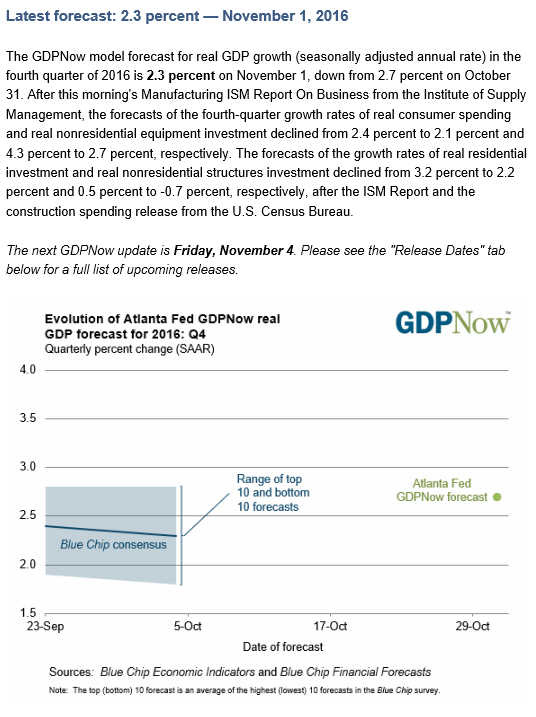

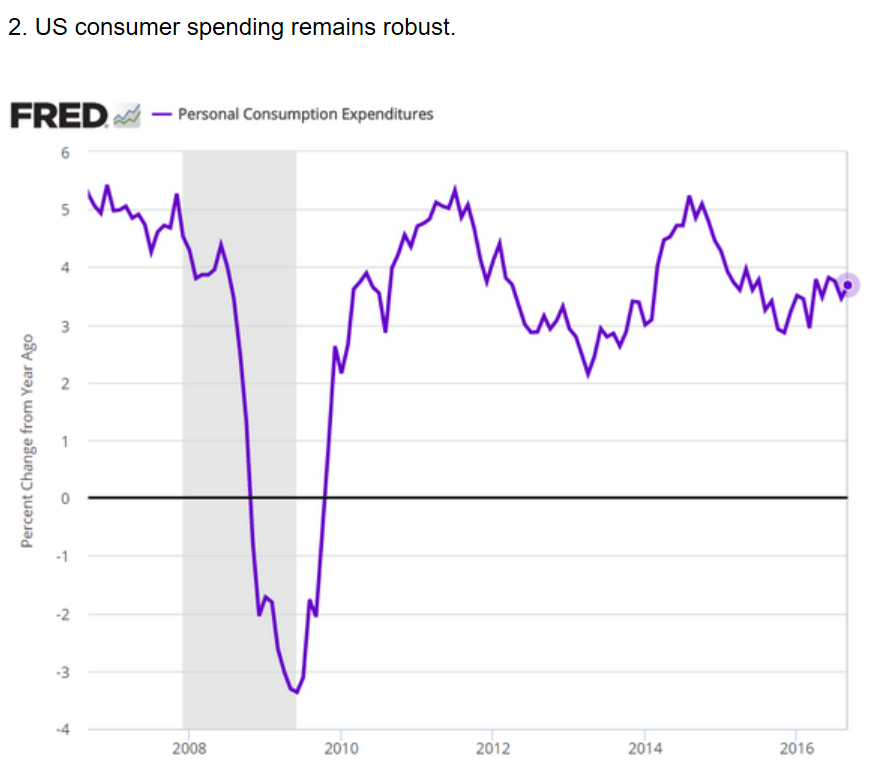

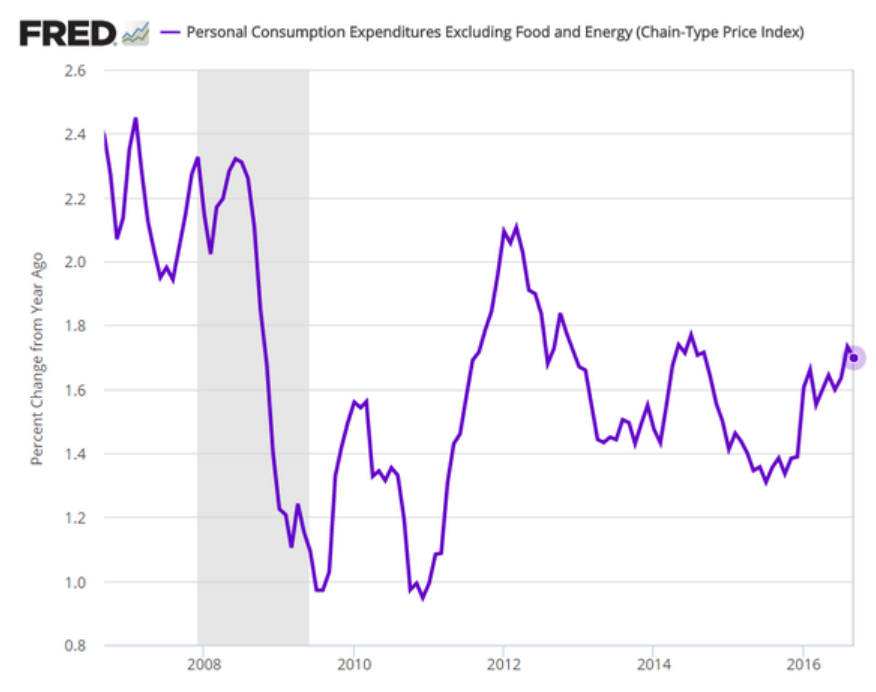

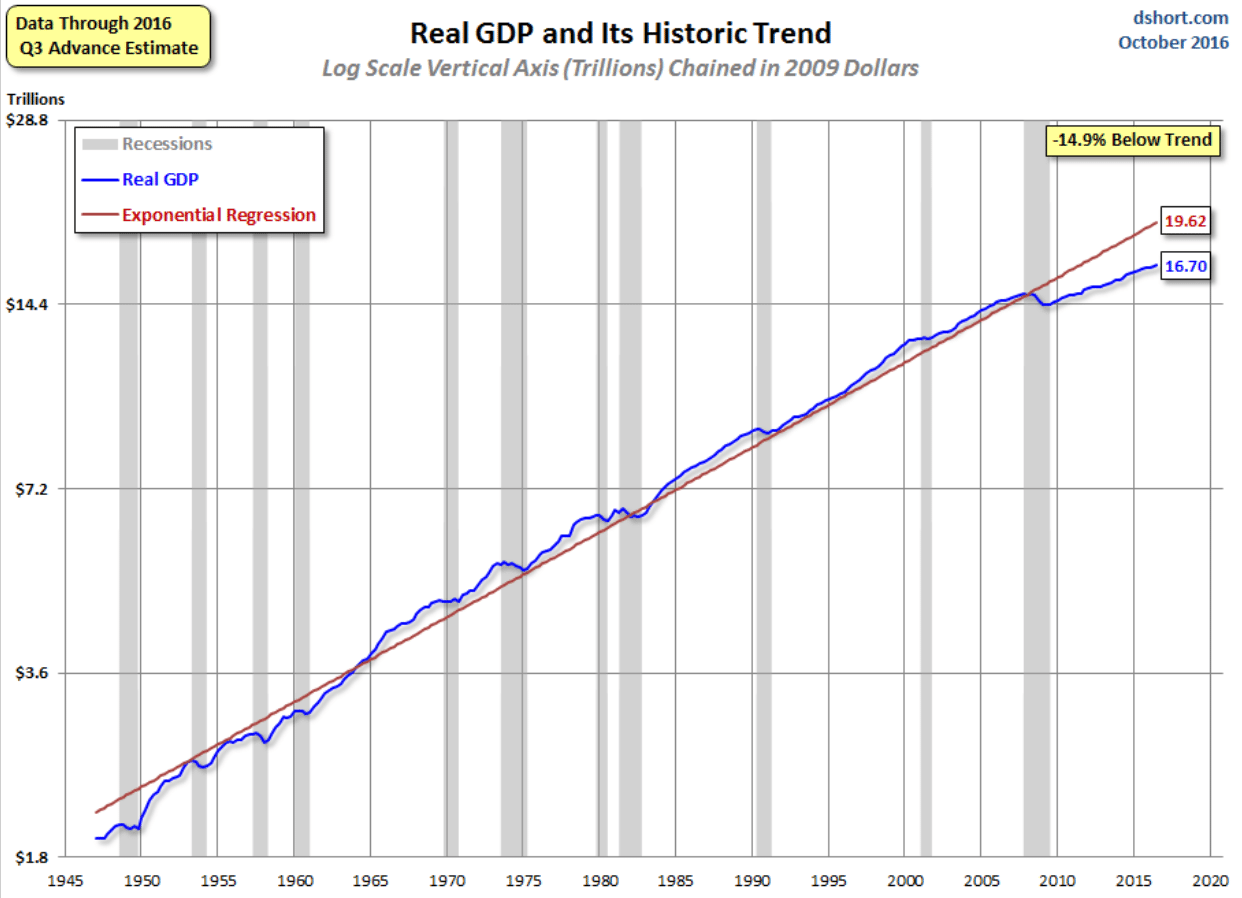

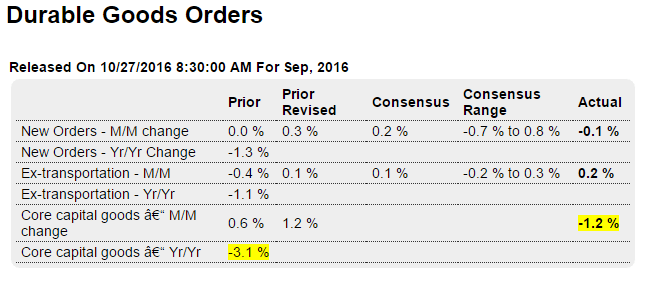

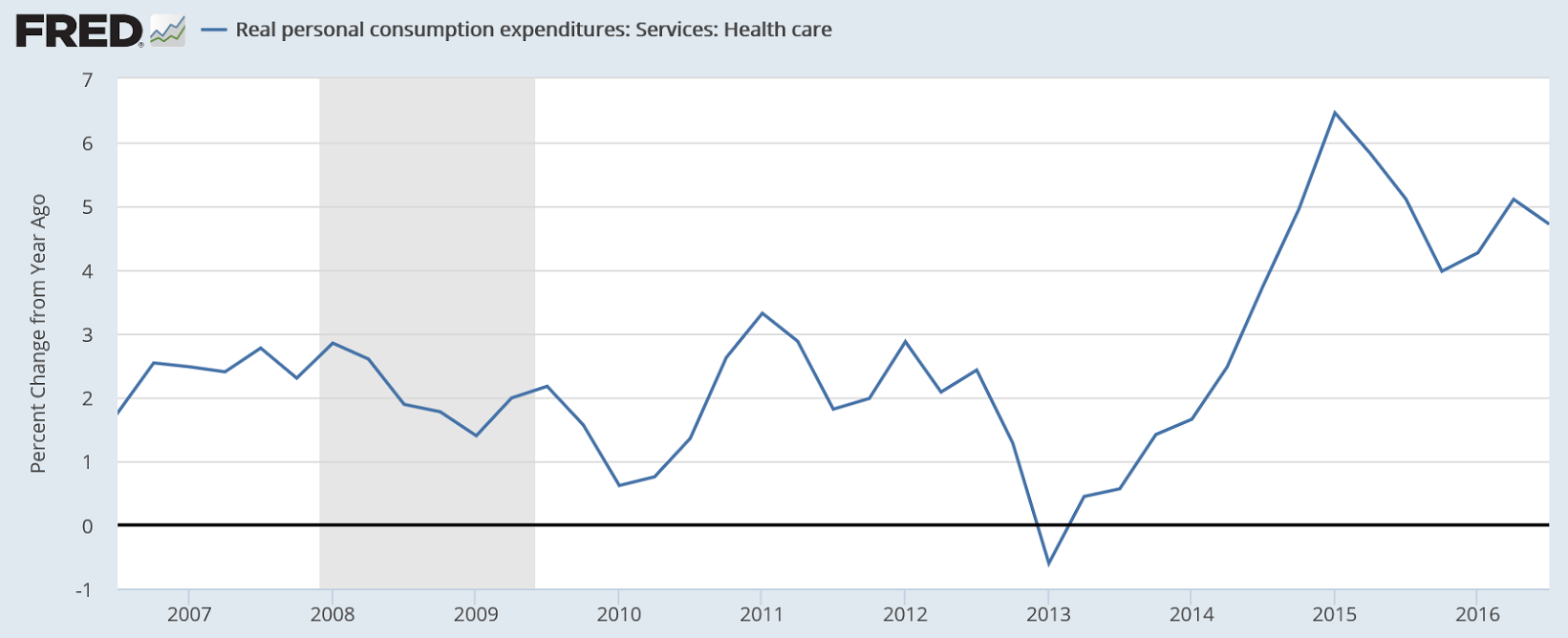

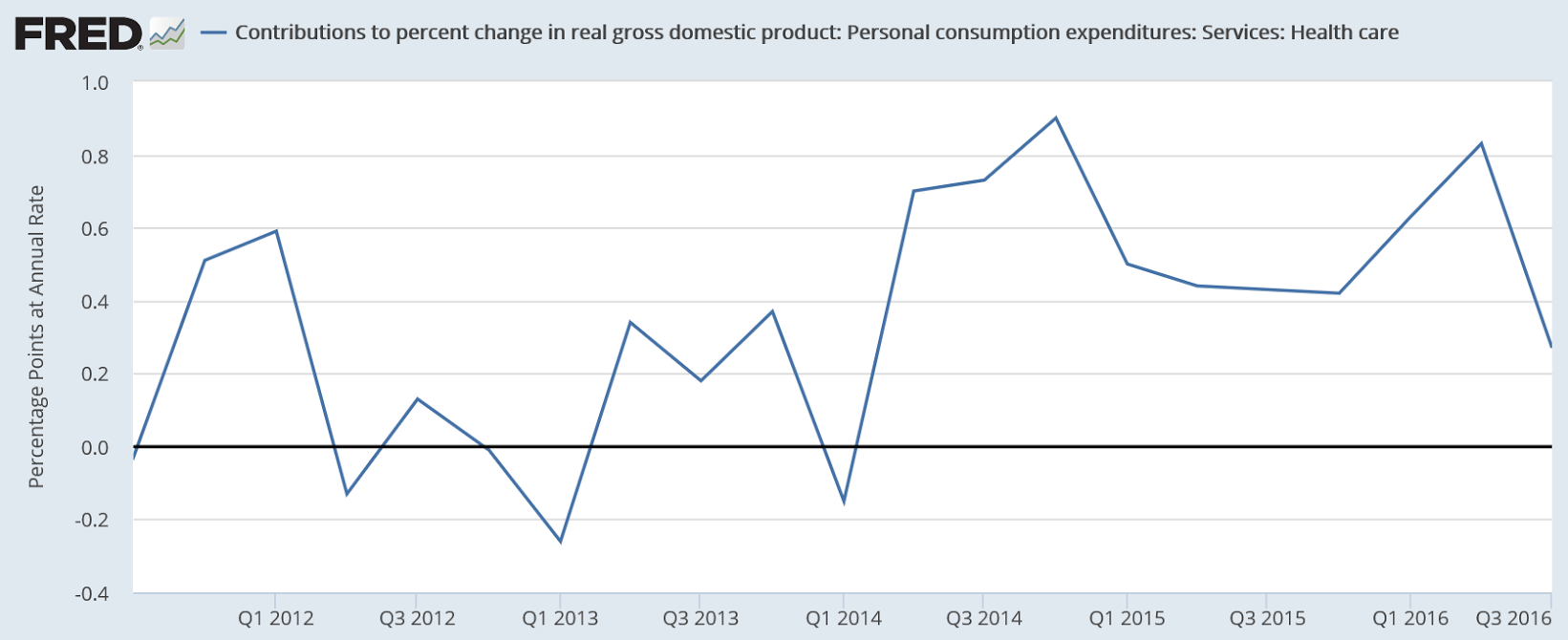

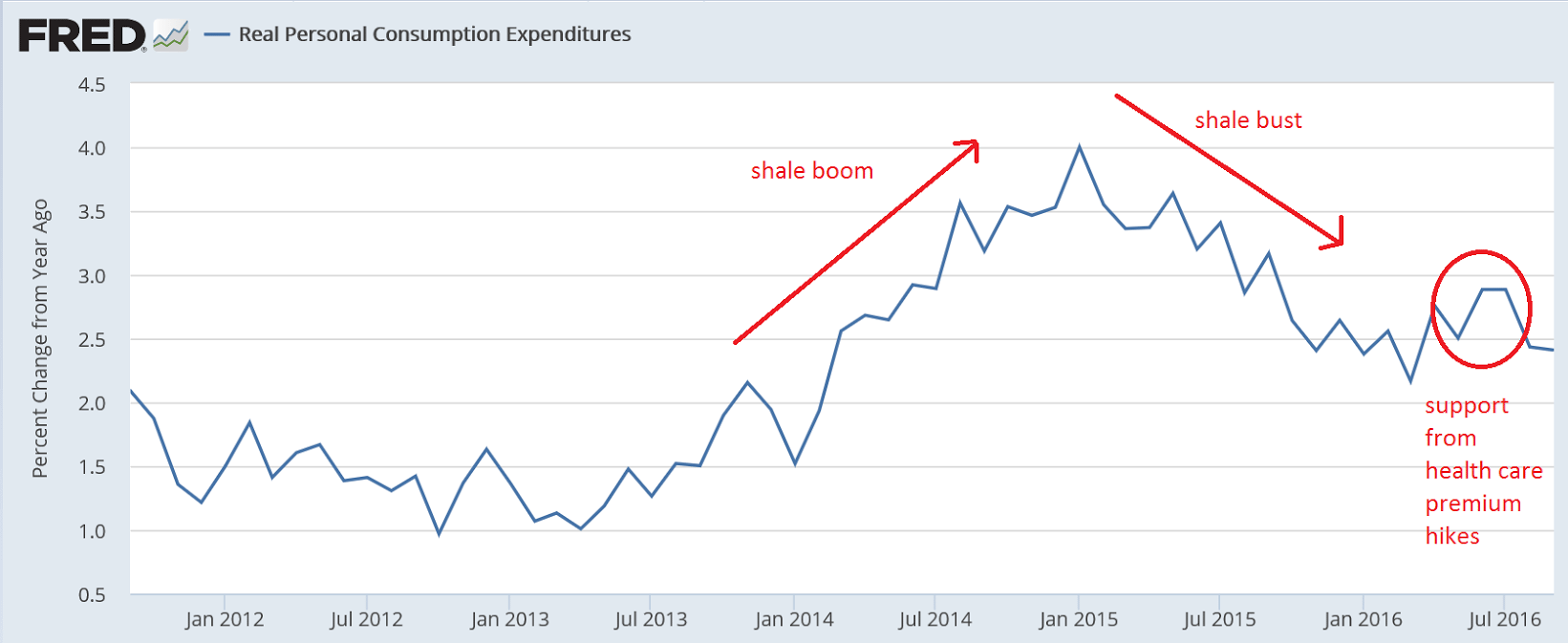

Best I can tell this is mainly about health care insurance premiums, which ‘count’ as personal consumption expenditures and have been adding support to GDP:

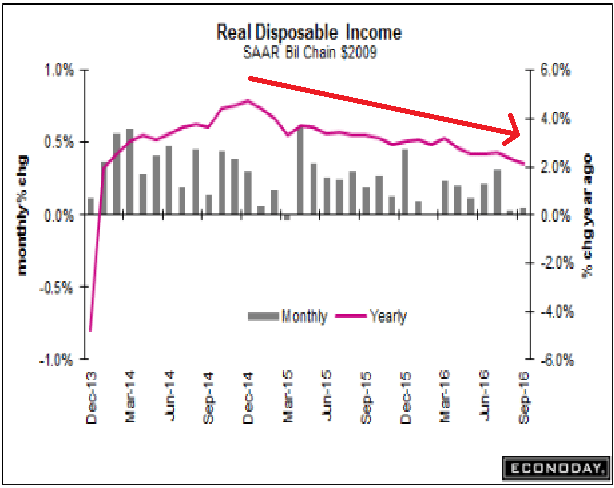

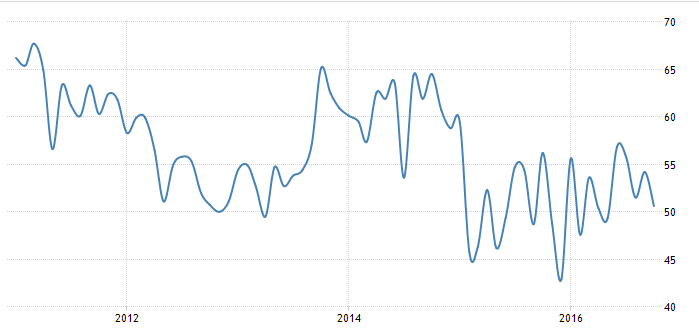

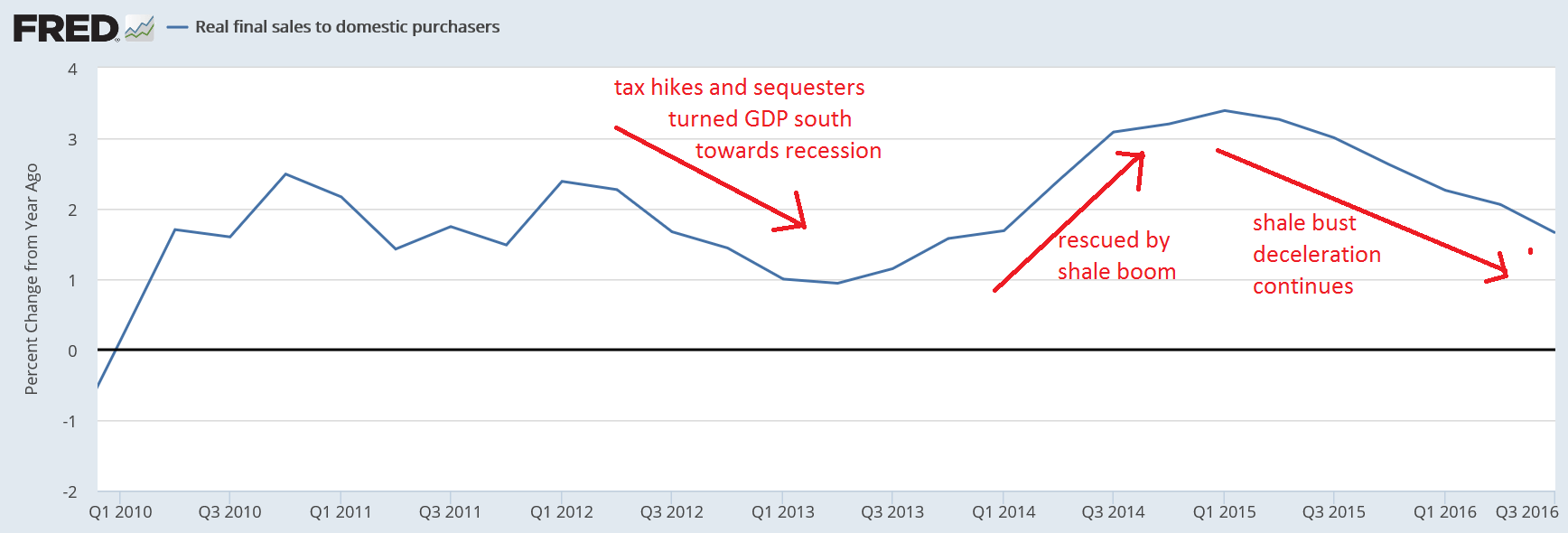

Inflation adjusted:

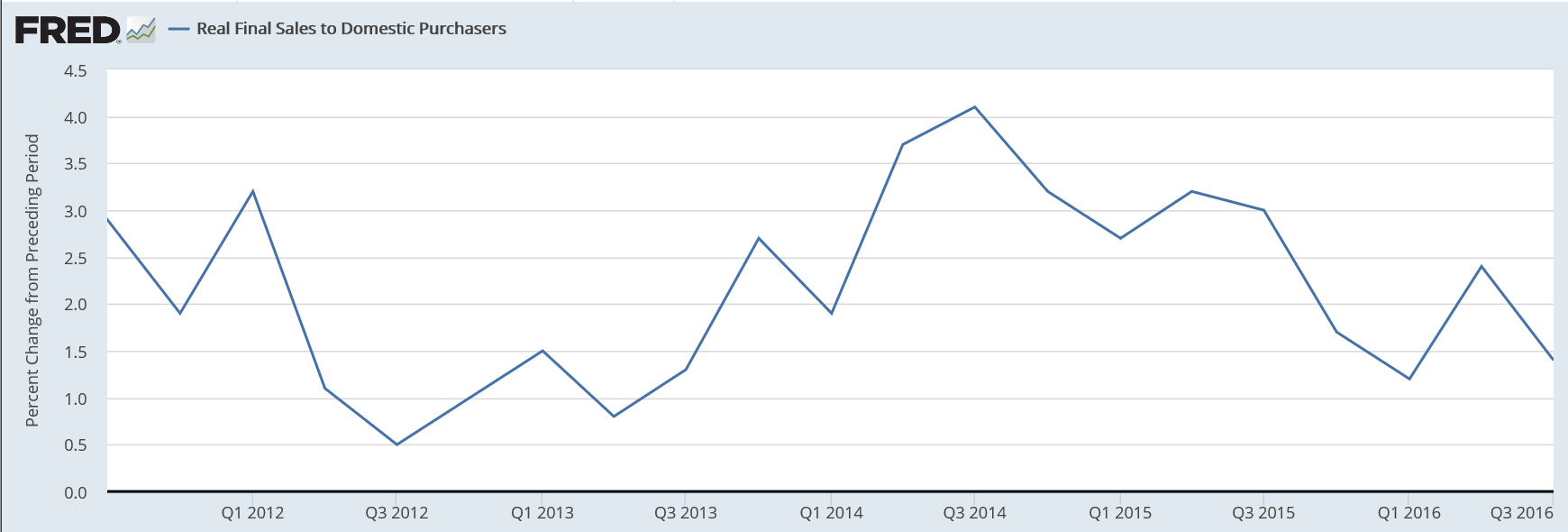

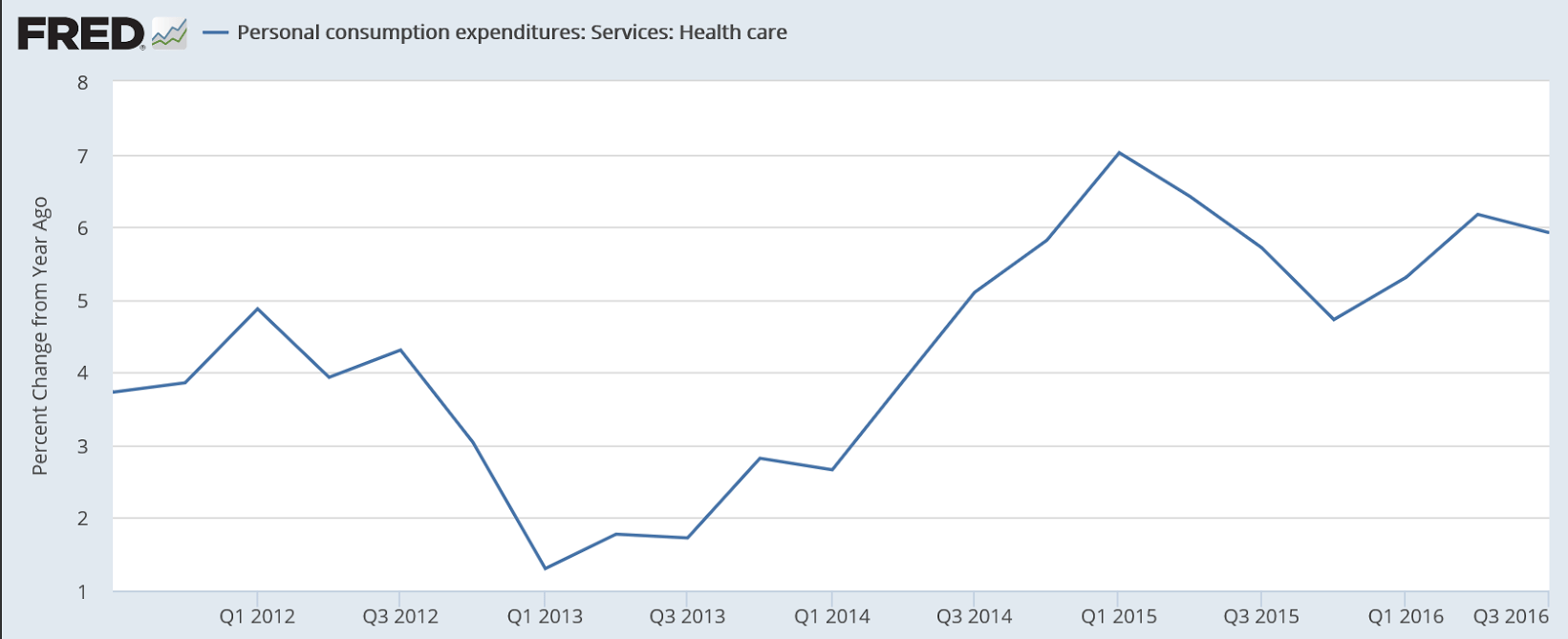

Not inflation adjusted:

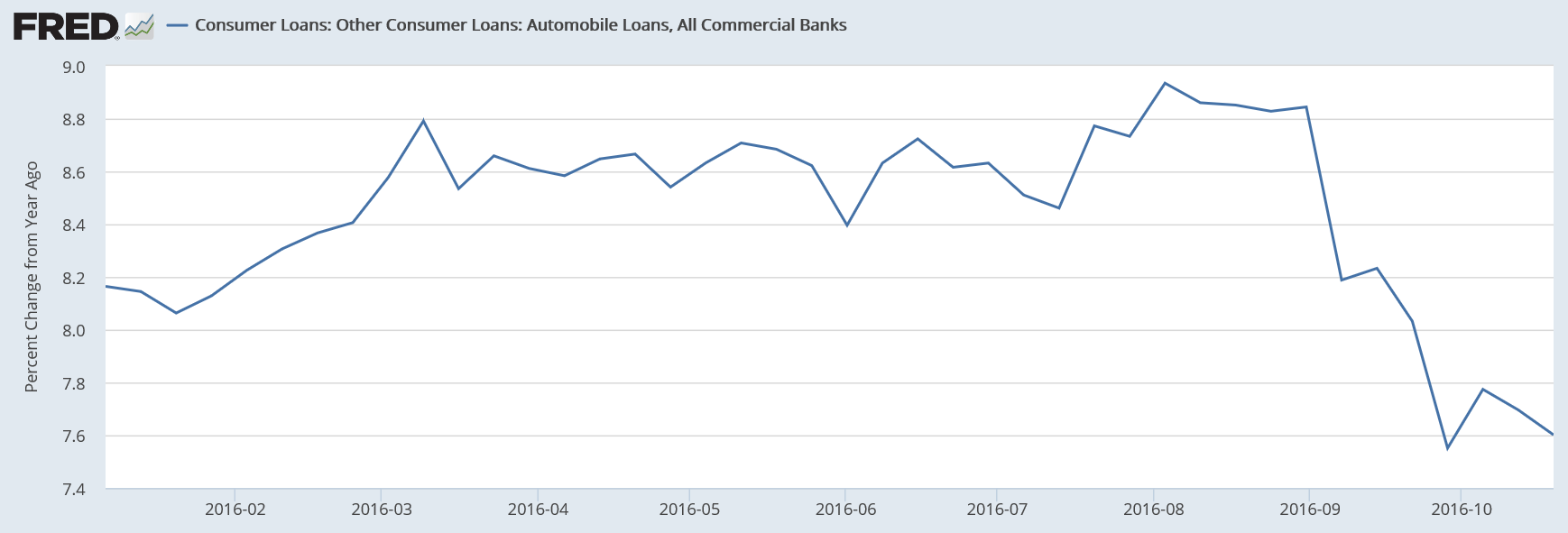

Looks like the support is starting to fade:

The ‘one time’ adjustment for Obamacare may have passed, along with it’s support

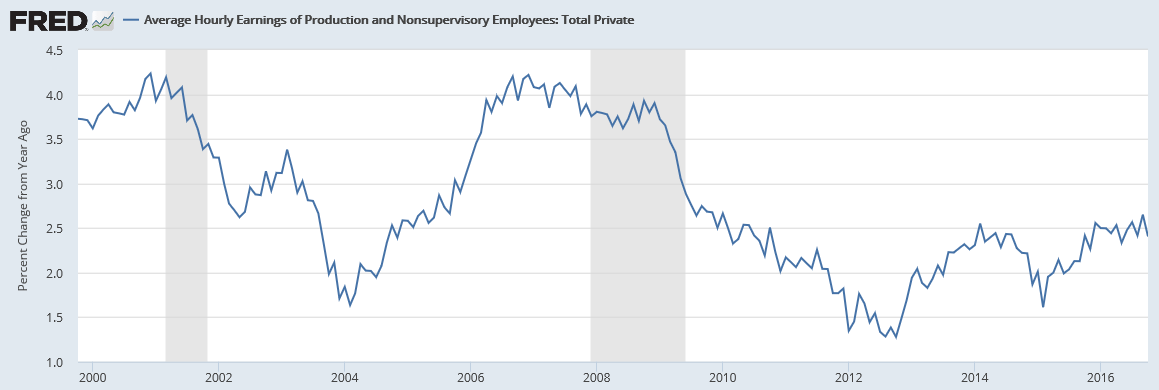

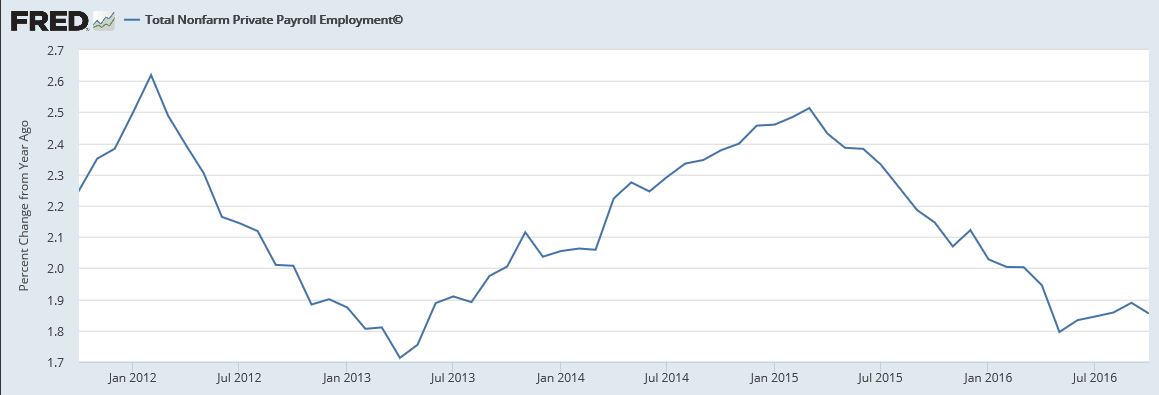

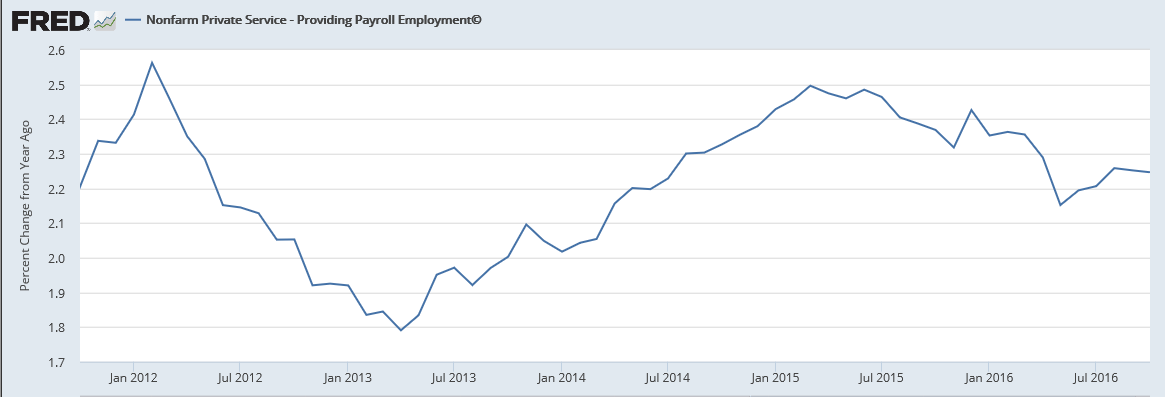

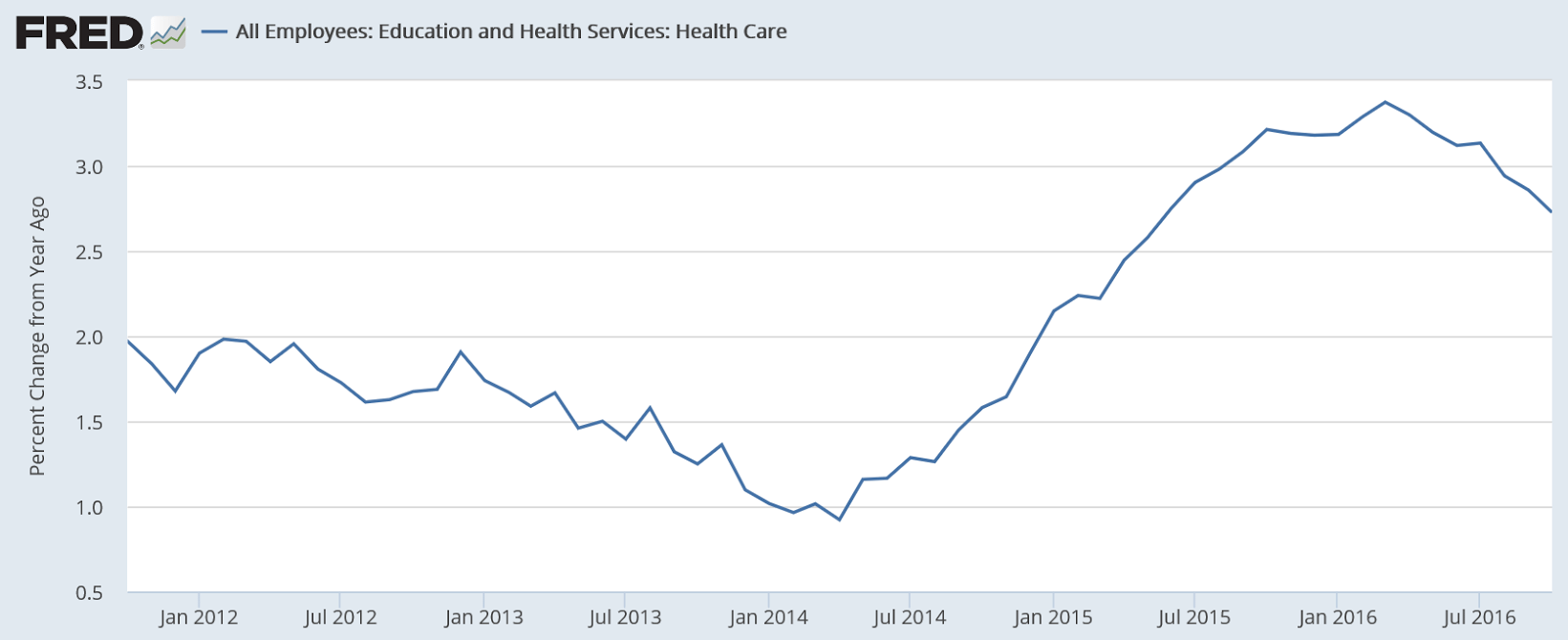

for GDP. And note the growth of employment was well below the growth in costs:

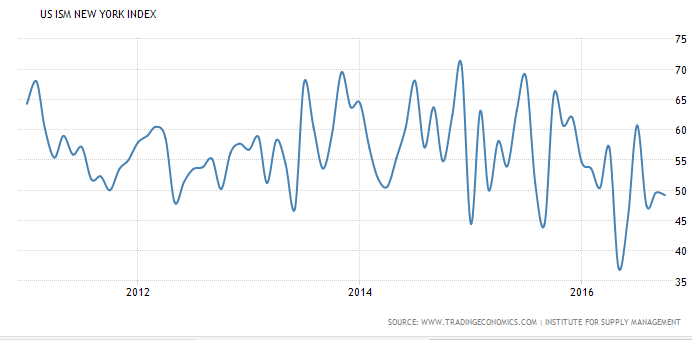

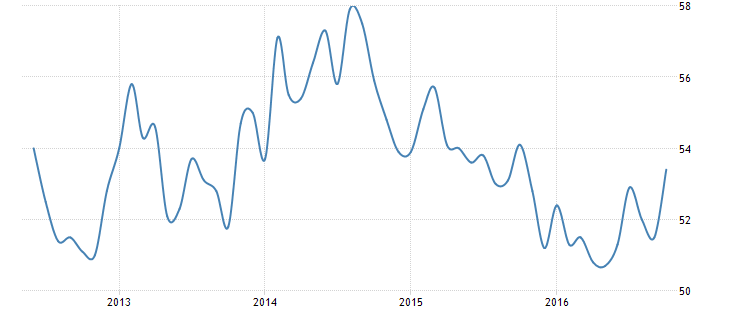

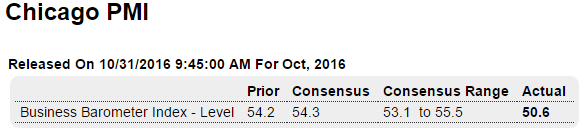

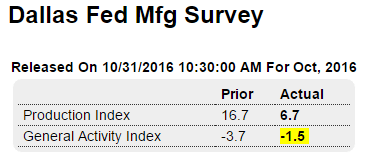

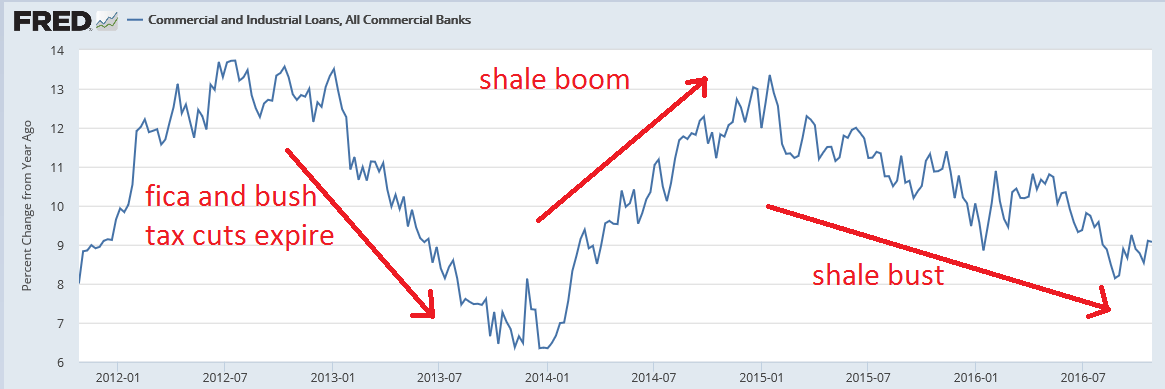

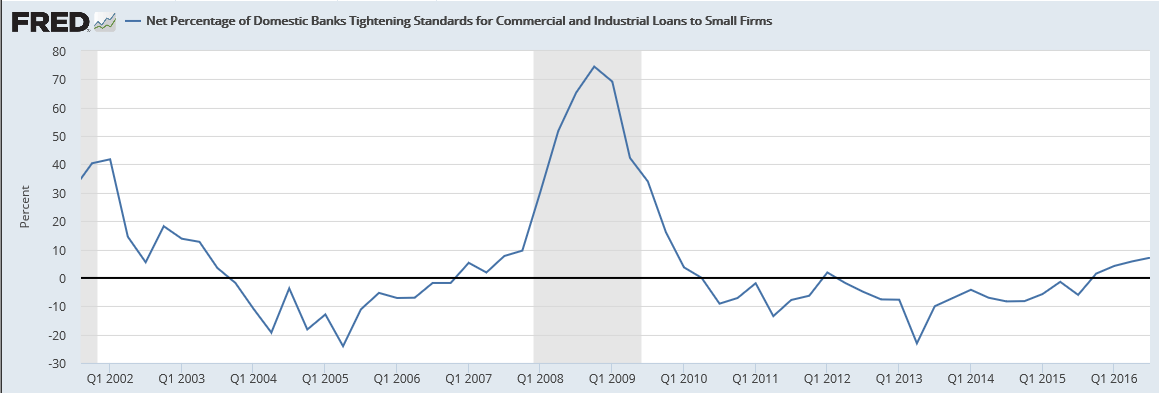

Bank credit tends to tighten up as the economy slows, which slows lending and makes matters worse.

The buzz word is ‘pro cyclical’:

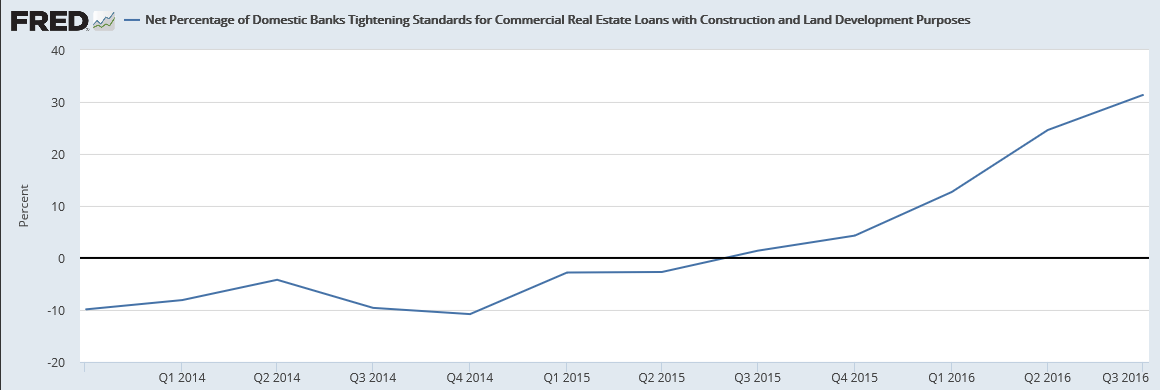

On net, domestic survey respondents generally indicated that their lending standards for CRE loans of all types tightened during the third quarter.6 In particular, a moderate net fraction of banks reported tightening standards for loans secured by nonfarm nonresidential properties, whereas significant net fractions of banks reported tightening standards for construction and land development loans and loans secured by multifamily residential properties.

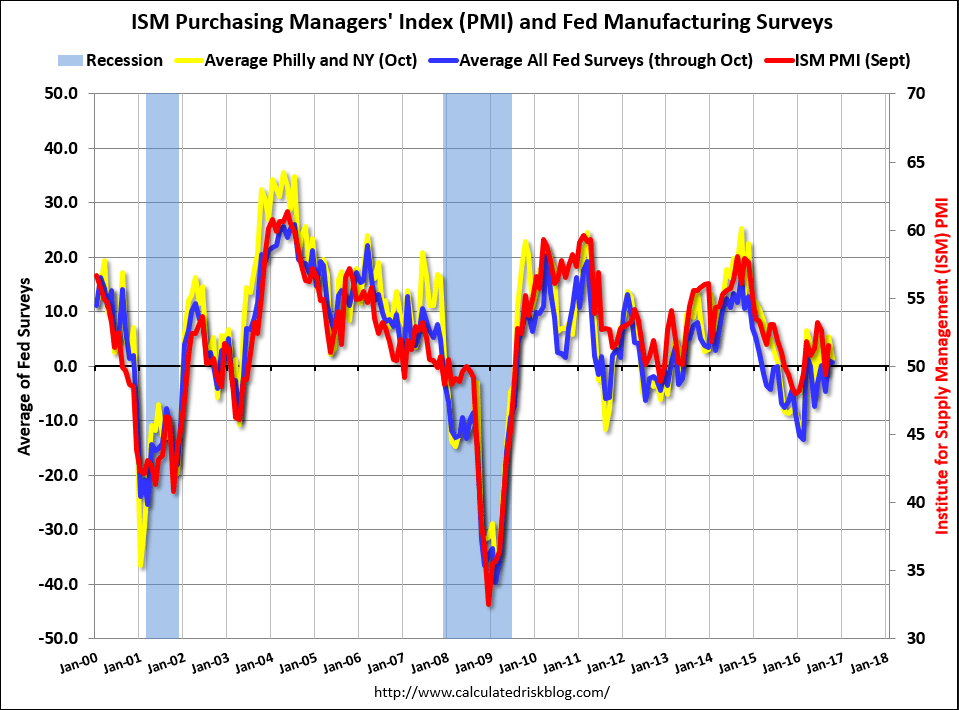

Read more at http://www.calculatedriskblog.com/#7PGBE67aLF27XSQ1.99

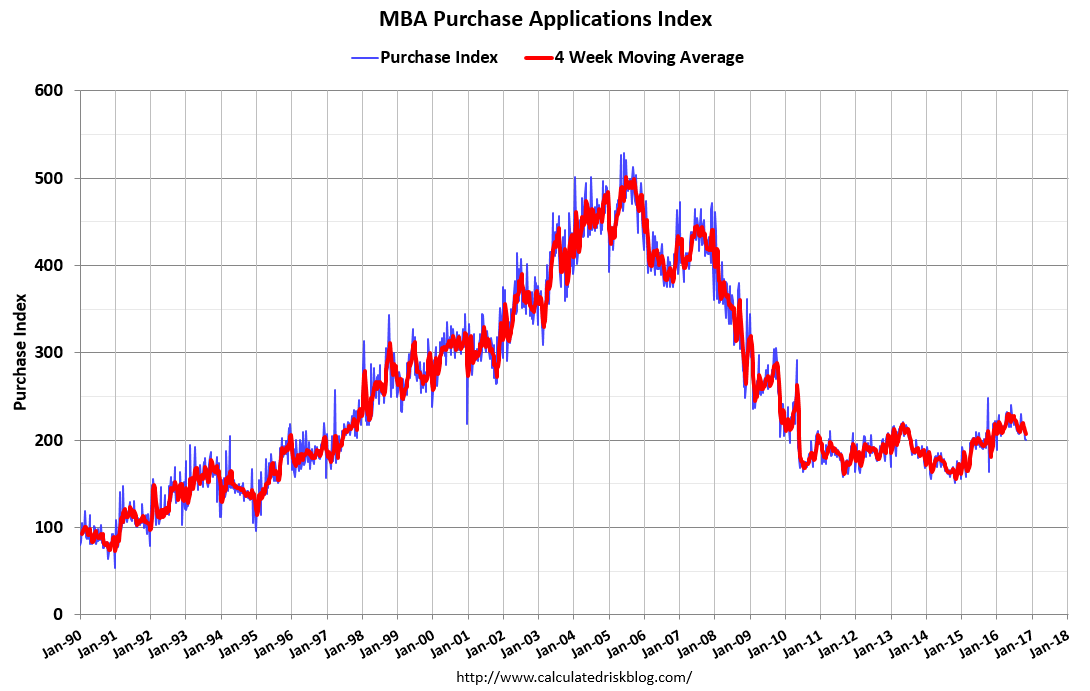

These are as of August 1, and have moved higher since as per the above text:

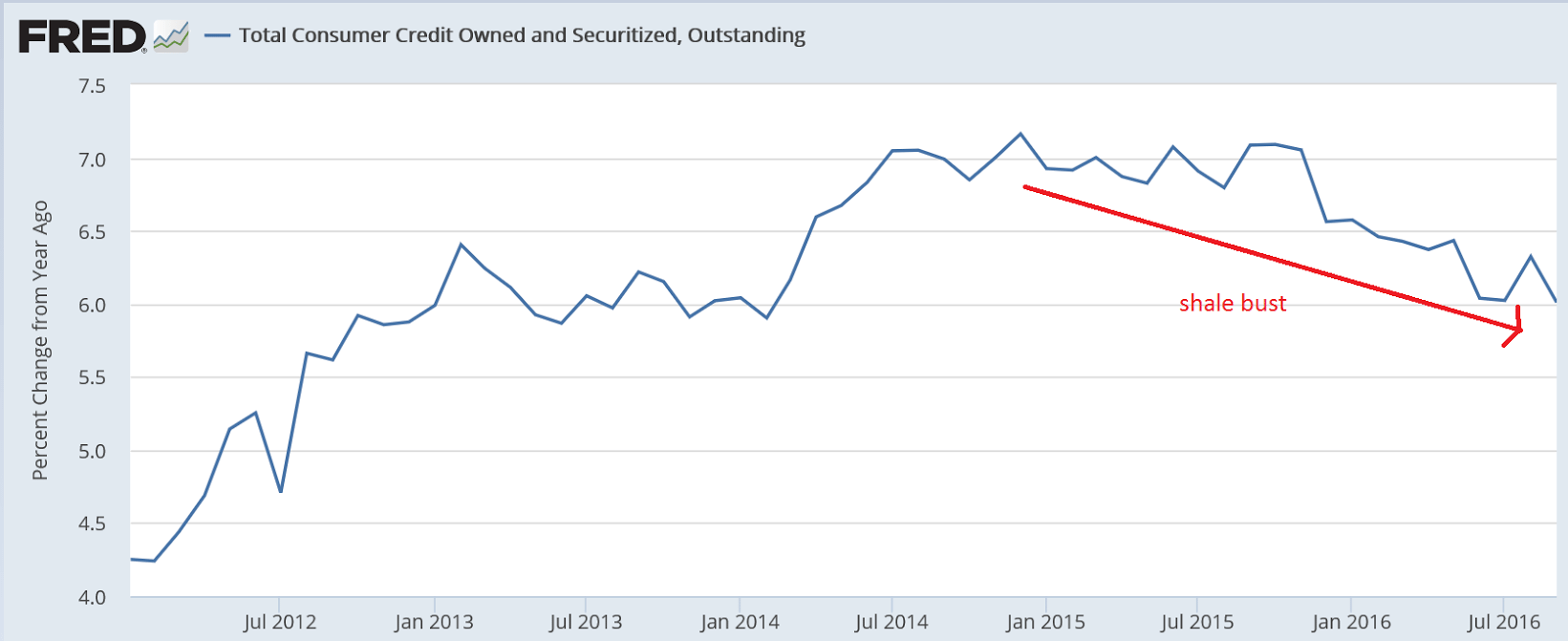

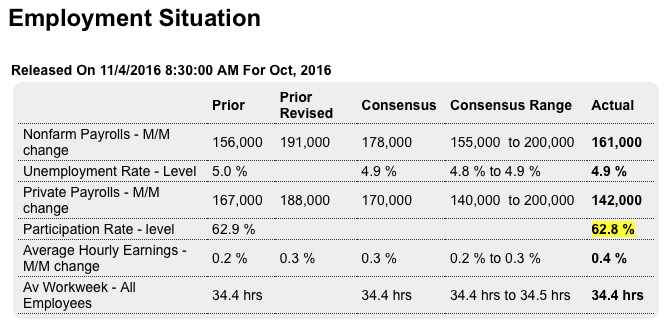

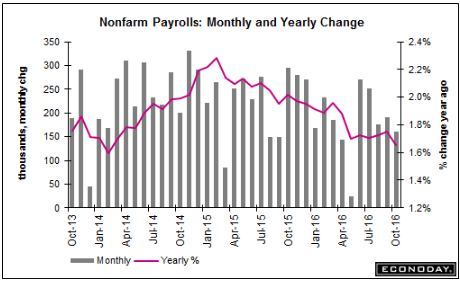

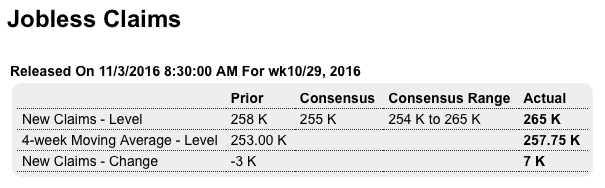

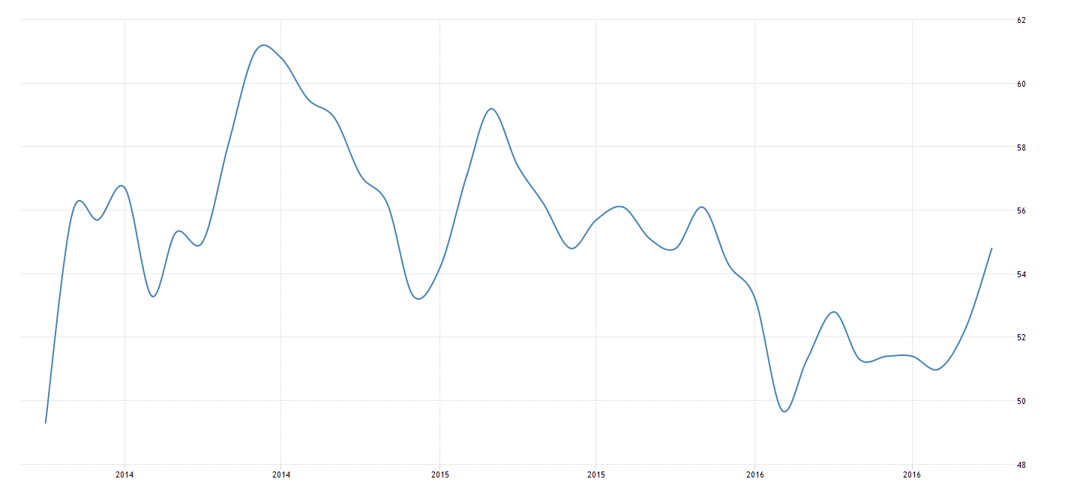

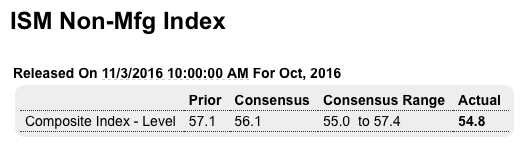

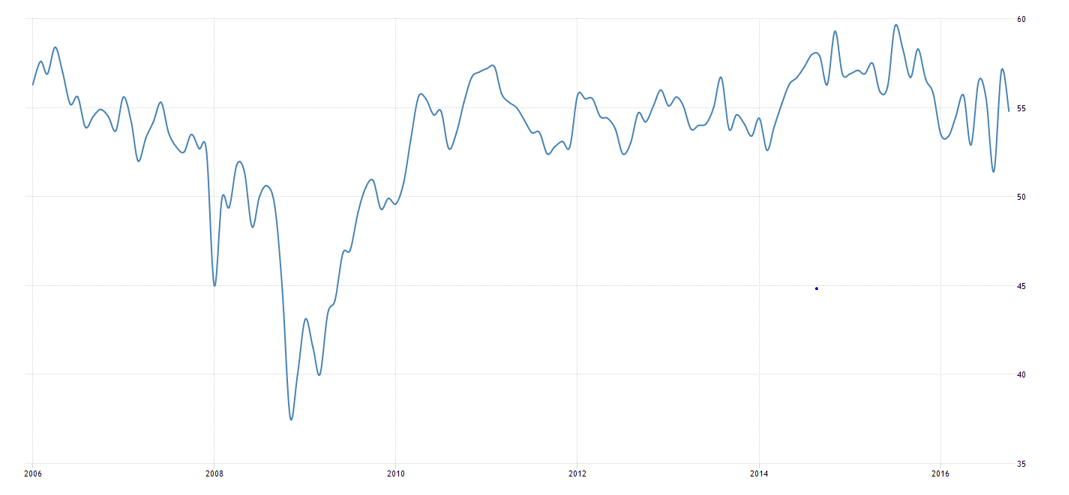

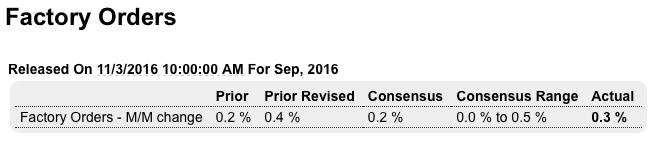

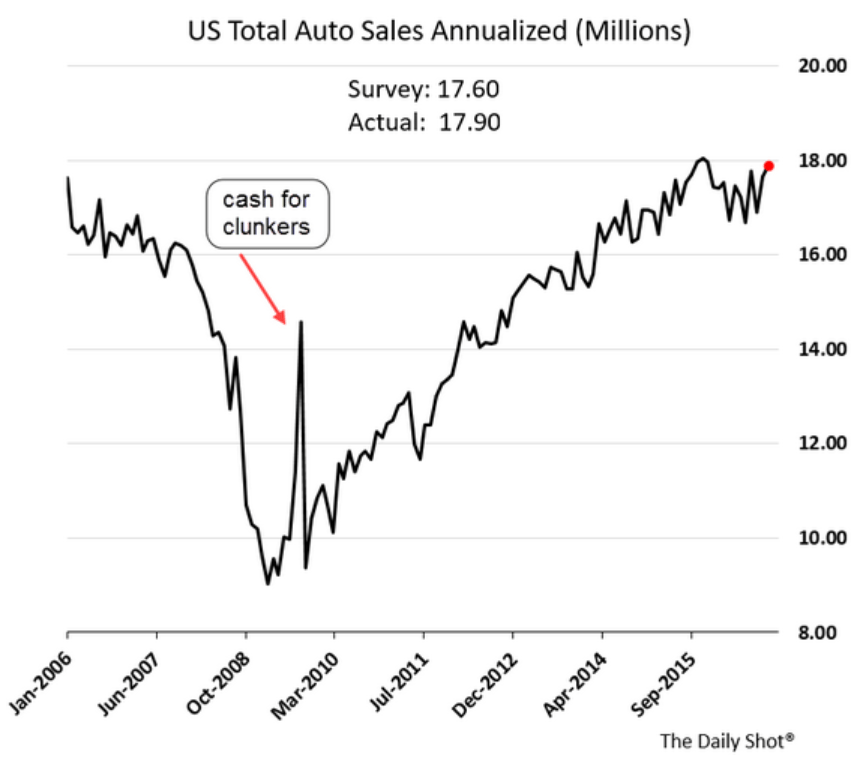

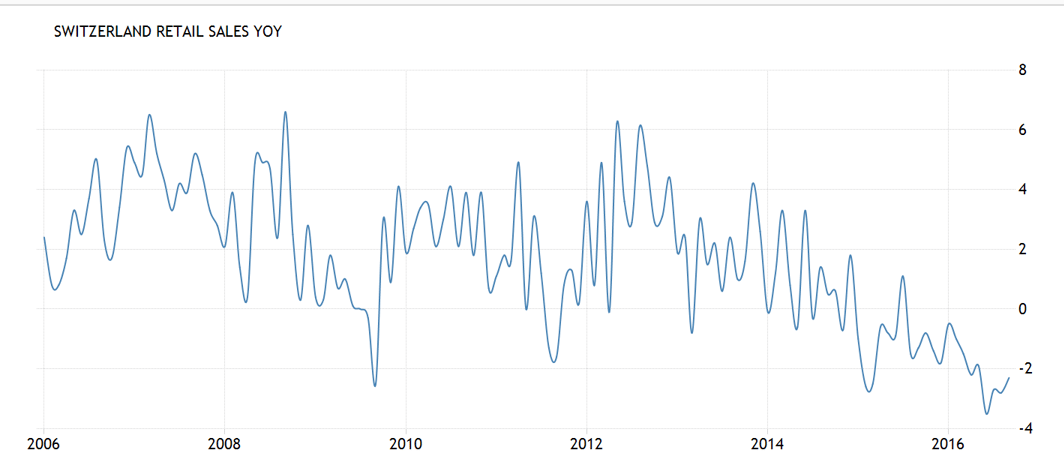

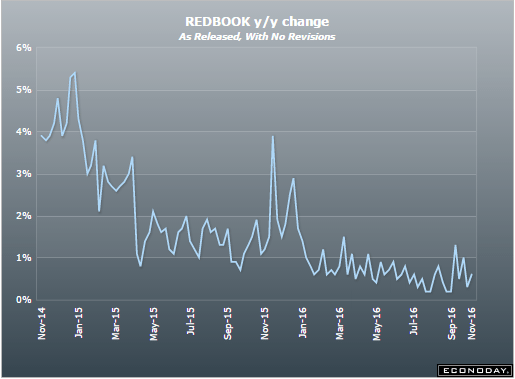

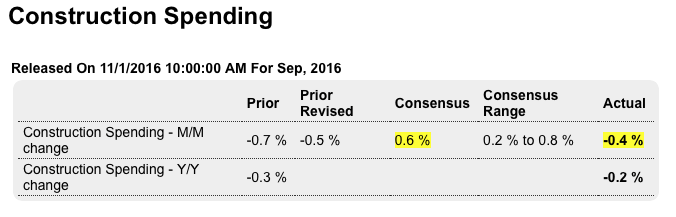

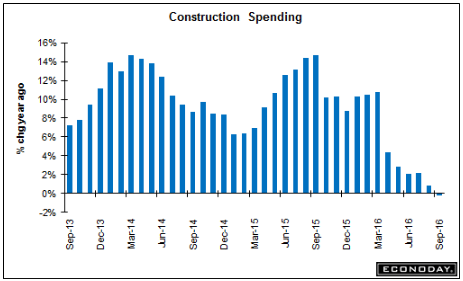

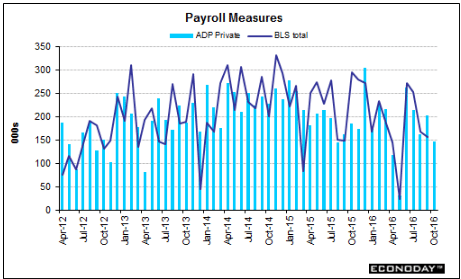

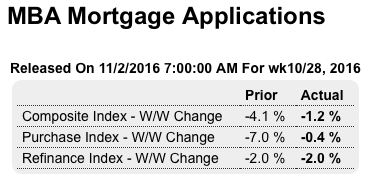

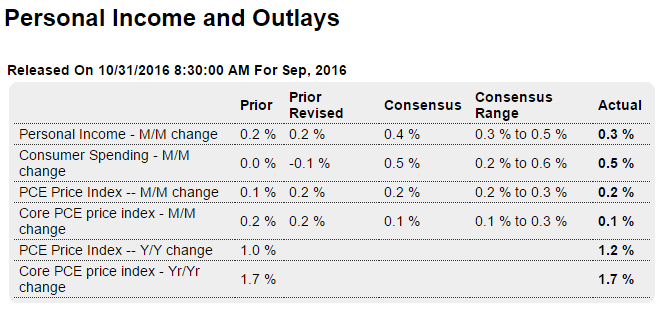

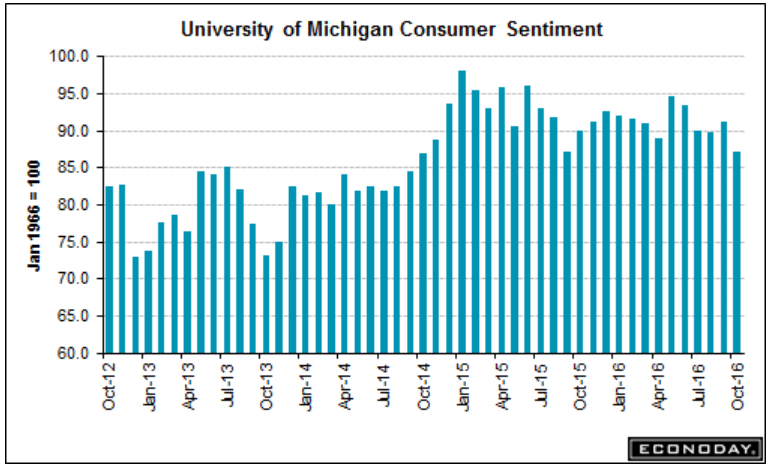

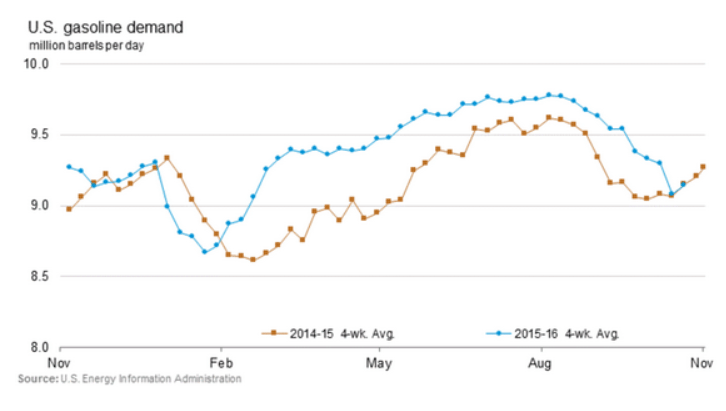

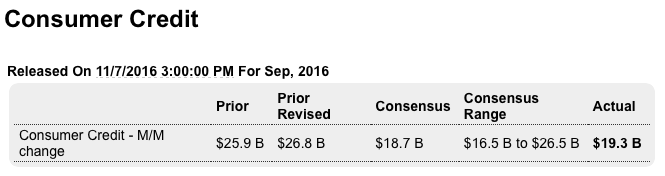

Close to expectations, no sign of any kind of meaningful increase in consumer spending:

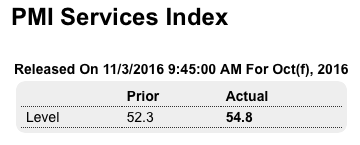

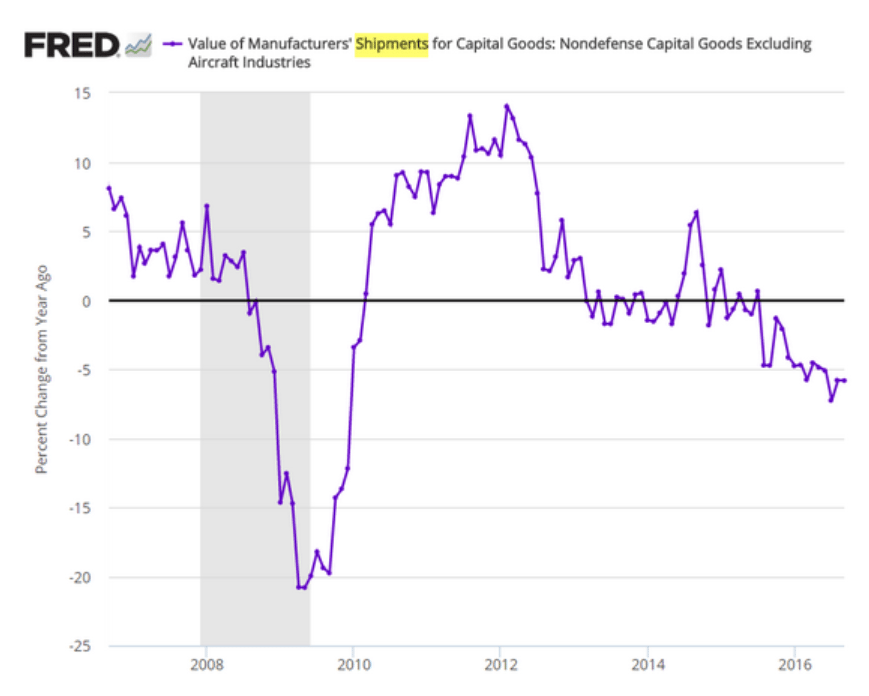

Remember, for GDP to grow just as fast as last year, on average the pieces have to grow just as fast. This one is decelerating to the extent it represents sales it is therefore subtracting from growth: