Comments people emailed me and my responses:

Bob Hart wrote:

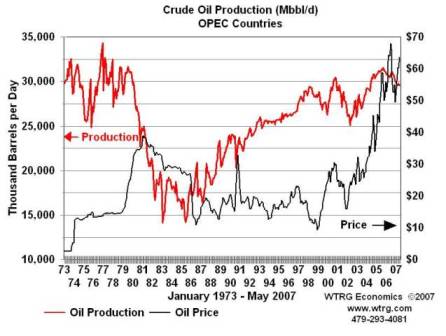

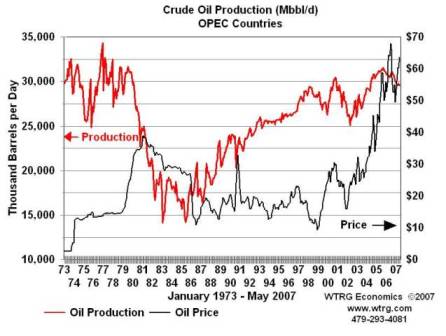

http://www.wtrg.com/prices.htm

This graph supports your statement below:

Prices fell from a high of maybe $40 per barrel to the $10-15 range for the next two decades

Thanks!

“So, there is nothing the US can do to keep core inflation in check? Only the Saudis (and other oil producers) control US inflation?”

In this case, yes. If the Saudis keep hiking cpi goes up and an inflation begins via the various channels that connect energy with other prices. And in this case exacerbated by our pension funds.

Randall Wray wrote:

right: previous high inflations have always been: energy, food, and shelter costs. I haven’t looked at shelter costs this time around.

Haynes wrote:

Great piece. I’ve been thinking along the same lines over the last few weeks. I wish I had been a lot shorter the long end but think that trade still makes sense, especially given future deficits over the next 3-5 years. Having been born in the 1980s and not lived through oil embargos, stock market stagnation and hyper inflation, I am not exactly sure what the play is over the near-term and longer term. If you were to set up a portfolio that couldn’t be changed over the next 3 yrs / 5yrs / 10yrs what do you think the mix should be?

I like AVM’s current mortgage construction: buy FN 5’s versus tailored swap at LIBOR plus 25 basis points with a ‘free’ embedded put. Put it on and sit tight for Fed hikes. Worst case you get LIBOR plus 25.

Call your AVM salesman ASAP before the spread vanishes!!!

Do you buy TIPS / Broad based commodities indices (DJP) / Gold / Stocks / short end / long end?

‘Raw’ TIPS imply a low real rate. If the Fed decides to rais the real rate, you lose.

You could do a 10 year break even bit, especially in Japan, but I like the mortgage trade better.

Think that you could get killed owning bonds but input prices have already run so much its hard to buy commodities in a potentially declining demand environment. Do you buy stocks hoping they simply stay inline with inflation or do you just hold cash?

In the medium- and long-term the S&P will probably more than keep up with inflation, but help to get the right one and to get the right entry point.

Thanks for the help. I know you are busy but any insight would be much appreciated. thanks.

Philip wrote:

I agree entirely with the view that the 1970s was a question of energy prices, a supply-side phenomenon rather than anything else. The implications for policy are important; we might produce a problem where it does not exist if policy is predicated on the wrong interpretation of the problem.