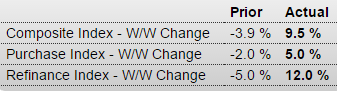

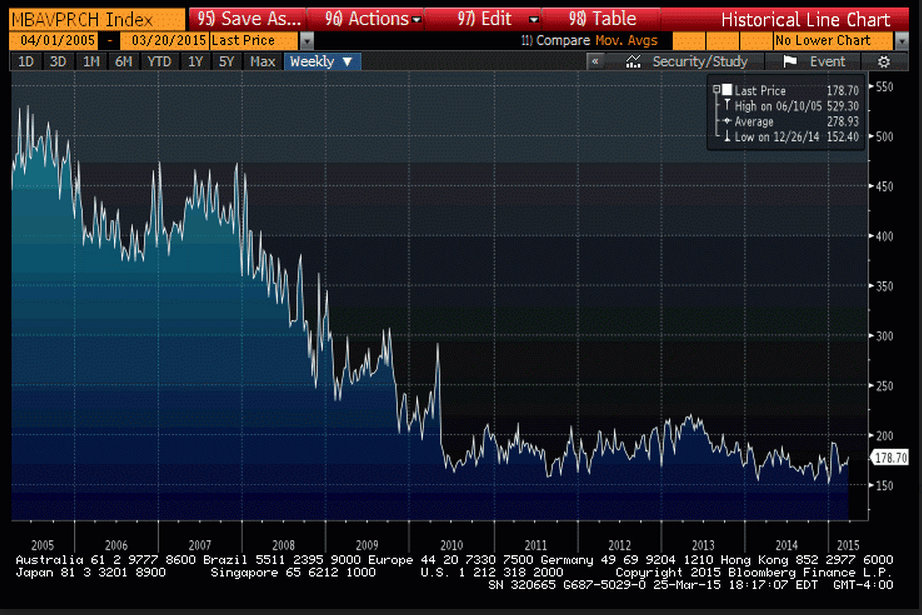

Still looking stone cold dead to me, with risk of going even lower.

Purchase apps up only 3% from a dismal period last year:

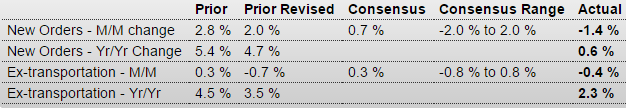

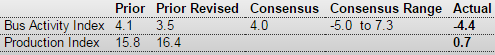

Way below expectations and prior month revised down, causing GDP estimates to be further cut as well:

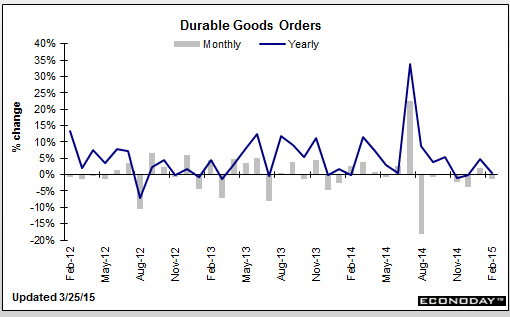

Durable Goods Orders

Highlights

The manufacturing sector continues to look weak. Durables orders fell 1.4 percent in February after rebounding 2.0 percent the month before. Market expectations were for a 0.7 percent gain. Excluding transportation, the core declined 0.4 percent, following a 0.7 percent drop in January. Analysts projected a 0.3 percent gain in February.

Transportation dropped 3.5 percent, following a monthly rebound of 8.8 percent the prior month.

Motor vehicles slipped 0.5 percent, nondefense aircraft decreased 8.9 percent, and defense aircraft fell 33.1percent.

Outside of the core, orders were mixed. Industries that advanced were primary metals and electrical equipment. Declines were seen in fabricated metals, machinery, computers & electronics, and “other.”

Nondefense capital goods orders excluding aircraft were down 1.3 percent, following a 0.9 percent dip in January. Shipments of this series were flat in February after rising 1.0 percent the month before.

The latest orders numbers point to continuing weakness in the manufacturing sector and may soften Fed hawk rhetoric-especially taking into account the latest sluggish March manufacturing surveys.

GDP growth estimates tumble

March 25 (WSJ) — At least one first-quarter tracking estimate is already close to zero. The Federal Reserve Bank of Atlanta on Wednesday put its gauge at 0.2%, down from its earlier estimate of 0.3%. Macroeconomic Advisers trimmed its estimate down to 1.2% from 1.5% beforeWednesday. The U.S. economy contracted at a 2.1% annual pace in the first quarter of 2014, a drop many economists attributed to severe winter weather. The economy bounced back with growth at a 4.6% pace in the second quarter, 5% in the third quarter and 2.2% in the fourth quarter.

Weak U.S. business spending data points to tepid first quarter growth

March 25 (Reuters) — Non-defense capital goods orders excluding aircraft dropped 1.4 percent last month after a downwardly revised 0.1 percent dip in January. The so-called core capital goods orders were previously reported to have increased 0.5 percent in January. Shipments of core capital goods rose 0.2 percent last month after slipping by a revised 0.4 percent in January. They were previously reported to have gained 0.1 percent in January. Order books for core capital goods dropped 0.3 percent after barely rising in January.