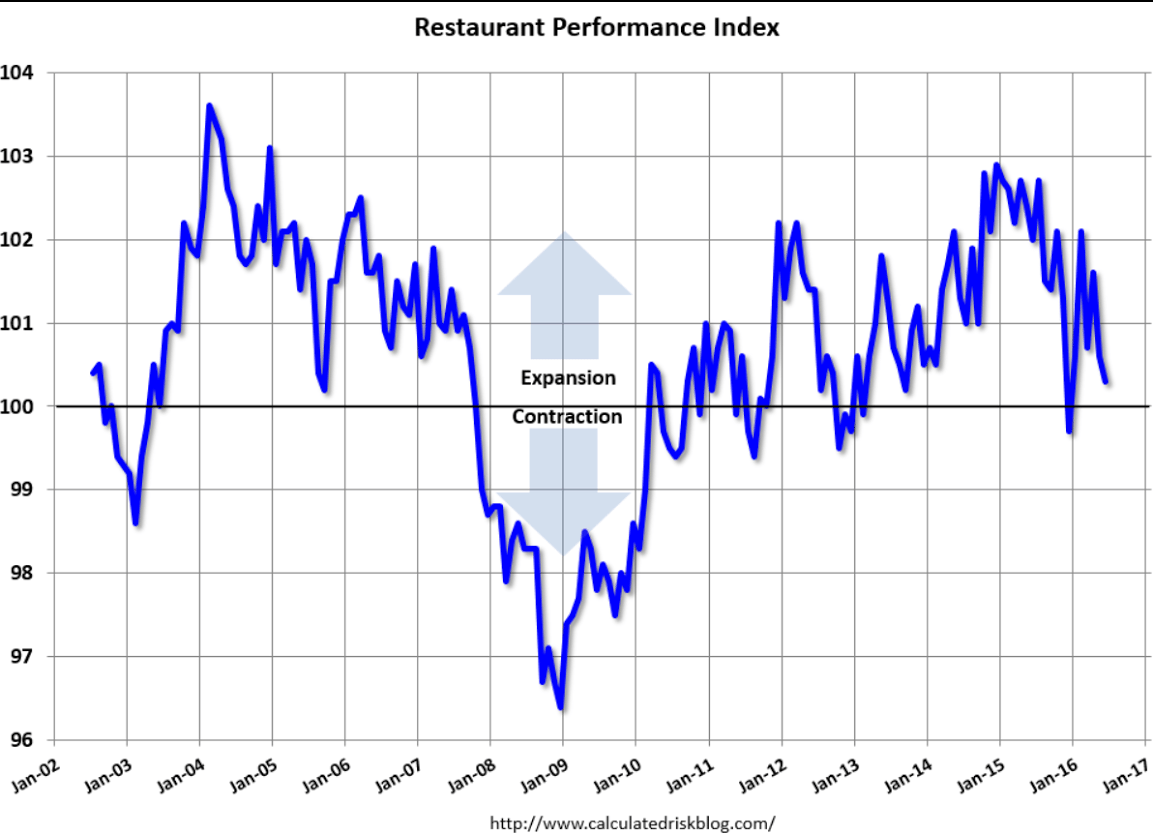

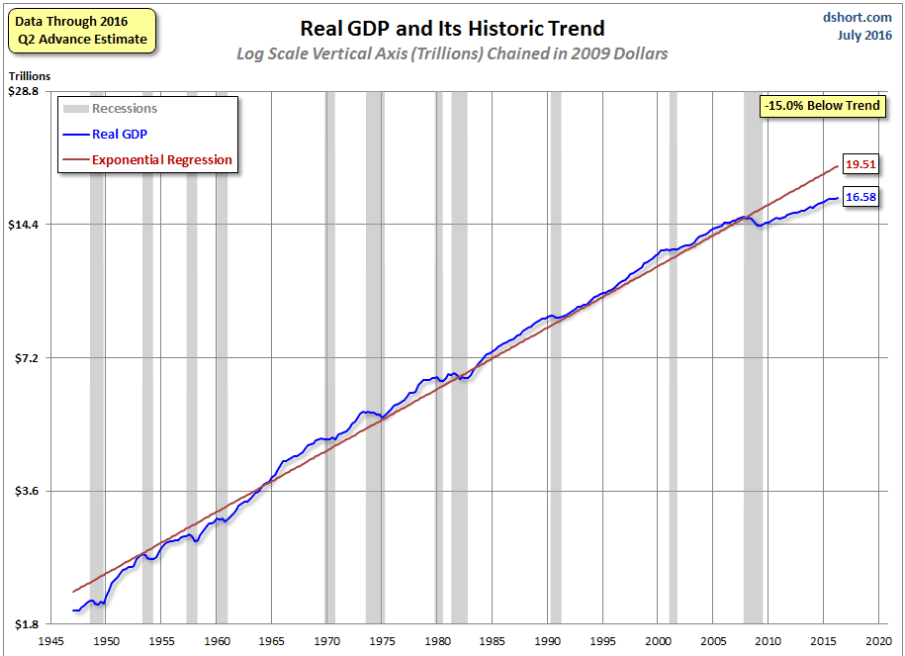

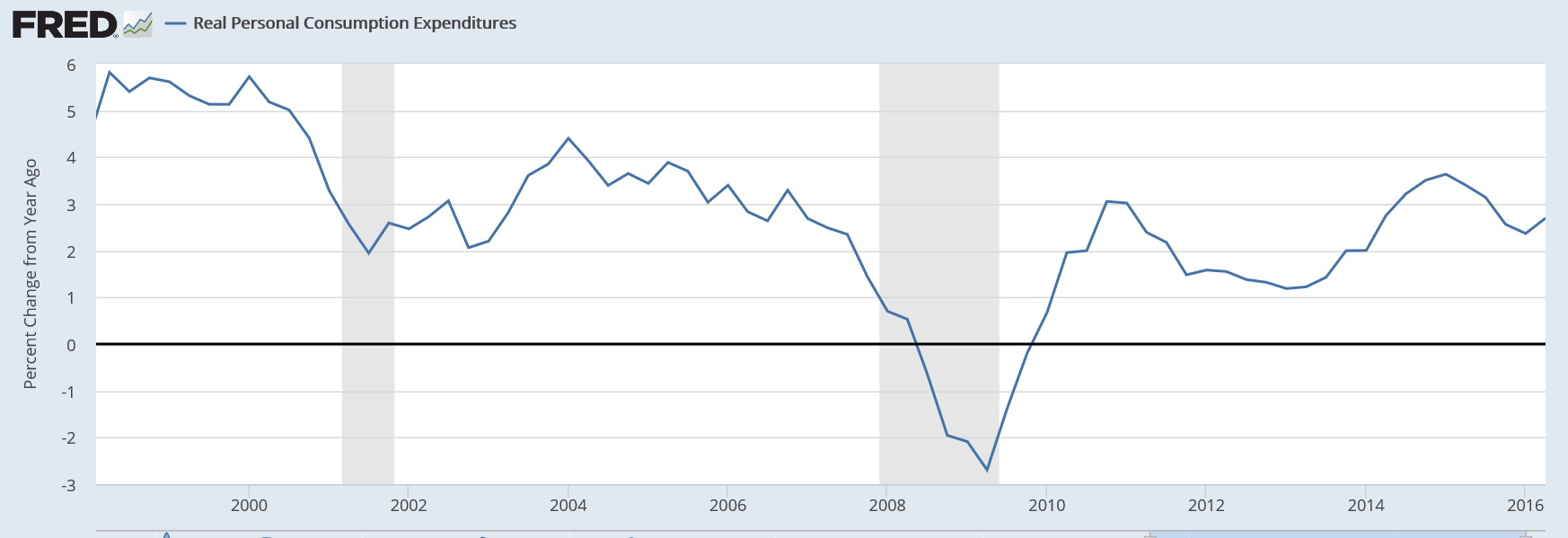

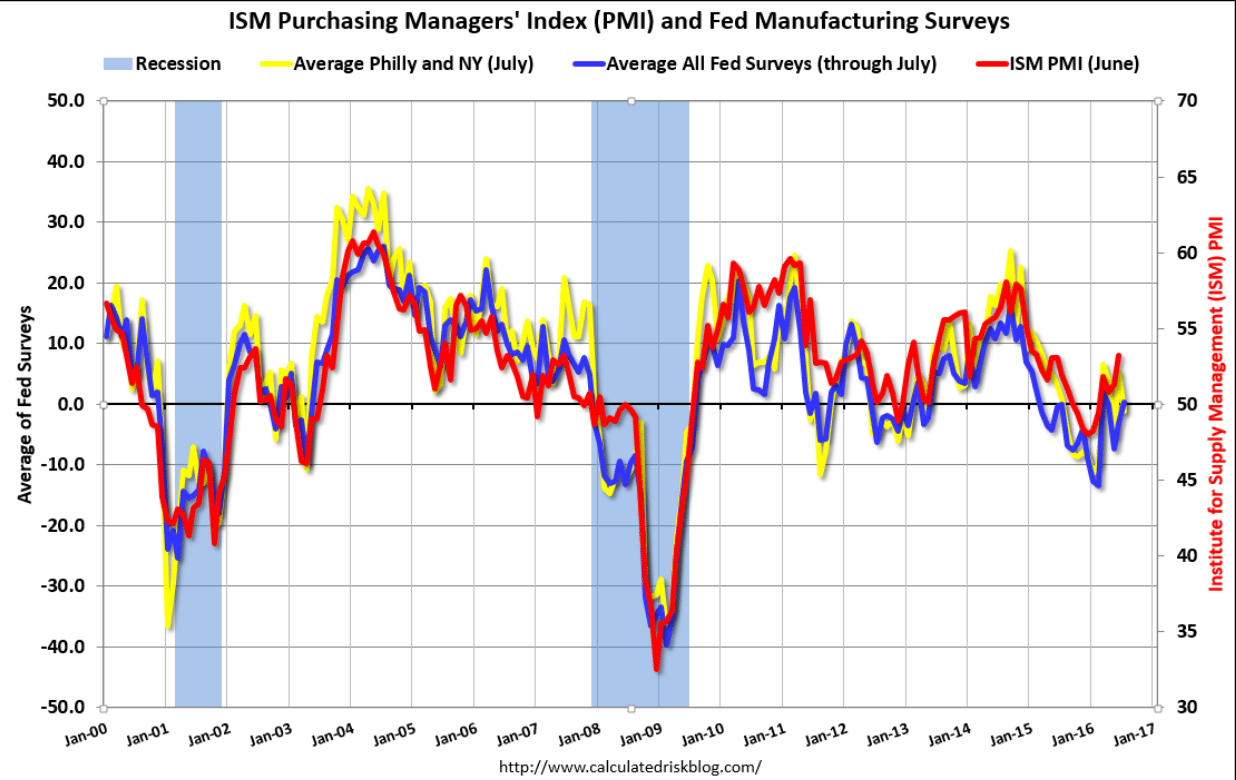

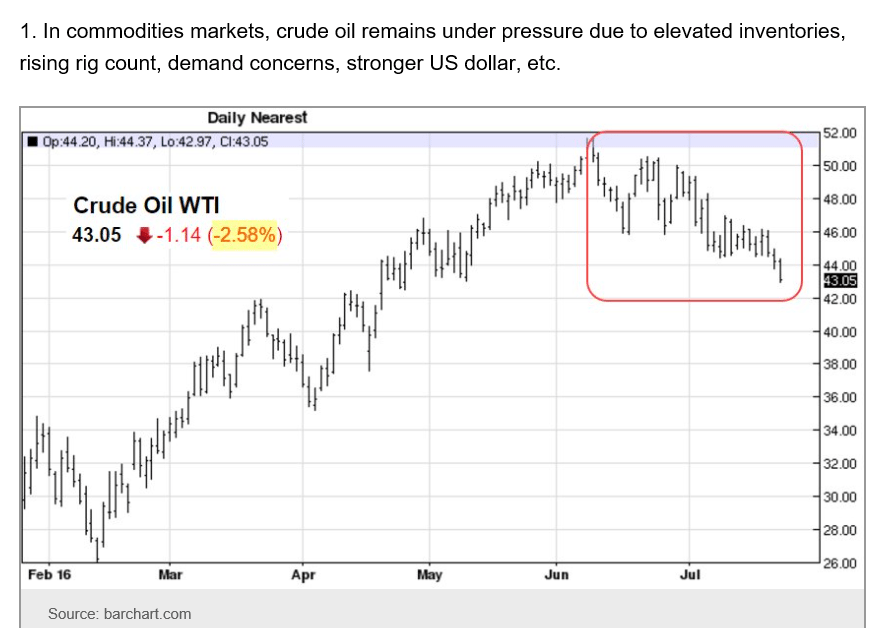

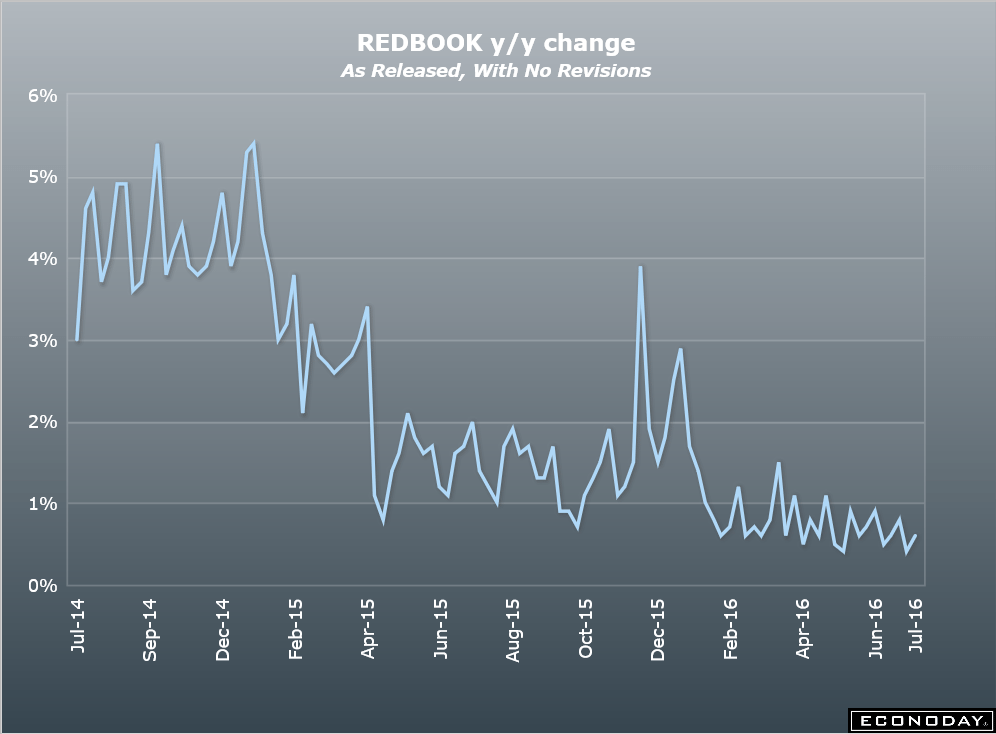

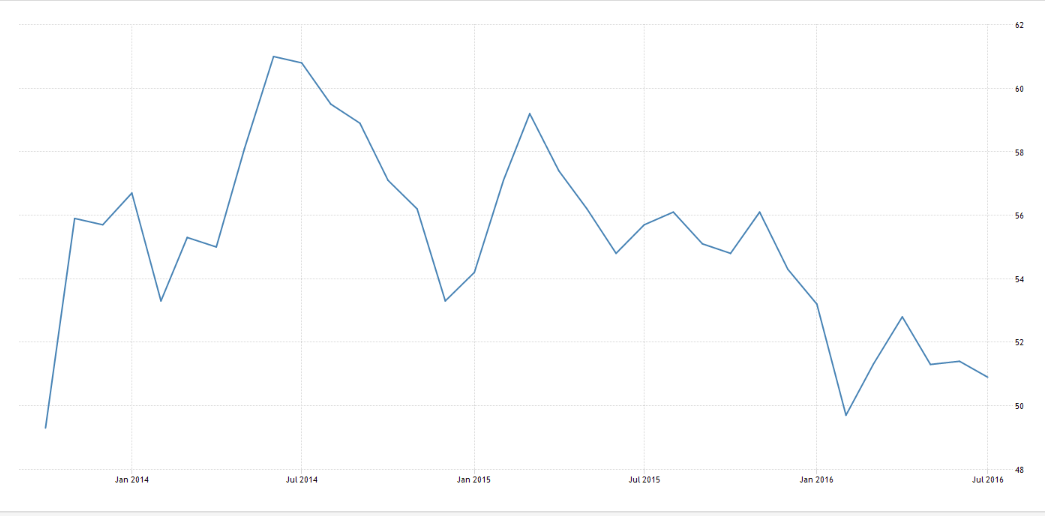

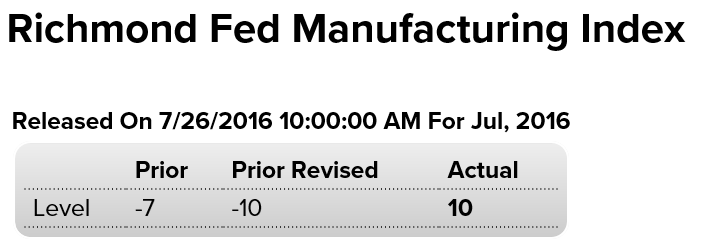

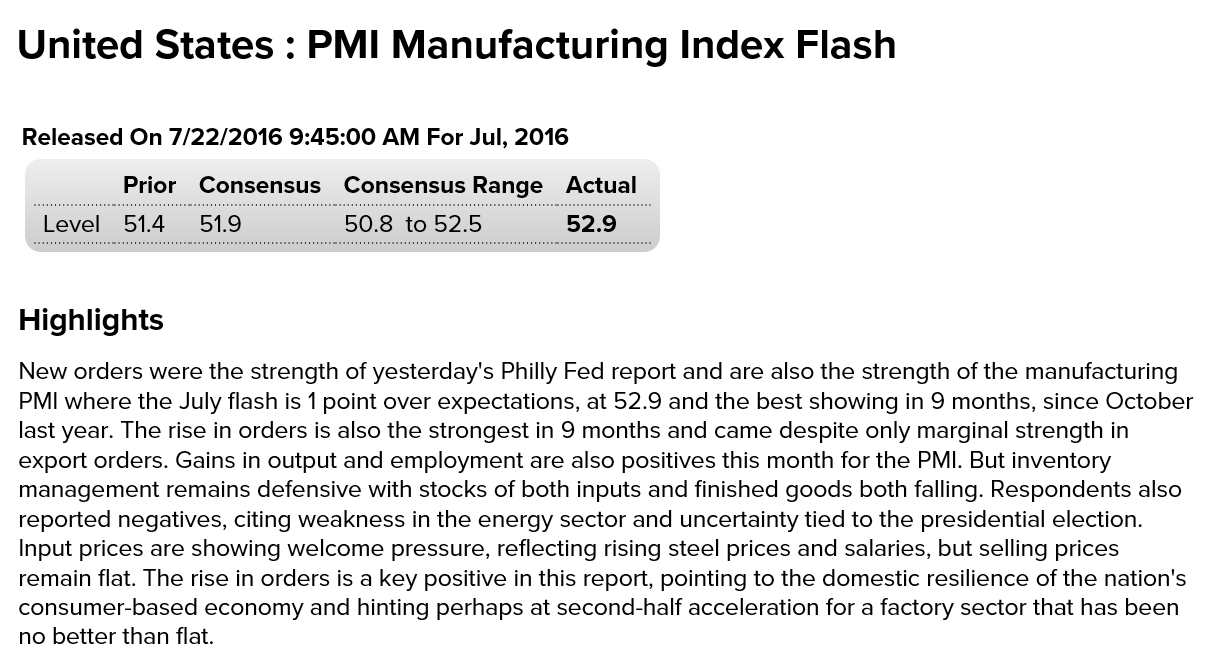

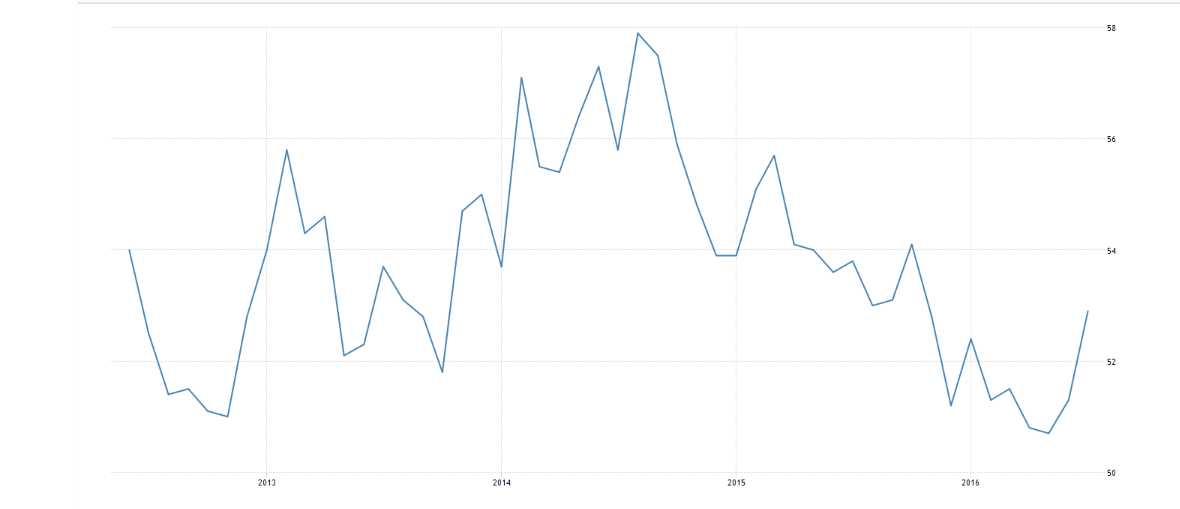

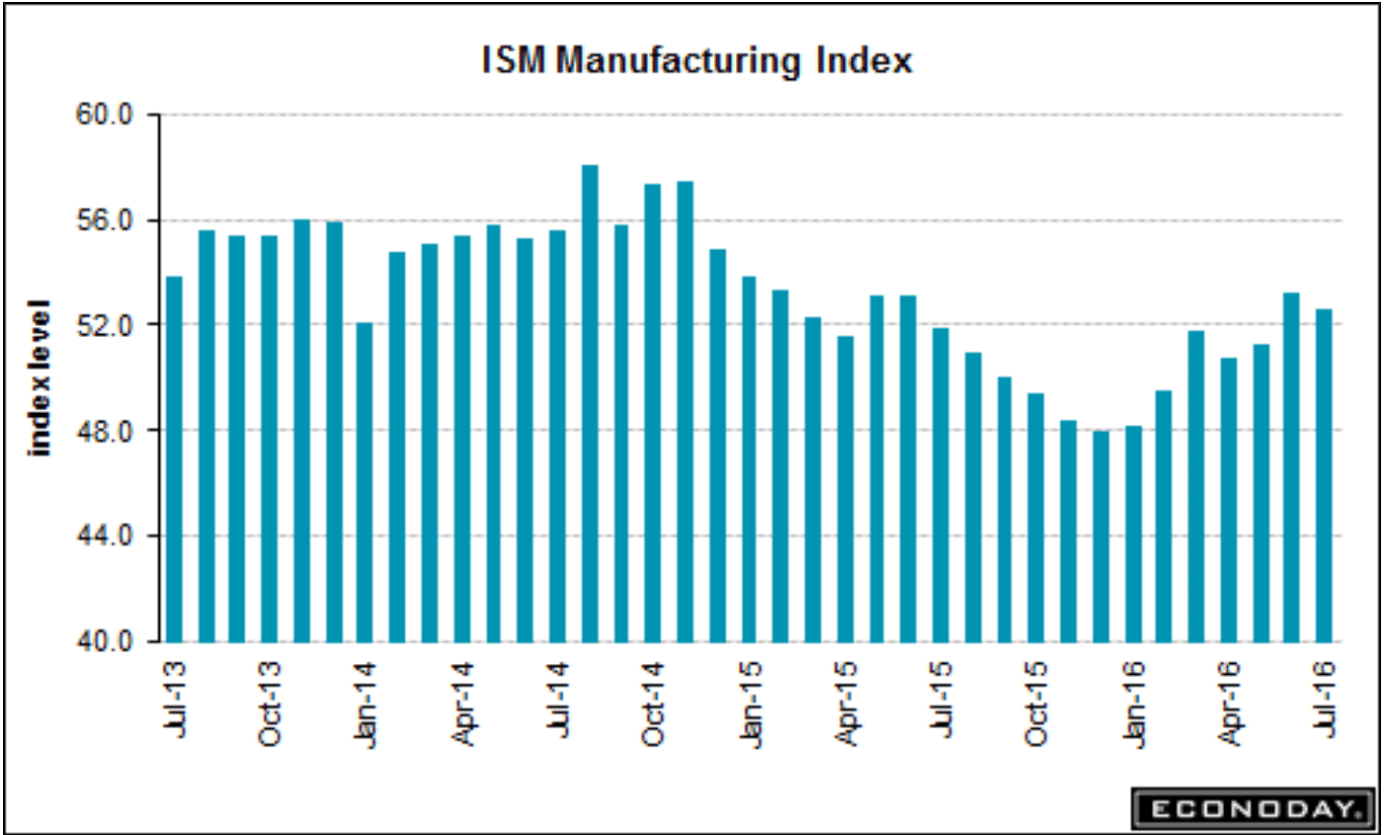

Manufacturing is showing signs of bottoming at the lower levels, as the lack of aggregate demand does it’s thing with the service sector:

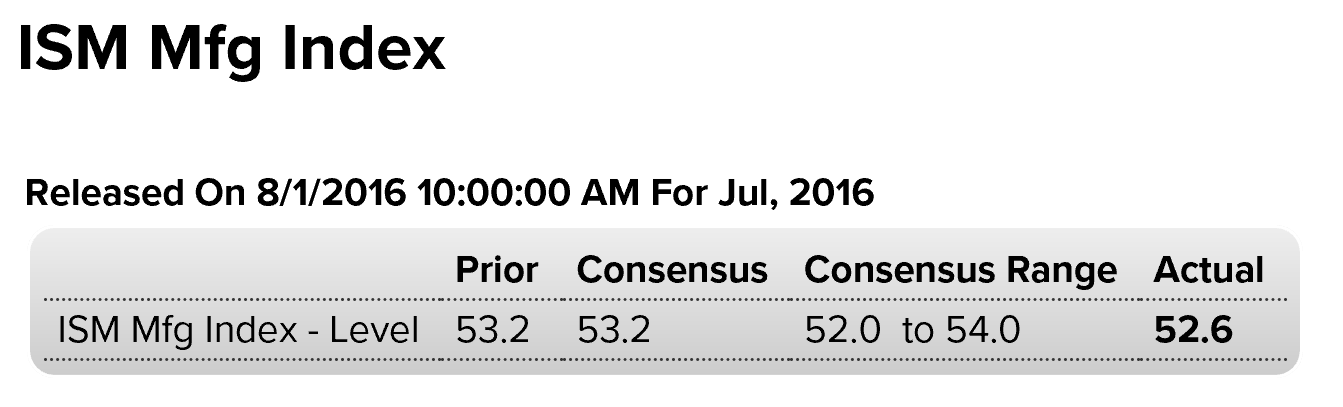

Highlights

Employment fell slightly and delays in delivery times eased, two factors that held down the July ISM index to 52.6 vs June’s 53.2. But that’s not the important news. The important news is the new orders index which remains extremely solid, at 56.9 and pointing to future strength for employment as well perhaps as slowing for future deliveries (slowing in deliveries is an indication of strength in demand, of congestion in the supply chain).Export orders are not as strong as domestic orders but they are respectable, at 52.5 which is safely above breakeven 50 to indicate monthly growth. The reading here echoes even stronger export results the manufacturing PMI which was released earlier this morning.

Production is solid in this report, at 55.4 for a 7 tenths gain in the month. Inventories are flat and prices for inputs are showing modest pressure.

But it’s the new orders index that is the standout in this report and which hints at badly needed improvement in government data where new orders have yet to show strength. If the ISM orders pan out, the economy looks to get a second-half lift from its lagging sector, the factory sector.

“The July PMI® registered 52.6 percent, a decrease of 0.6 percentage point from the June reading of 53.2 percent. The New Orders Index registered 56.9 percent, a decrease of 0.1 percentage point from the June reading of 57 percent. The Production Index registered 55.4 percent, 0.7 percentage point higher than the June reading of 54.7 percent. The Employment Index registered 49.4 percent, a decrease of 1 percentage point from the June reading of 50.4 percent. Inventories of raw materials registered 49.5 percent, an increase of 1 percentage point from the June reading of 48.5 percent.”

Read more at http://www.calculatedriskblog.com/#JQDxgoXe0yUEgICs.99

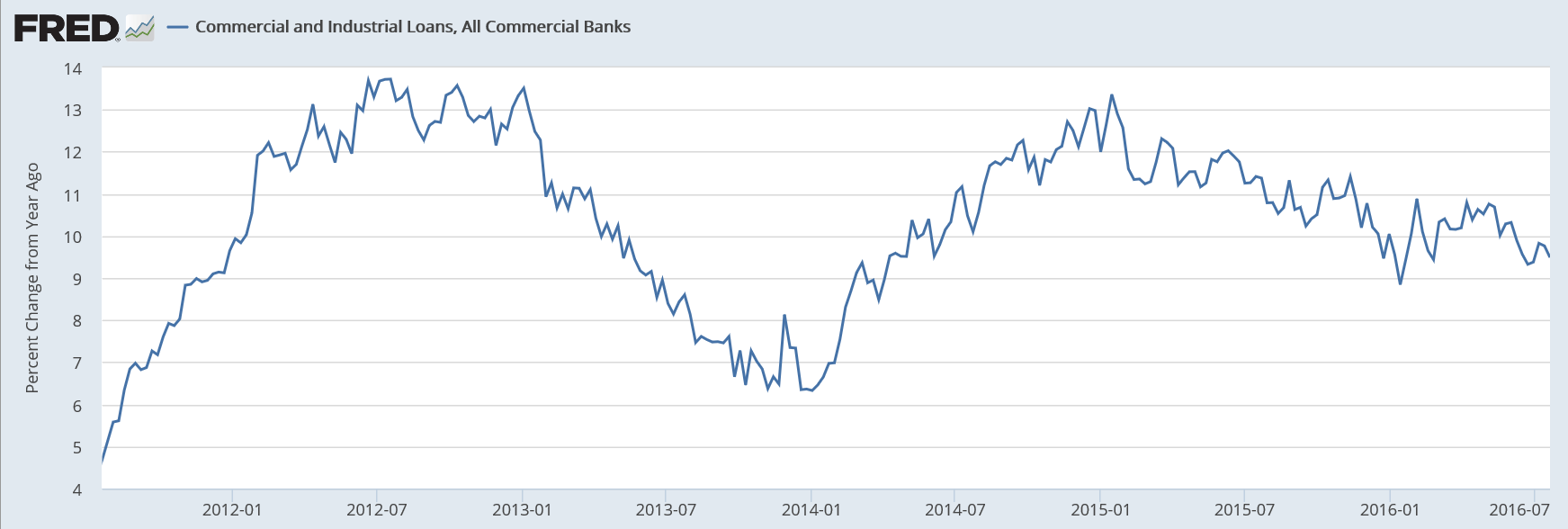

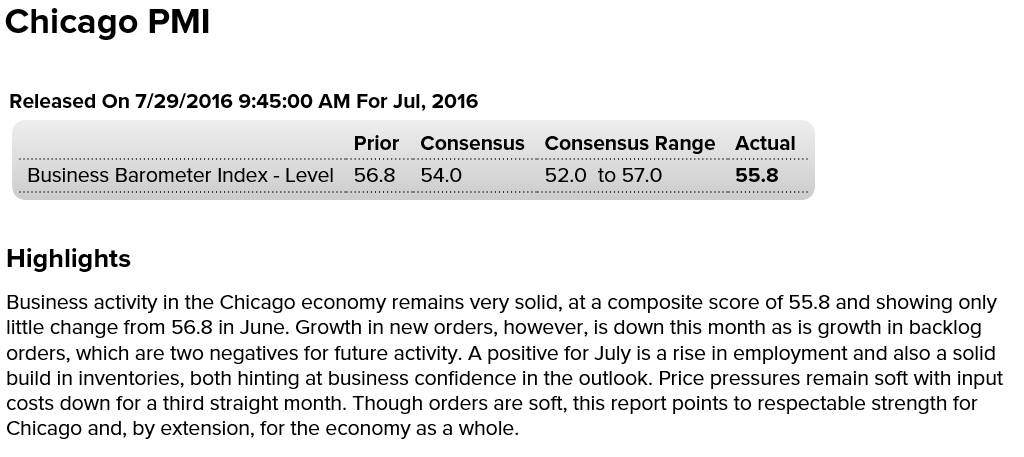

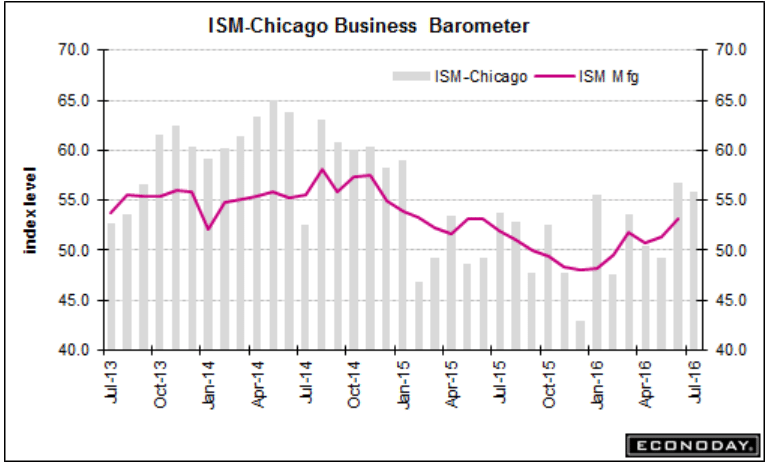

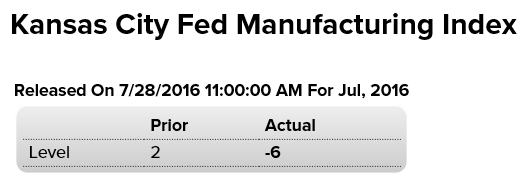

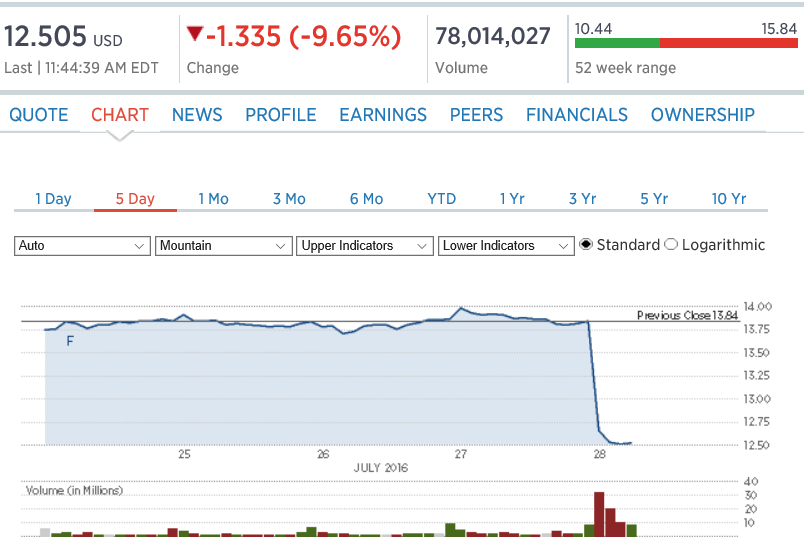

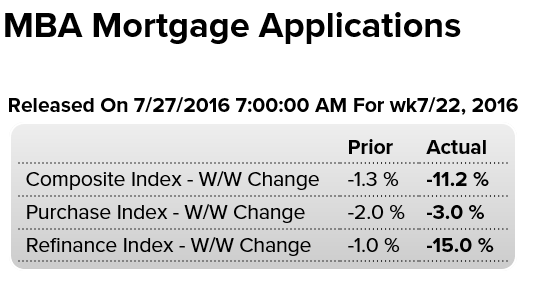

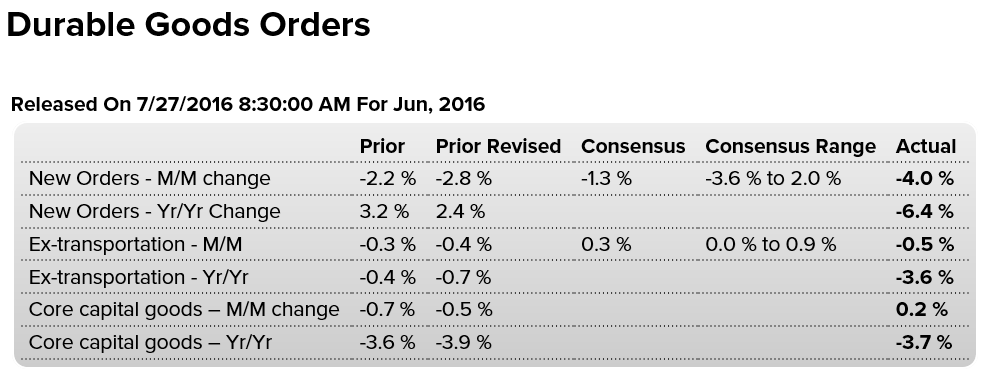

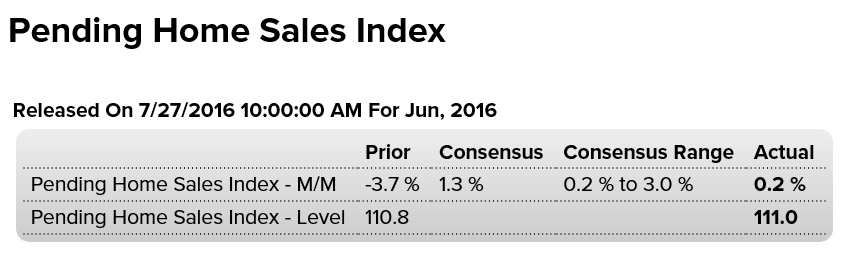

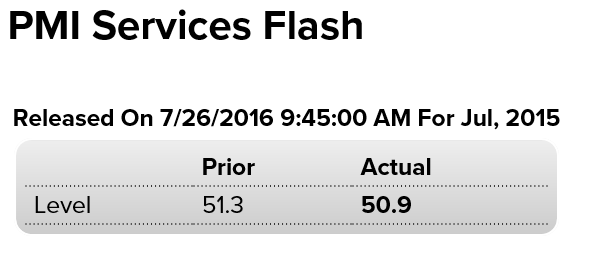

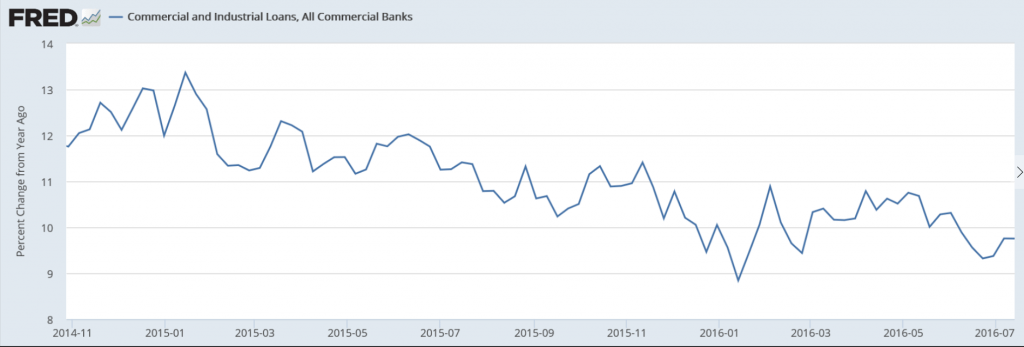

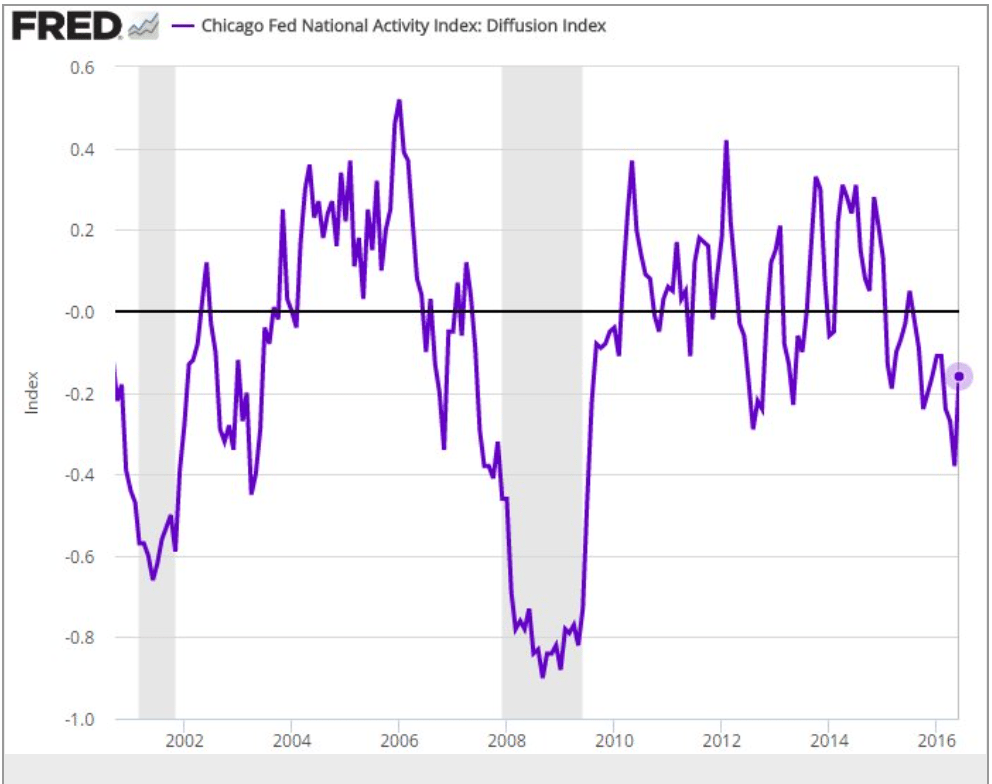

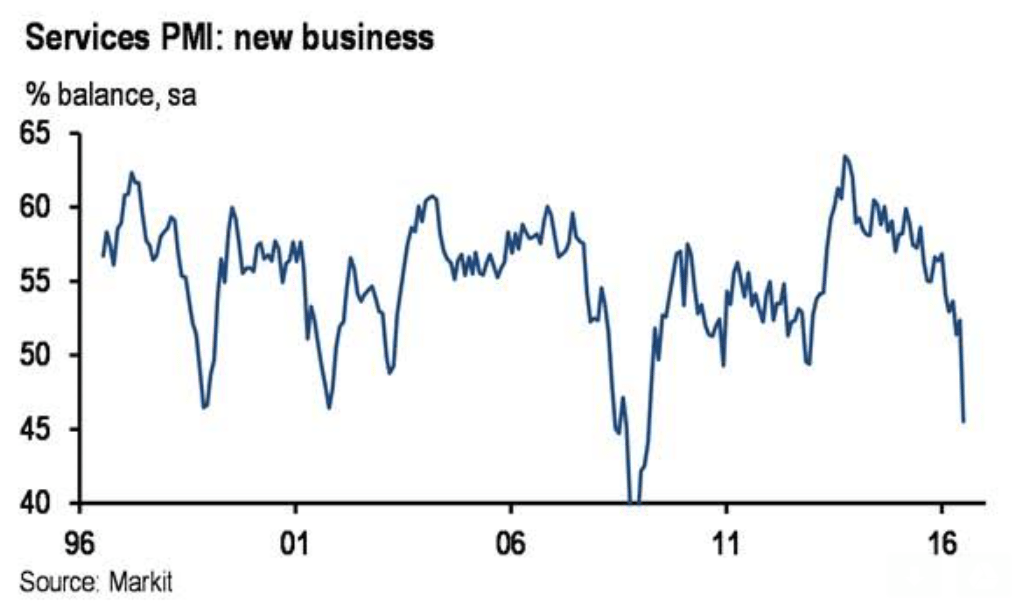

A bit at odds with the ISM, though still on the low side:

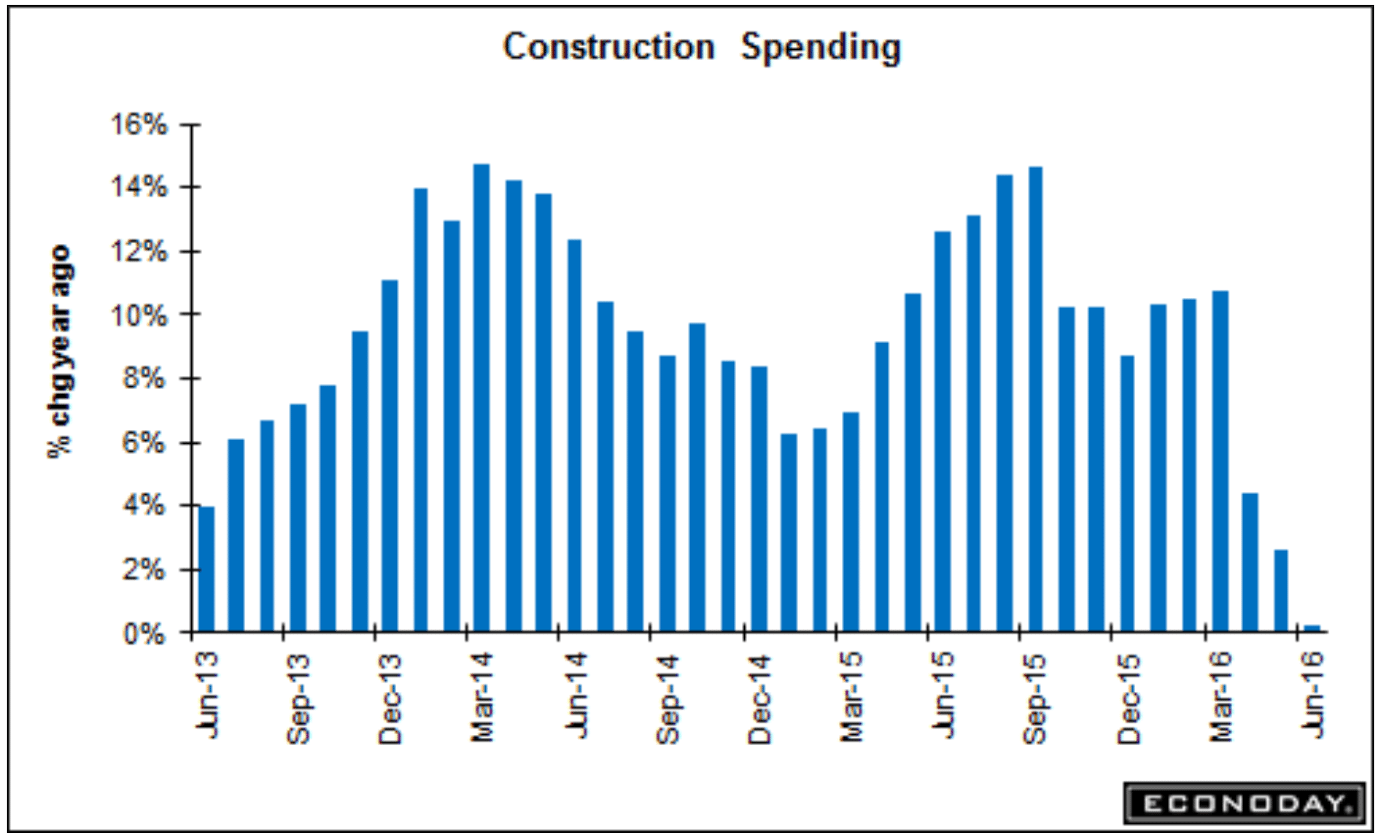

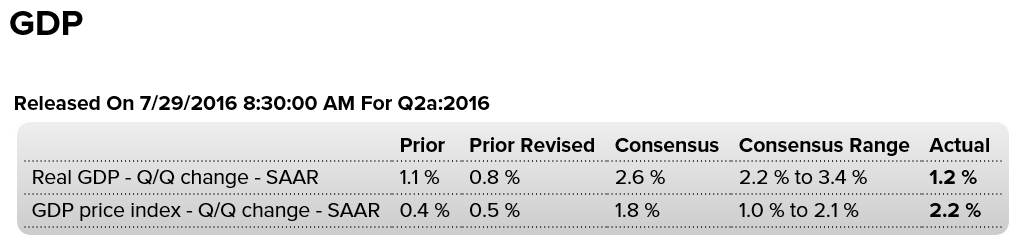

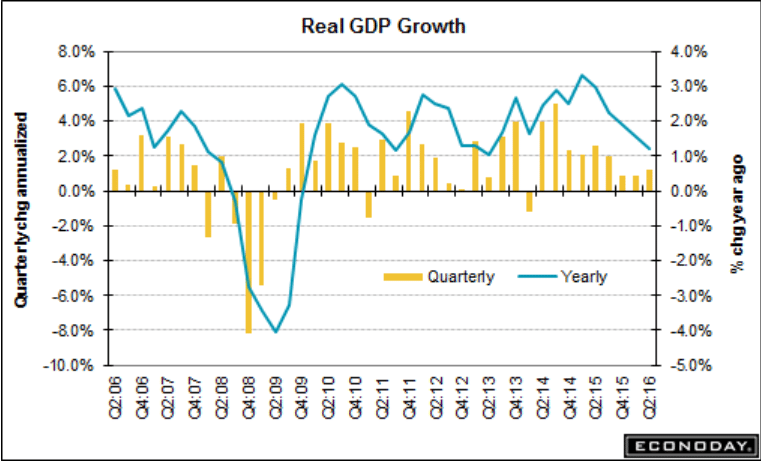

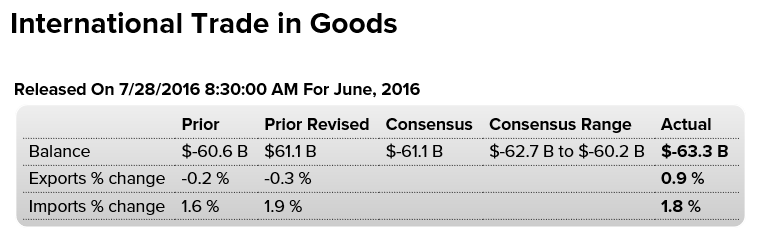

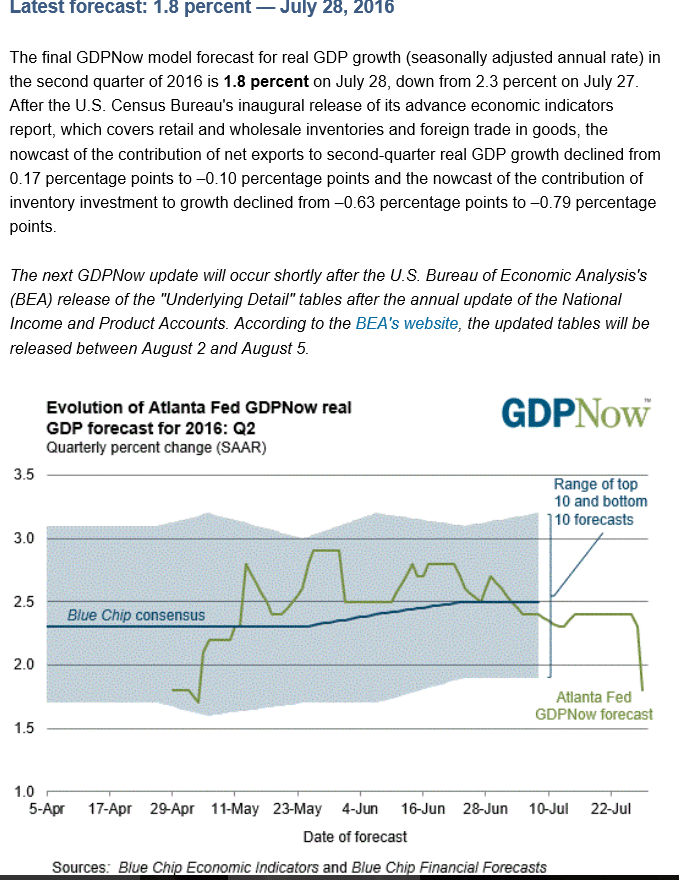

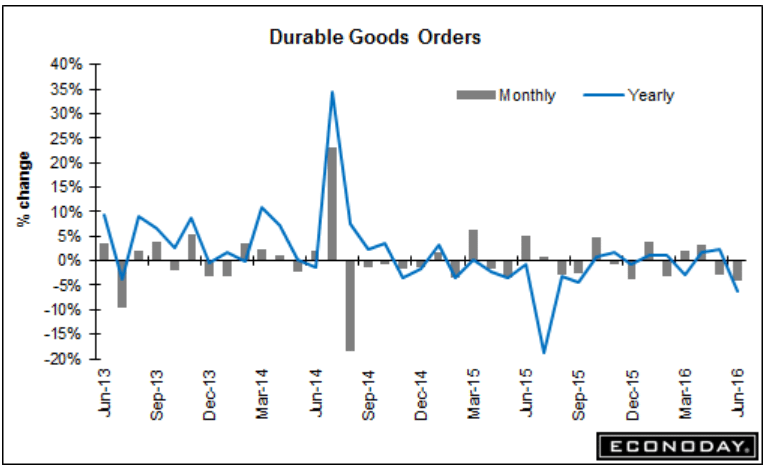

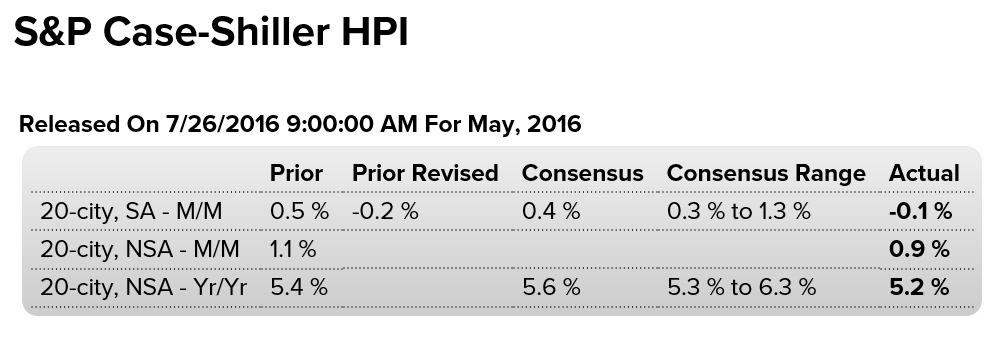

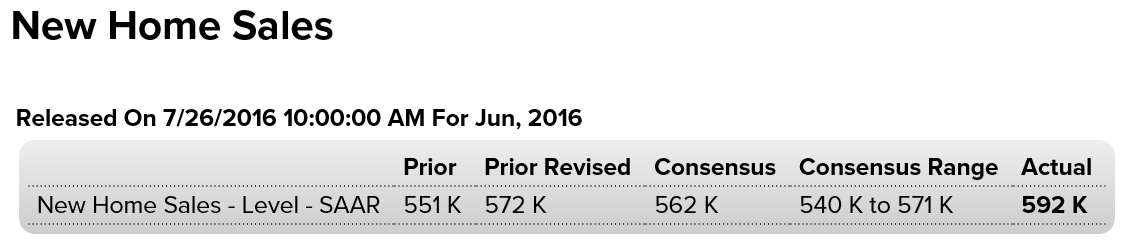

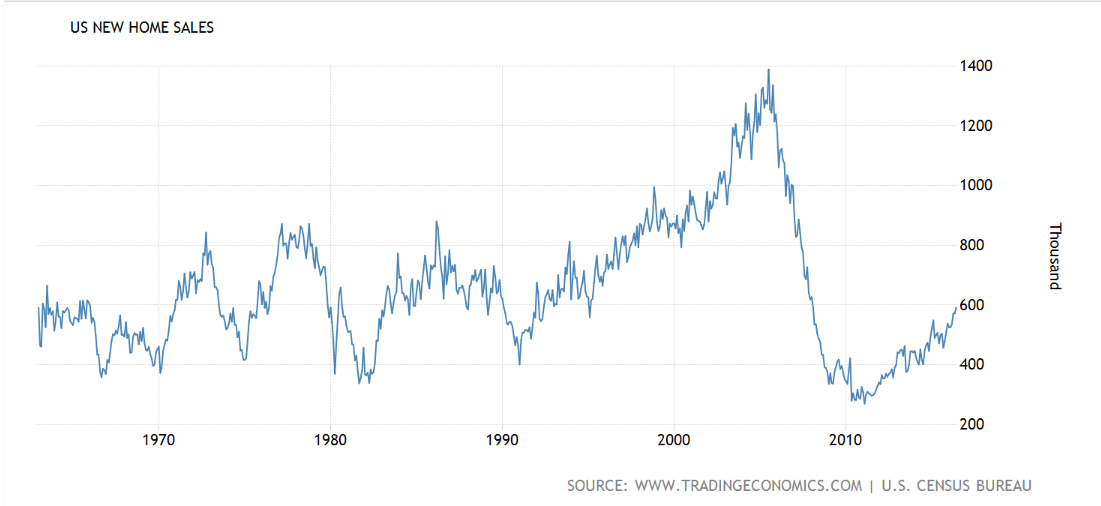

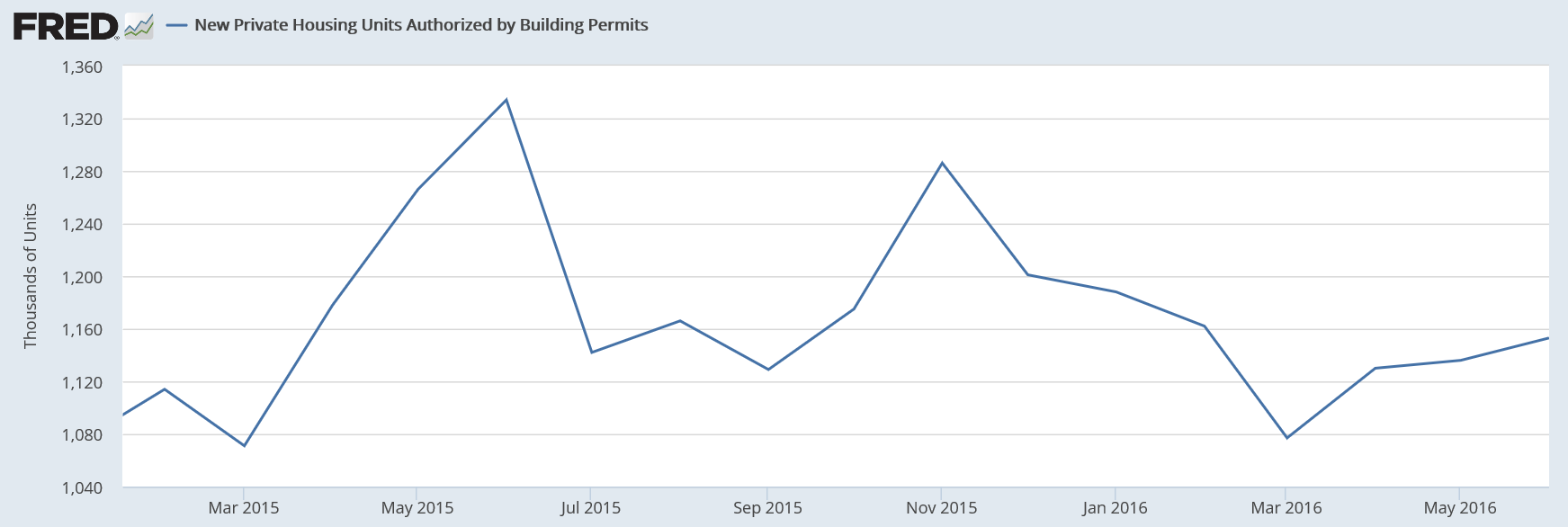

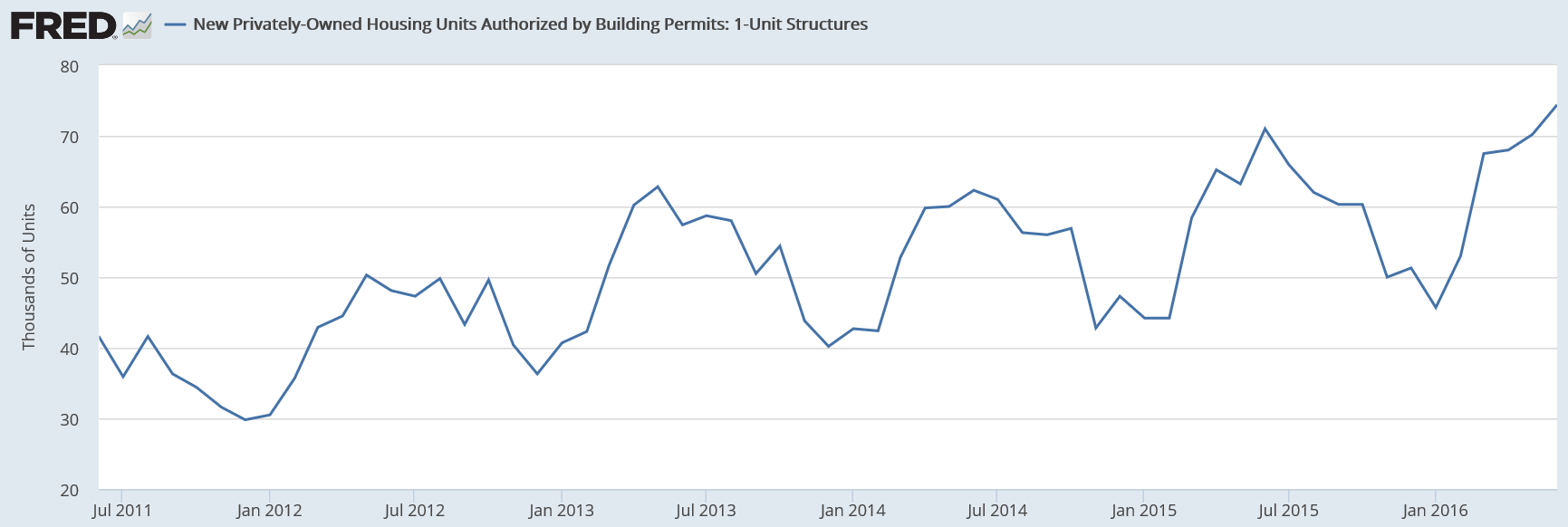

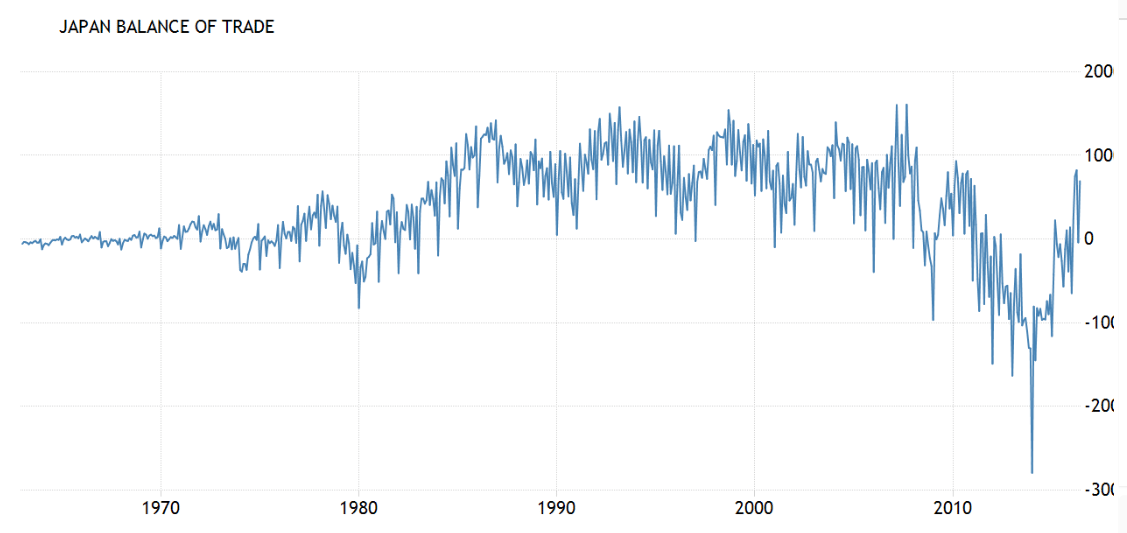

Worse than expected and the chart says it all: