All going to heck, no explanations necessary:

https://tradingeconomics.com/united-states/job-offers

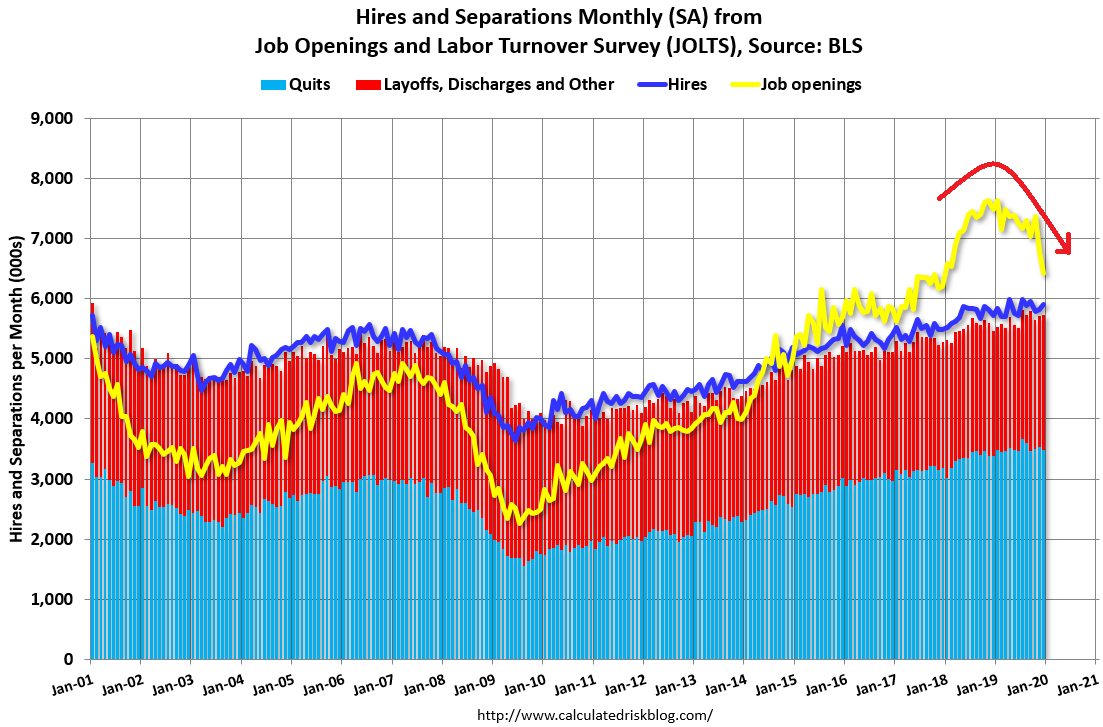

The number of job openings in the US fell by 364,000 to 6.423 million in December 2019 from a revised 6.787 million in November and well below market expectations of 7.0 million. It was the lowest level since December 2017, as openings slumped by 332 thousand in the private sector and were down by 32 thousand in government. Over the year, the job openings level declined by 14.9 percent.

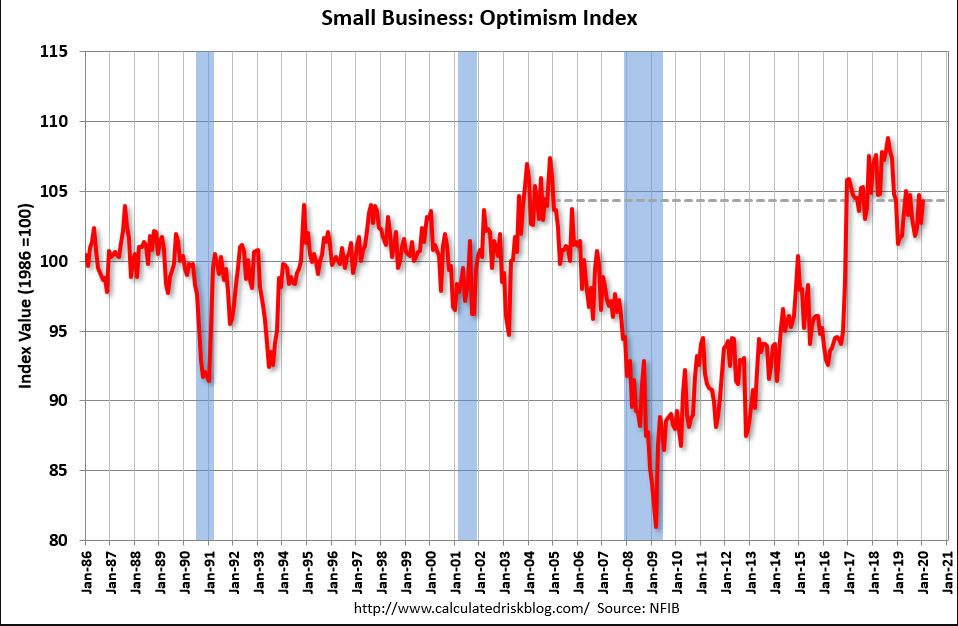

Still with the trumped up expectations, but working its way lower:

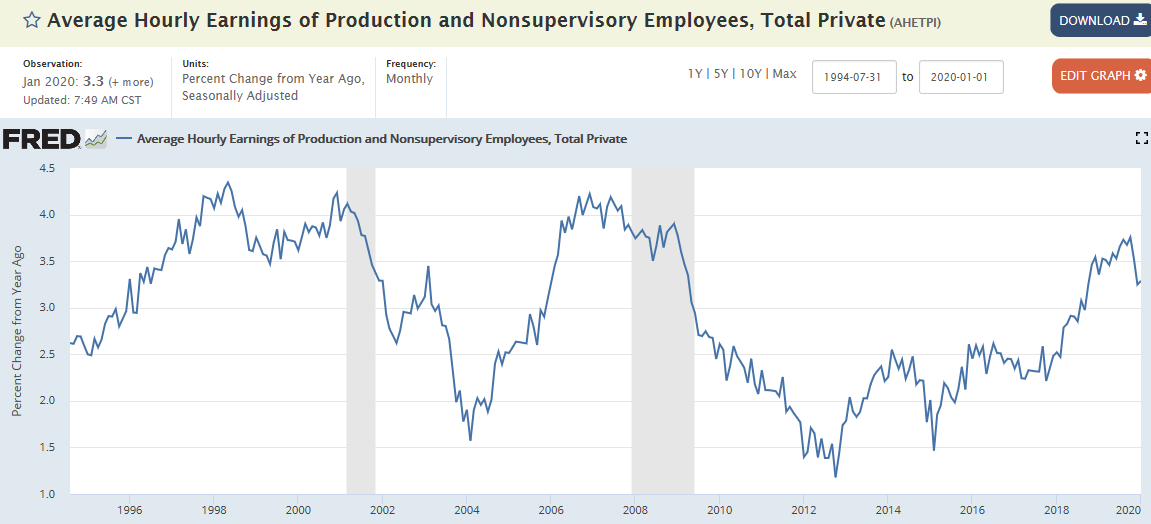

Growth seems to be moderating as the economy has moderated:

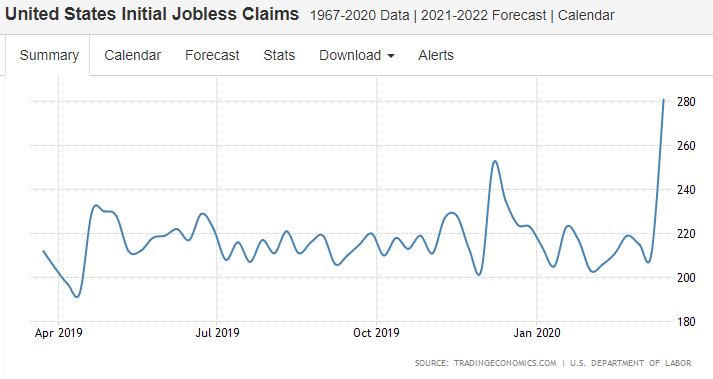

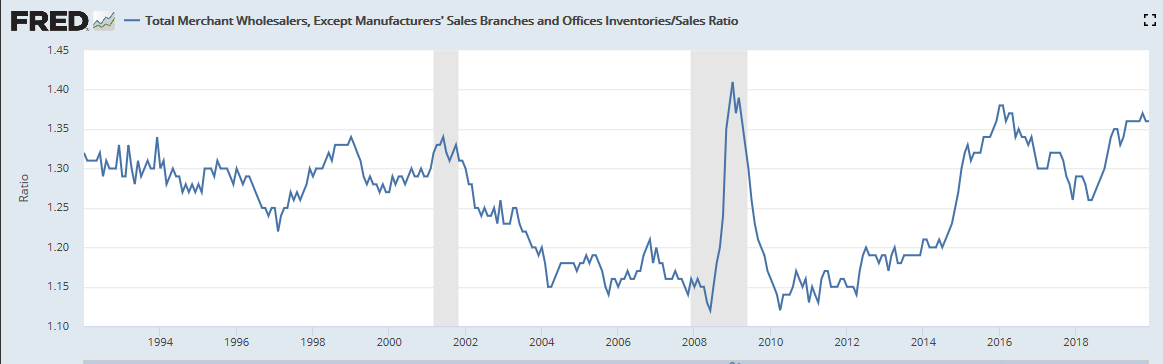

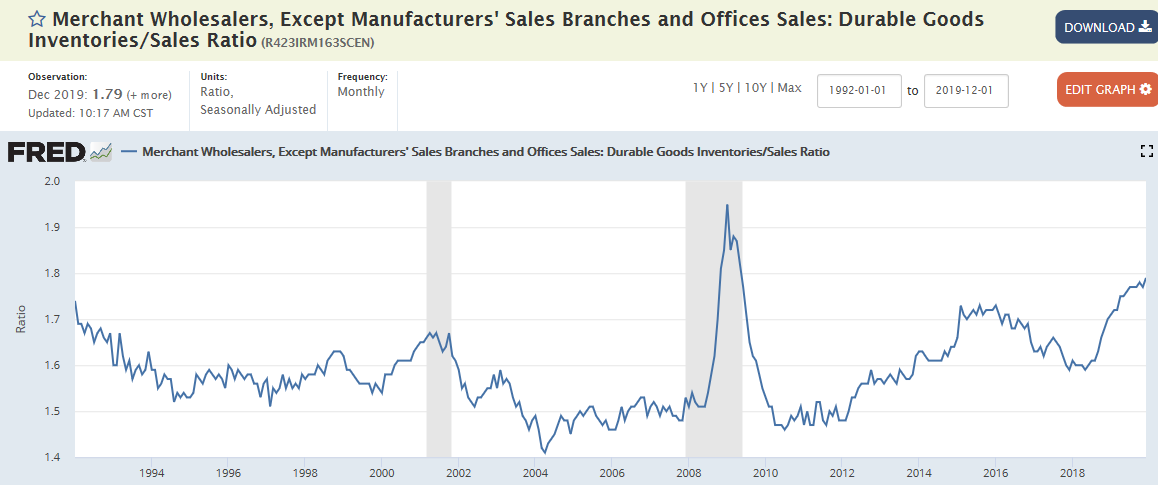

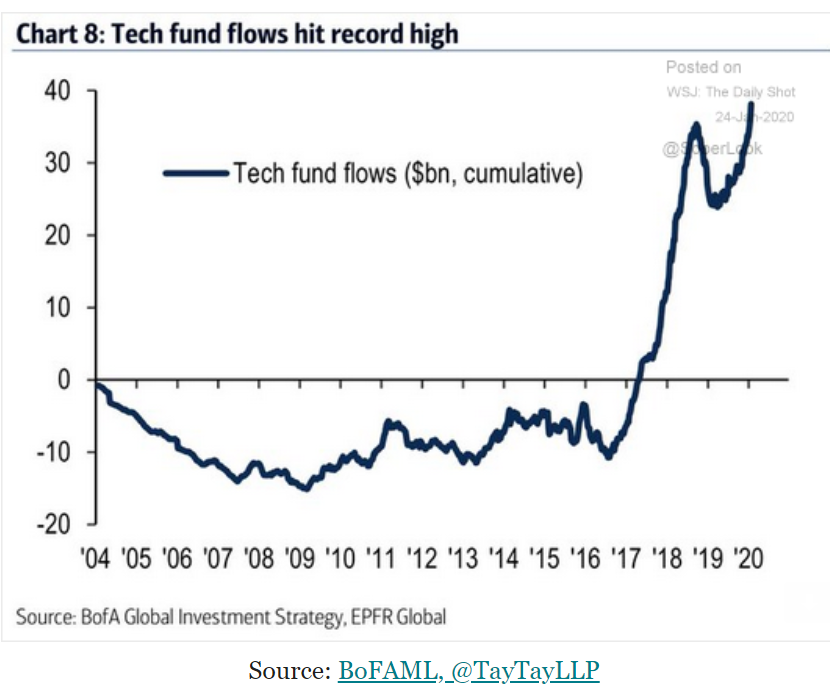

Elevated!

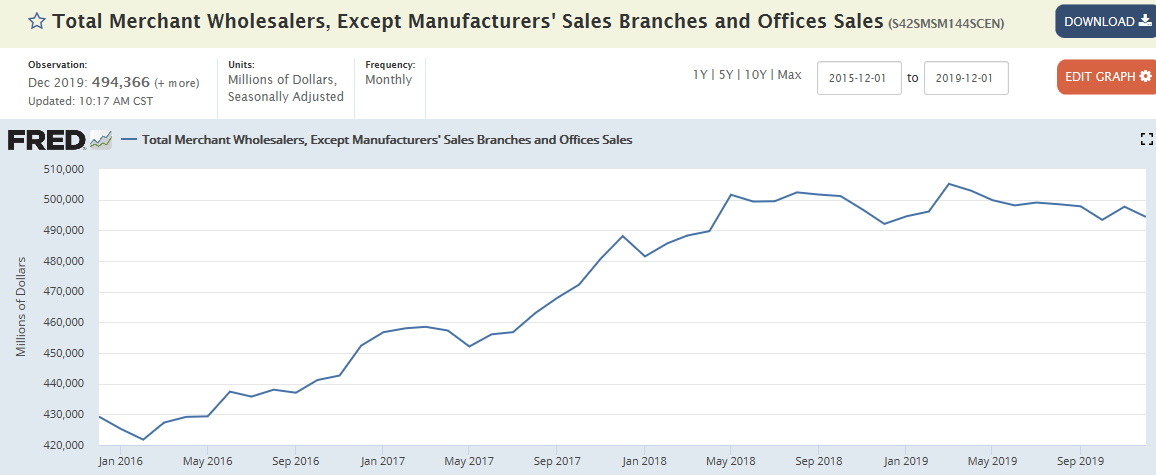

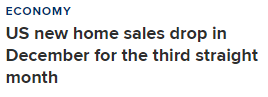

Sales have gone flat at best:

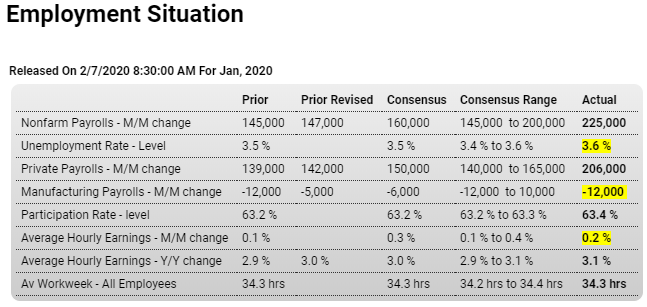

Year over year growth declined, at least for now reversing a small move up in the context of a larger move lower. Decelerating employment growth generally coincides with decelerating GDP, as has been the case:

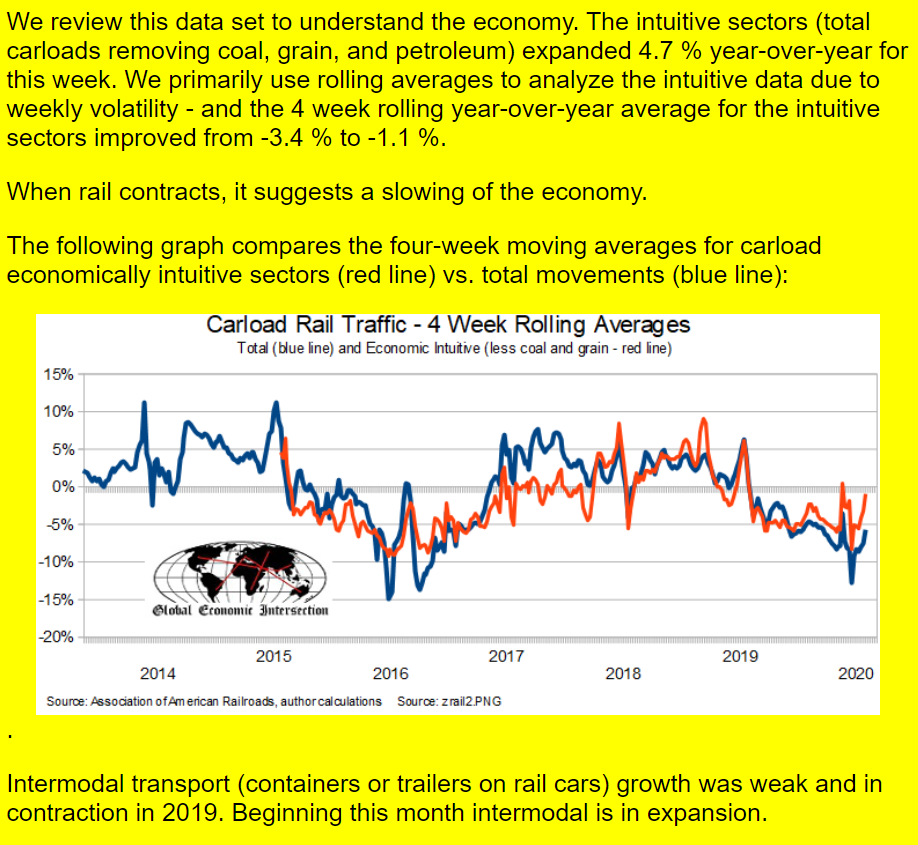

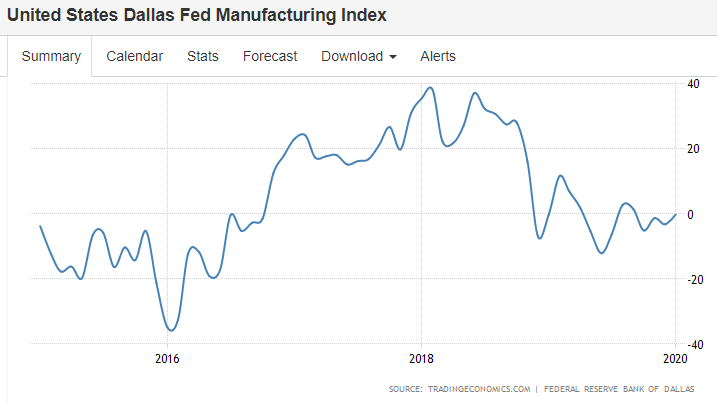

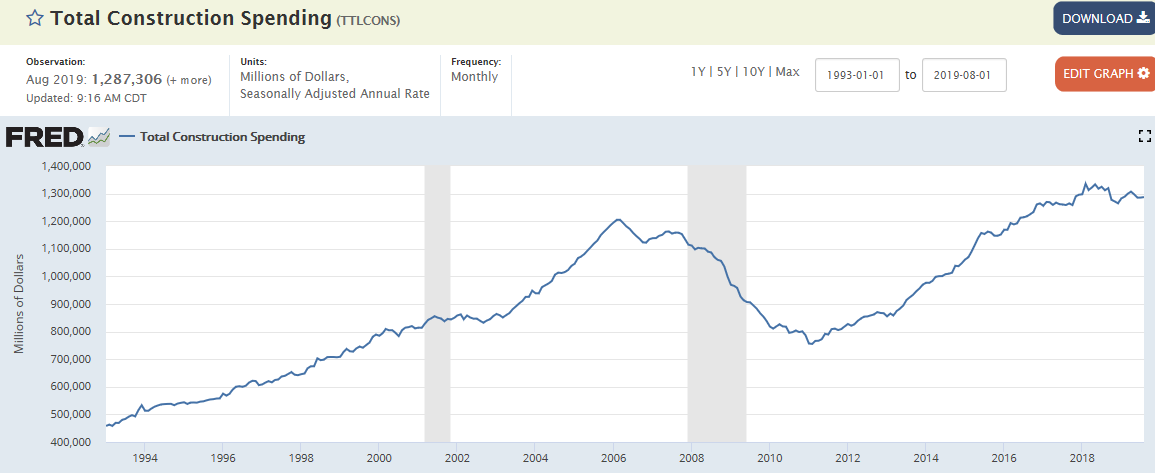

Another indicator that’s been perking up. May be weather related:

Intermodal traffic’s prolonged contraction shifted to expansion last month:

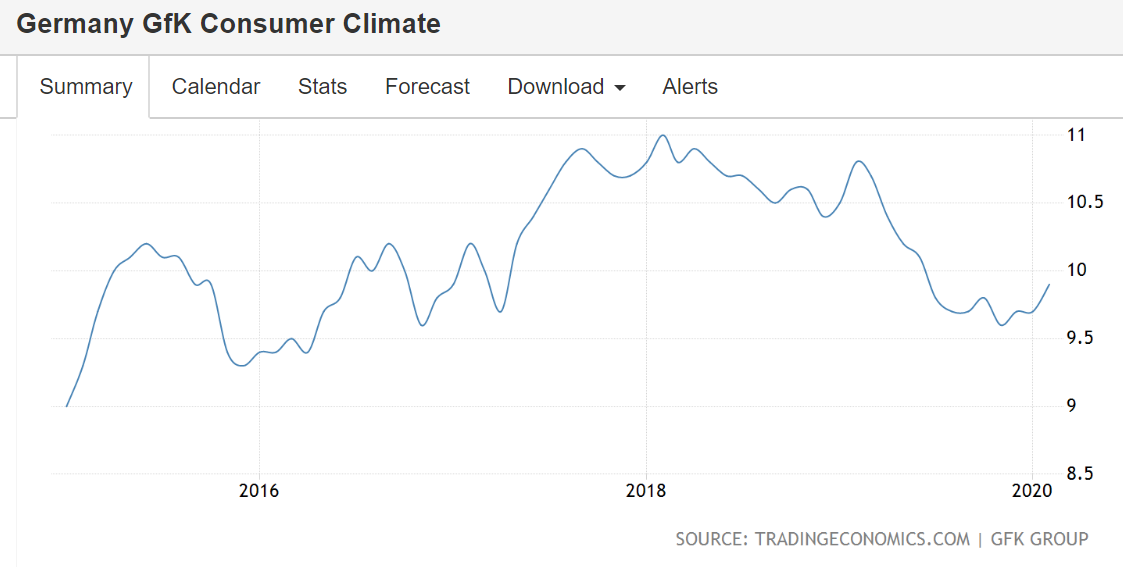

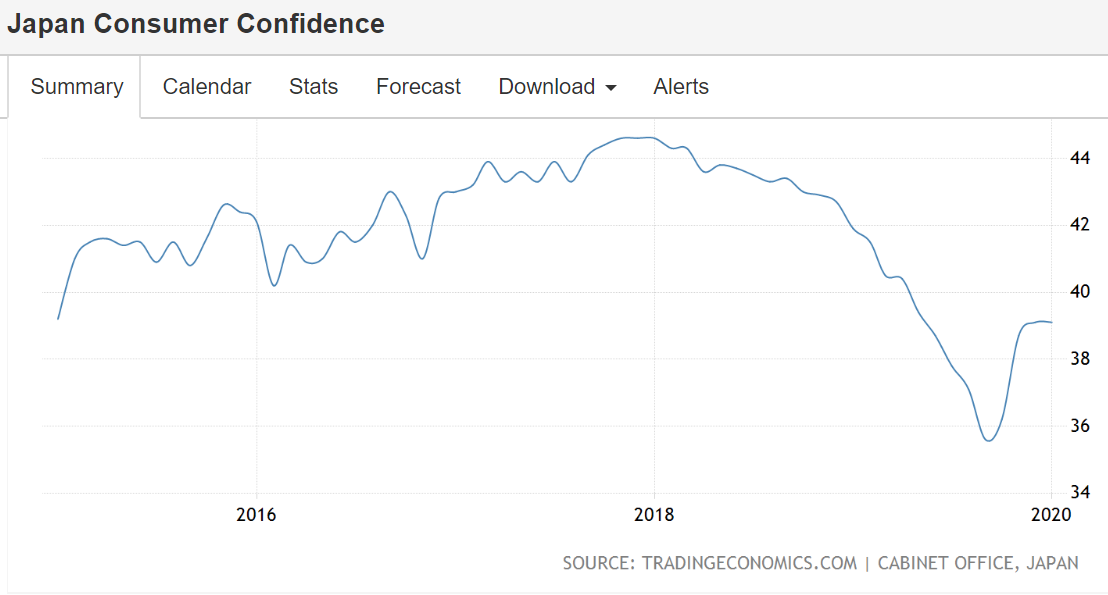

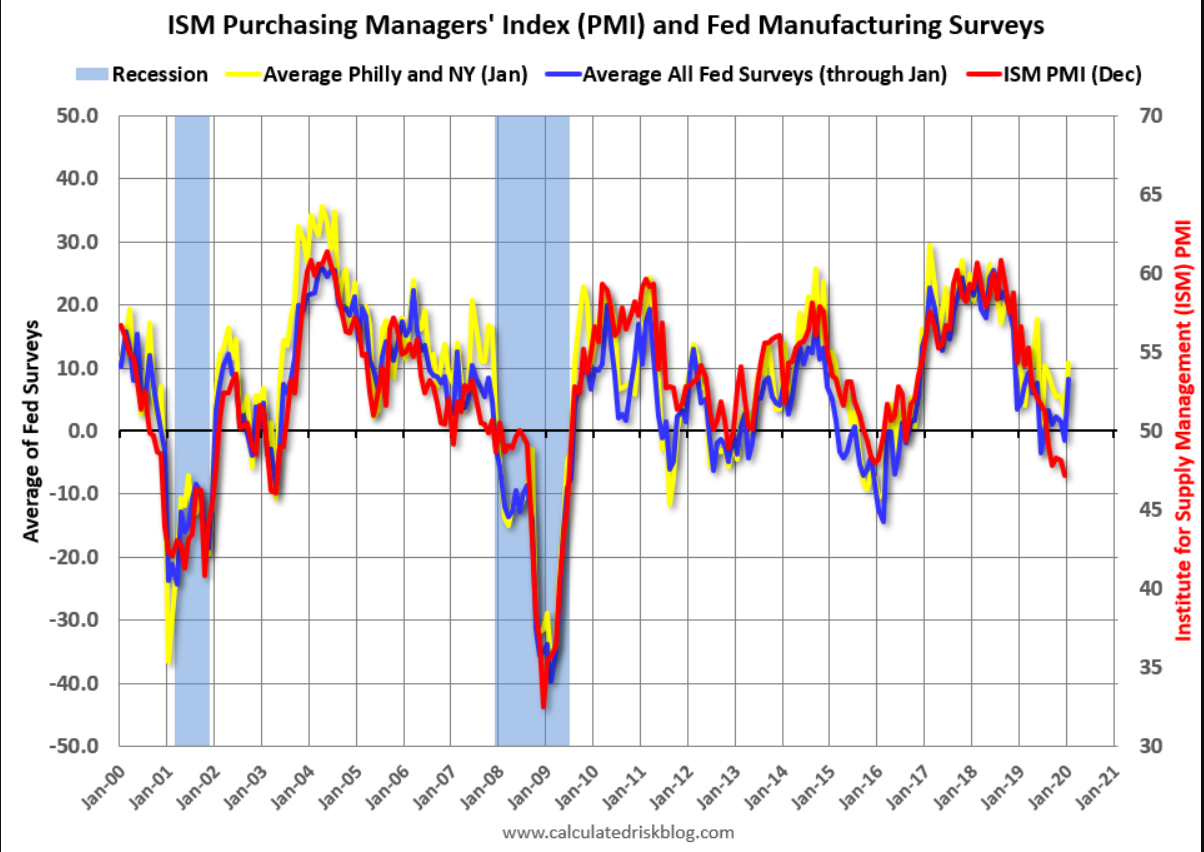

Lots of surveys turning up a bit on hopes for the trade deal:

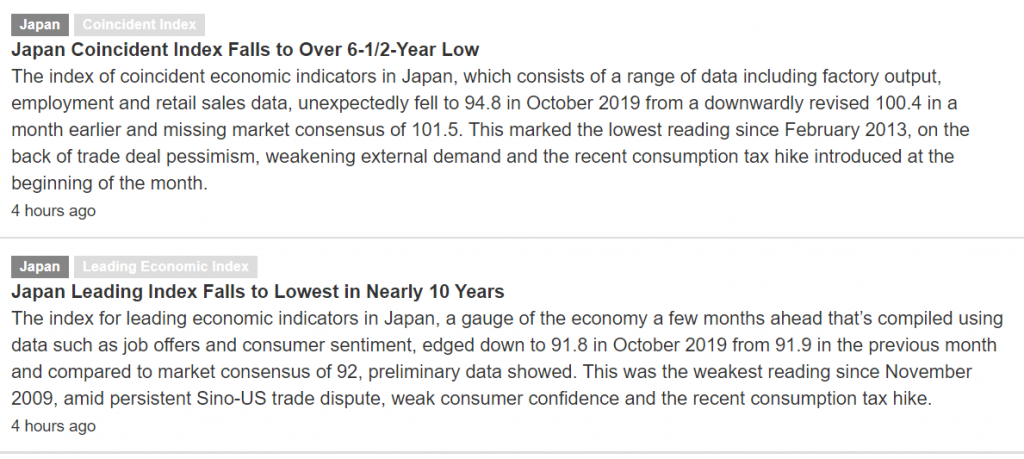

And Japan passed a modest positive fiscal adjustment:

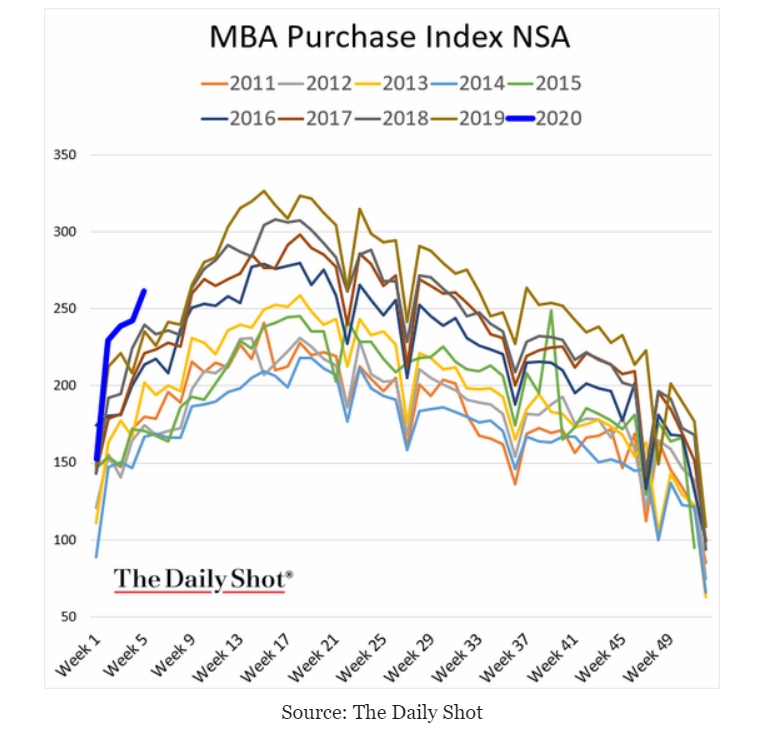

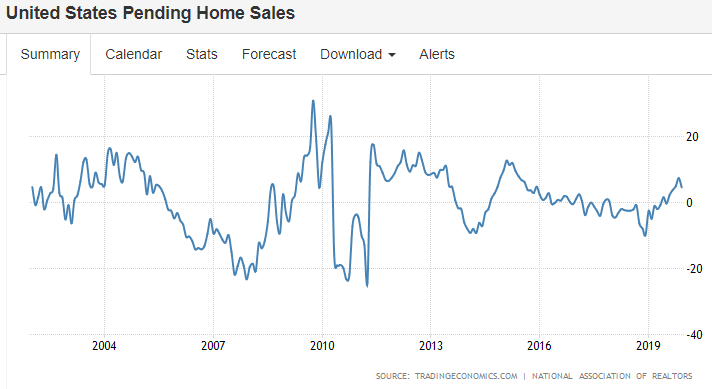

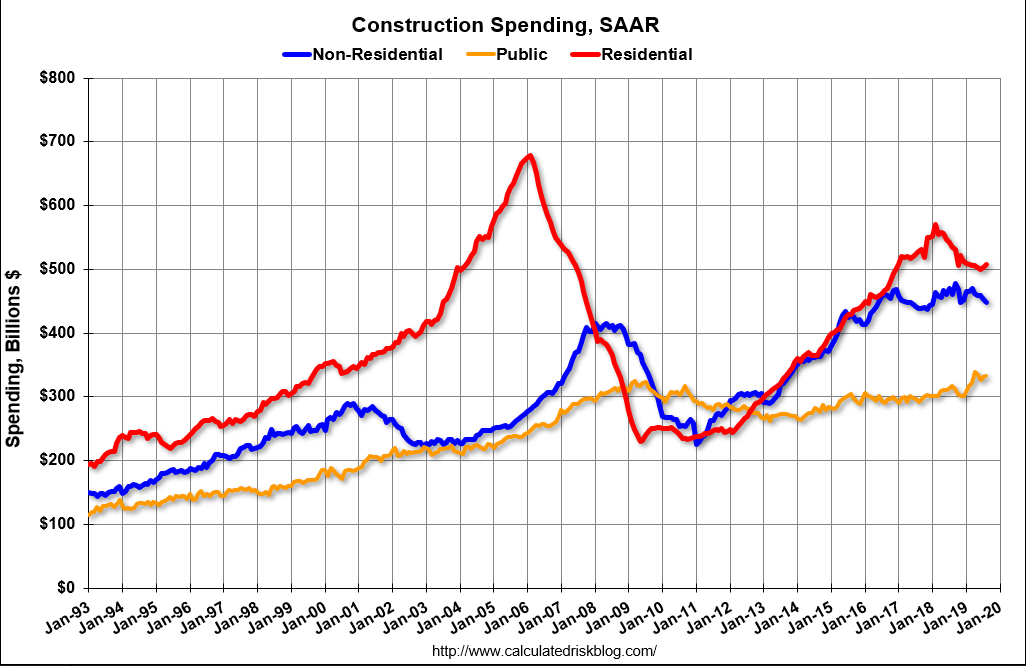

Doesn’t look like the lower rates are triggering any kind of housing boom…

;)

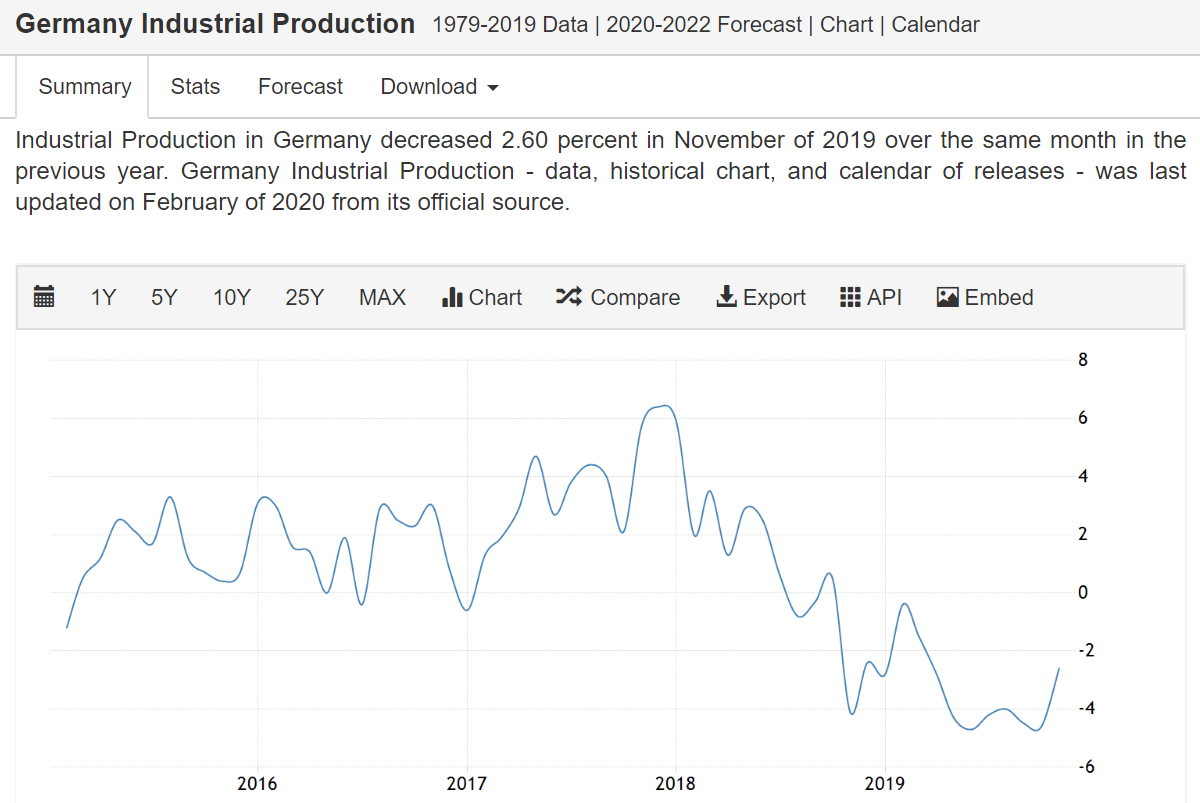

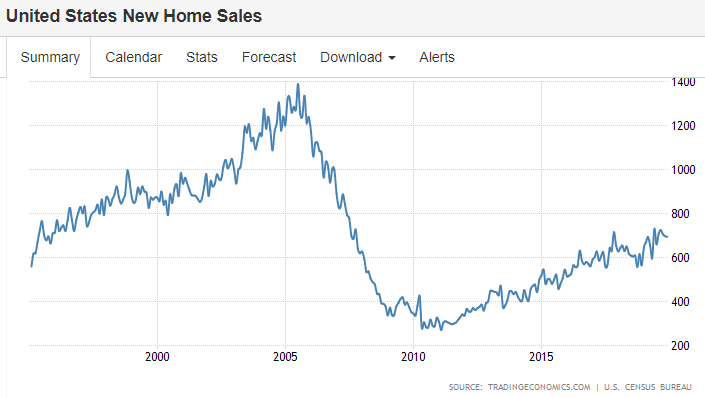

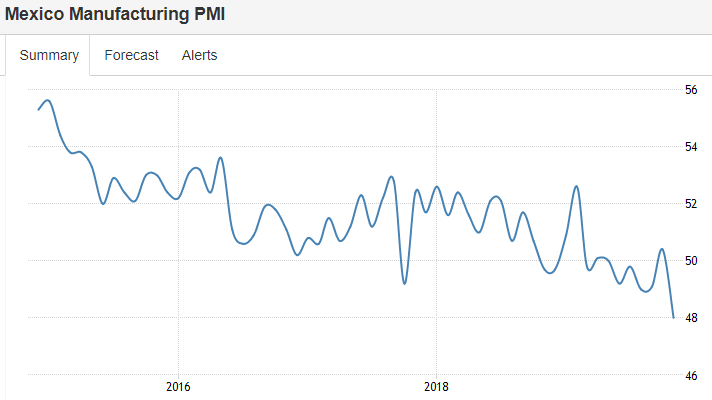

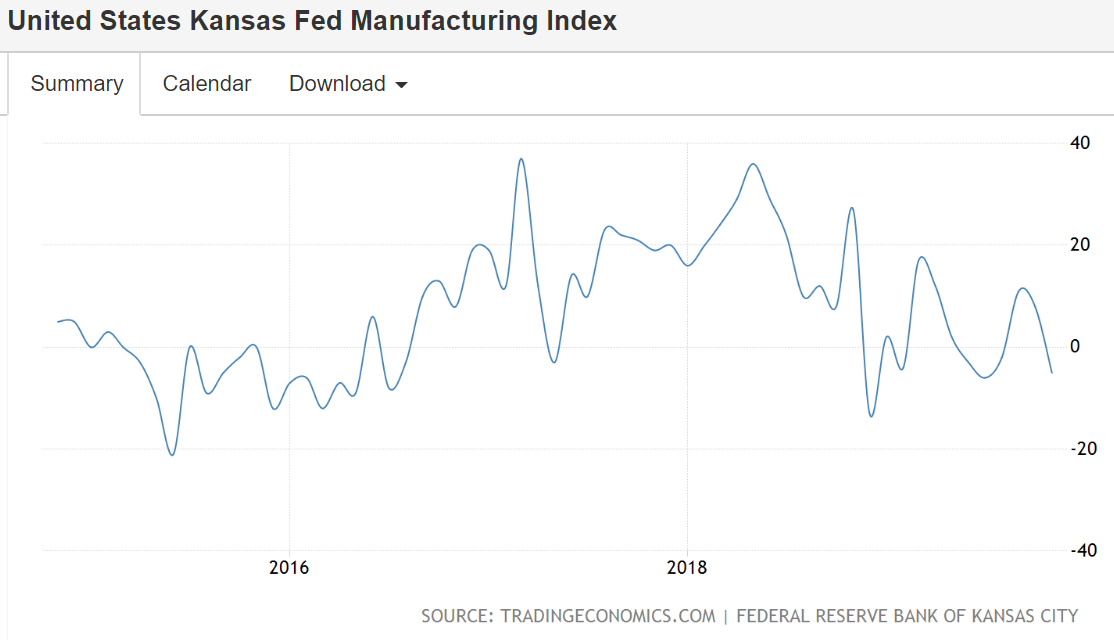

Still in contraction:

Some of the recent moves higher may be reversing?

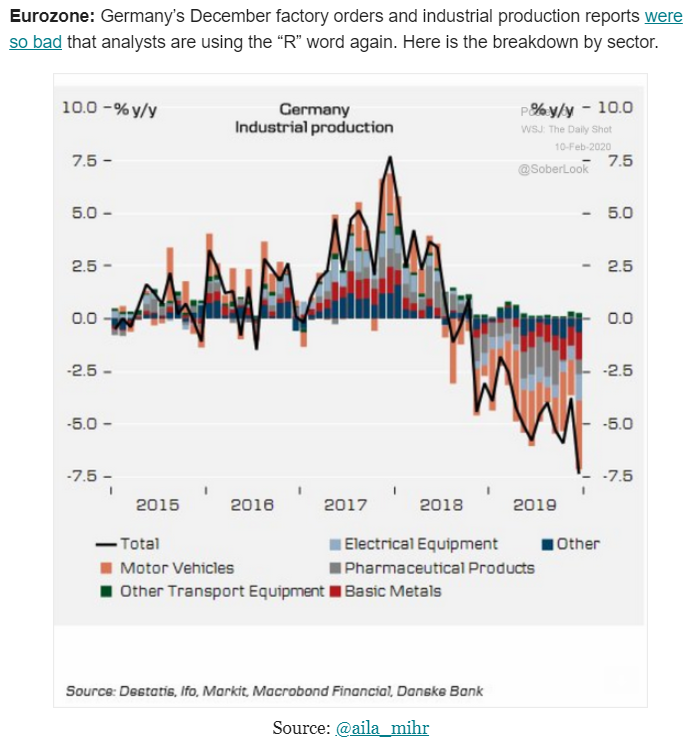

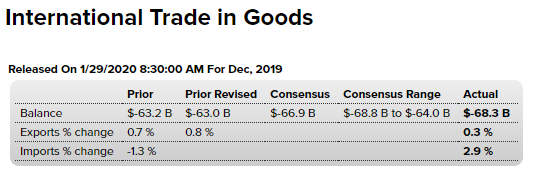

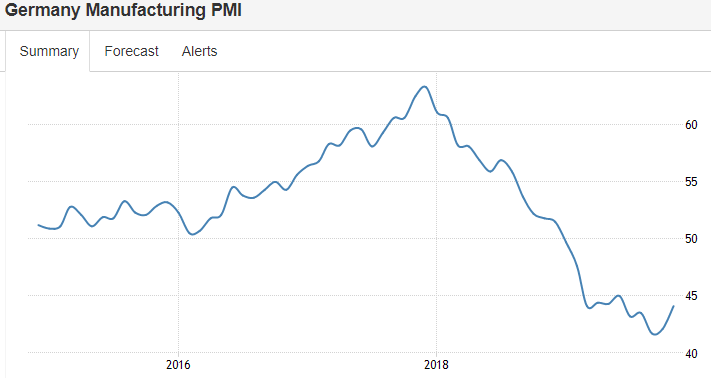

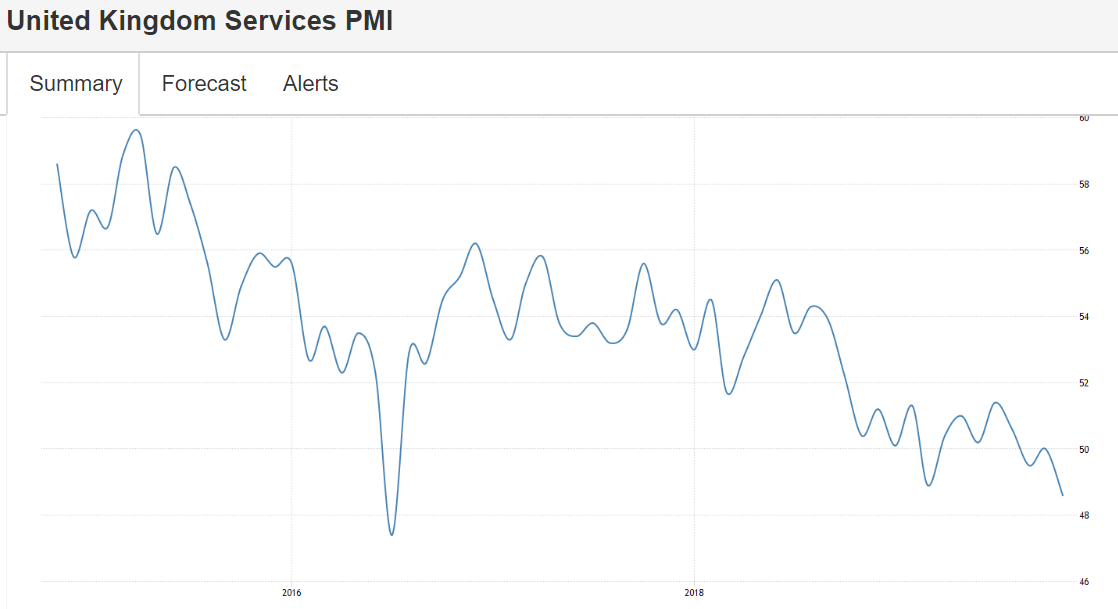

Not at all good:

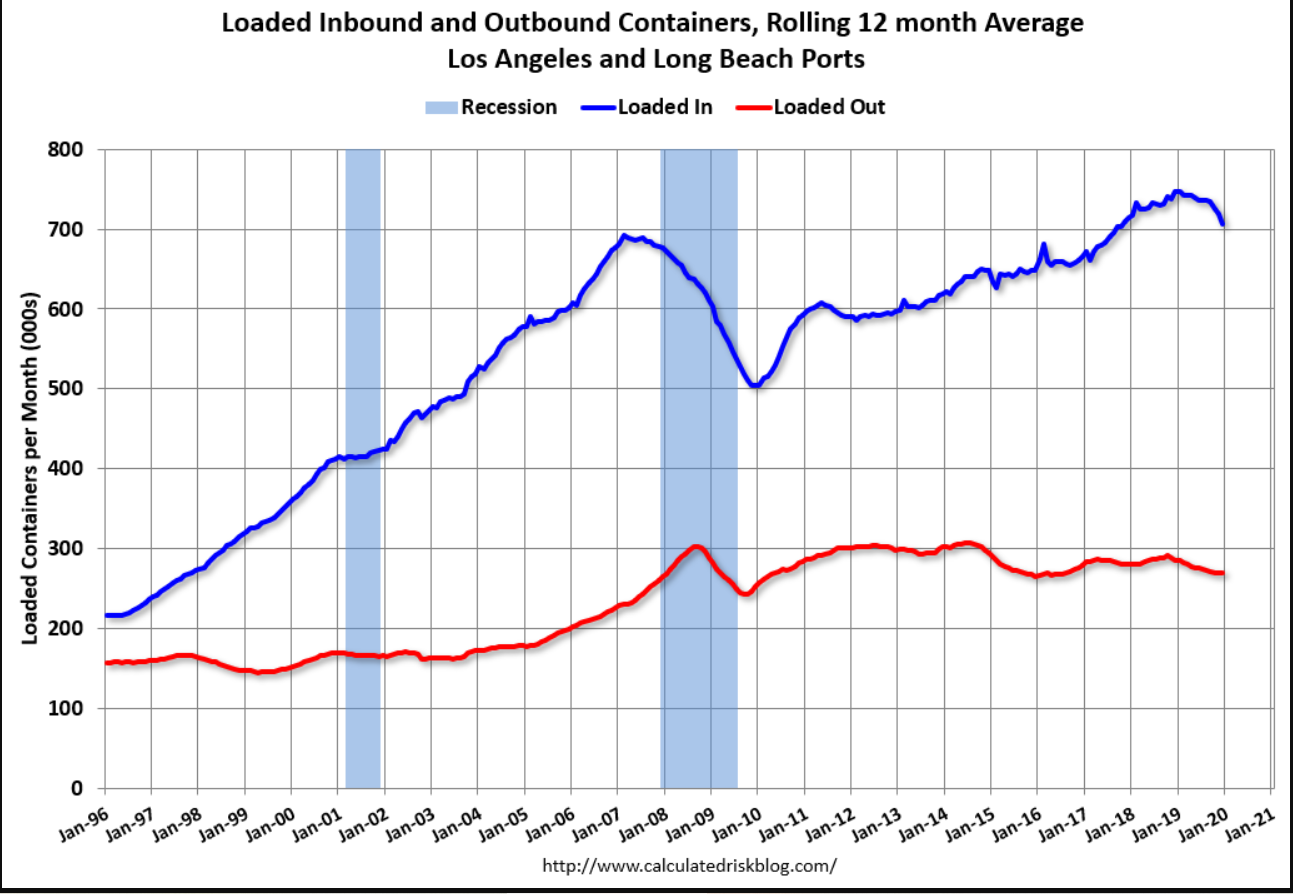

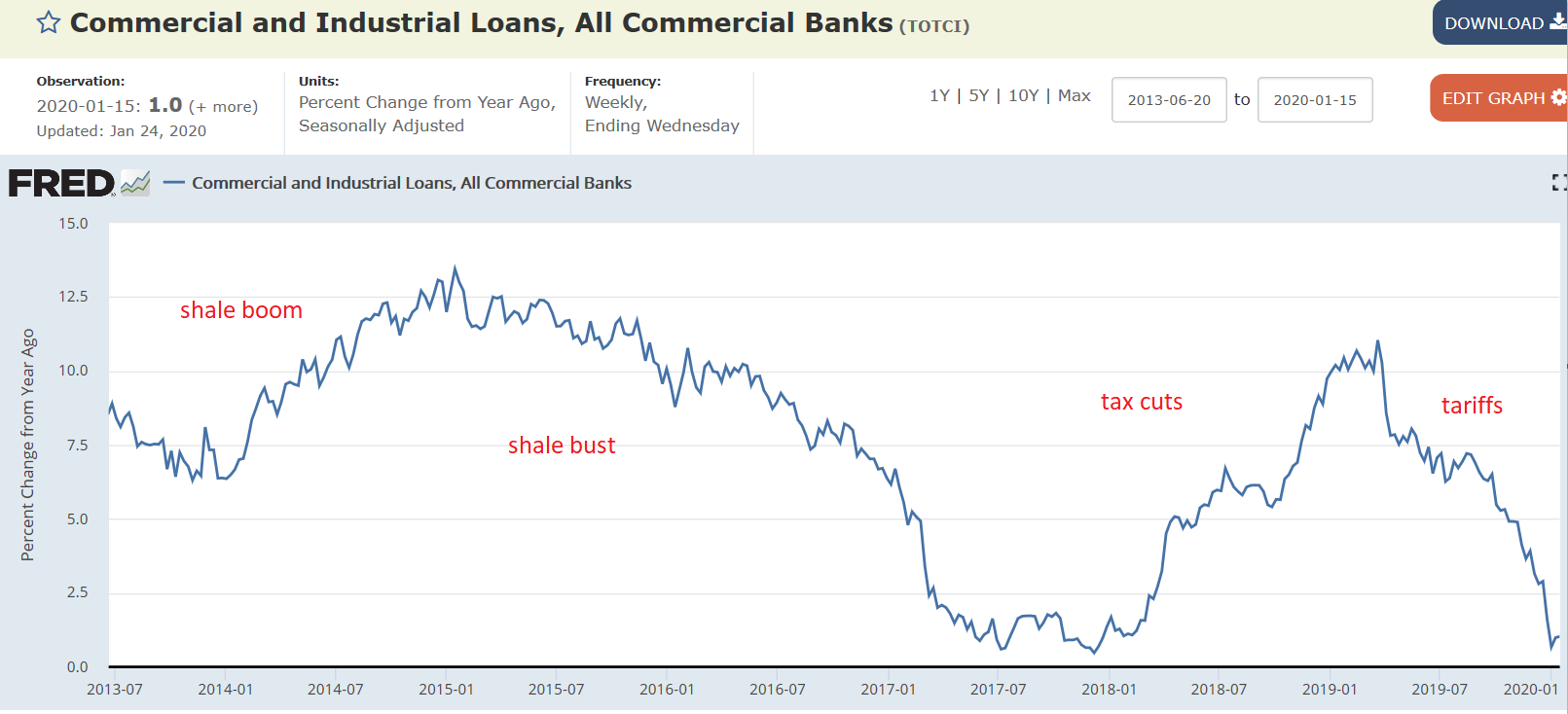

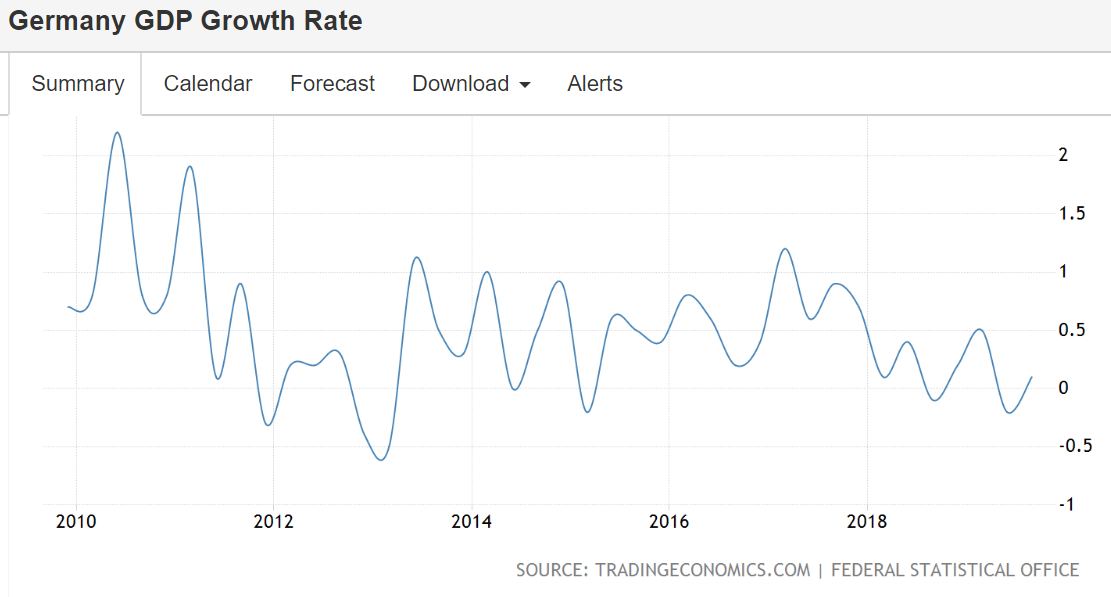

Deceleration from tariffs continues:

The catalyst that reverses the climb in equity valuations?

Deeper into contraction:

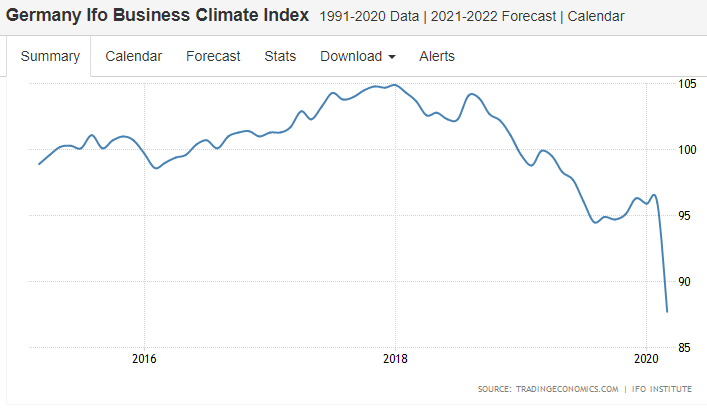

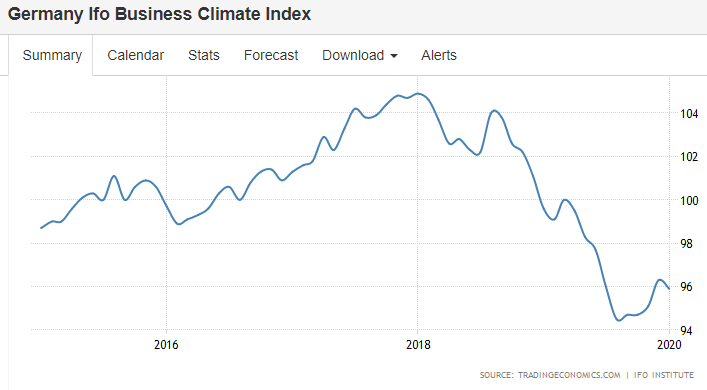

German Industrial Output Falls Unexpectedly

Industrial production in Germany dropped by 1.7% mom in October 2019, missing market expectations of a 0.1% growth and following a 0.6% fall in September. This marked the steepest monthly decrease in industrial output since April, as production fell for capital goods (-4.4%), including tools, vehicles and machinery. Year-on-year, industrial output slumped 5.3%, the most in a decade. Manufacturing alone went down 5.7%.

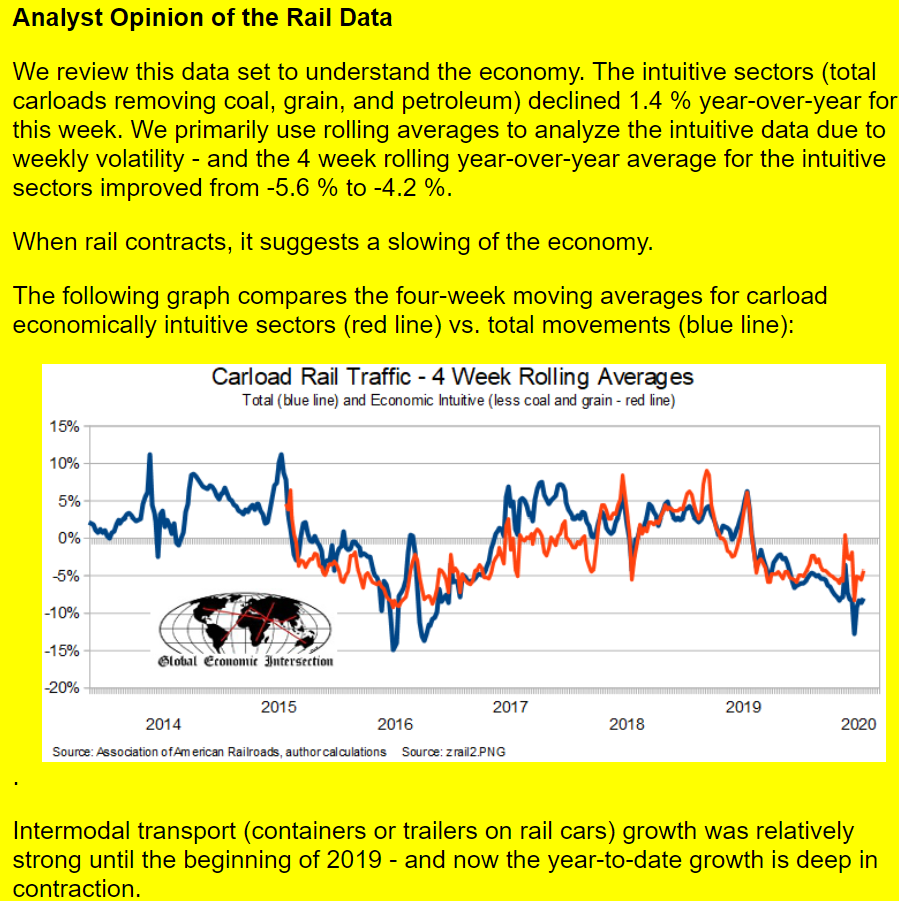

AAR: November Rail Carloads down 7.5% YoY, Intermodal Down 7.4% YoY

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Rail traffic continues to struggle because U.S. manufacturing is soft, trade disputes and the uncertainty they entail are ongoing, and economic growth abroad isn’t what it could be.

…In November 2019, total U.S. rail carloads were down 7.5% and total intermodal originations were down 7.4% from November 2018 — making 10 straight monthly declines for both.

Contraction:

Also heading south:

Deceleration:

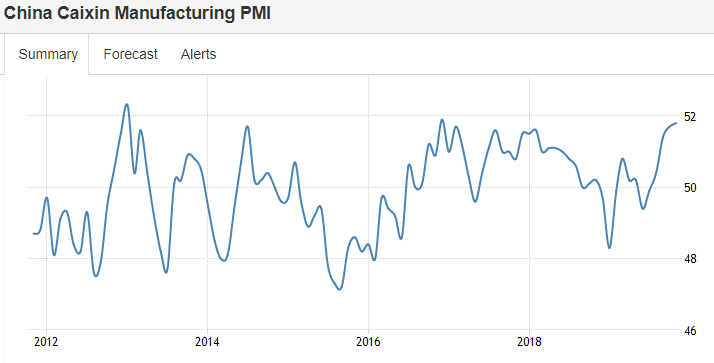

China using fiscal adjustments to sustain domestic demand while redirecting trade which won’t help the US:

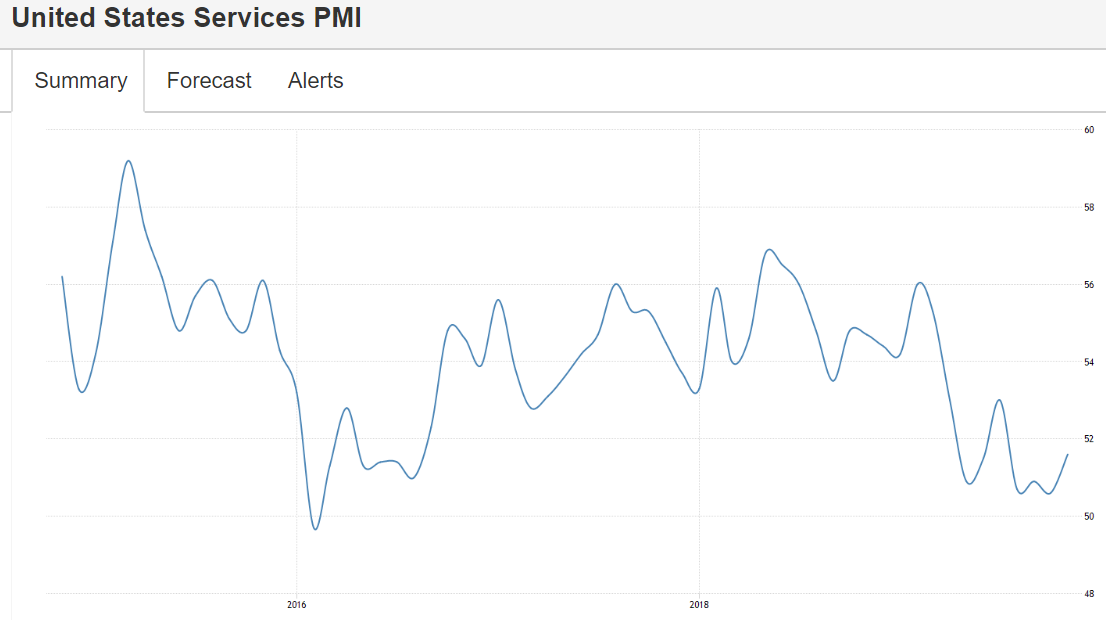

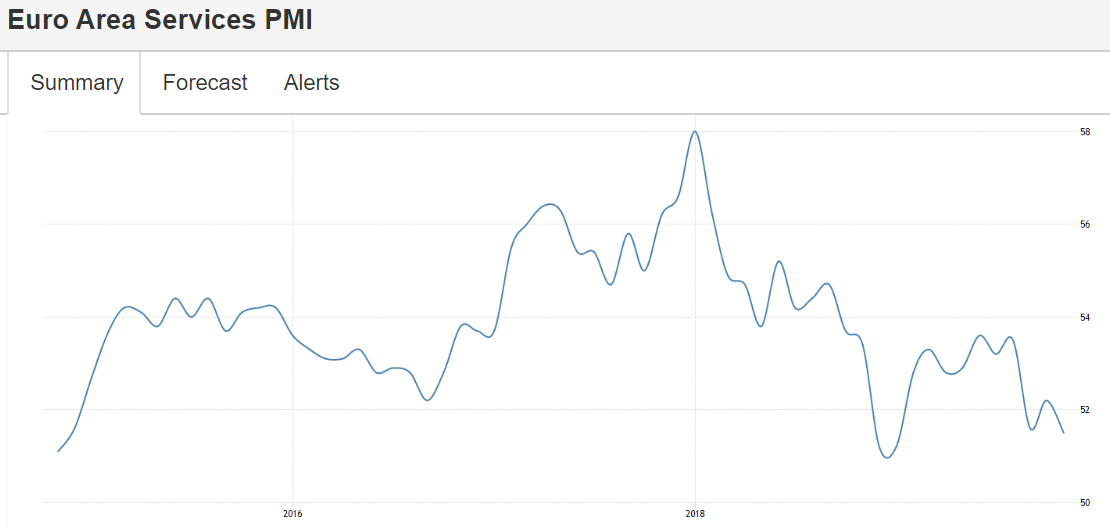

Tariffs taking their toll and no end in sight as global deceleration continues for both goods and services.

These surveys are up a bit this month but still very low and too soon to suggest a reversal:

Note how this blipped up last month but then resumed the downtrend:

Deceleration resumes after a small blip up last month:

Germany Private Sector Contracts for 3rd Month

The IHS Markit Germany Composite PMI increased to 49.2 in November 2019 from 48.9 in the previous month and below market expectations of 49.4, preliminary estimates showed. Still, it is the third consecutive month of contraction in the private sector, as manufacturing output continued to shrink and services activity growth slowed to a 38-month low. New orders went down for the fifth straight month while exports orders decreased at softer pace. Job creation was virtually unchanged after falling in October for the first time in six years. Also, lower backlogs of work were reported for the thirteenth month running. In terms of prices, output charge inflation was modest, staying close to October’s 38-month low. Meanwhile, expectations towards output in the next 12 months turned positive for the first time in four months.

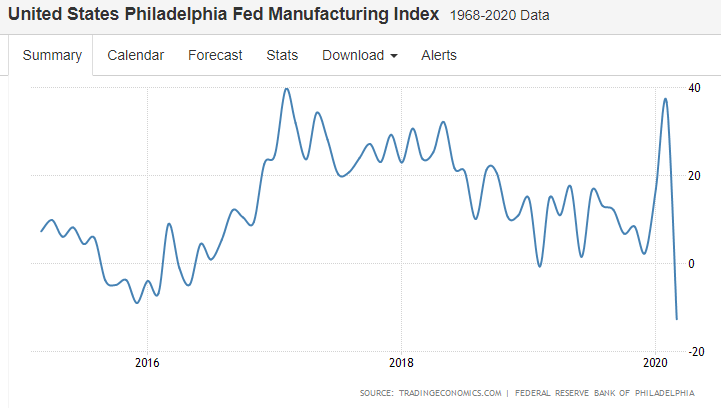

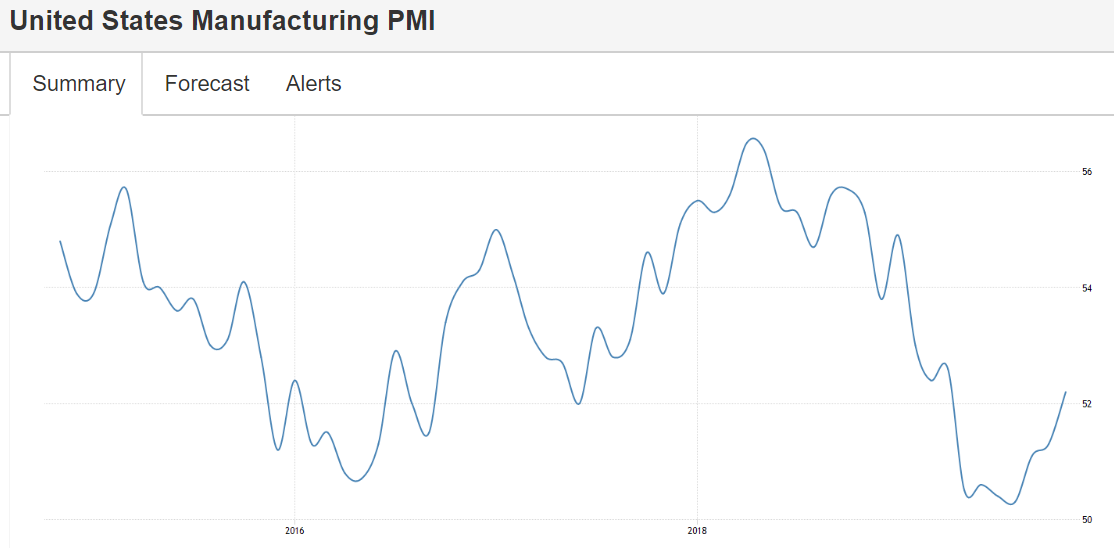

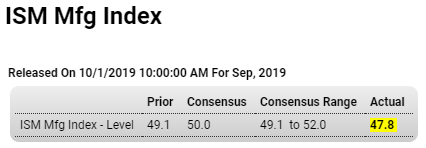

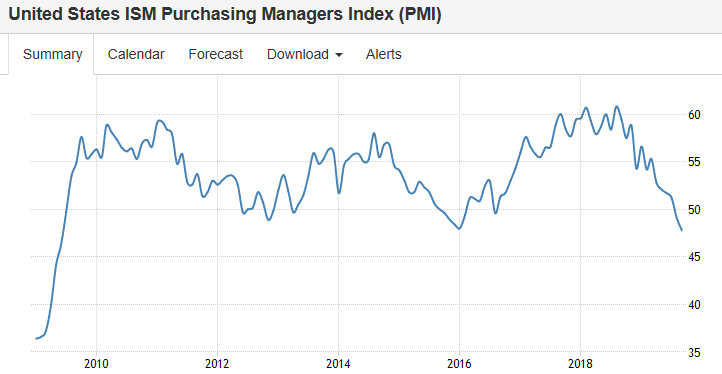

The deceleration that’s been going on all year due to the tariffs seems to finally be getting some media attention after US manufacturing reports that it’s in contraction. Something like the 10th plague…

Highlights

Contraction in export orders is severe and is pulling composite activity for ISM manufacturing’s sample under water. September’s 47.8 headline is more than 1 point under Econoday’s consensus which is significant, since nearly all forecasters take a stab at this report. And bleeding at a troubled rate are new export orders which at 41.0 posted their the third straight month of contraction that echoes the very substantial contraction being suffered by the PMI manufacturing sample in Germany right now.

Total new orders in September’s report are at 47.3 and also well below break even 50 to indicate outright monthly contraction. Backlog orders at 45.1 have been in contraction for this sample since May, and evaporating backlogs are not a positive signal for employment which at 46.3 is under 50, and well under 50, for a second straight month and is pointing to trouble for factory payrolls in Friday’s employment report. Suffering from a downturn in new orders and a lack of backlogs to work down, production is also under 50 for a second straight month, at 47.3.

Other details include flat price pressures for inputs, contraction in inventories, and improvement in delivery times — all consistent with a sample that is sinking. This report is very closely watched, whether among policy makers or among US manufacturers themselves who frequently cite it in their own statements and forecasts. Slowing in global trade has hit this sample hard and confirms the concerns at the Federal Reserve which started its move to rate cuts in July citing the risk that slowing global demand would specifically hurt US manufacturers. Today’s report will build expectations for now that the Fed, despite its own internal divisions, is likely to cut rates at least one more time this year.

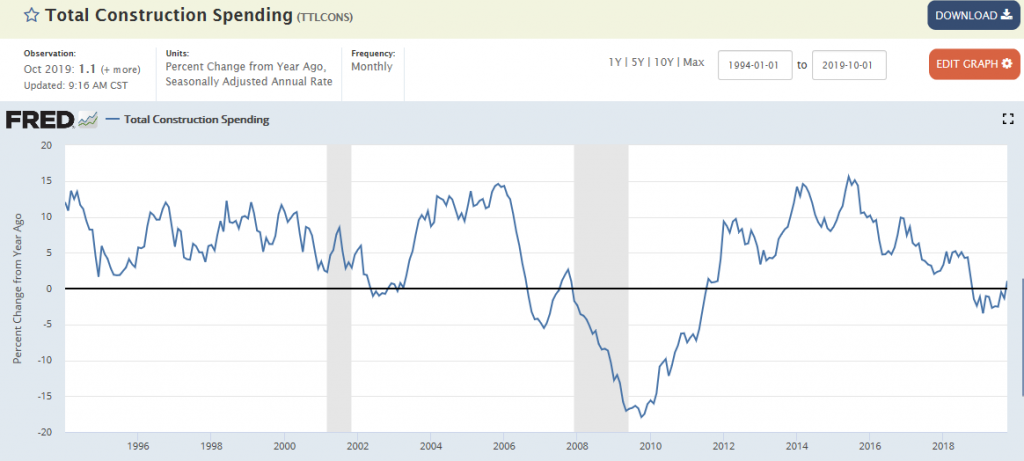

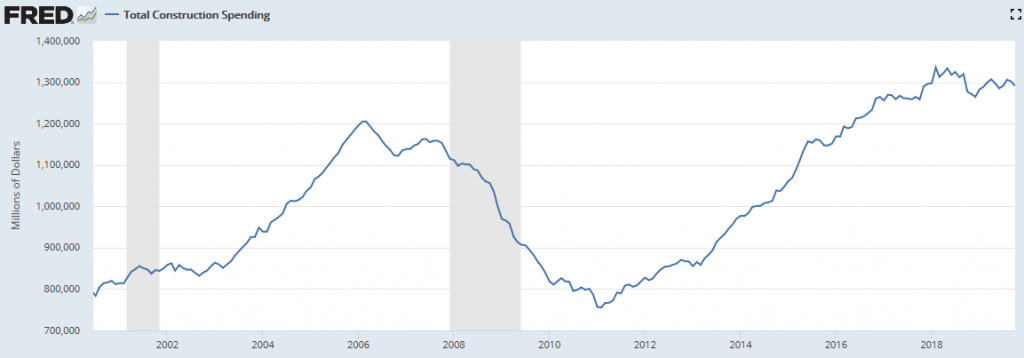

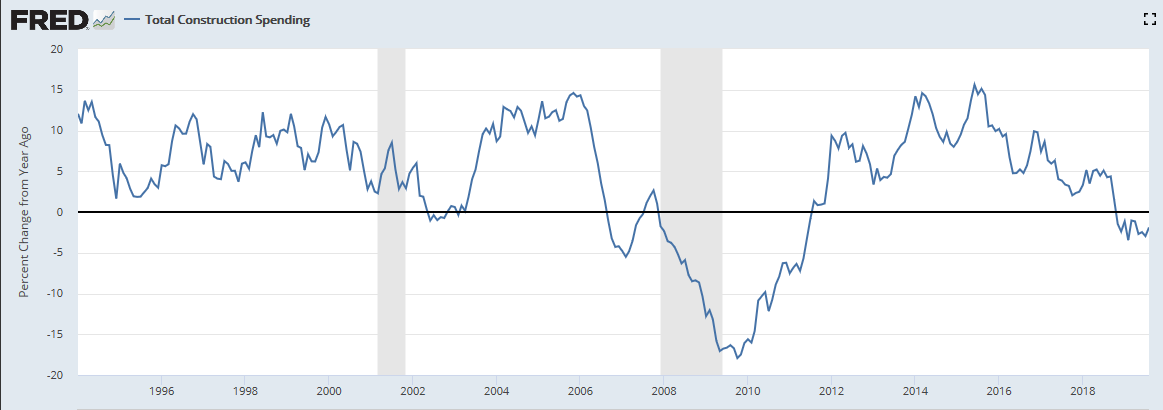

Rolled over and heading south. And adjusted for inflation still way below prior cycle peak:

The President has the interest rate thing backwards, of course, but so does the Fed, and pretty much everyone else, as markets anticipate more fed rate cuts in response to the weak economic data: