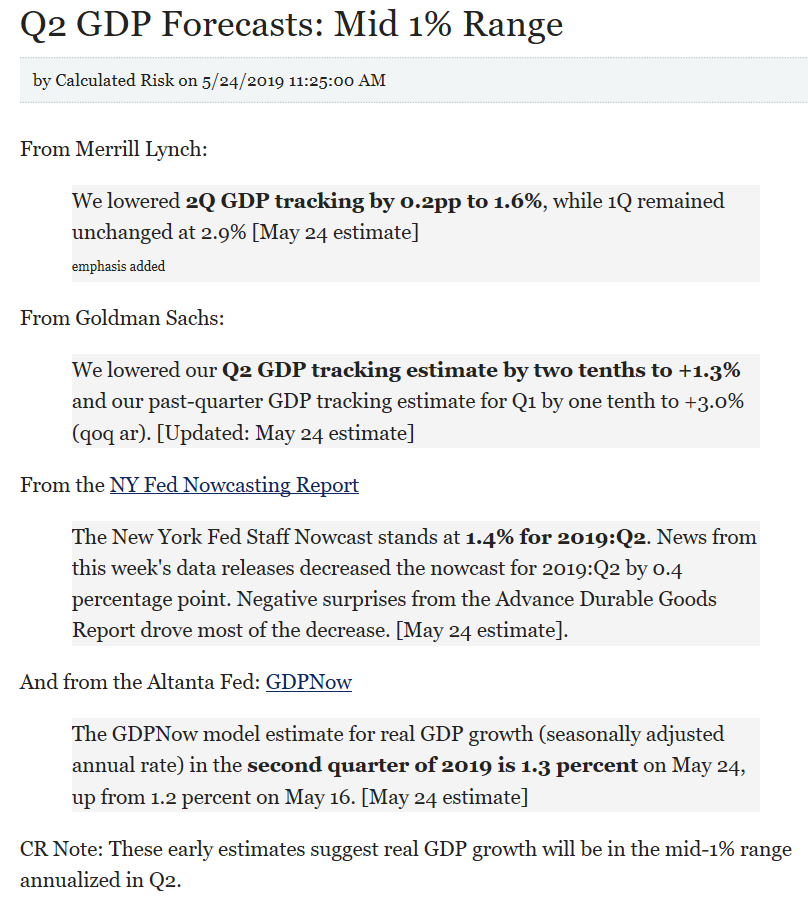

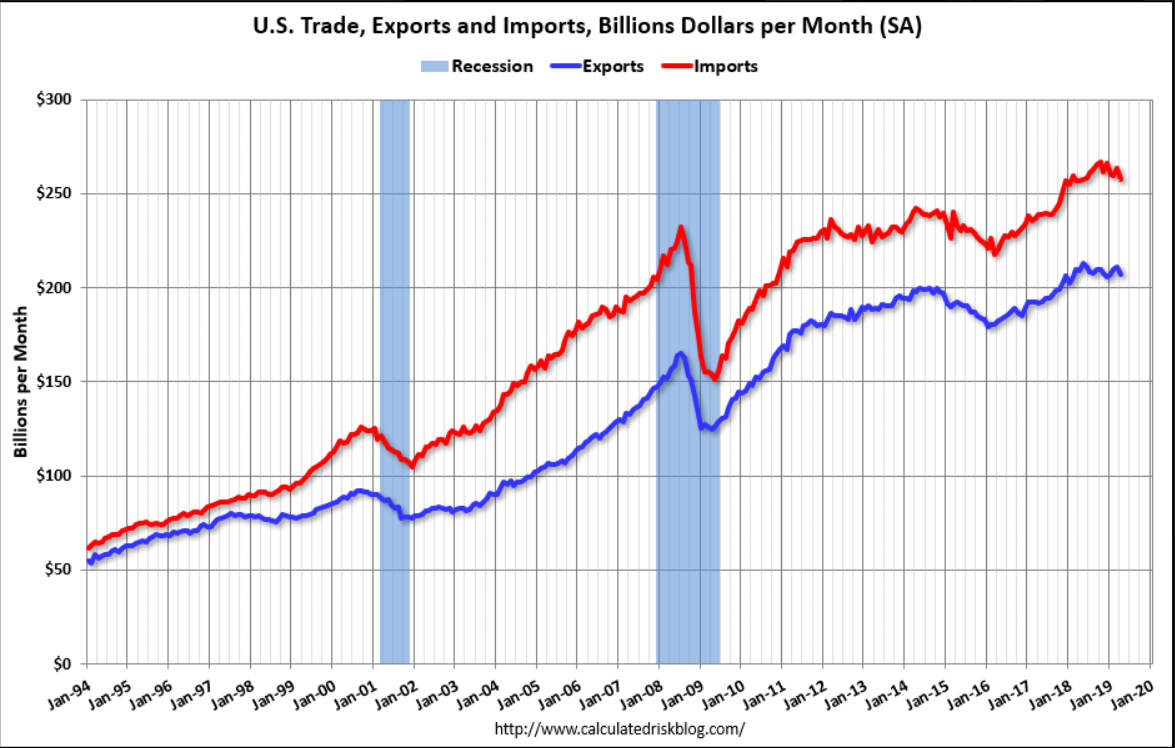

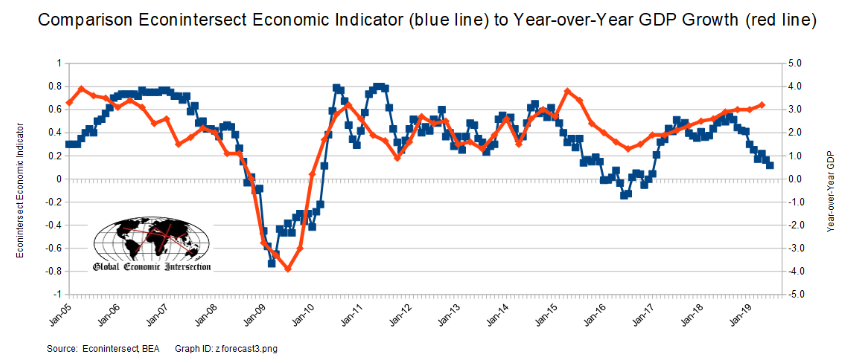

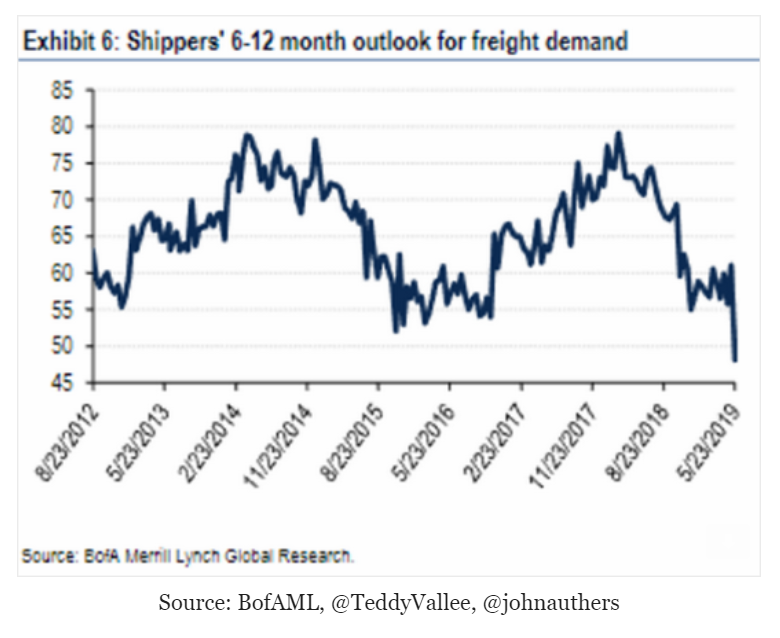

Imports and exports both decelerating:

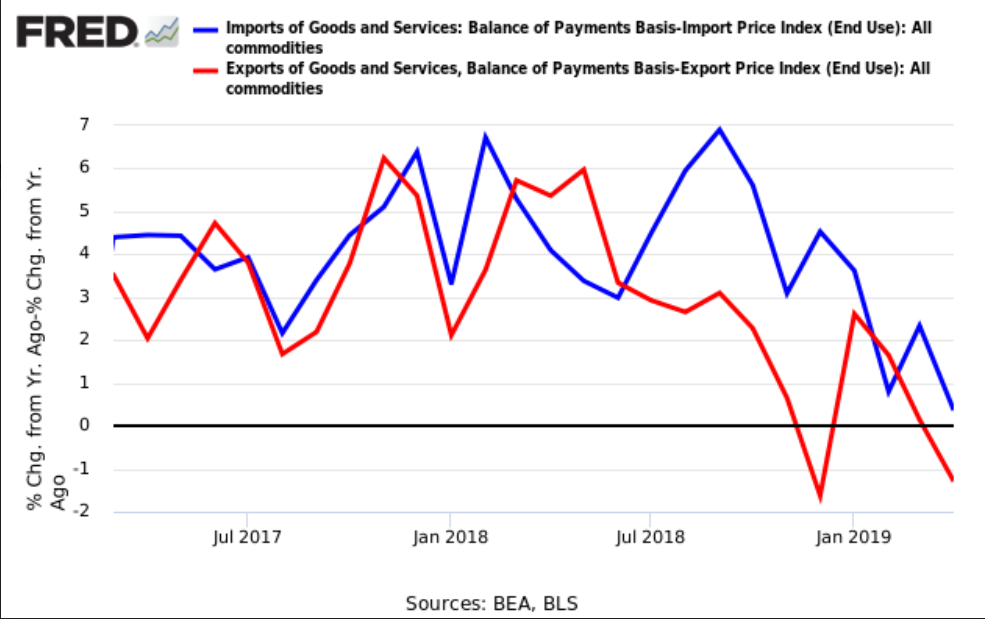

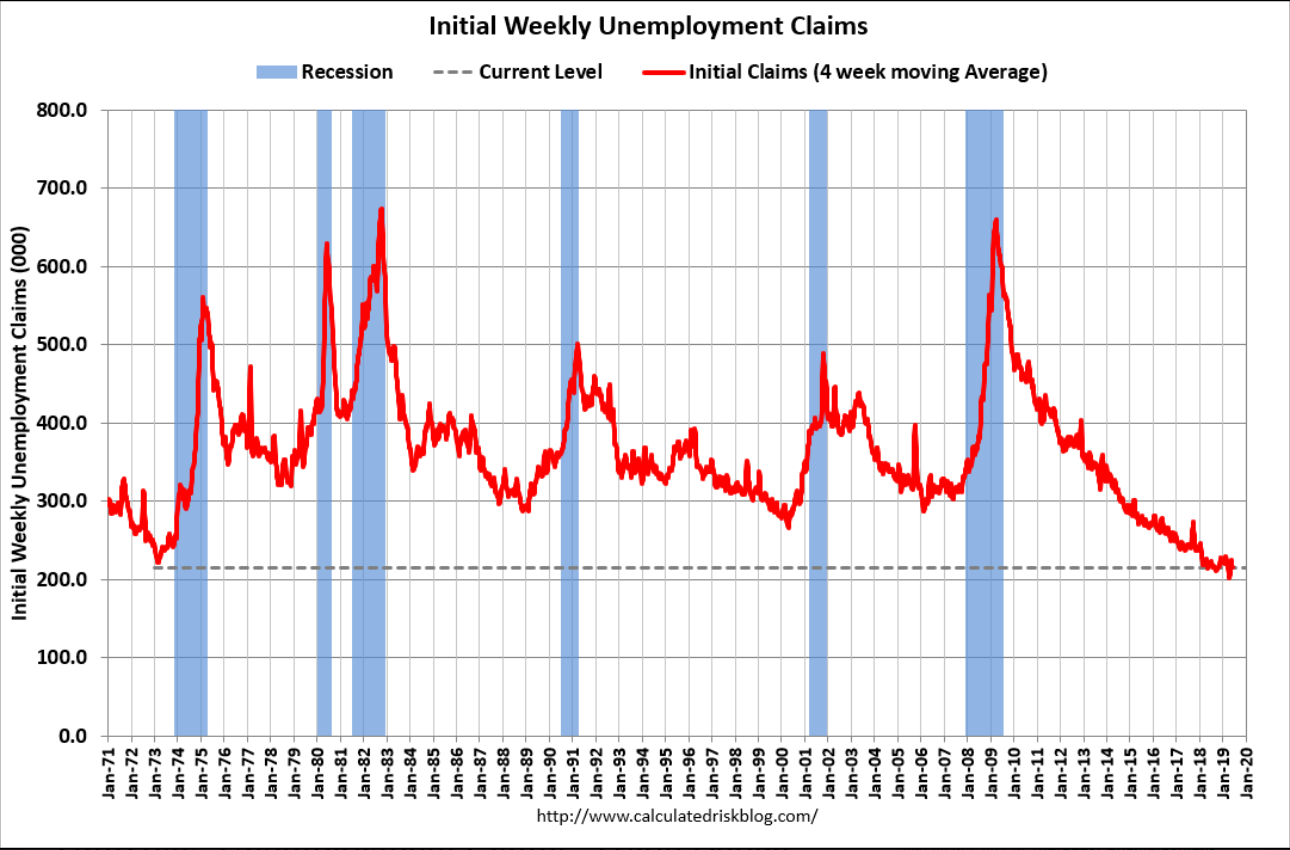

Still in contraction:

Trump says ‘devalued’ currencies put US at a disadvantage and the Fed doesn’t have a ‘clue’

President Donald Trump said Tuesday the U.S. dollar is at a disadvantage compared to other major currencies like the euro as other central banks keep interest rates low while the Federal Reserve’s rates are higher by comparison.

“The Euro and other currencies are devalued against the dollar, putting the U.S. at a big disadvantage,” Trump tweeted, adding the Fed doesn’t have “a clue.”

Trump also said in a separate tweet the U.S. has low inflation, calling it “a beautiful thing.”

Seems the President like tariffs because they are very profitable for the Treasury:

“We can always go back to our previous, very profitable position on tariffs — but I don’t believe that will be necessary,” the president said in a Twitter post Sunday.

The deal to avert tariffs that President Trump announced Friday with great fanfare consists largely of actions that Mexico had already promised to take, officials from both countries said.

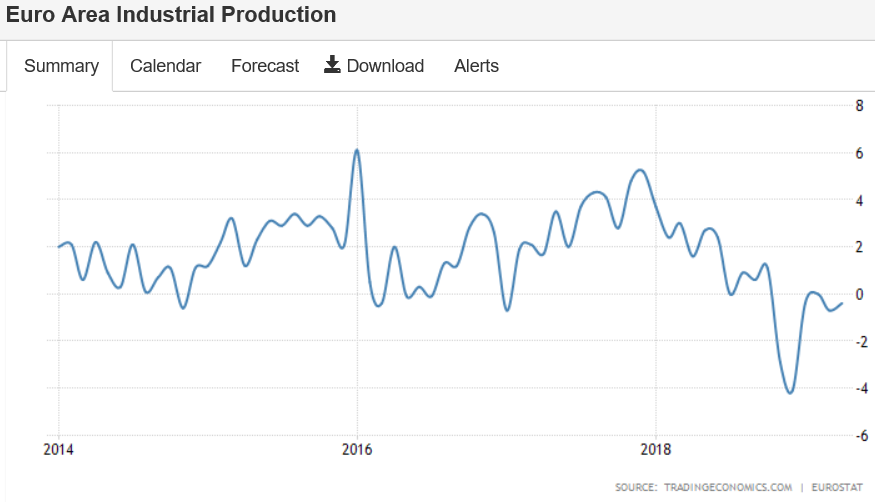

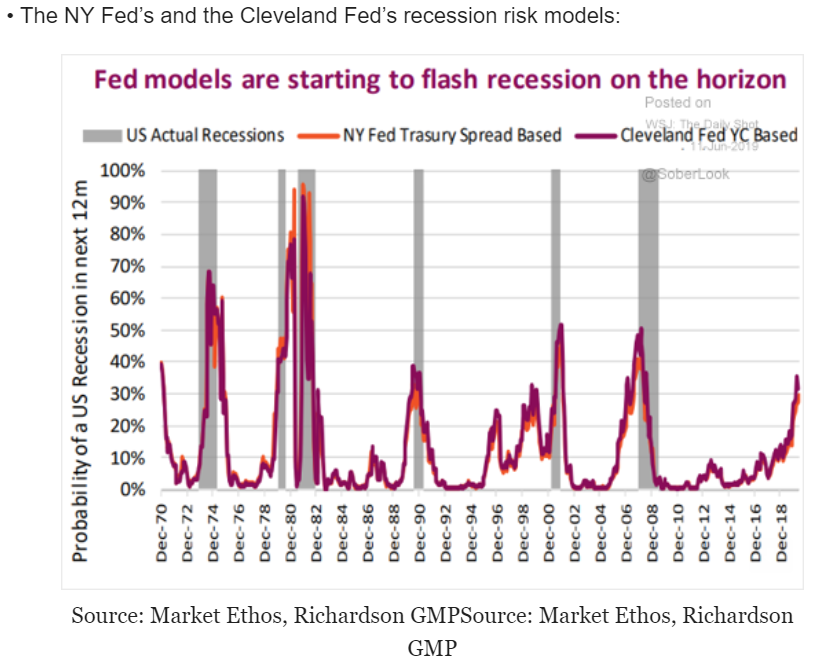

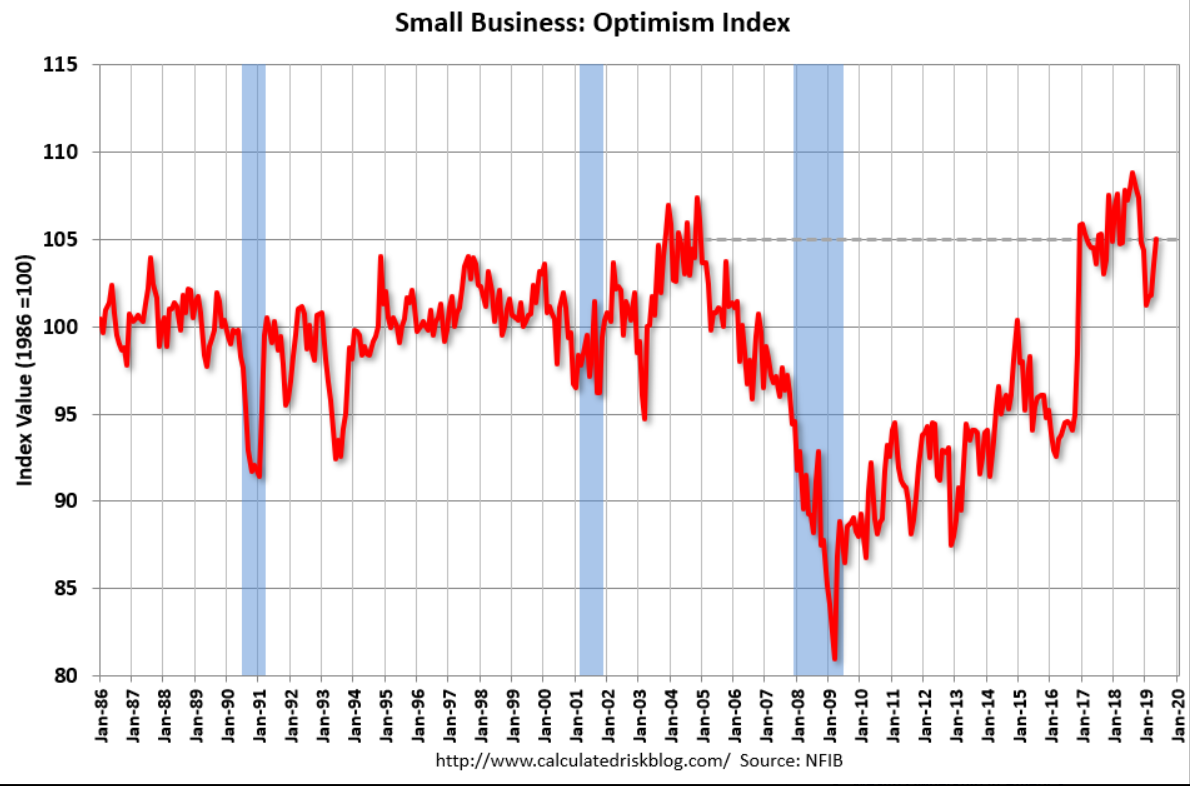

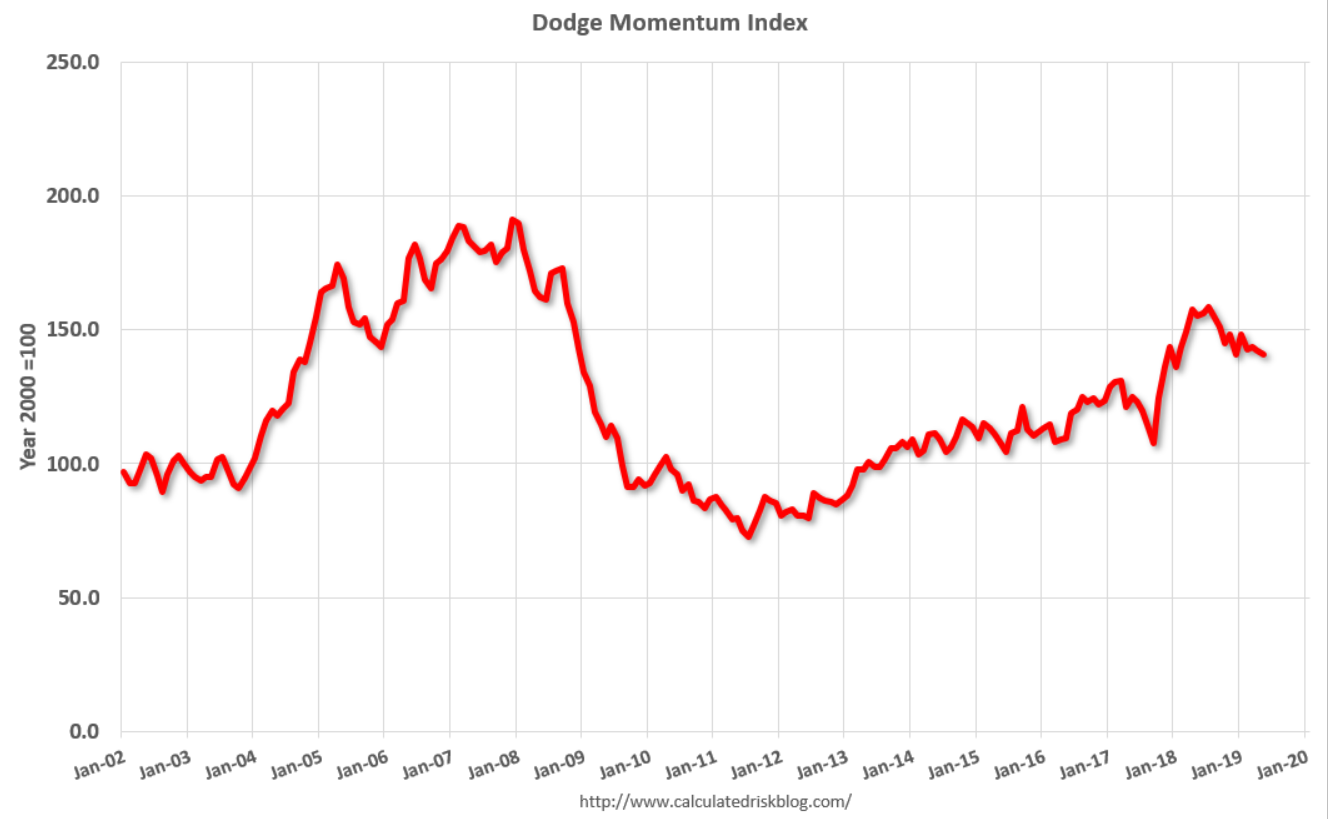

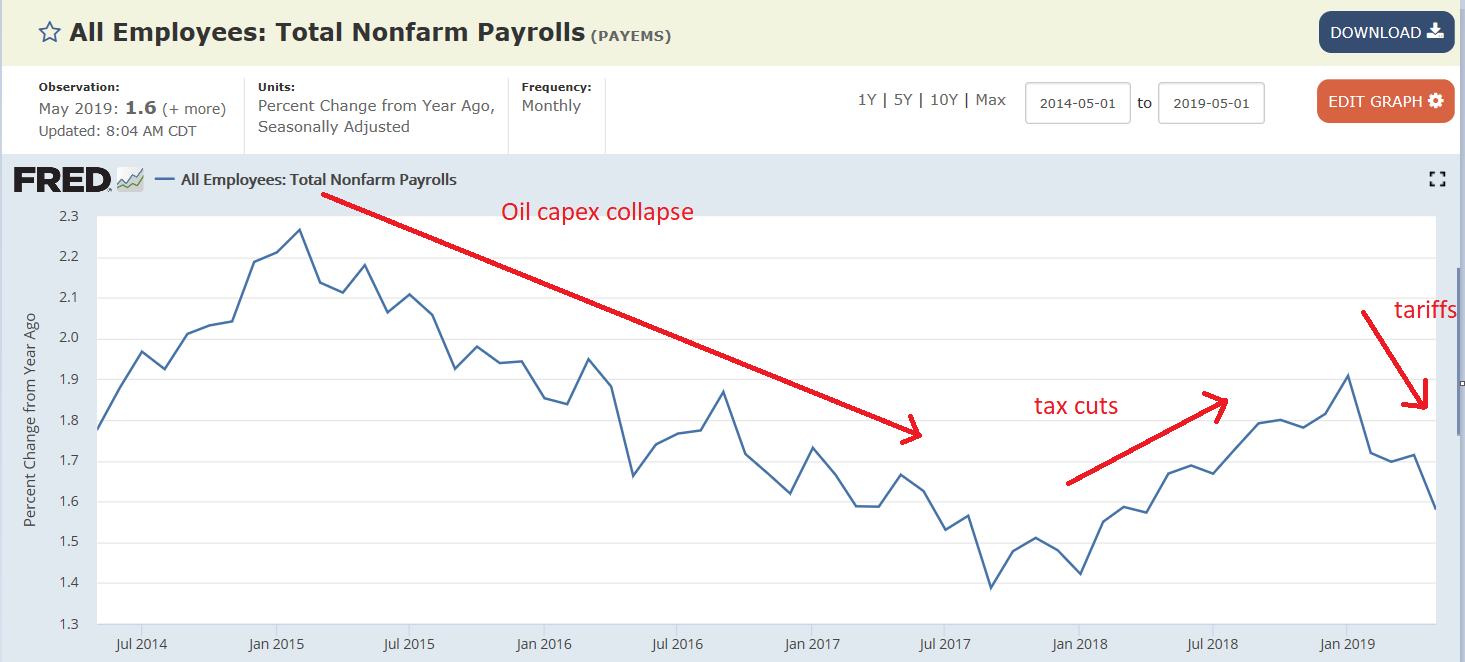

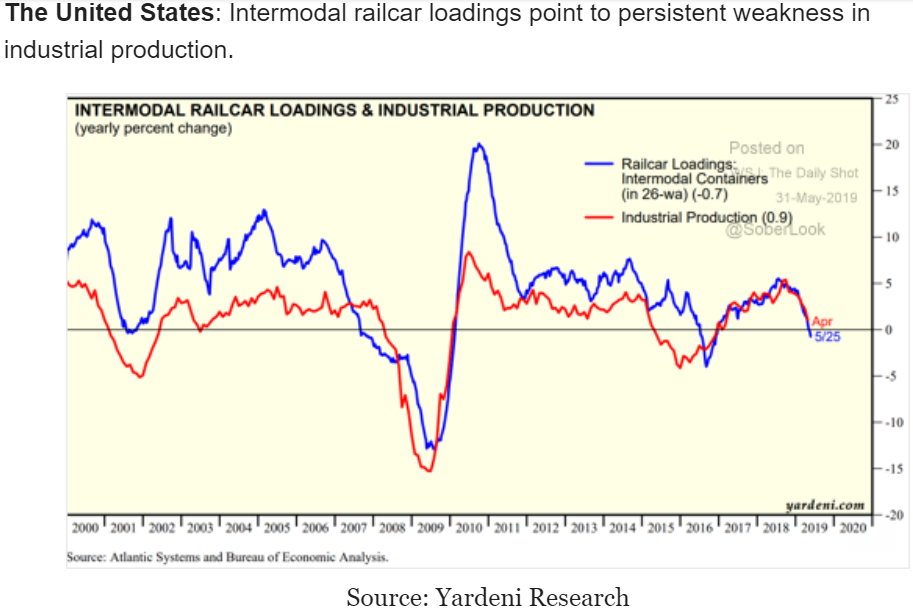

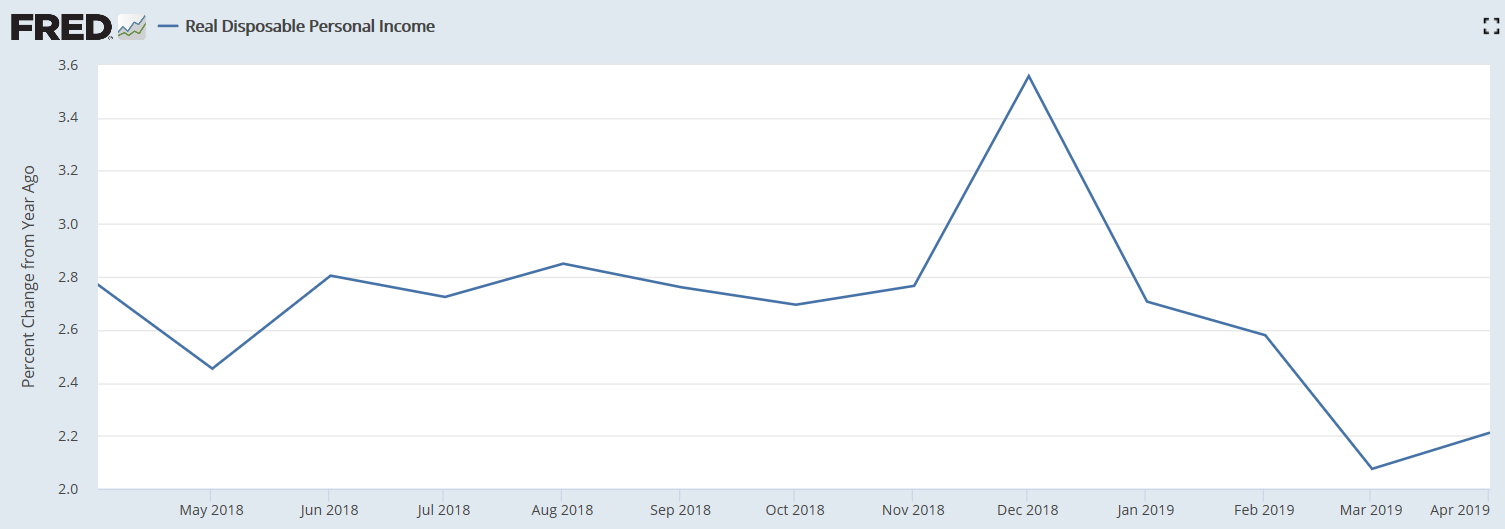

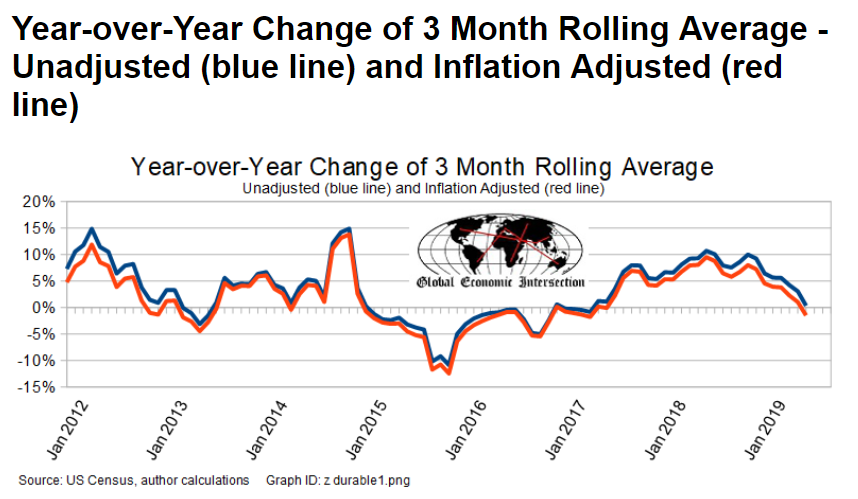

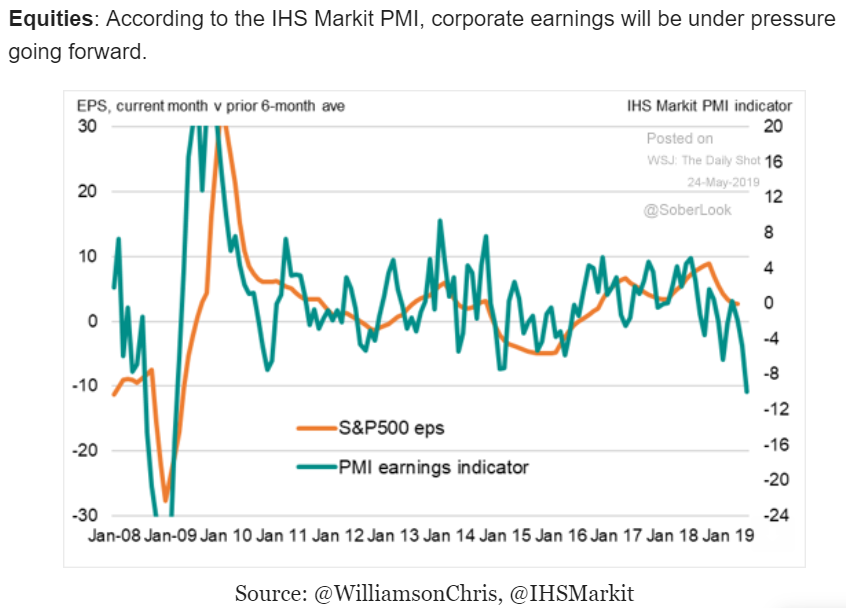

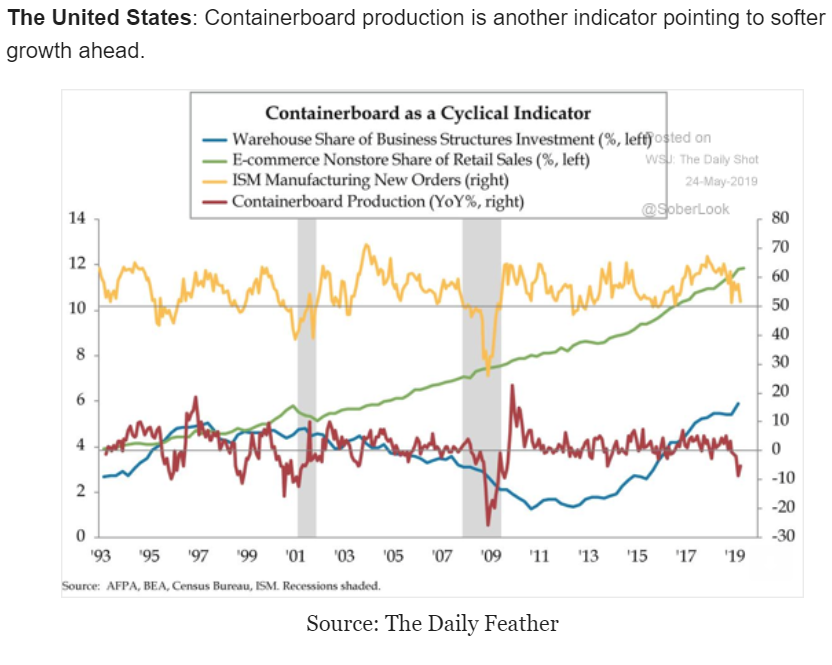

Now even the lagging indicators are pointing south. And lower rates from the Fed will only make it a bit worse by cutting gov. interest payments to the economy:

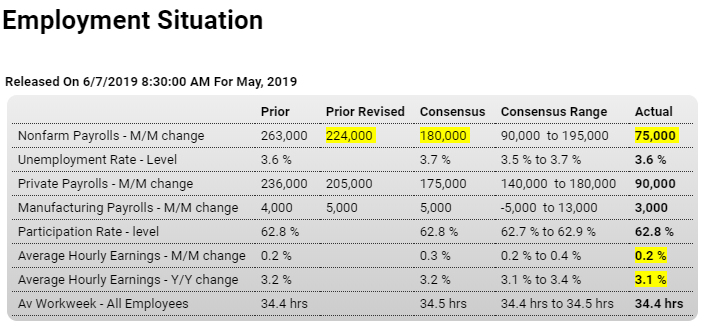

Highlights

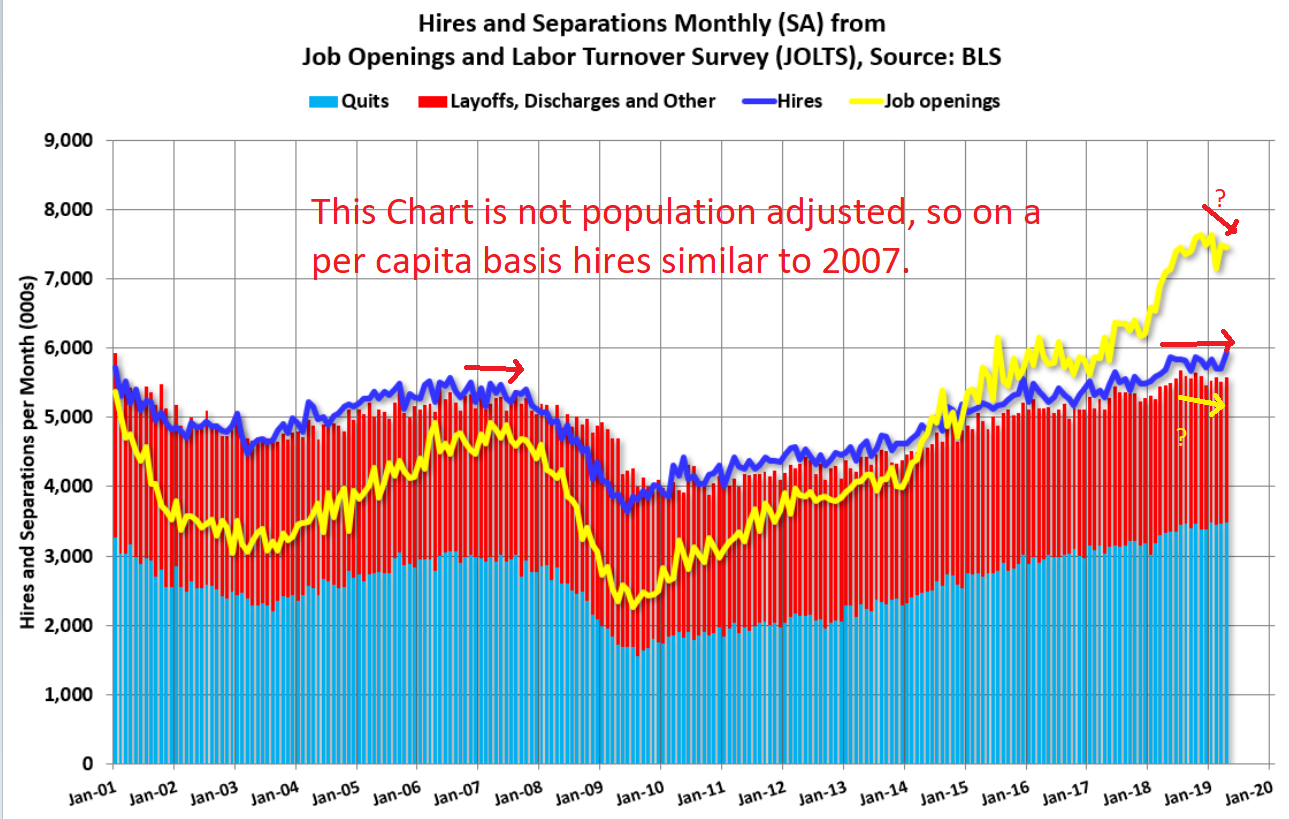

Move up the rate-cut plans is the theme of the May employment report which shows declining growth in the labor market and topping pressure for wages. Nonfarm payrolls, at 75,000, came in below Econoday’s consensus range and include a total of 75,000 in downward revisions to April and March.

Data on wage inflation are at the bottom of the consensus ranges — only a 0.2 percent monthly increase for average hourly earnings and, in the lowest reading since last September, a slumping 3.1 percent gain for the year-on-year rate.

The unemployment rate remains very low, unchanged at a lower-than-expected 3.6 percent with the pool of available workers low and holding steady at 10.9 million. Subdued wage gains won’t help to pull up the participation rate which is also unchanged at 62.8 percent.

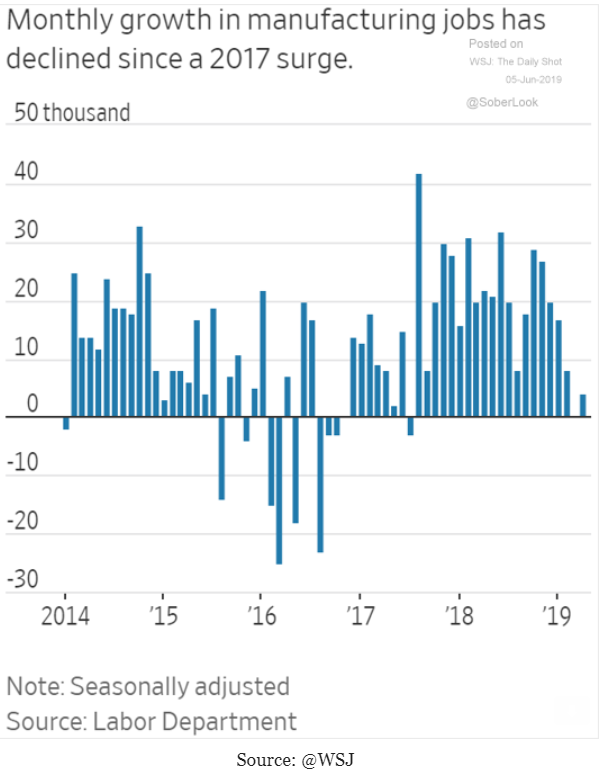

And subdued gains show themselves in the payroll breakdown headlined by a soft 3,000 rise for manufacturing. Construction payrolls rose only 4,000 which contrasts sharply with 30,000 and 15,000 gains in the prior two months while government payrolls, after April’s 19,000 jump, fell 15,000 in today’s report. Retail, where traditional stores keep closing, extended its long stretch of declines with an 8,000 payroll contraction. Yet professional business services continue to post increases, up a solid 33,000 to suggest that businesses, trying to meet demand and having difficulty finding the right people, are turning to contractors to fill slots.

For the Federal Reserve, open talk of a near-term rate cut is likely to pick up force at the mid-month FOMC. Against a backdrop of soft inflation, stalling employment growth at a time of trade risks and also Brexit risks point to the need, at least for the doves, for policy insurance.

Trump’s Tariffs Have Already Wiped Out Tax Bill Savings for Average Americans

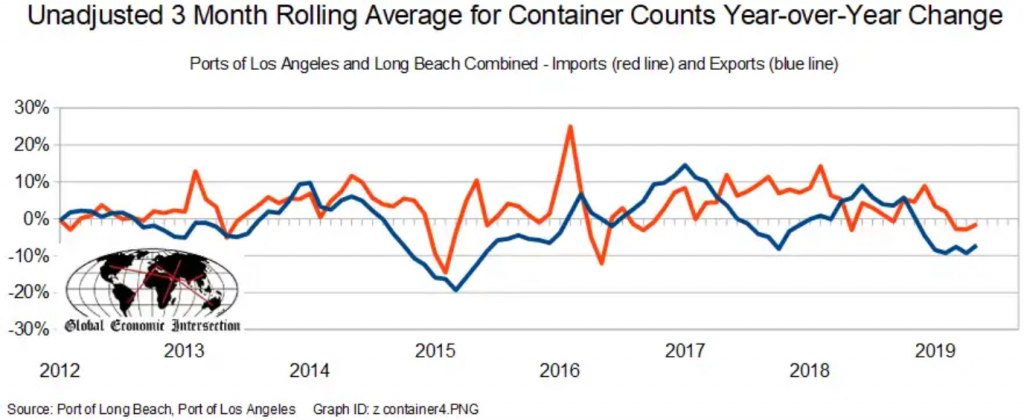

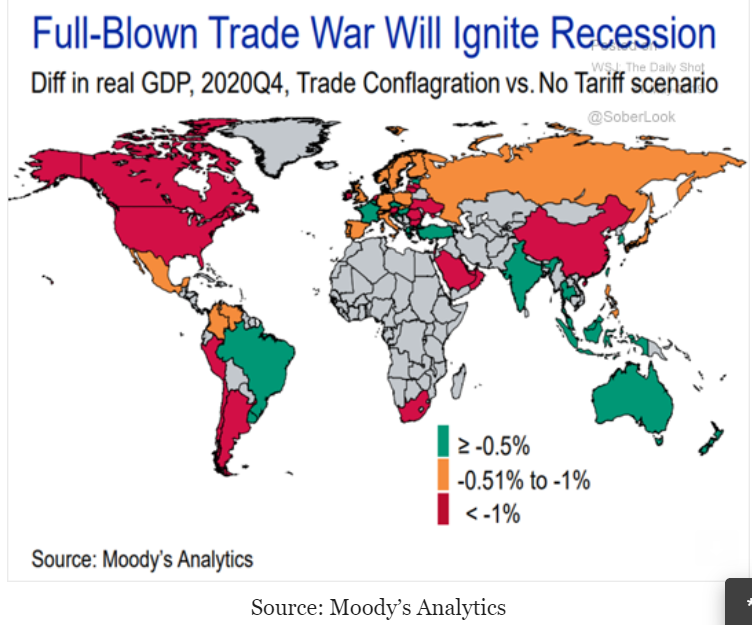

German industrial production plunged 1.9 percent from a month earlier in April 2019, much worse than market expectations of a 0.4 percent fall and after a 0.5 percent gain in the previous month. That was the biggest drop in output since August 2015, amid falls in the production of capital goods (-3.3 percent), intermediate goods (-2.1 percent), energy (-1.1 percent) and consumer goods (-0.8 percent). Meanwhile, construction output increased 0.2 percent. Year-on-year, industrial production dropped 1.8 percent in April, following a 0.9 percent fall in March.

As previously discussed, unemployment benefits have become much harder to get than in prior cycles, which means they will go up that much less as employment slows, and also that they won’t function as an automatic fiscal stabilizer to the extent they did in prior cycles, which will work to delay a recovery:

Tariff update- more to come:

Trump says tariffs on China could be raised by another $300 billion if necessary

Former Commerce secretary: Trump’s 5% tariffs on Mexico will go into place but not any further

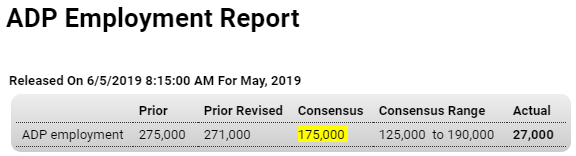

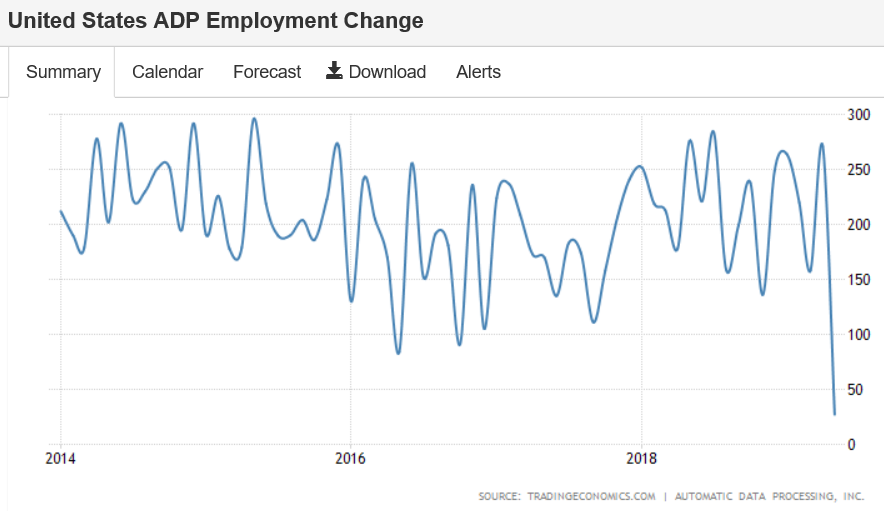

Employment can be a lagging indicator, so this forecast of Friday’s employment number could be verifying the rest of the weakness that’s been reported:

US Private Sector Jobs Rise the Least in 9 Years

Private businesses in the US hired 27 thousand workers in May, less than an expected 180 thousand and compared to April’s 271 thousand increase. It was the smallest payroll increase since March 2010, as the service-providing sector added 71 thousand jobs while the goods-producing sector shed 43 thousand jobs, mainly in the construction sector.

Highlights

ADP sees private payrolls coming in at a very weak and far lower-than-expected 27,000 in Friday’s employment report for May. Forecasters expected today’s ADP estimate to come in at a solid 175,000. The consensus for Friday’s private payrolls going into today’s ADP report was also for a 175,000 increase. Private payrolls rose 236,000 in April. ADP’s forecast, one that if proves accurate would intensify expectations for a Federal Reserve rate cut, is likely to trigger at least some downward revisions among forecasters for Friday’s results.

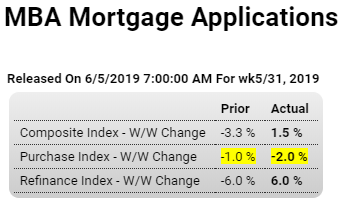

Purchase apps down even with lower rates:

Highlights

Rates moved sharply lower in the May 31 week which gave a boost to refinancing applications, up 6.0 percent in the week, but not purchase applications which fell 2.0 percent. Year-on-year, the purchase index is suddenly showing weakness with only a 0.5 percent gain. Conventional 30-year mortgages fell 10 basis points in the week to 4.23 percent. The housing sector has been moving higher this year though improvement has been uneven.

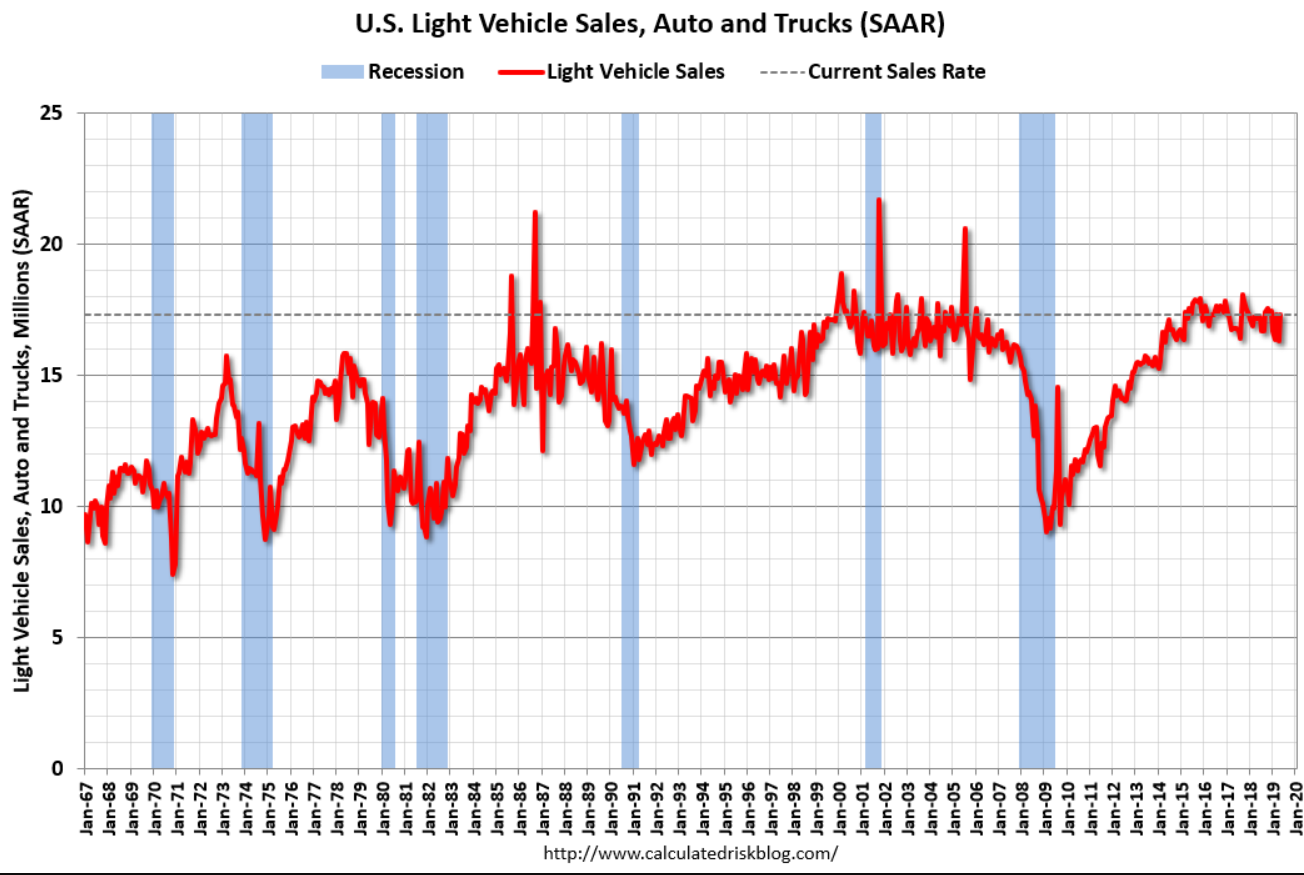

May vehicle sales up a bit from April, but as the chart shows they are nonetheless working their way lower:

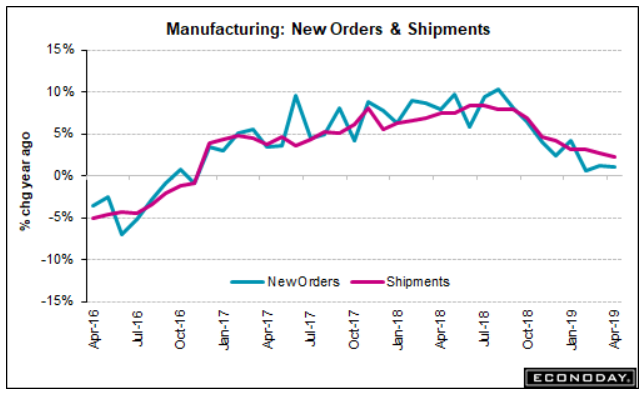

US Factory Orders Fall the Most in 6 Months

New orders for US manufactured goods fell 0.8% in April, the most since October last year, due to lower demand for transportation equipment, computers and electronic orders, and primary metals. Meanwhile, shipments of manufactured goods declined 0.5% in April, the largest drop since April 2017.

Highlights

At an as-expected minus 0.8 percent, April’s factory orders report closes the book on what was a weak month for US manufacturing. The split between the report’s two main components shows a 0.5 percent rise for nondurable goods — the new data in today’s report where strength is tied to petroleum and coal — and a 2.1 percent dip for durable orders which is unrevised from last week’s advance reading.

Core capital goods (nondefense ex-aircraft) are very weak in the report, down 1.0 percent for orders and unchanged for shipments. Both readings hint at slowing for second-quarter business investment. General weakness is evident in the market breakdown with orders for primary metals, fabrications, machinery, and new vehicles all weak.

Data on civilian aircraft are always volatile month-to-month but April’s declines in new orders and unfilled orders were limited, suggesting that possible effects from the 737 grounding have yet to hit. Aside from this, however, the April factory report is consistent with a sector that continues to struggle and, unlike last year, does not look to contribute to 2019 growth.

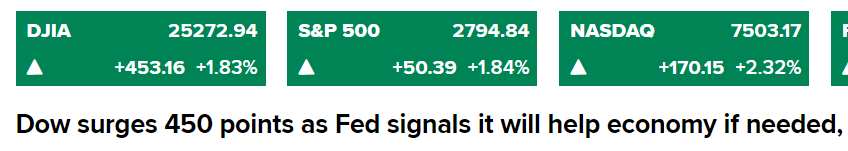

Seems the Fed Chairman and ‘the market’ still don’t know they’ve had the interest rate thing backwards. Lower rates remove interest income from the economy as the US Treasury pays less interest on its net spending, causing net spending to decrease.

This is today’s statement that is driving today’s expectations of growth:

The Fed “will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective”, Chair Jerome H. Powell said at a conference in Chicago. The chairman also noted that the proximity of interest rates to the effective lower bound (ELB) has become “the preeminent monetary policy challenge of our time”, as it limits the central bank’s ability to support growth by cutting rates.

Slow motion trainwreck by Agent Orange, aka Tariff Man, continues…

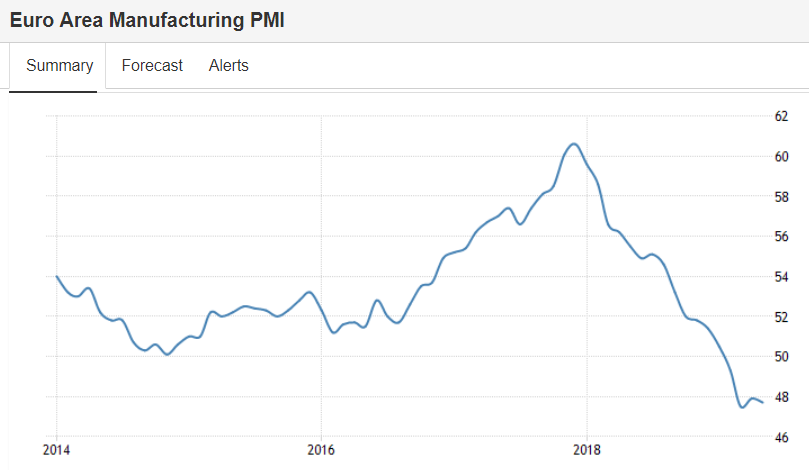

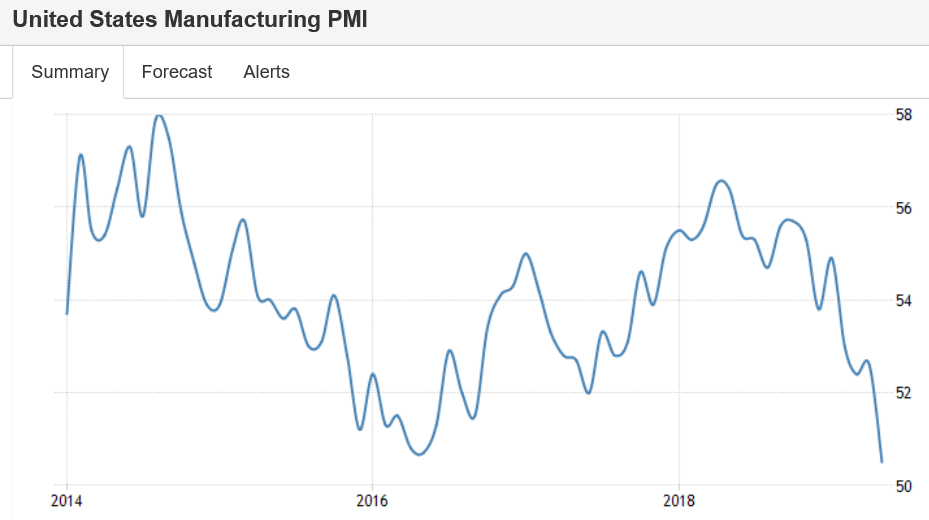

Below 50 indicates contraction:

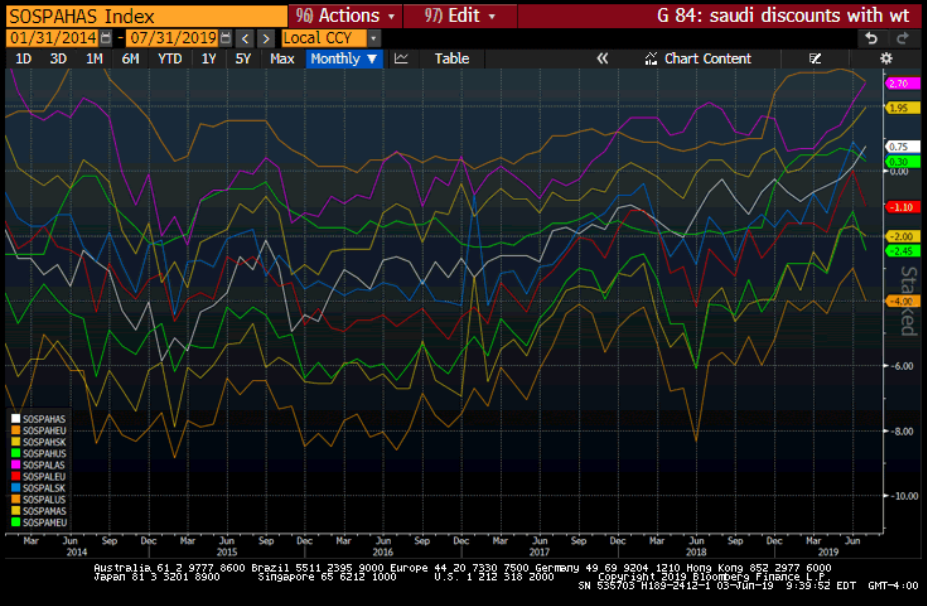

Demand for Saudi oil has fallen back:

Saudi pricing of discounts generally trending higher but most recently there’s been a small move back:

And how about this?

https://www.cnbc.com/2019/06/03/trump-calls-for-a-boycott-of-att-to-force-big-changes-at-cnn.html

Interest-Rate Policy Is Backward, Modern Monetary Theory Pioneer Mosler Says

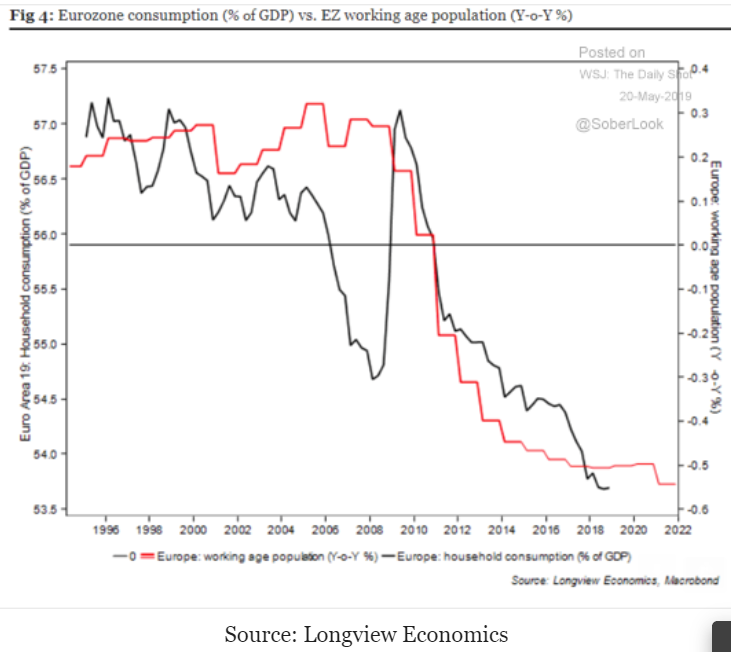

Under consumption identity: for ever agent that spent less than his income, another must have spent more, or the output would not have been sold.

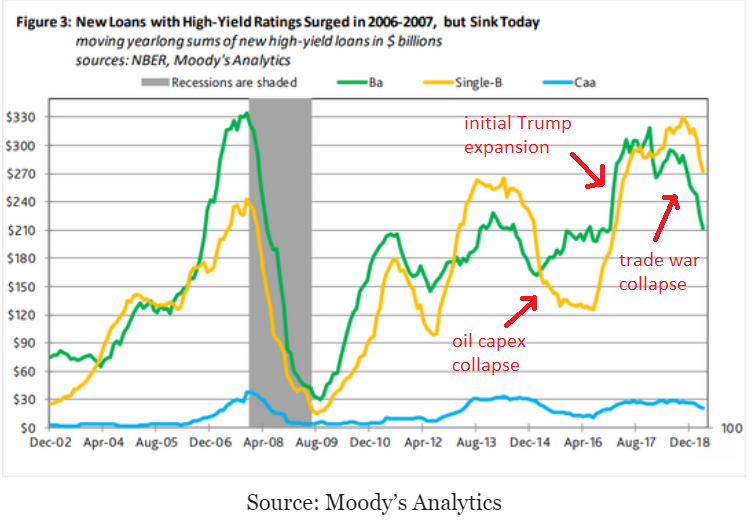

In other words, deficit spending, private or public, is the ‘offset’ to unspent income (savings). The chart shows one of the components of private sector deficit spending which appears to align with economic growth:

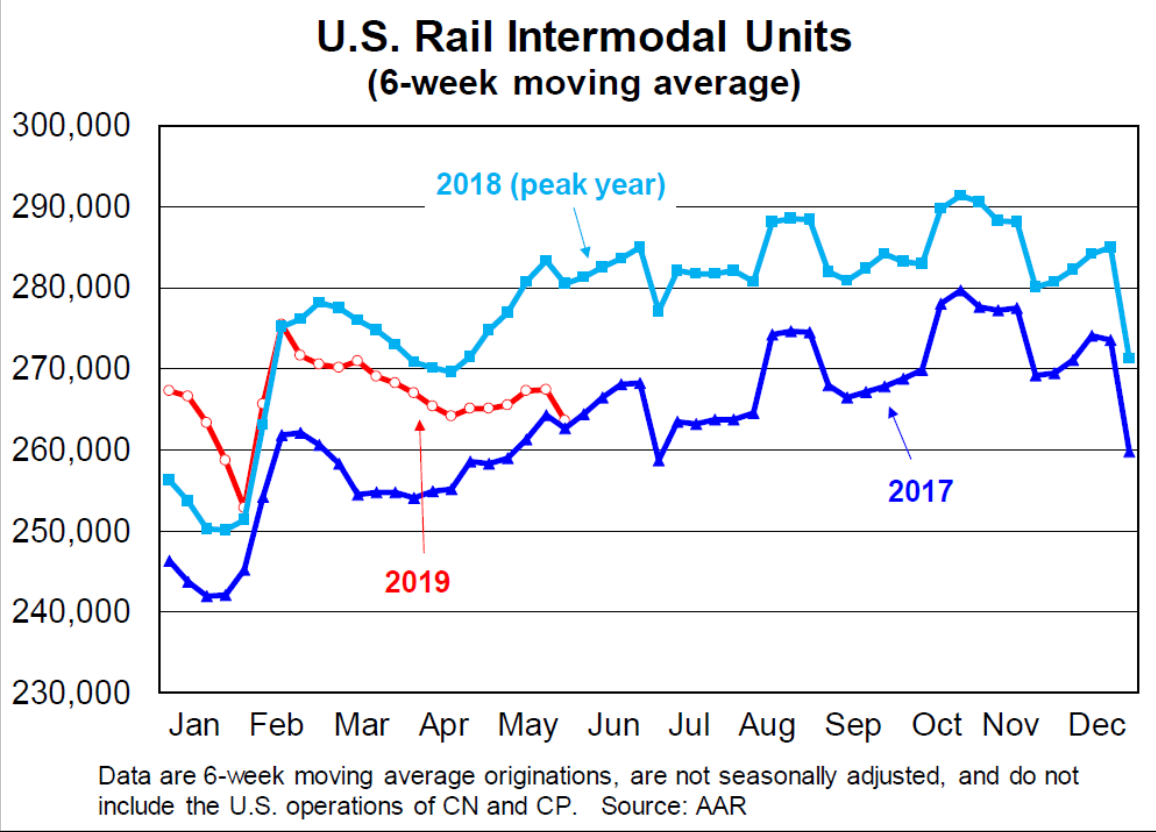

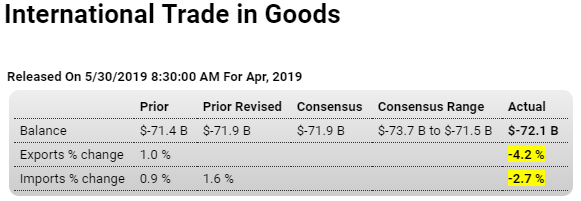

Tariffs (levied on the grounds that China and others weren’t charging us enough…) causing the collapse in exports globally, and import weakness most often is a sign of domestic demand weakness:

Highlights

Sharp declines in exports are unwelcome headlines in April’s advance data on goods trade. The monthly deficit remains very deep, at $72.1 billion with exports falling 4.2 percent year-on-year and with imports also down, 2.7 percent lower. The deficit compares unfavorably with a $71.3 billion monthly average in the first quarter that marks a weak opening for net exports in the second quarter.

Capital goods are the US’s largest exports and these fell 6.5 percent in the month to $44.3 billion. Compared with April last year, capital goods exports are down 3.7 percent. Auto exports are also down, 7.2 percent lower to $12.9 billion and 6.7 percent below last year. The only export component showing a gain is food & feeds which rose 0.5 percent to $11.2 billion but which is nevertheless 6.2 percent below April last year.

The decline on the import side is also led by a 3.5 percent decline for capital goods ($55.4 billion) but also includes 3.1 percent and 2.3 percent monthly declines in autos ($30.9 billion) and consumer goods ($54.2 billion) as well as a 1.1 percent drop in foods ($12.8 billion).

Global trade figures have been contracting and the latest US numbers are part of that picture. Today’s report gets second-quarter GDP, already held down by contractions for April retail sales and industrial production, off to a slow start.

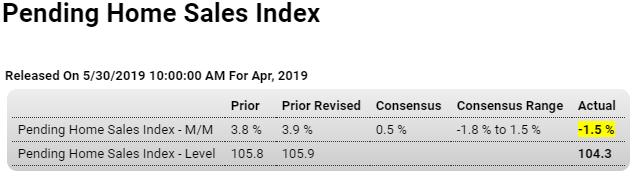

Weakness in housing continues:

Highlights

The forecasters were optimistic but pending home sales couldn’t deliver. The index fell 1.5 percent in April vs a consensus for a 0.5 percent gain, yet the monthly drop does follow an outsized 3.9 percent revised gain in March which makes for a hard comparison. Nevertheless a decline in April is not a good indication for momentum in the spring sales season. Existing home sales have been moving higher this year but today’s report will hold down expectations for May and June.

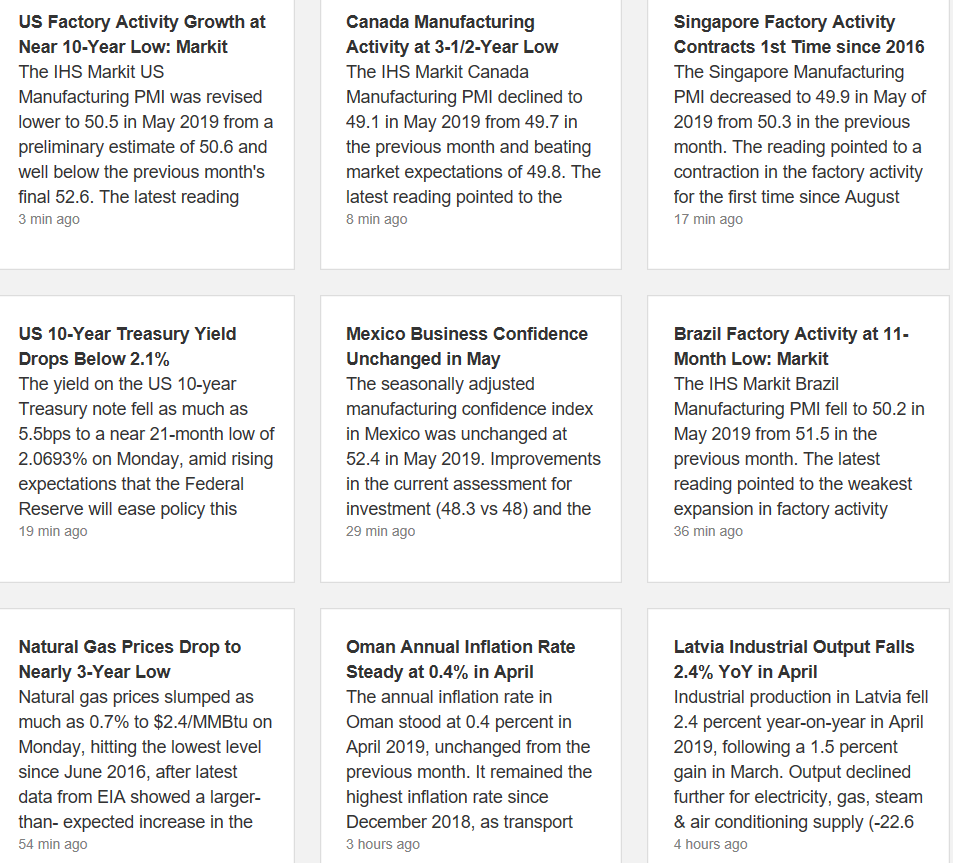

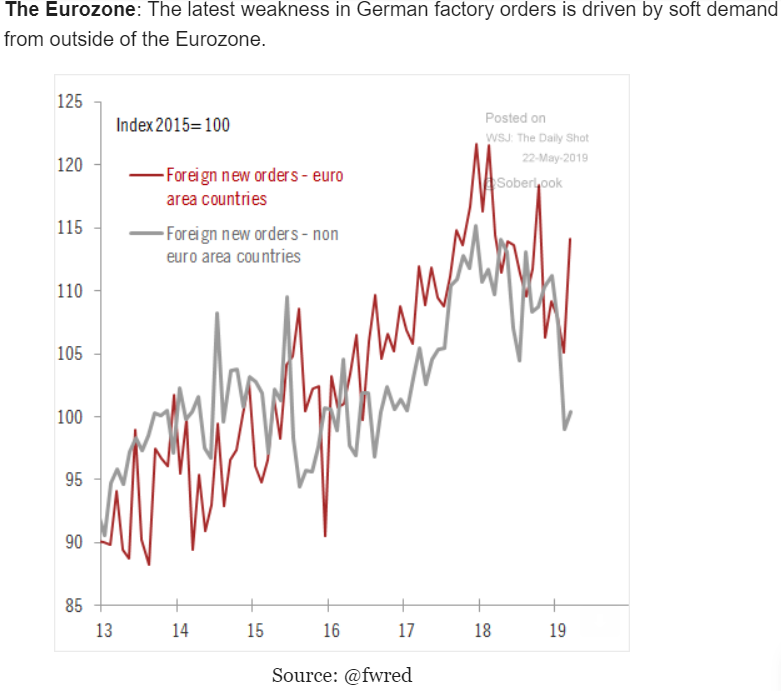

More of same as trade war takes its toll globally:

Trump to Democrats: No infrastructure without trade deal

On the eve of a highly anticipated meeting with Democrats at which President Donald Trump was expected to unveil a way to fund a $2 trillion infrastructure proposal, Trump instead put Congress on notice that it will have to take a backseat to a trade deal.

“Before we get to infrastructure, it is my strong view that Congress should first pass the important and popular USMCA trade deal,” Trump wrote in a letter to House Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer Tuesday evening.

At an impromptu press conference late Thursday afternoon during a photo-op with farmers, Trump lit into Pelosi, who earlier in the day said that the president had committed “impeachable offenses” and was in need of “an intervention” by family and friends. The president lashed out at the speaker, calling her a “mess.”