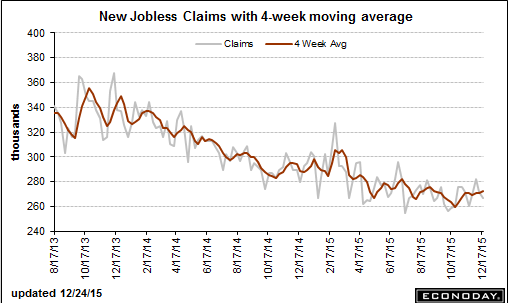

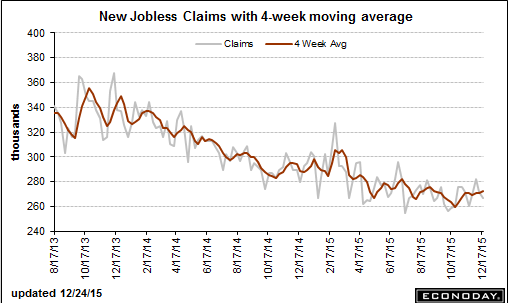

Claims readings could be distorted because a smaller share of those potentially eligible for benefits are applying. The share of recently unemployed workers seeking benefits has fallen this year to just above 50%, according to the National Employment Law Project, a group that advocates for the unemployed.

The rate is down from record high of almost 80% just after the recession ended.

The application rate typically declines as expansions age, but the current pace is the lowest in 15 years. NELP Policy Analyst Claire McKenna said the low rate reflects a vastly different labor market for those who recently lost their jobs versus the long-term unemployed.

The unemployment rate for those out of work for five weeks or less fell below prerecession levels this year. The rate for those out of work for six months or more is well down from 2009, but it remains about double the rate recorded in mid-2007.

“This late into a very slow recovery you have a sizable population of unemployed people that are less likely to establish eligibility for benefits,” Ms. McKenna said. In past cycles, even those workers who didn’t find long-term jobs would have landed shorter-term work that subsequently allowed them to again seek for benefits.

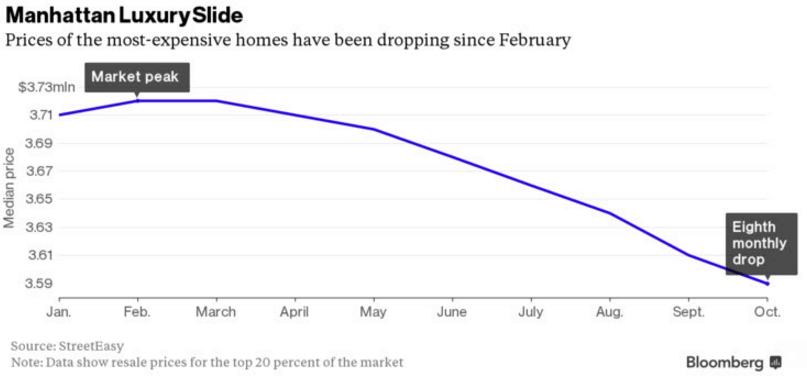

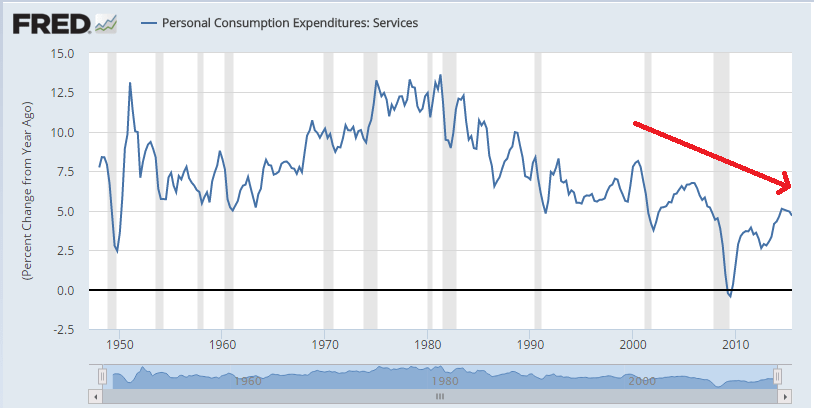

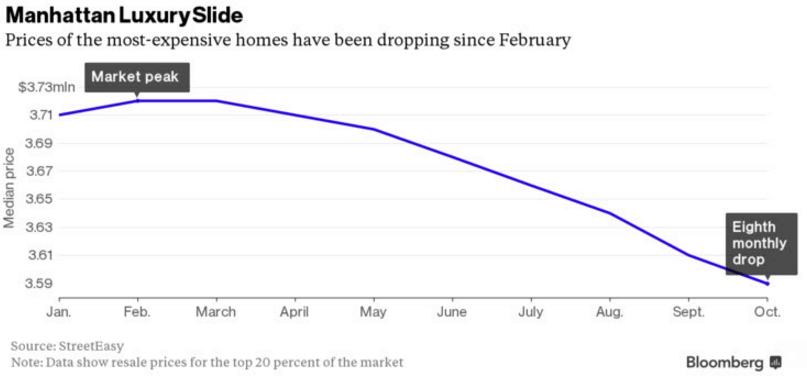

Must be a consequence of income reductions for people getting oil related revenues…

;)

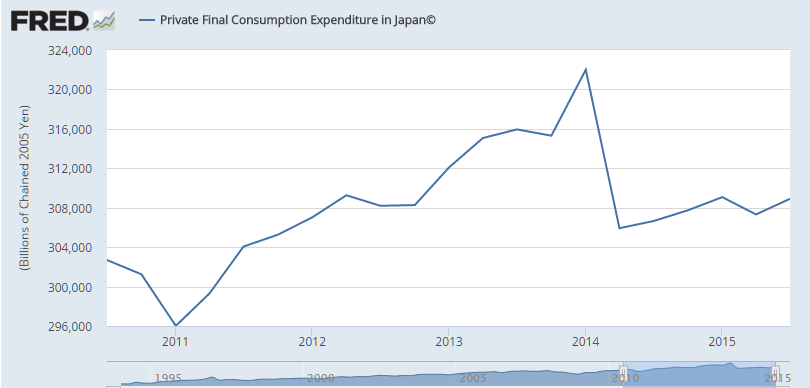

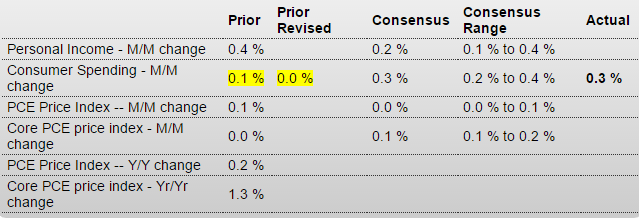

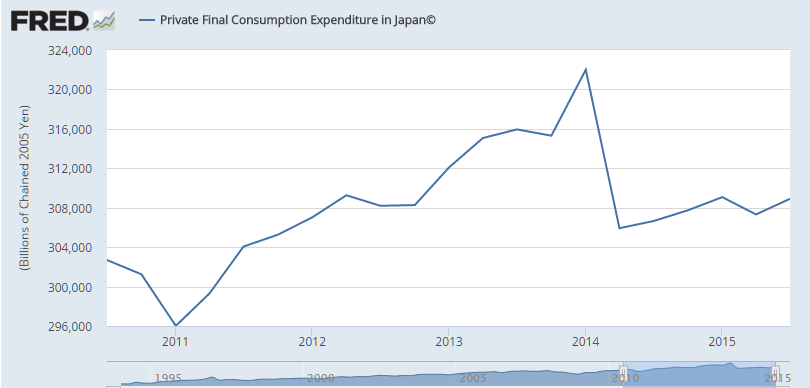

Spending is the measure of ‘policy success’ for the households:

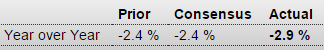

Japan : Household Spending

December 1 chart. Can you spot the hike in the consumption tax?

Six years into Greece’s economic crisis and following successive “bailouts,” there still seems to be no light at the end of the tunnel. Greece’s economy continues to shrink and unemployment remains at record high levels while the Syriza-led government coalition has reneged on its promises of radical change and ending austerity. The troika, in turn, continues to insist that strict austerity measures, including budget cuts and mass privatizations, be enforced in Greece.

In this interview, economist Warren Mosler, a leading figure in the field of modern monetary theory and the cofounder of the Center for Full Employment and Price Stability at the University of Missouri-Kansas City, discusses money, debt and the role of the European Union’s deficit limits in perpetuating the crisis, and shares the proposals he believes could help lead Greece out of its crisis.