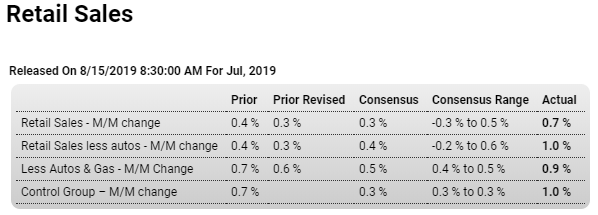

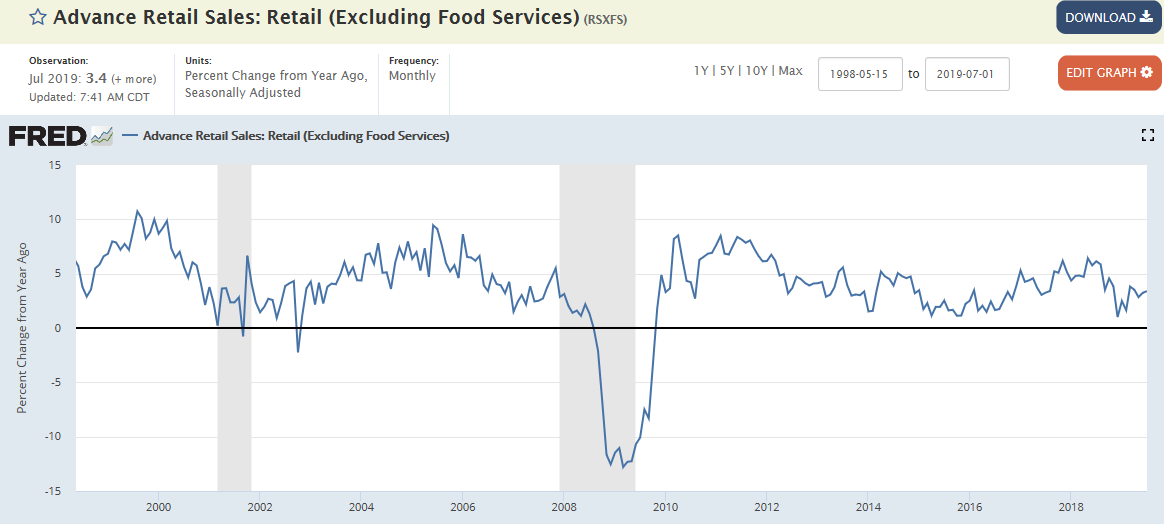

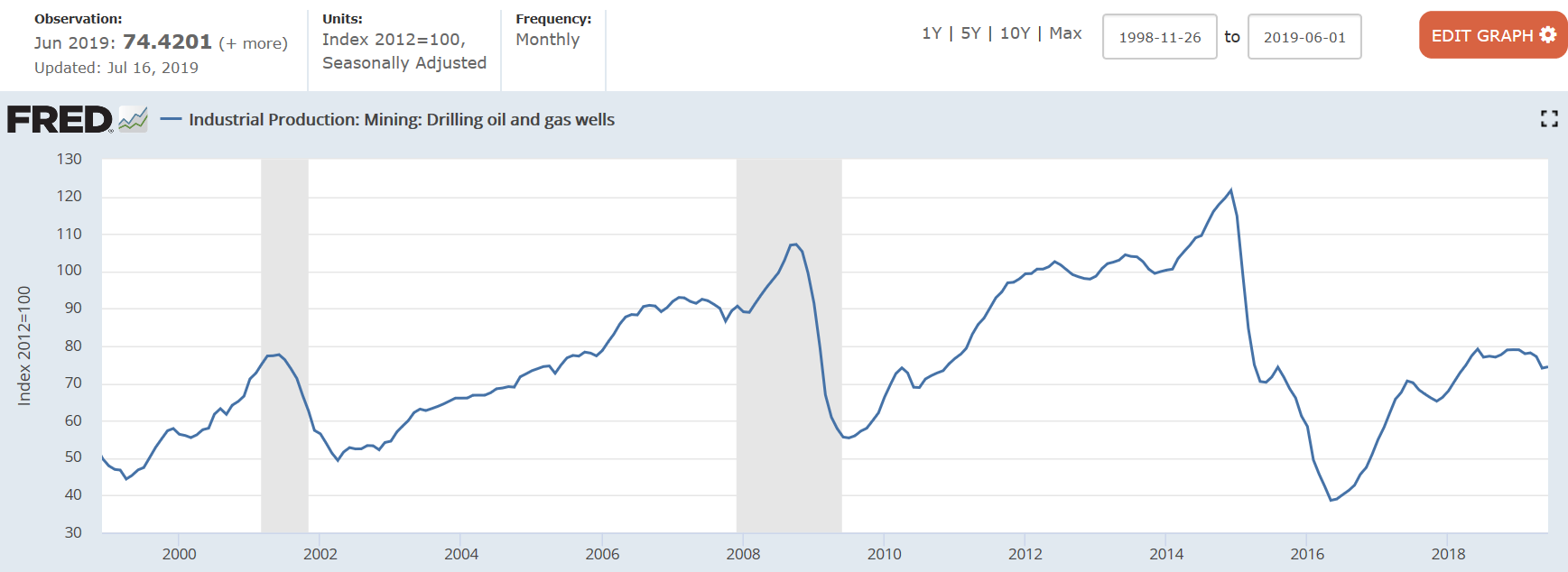

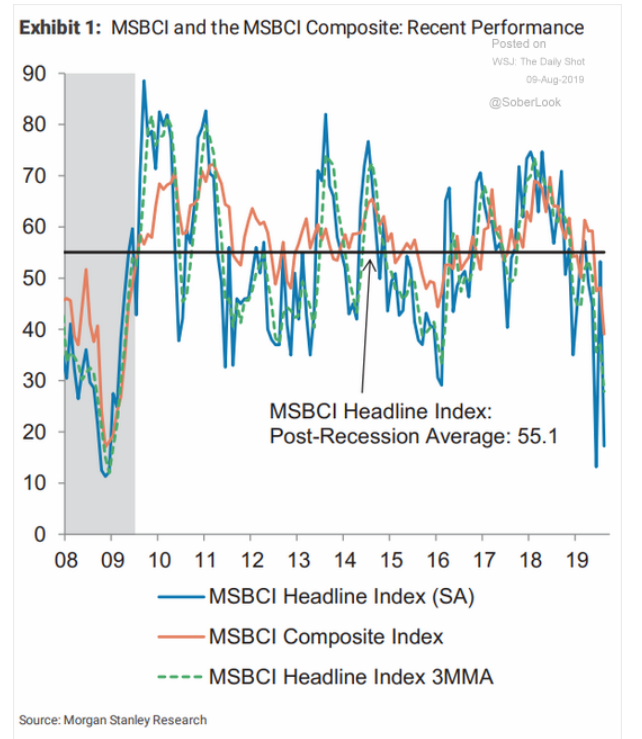

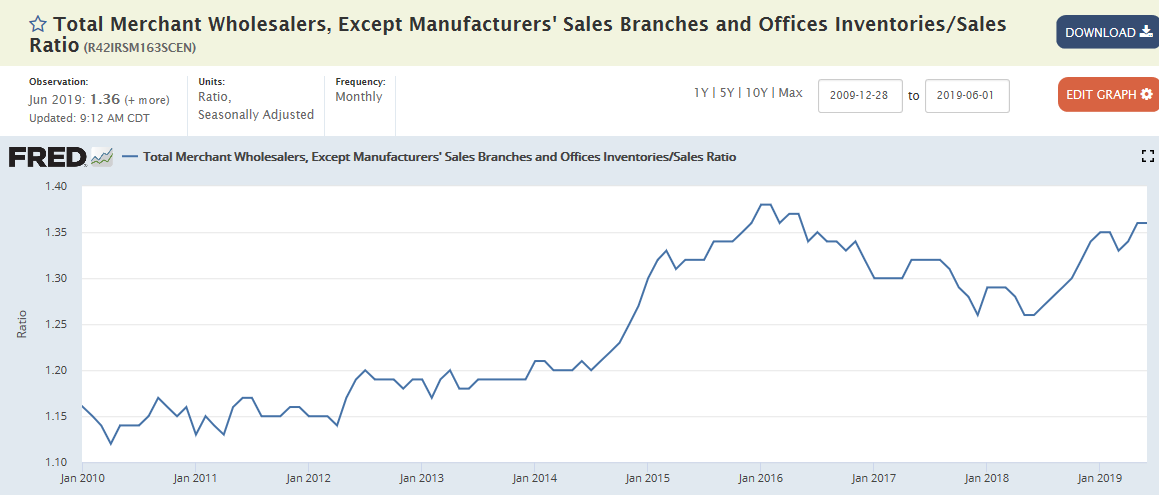

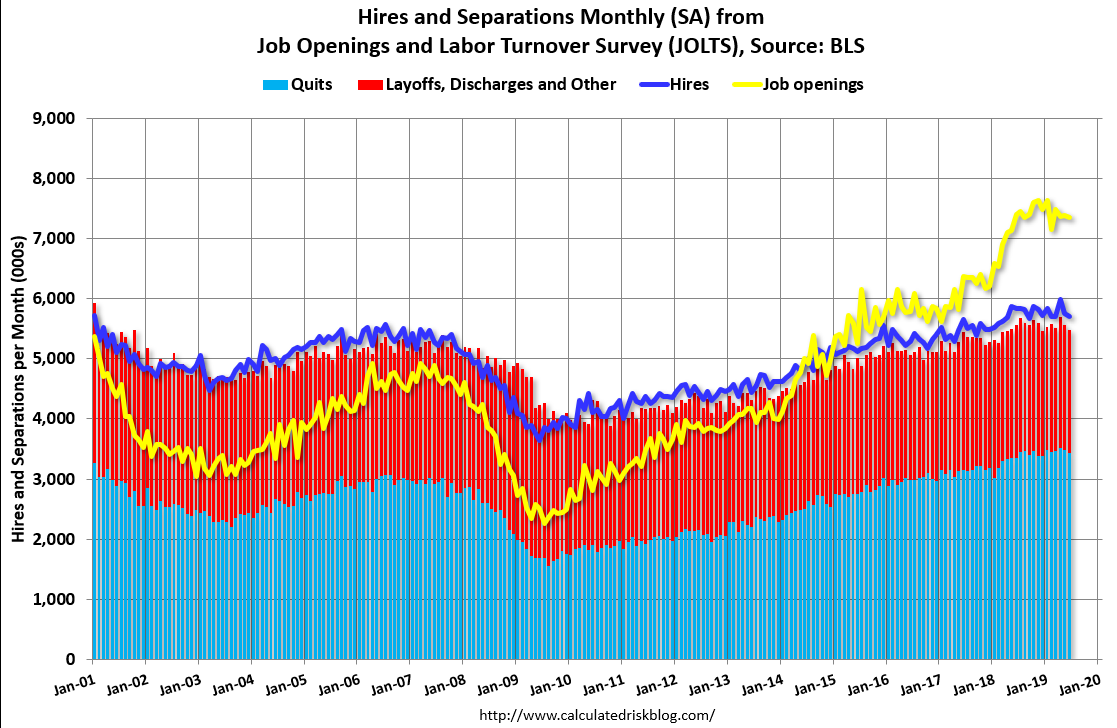

Still elevated:

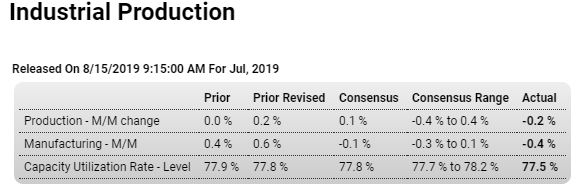

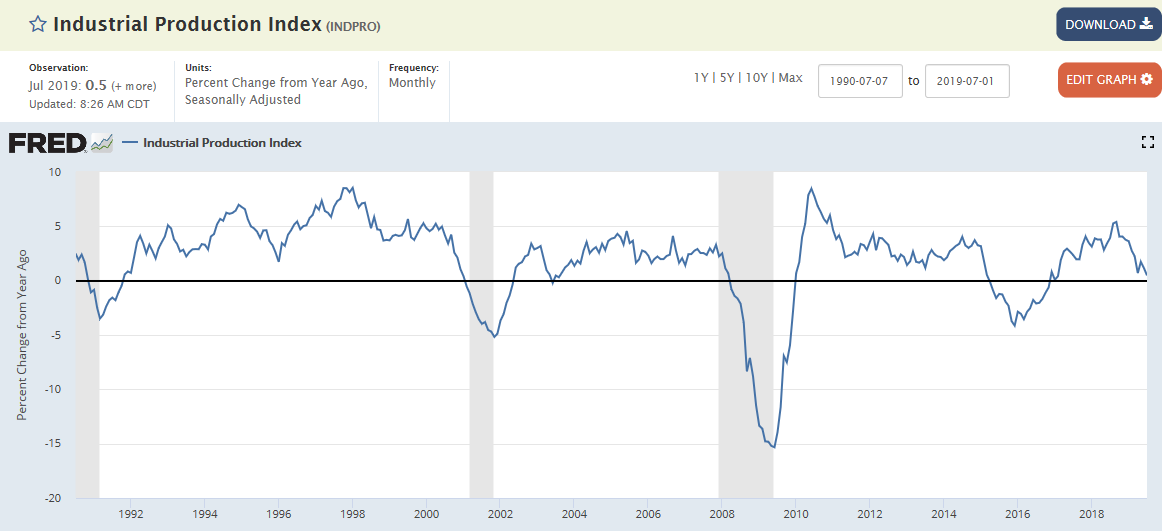

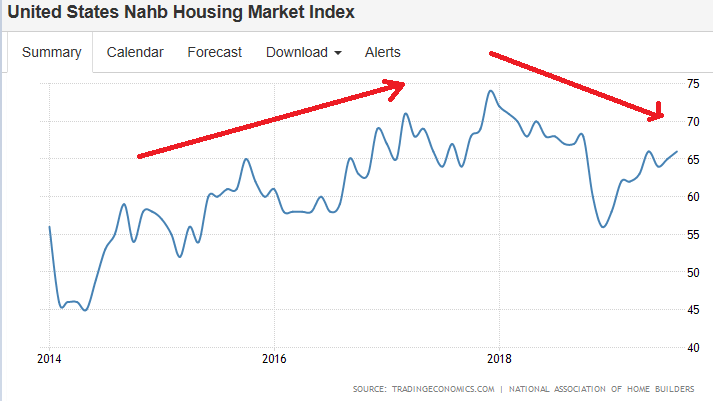

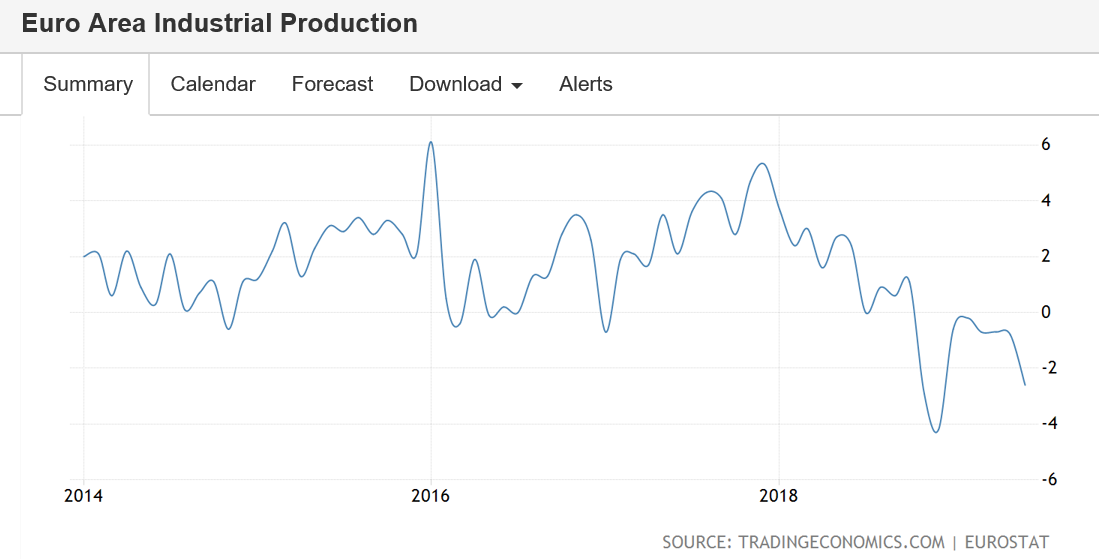

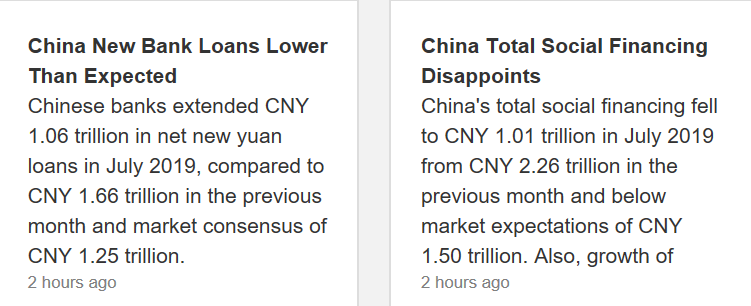

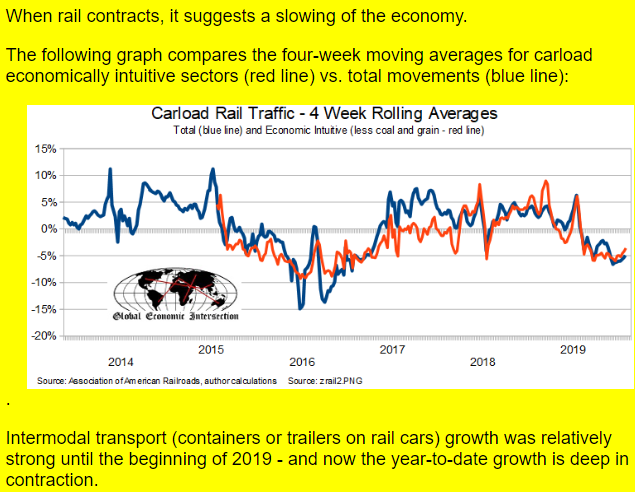

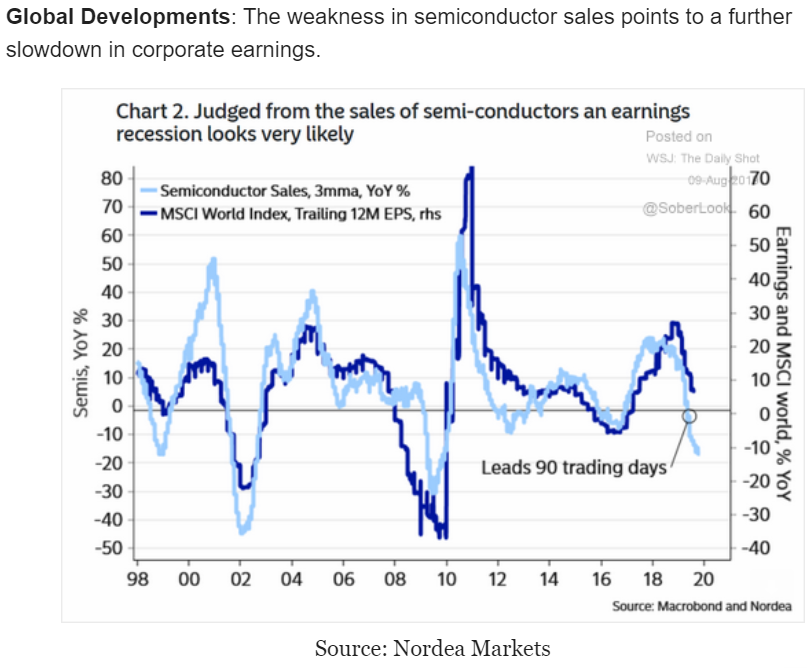

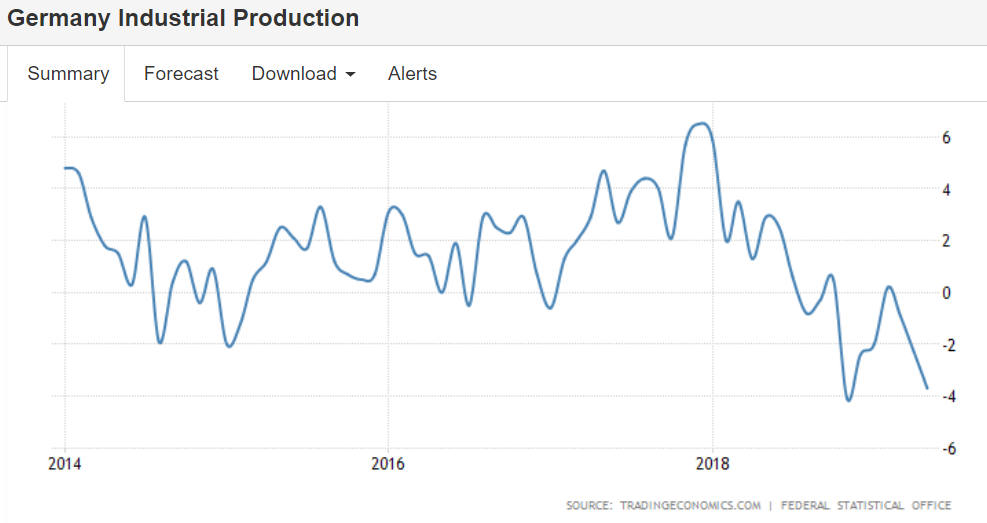

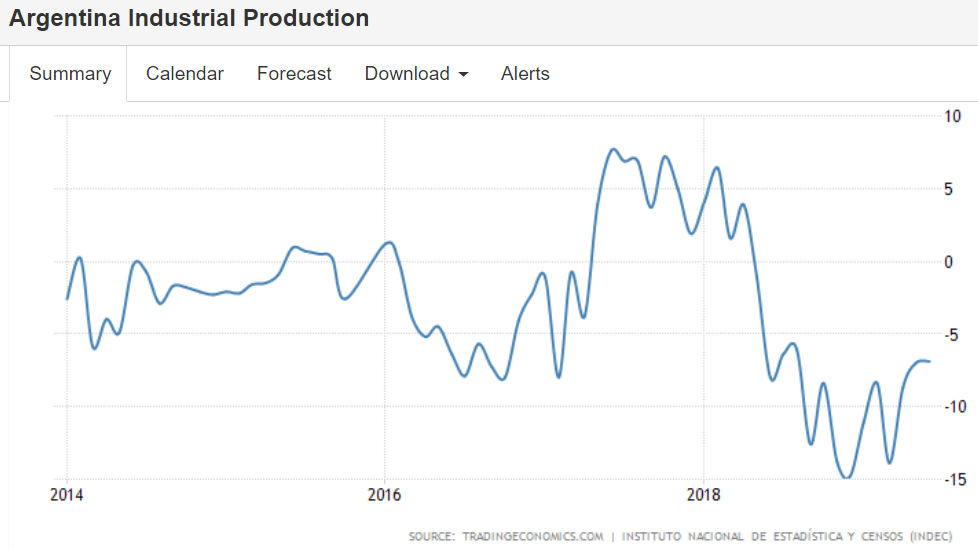

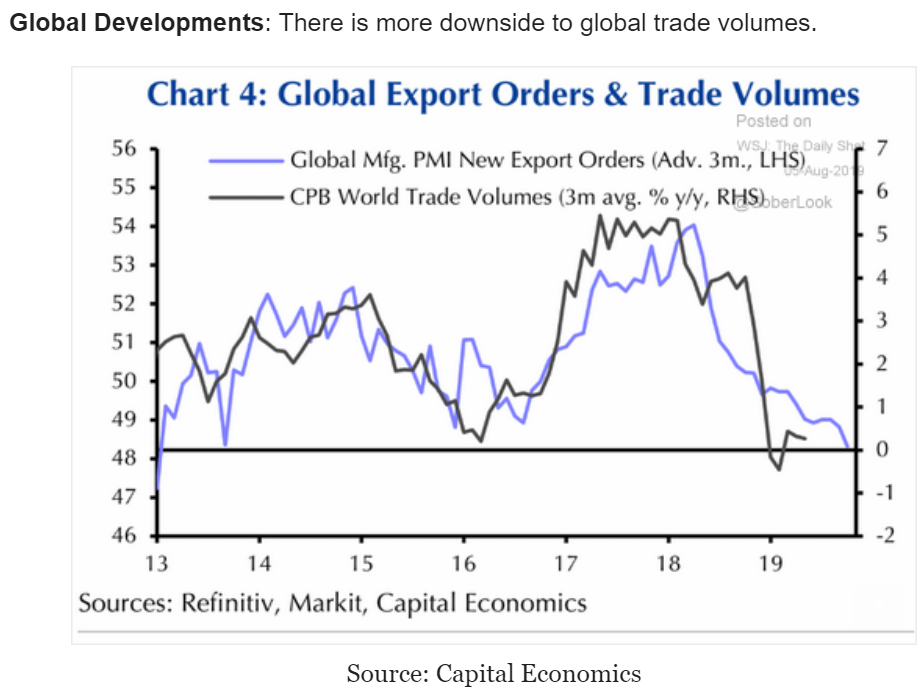

Not looking good:

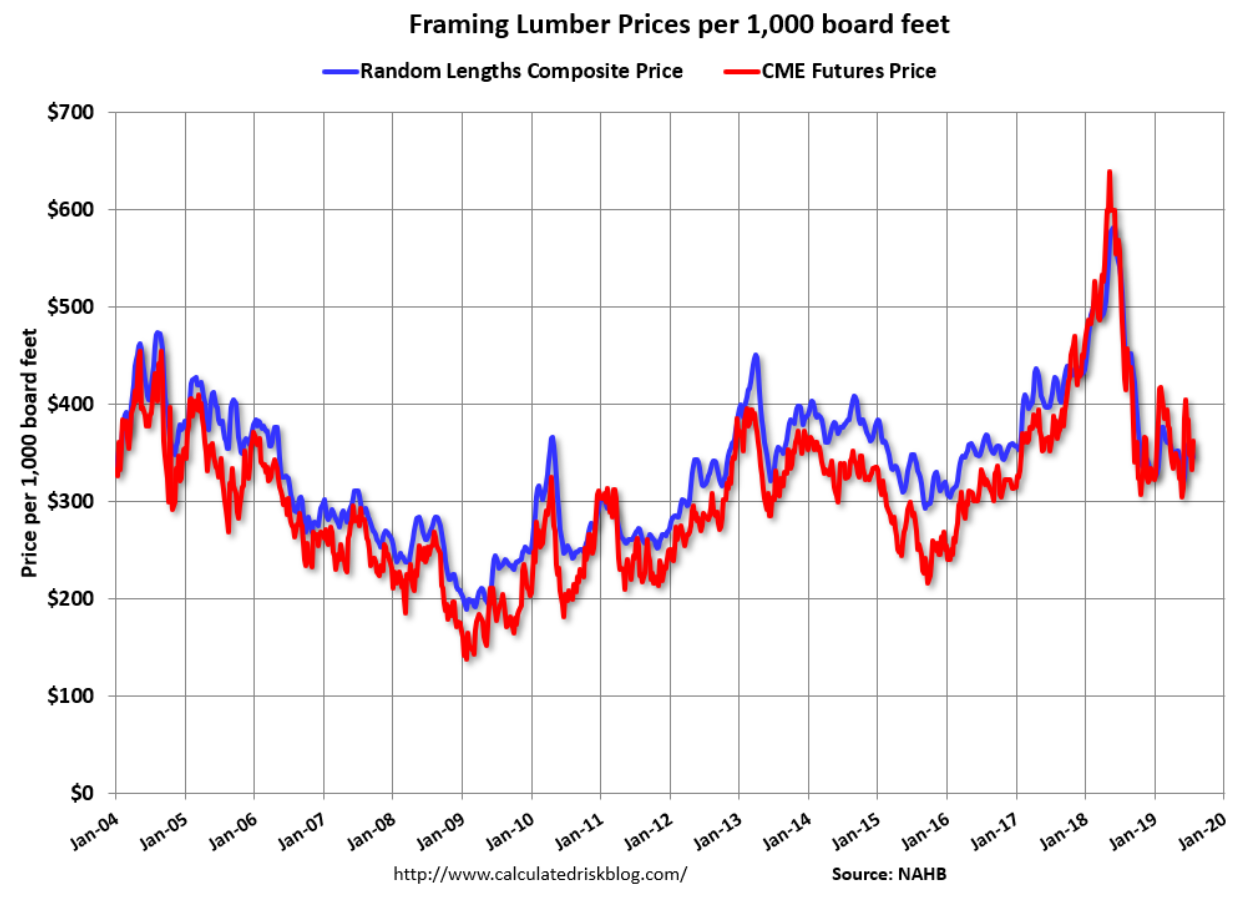

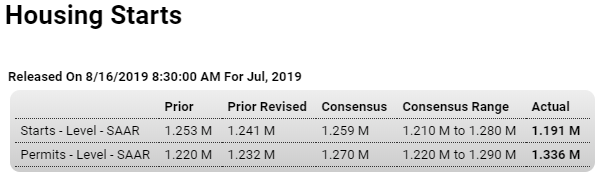

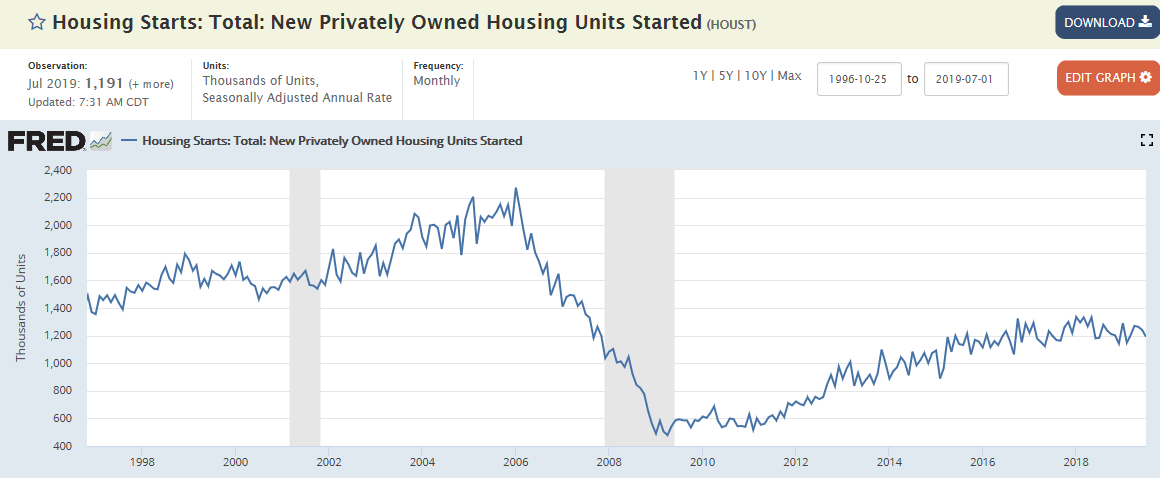

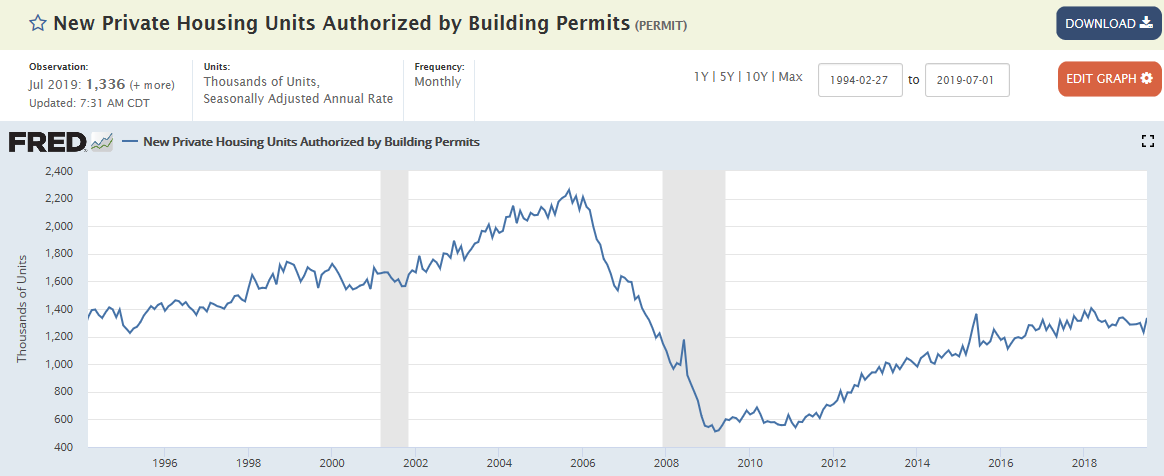

Starts down and rolling over, permits up for the month but still trending lower, as per the charts:

Highlights

A slow turn upward is the indication from a mixed but still positive housing starts and permits report for July, headlined by a much lower-than-expected rate for starts and a much higher-than-expected rate for permits.

Starts, at a total 1.191 million annual rate, were dragged lower by a sharp fall for multi-family homes to a 315,000 annual rate and 2.8 percent contraction from July last year. Yet starts for single-family homes, which are key for the residential component of GDP, actually rose to a 876,000 rate for a 1.9 percent year-on-year gain.

The news on permits, at a total 1.336 million rate, is strong throughout including a jump for multi-family homes to a 498,000 rate for an 11.9 percent yearly gain and a solid rise for single-family homes to a rate of 838,000 which is still down, however, 3.8 percent on the year. Improvement in permits doesn’t point to immediate gains for residential investment but they are a positive for the outlook.

Strong gains for completions cap July’s report, up 7.2 percent on the month to a 1.250 million rate and offering new supply and more choices for buyers and sellers alike. Three-month averages help smooth out the volatility associated with housing data and these have been slowly but clearly curving higher the past several months, at 852,000 for single-family starts versus April’s 2-year low at 829,000. Residential investment has pulled down GDP in each of the last six quarters and though July’s uneven results don’t point yet to relief in the third quarter, they do, along with falling mortgage rates, point to improvement ahead.

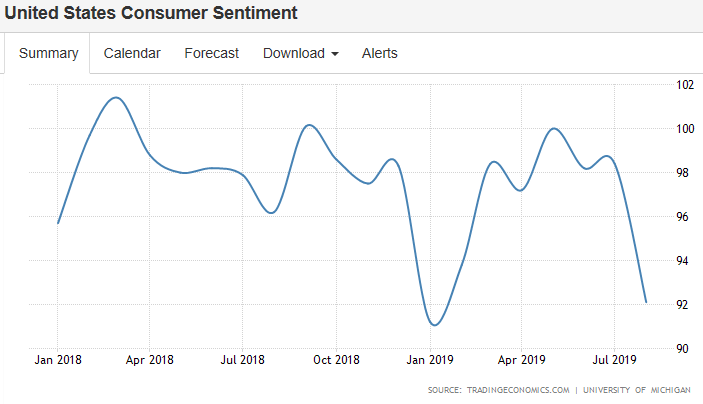

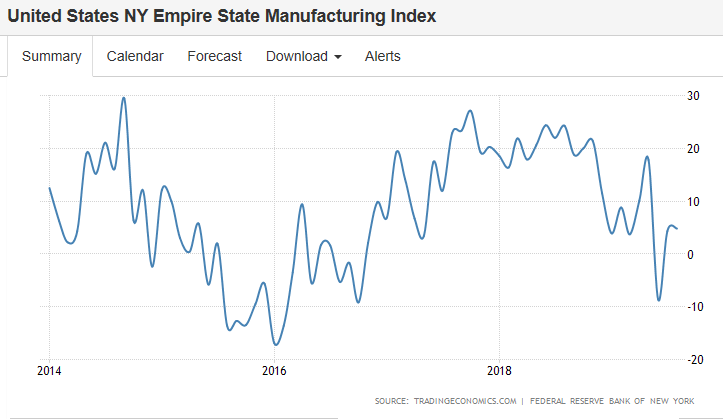

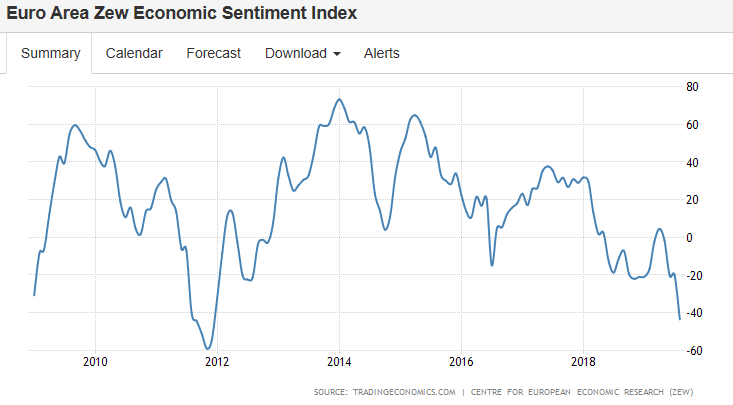

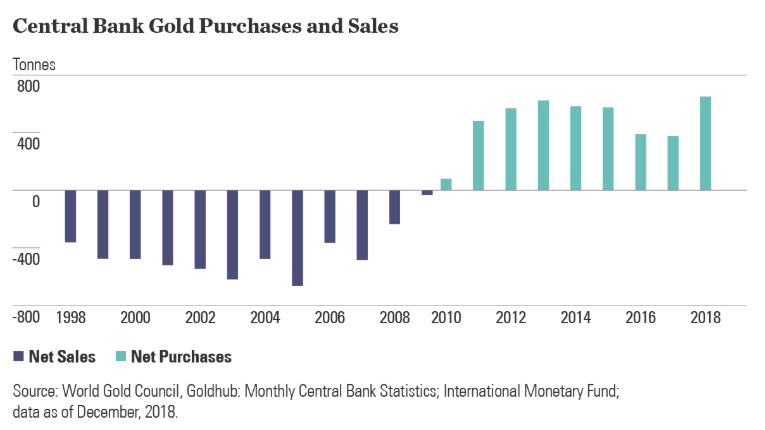

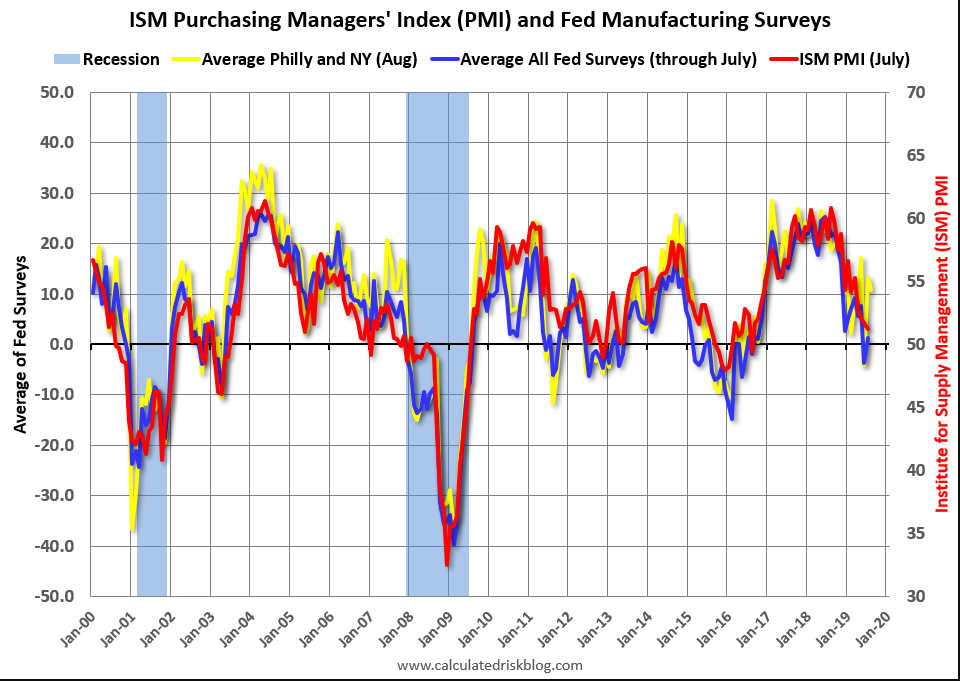

Seems to move with the stock market?

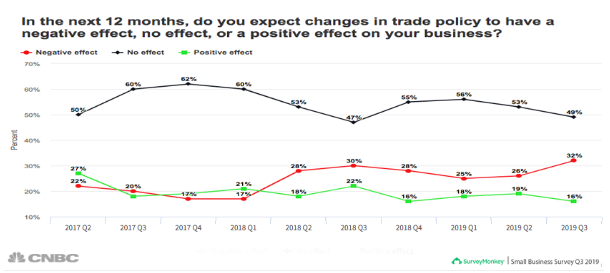

US Consumer Sentiment Drops to 7-Month Low

The University of Michigan’s consumer sentiment for the US fell to 92.1 in August 2019 from 98.4 in the previous month and well below market consensus of 97.2, a preliminary estimate showed. That was the lowest reading since January, as monetary and trade policies have heightened consumer uncertainty about their future financial prospects.