Income Slides to 1996 Levels in U.S. The income of the typical American family—long the envy of much of the world—has dropped for the third year in a row and is now roughly where it was in 1996 when adjusted for inflation.

Category Archives: Uncategorized

from prof Andrea Terzi

The US government currently owes about $14.2 Trillion. Who did we borrow that money from, and how did those financiers get that money?

Has that money always been on earth? If not, then where did it come from? Did somebody issue it into existence? If so, then by what authority did they do so, and for what reason do nations lack that authority?

This is an excellent question. Where does the money that the Government borrows come form? And the answer is: It comes from the Treasury and the Fed! And it cannot come from any other source. This is what so few people realize, perhaps because economists are too reluctant to explain.

When the Government ‘borrows’, it sells Treasury securities and receives reserves from banks. Bank reserves are deposits at the Fed owned by banks. Deposits at the Fed can only come into existence through two channels:

1. Government spending (e.g., when the Treasury buys output from business or pays federal employees); and

2. Fed lending (e.g., when the Fed makes loans to banks).

This means that the money that government borrows (bank reserves) ultimately comes from the Treasury or from the Fed.

This simple statement has significant consequences:

-The Government does not borrow money created by others,

-The Government does not borrow anything it cannot create itself,

-The Government has no functional need to borrow,

-The Government issues securities because if it did not, the banks would have an excessive amount of reserves and the interest rate would go to zero,

-When the Government borrows, it functionally makes monetary policy (in the same way as the Fed doing open market operations),

-Governments self inflict deficit and debt rules onto themselves that are causing the world economy to collapse

-Rules for governments that aim to promote jobs and prosperity should be:

1. Do not overtax the economy for any desired size of the government sector;

2. Let deficits grow until we reach full employment;

3. Do ‘quality spending’ to create jobs and control prices.

“The voices which, in such a conjuncture, tell us that the path of escape is to be found in strict economy and in refraining, wherever possible, from utilising the world’s potential production, are the voices of fools and madmen.”- John Maynard Keynes

Nightmare on Main Street: Krueger – more financial regression from the Obama administration

The Obama administration continues on the path of financial regression with the addition of Alan Krueger (no relation to Freddy?).

Note below, how he favors the govt making the tough choice of hitting the poor harder than the rich with his proposed tax.

I have yet to see anything even remotely progressive from this administration, which has somehow managed to retain it’s ‘socialist’ label.

Factbox: Obama picks labor economist as top aide

Krueger argued in the New York Times in January 2009 for a 5 percent consumption tax, to take effect in 2011. he said this would boost revenues by $500 billion a year once it kicked in, and would spur spending in the meantime as consumers race to make their purchases before the tax was implemented. He warned it might dull economic activity, and could hit the poor harder because they spend a relatively higher share of their income than the rich. But he also noted that government was all about making tough choices and once the budget position had improved, thanks to the higher revenues, the impact of the tax could be offset by reforms to corporate and income taxes.

statement by President Herbert Hoover, Nov 1928

In Nov. 1928, Hoover gave a speech (accepting the Republican nomination) saying, in part:

“We in America today are nearer to the final triumph over poverty than ever before in the history of any land. The poorhouse is vanishing from among us. We have not yet reached the goal, but, given a chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation.”

Statement by President Herbert Hoover on March 8, 1932

This statement was issued by President Herbert Hoover on March 8, 1932:

“The whole of the administrative officials are cooperating with the special Economy Committee appointed by the House of Representatives in the drive to bring about further drastic economies in Federal expenditure.

“You will recollect that the budget sent to Congress represented reductions in expenditures for the next fiscal year of about $365 million below the present fiscal year. The House Appropriations Committee has reduced the amounts of bills so far reported out by about $112 million. Of this, however, between 60 and 70 million is a deferment until Congress meets next December when they will be compelled to meet positive obligations by deficiency bills. To this extent, therefore, the reductions do not help next year’s expenditures.

“In order to meet the requirements of the Ways and Means Committee that expenditures must be reduced by $125 million in order to balance the budget, it is necessary that further cuts be made. There is very little room left for reductions by administrative action and the House Appropriations Committee has passed upon the major supply bills except the Army and Navy. Further economies must be brought about by authorization of Congress, either by reorganization of the Federal machinery or change in the legal requirements as to expenditure by the various services.

“The Director of Veterans’ Affairs has proposed to the special House Committee on Economy some changes in the laws relating to pensions and other allowances which would produce economies of between 50 and 60 millions per annum. The Postmaster General is placing before the committee changes in the legal requirements of Post Office expenditures. The Secretary of Agriculture has suggested changes in the law requiring expenditures in the Department of Agriculture, and the other departments are engaged in preparation of similar drastic recommendations.

“I believe the Committee on Economy, through administrative reorganization and such methods as I have mentioned, will be able to find a large area of economy.

“Nothing is more important than balancing the budget with the least increase in taxes. The Federal Government should be in such position that it will need issue no securities which increase the public debt after the beginning of the next fiscal year, July 1. That is vital to the still further promotion of employment and agriculture. It gives positive assurance to business and industry that the Government will keep out of the money market and allow industry and agriculture to borrow the monies required for the conduct of business. I cannot overemphasize the importance of the able nonpartisan effort being made by the Ways and Means Committee and the Economy Committee of the House whose work are complementary to each other.

From Professor Andrea Terzi, MMT’s non-gnome soldier in Lugano

Andea Terzi is a former student of Paul Davidson, now a professor of economics at Franklin College, Lugano, Switzerland.

The institutional structure in the euro zone has been it’s own undoing since inception, very much like we all described at that time.

Current policy responses continue to support the same repressive fiscal policies that again look to be driving the otherwise prosperous euro zone into negative GDP growth.

The glimmer of hope may be that they have discovered the sector balance approach.

The next step in the right direction would be a recognition of the actual causations.

From Professor Tezi:

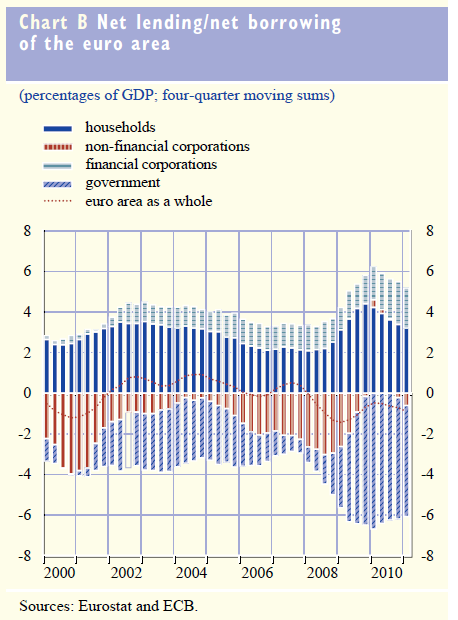

Does the ECB understand sector financial balances?The August 2011 Monthly Bulletin of the European Central Bank has an interesting chart of financial balances of different sectors in the euro area. The chart is reproduced below.

The figure shows how rising deficits in Europe in 2008 and 2009 have produced higher net financial savings in the private sector.

This is evidence that automatic (anti-cyclical) stabilizers worked as usual: as growth declines, or goes negative, tax revenues fall, government deficits increase, and this stops the economy from falling further. This can only work, however, until market-constrained governments in the euro area begin acting pro-cyclically. Governments acting pro-cyclically during recessions means that deficit reductions will reduce private savings below the desired level, and this means a further fall of demand and incomes.

Looking at 2010, and considering that the euro area’s current account balance is marginally negative, there is evidence of this pro-cyclical effect, as government deficits declined, and net private lending inevitably declined.

What is remarkable is how the ECB interprets the chart:

With euro area total investment growing faster than saving, the net borrowing of the euro area increased (to 0.9% of GDP, expressed as a four-quarter sum). From a sectoral point of view, this masked further rebalancing between sectors, with another reduction in government net borrowing (the government de?cit falling to 5.5% of GDP on a four-quarter moving-sum basis, from a peak of 6.7% in the ?rst quarter of 2010) and a further decline in households net lending, while the net borrowing of NFCs increased sharply. (ECB, Monthly Bulletin, August, 2011, pp. 37-8)

The ECB is assuming that savings are needed to finance investment and sector rebalancing is always a good thing. And it makes no reference to the connection between financial balances and nominal GDP growth.

In plain language, this is what the ECB is telling us:In 2010, Euro area’s savings were insufficient to finance investment. Business needed to borrow to finance their investments and households savings were not enough to fill the gap. This is why the euro area runs a current account deficit, and is a net borrower. European governments, however, are doing their part by reducing their own net borrowing, thus contributing to a progressive rebalancing in financial deficits/surpluses across sectors.

For the ECB, the government net borrowing bar getting shorter (in the chart above) is a reason for optimism. In our reading, this optimism is unwarranted, and what the ECB calls “rebalancing between sectors” is a most worrying financial development of the euro area.

The Disruptor Algo

Lots of public purpose here…

Subject: The Disruptor Algo

Perhaps this explains some of the craziness.

A Trillion Bytes of Data Friday Hides A Lot of Sins

Jon “DRJ” Najarian | ask-drj@optionmonster.com

Last night over 14 months after the Flash Crash, US regulators finally sent subpoenas to HFT firms. In light of that and the games that were played last week, I offer more insights into HFT from my friends at Nanex, which supports what our HeatSeeker saw as the quants had their way with the markets to the detrement of all investor classes:

On Friday, Aug 5, 2011, we processed 1 trillion bytes of data for all U.S. equities, options, futures, and indexes. This is insane. A year ago, when we processed half of that, we thought it was madness. A year before that, when it was 250 billion bytes, we thought the same. There is no new beneficial information in this monstrous pile of data compared to 3 years ago. It is noise, subterfuge, manipulation. The root of all that is wrong with today’s markets.

HFT is sucking the life blood out of the markets: liquidity. It is almost comical, because this is what they claim to supply. No one with any sense wants to post a bid or ask, because they know it will only get hit when it’s at their disadvantage. Some give in, and join the arms race. Others leave.

Take the electronic S&P 500 futures contract, known as the emini, for example. This is, or used to be, a very liquid market. The cumulative size in the 10 levels in the depth of book was often 20,000 contracts on each side. That means a trader could buy or sell 20,000 contracts “instantly” and only move the market 10 ticks or price levels. Even during the flash crash, before the CME halt, when hot potatoes were flying everywhere, the depth would still accommodate an instant sale of 2,000 contracts.

Not anymore. On Friday, 2,000 contracts would have sliced right through the entire book. Not during a quiet period, or before a news event. Pretty much any minute of trading that day after the 9:54 slide. And it wasn’t just Friday, the trend in the depth of book size has been declining rapidly over the last few week. What used to be the most liquid and active contract in the world, which served as a proxy for the true price of the US stock market for decades, is getting strangled by the speed of light, a weapon wielded by HFT.

Without going into detail at this time, we think we know one cause of the drop in liquidity. A certain HFT algorithm that we affectionately refer to as The Disruptor, will sell (or buy) enough contracts to cause a market disruption. At the same exact time, this algo softens up the market in ETFs such as SPY, IWM, QQQ, DIA and other market index symbols and options on these symbols. When the disruptor strikes, many professional arbitrageurs who had placed their bids and offers in the emini suddenly find themselves long or short, and when they go to hedge with ETFs or options, find that market soft and sloppy and get poor fills. Naturally, many of these arbitrageurs realize the strategy no longer works, so they no longer post their bids and offers in the emini. Other HFT algos teach the same lesson — bids or offers resting in the book will only become liabilities to those who can’t compete on speed.

In summary, HFT algos reduce the value of resting orders and increase the value of how fast orders can be placed and cancelled. This results in the illusion of liquidity. We can’t understand why this is allowed to continue, because at the core, it is pure manipulation.

Warren Mosler in the Huffingtonpost- comments welcome!

Bernanke: No Plans to Add New Stimulus Measures Now

More evidence of the suspected understanding with China- they resumed buying US Tsy secs in return for no more QE:

The U.S. economy “has been doing worse than expected” and Beijing needs to “seriously assess” possible risks to its vast holdings of American debt, said Yu Bin, an economist in the Cabinet’s Development Research Center.

Yu expressed concern about a possible third round of Fed purchases of government bonds, known as “quantitative easing” or QE. He said that might hurt China by depressing the value of the dollar and driving up prices of commodities needed by its industries.

Bernanke: No Plans to Add New Stimulus Measures Now

July 14 (Reuters) — Federal Reserve Chairman Ben Bernanke backed away slightly from promising a third round of stimulus measures, telling a Senate panel Thursday that the central bank “is not prepared at this point to take further action.

The comments during his second day of congressional testimony sent the US dollar higher and caused stock to pare their gains.

On Wednesday, Bernanke suggested to a House panel that the Fed was ready to take further steps to boost the flagging US economy. That sent stocks soaring and pushed the dollar lower.

But on Thursday, Bernanke seemed to back away a bit from that plan.

“The situation is more complex,” he told the Senate Banking Committee. “Inflation is higher…We are uncertain about the near-term developments in the economy. We would live to see if the economy does pick up. We are not prepared at this point to take further action.”

He also said a third round of stimulus may not be that effective.

Bernanke also repeated his warning that a U.S. debt default would be devastating for the U.S. and the global economy.