I suspect the Chairman is seriously concerned about living out his life with his legacy, as told by the mainstream, going something like this:

“Blindsided by an intense financial crisis, the Chairman, a champion of full employment and student of the Great Depression, did everything he could come up with to support growth and employment. However, after nearly 5 years of 0 rates and massive QE were beginning to hint at positive results, and just as his term ended, he fell asleep the switch, allowing mortgage rates to spike by over 1%, sending the economy back into recession.”

;)

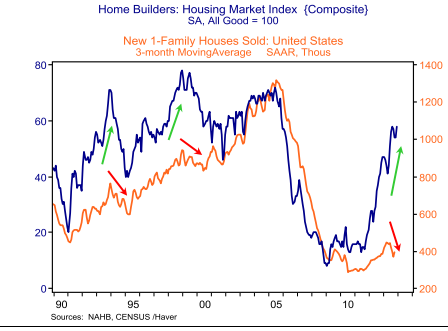

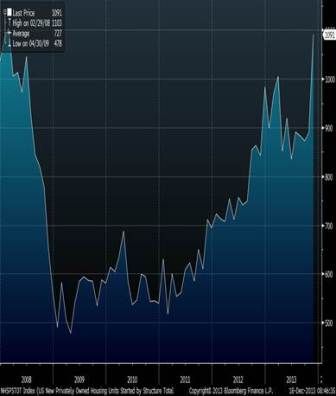

The latest housing starts spike seems most likely to be revised lower or followed by a big drop.

Full size image

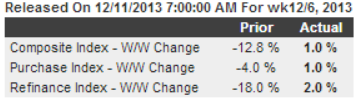

Purchase Applications:

Full size image

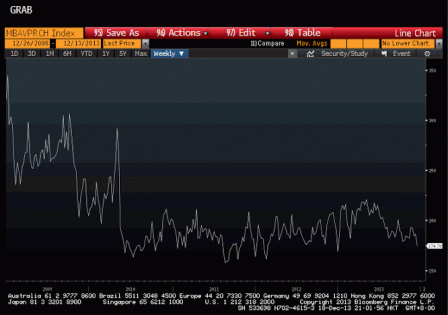

Housing Starts:

Full size image

Full size image