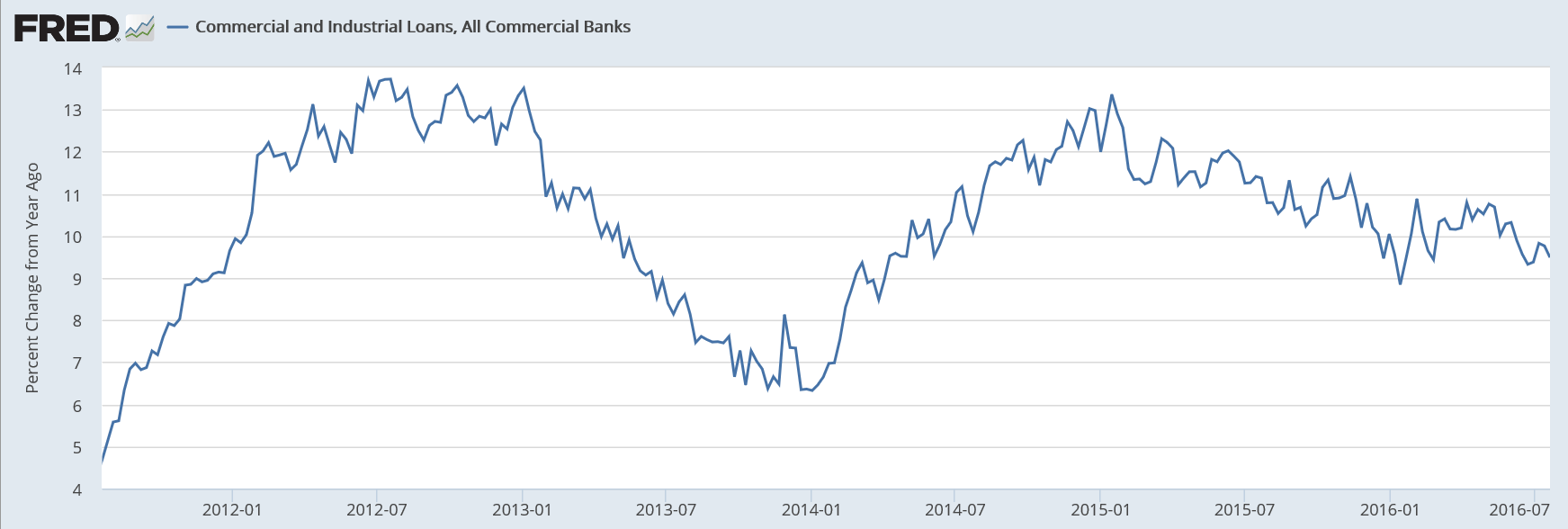

The deceleration that began with the peak in oil capex continues:

Trending lower ever since oil capex collapsed. But remember the hype for the one spike up it took early this year before reversing?

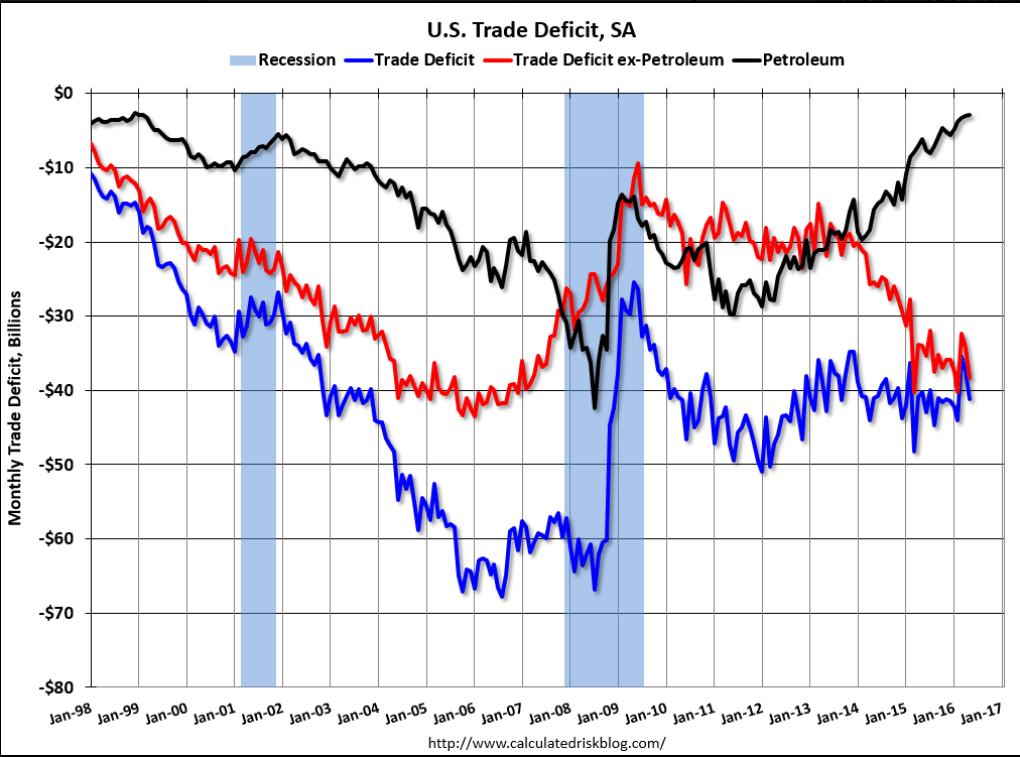

Wouldn’t surprise me if net trade, which worked in favor of Q2 GDP, reverses gets revised down for Q2 with the June data coming out on Tuesday, with growing oil imports, stronger non oil imports, and weaker exports as per the latest monthly data: