Warren Mosler of Mosler Automotive Seeks Managing Partner

Warren Mosler, founder and owner of Mosler Automotive, manufacturer of the Mosler MT900 road and race cars, has announced that he is seeking to sell a majority interest in Mosler Automotive to a managing partner. “I’m 61 years old, about to start collecting social security, and living too far away here in the US Virgin Islands to properly manage the company on a day to day basis. It’s time for me to find an enthusiast interested being on the Florida site full time and taking the reins as majority owner,” said Warren Mosler, who founded the company in 1985, “With the latest Mosler Photon road car, (winner of the Car and Driver Lightning Lap), and increased production capacity coming online, job One for the new owner/manager will be implementing a global marketing effort.”

Mosler Automotive is based in Riviera Beach in Florida, and includes Mosler Europe in Cambridgeshire in the UK, where Martin Short leads Mosler’s immensely successful international racing efforts. With over 20 teams world wide racing Moslers on circuits all over the world.

“In GT3 racing the Mosler remains very competitive around a race track compared to the latest and greatest entries from competing manufacturers including Ferrari, Porsche, and Lamborghini, despite hundreds of pounds of ballast and other restrictions to slow it down. It looks spectacular and will surely remain competitive for a very long time to come. This last weekend saw a pole and double Mosler GT3 win in Australia where 5 Moslers compete in the Australian GT Series.” said Martin Short, “In other European series, the Moslers are allowed to compete without severe restrictions, and the result is lap times many seconds a lap quicker than GT3 cars and over-all victories for the series. We are as far afield as Japan in the Super GT series.”.

Warren is willing to sell a majority interest in his company to the right buyer for a fraction of the value of the real estate and the inventory. “I want a partner who has the right stuff to keep this company on top” said Mosler.

Links:

Mosler Auto

Mosler UK

Mosler Challenge

Klark Quinn wins again in the Aussie GT series March 2011.

Category Archives: Uncategorized

Mosler win 2 events in Australia

Klark Quinn sweeps the Vodka O Australian GT round at Clipsal 500

KLARK QUINN powered to a second win on the streets of Adelaide in his VIP Petfoods motorsport Mosler today at the Clipsal 500 to take an early lead in the 2011 Vodka O Australian GT Championship.

After tasting success by way of a dramatic victory in the one-hour Murray Walker GT Tourist Trophy race on Friday night, Quinn again led from start-to-finish in today’s 12-lap sprint race to record his second of two wins this weekend.

NATO denies rumor Italy has surrendered

Guest on Reuters Insider

>

> (email exchange)

>

> Hi Warren – No, its not live. It’s going to be taped in two separate segments, and probably put

> up on the platform on Monday. FYI, its not cable TV, but internet. We also do live shows, infact

> most of them are live. We did a live FOMC show this week on Tuesday which included former

> Fed governor Mark Olsen and and Bill Ford from the Atlanta Fed. We wanted to have you

> appear on that occasion but the timing didn’t work.

>

Link will be posted when available.

Why public sector workers should not have actual bargaining power

Government, desirous of provisioning itself, does it as follows:

1. It imposes nominal tax liabilities payable in it’s currency of issue.

2. This serves to create a population desirous of obtaining the funds needed to pay the tax.

3. The real tax is then paid as government transfers real resources from private to public domain by spending it’s otherwise worthless currency, hiring its employees and buying the goods and services it desires to provision itself and function as directed by the legislature.

4. Prices paid by government when it spends defines the value of the currency, and therefore the terms of the real taxation.

Therefore, the hiring and compensation of public sector employees is the real taxation, which is a legislative function.

Letting individuals negotiate the terms of their taxation other than through the legislative process makes no sense whatsoever.

This is not to say that public employees can not have representatives to make their case before the legislature, much like any tax payer or group of taxpayers might address the legislature.

And this is not to say public employees should not be treated well, well paid in real terms, or abused.

It is to suggest public employee compensation be recognized as part of the real process of taxation of the electorate and treated accordingly by all parties involved.

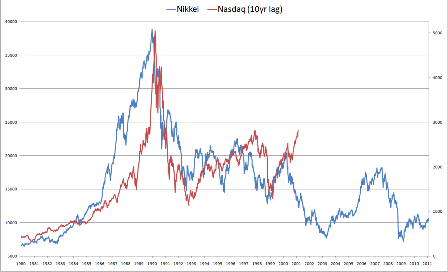

Nikkei/Nasdaq full graph

Greenspan on the gold standard

Fed Chairman – Alan Greenspan! In an interview with Fox Business: “We have at this particular stage a fiat money which is essentially money printed by a government and it’s usually a central bank which is authorized to do so. Some mechanism has got to be in place that restricts the amount of money which is produced,

Yes, it’s called Congress.

And right now, for the size govt we have, they are grossly over taxing us.

either a gold standard or a currency board, because unless you do that all of history suggest that inflation will take hold with very deleterious effects on economic activity… There are numbers of us, myself included, who strongly believe that we did very well in the 1870 to 1914 period with an international gold standard.” And a further stunner: Greenspan himself wonders if we really need a central bank.

macro currency update

So it looks to me like all the major currencies have somewhat strong fundamentals.

That is, policy is working to make them ‘harder to get.’

EU and UK austerity policies are proactively cutting net govt spending from where it was.

And the EU has figured out that the ECB can fund at will entirely without ‘finance’ concerns, gradually removing the perceived chances of catastrophic defaults and the break up of the currency union with each succeeding intervention.

While higher crude prices are making the $US a bit easier to get offshore, interest rate policy, including QE2, is removing dollars from the non govt sectors that would have otherwise been paid out by the US govt, and domestic credit expansion remains anemic, particularly with regards to housing, the traditional source of ‘borrowing to spend.’ And the international stampede out of the dollar due to unwarranted fears of QE2 is still in the process of getting reversed. This flight took a variety of forms, from selling the dollar vs other currencies to buying gold, silver, and other commodities in general.

China is tightening up on state sponsored lending which makes yuan harder to get as they ramp up their politically motivated struggle to fight inflation.

And there are at least some noises that even India and Brazil seem to be at least leaning towards less inflationary policy, though sometimes misguided.

And while Japan has done a bit of fiscal expansion, and a bit of dollar buying, markets are telling us it hasn’t done enough, at least not yet, as the yen remains firm even after more than a decade of a near 0 rate policy.

All the currencies getting strong at the same time with only minor shifts in relative value is also evidenced by a general deflationary bias in the market place.

And, as previously discussed, this is coming after rising commodity prices have had a chance to bring on higher levels of supply.

Low interest rates have also added their positive supply side effects, as inventory is cheap to hold and capacity cheap to bring on line and keep in reserve.

Historically, private sector credit expansion has kicked in as economies recover, replacing the aggregate demand from government deficit spending, as the automatic fiscal stabilizers work to increase tax payments and reduce fiscal transfers for the likes of unemployment compensation.

This time, however, it seems to be different, with govts. taking proactive measures to contain and reduce deficits rather than continuing the govt. deficit spending until the hand off to private sector credit expansion takes over and the automatic fiscal stabilizers kick in.

In other words, for the size govt we have, we remain grossly over taxed as evidenced by the still massive output gap.

Gravity Mosler readying for Dubai 24 Hours on Friday

DOE Gasoline Demand Looking Very Flatish

Nothing here to support price hikes if price was from demand,

and not being set by a foreign monopolist as necessarily is the case today.