Construction spending and PMI still look to me to be relatively low and, if anything, modestly decelerating? And details and revisions looking worse as well.

Also, the talk remains, once the drag from the tax hikes and spending cuts is out of the way, growth will accelerate.

Except the govt deficit was contributing maybe 7% of GDP last year before the fiscal adjustments, and when the proactive fiscal adjustments stop reducing the deficit the support will probably be below 4% of GDP as the modest growth we’ve been having is also reducing the deficit via the automatic fiscal stabilizers.

And if that reduction of fiscal support isn’t offset by some other agent spending that much more than his income than before, the output doesn’t get sold and GDP/output/employment doesn’t happen.

Yes, corporations and individuals have the ability to increase their deficit spending to fill the gap, but so far they have not shown any sign of being willing to further extend themselves.

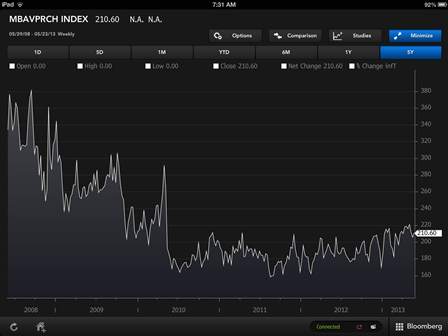

Construction Spending Y/Y:

Full size image

PMI:

Full size image