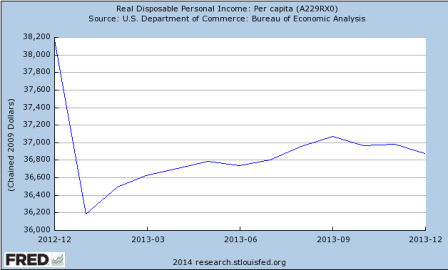

The post weather ‘bounce’ didn’t even reverse the prior month’s drop:

Highlights

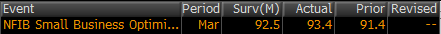

There are signs of confidence in the small business optimism index which jumped 2.0 points to 93.4 to nearly reverse a 2.7 point downswing in February. The March gain is led by expectations for future sales and by plans to build inventories — both pointing to expectations of building strength. Of the 10 components, six are up in the month, two are unchanged, and only two are down. Unfortunately, of the two that are down one is hiring plans.