Wall Street’s Brightest Minds Reveal THE MOST IMPORTANT CHARTS IN THE WORLD

By Mathew Boesler

Monthly Archives: October 2013

mtg purch apps

Construction Spending

Construction spending Y/Y up but volatile and not yet anything to get excited about:

Full size image

Redbook

While of limited value, this particular indicator not doing so well.

Weekly Redbook Y/Y:

Full size image

July payrolls revised down to 89,000

July was first initially released at up 162,000 which, while lower than expected, I noted was still inconsistent with low top line growth. That is, without top line growth there aren’t any new private sector jobs unless productivity is negative. And causation runs from sales to employment.

So there’s no reason to expect job growth without top line growth that exceeds underlying productivity increases.

Also, the conventional wisdom all year has been that when govt ‘gets out of the way’ the ‘underlying private sector strength’ will come through and growth will resume. It was noted that reduced job totals were lowered by govt cutbacks while private jobs remained high. I suggested govt employment cutbacks would reduce private sector job growth, as that many fewer govt employees meant that much less spending/sales/employment for the private sector.

Conclusion-

With fiscal support down to less than 3% of GDP from around 7% about a year ago, and at least 1.5% of that from the recent proactive tax hikes and spending cuts, and the automatic fiscal stabilizers as aggressive as they are, and with ‘financial conditions’ as they are, I don’t see any signs of the domestic credit expansion needed to support anything more than

very modest levels of real growth. And I also continue to see substantial risk of negative growth should the housing softness persist, auto sales revert back to the 15 million level, student loan growth continue to decelerate, business investment not accelerate, and net imports not do a lot.

Lower fuel prices are a plus but not yet nearly enough overcome the fiscal hurdles.

(feel free to distribute)

Employment Situation

Released On 10/22/2013 8:30:00 AM For Sep, 2013

Highlights

The payroll data and household numbers were mixed in September at the headline level but soft in detail. Markets were looking over their collective shoulder at the Fed. Total payroll jobs in September advanced 148,000, following a revised increase of 193,000 for August (originally up 169,000) and after a revised gain of 89,000 for July (previous estimate was 104,000). The consensus forecast was for a 184,000 gain for the latest month. The net revisions for July and August were up 9,000.

The unemployment rate slipped to 7.2 percent after dipping to 7.3 percent in August. Analysts expected a 7.3 percent unemployment rate. But the improvement was largely related to a decline in the pool of available workers, affecting the number of unemployed.

Turning back to payroll data, growth in recent months has been on a slowing trend. Private payrolls gained 126,000, following an increase of 161,000 in August (originally 152,000). The median forecast was for a 184,000 rise.

Wage growth eased in September, rising only 0.1 percent for average hourly earnings, following 0.2 percent the month before. Expectations were for a 0.2 percent gain. The average workweek held steady at 34.5 hours, matching the consensus projection

NFP:

Full size image

Private NFP:

Full size image

Y/Y growth in household labor force survey:

Full size image

C and I bank loans and commercial paper

So I see the reports of C and I loans going up about $20 billion but nothing on commercial paper dropping about $30 billion?

I still don’t see the domestic credit driven ‘borrowing to spend’ stepping up to replace the proactive govt cuts.

C and I loans:

Full size image

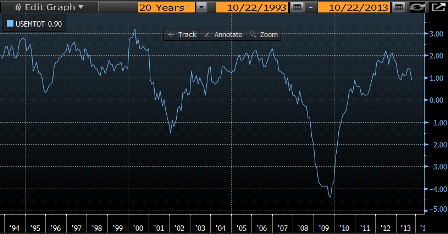

Commercial paper:

Full size image

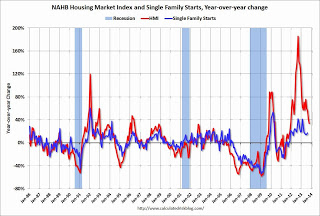

builder confidence vs single family starts, year over year change

Zillow: Home Value Appreciation slows in Q3

Feeling like we have a bit of a hole to dig out of from the rate spike and shutdown

Zillow: Home Value Appreciation slows in Q3

Euro up to 137 vs $

The last thing they want is the euro to get strong and eat into their fledgling trade surplus and, in general, do its deflationary thing.

But what can they do? Discourage Japan and the rest from buying their member nation’s debt? Not.

Buy $, yen, etc? No- ideologically impossible. Gives the appearance that fx reserves are backing the euro, etc.

That leaves ‘monetary easing’ of some sort that doesn’t directly work, but hopes to scare investors out of euro.

Ted’s Dad’s sermon

No relation to former Senator Ted Kennedy…

Cruz’ Father Suggests Ted Cruz Is “Anointed” to Bring About The “End Time Transfer of Wealth”

“In a sermon last year at an Irving, Texas, megachurch that helped elect Ted Cruz to the United States Senate, Cruz’ father Rafael Cruz indicated that his son was among the evangelical Christians who are anointed as “kings” to take control of all sectors of society, an agenda commonly referred to as the “Seven Mountains” mandate, and “bring the spoils of war to the priests”, thus helping to bring about a prophesied “great transfer of wealth”, from the “wicked” to righteous gentile believers.”