The drop in housing starts may be keeping the rental market tight, as about a 80,000 fewer new units are being built each month.

U.S. Apartment Vacancy Unchanged at 5.9 Percent, Rents Increase

(Bloomberg) The vacancy rate for U.S. rental apartment buildings was unchanged at 5.9 percent in the second quarter as the housing slump and a weakening economy deterred people from buying homes, Reis Inc. reported.

The average monthly U.S. asking rent rose 1 percent to $1,047, the 25th consecutive quarter that rents increased or stayed the same, according to Reis, a New York-based research firm.

Home prices in 20 U.S. metropolitan areas declined in April by the most on record and new home sales fell 40 percent in May from a year ago. The slumping housing market means apartment rents should remain steady even as gasoline prices rise and U.S. companies cut jobs, Sam Chandan, chief economist for Reis, said in an interview. Payrolls fell by 62,000 in June and 438,000 in the first half, the Labor Department said July 3.

“Our projection is rent growth will moderate through 2009, but we don’t think it will turn negative as it did in the early 2000s,” Chandan said. “The bias will be weighted toward rental, in our view. People fear home prices will fall further.”

The last time U.S. rents fell was the first quarter of 2002, when they declined by 0.2 percent, according to Reis.

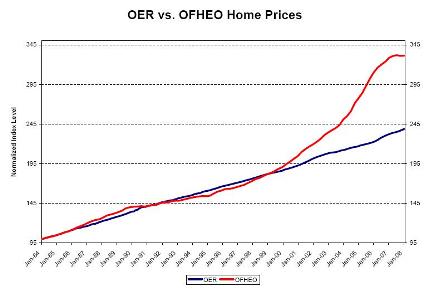

The five-year housing boom that ended in 2006 attracted investment to homebuilding, so fewer apartment buildings were constructed, Chandan said.

“There has been very little apartment development because all the money was made in housing development,” he said. “We don’t have a strong pipeline of apartments.”

San Francisco

San Francisco asking rents grew the most in the second quarter from the previous 12 months, increasing 9.4 percent. New York gained 7.7 percent, Seattle rose 7.4 percent, San Jose, California increased 7.3 percent and Salt Lake City increased 6.1 percent, according to Reis.

New York had the highest average U.S. rent at $2,847 a month, followed by San Francisco at $1,825, Fairfield County, Connecticut at $1,757, Boston at $1,646 and Long Island, New York at $1,521, Reis said.

Orange County, California, ranked sixth at $1,520, followed by San Jose at $1,504, Northern New Jersey at $1,460, Ventura County, California at $1,409 and Los Angeles at $1,408, according to Reis.

New York had the lowest vacancy rate at 2.2 percent, followed by Long Island at 2.9 percent, Central New Jersey at 3 percent, San Jose at 3.2 percent and New Haven, Connecticut at 3.3 percent, Northern New Jersey at 3.5 percent, Syracuse, New York at 3.6 percent, San Diego and San Francisco at 3.8 percent and Minneapolis at 3.0 percent, Reis said.