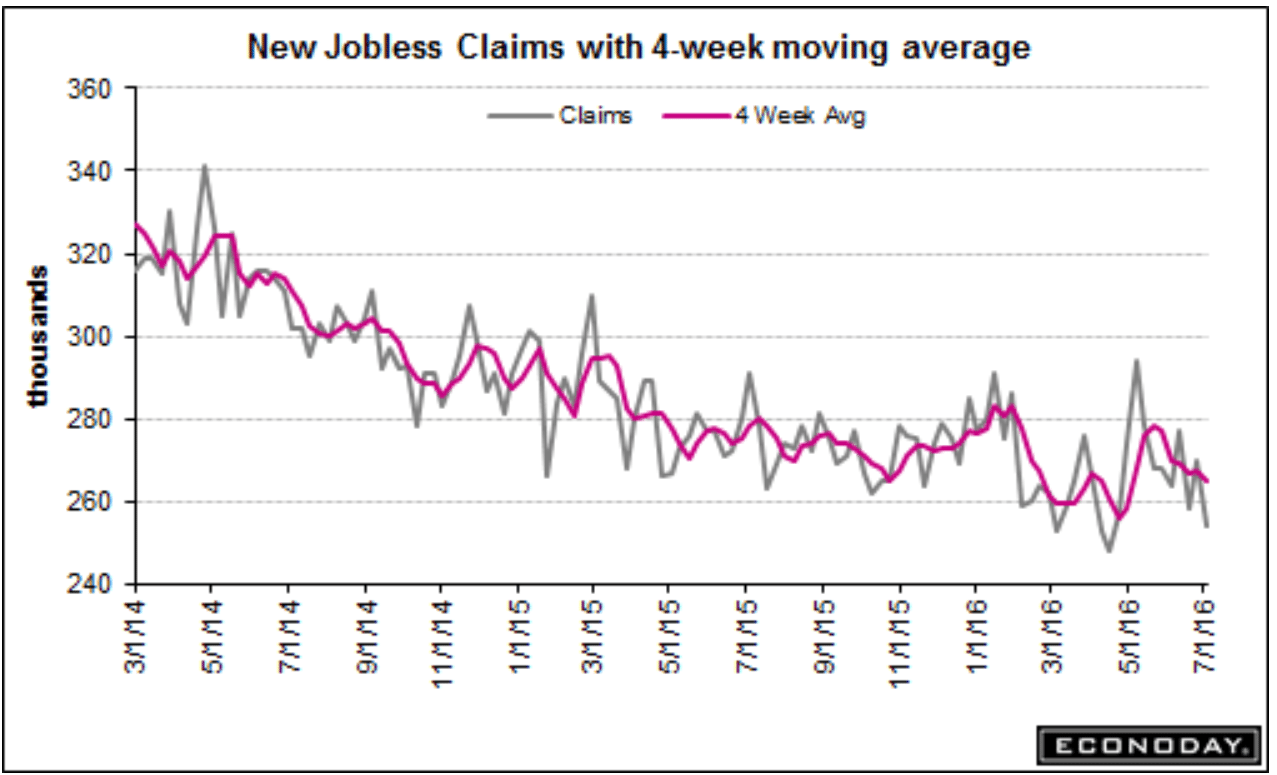

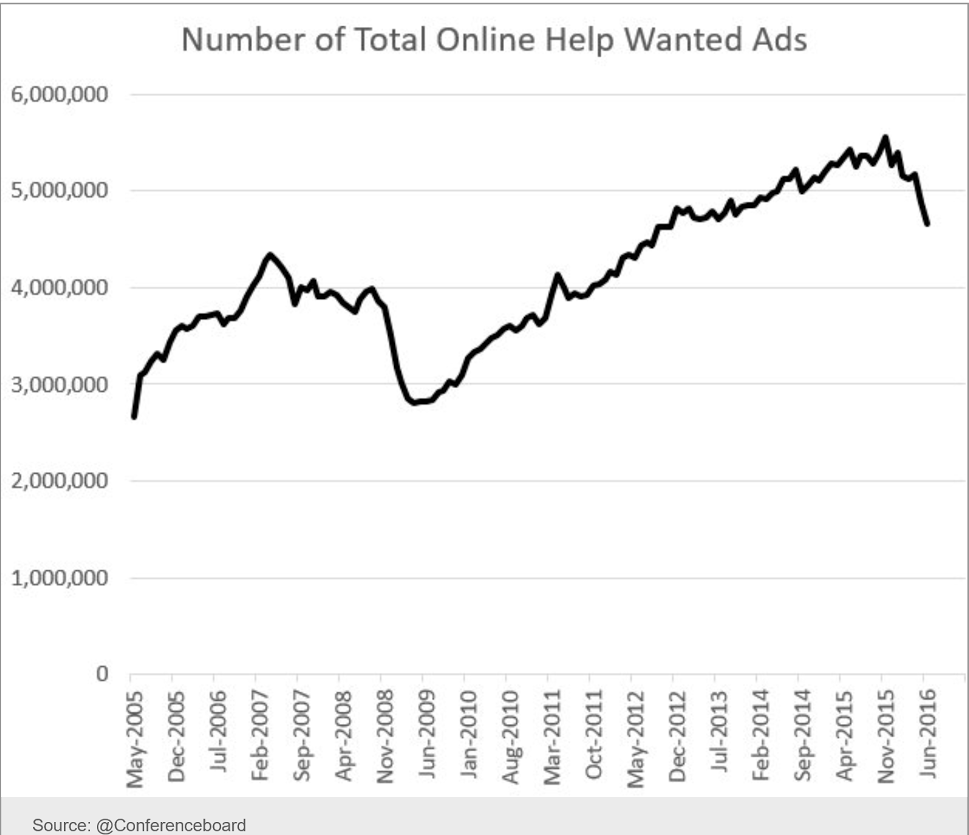

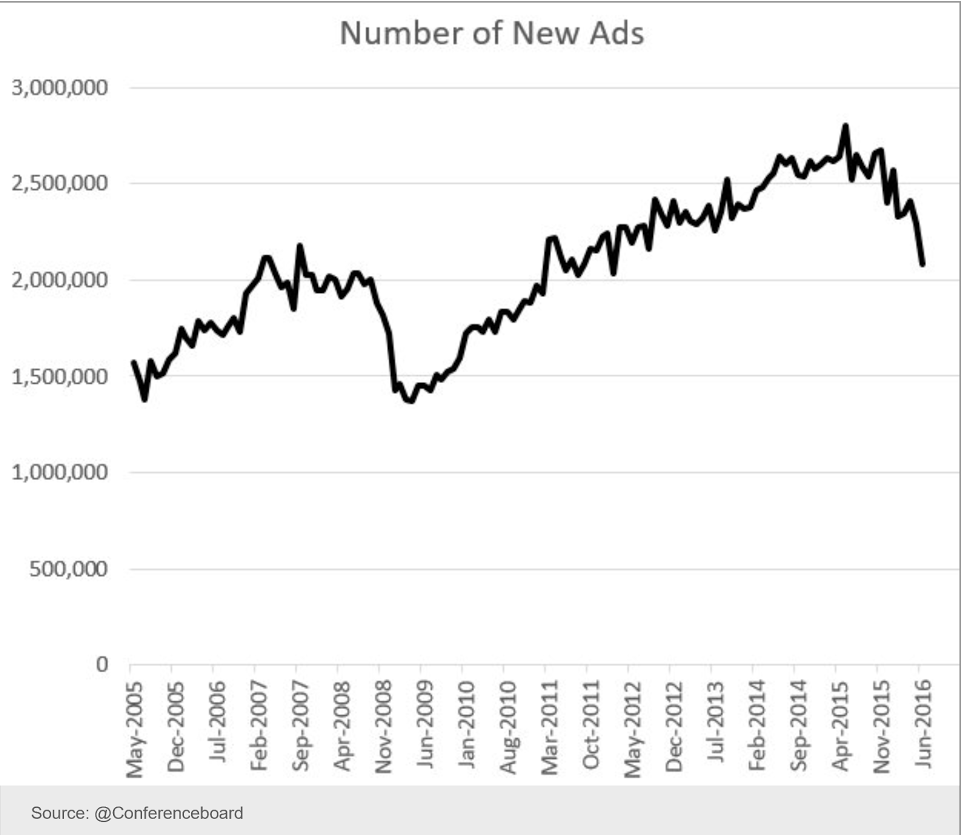

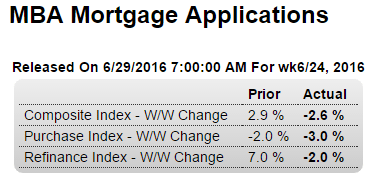

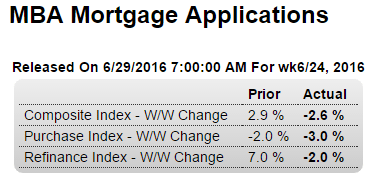

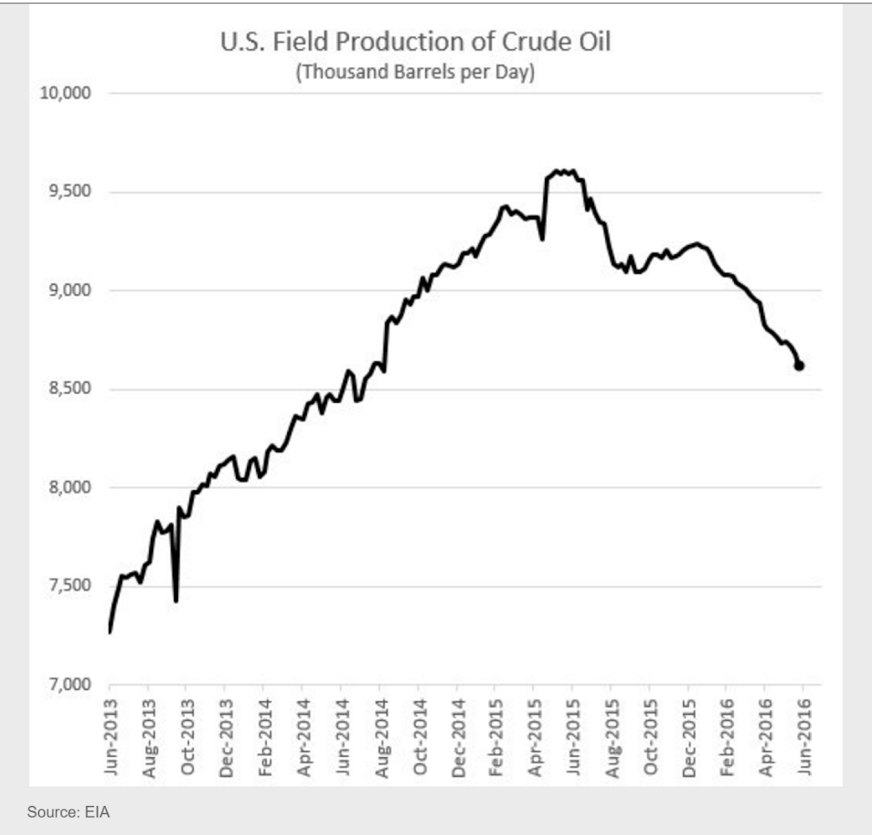

Continues to decline and now down for the month:

Highlights

The lowest mortgage rates in three years are not causing much of a stir in purchase applications for home mortgages, down 3 percent in the June 24 week for the third weekly decline straight. The year-on-year increase in purchase applications volume is a still very strong 13 percent, though far below the 30 percent gains seen in March. Even mortgage refinancing activity abated, down 2.0 percent after rising 7 percent in the prior week. The average rate for 30-year fixed rate mortgages on conforming loans ($417,000 or less) fell 1 basis point to 3.75 percent, the lowest rate since May 2013.

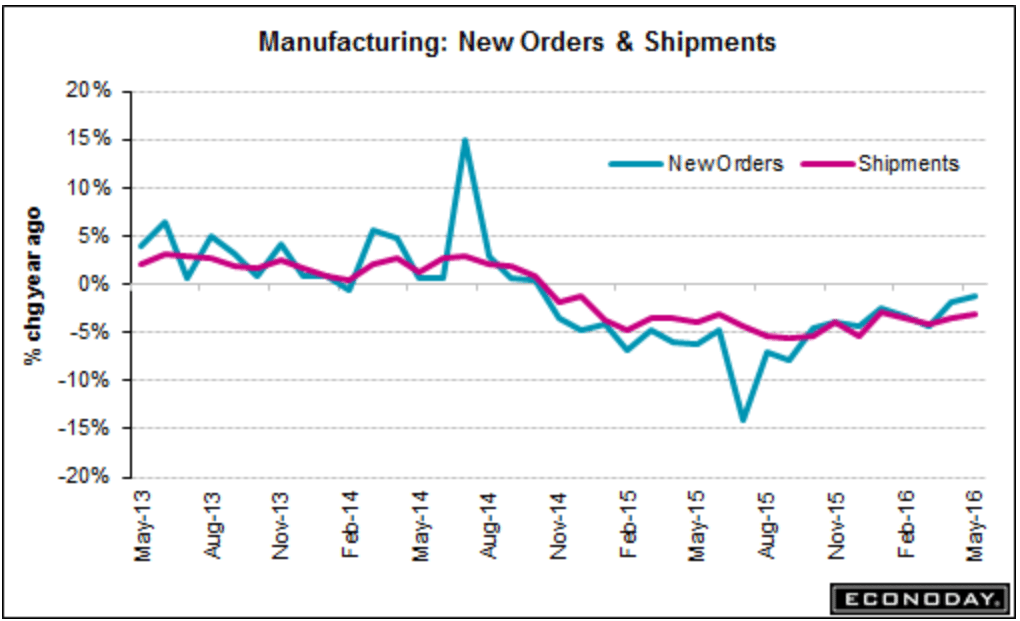

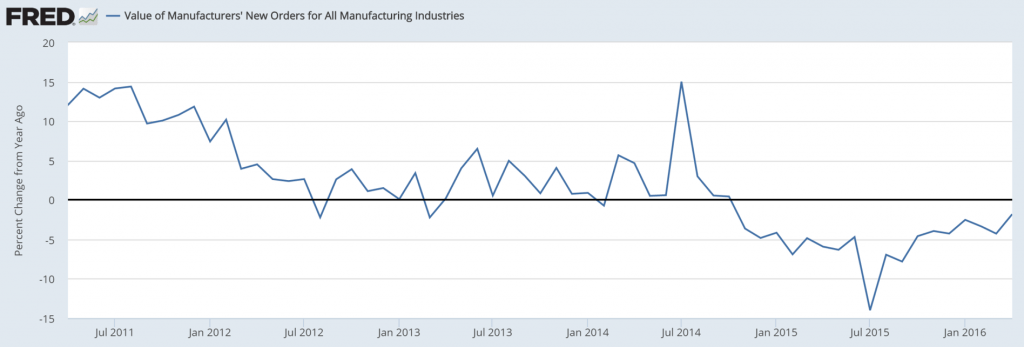

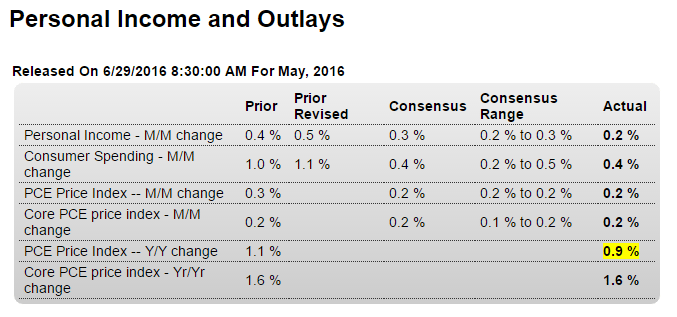

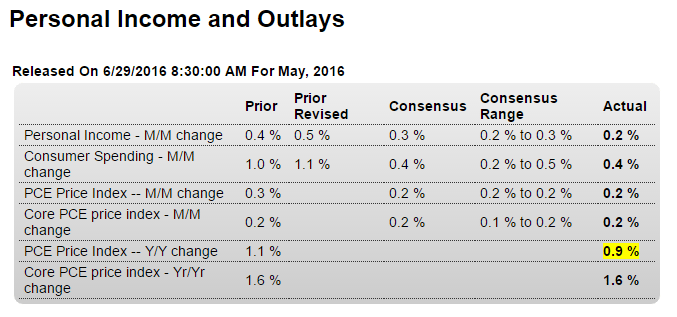

Reversing April’s uptick, as previously discussed:

Highlights

Personal income as well as personal spending slowed in May at the same time that price data remained quiet. Income rose at the low end of expectations, up only 0.2 percent, while spending showed a little life, up 0.4 percent.

The PCE core price index rose only 0.2 percent with the year-on-year rate unchanged and still below the Fed’s 2 percent target at 1.6 percent. Overall prices also rose 0.2 percent with the year-on-year rate dipping 2 tenths to only plus 0.9 percent.

Details on income show only a 0.2 percent rise in wages & salaries, down from April’s outsized 0.5 percent gain. With income growth stalling, consumers may have tapped into their savings slightly to fund May’s spending as the savings rate edged 1 tenth lower to 5.3 percent for the lowest rate of the year. Details on spending show gains concentrated in nondurable goods where price effects for gasoline and energy are inflating the totals. Spending on durable goods, despite a solid rise in vehicle sales during May, rose a soft 0.3 percent. Service spending was respectable with a 0.4 percent gain.

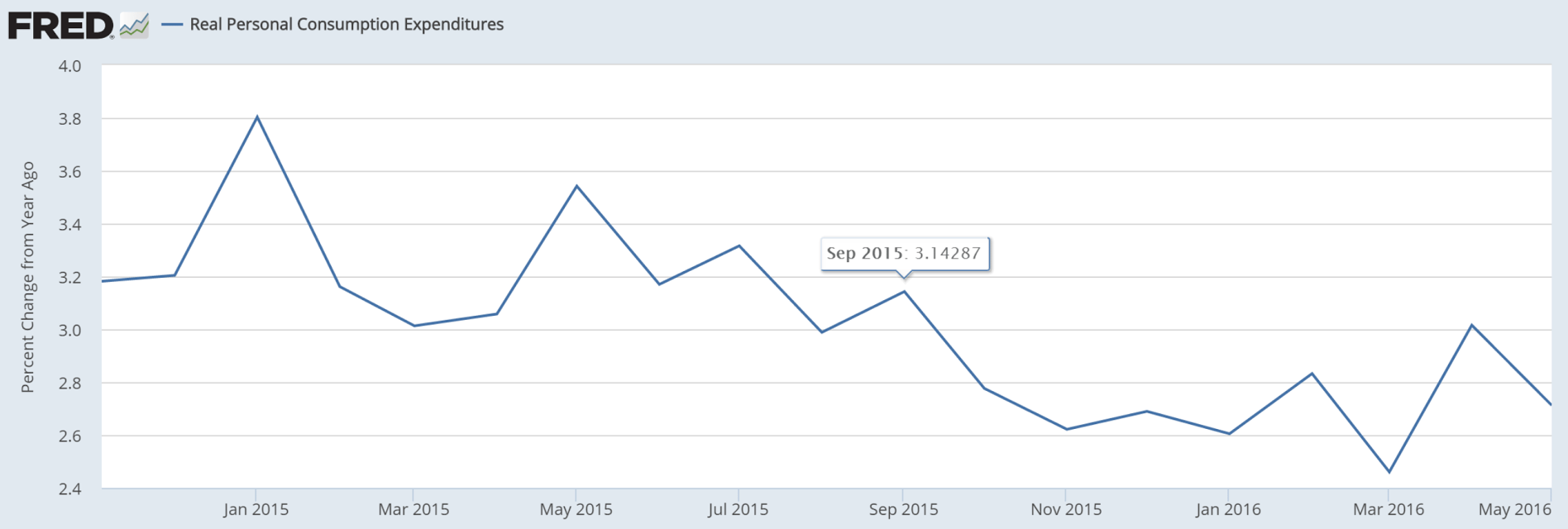

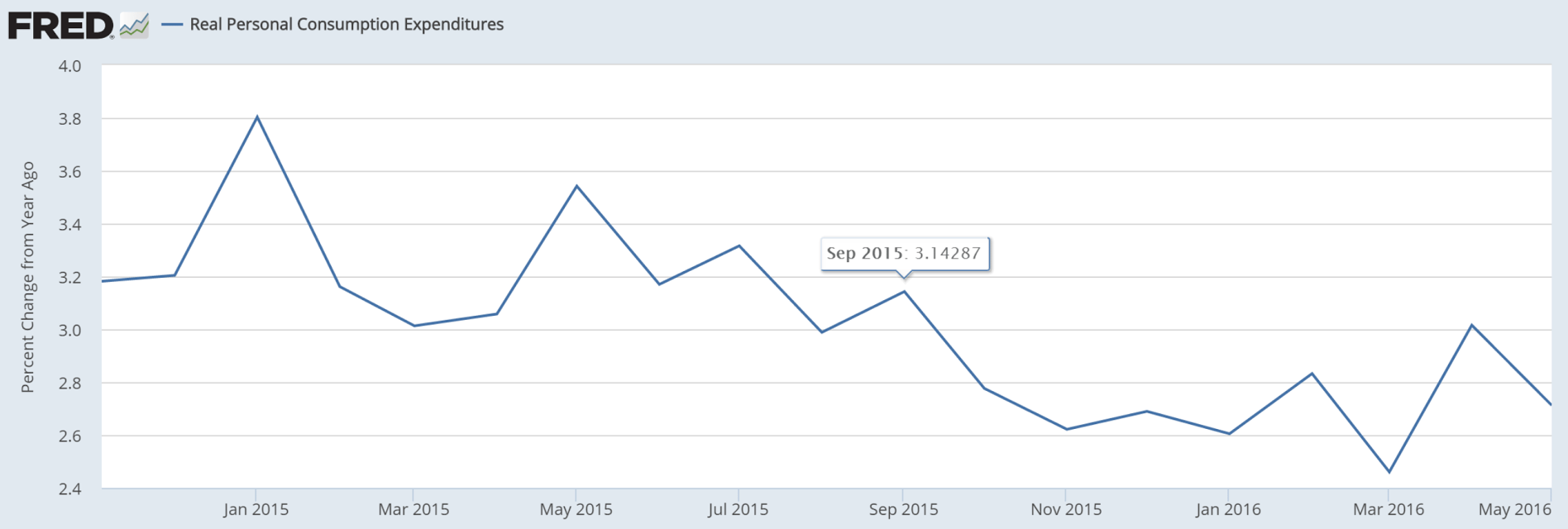

The spending side of May’s report isn’t robust though it was robust in April, revised in fact 1 tenth higher to a recovery best 1.1 percent. When adjusted for inflation, the two months combined show an annualized growth rate of about 4 percent which, with June’s results still pending, will support a jump in second quarter GDP.

But based on trends including May’s results, April may very well prove to be an outlier for spending. April aside, today’s report is consistent with moderate economic growth and does not point, especially with the uncertainty of Brexit in play, to a Fed rate hike anytime soon.

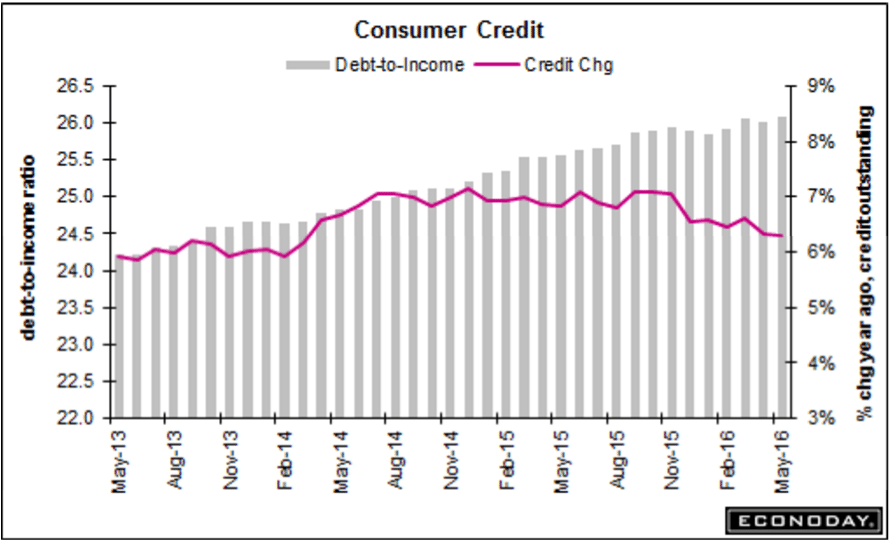

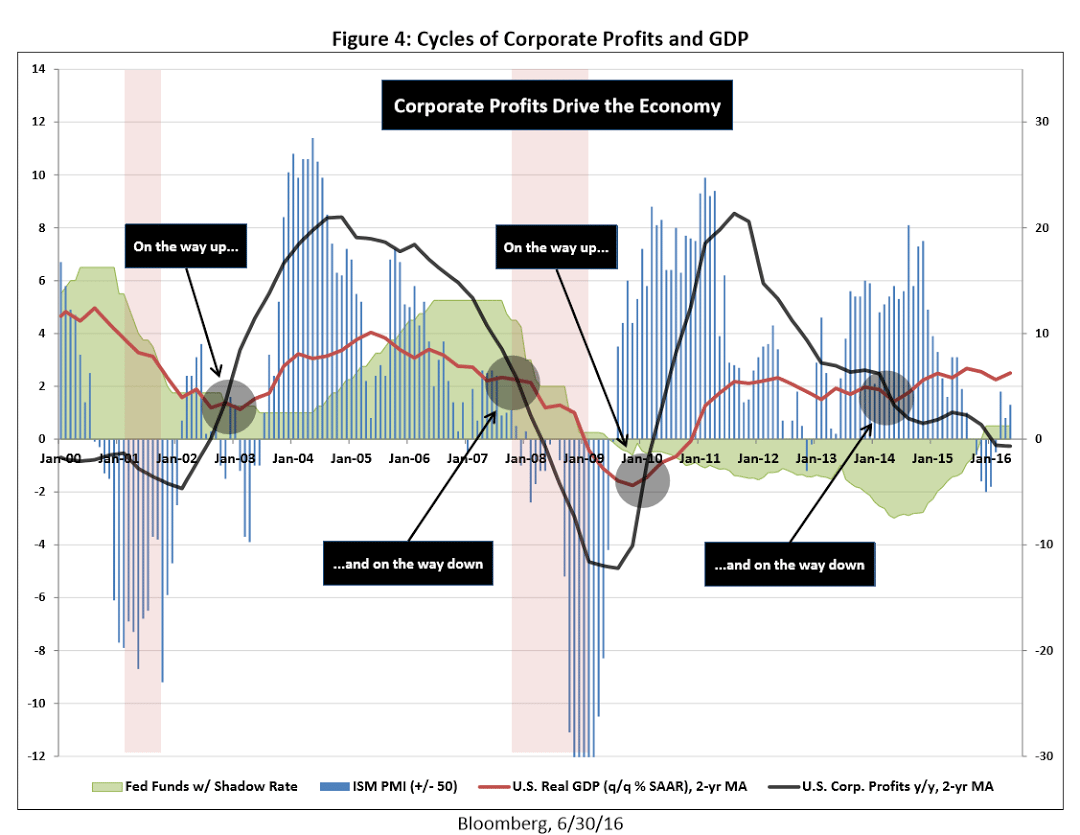

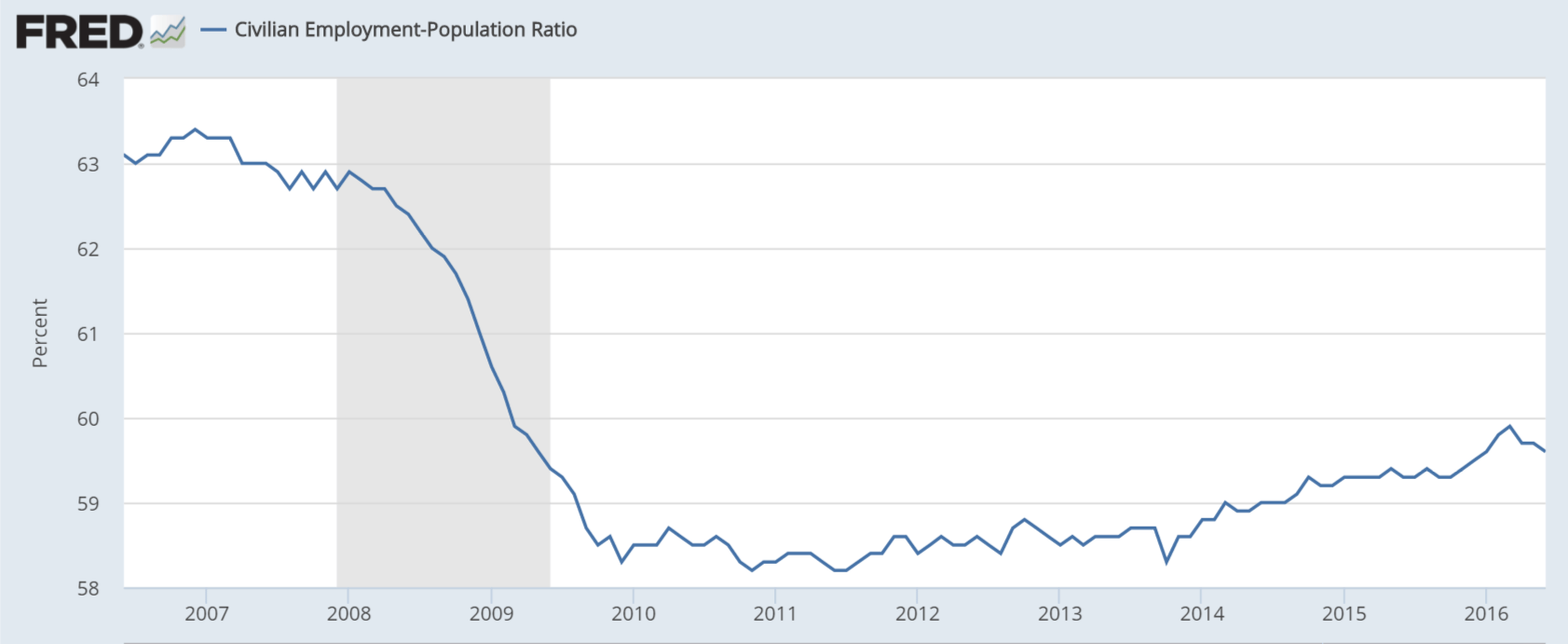

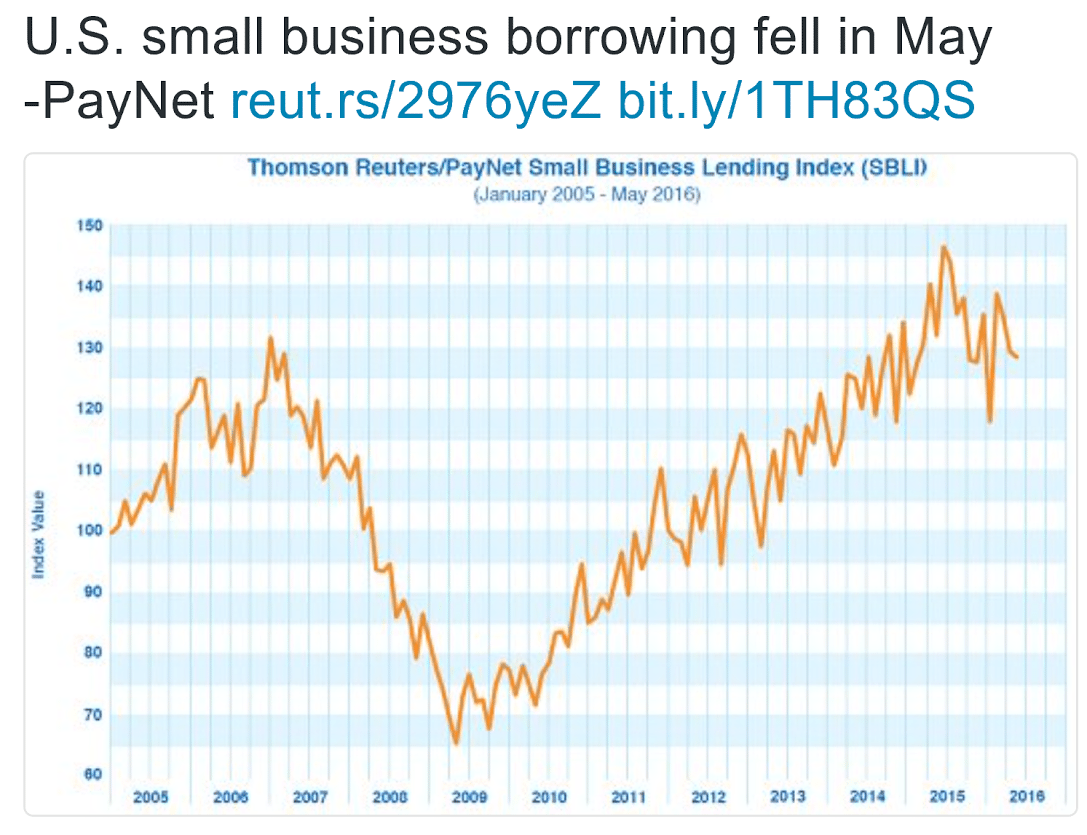

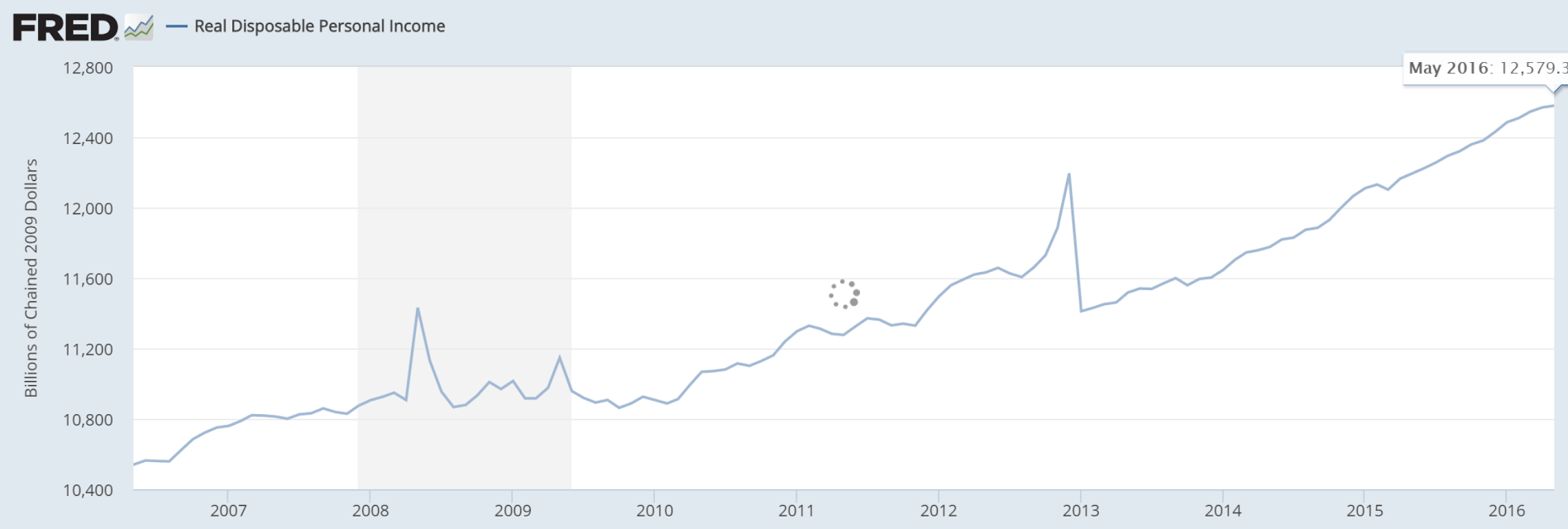

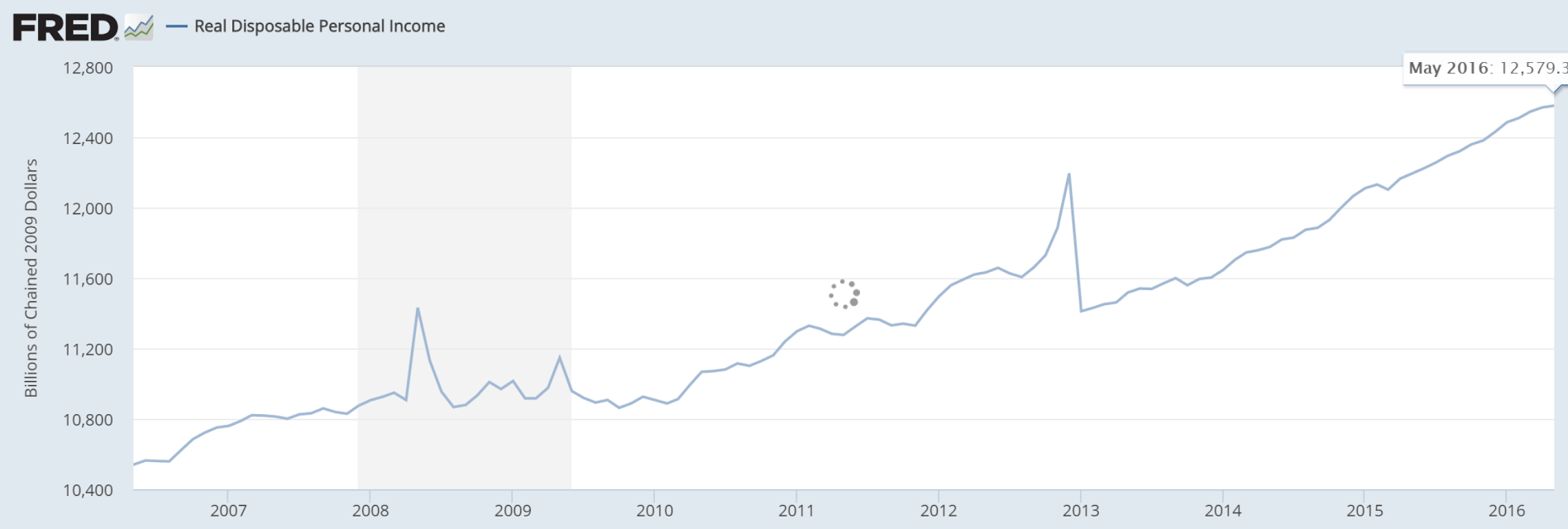

Note the damage done by the recession and then the tax hikes (Jan 2013):

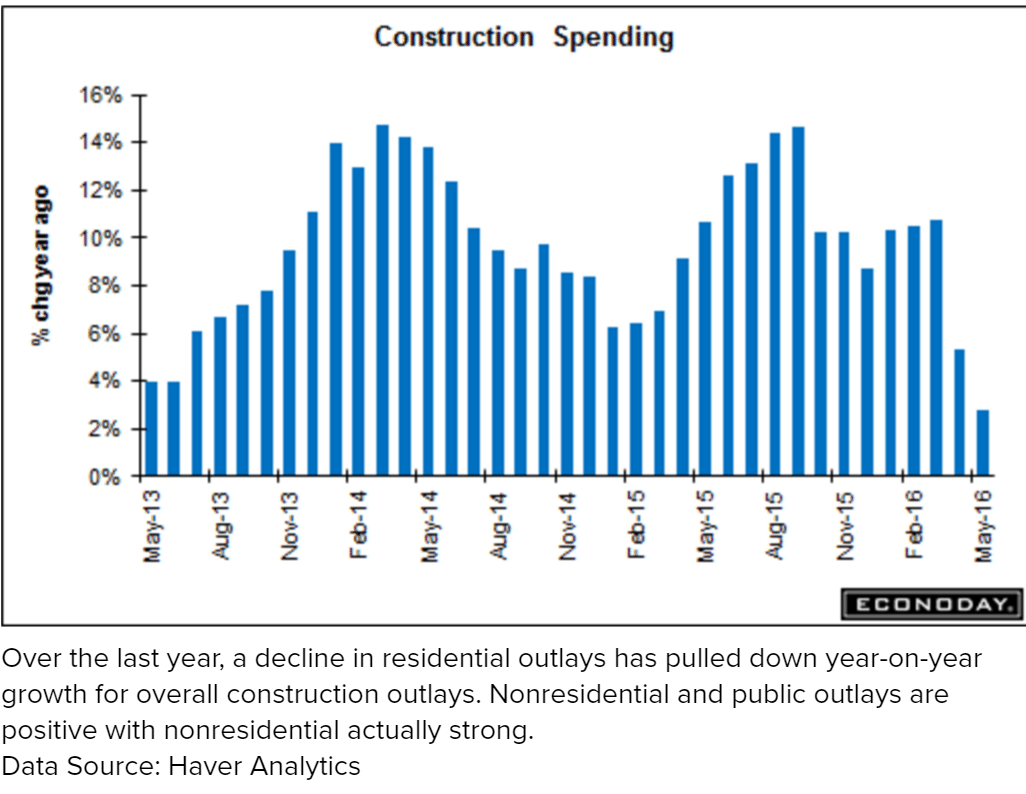

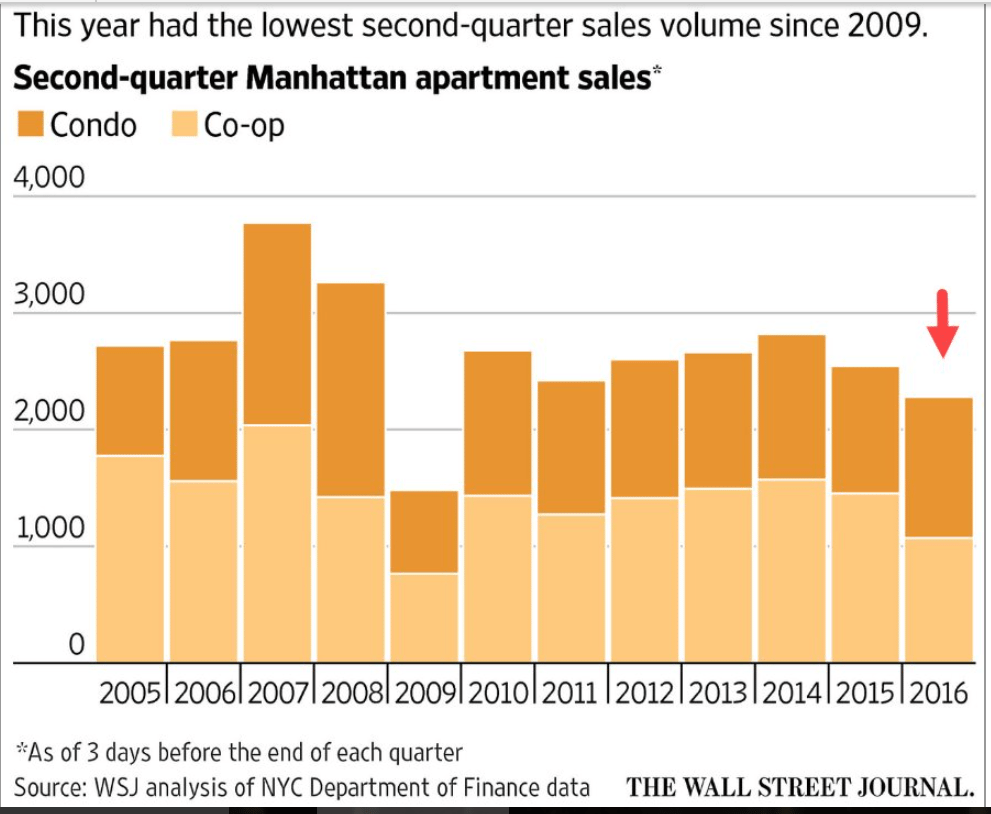

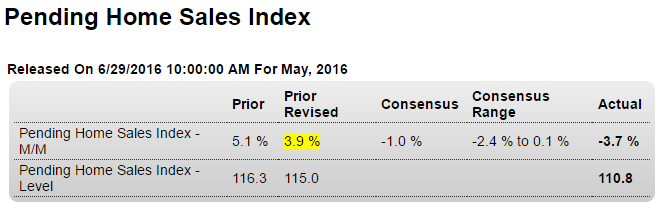

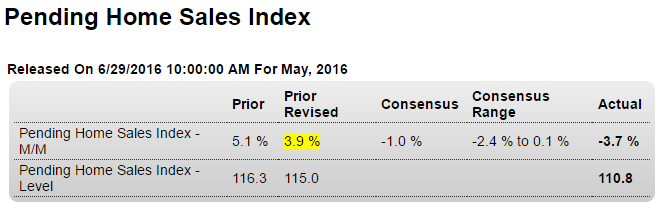

Not good- another April uptick that reversed in May, and this time with April being revised down as well. Housing is looking less and less likely to be contributing to growth this year:

Highlights

Existing home sales have been trending higher but today’s pending home sales index, which tracks contract signings, may be pointing to slowing for the early part of the summer. The index fell a steep 3.7 percent in the May report to nearly reverse a downward revised 3.9 percent jump in April. Year-on-year, the pending sales index is down 0.2 percent which hints at moderation for the 4.5 percent rate of final sales. Details data show monthly declines across all four regions with year-on-year rates all flat near zero. Housing data have been up and down this year but behind the noise have been deceptively solid rates of growth, among the strongest rates of the nation’s slow-growth economy.

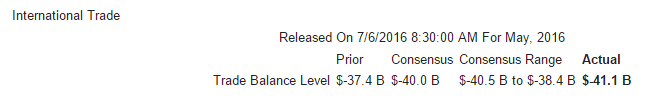

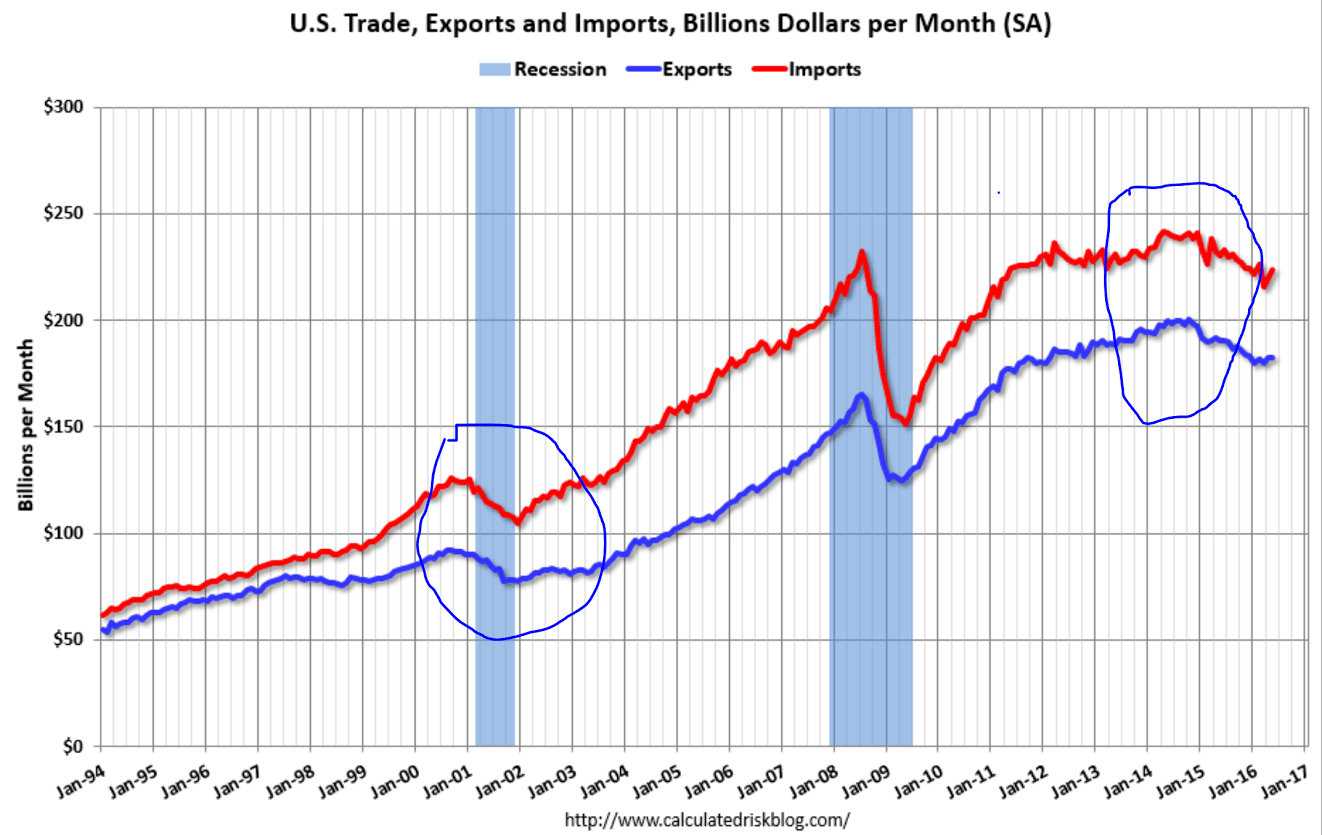

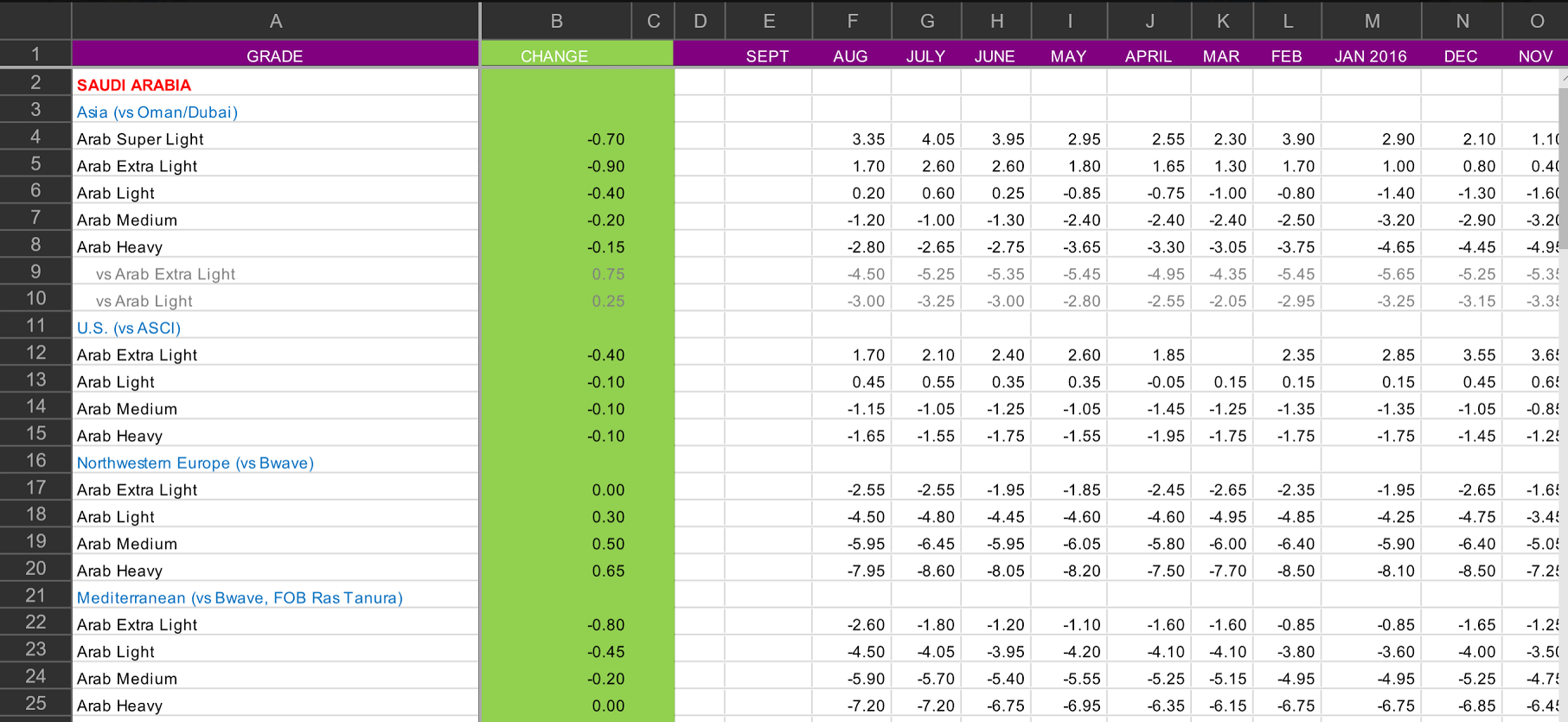

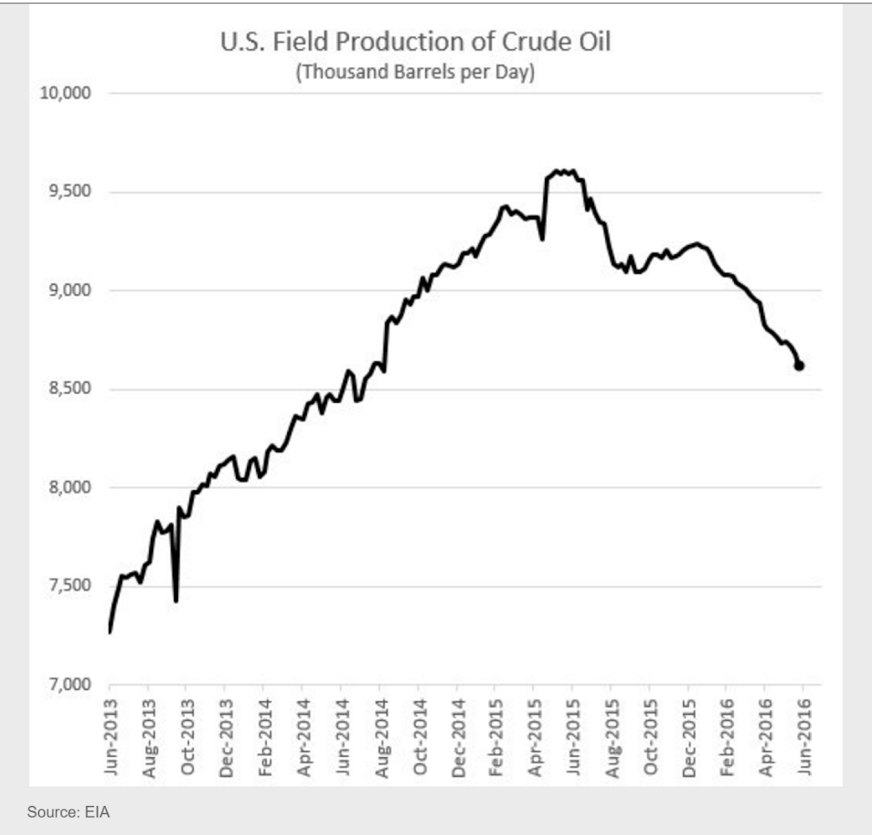

This is causing a rise in oil imports and is thereby dollar unfriendly:

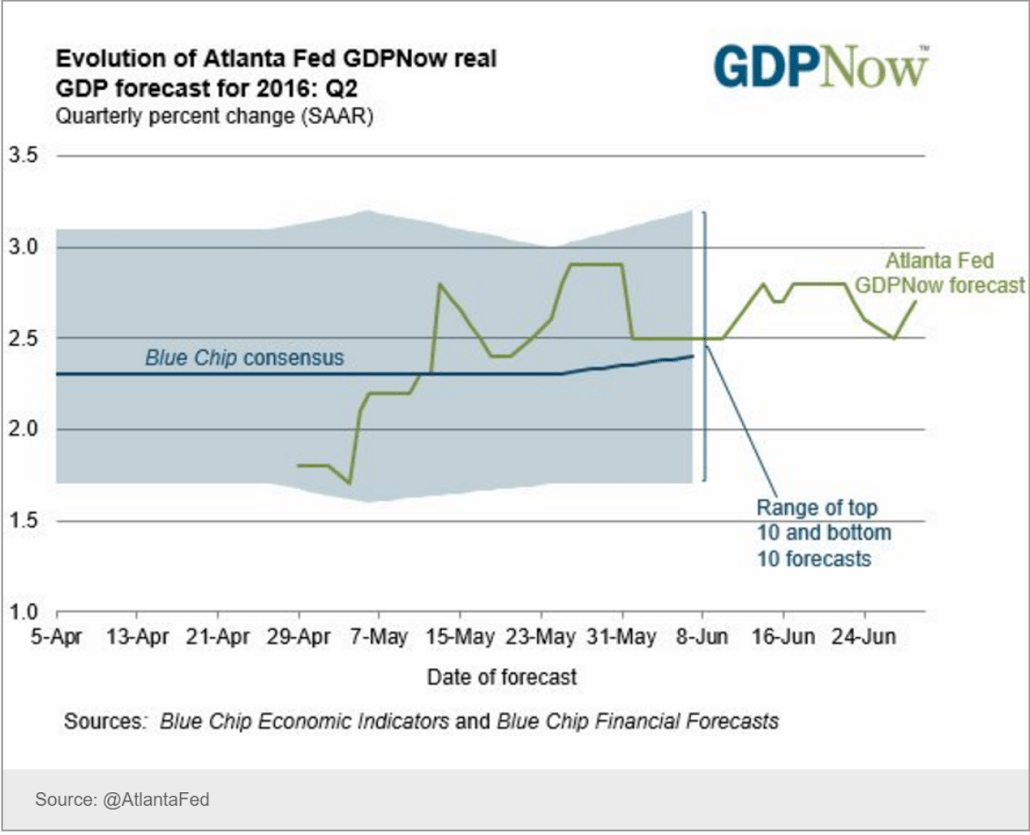

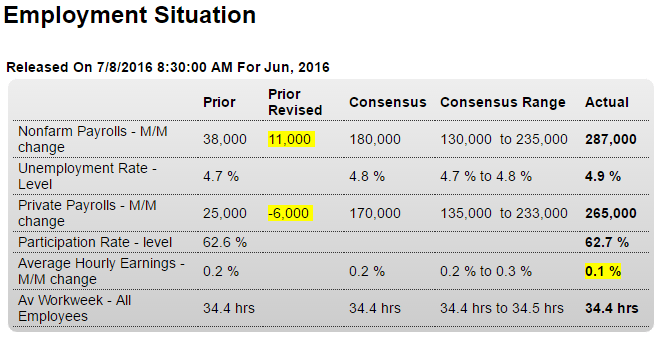

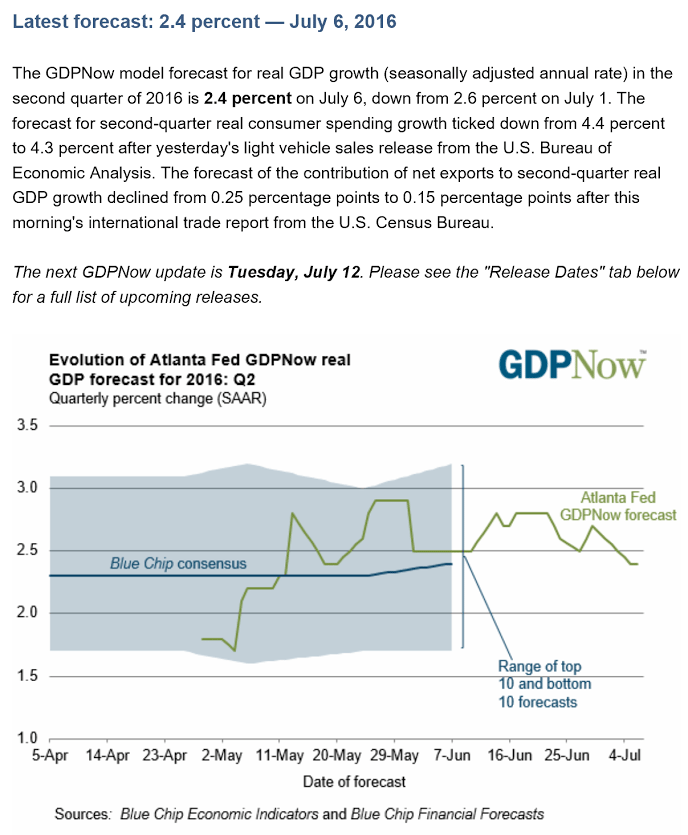

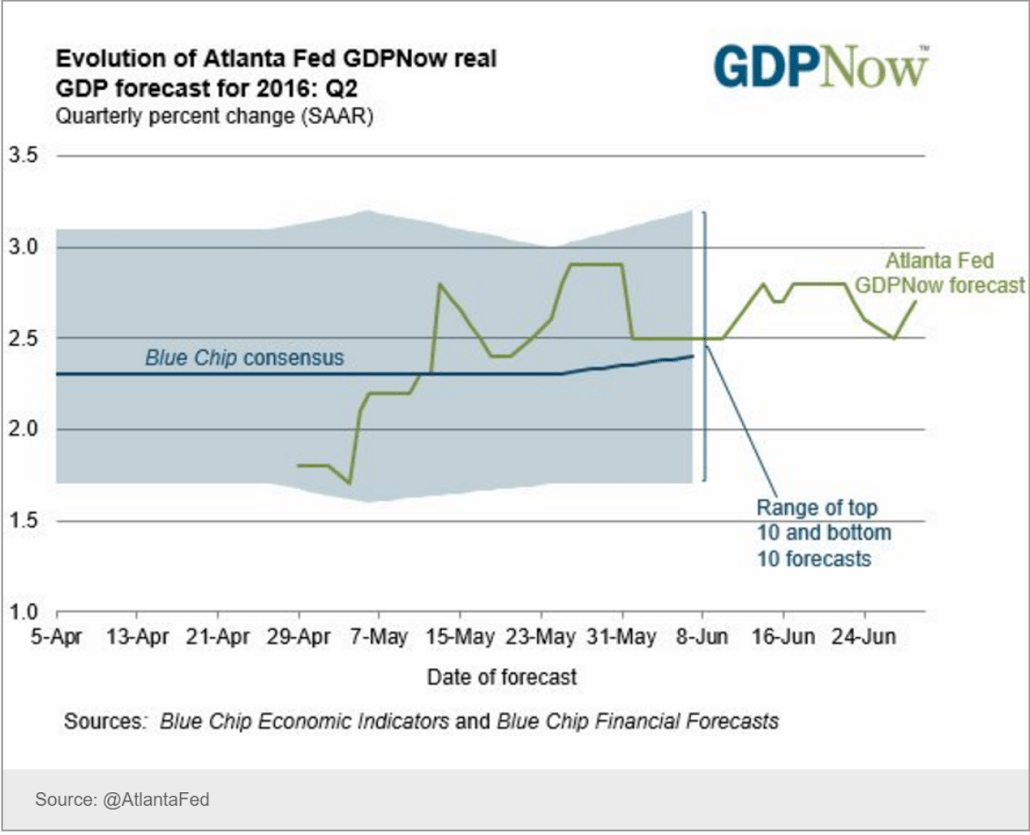

This is up based on the stronger April numbers that wouldn’t surprise me if they continue to reverse through June, which could dramatically lower this forecast: