30 (WSJ) — China Places Cap on Local Government Debt () Chinese lawmakers have placed a 16-trillion-yuan cap on local government debt. The Standing Committee of China’s National People’s Congress imposed a 600 billion yuan limit on the direct debt local governments are allowed to run up this year. That would be on top of 15.4 trillion yuan on debt owed by local governments as of the end of 2014. The caps don’t include indirect liabilities, which officials said totaled 8.6 trillion yuan. The latest government estimate put China’s local debt load at 17.9 trillion yuan as of the middle of 2013, up from negligible levels just six years before, including debt held indirectly.

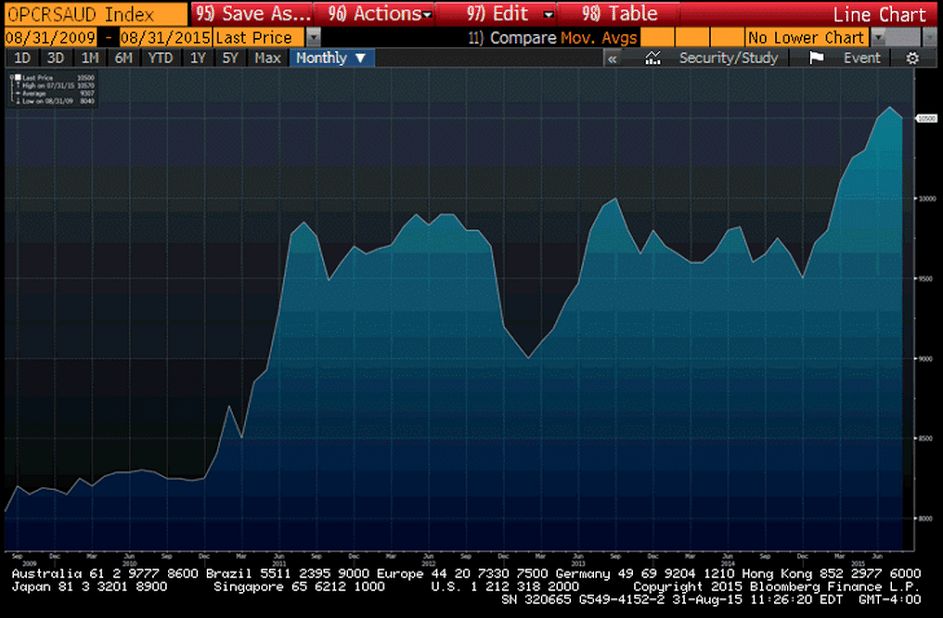

Saudi output fell only a small amount, indicating that demand held reasonably steady at that level at their posted prices, and that they remain comfortably control of price:

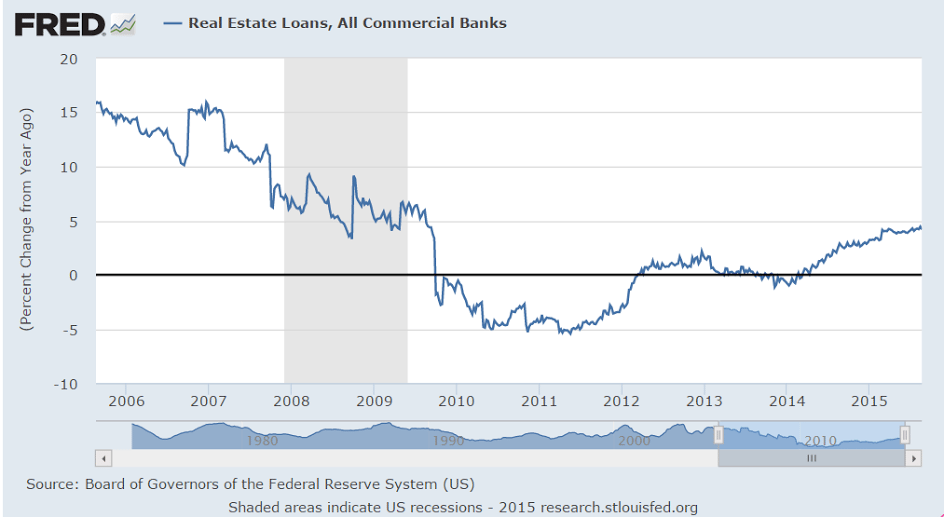

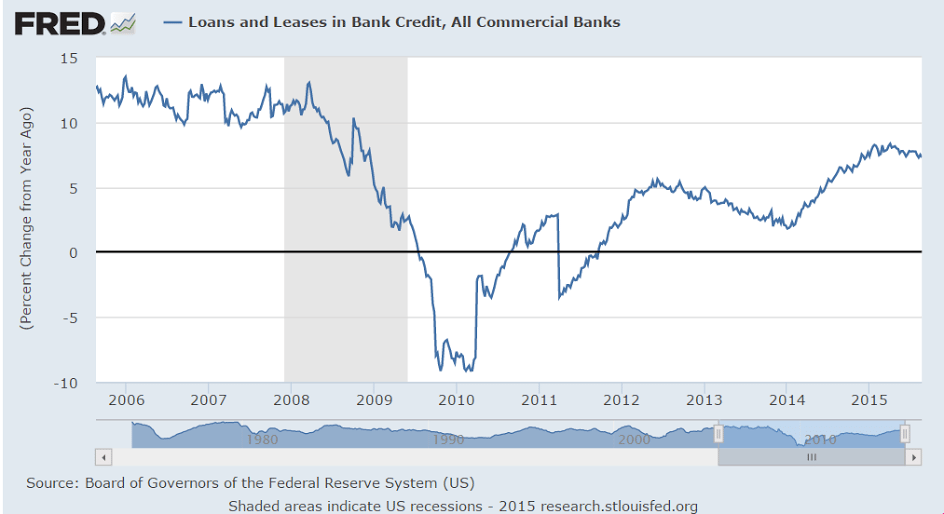

Growth still slowing:

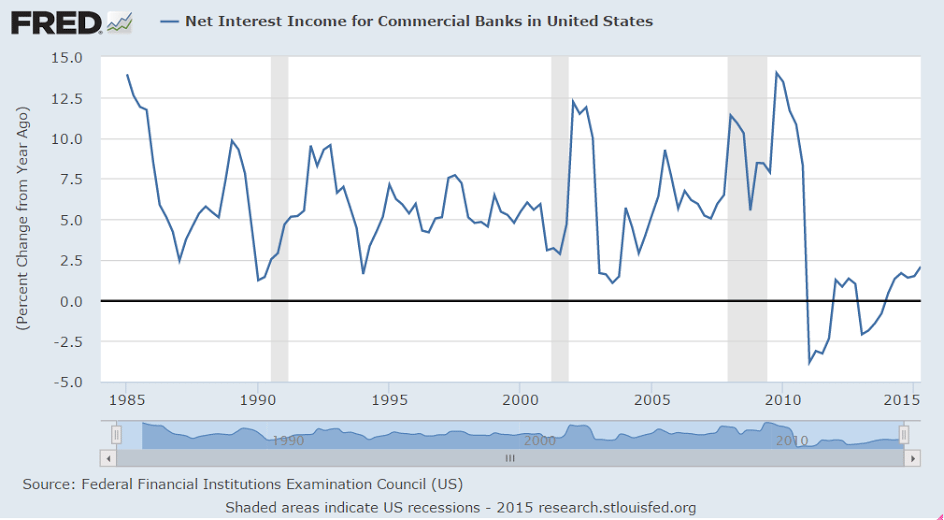

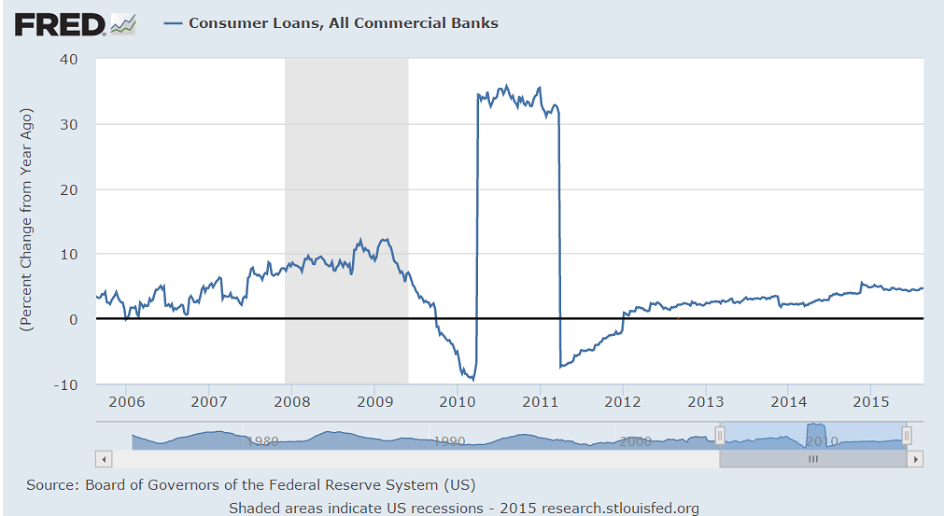

This one’s showing steady growth, though low still very low: