Violence continues against the government across Egypt

By: David D Kirkpatrick

CAIRO — Deadly violence against the government broke out around Egypt on Monday as health officials raised to 53 the number said to have been killed the day before in clashes between supporters and opponents of the military takeover that ousted President Mohamed Morsi three months ago.

Monthly Archives: October 2013

We’re saved! China Harvard educated Liu He on the job!

Got it-

We’re saved!

China has a Harvard grad on the job!!!

Meet Liu He, Xi Jinping’s Choice to Fix a Faltering Chinese Economy

By Bob Davis and Lingling Wei

October 6 (WSJ) — Liu He, male, is of Han nationality. He was born in 1952, studied at the Renmin University of China, Seton Hall University and Harvard University. Liu He is a famous economist who has focused on macroeconomics, industrial structure, new economic theory and the information industry. Liu has been innovative in his research in these fields since 1987. In recent years, he has published 200 articles, three of which won the National 1st Science Award. One of the three articles was commended by the leaders of the State Council. He has also published 4 monographs, including research on the concepts and practice of Chinese Industry Policy, the rapid increase of the Chinese Economy, enterprise management and developing economic theory. Liu He has participated in several international conferences on behalf of the Chinese Government in the field of economic development, the tendency of macroeconomy, new economy research and enterprise management system research. Currently he is the most influential middle-aged economist in China.

QE is bad for banks

The Fed’s quantitative easing policy per se is nothing but bad for banks.

1. QE forces the member banks to have excess reserves as assets on their balance sheet. These balances earn only .25% lowing the banking system’s net interest margin, return on assets, and return on equity.

2. To maintain high enough average net interest margins (that include the holding of excess reserves) to attract capital, banks tend to charge a bit more for loans to business and consumers, which causes more borrowers to go direct to credit markets and private lenders in general. In other words, QE tends to support disintermediation, as those who can avoid the banks do so.

3. QE lowers interest income paid by govt to the economy, as per the $100 billion of Fed profits turned over to treasury last year. Lower interest income makes the economy that much less credit worthy, thereby lowering its ability to borrow and service bank loans.

Bottom line- QE is a tax on the economy.

And QE is functionally the same as the tsy not having issued the securities in the first place.

However I favor, for example, the tsy not issuing anything longer than 3 mo bills, which is functionally ‘QE max’

Yes, it reduces aggregate demand.

But, for example, I’d rather get my aggregate demand, for a given size govt, from lower taxes than from the tsy or Fed paying interest.

But that’s just me.

;)

AMI report

AMI keeps hitting new lows:

Prof. Joseph Huber from Martin Luther University in Germany gave an outstanding presentation of the New Currency Theory (NCT) which supports monetary reform, and compared this with his analysis of Modern Money Theory (MMT). Professor Huber found that MMT reflects banking doctrine much more than currency teachings, and concluded that to be supportive of monetary reform, any economic theory must break off the shackles of banking doctrine and adopt the new currency teachings for monetary sovereignty.

One of the highlights of the conference was at the gala dinner when Professor Huber was presented with the AMI Advancement of Monetary Science Award for his work. Professor Huber showed his modesty by being genuinely surprised to be given such an award, even though it is thoroughly deserved. Dr. Michael Kumhof and Prof. Kaoru Yamaguchi are the only other persons who have previously received this award.

Fed seems to know QE doesn’t work to help the economy

Seems the A students know it’s just a tax.

That leaves the Fed in a very bad place. They are utilizing a tool, QE, that only works to bring down rates if markets believe it doesn’t actually work to help the economy.

That is, if markets believe QE is good for the economy, they will price in Fed rate hikes that much sooner, keeping mortgage rates high.

And if they think QE is bad for the economy, they will price in lower rates down the road, which brings mortgage rates lower.

So if the Fed wants lower rates, they know that more QE will only bring rates down if markets think it doesn’t help the economy.

Fed’s Bernanke focused on whether bond-buying works, Fisher says

By Ann Saphir

October 4 (Reuters) — The Federal Reserve’s powerful chairman and architect of the U.S. central bank’s massive bond-buying program is serious about questioning its effectiveness, a Fed policymaker known for his opposition to the program said on Thursday.

“The difference I have with my colleagues is the question of efficacy,” Richard Fisher, president of the Dallas Federal Reserve Bank, told a group of CEOs in Little Rock, Arkansas. “To his great credit, Chairman Bernanke has made this the driving point of every discussion: Is this working or is it not working?”

Fisher, repeating comments he made just hours earlier in his hometown of Dallas, said he believes it is not.

The Fed, he said, has done enough, and it is up to Congress to create tax and regulatory certainty so that businesses feel comfortable hiring again.

“I am not alone” at the Fed in doubting the program’s effectiveness, he said.

Gross: the economy is slowing by itself

He’s not always right…

;)

Gross: Don’t run for the hills b/c of the #shutdown or the debt ceiling – Run b/c the economy is slowing by itself.

— PIMCO (@PIMCO) October 3, 2013

Fed–Williams uber dovish

Looks to me like there’s been more push back on rates due to risks to housing, perceived to be the most rate sensitive ‘engine of growth’. I don’t think this Fed wants its legacy to be ‘just when things got going after 5 years of hard work the let rates go up and it all went bad again.’

The problem is that if markets believe these Fed tools do work to support higher rates of growth than otherwise, that means Fed rate hikes will actually be sooner/faster etc. which works to keep rates higher. So seems it’s a bit of a conundrum. The policy designed to keep term rates down can instead work to keep them higher.

And should the stock market ‘crater’, the Fed will likely look to ‘do more’ which could be anything from ‘more of same’- more QE, guidance, tolerances, etc- to outright rate caps, which are the only ‘reliable’ way to set lower term rates.

*FED’S WILLIAMS: AFTER FIRST RATE HIKE, ONLY GRADUAL INCREASES

*WILLIAMS SAYS UNEMPLOYMENT IS TOO HIGH, INFLATION TOO LOW

*FED’S WILLIAMS SEES UNCONVENTIONAL STIMULUS FOR NEXT FEW YEARS

*FED’S WILLIAMS: AFTER FIRST RATE HIKE, ONLY GRADUAL INCREASES

*WILLIAMS HAS SUPPORTED RECORD MONETARY POLICY STIMULUS

*WILLIAMS DOESN’T VOTE ON MONETARY POLICY THIS YEAR

*SAN FRANCISCO FED PRESIDENT JOHN WILLIAMS SPEAKS IN SAN DIEGO

*WILLIAMS SAYS UNEMPLOYMENT IS TOO HIGH, INFLATION TOO LOW

*FED’S WILLIAMS SEES UNCONVENTIONAL STIMULUS FOR NEXT FEW YEARS

How about Congress passes the debt ceiling but not the continuing resolution?

Shutdown- this time it’s very different

The negatives:

Profit growth already low and slowing

Car sales rolled over in September

New home sales already rolled over

Housing starts flattened

Personal income anemic, and distribution issues further softening demand

800,000 federal workers not getting paid

0 rate policy/QE is a deflationary bias

Pro active austerity already initiated

Federal deficit looking too low for financial conditions

Markets/analysts have ignored/ridiculed the paradox of thrift so are ‘long and wrong’

Japan’s currency depreciation works against US and euro domestic demand

Not only no chance of fiscal relaxation if things go bad, but more likely further fiscal tightening.

So it’s thereby worse than flying without a net.

The positives:

Just rhetoric-

Americans are resilient and all that…

feel free to distribute.

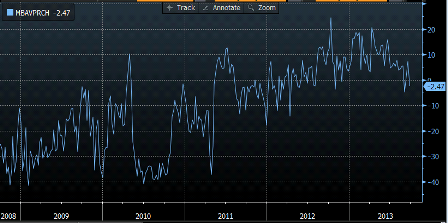

mtg purchase apps

Headed back south before the shutdown…

If Congress doesn’t let up we’re on the way to negative GDP this quarter

Full size image

Y/Y has gone negative!

Full size image