Headlines look good, chart not so good:

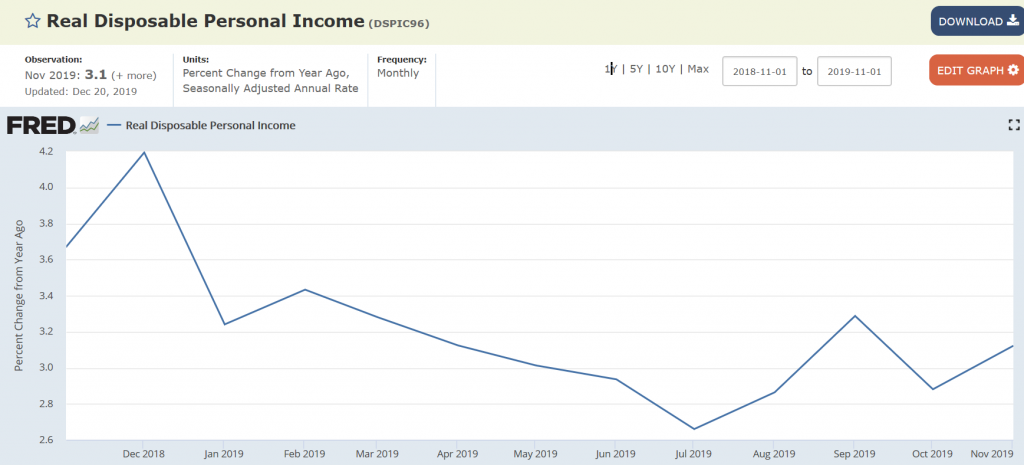

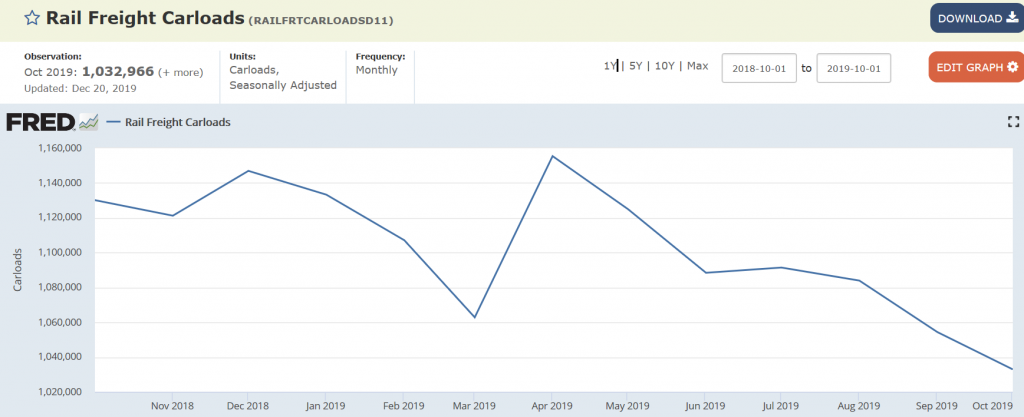

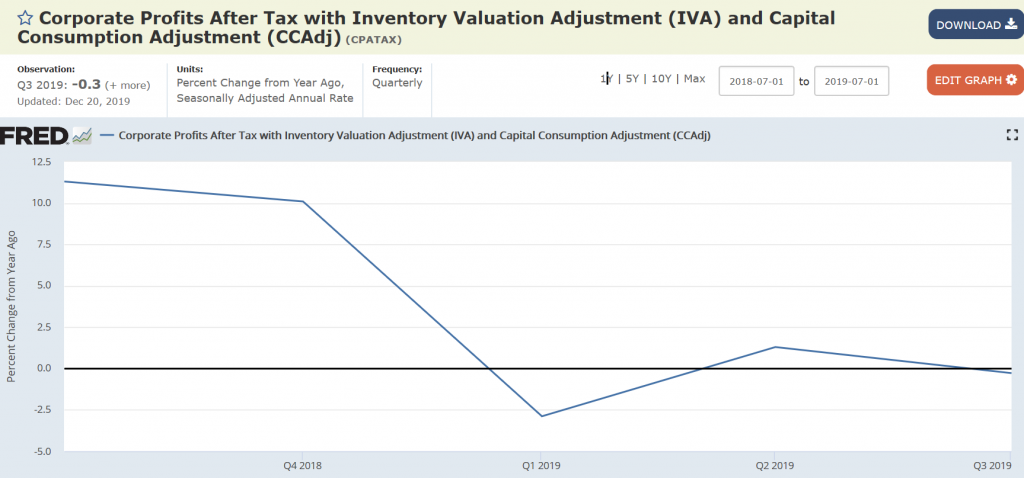

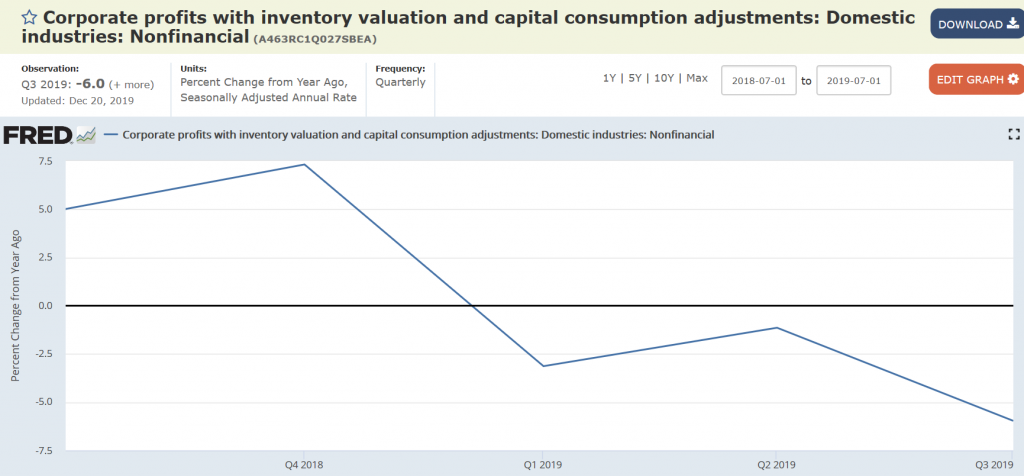

Still depressed:

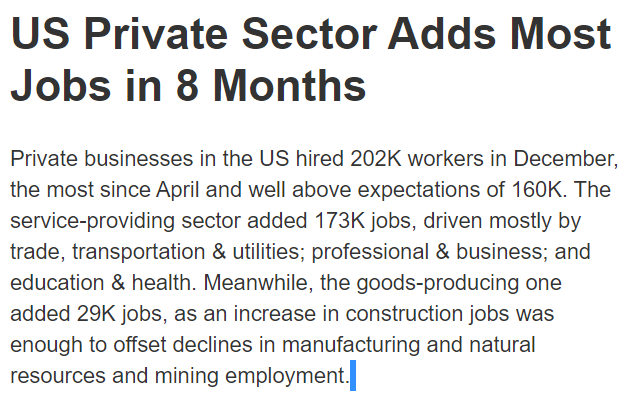

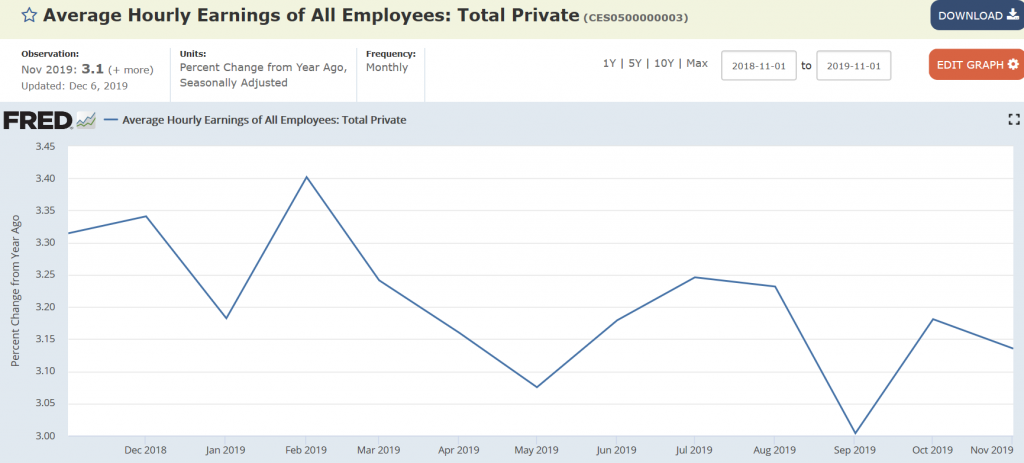

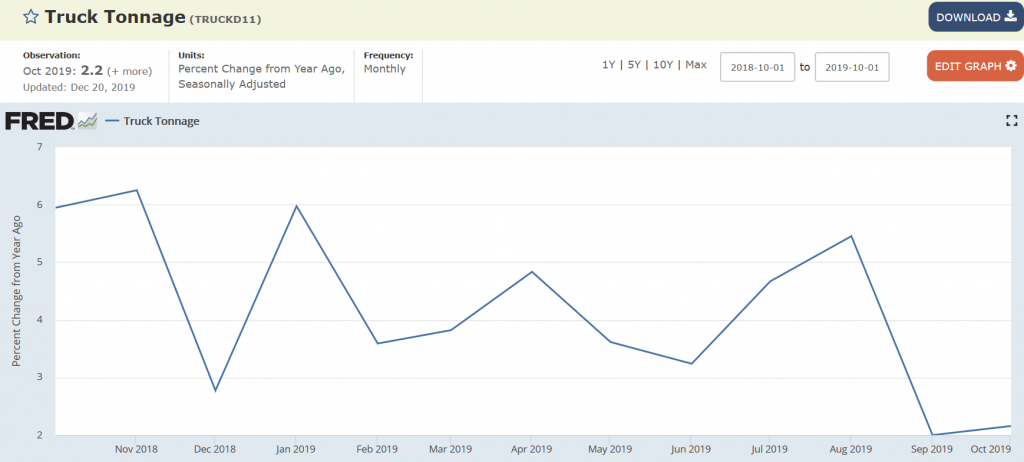

Headlines look good, chart not so good:

Headlines look good, chart not so good:

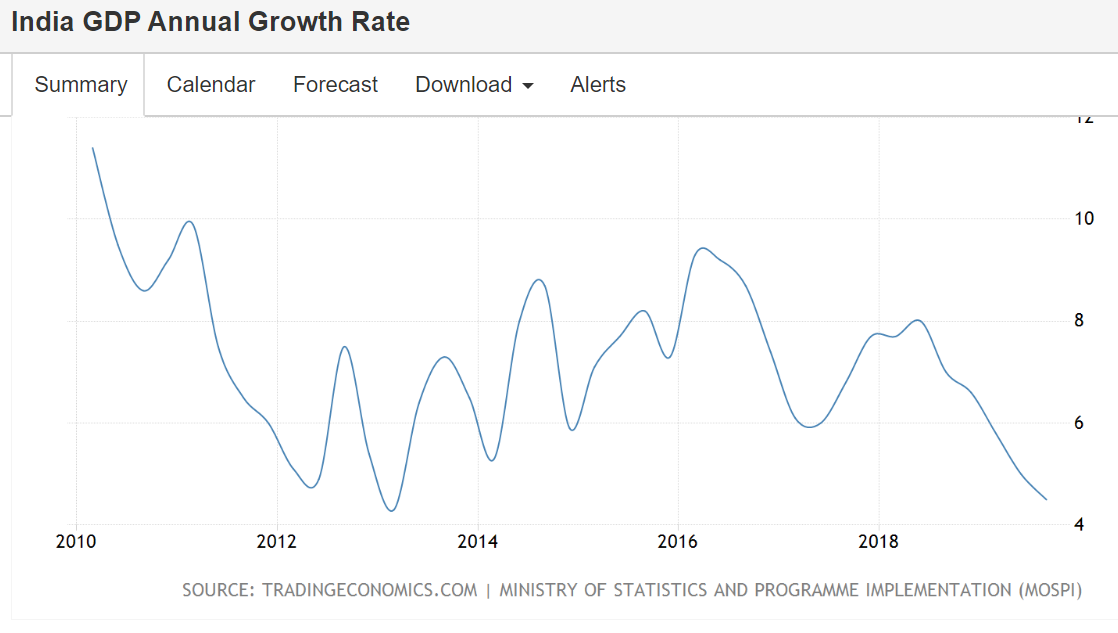

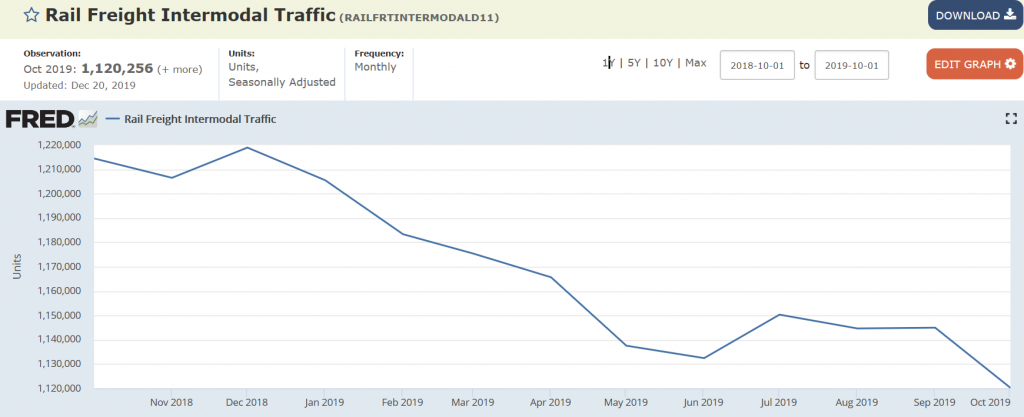

Still depressed:

Headlines look good, chart not so good:

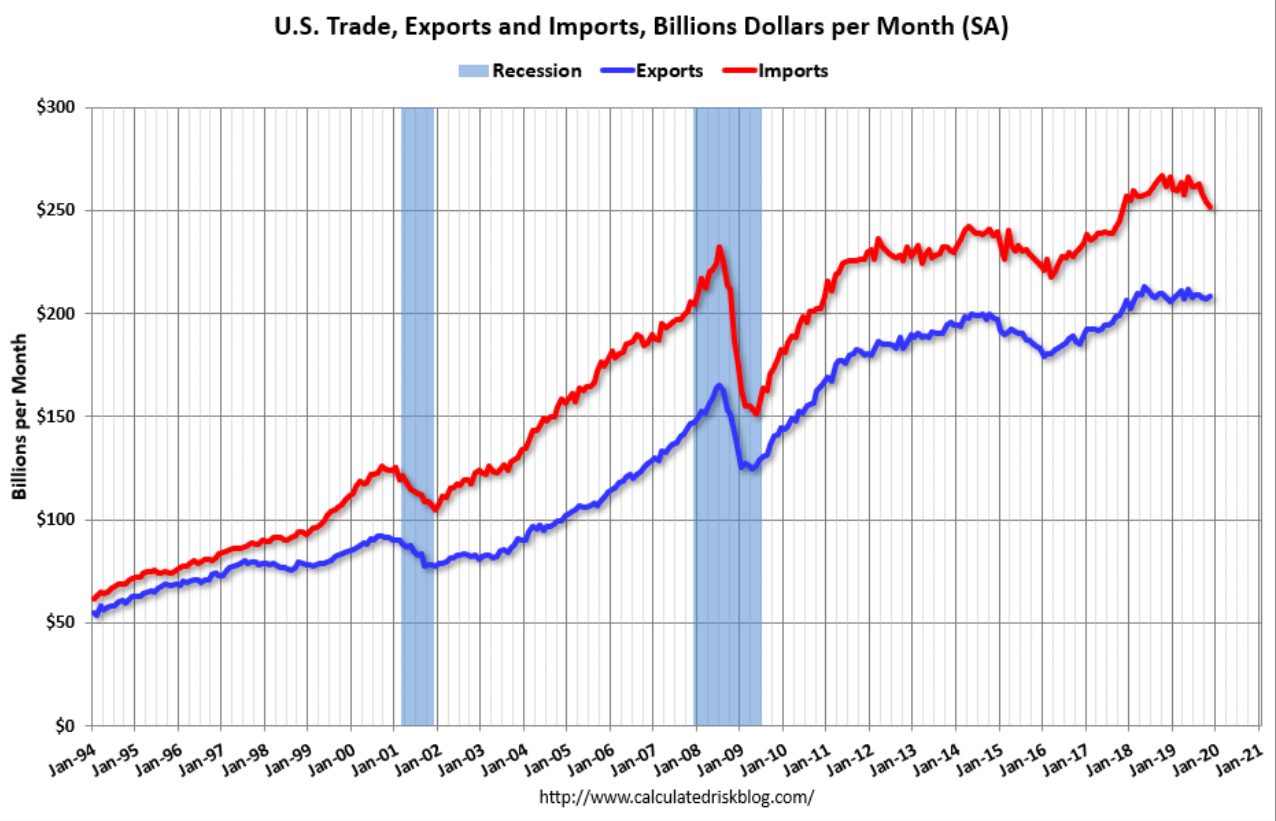

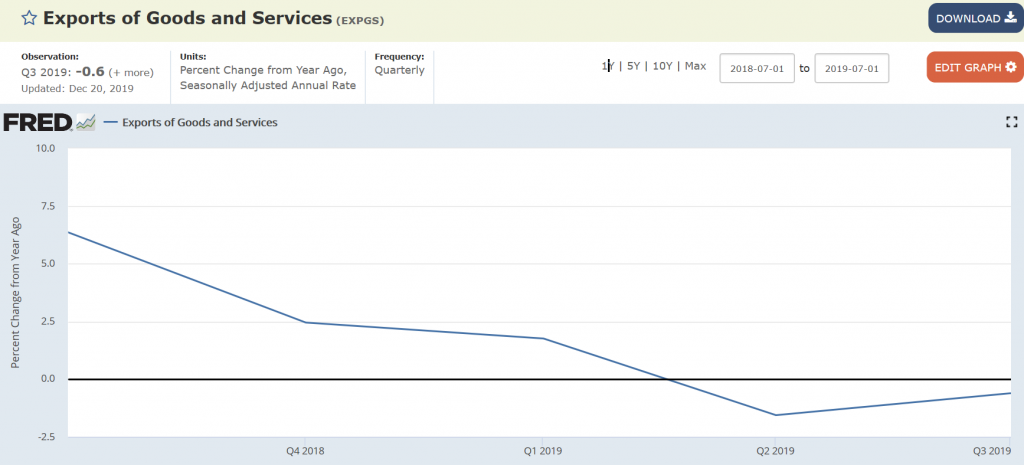

Both imports and exports falling as per the global trade collapse. Falling imports are also an indication of consumer weakness:

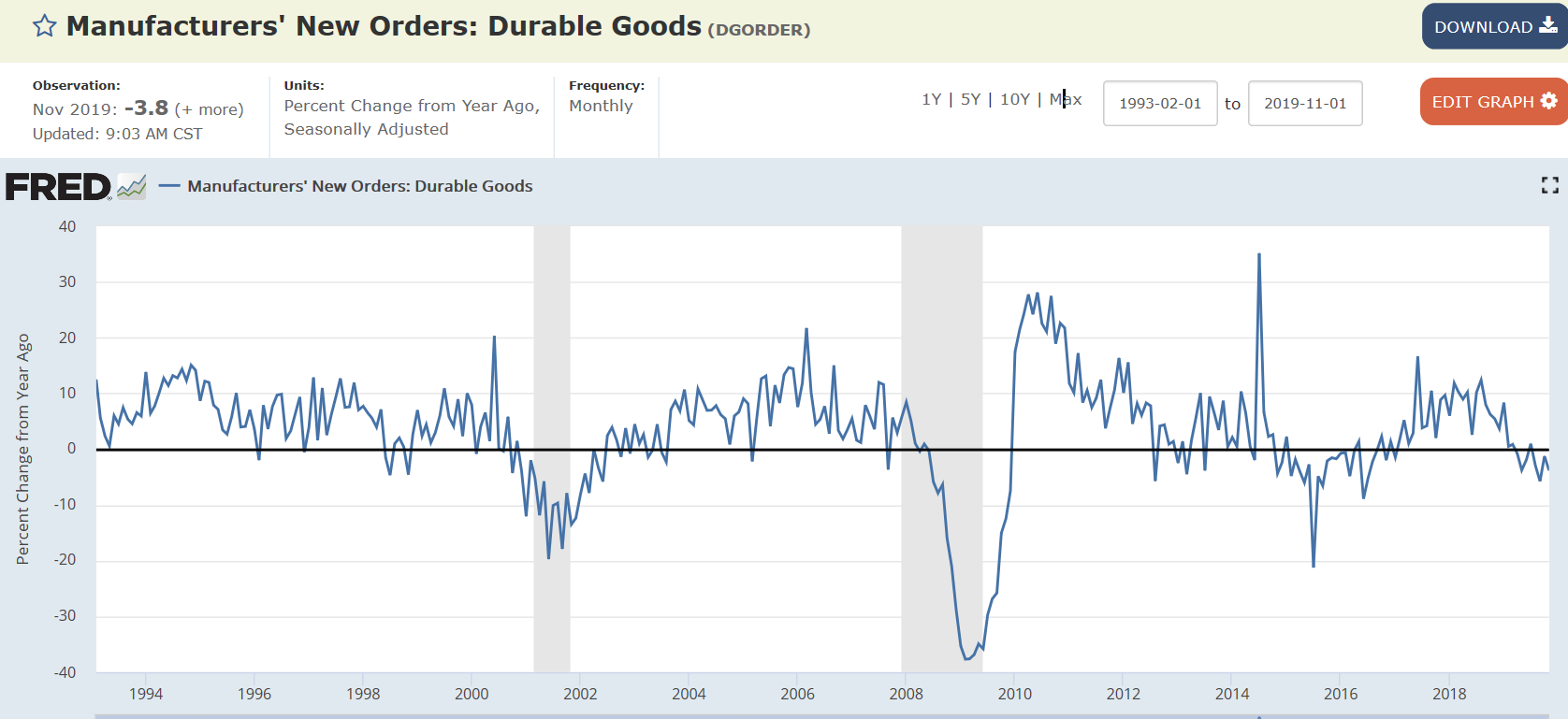

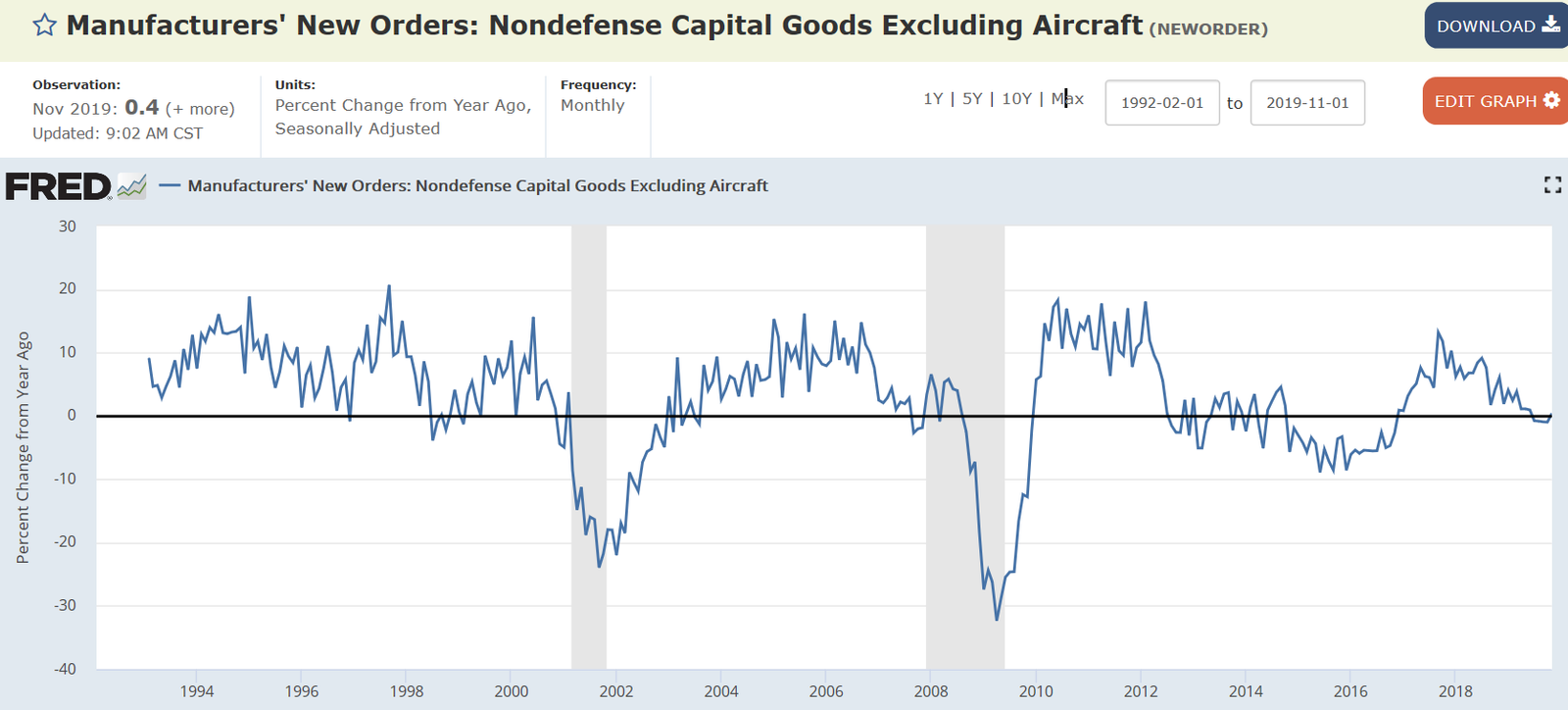

New orders heading south with tariffs:

Familiar pattern:

Fire related maybe:

Australia Construction PMI Contracts Further

The Ai Group Australian Performance of Construction Index declined to 38.9 in December 2019 from 40 in the previous month, falling to the lowest level since May 2013 and adding weight to calls for fiscal stimulus. The activity index fell sharply again in December with its biggest monthly drop in 12 months (down 4.4 points to 36.5). second month (up 0.8 points to 50.8). In contrast, apartment building remained deep in negative territory (up 0.9 points to 37.4). There is now a clear danger of a self-Meanwhile, new orders declined 0.6 to 36.9 points. Of the four construction sectors, house building was the best performing sector with activity showing stability for a reinforcing downturn across significant parts of the domestic economy,” Ai Group Head of Policy, Peter Burn, said.

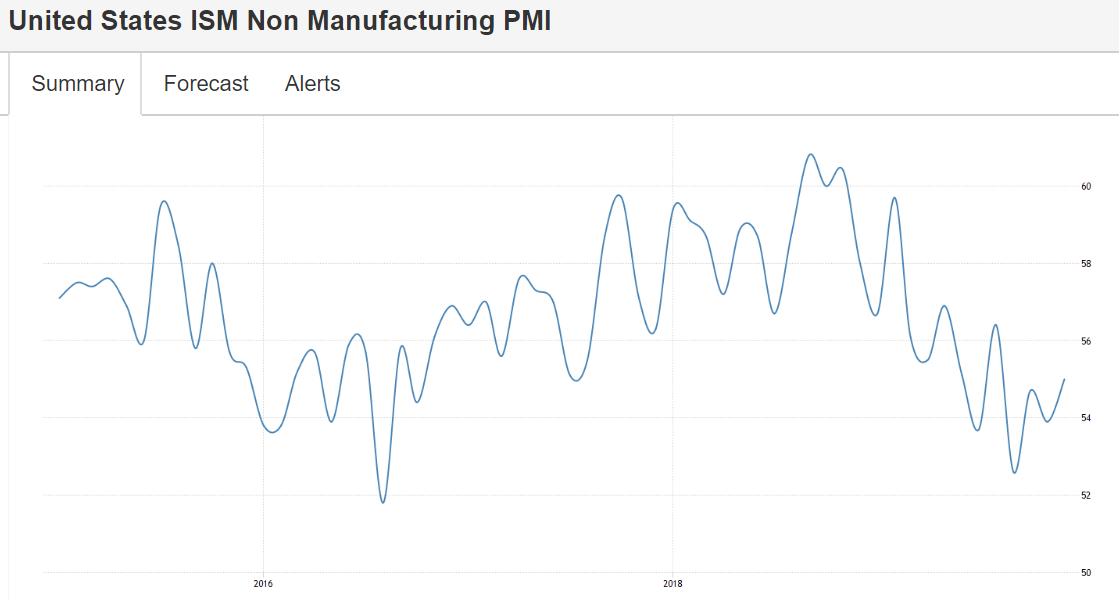

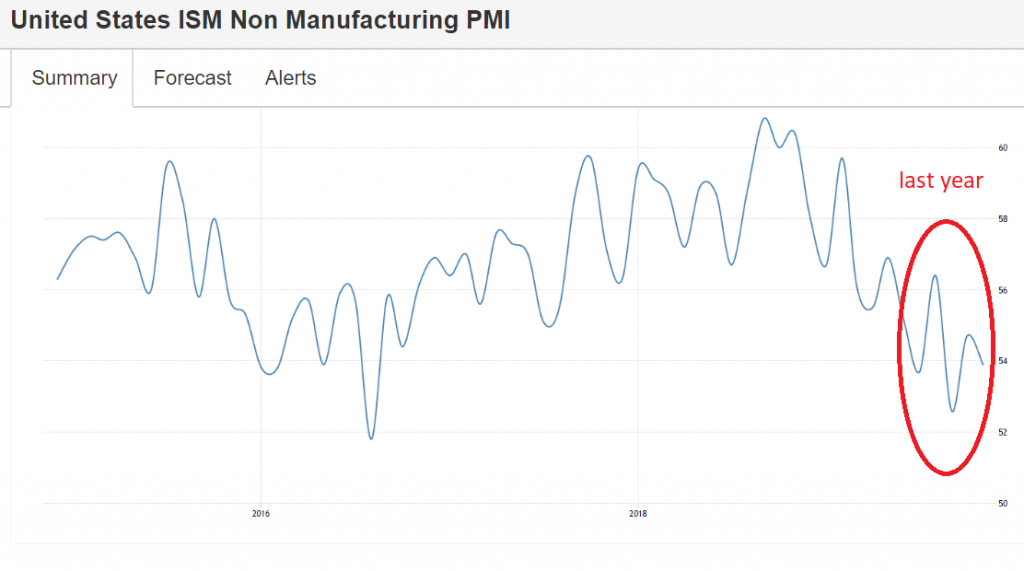

Chart still looking lower:

The ISM Non-Manufacturing PMI for the US increased to 55 in December of 2019 from 53.9 in November, slightly beating market forecasts of 54.5. The reading pointed to the biggest expansion in the services sector in four months as production and inventories rose faster while new orders, new export orders and employment slowed. Companies are positive about the potential resolution on tariffs and capacity constraints have eased a bit although difficulties with labour resources remain, according to Anthony Nieves, Chair of the ISM.

Got to give Trump credit, the assassination got us out of Iraq!

Iraqi parliament calls for US troops to be expelled —coalition suspends operations against ISIS

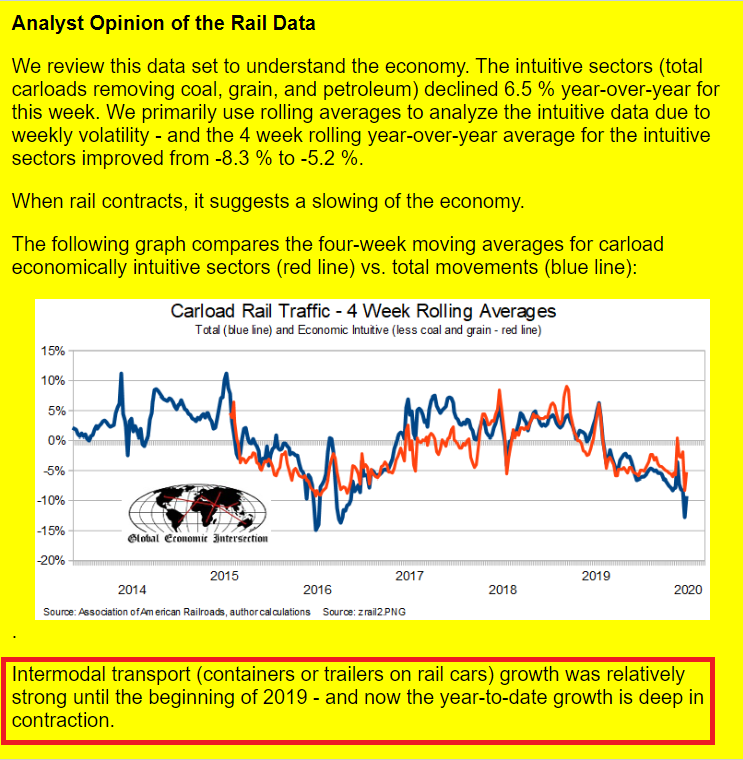

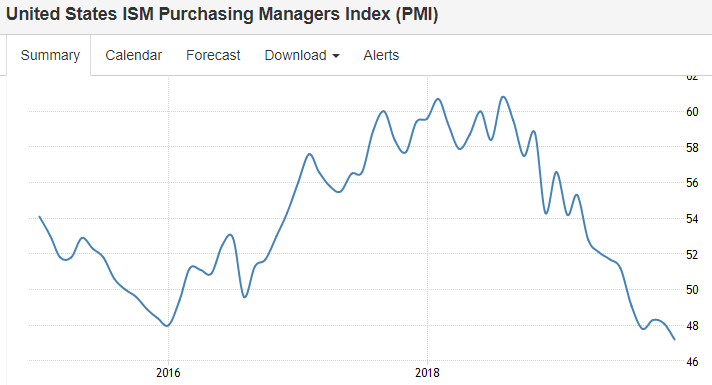

Deeper into contraction:

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The December PMI® registered 47.2 percent, a decrease of 0.9 percentage point from the November reading of 48.1 percent. This is the PMI®’s lowest reading since June 2009, when it registered 46.3 percent. The New Orders Index registered 46.8 percent, a decrease of 0.4 percentage point from the November reading of 47.2 percent. The Production Index registered 43.2 percent, down 5.9 percentage points compared to the November reading of 49.1 percent. The Backlog of Orders Index registered 43.3 percent, up 0.3 percentage point compared to the November reading of 43 percent. The Employment Index registered 45.1 percent, a 1.5-percentage point decrease from the November reading of 46.6 percent. The Supplier Deliveries Index registered 54.6 percent, a 2.6-percentage point increase from the November reading of 52 percent. The Inventories Index registered 46.5 percent, an increase of 1 percentage point from the November reading of 45.5 percent. The Prices Index registered 51.7 percent, a 5-percentage point increase from the November reading of 46.7 percent. The New Export Orders Index registered 47.3 percent, a 0.6-percentage point decrease from the November reading of 47.9 percent. The Imports Index registered 48.8 percent, a 0.5-percentage point increase from the November reading of 48.3 percent.

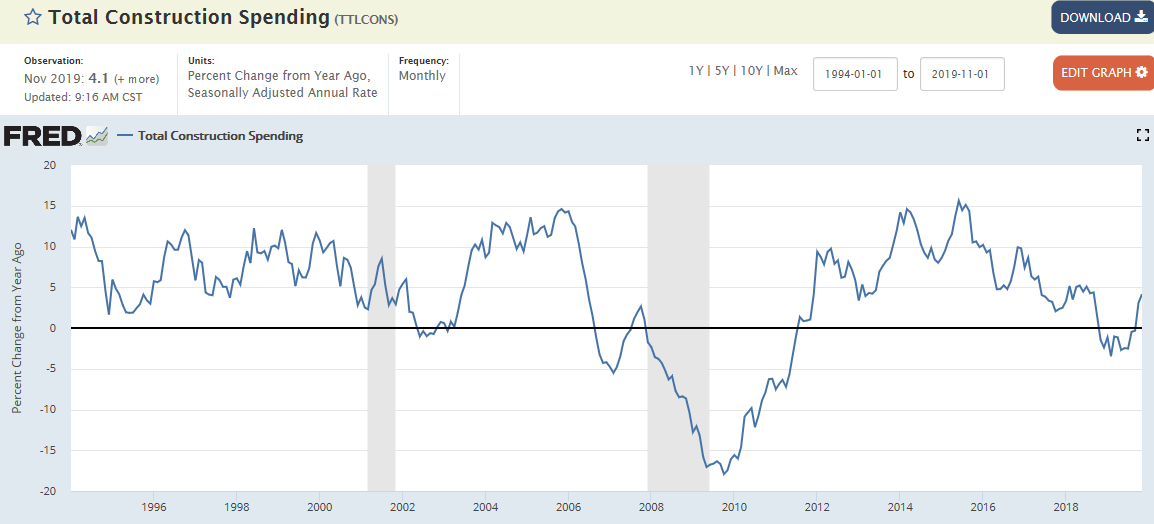

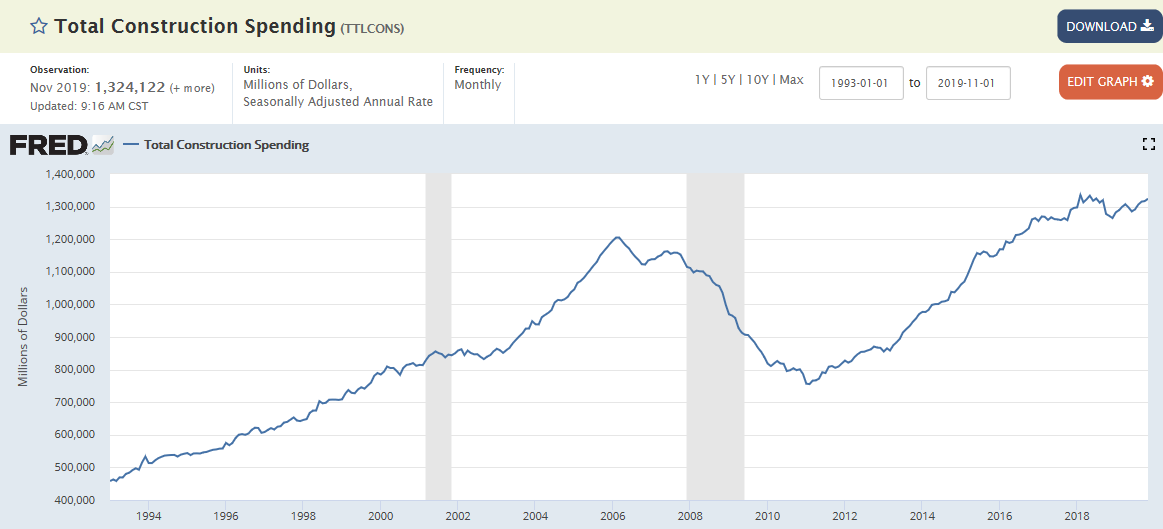

Up a bit last month but still weak hovering around contraction. And note that these charts are not adjusted for inflation, so inflation adjusted construction spending is substantially lower:

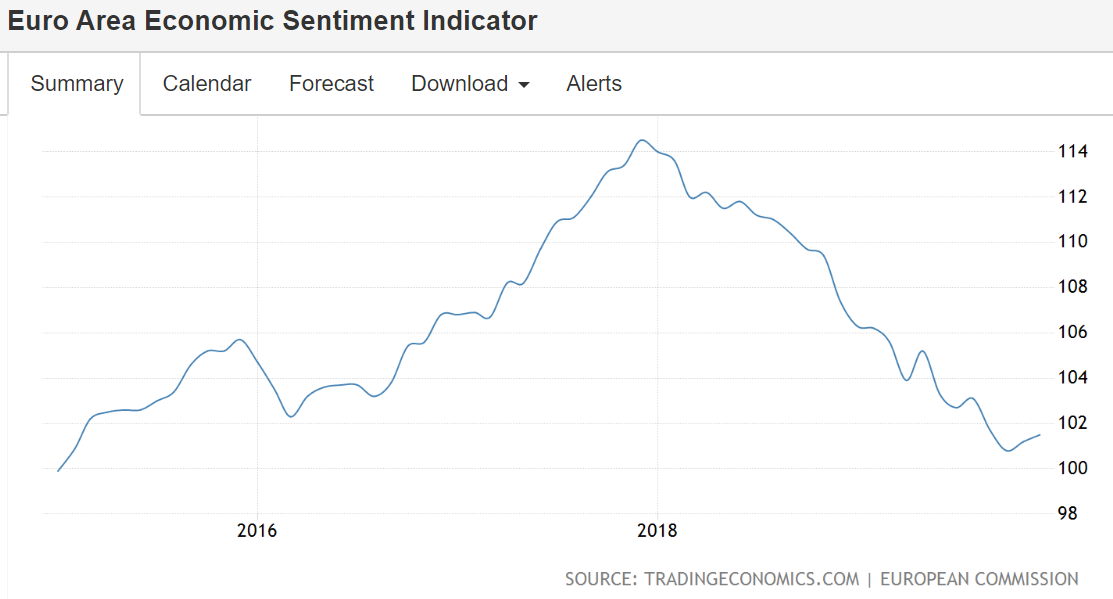

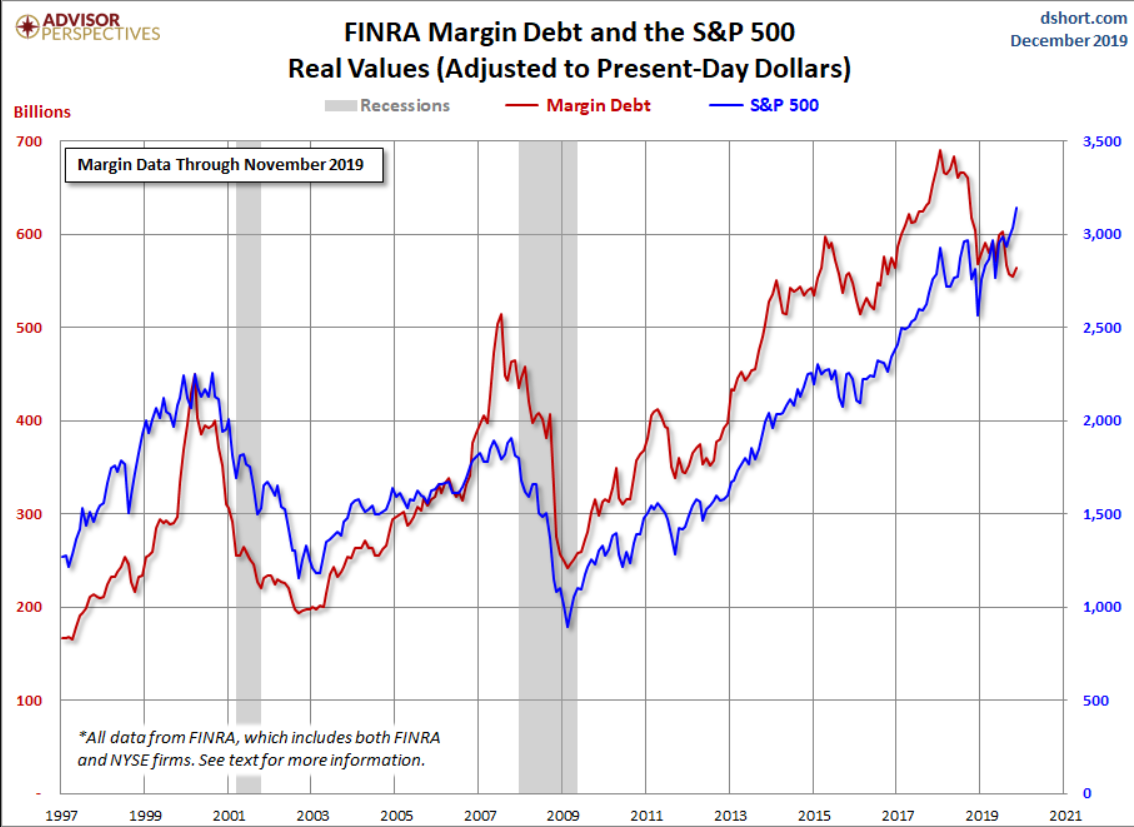

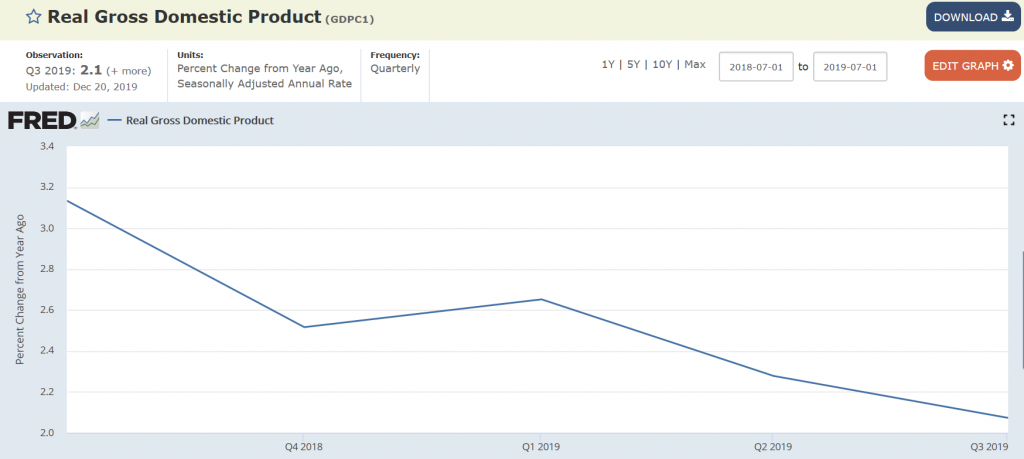

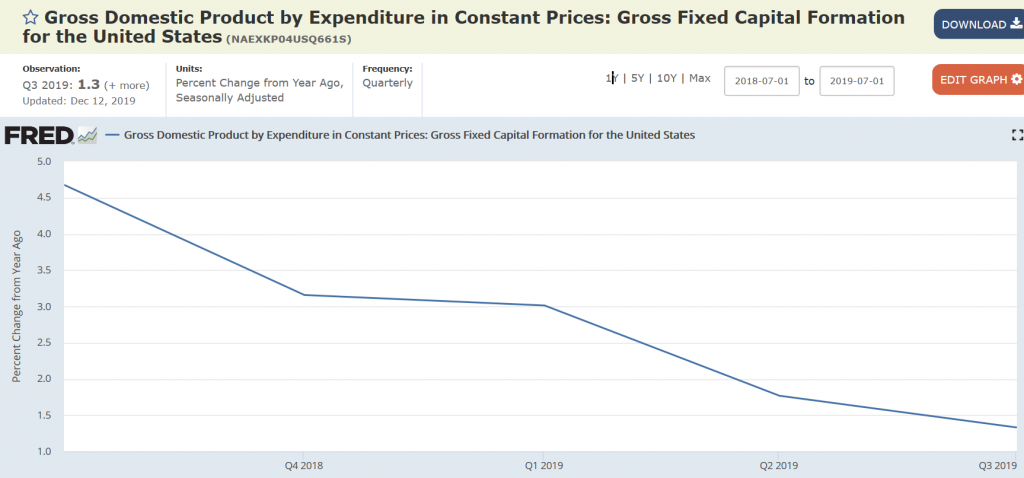

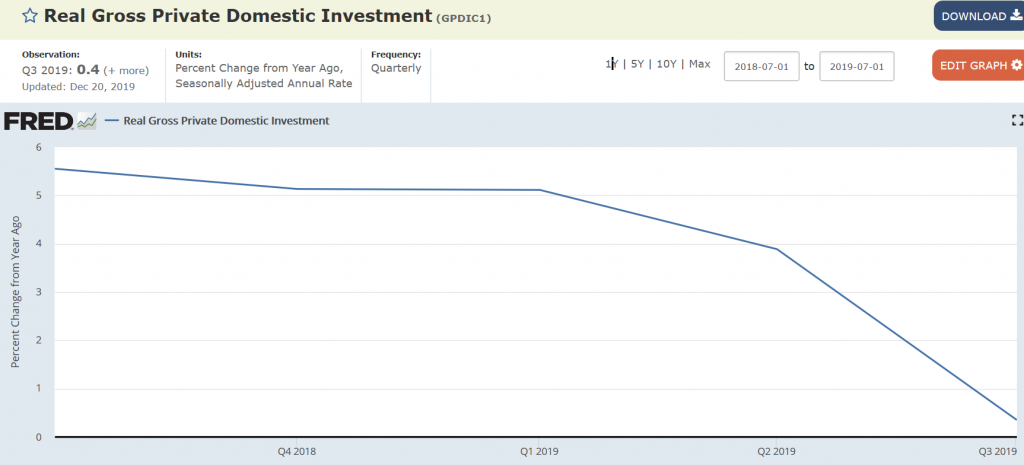

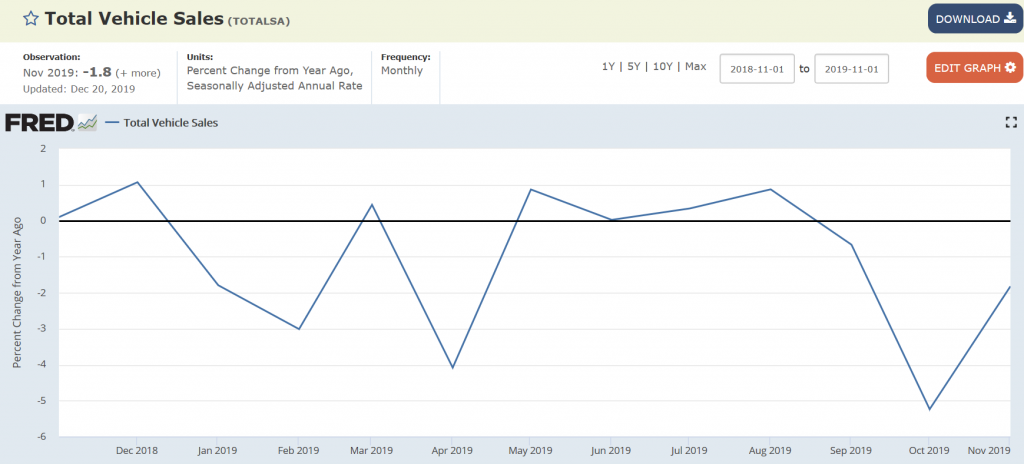

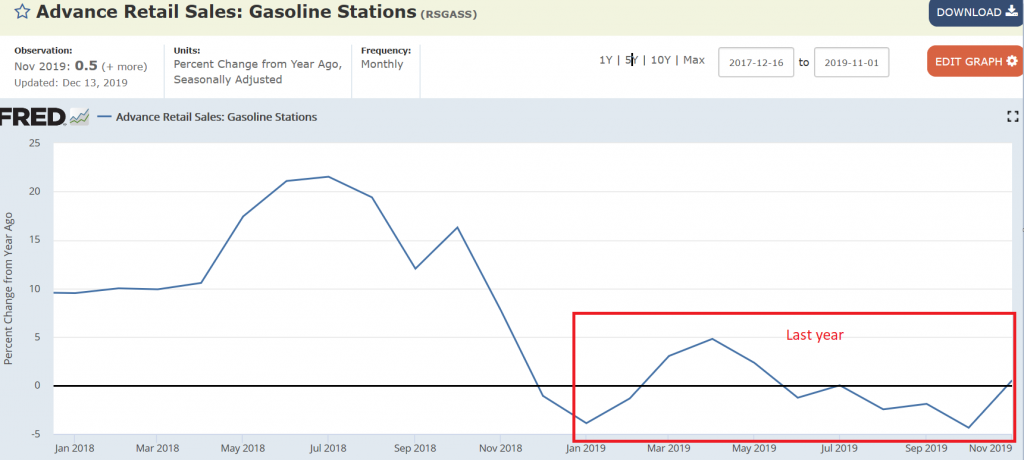

So how has 2019 been vs 2018?

Tariffs continue to take their toll,

and all the voters seem to notice is the stock market?

Whatever!

Fed study finds Trump tariffs backfired

This is only a partial list:

(service sector)

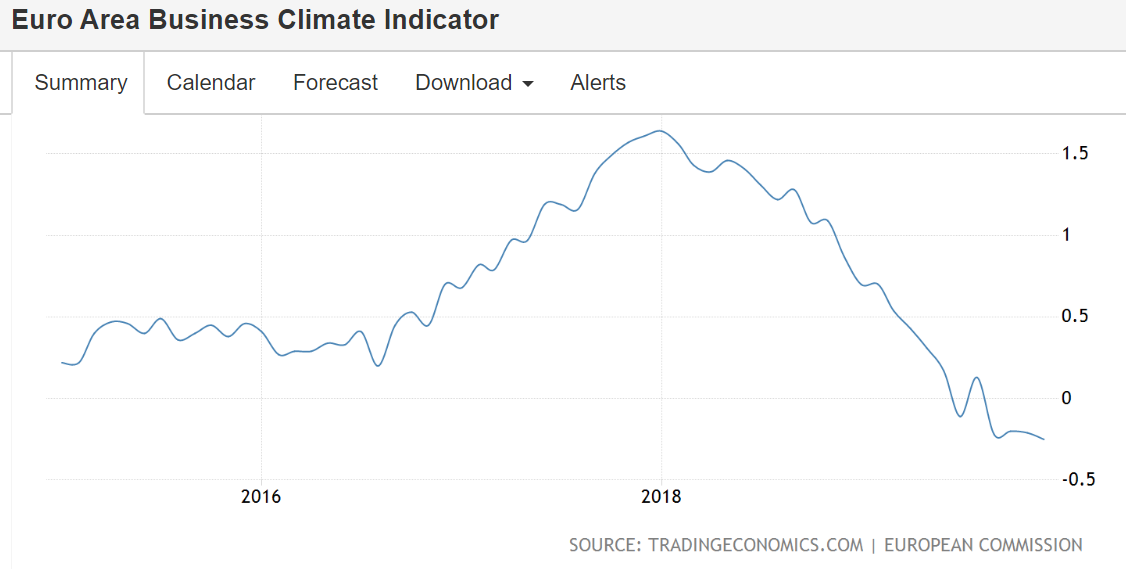

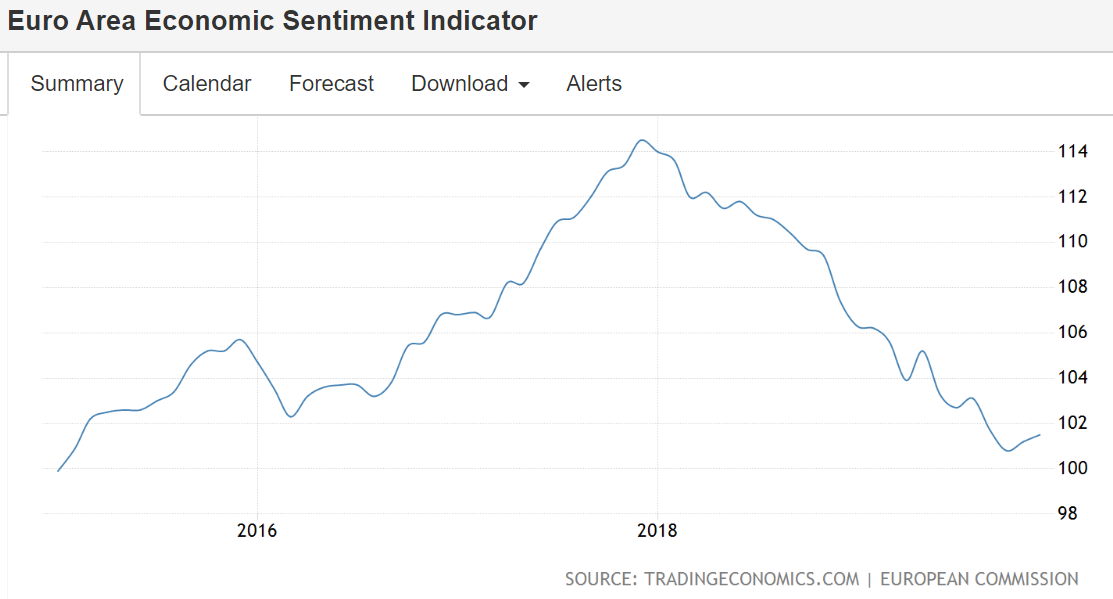

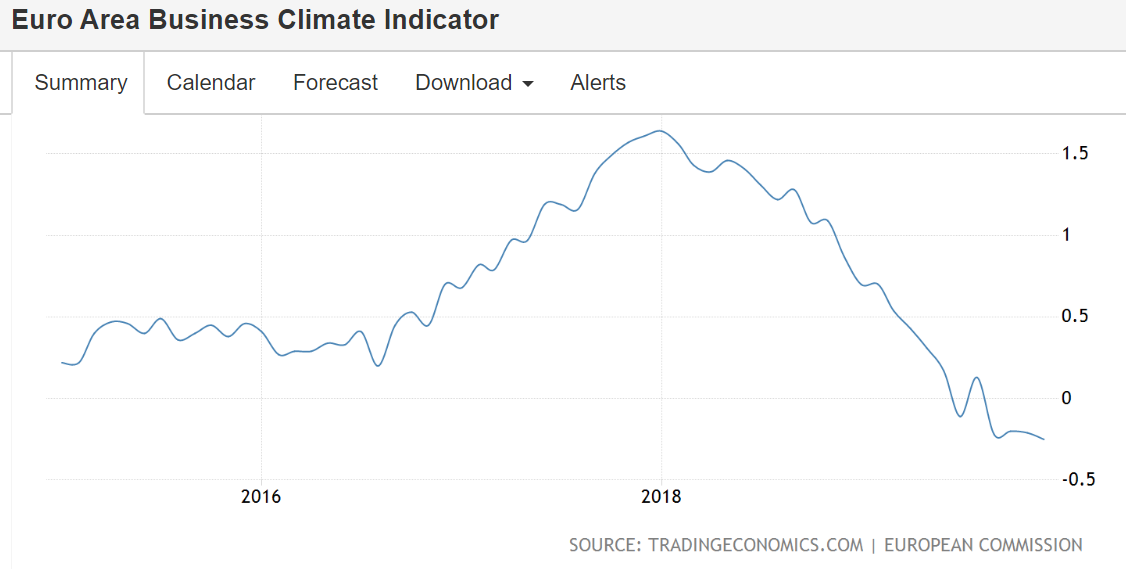

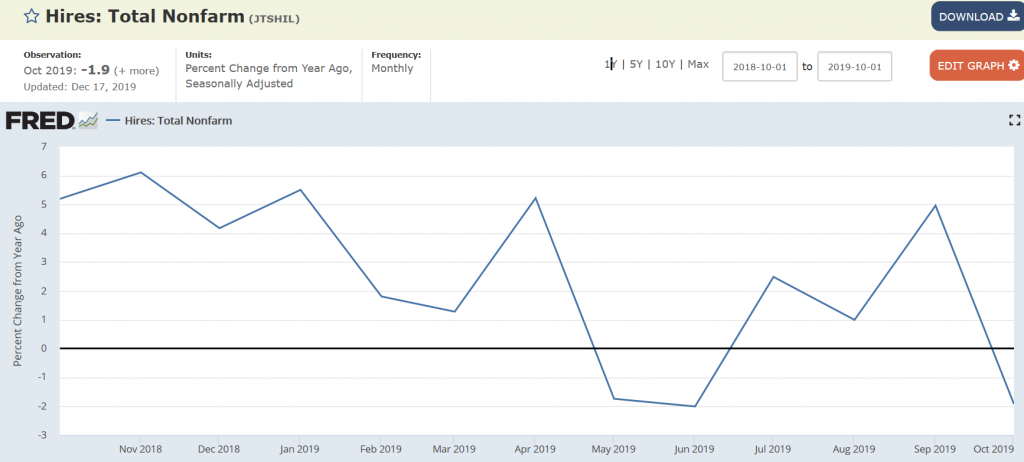

Going south fast since the tariffs:

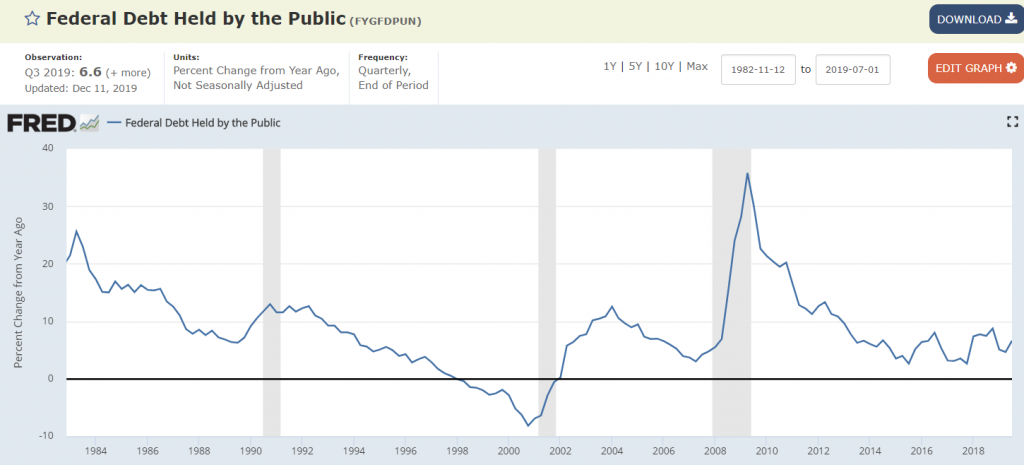

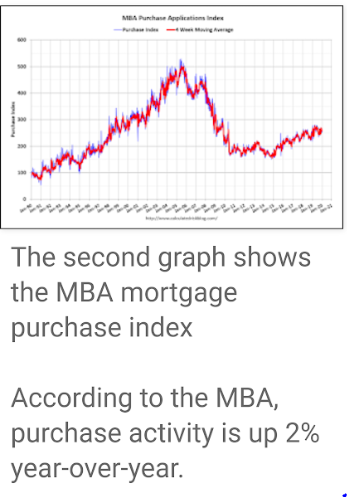

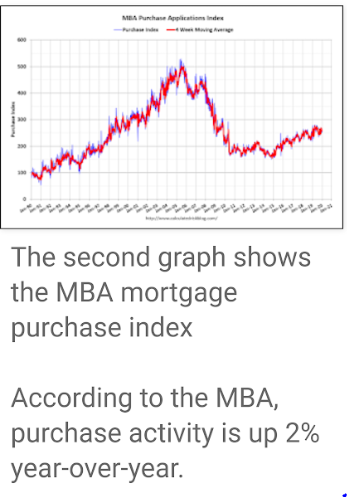

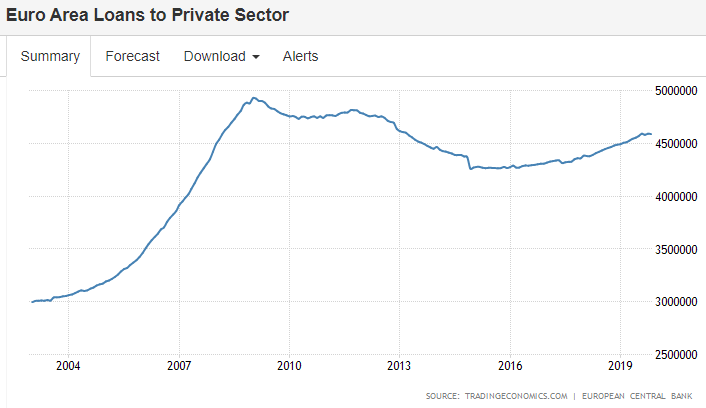

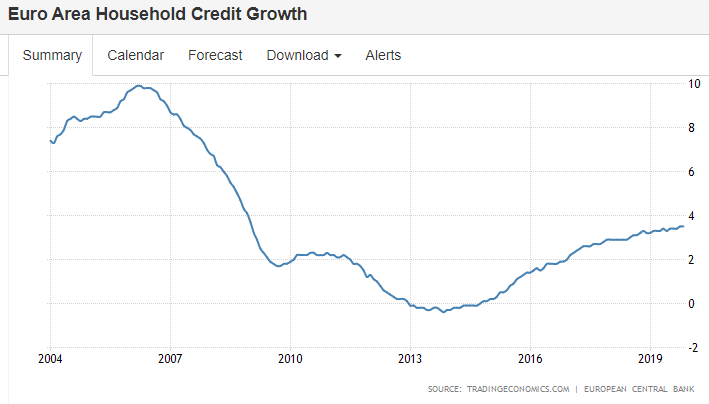

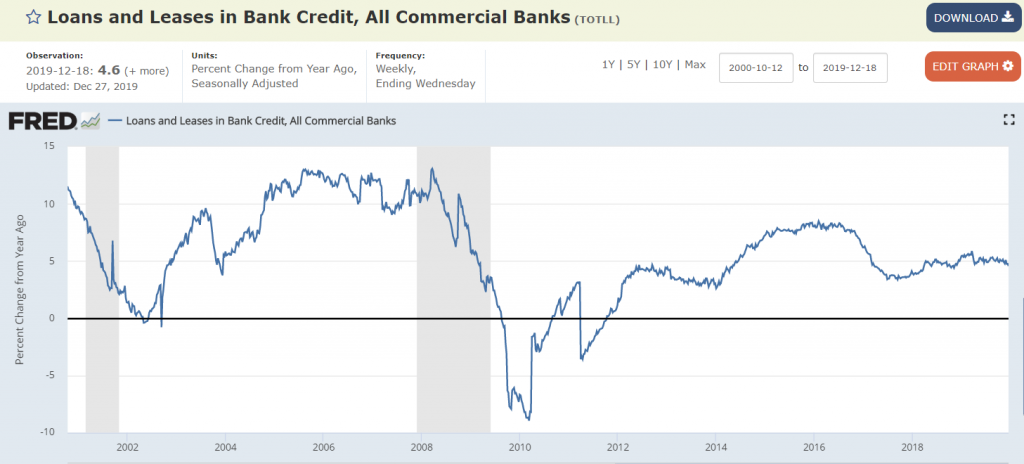

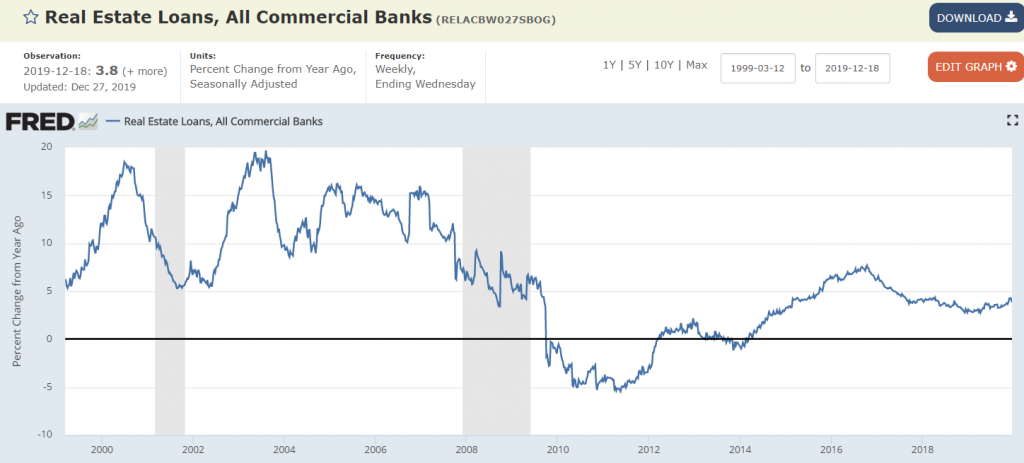

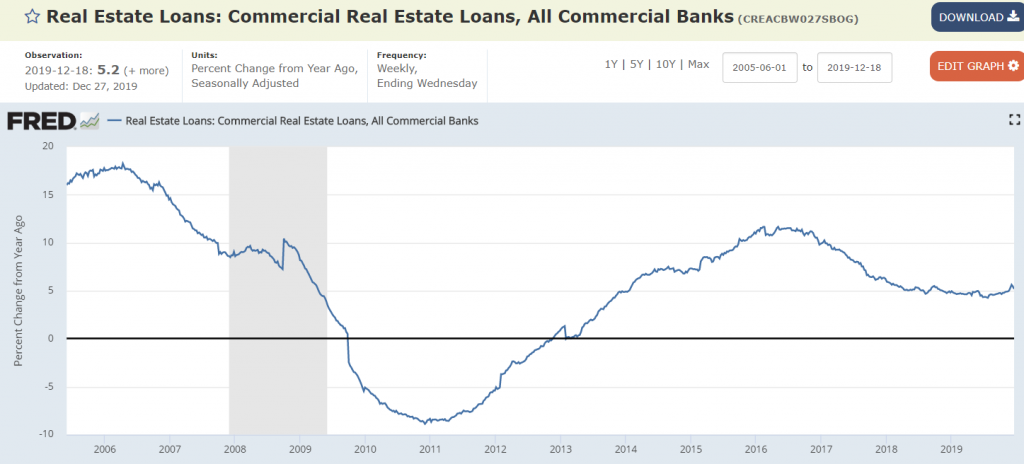

Tiny blip up from rate cuts seems to have reversed as real estate lending growth remains depressed:

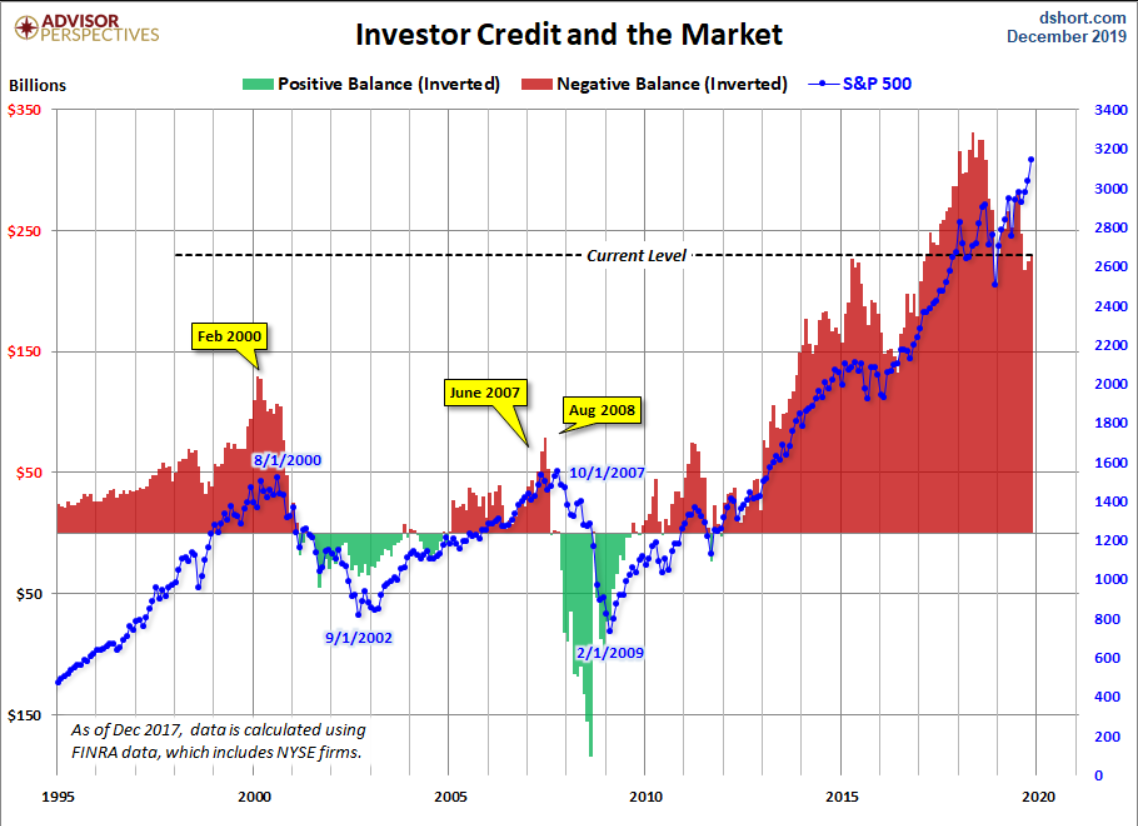

This is best thought of as the ‘net money supply’ or ‘the equity that supports the

credit structure:’