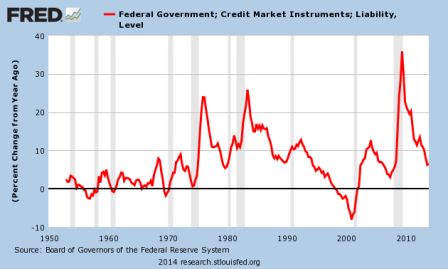

Keeps coming back to fiscal for me.

I see the year over year change going from up nicely to flattening/decelerating as the tax hikes, followed shortly after by the sequesters, took their toll. And with the federal deficit way down, that ‘spending more than income’ isn’t there to help offset the ever growing ‘demand leakages’, meaning we need that much more ‘borrowing to spend’ to grow, etc.

So far, with GDP tracking at about -.5 for q1 and +4.5 for q2, that’s about a +2% first half, down a lot from H2 2013, which I saw as higher than otherwise due to inventory building and ‘mysterious’ year end surges that had the appearance of spending ahead of expiring tax credits, etc.

So I see what’s happened (and worse) as consistent with my narrative, with the evidence looking more and more like the demand leakages may now be ‘winning the race.’

Which also explains the long bond coming down in yield??? ;)

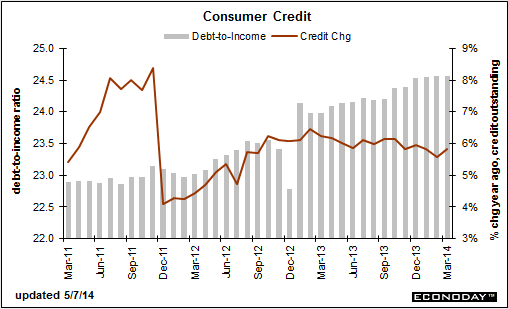

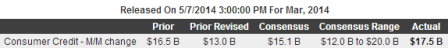

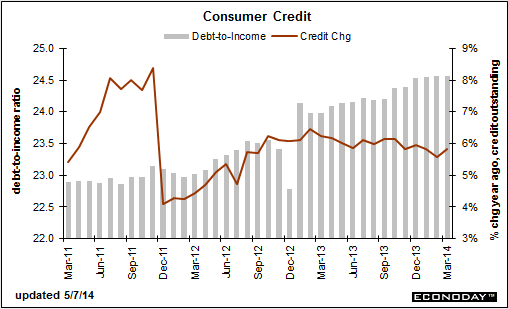

Consumer Credit

Highlights

Credit card debt is not building, a plus for consumer wealth perhaps but a definite minus for store sales. Consumer credit did expand by a sharp $17.5 billion in March but, as has been the case since the 2008 financial meltdown, the gain is centered almost entirely in non-revolving credit which continues to get a boost from strong vehicle sales and the government’s acquisition of school loans from private lenders. Revolving credit is barely showing any life, up $1.1 billion following a decline of $2.7 billion in February.