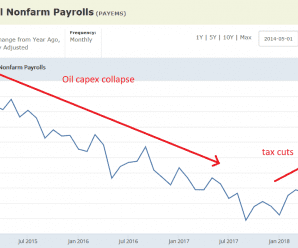

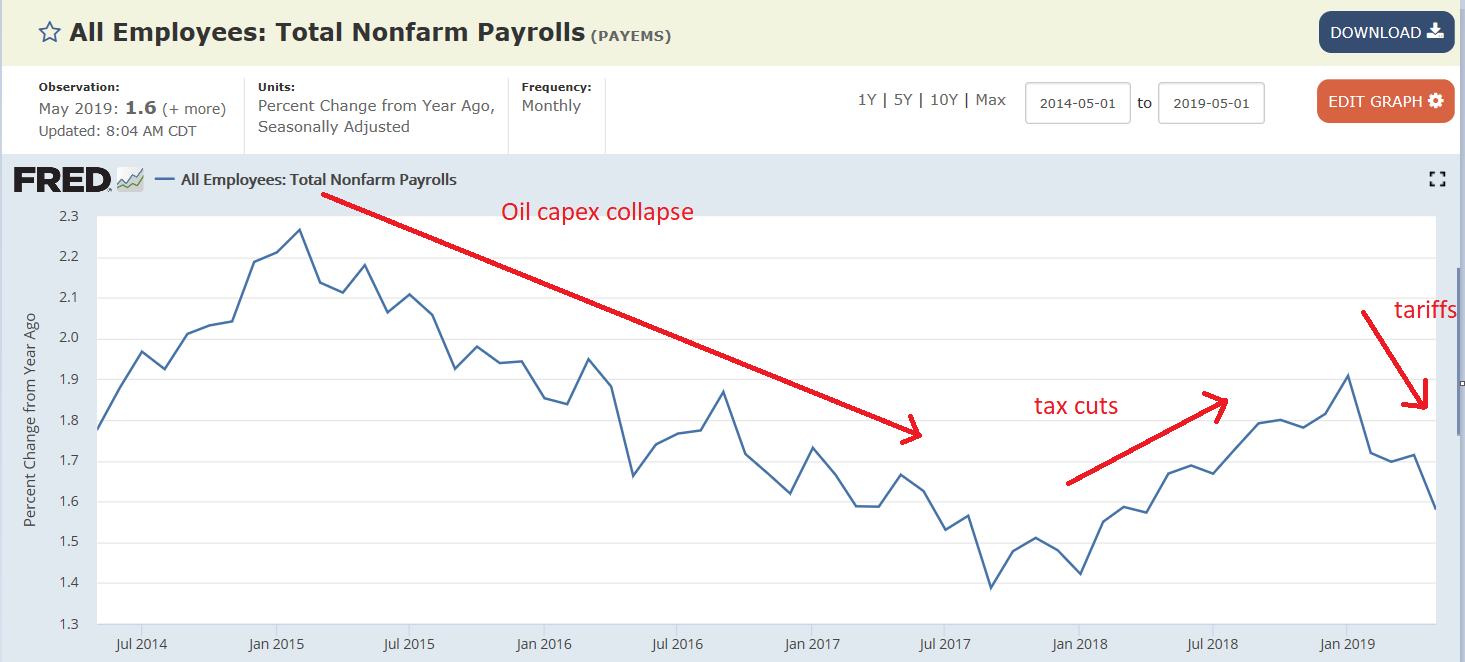

Now even the lagging indicators are pointing south. And lower rates from the Fed will only make it a bit worse by cutting gov. interest payments to the economy:

Highlights

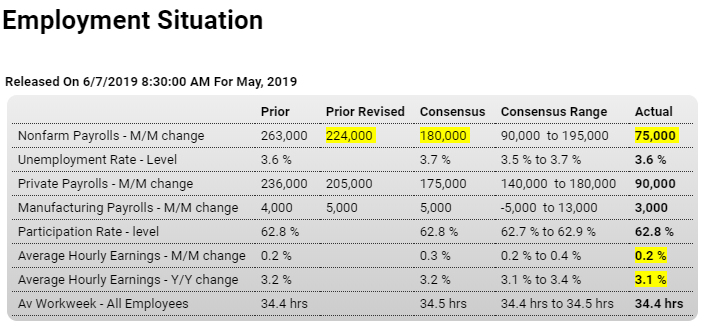

Move up the rate-cut plans is the theme of the May employment report which shows declining growth in the labor market and topping pressure for wages. Nonfarm payrolls, at 75,000, came in below Econoday’s consensus range and include a total of 75,000 in downward revisions to April and March.

Data on wage inflation are at the bottom of the consensus ranges — only a 0.2 percent monthly increase for average hourly earnings and, in the lowest reading since last September, a slumping 3.1 percent gain for the year-on-year rate.

The unemployment rate remains very low, unchanged at a lower-than-expected 3.6 percent with the pool of available workers low and holding steady at 10.9 million. Subdued wage gains won’t help to pull up the participation rate which is also unchanged at 62.8 percent.

And subdued gains show themselves in the payroll breakdown headlined by a soft 3,000 rise for manufacturing. Construction payrolls rose only 4,000 which contrasts sharply with 30,000 and 15,000 gains in the prior two months while government payrolls, after April’s 19,000 jump, fell 15,000 in today’s report. Retail, where traditional stores keep closing, extended its long stretch of declines with an 8,000 payroll contraction. Yet professional business services continue to post increases, up a solid 33,000 to suggest that businesses, trying to meet demand and having difficulty finding the right people, are turning to contractors to fill slots.

For the Federal Reserve, open talk of a near-term rate cut is likely to pick up force at the mid-month FOMC. Against a backdrop of soft inflation, stalling employment growth at a time of trade risks and also Brexit risks point to the need, at least for the doves, for policy insurance.

Trump’s Tariffs Have Already Wiped Out Tax Bill Savings for Average Americans

German industrial production plunged 1.9 percent from a month earlier in April 2019, much worse than market expectations of a 0.4 percent fall and after a 0.5 percent gain in the previous month. That was the biggest drop in output since August 2015, amid falls in the production of capital goods (-3.3 percent), intermediate goods (-2.1 percent), energy (-1.1 percent) and consumer goods (-0.8 percent). Meanwhile, construction output increased 0.2 percent. Year-on-year, industrial production dropped 1.8 percent in April, following a 0.9 percent fall in March.