That Confounding Mr. Market

By Gary Carmell

Category Archives: Uncategorized

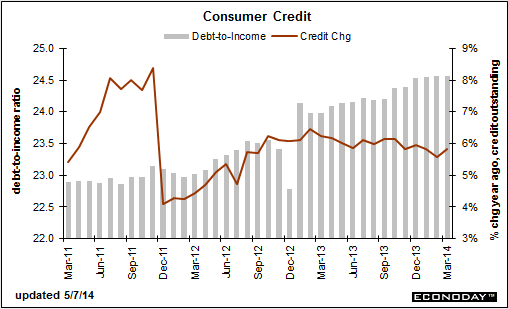

Consumer credit

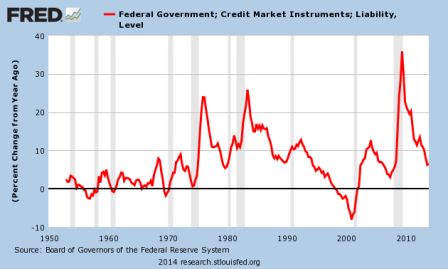

Keeps coming back to fiscal for me.

I see the year over year change going from up nicely to flattening/decelerating as the tax hikes, followed shortly after by the sequesters, took their toll. And with the federal deficit way down, that ‘spending more than income’ isn’t there to help offset the ever growing ‘demand leakages’, meaning we need that much more ‘borrowing to spend’ to grow, etc.

So far, with GDP tracking at about -.5 for q1 and +4.5 for q2, that’s about a +2% first half, down a lot from H2 2013, which I saw as higher than otherwise due to inventory building and ‘mysterious’ year end surges that had the appearance of spending ahead of expiring tax credits, etc.

So I see what’s happened (and worse) as consistent with my narrative, with the evidence looking more and more like the demand leakages may now be ‘winning the race.’

Which also explains the long bond coming down in yield??? ;)

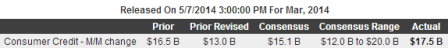

Consumer Credit

Highlights

Credit card debt is not building, a plus for consumer wealth perhaps but a definite minus for store sales. Consumer credit did expand by a sharp $17.5 billion in March but, as has been the case since the 2008 financial meltdown, the gain is centered almost entirely in non-revolving credit which continues to get a boost from strong vehicle sales and the government’s acquisition of school loans from private lenders. Revolving credit is barely showing any life, up $1.1 billion following a decline of $2.7 billion in February.

Auto stabilizers reduce the deficit until growth goes negative causing them to reverse

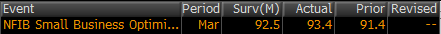

small business optimism index

The post weather ‘bounce’ didn’t even reverse the prior month’s drop:

Highlights

There are signs of confidence in the small business optimism index which jumped 2.0 points to 93.4 to nearly reverse a 2.7 point downswing in February. The March gain is led by expectations for future sales and by plans to build inventories — both pointing to expectations of building strength. Of the 10 components, six are up in the month, two are unchanged, and only two are down. Unfortunately, of the two that are down one is hiring plans.

March U.S. Auto Sales Were In Like A Lamb, Out Like A Lamb – Forbes

Not a lot of bounce back here yet:

March U.S. Auto Sales Were In Like A Lamb, Out Like A Lamb

By Jim Henry

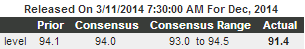

NFIB Small Business Optimism Index

Weather worse than expected.

;)

This is a lesser indicator that only matters if it goes up…

;)

NFIB Small Business Optimism Index

Highlights

The small business optimism index, which had been on a rebound, fell sharply in February, down 2.7 points to 91.4. A weakening in sales expectations pulled the index down the most followed by economic expectations and hiring plans.Respondents continue to reduce inventories and are reporting no more than limited pricing power.

Bernanke out visiting friends…

Plus airfare, hotel, meals, airport limo, etc. ;):

Bernanke received at least $250,000 for his appearance at the financial conference staged by National Bank of Abu Dhabi, the UAE’s largest bank, according to sources familiar the matter. NBAD did not announce the fee.

Because of Abu Dhabi’s oil wealth, state-controlled NBAD prospered during the global crisis caused by Lehman’s collapse, taking market share from hard-hit U.S. and European banks.

Bernanke’s speaking fee is similar to one received by his predecessor Alan Greenspan for an Abu Dhabi speaking engagement in 2008, the sources said.

Greenspan embarked on a series of lucrative speeches after he stepped down, and Bernanke now appears to be doing the same. He is scheduled to speak at an event in South Africa on Wednesday and in Houston on Friday.

Strapped Scientists Abandon Research and Studentst

:(

Strapped Scientists Abandon Research and Students

Less money means less science, as shown by a Chronicle survey of more than 10,000 researchers.

Business borrowing down 44% from Dec

Expiring tax cuts accelerated capex?

U.S. business borrowing for equipment rises in January: ELFA

Feb 25 (Reuters) — U.S. companies borrowed more in January to spend on capital investment, the Equipment Leasing and Finance Association (ELFA) said.

Companies signed up for $6 billion in new loans, leases and lines of credit last month, up 2 percent from a year earlier, but fell 44 percent from December, according to data from the ELFA.

“With fiscal pressures in Washington subsiding … and most major U.S. economic indicators showing positive signs, we are hopeful that these factors will help promote a favorable climate for continued investment in 2014 and beyond,” ELFA Chief Executive William Sutton said.

Washington-based ELFA, a trade association that reports economic activity for the $827 billion equipment finance sector, said credit approvals totaled 76.9 percent in January, down from 78.3 percent in December.

ELFA’s leasing and finance index measures the volume of commercial equipment financed in the United States. It is designed to complement the U.S. Commerce Department’s durable goods orders report, which it typically precedes by a few days.

Portugal comments

From FT on Portugal, says it all:

The national statistics office noted worrying signs that domestic demand was contributing positively to growth in the last quarter for the first time since 2010. This may reflect the impact of previous cuts in public sector pay and pensions that were subsequently overturned by Portugals constitutional court. An over-reliance on the domestic market has been seen as one of Portugals structural weaknesses but exports are now driving the turnround.