Still looks to me like the vote will have no material financial consequences?

“The UK will have to renegotiate 80,000 pages of EU agreements, deciding those to be kept in UK law and those to jettison. British officials have said privately that nobody knows how long this would take, but some ministers say it would clog up parliament for years.”

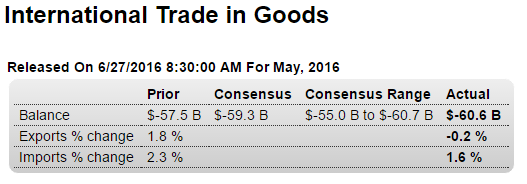

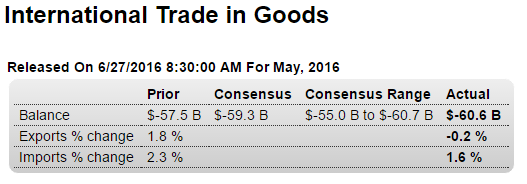

As previously discussed, the drop in oil prices led to increased consumer imports and reduced exports, both of which fundamentally work against the dollar:

Highlights

Goods exports were soft in May while at the same goods imports rose, making for a widening in the nation’s goods gap to $60.6 billion from April’s $57.5 billion. Exports fell 0.2 percent reflecting declines in auto exports and, unfortunately, capital goods exports as well. Imports rose a sharp 1.6 percent with imports of consumer goods especially strong in a gain that points to business confidence in U.S. retail expectations. Imports of industrial supplies show a large gain made larger by upward price effects tied to oil. But like the export side, capital goods imports were weak hinting at contraction in business investment and continuing trouble for productivity growth. Though the import data is consistent with strong domestic demand, exports point to soft global demand. Note also that the widening of May’s gap is a negative for second-quarter GDP.

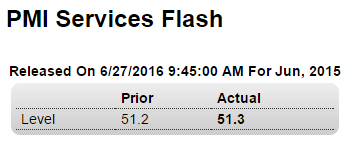

Still weak:

Highlights

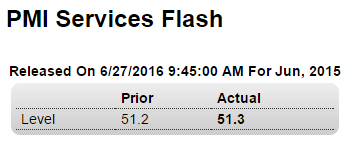

Service sector activity remains slow, little changed at an index of 51.3 for Markit’s June flash. New orders are picking up but remain soft while job creation is slowing for a third straight month. Confidence in the year-ahead outlook continues to moderate. Price data are subdued both for inputs and for selling prices. The bulk of the U.S. economy is chugging along at marginal rates of growth heading into Brexit fallout and ongoing market volatility.

By Stephanie Landsman

June 26 (CNBC) —

If Donald Trump becomes president and implements his current economic plan, Moody’s Analytics chief economist Mark Zandi said it would create dire consequences for the U.S. economy.

“The key thing is the very large budget deficits which would ensue under his plan,” Zandi recently told CNBC’s “Fast Money.”

The large deficits would add to output and employment, as every economist who gets paid to be right knows and incorporates into his forecasts.

That is, if congress increases the deficit by cutting taxes or increasing spending, GDP forecasts are always revised up accordingly.

Zandi, a former economic advisor to 2008 republican presidential candidate John McCain, is the man behind a new report that suggested a Trump presidency would send the economy spiraling into a recession. He cites the “massive tax cuts” in Trump’s plan as his plan’s biggest problem.

“Only a small part of that is paid for so you get very large budget deficits and much higher government debt—on top of an economy that’s already at full employment,” Zandi explained. That “results in much higher interest rates which combined with a lot of other things undermines corporate earnings and ultimately stock prices.”

All evidence shows increased deficits support higher earnings. And interest rates are set by the Fed, so they would go up only if the Fed votes to raise them. And the size of the deficit per se is not the driving force of the Fed’s reaction function.

And while headline unemployment is relatively low at 4.7%, he also knows that doesn’t mean there is no one left to be hired, particularly with the ultra low participation rates that contribute to the near 10% U6 rate of unemployment.

Zandi, who’s getting ready to release special analysis of Hillary Clinton’s economic plan, believes a watered-down Trump measure is the likeliest scenario if he wins the race for the White House. Zandi added that a less aggressive economic plan would still negatively alter the current economy’s state.

“I don’t think the Congress, no matter what it (the plan) looks like, would actually pass what he has proposed,” he said. “It’s pretty clear that everyone would end up in a pretty bad place.”

Moody’s isn’t the only one to find fault with Trump’s tax plan. Just months ago, the nonpartisan Tax Foundation said the real estate mogul’s tax and spending proposals were “unrealistic”, and could explode the U.S.’s debt burden.

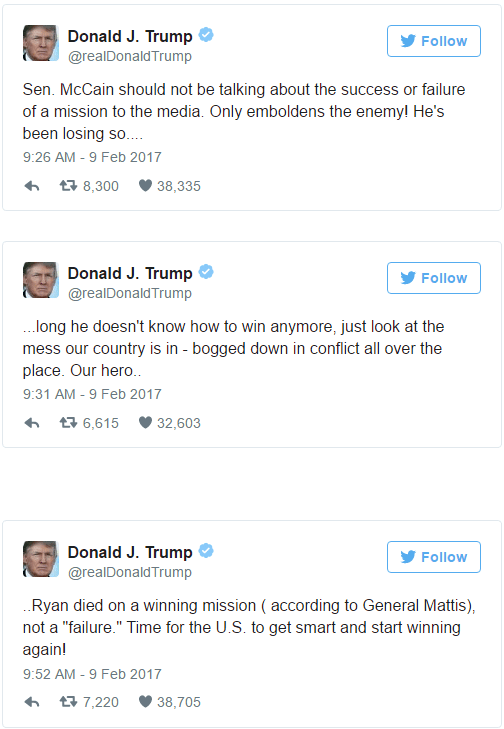

However, the Trump campaign took issue with Zandi’s research, firing back with salvos of its own.

“The errors in Zandi’s analysis are profound,” Trump campaign senior policy advisor Stephen Miller wrote in a statement released to CNBC.

“Closing the trade gap with China would create millions of jobs, as would lowering taxes, unleashing energy production, streamling regulations, and ending the fiscal drain of open borders,” Miller added.

Nor does any of that address Zandi’s point about the us being at full employment with no one left to hire.

Zandi, however, responded that his study is “error free.”

And they all miss the risk of depression should Trump attempt to execute his play to pay off the public debt in 8 years.

Instead, thinking that would be a good thing, it’s never addressed…