I’m not arguing with Karim’s view on the Fed’s reaction function.

Just saying it doesn’t look all that exciting to me.

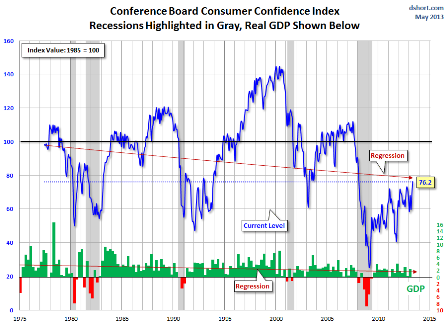

Full size image

I’m not arguing with Karim’s view on the Fed’s reaction function.

Just saying it doesn’t look all that exciting to me.

Confidence up but still at levels typical of prior recessions, and note regression analysis.

And seems to lag the Optimism index?

Karim responds:

What matters is the rate of change, not the index level. Have been in recession at 120 level on the index and have had 4% growth at 50.

Same reason why you we can have rate cuts priced at 5.5% unemployment (if coming from 4%) and rate hikes priced in at 7.5% (if coming from 10%).

When it comes to the Fed’s reaction function, don’t fight Karim!!!!

Sequestration Cuts Flatlining Key Medical Research

John W. Schoen

May 28 (CNBC) — As Congress debates immigration reform to allow more highly-skilled workers to come to the U.S., the irony is that it is chasing away a generation of young American scientists by starving them of billions of dollars in funding for important medical research.

I know, to a hammer everything looks like a nail, etc…

But looks like it might still be in ‘dead cat bounce’ territory?

;)

I’m sure stocks will surge on this report, which means little or nothing for output and profits, as it’s that kind of market.

As you know, if prices go down, say, 50%, they have to go up 100% to get back to where they started.

So comparing these kinds of % increases from current, depressed levels, to % increases of 7 years ago and calling it a ‘boom’ is highly misleading.

Also, home prices fell below replacement cost during the liquidation phase, so a recovery from those levels happens even in a very slow growth economy.

Boom Is Back: US Home Prices Jump Most in Seven Years

May 28 (Reuters) — U.S. single-family home prices rose in March, racking up their best annual gain in nearly seven years as the housing recovery continues to provide a source of strength for the economy, a closely watched survey showed on Tuesday.

The S&P/Case-Shiller composite index of 20 metropolitan areas gained 1.1 percent in March on a seasonally adjusted basis, topping economists’ forecasts for 1 percent.

Prices in the 20 cities jumped 10.9 percent year over year, beating expectations for 10.2 percent and the biggest increase since April 2006.

All 20 cities covered by the index saw yearly gains for the third month in a row. Average prices in March were back at their late-2003 levels.

For the first quarter of this year, the seasonally adjusted national index rose 3.9 percent, stronger than the 2.4 percent gain that was seen in the final quarter of last year.

More evidence the western educated kids have taken over.

:(

China Plans to Reduce the State’s Role in the Economy

By David Barboza and Chris Buckley

May 24 (NYT) — The Chinese government is planning for private businesses and market forces to play a larger role in its economy, in a major policy shift intended to improve living conditions for the middle class and to make China an even stronger competitor on the global stage.

More of: “In the land of the blind the one eyed man gets his good eye poked out…”

Operationally, the BOJ, monopoly supplier of yen reserves, can peg long rates just as easily as short rates.

If they back off on fiscal they’re right back where they started from, as QE is a bit of a tax hike, but for the most part just a placebo.

And lighting up the nukes likely puts trade back in surplus, firming the yen again, with the lifers who sold JGB’s for foreign bonds and foreign currency exposure/got short yen adding a bit of excitement when they try to cover.

Not to mention the China slowdown.

And none of this helps US demand any.

Tokyo Panel Urges Abe to Tighten Finances

Mitsuru Obe

May 27 (WSJ) —TOKYO—Following last week’s brief jump in Japanese government bond yields that helped precipitate a sudden slide in Tokyo stocks, an advisory panel to Japan’s finance minister published a report Monday urging the government to undertake serious fiscal reform to avoid further rises in yields.

“Fiscal reconstruction has become all the more important” because of Prime Minister Shinzo Abe’s aggressive monetary and fiscal stimulus measures, the report said, while warning that a loss of fiscal rectitude could send bond yields higher and undermine the efforts of the Bank of Japan 8301.JA -1.43%to stimulate the economy.

The report comes after the central bank launched an aggressive bond-buying program in April. The BOJ’s change in stance initially pushed bond yields down. But uncertainty over the impact of buying on such a huge scale—up to 70% of newly issued debt—saw yields bounce back up.

As the country’s currency, the yen, broke above 100 to the dollar earlier this month for the first time in more than four years, bond yields climbed along with equity prices. When they hit 1% on May 23, a level not seen in more than a year, the equity market’s upward march halted.

The panel’s chairman, Tokyo University Prof. Hiroshi Yoshikawa, declined to say how last week’s financial turmoil may have influenced the panel’s conclusion in the report. But Mr. Yoshikawa didn’t mince his words, as he warned against any attempt by the Abe administration to push back painful reforms, such as planned tax hikes and fiscal consolidation.

“Any attempt to go ahead with more fiscal stimulus would be a contravention of the spirit of this report,” he told a news conference.

Mr. Abe’s administration came into office in late December, amid an economic slowdown in Europe and China. Pledging to lift the Japanese economy out of decadeslong stagnation, Mr. Abe’s government has launched aggressive monetary easing and fiscal stimulus measures, a policy program popularly known as Abenomics.

The report argued, however, that “such unusual policy measures cannot be continued indefinitely.”

“Unless the government moves ahead with and makes progress in fiscal consolidation, the BOJ’s policy could be viewed as an act of debt financing by the central bank, causing bond yields to rise, and canceling out the effects of its monetary easing,” it said.

The report also noted that a rise in bond yields would also complicate the task of the exiting the so-called quantitative easing program down the line. Under a newly introduced inflation target, the BOJ is obliged to achieve 2% price growth, and the bank has said it would keep its aggressive easing in place until it secures that target.

The report said that “even if the BOJ wants to reduce its government bond purchases, it won’t be able to do so unless there are alternative buyers of bonds in the market.” Without private sector buyers, long-term interest rates could go up far beyond levels in line with economic growth rates, the report warned.

The Abe administration is expected to make clear its fiscal reform goals next month.

The report urged the government to produce a credible and concrete fiscal reform road map that would include specific numerical targets, rather than just expressing a strong determination.