German IFO, GDP & Eurogroup: After last month’s drop to 107.4, MS Research expects the IFO business climate to decline by further 0.4 points to a reading of 107.0 in November. They would expect both business expectations for the next 6 months and current business conditions to have corrected, with the expectations component losing more. The drop in sentiment underscores the fragile nature of the economic recovery and the rising concerns of business leaders about the economic policies likely to be pursued by the Grand Coalition. The PMIs yesterday confirmed that growth in the euro area has stalled in 2H. That said, a surprise shock to the downside will further strengthen case for further ECB measures. We also have the release of Q3 GDP where MS research expects growth to have decelerated materially, with headline growth declining from 0.7%Q to just 0.3%Q. On the policy front, Eurogroup finance ministers will discuss the European Commissions recommendations on the 2014 draft budgets. Market participants are likely to pay close attention to France, Italy and Spain.

Monthly Archives: November 2013

FOMC’s Bullard coming around to what I posted in 2008?

“I think the December 2008 FOMC decision unwittingly committed the U.S. to an extremely long period at the zero lower bound similar to the situation in Japan, with unknown consequences for the macroeconomy,” Bullard said. Pointing to the Bank of Japan’s long struggle against deflation and slow growth, Bullard said he has seen “no evidence” that a faster economic recovery results from quickly lowering interest rates to near zero.

philadelpha fed breakdown

I know, prices paid are up which is the most reliable indicator of a strong economy…

And higher inventory is the best indicator of future sales and deliveries…

And it’s better than the May numbers…

;)

More seriously, the attached graph doesn’t look as bad as the breakdown.

Full size image

Full size image

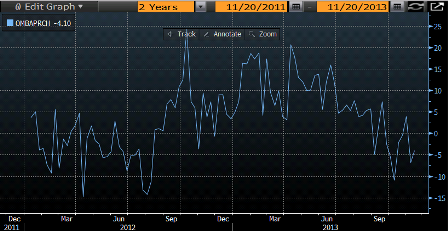

purch apps y/y

Bernanke and Yellen pushing back on higher mortgage rates

Seems to me the Fed is making an all out effort to push back on the higher longer term rates, particularly mortgage rates. However, at least so far those rates remain elevated and at least so far mortgage purchase applications remain down year over year.

Again, seems to me it comes down to the notion that if forward guidance works to firm the economy, rates will move higher/sooner than if it doesn’t work to firm the economy.

This means forward guidance works to bring long rates down only if markets don’t believe it helps the economy.

So what’s a Fed to do to bring long rates down?

Seems to me the only tool left is unconditional guidance or purchasing securities on a price basis, rather than a quantity basis. Which does of course work, to the basis point.

That is, if the Fed announced it had a 2% bid for unlimited quantities of 10 year notes they would not trade higher than 2% while that bid was active. My recollection was that this was done during WWII.

And that we didn’t lose.

;)

fiscal update

No talk yet of waiving the sequesters?

McConnell: Stand Firm on Spending

November 19 (WSJ) — With budget negotiations stalled, Senate Minority Leader Mitch McConnell is pushing his GOP colleagues to resist efforts to ease across-the-board spending cuts due to take effect in mid-January. Mr. McConnell has argued it is better to let the cuts take effect than to agree to a budget deal that would allow overall spending to increase or revenues to rise. House Budget Committee Chairman Paul Ryan, also speaking at the Journal event, said he would continue negotiating with Democrats to reach an agreement but didn’t express optimism. Mr. Ryan, who chairs the conference, said if necessary Republicans would pass a bill to keep the government open and allow the sequester’s new spending cuts to take effect.

Comments on Baker/Bernstein book

Seems there’s new full court press on for full employment by the headline left. And they lifted it directly out of what I’ve been posting and publishing at least since ‘Soft Currency Economics’ written in 1993, with editorial assistance by Art Laffer and Mark McNary. And even earlier Professor Bill Mitchell had been independently writing about and urging what he then called buffer stock employment, which he has continued to promote on his widely read blog as the Job Guarantee. In fact, throughout the later 1990’s we co authored and published numerous times on exactly this topic.

In 1996 with the urging and intellectual support of Professor Paul Davidson, I wrote ‘Full Employment and Price Stability’ that was published in the Journal of Post Keynesian Economics and gives a full outline of the current Baker/Bernstein proposal in full detail, including the debits and credits at the Fed that support it. And, at the same time, a supporting math model was published by Professor Pavlina Tcherneva.

In 1998 Professor Randall Wray, a student of Hyman Minsky and one of our original ‘MMT family’, published ‘Understanding Modern Money’ which again outlined the same proposal, which he called ‘the employer of last resort’ (ELR), a term believed to be first used by Professor Minsky.

In 2010, I published ‘The 7 Deadly Innocent Frauds of Economic Policy’ that again promotes an employed labor buffer stock policy, vs today’s policy of using an unemployed labor buffer stock. By that time I had begun framing it as a ‘transition job’ policy, to facilitate the transition from unemployment to private sector employment, recognizing that employers prefer to hire people already working. And directly to the point of this post, a few years ago I met with Dean Baker for at least two hours in his office, after he had read my book, discussing the fine points of the various proposals. Not to mention the continuous stream of research and publications on full employment and the transition job concept by UMKC Professors Mat Forstater and Stephanie Kelton, Professor Scott Fullwiler, and all the UMCK PhD alumni now teaching and publishing globally. Additionally, Professor Jan Kregel published a similar proposal for the euro zone.

I apologize in advance to everyone I’ve inadvertently omitted who have also worked to advance this proposal over the last 20 years.

So with this context please note the following from the new Baker/Bernstein book:

Page 73:

” The second policy idea is to launch a system of publicly funded jobs that can ramp up and down, expand and contract, as needed, in tandem with the business cycle. Under such a system the federal government, working through local intermediaries, would supply funds to subsidize hiring in the private sector as well as in important community services like education, child care, and recreation.”

Page 81:

“Thus, a transitional jobs program, which could offer extra services to hard to employ populations or simply provide a temporary public or subsidized private job to a long term unemployed person, would be a useful component of a strategy of publicly funded jobs. For the long term unemployed, it will be easier to find a permanent job if theyve already got a temporary one”

The promotional page can be found here.

The full book can be found here.

But don’t bother to read the text. It’s highly flawed and ‘out of paradigm’ throughout, and wouldn’t get anywhere near a passing grade in any UMKC classroom.

The only interesting part and the point of this post is the shameless lack of any attribution whatsoever to any of the above mentioned MMT economists for ideas and language ‘copied and pasted’, so to speak.

I recall the critical outcry when MLK was found out to have plagiarized some paper when he was in school and suspect in this case we’ll see the old double standard at work leaving this stone unturned.

Corporate Results Expose Lack of Confidence

Corporate Results Expose Lack of Confidence

November 18 (WSJ) — Though corporate profits were higher overall, companies slashed their spending on factories, equipment and other performance-enhancing investments by 16% from year-earlier levels, according to an analysis by REL Consultancy for The Wall Street Journal. Almost 90% of the companies that have given financial forecasts for the final quarter of the year have prompted Wall Street analysts to lower their numbers. Only a dozen companies have painted rosier pictures, according to data tracker FactSet. With more than 90% of companies in the S&P 500 index having posted results for the quarter, blended earnings were up 3.5% from a year earlier, and profit remained in record territory, according to FactSet. Profit margins, at 9.6%, were near records, thanks to cost cutting, automation and lower commodity prices. But revenue growth was a tepid 2.9% from a year earlier.

Tweet from Stephanie Kelton (@StephanieKelton)

Housing Market index down a bit

I imagine the Fed is concerned about mortgage rates that have come down some but remain elevated from earlier in the year. About all that’s left is ‘unconditional forward guidance’ which has yet to be considered, at least not in public.

Also, while I was away impersonating an economics professor in Italy ;), where I stated that all the regulations sprouted from Brussels :( and reminding Cliff about the merits of lateral motion (congrats again to Cliff!), and getting past a pink grip on a tennis racket Francis loaned me, several posts were not emailed but can be viewed at www.moslereconomics.com

NAHB Housing Market Index