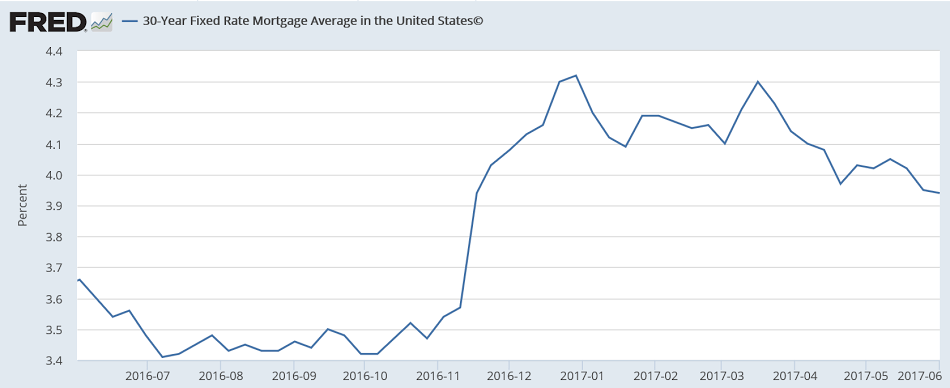

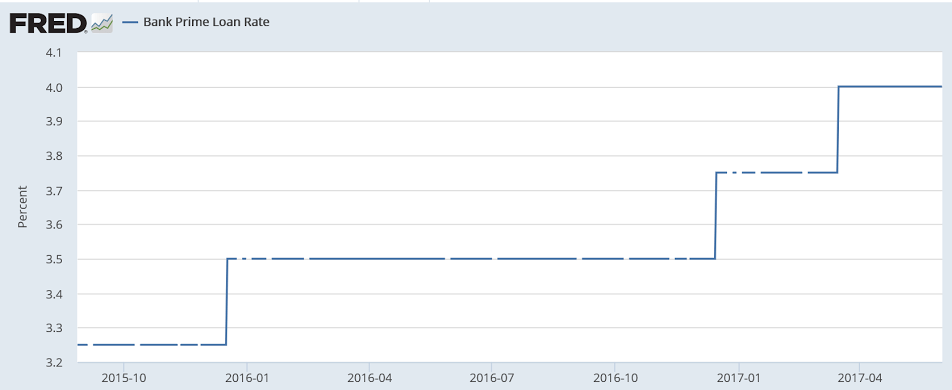

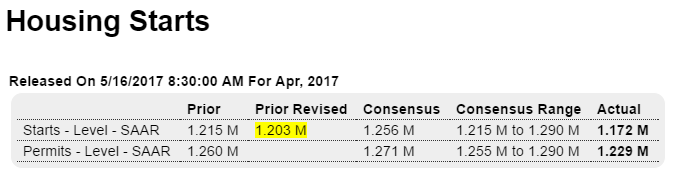

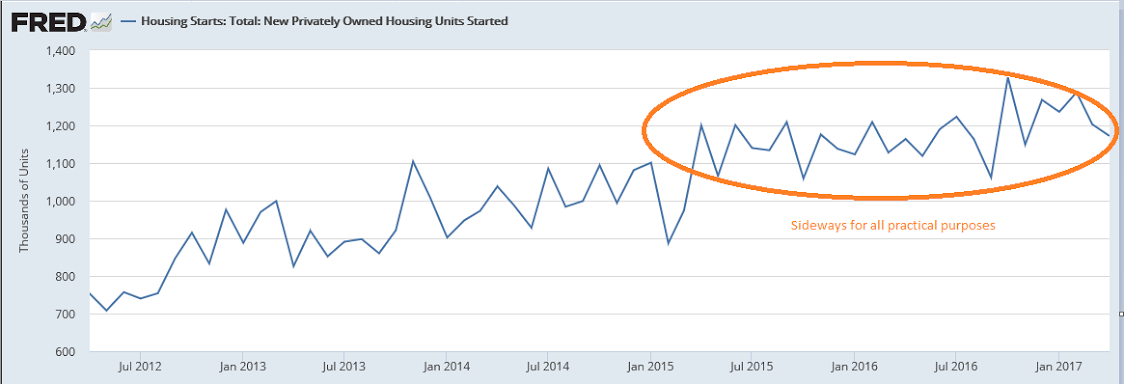

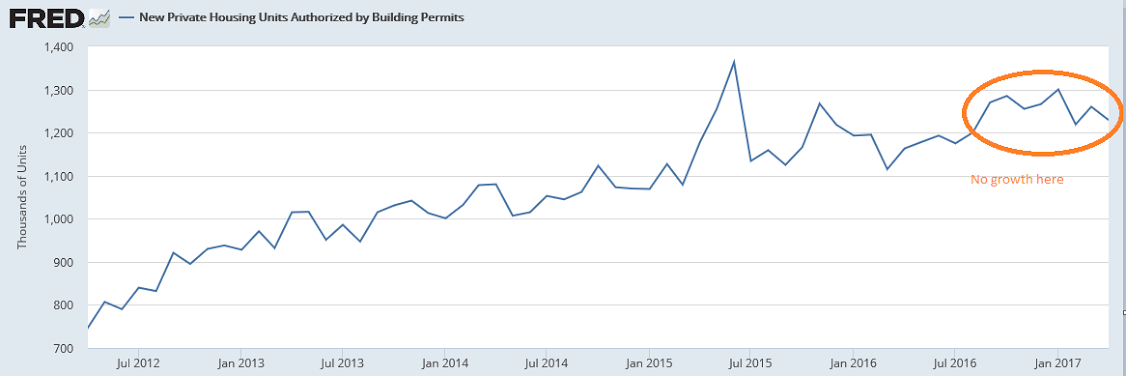

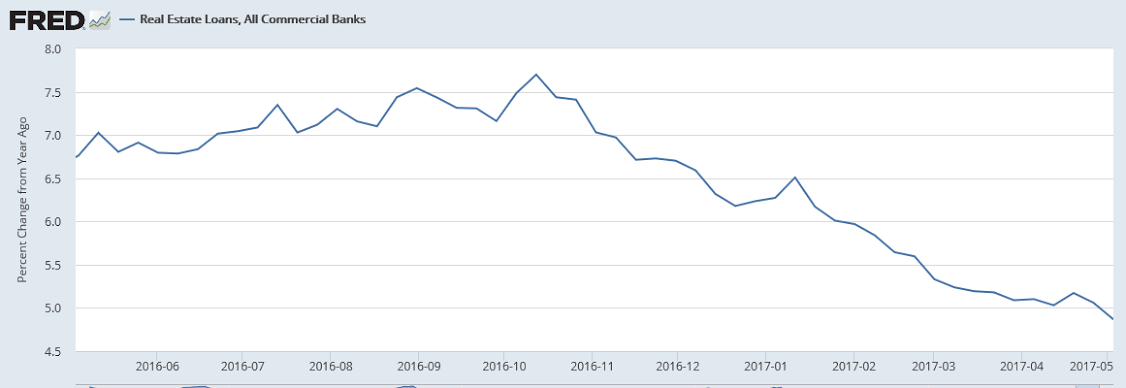

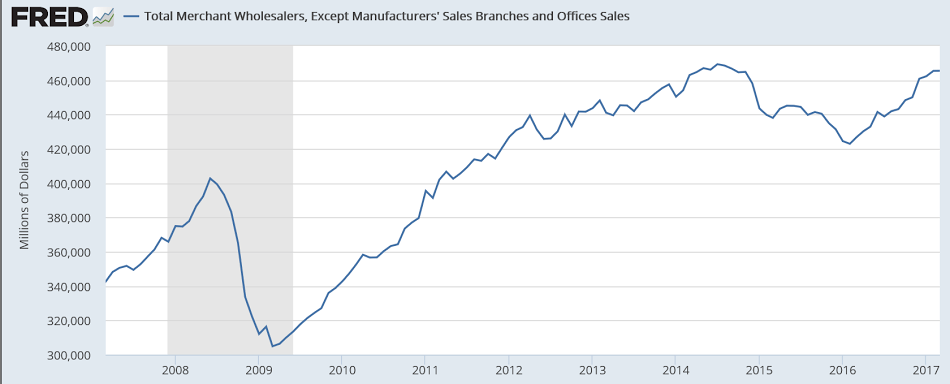

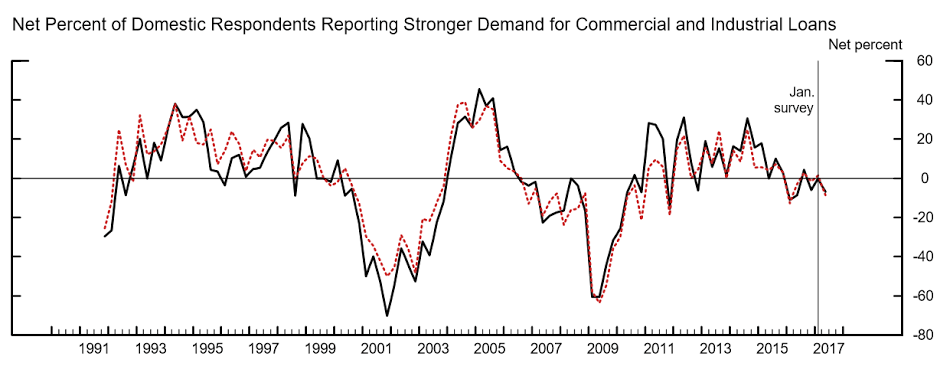

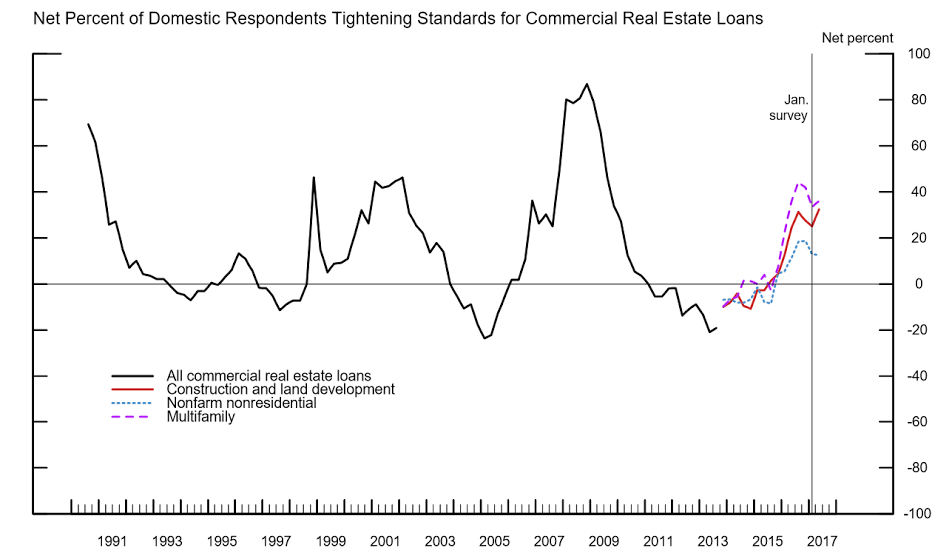

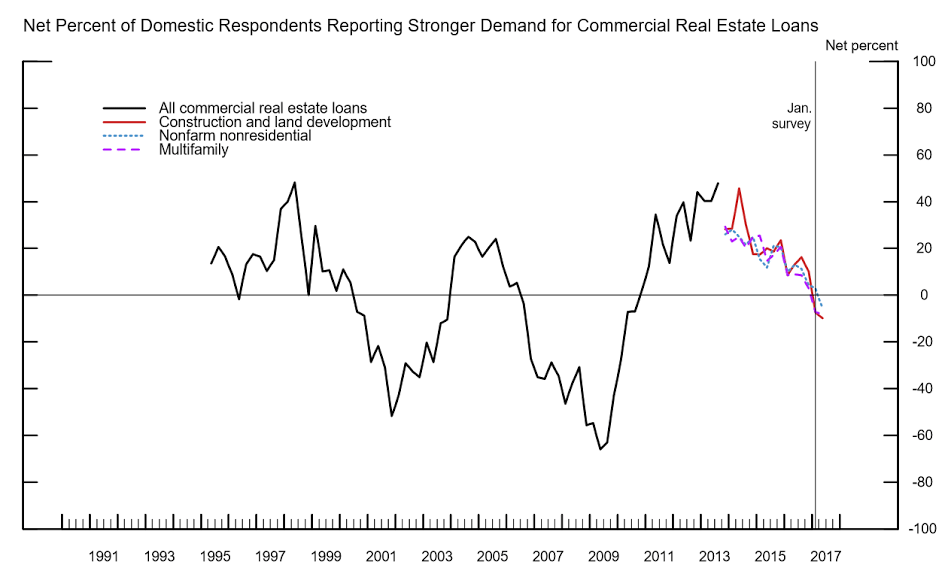

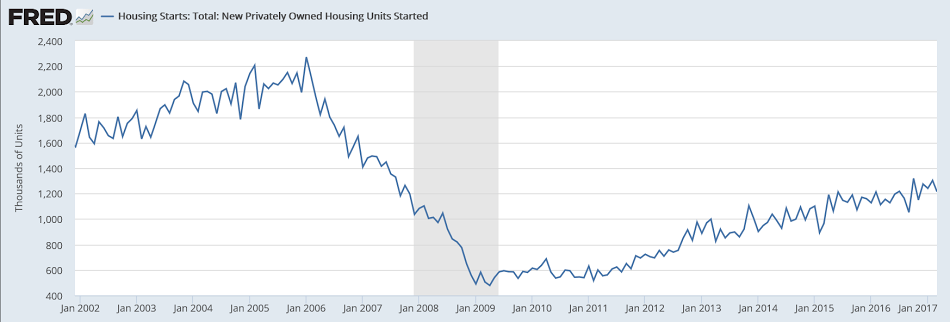

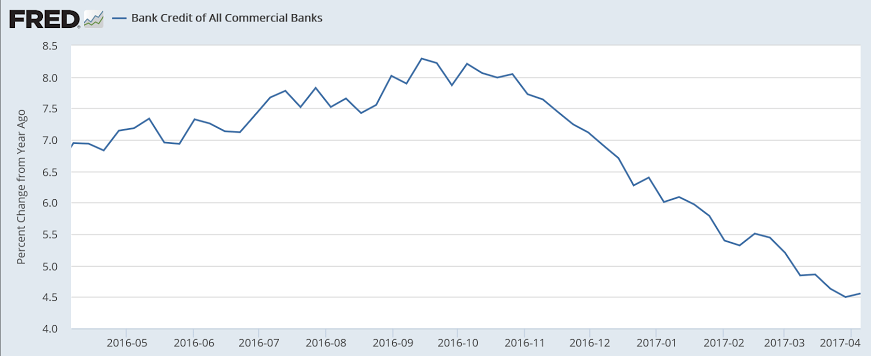

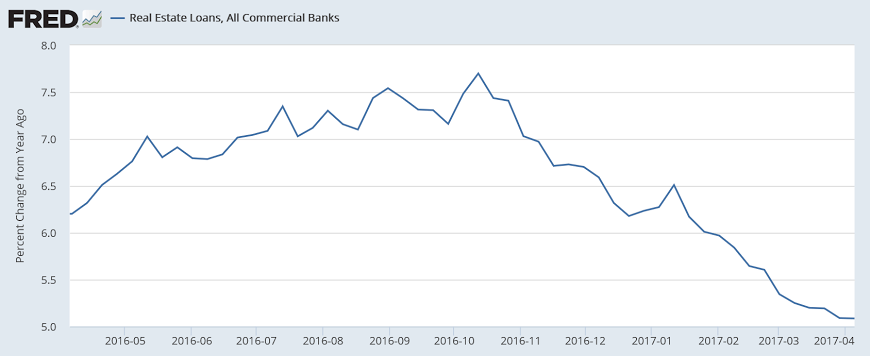

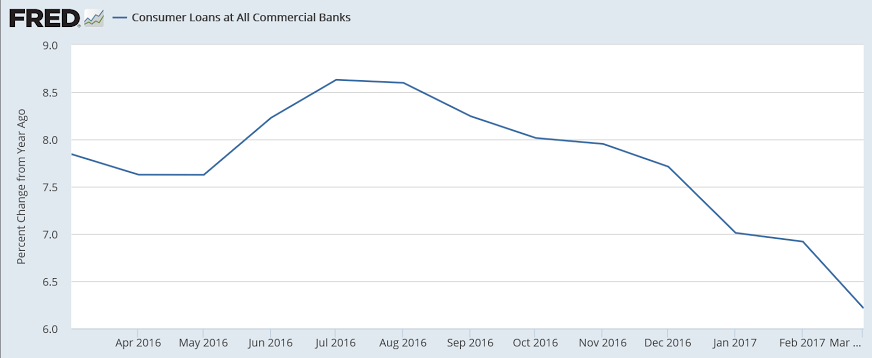

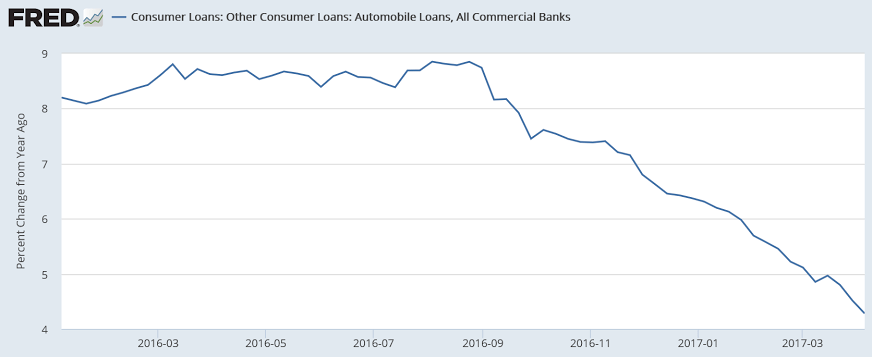

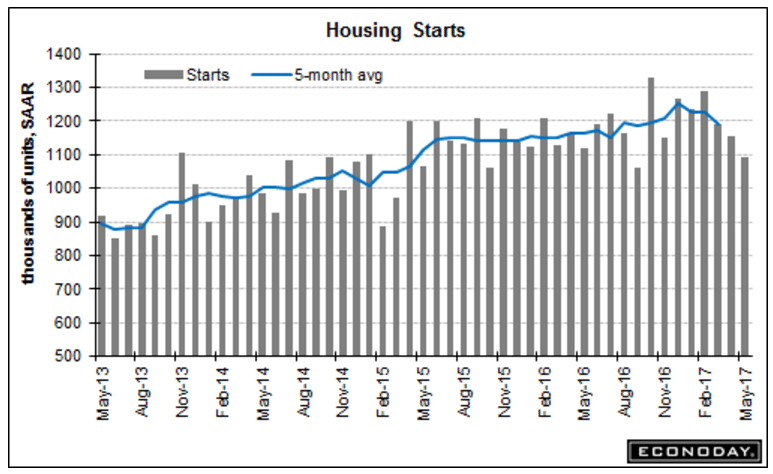

Down and prior month revised down and permits way down as well. All in line with the previously discussed deceleration in bank real estate lending that began just after the elections in November:

Highlights

The bad economic news keeps building, this time in the housing sector. Housing starts fell an unexpected 5.5 percent in May to a far lower-than-expected annualized rate of 1.092 million with permits likewise very weak, down 4.9 percent to a 1.168 million rate.

All components show declines with single-family starts down 3.9 percent to a 794,000 rate and permits down 1.9 percent to 779,000. Multi-family starts fell 9.7 percent to 298,000 with permits down 10.4 percent to 389,000. Total completions did rise 5.6 percent to a 1.164 million rate, which adds supply to a thin market, but homes under construction slipped 0.7 percent to 1.067 million.

Adding to the bad news are downward revisions to starts including April which is now at 1.156 vs an initial 1.172 million. Looking at the quarter-to-quarter comparison, starts have averaged 1.124 million so far in the second quarter, down a very sizable 9.2 percent from 1.238 million in the second quarter. Permits, at an average of 1.198 million, are down 4.9 percent.

Residential investment looks to be yet another negative for second-quarter GDP.

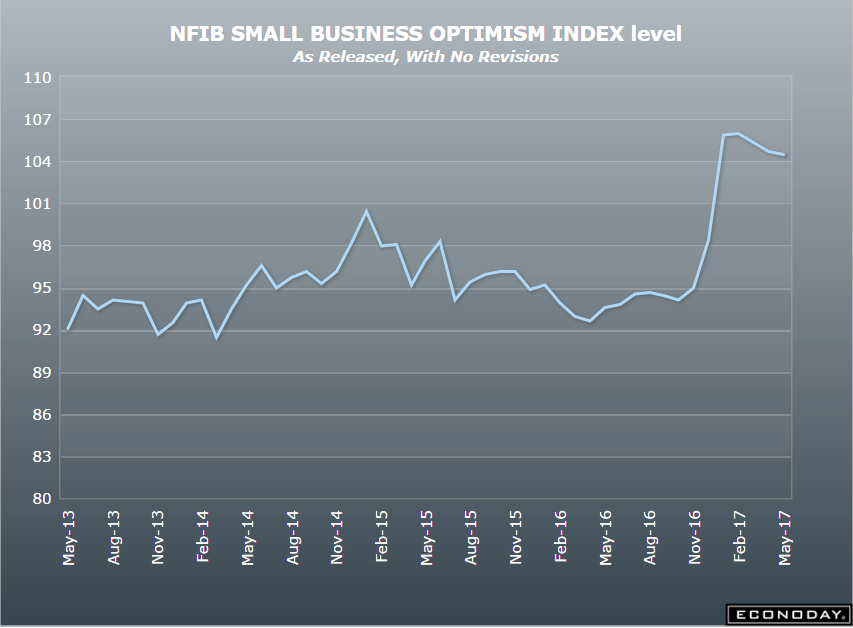

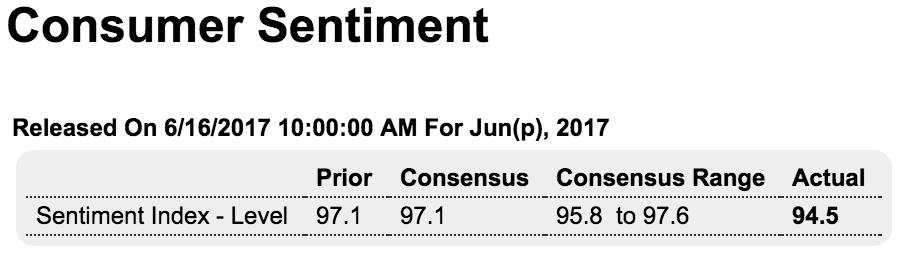

Trumped up expectations continue to unwind:

Highlights

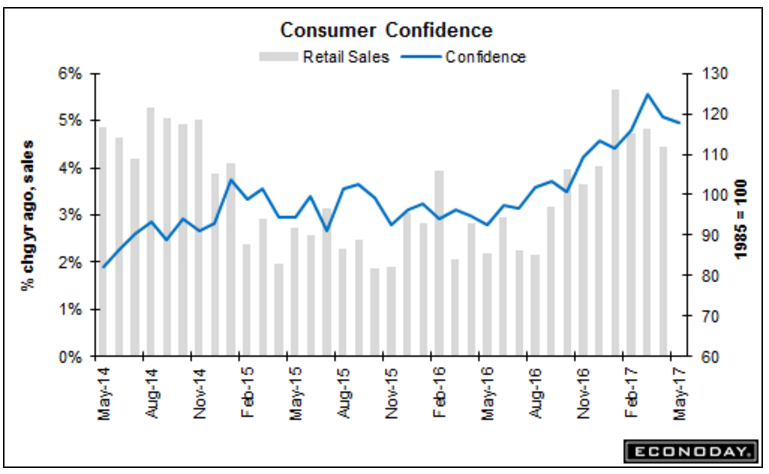

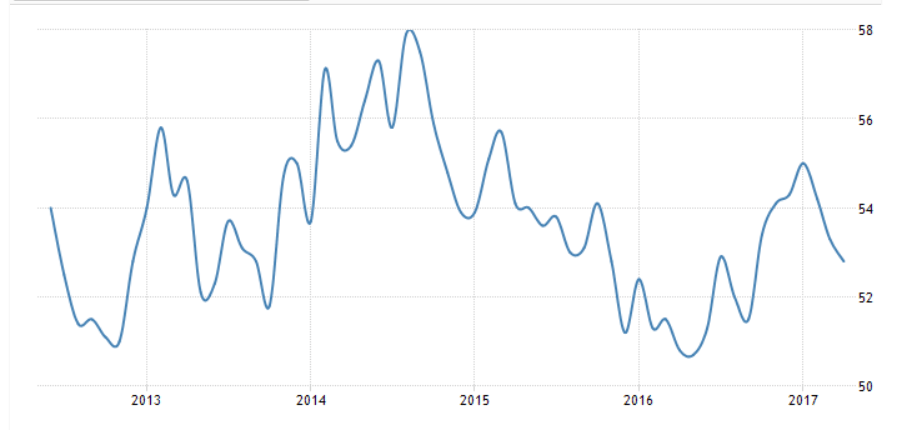

In the least optimistic reading since the November election, the preliminary June consumer sentiment index fell to a much lower-than-expected 94.5. This compares with 97.1 for May and 97.7 for preliminary May.

Both components are down with expectations at 84.7 for a 3 point decline from May which points to less confidence in the jobs outlook. The current conditions index is at 109.6 for a 2.1 point decline which is a negative indication for consumer spending in June.

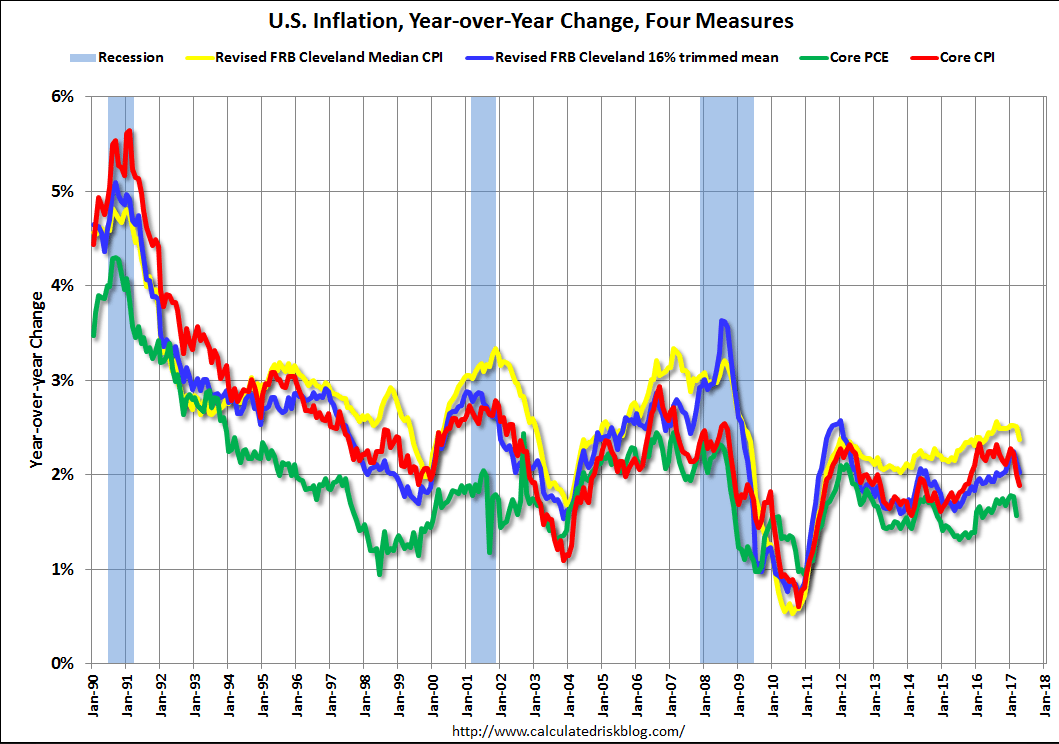

The report notes that this month’s decline reflects easing confidence among both Republicans and Democrats. Inflation expectations are mixed with the 1-year outlook unchanged at 2.6 percent but with the 5-year up 2 tenths and also at 2.6 percent.

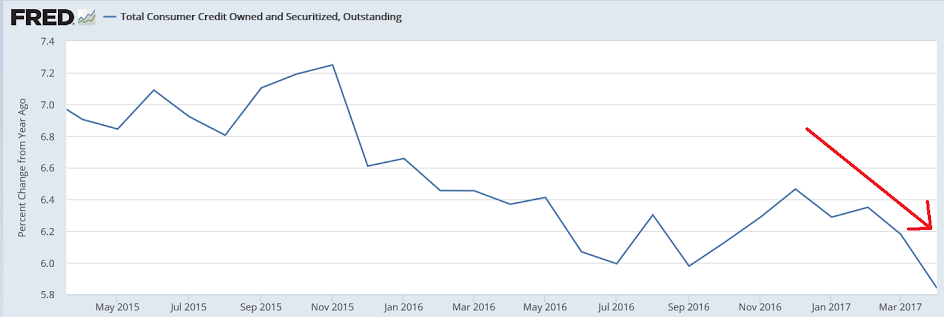

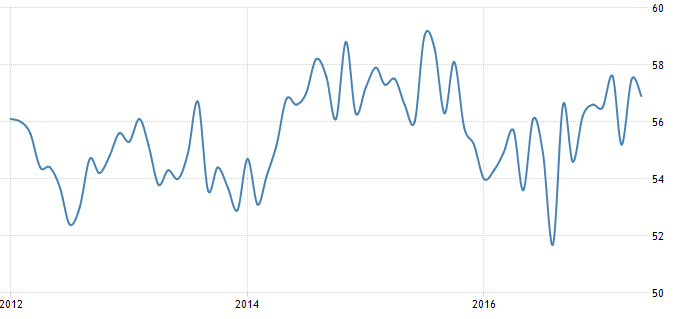

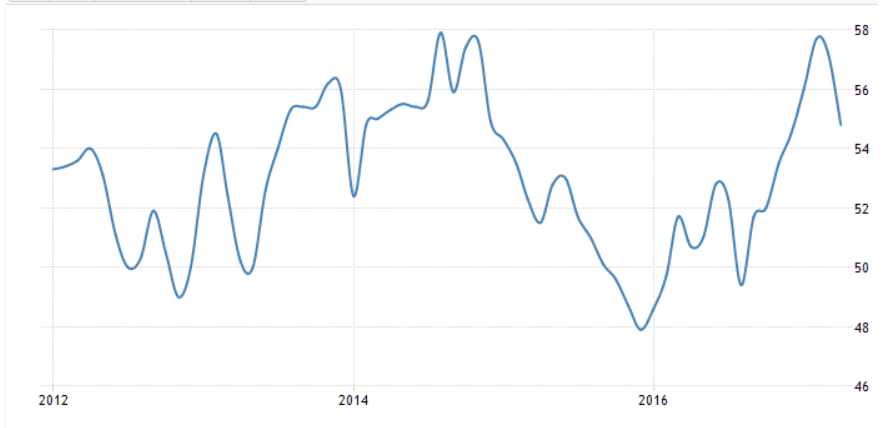

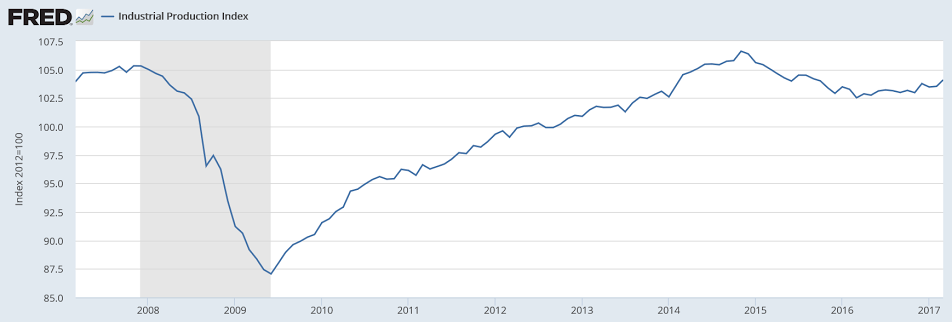

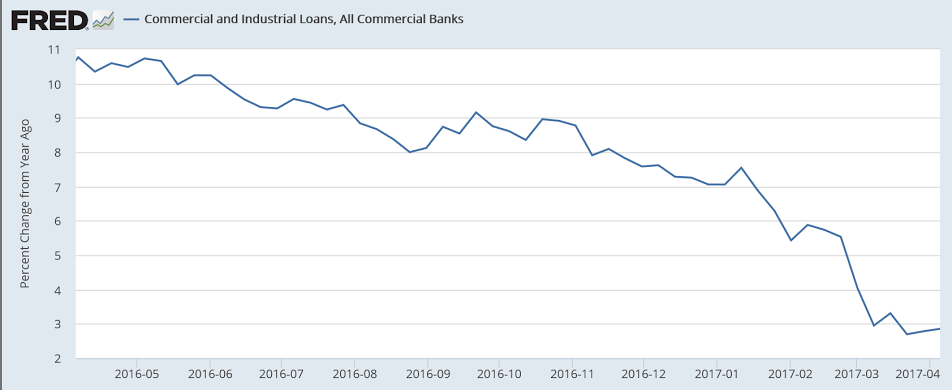

Life in the Slow Lane: U.S. Bank Lending Falls Behind a Laggard

By Mike Bird

June 15 (WSJ) — After six years of meager growth, eurozone bank lending to nonfinancial corporations increased by an annual 2.4% in May, its fastest pace since mid-2009. The deceleration in U.S. commercial and industrial loan growth has been steep. Annual growth has fallen from over 10% a year ago to just 2% in June, according to the latest figures published by the Federal Reserve. Europe’s has accelerated from 1.8% in the same period. The last time corporate credit growth was faster in the eurozone than the U.S. was in early 2011, when the full debilitating effect of the sovereign-debt crisis was yet to feed through to local data.