All these surveys are now declining:

From the NY Fed: Empire State Manufacturing Survey

The February 2015 Empire State Manufacturing Survey indicates that business activity continued to expand at a modest pace for New York manufacturers. The headline general business conditions index edged down two points to 7.8. The new orders index fell five points to 1.2—evidence that orders were flat—while the shipments index climbed to 14.1. Employment indexes pointed to an increase in employment levels and little change in the average workweek.

Indexes assessing the six-month outlook, though generally positive, conveyed considerably less optimism about future business activity than in recent months. The index for future general business conditions plunged twenty-three points to 25.6, its lowest level in more than two years.

emphasis added

Maybe it’s because lower oil prices merely shift income from sellers of oil to buyers of oil? Leaving falling capital expenditures as the net effect? Along with the negative effect of falling net worth as the value of energy holdings declines?

MORGAN STANLEY: US consumers just aren’t spending their gas savings like we thought they would

By Akin Oyedele

Feb 16 (BI) — US consumers are getting more cautious about how they spend their savings from low gas prices.

Gas prices have fallen 40% since September, giving consumers a ‘tax break’ of more than $60 billion, according to Morgan Stanley chief US economist Ellen Zentner.

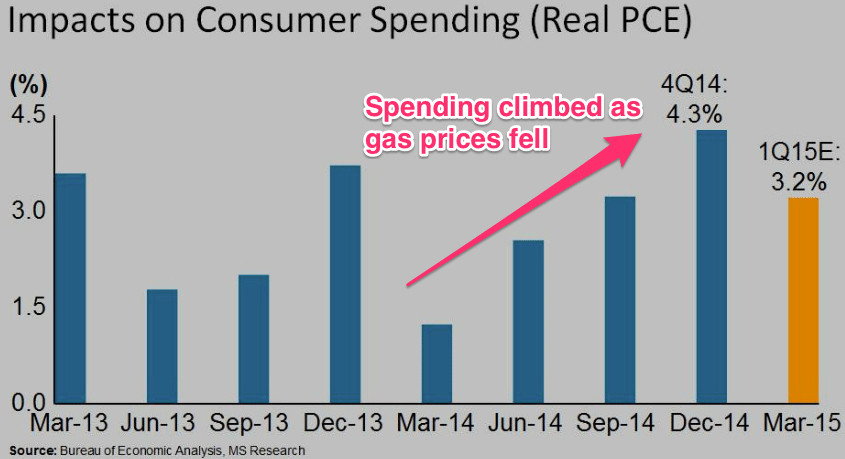

As gas prices fell, the pace of real Personal Consumption Expenditures (PCE) growth accelerated above the 2% average of the last four years, Zentner said in a video Friday. It reached 4.3% for the fourth quarter of 2014.

Yet, that was less than what it could have been.

“What we found is some lingering caution, that sales could actually be stronger,” Zentner said. “So some of the discretionary categories have shown some weakening of late. Households simply aren’t spending as much out of the gas savings as we thought they would.”

“That lingering caution we think continues in the first quarter,” she added, showing that real PCE growth is estimated to fall to 3.2% for the first quarter. The benefit of the slowdown in spending is that people are using the extra money to pay off debt, or are stashing it away as savings, Zentner said. This ultimately improves households’ finances.

Housing Market Index

Recent History Of This Indicator

The NAHB housing market index continued to report solid conditions with the housing market index at 57 in January versus an upwardly revised 58 in December. January was the 7th plus-50 score in a row. January’s strength was led by the most heavily weighted component, present sales, which held steady at 62. But the second most heavily weighted component, traffic, remained weak, down 2 points to 44 and reflecting a significant lack of first-time buyers in the new home market. The final component, future sales, did fall 4 points but remained very solid at 60.