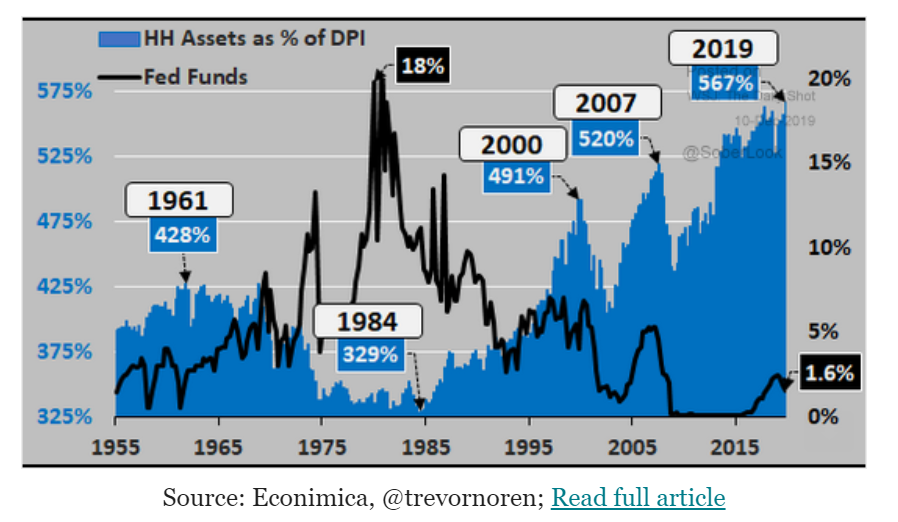

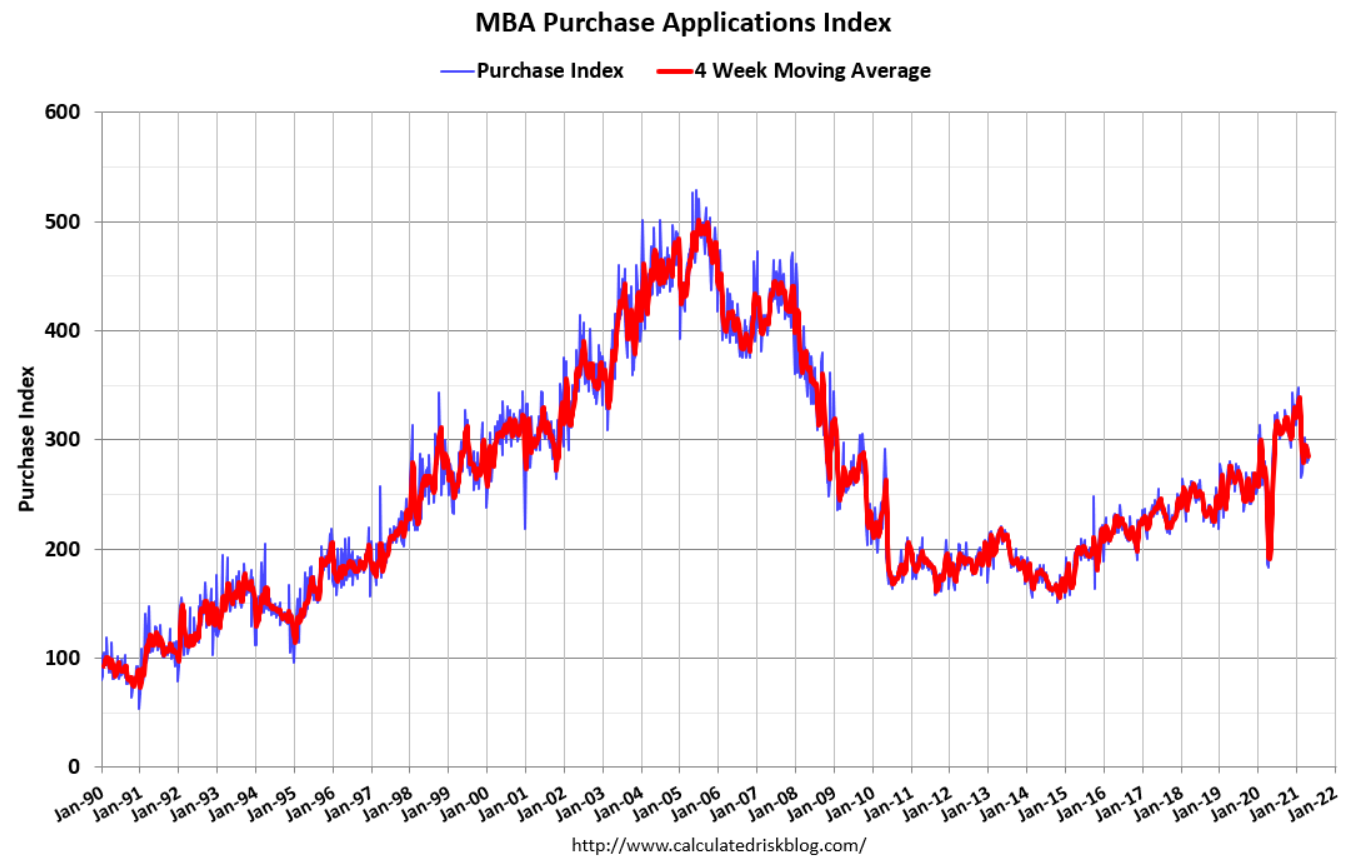

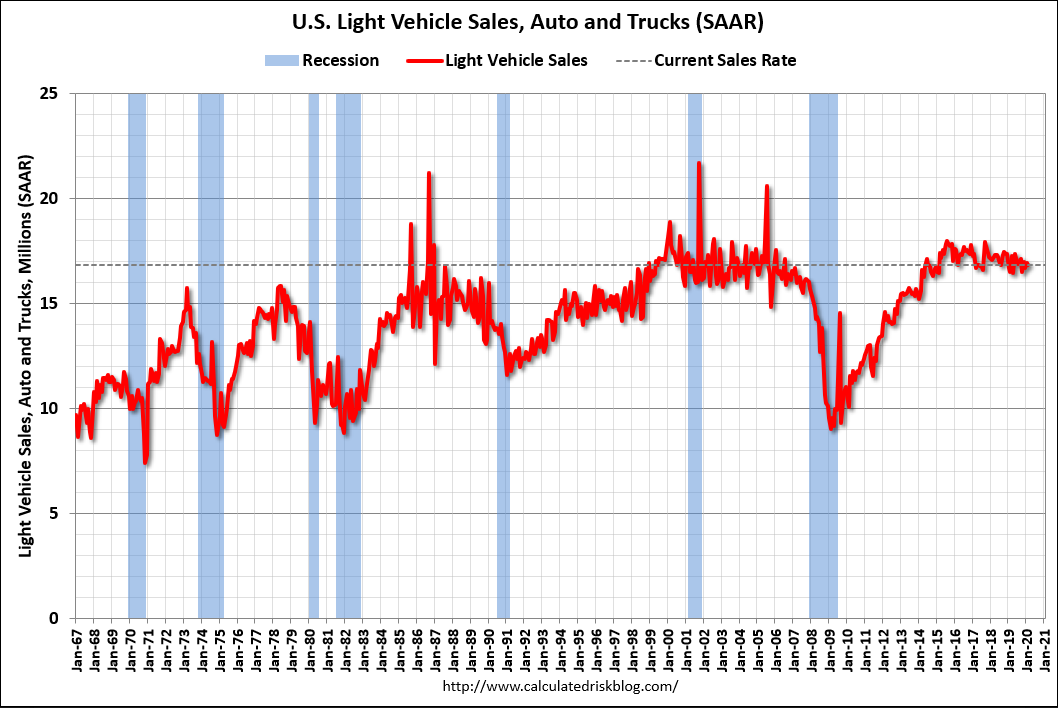

Doesn’t look like much of a housing boom here:

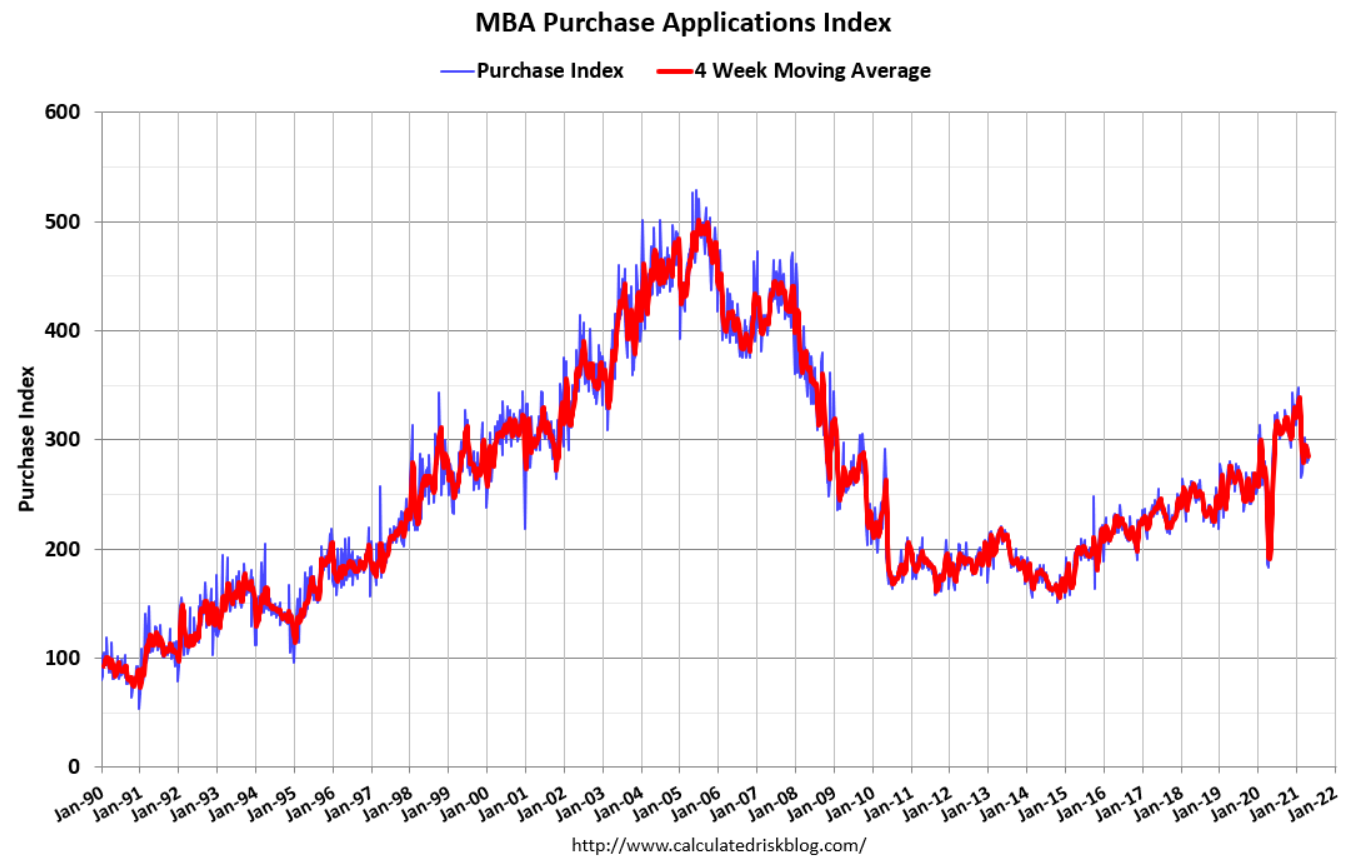

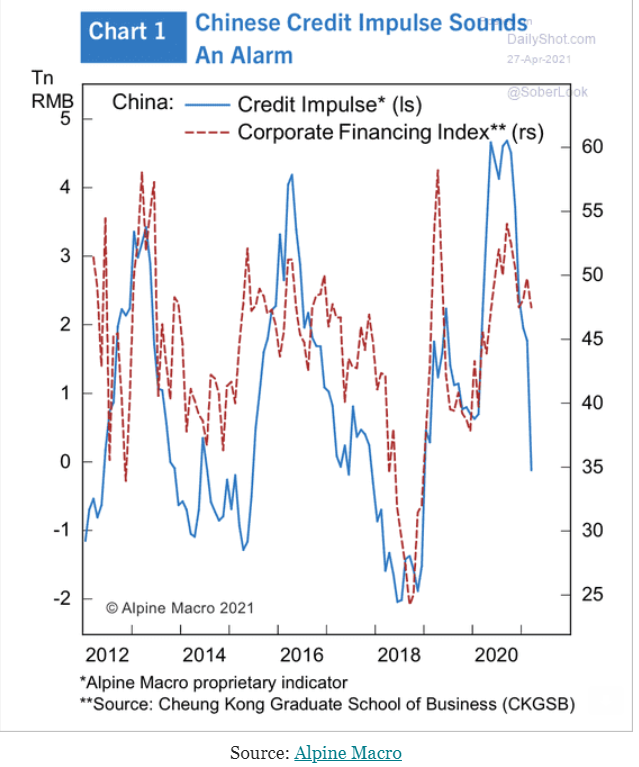

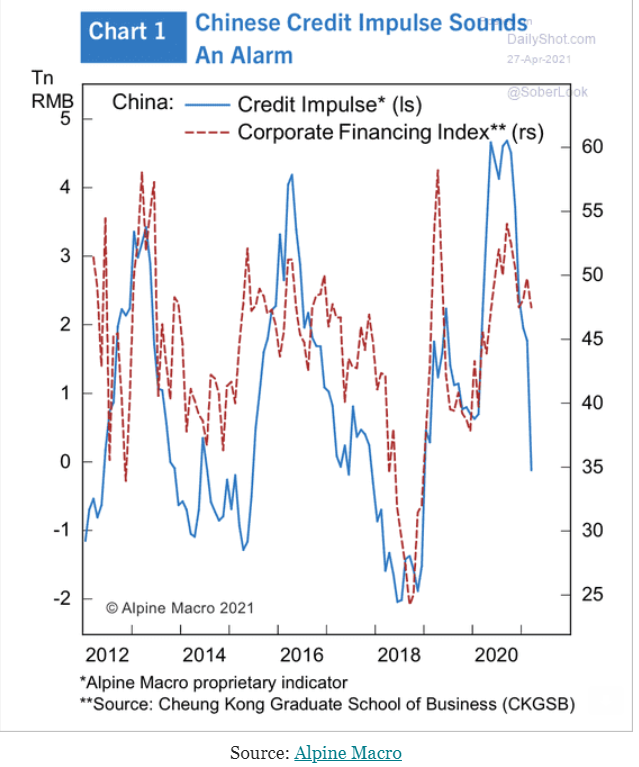

China had been expanding:

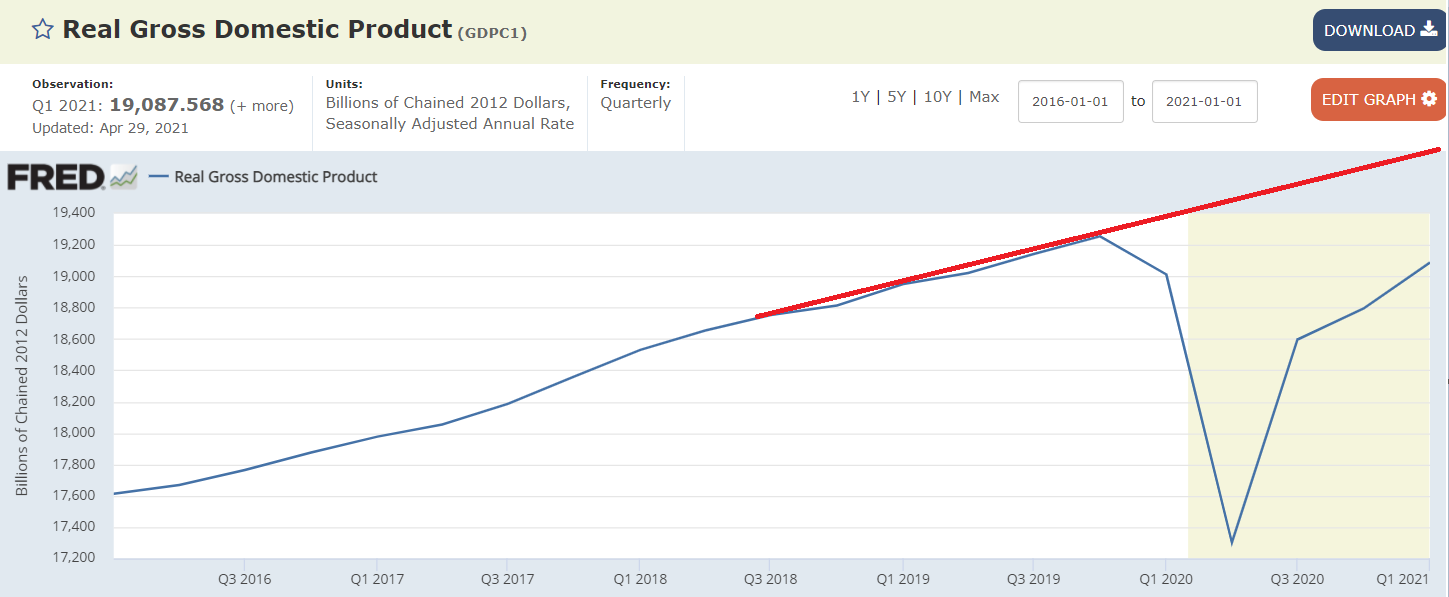

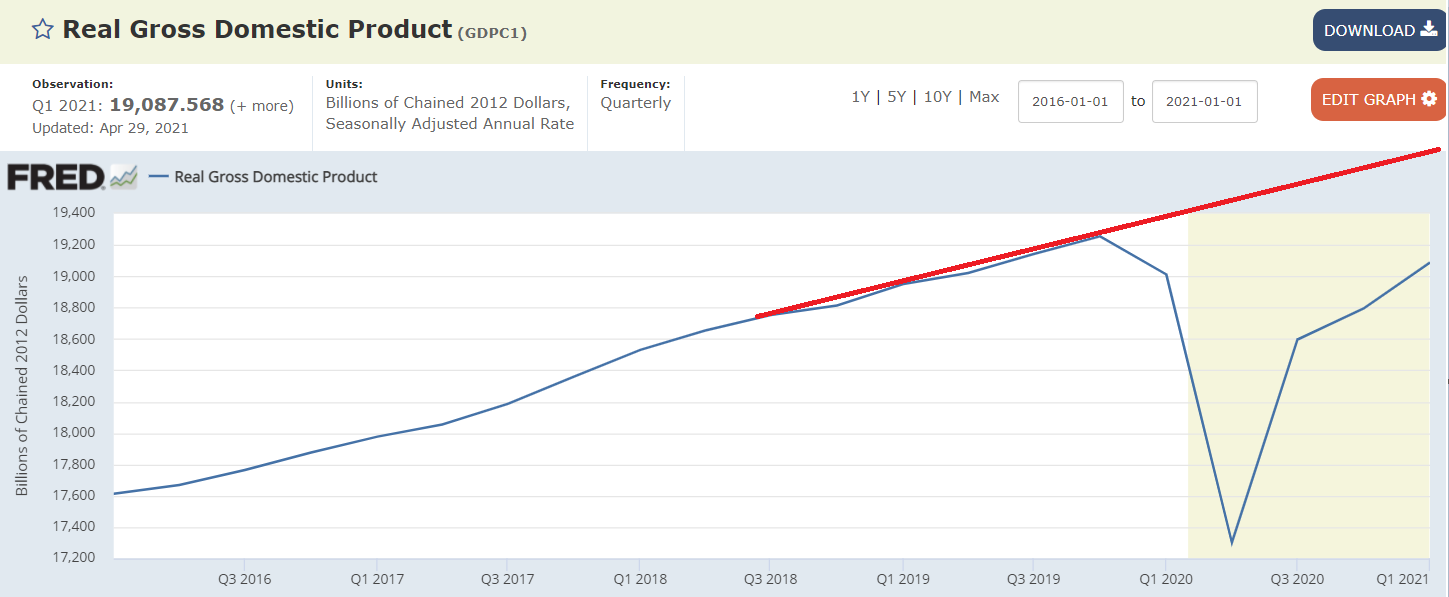

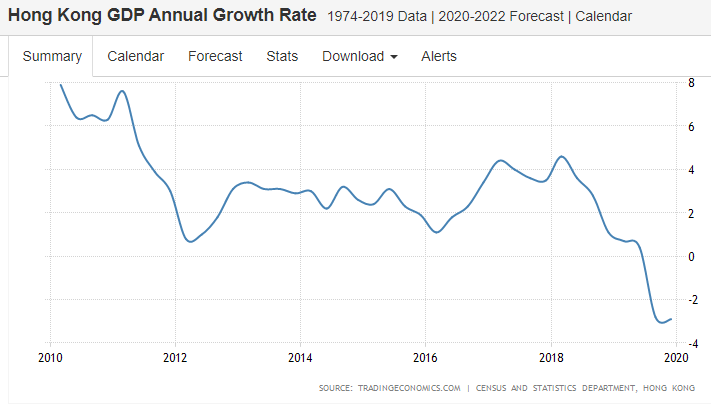

GDP is rising but still has a long way to go:

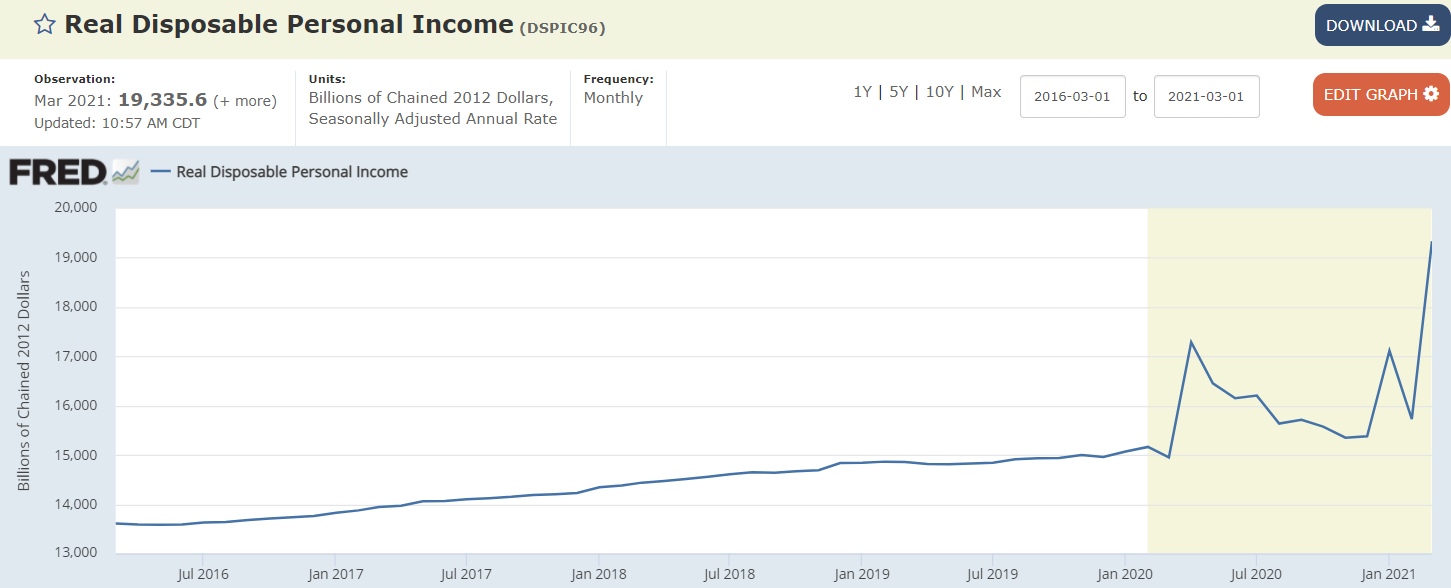

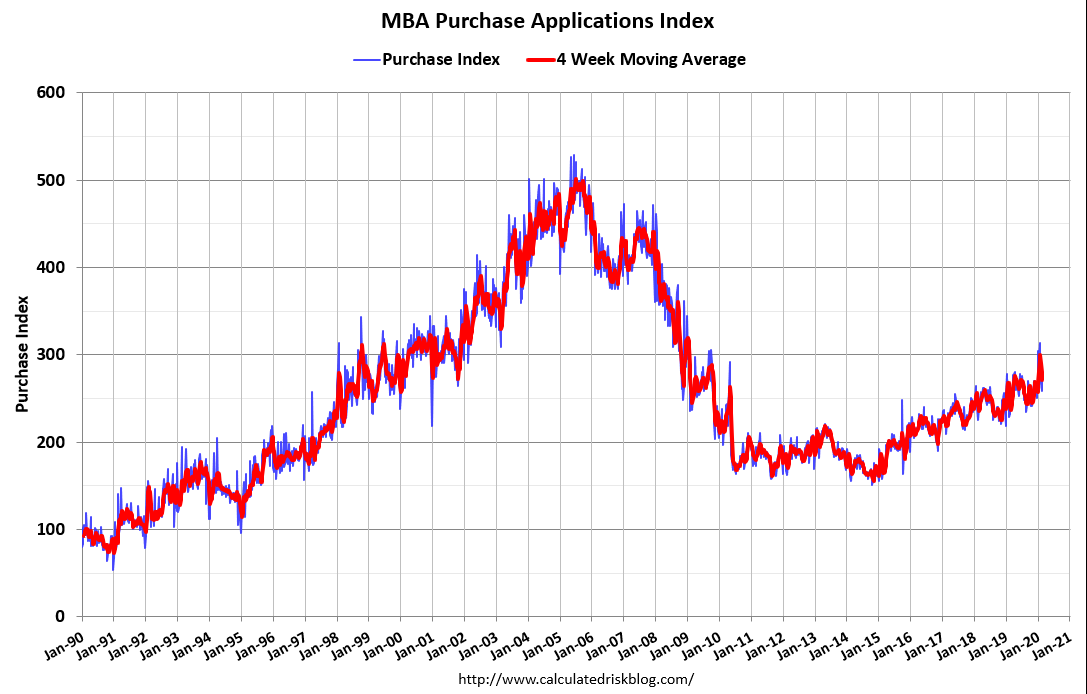

Doesn’t look like much of a housing boom here:

China had been expanding:

GDP is rising but still has a long way to go:

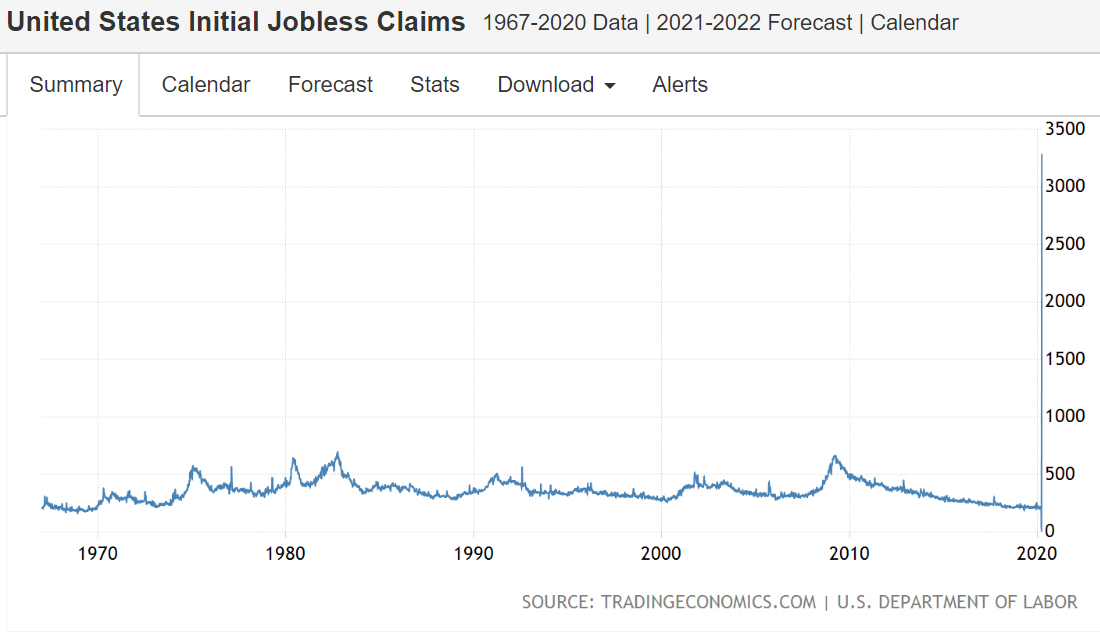

Big spike up:

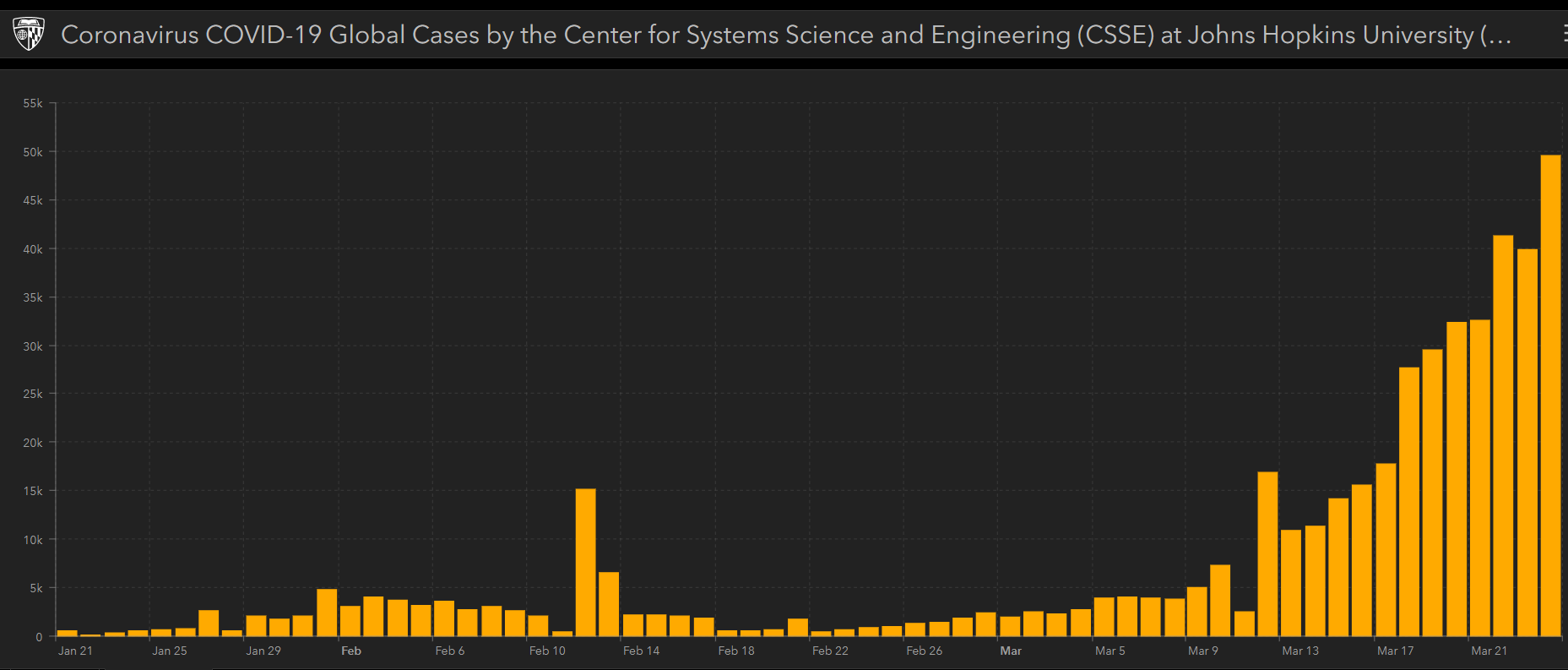

New daily global confirmed cases growing:

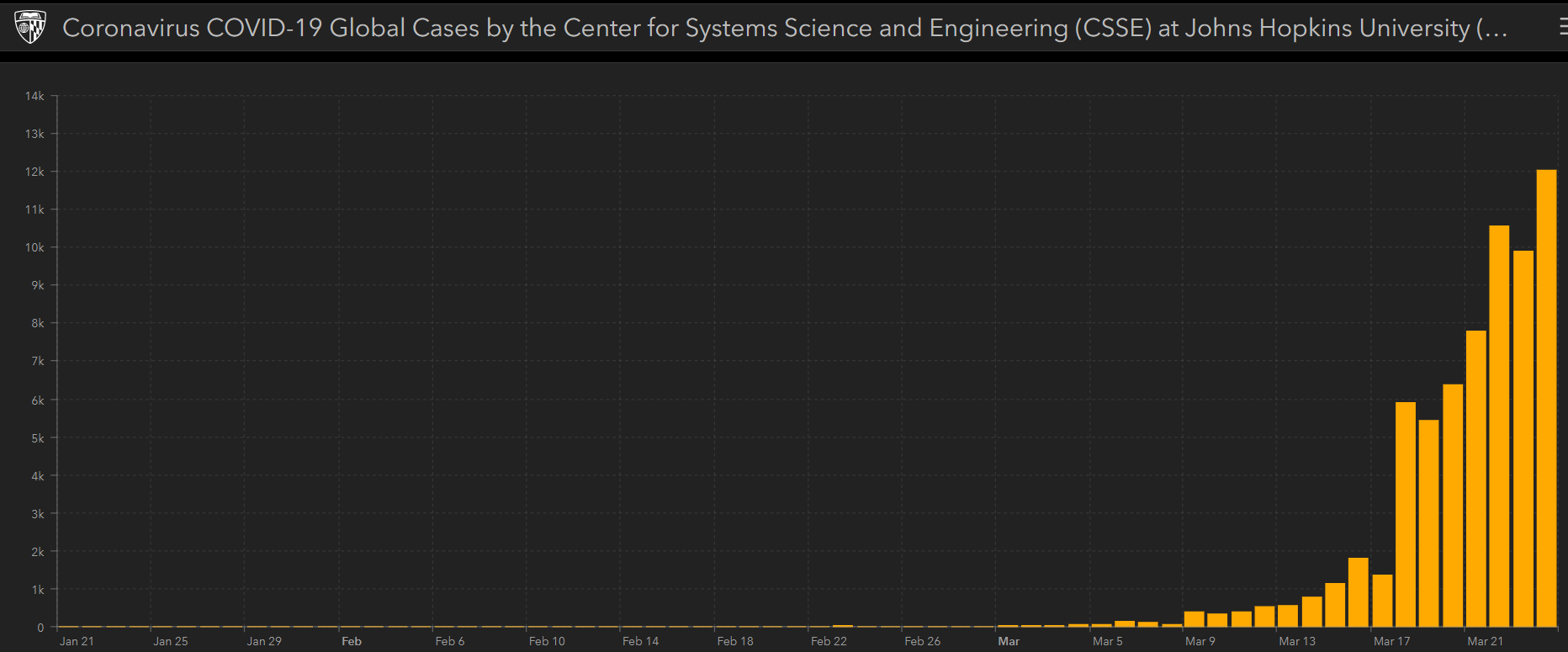

US cases growing rapidly and soon to surpass Italy and China to take the lead globally:

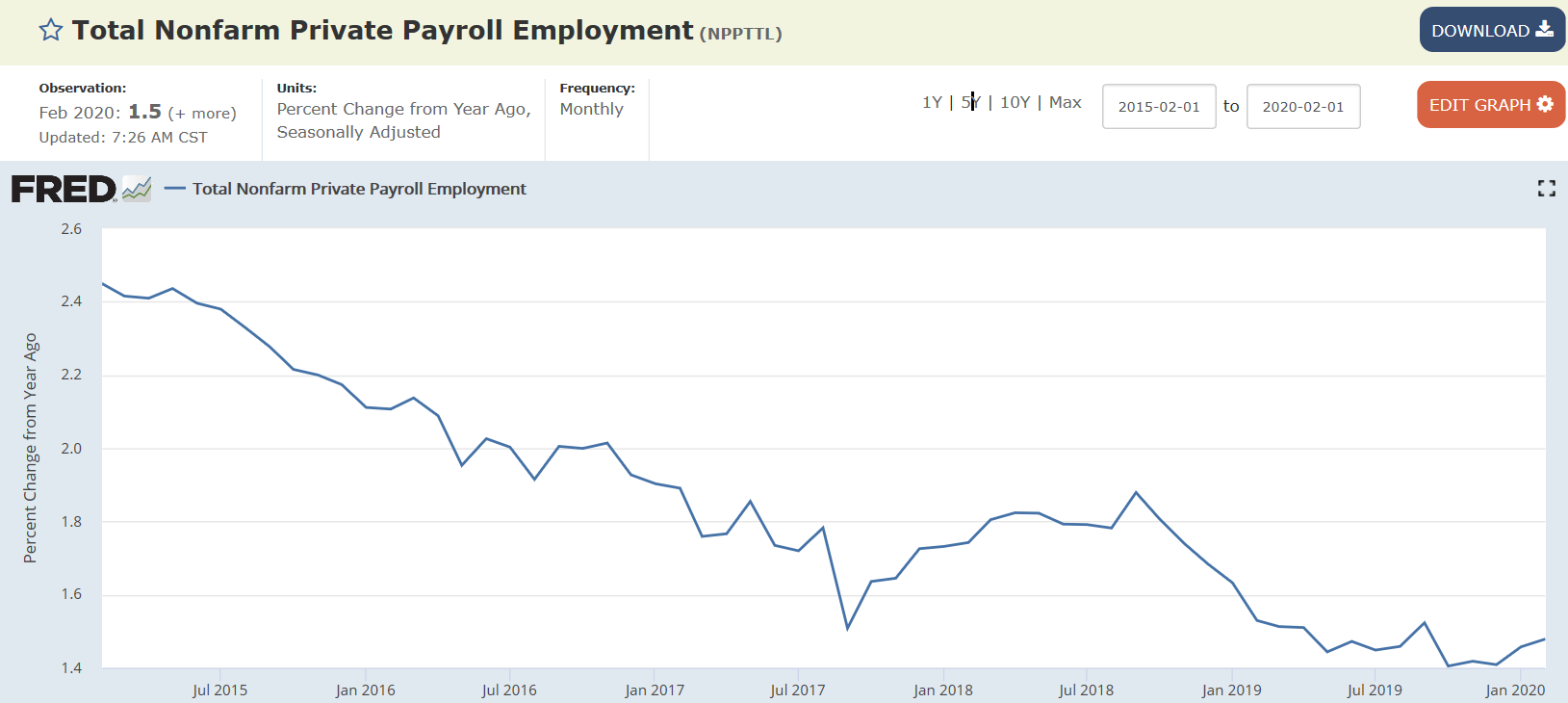

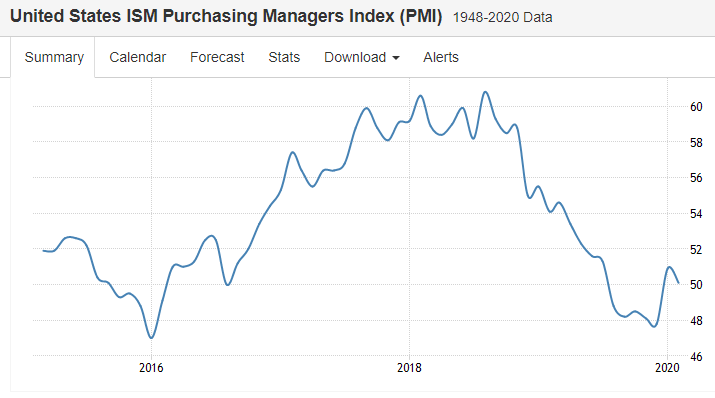

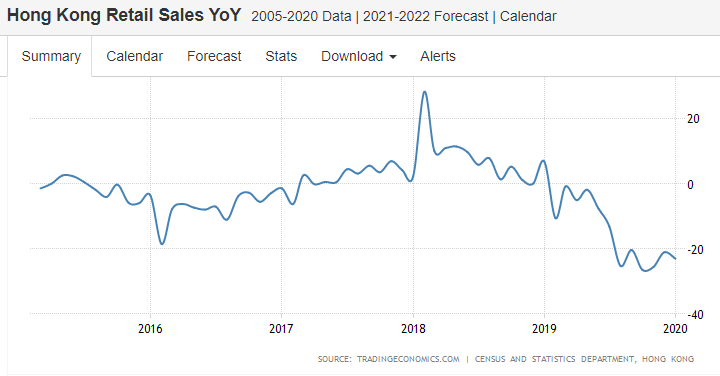

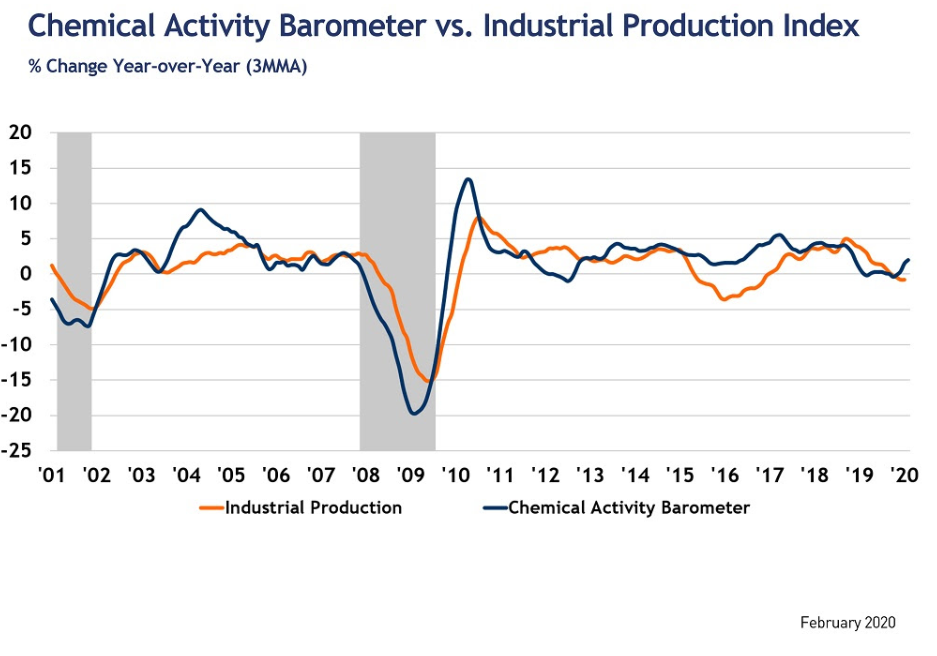

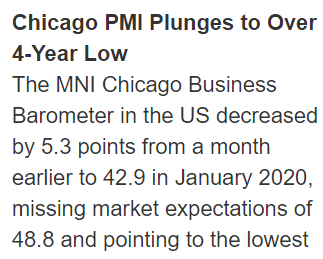

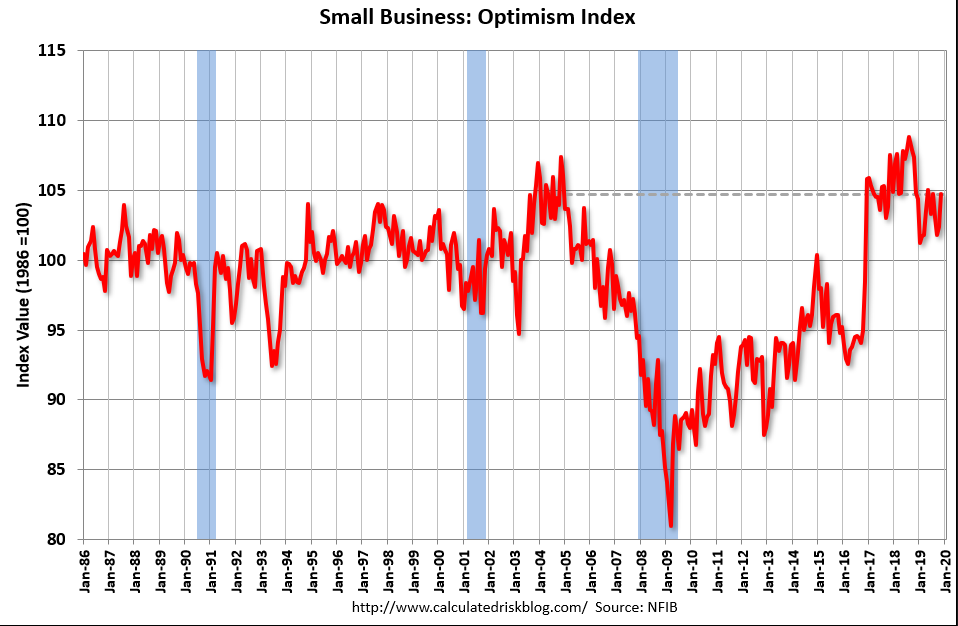

Beat down by the tariffs, virus effects soon to come:

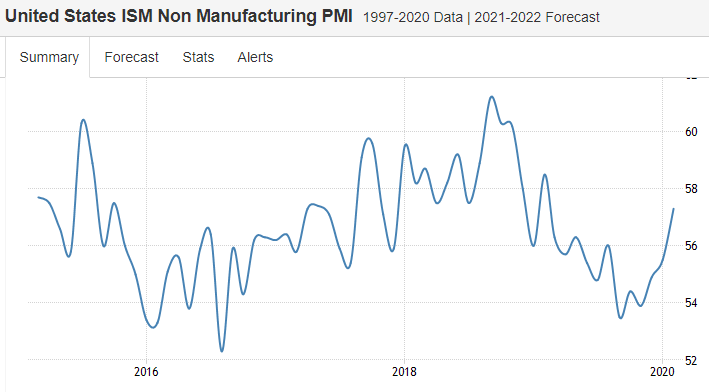

Nice move up against the trend. We’ll see if it reverses like the Markit survey has:

Examples of a recent reversals:

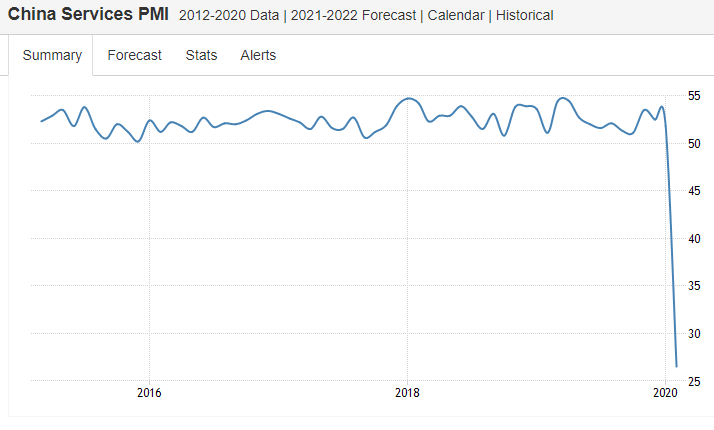

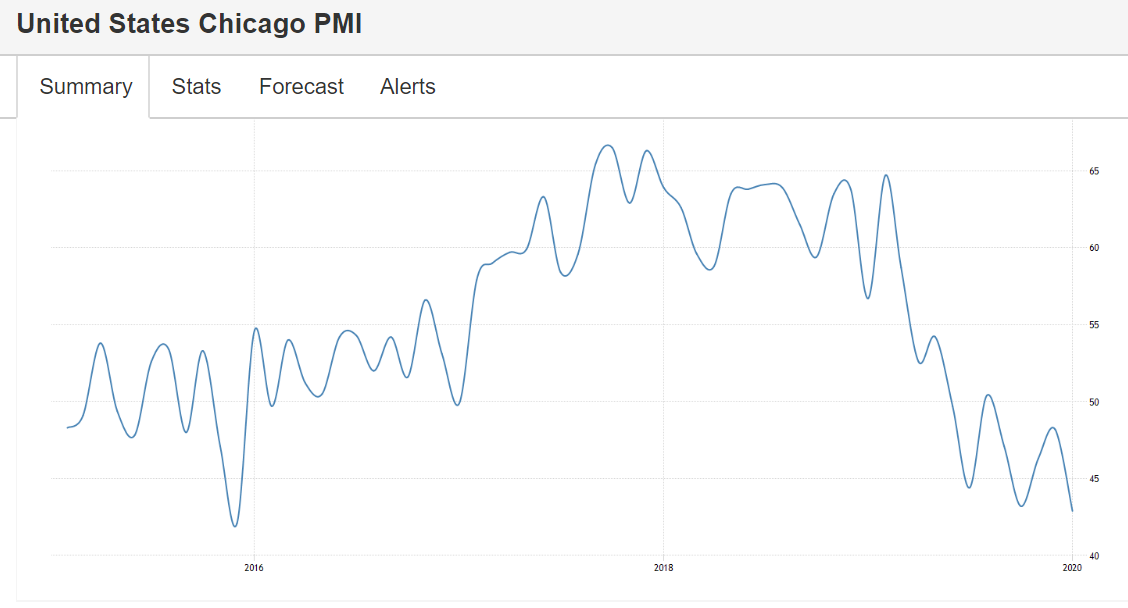

Bit of a move down here as the virus slows things down in China:

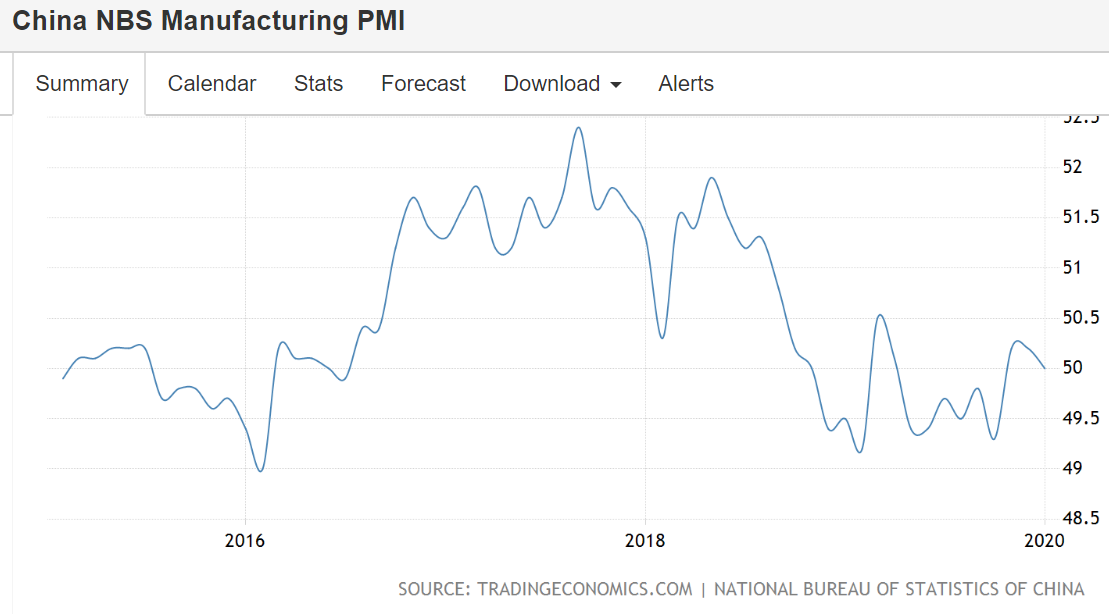

Still decelerating:

Another one of those brief moves up after the long slide seems to be reversing:

The ISM Manufacturing PMI for the US declined to 50.1 in February of 2020 from 50.9 in January and below market expectations of 50.5. New orders contracted (49.8 from 52), production slowed (50.3 from 54.3) and both employment (46.9 from 46.6) and inventories (46.5 from 48.8) continued to fall. Also, price pressures declined (45.9 from 53.3). Global supply chains are impacting most, if not all, of the manufacturing industry sectors.

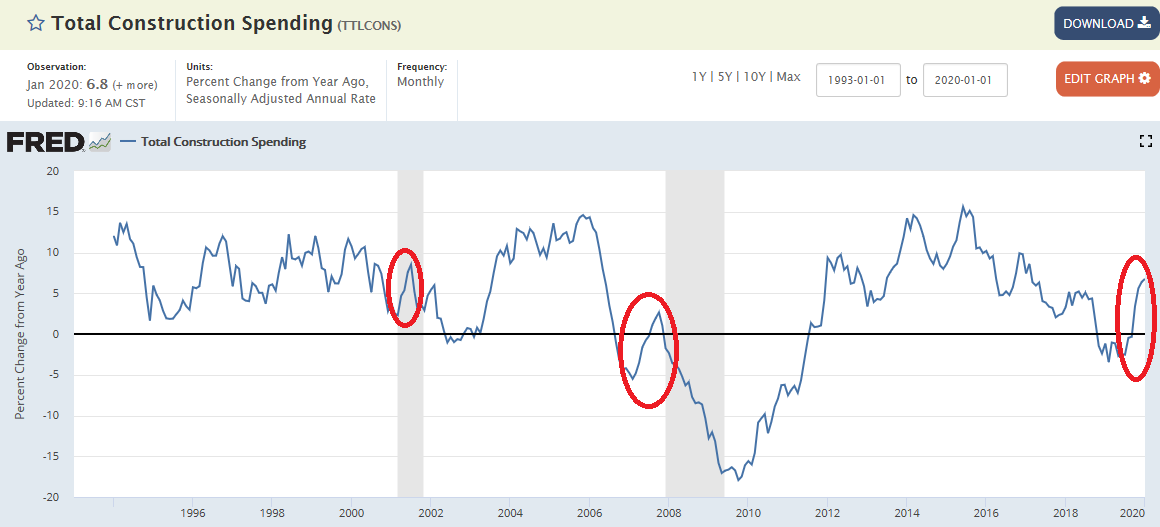

Construction spending mover up a bit, but that was January with its warmer than average weather immediately after rates fell and pre virus. And note similar moves up in prior cycles:

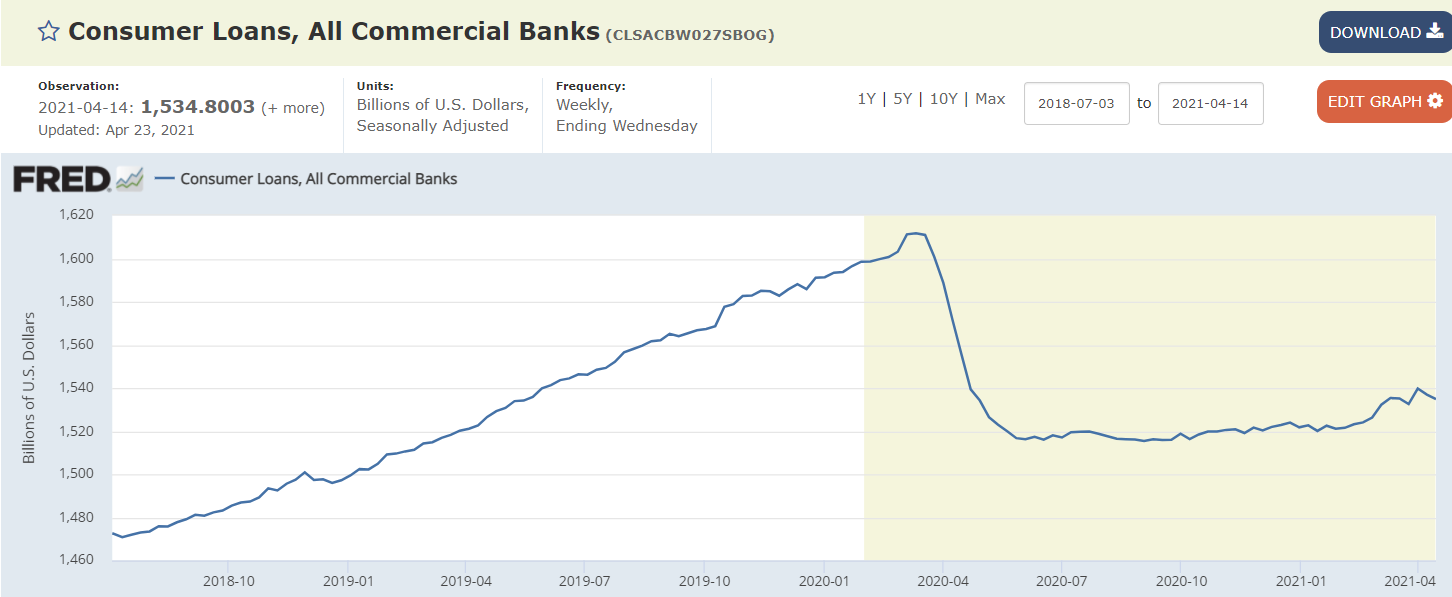

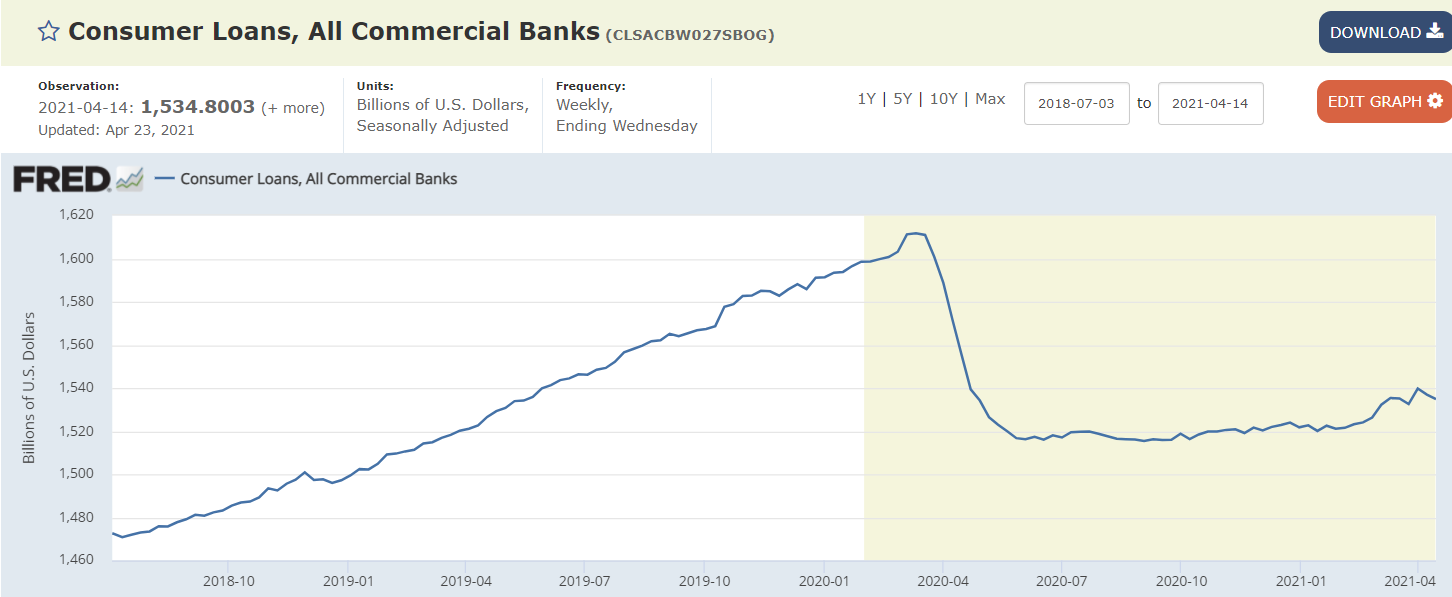

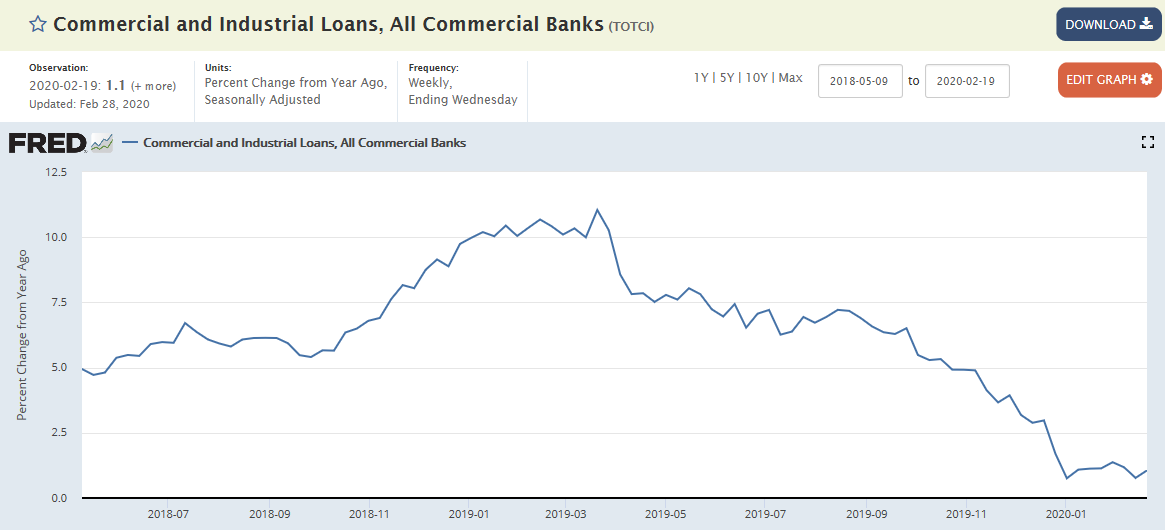

Commercial and industrial loan growth remains depressed at near 0:

Glimpse into China:

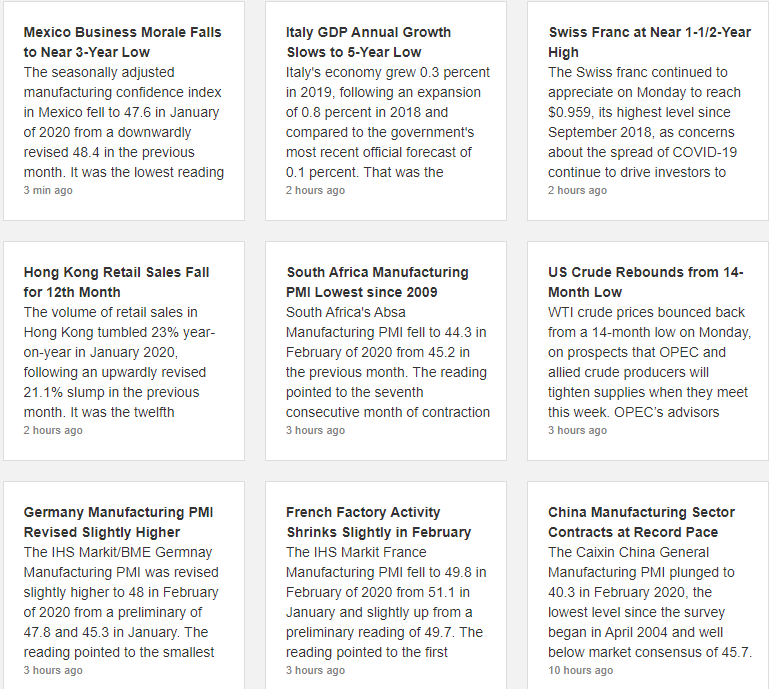

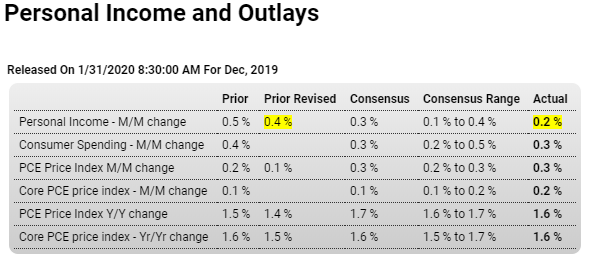

Headline snapshot:

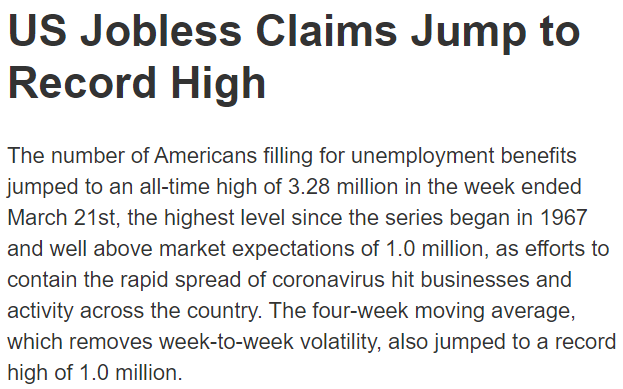

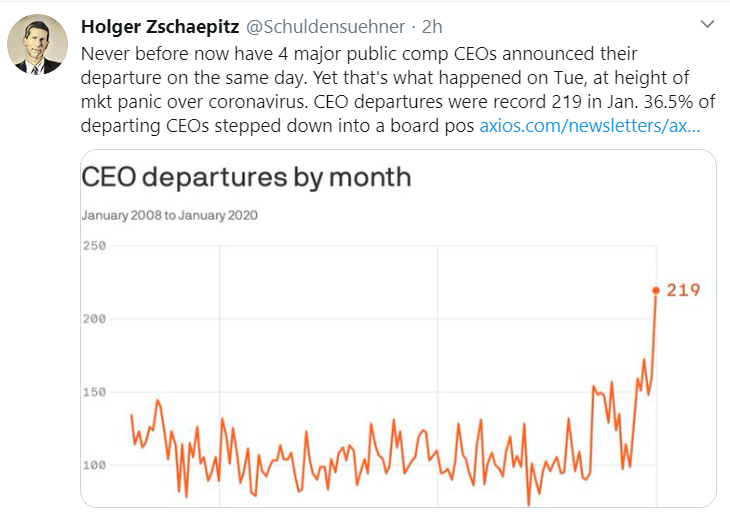

Not a good sign:

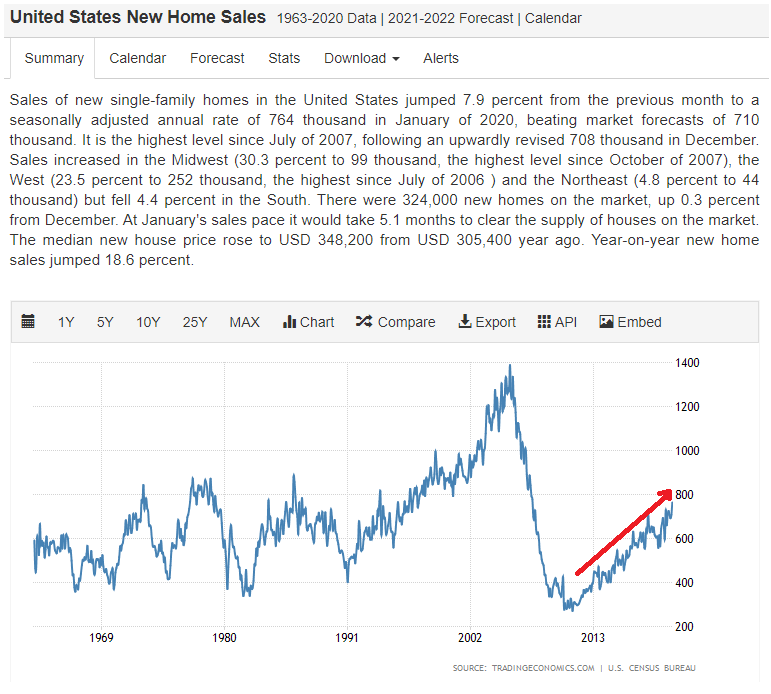

New home sales continue to grow at a slower pace than prior cycles, with absolute levels remaining historically depressed. The chart is not population adjusted:

Can also be a reflection of what’s going on in China:

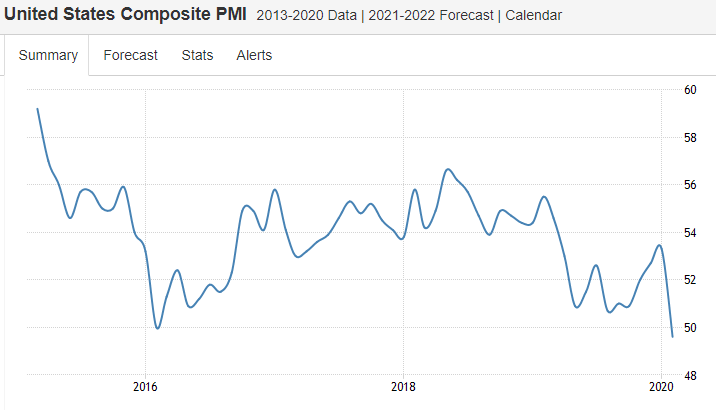

Another one of those recent moves up that is now likely to reverse:

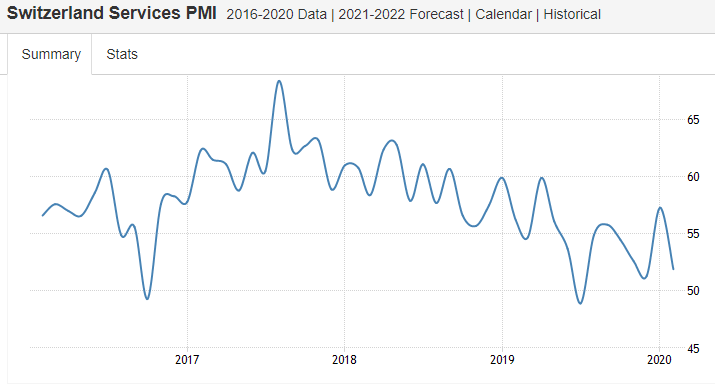

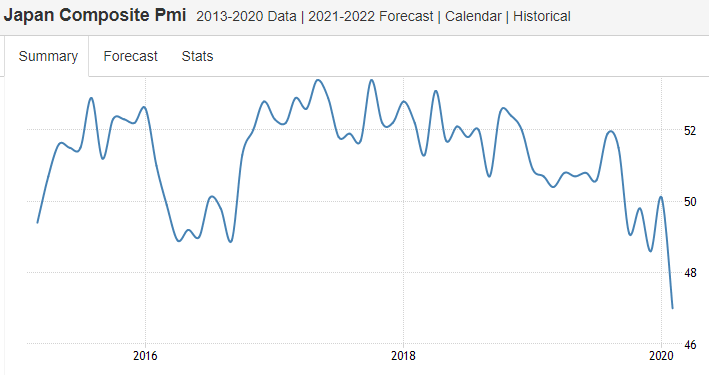

One blip up that reversed:

Here’s another:

And another:

And another:

This one blipped up, but with employment and income growth on the decline, don’t be surprised if it reverses in January:

Still elevated vs before the election, but working its way down from the highs:

China Auto Sales Fall for 17th Straight Month

Vehicles sales in China dropped 3.6 percent from a year ago to 2.46 million units in November 2019, marking the 17th consecutive month of decline, as local governments accelerated changes to emission standards this year. Sales of new energy vehicles (NEVs), including plug-in hybrids, battery-only electric vehicles and those powered by hydrogen fuel cells, decreased for a fifth month in a row (-43.7 percent), after the government reduced incentives for purchases of such cars amid criticism that some firms have become overly reliant on the funds. China’s car sales fell last year for the first time since the 1990s due to slowing economic growth and ongoing trade tensions with the US.

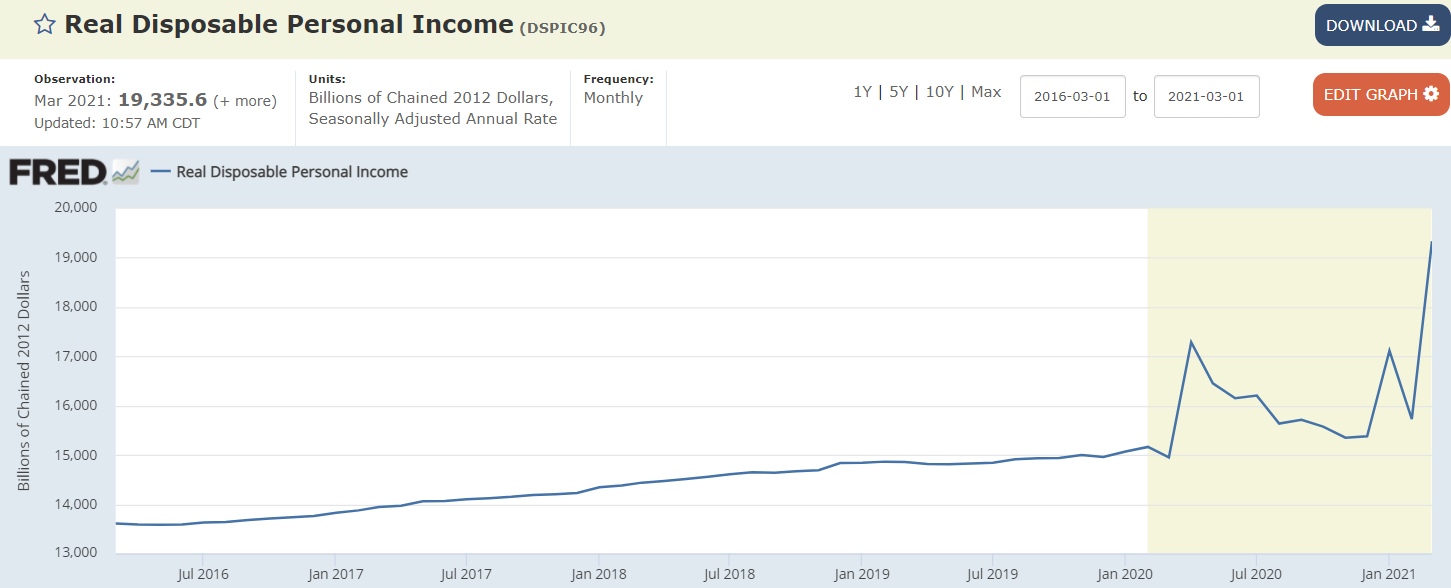

Interesting as income tends to be the fundamental support for asset values: