Full size image

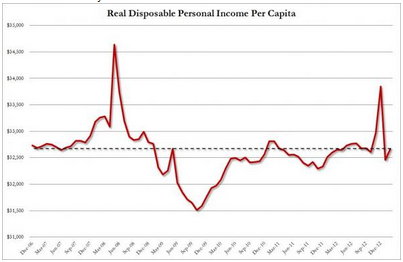

Rolling over from ever lower cyclical levels???

Higher than first reported, but still not looking at all good. Particularly compared to previous cycles.

Congrats!!!

FW from President Gregory Warden:

It is with great pleasure and tremendous pride that I am able to announce that the Swiss University Conference [SUK/CUS], the governing body for higher education in Switzerland, has granted Franklin College Switzerland full university institution accreditation, stating in its recent notification:

We are pleased to inform you of the positive decision made by the SUK [CUS] on April 18, 2013 regarding the accreditation of Franklin College Switzerland as a university institution.

The notice of accreditation went on to state:

The expert team is convinced that Franklin College Switzerland has gone through a major development since the last accreditation. This is largely the result of the realization of the recommendations by the 2005 OAQ expert team. Franklin College Switzerland now is better integrated within the Swiss landscape, as well as being connected within Europe. According to the expert team, it has above all strengthened its research activities. The qualifications and in particular the research activities of the faculty have significantly increased since the last accreditation.

In 2005 the Swiss University Conference granted Swiss university accreditation to all major programs of study leading to the Franklin College Bachelor of Arts degreemaking Franklin the first and only university to receive such recognition. With our new institutional accreditation, it is with even greater pride that Franklin is now the first and only university to have institutional university accreditation in both the United States and Switzerlanda distinction that will serve Franklin and its past and future graduates well.

In the Swiss Center of Accreditation and Quality Assurance in Higher Educations expert team recommendation to the Swiss University Conference they stated that Franklin College fulfills all accreditation standards, making the following statement and recommendation:

Franklin College is an American and private institution of higher education in Europe, and thus it represents a kind of hybrid organization. It has introduced new educational principles into the European setting, it is very international by its course offerings and by its student body, and in its teaching it puts heavy emphasis on the general skills and human values, that are especially appropriate for the 21st century world. Its programs are well linked to meet the current challenges in higher education, also on a global scale. Its teaching methods are innovative and appropriate. The students also have a strong feeling of belonging to the Franklin community. The network of its alumni appears to be very active, spread all over the world. The Franklin graduates appear to be well placed especially in international companies. Its strategic goals appear very appropriate to meet the needs and challenges higher education at large is currently facing at least in Europe, but also globally. The experts group recommends accreditation of Franklin College Switzerland, without conditions.

Everyone associated with Franklin should be very proud of all that has been achieved since it was founded in 1969. This recognition is an affirmation of the quality of the institution as a whole and the hard work and contributions of so many peoplefaculty, staff, students, alumni, parents and trustees. Franklin would not be the special place it is today if it were not for each and everyones efforts on its behalf.

Thank you and best regards,

P. Gregory Warden

President

Tim Cook says ‘no’ to iPhone with larger screen, says there are too many trade-offs

And no touch screen laptops or desktops.

:(

The Mosler MT900 has been out for 13 years now and is still winning races against current year Astons, Ferraris, Porsches, etc.

And still handicapped with ballast and restrictors most places!

Spanish Pair Conquer Saturated Donington

By Michael Passingham

Karim writes:

More upside surprises for Q1 consumer spending-now tracking 3.25-3.5%

March Car/LT Sales – 15.2 Million Units FINAL

Stone & McCarthy (Princeton)

Key “Take Aways”:

March Domestic Light Vehicle sales were stronger than last month at 12.00M

Total vehicle sales posted a slightly slower pace compared to Feb: 15.2M

Car sales were weaker than expected, but light truck sales picked up the slack

Q1 PCE looking strong: around 3.3-3.5% with Q1 GDP approx. 3%

So I see this:

More Signs of Sturdy Growth: Consumer Spending Rises

March 29 (Reuters) — U.S. consumer spending rose in February and income rebounded, further signs economic activity accelerated in the first quarter, even though part of the increase in consumption reflected higher gasoline prices.

The Commerce Department said on Friday consumer spending increased 0.7 percent last month after an upwardly revised 0.4 percent rise in January. Spending had previously been estimated to have increased 0.2 percent in January.

Economists polled by Reuters had expected spending, which accounts for about 70 percent of U.S. economic activity, to increase 0.6 percent last month.

After adjusting for inflation, spending was up 0.3 percent after advancing by the same margin in January.

While Americans paid 35 cents more for gasoline last month, they also bought long-lasting goods such as automobiles and spent more on services, thanks to a bounce-back in income growth.

Income increased a healthy 1.1 percent after tumbling 3.7 percent in January.

“Both numbers are consistent with a continued recovery of the U.S. economy,” said Kathy Lien, managing director at BK Asset Management in New York.

A sustained pace of steady job gains is starting to boost wages, which should help to provide some cushion for households from higher taxes and support economic growth.

Personal income in December was sharply higher because of a rush to pay dividends and bonuses before tax hikes took effect this year. That also skewed data for January.

A 2 percent payroll tax cut expired on Jan. 1 and tax rates for wealthy Americans also went up. Data ranging from employment to factory activity has so far shown little sign the tighter fiscal policy has been a major drag on the economy.

First-quarter GDP growth estimates currently range as high as a 3.2 percent annual rate. The economy grew at only a 0.4 percent pace in the fourth quarter.

INFLATION GENERALLY MUTED

Last month, the income at the disposal of households after inflation and taxes increased 0.7 percent in February after dropping 4.0 percent in January.

With income growth outpacing spending, the saving rate – the percentage of disposable income households are socking away – rose to 2.6 percent from 2.2 percent in January.

The higher gasoline prices pushed up inflation, with a price index for consumer spending rising 0.4 percent after being flat for two straight months. February’s increase in the PCE index was the largest since August.

But a core reading that strips out food and energy costs rose only 0.1 percent after increasing 0.2 percent in January, showing no sign of underlying inflation pressures.

Over the past 12 months, inflation has risen 1.3 percent after rising by the same margin in the period through January.

Core prices were up 1.3 percent, well below the Federal Reserve’s 2 percent target. They also had risen 1.3 percent in the 12 months through January.

The benign inflation picture should give the U.S. central bank room to continue with its monetary stimulus as it seeks to boost job growth.

The Fed said last week it would maintain its monthly $85 billion purchases of mortgage and Treasury bonds until it saw a substantial improvement in the job market.

Then this: