Maybe go visit for Thanksgiving?

;)

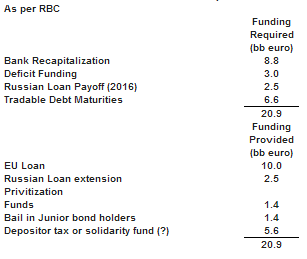

In line with prior info.

Also, Europe is entirely dependent on Russia for a large chunk of its gas and some oil as well.

They made Russia promise and cross their hearts never to cut it off, but they could jack up the price to cover Cyprus…

Karim writes:

The single most important economic indicator in Europe was released today, the Composite PMI.

For March, it was expected to increase to 48.2 from 47.5; it fell to 46.5, the lowest level since November.

In the U.S.:

So, latest NowCasting forecasts:

Europe: Q1 -0.8% and Q2 revised from +0.1% to -1.05% after todays data

U.S.: Q1 +2.6% and Q2 revised from 2.8% to 3.4% over the past week (they will not account for sequester hit as forecast simply based on incoming data flow).

Euro PMI (white) vs U.S. ISM Mfg (orange) and Services (yellow): link

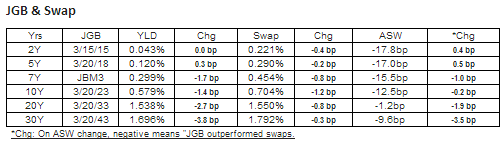

Debt to GDP over 200%

0 rates for decades

Strong currency

Alarmingly low term structure of rates

Recent yen weakness looking ‘fundamental’ as trade goes negative maybe until nukes are restarted and ‘replacement’ gas and oil imports go back to where they were.

Trade going negative after initial yen weakening due to ‘j curve’ effect where initially actual quantities of imports stay pretty much the same but prices are higher. Only some time later do quantities respond to the higher price.

Warning- a weakening economy will make their deficit go up!

;)

German Manufacturing Output Surprisingly Contracted in March

By Zoe Schneeweiss

March 21 (Bloomberg) — A German index based on a survey of purchasing managers in the manufacturing industry declined to 48.9 this month from 50.3 in February, while a services gauge fell to 51.6 from 54.7, London-based Markit Economics said in an e-mailed report today. A reading below 50 indicates contraction. Economists had forecast a reading of 50.5 for the manufacturing index and 55.0 for the services gauge, according to the median estimates in Bloomberg News surveys.