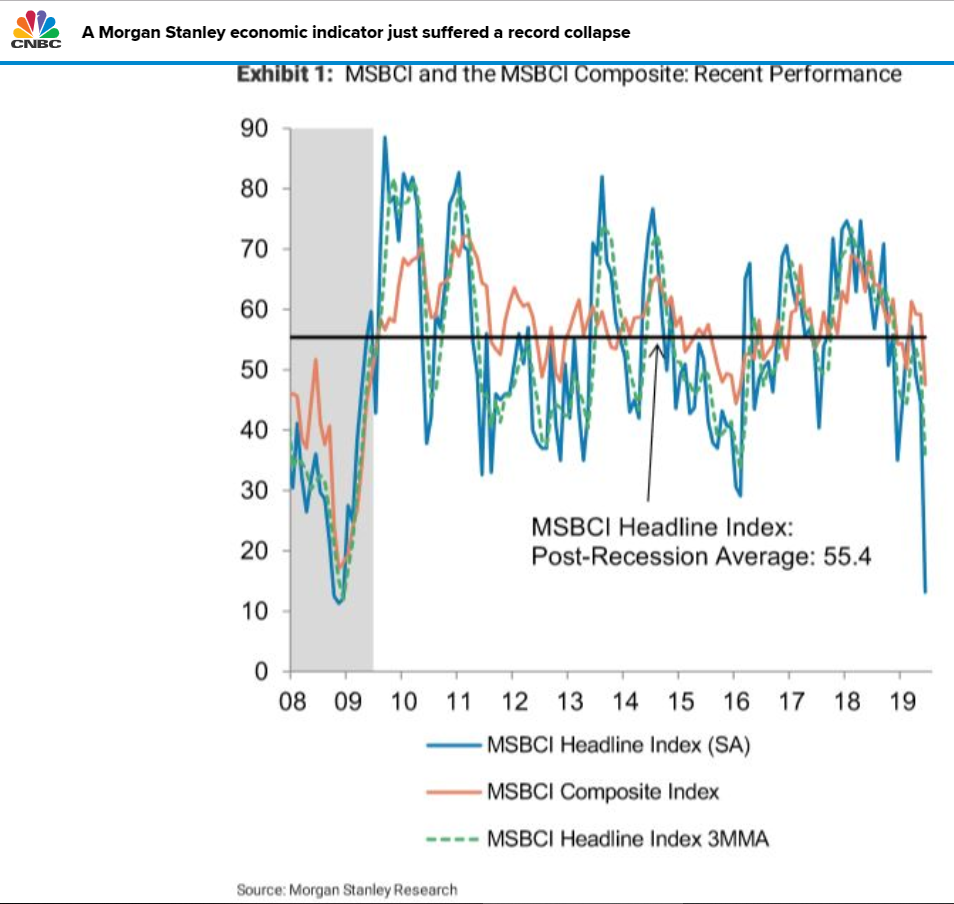

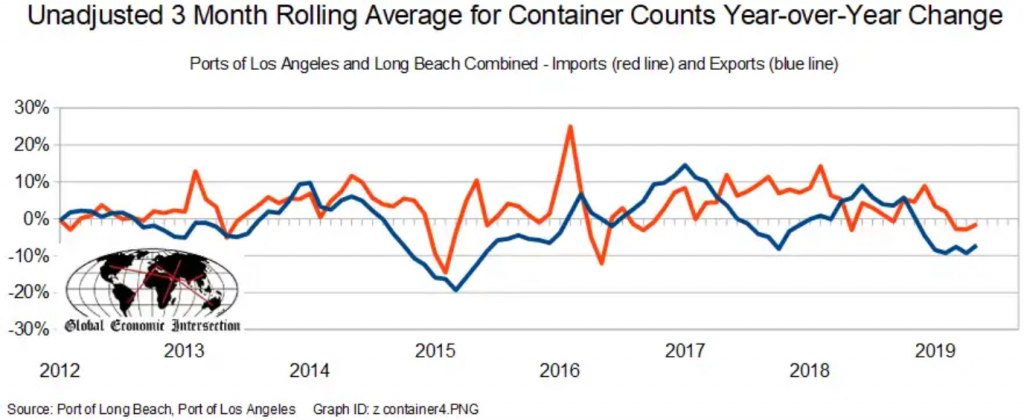

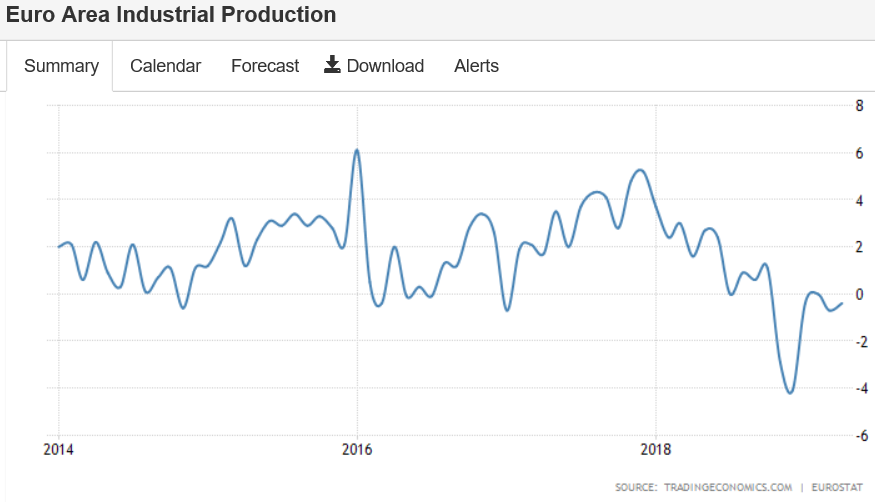

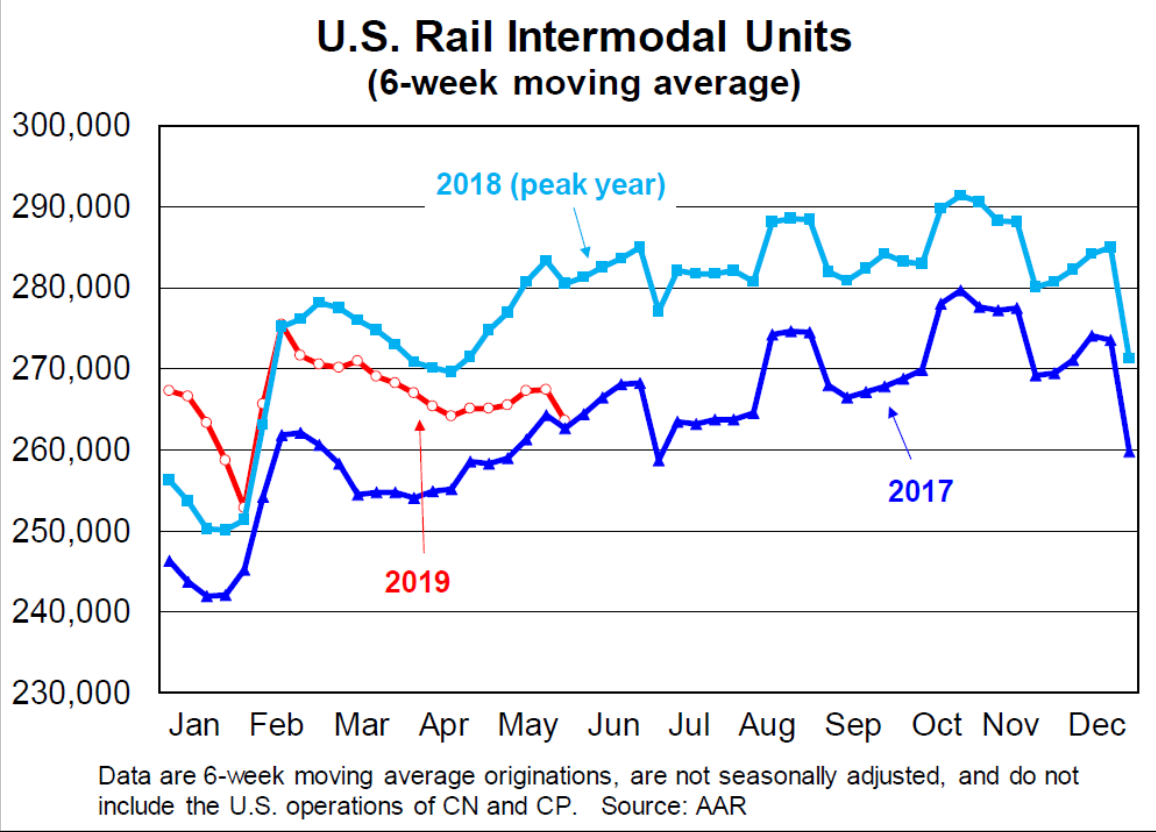

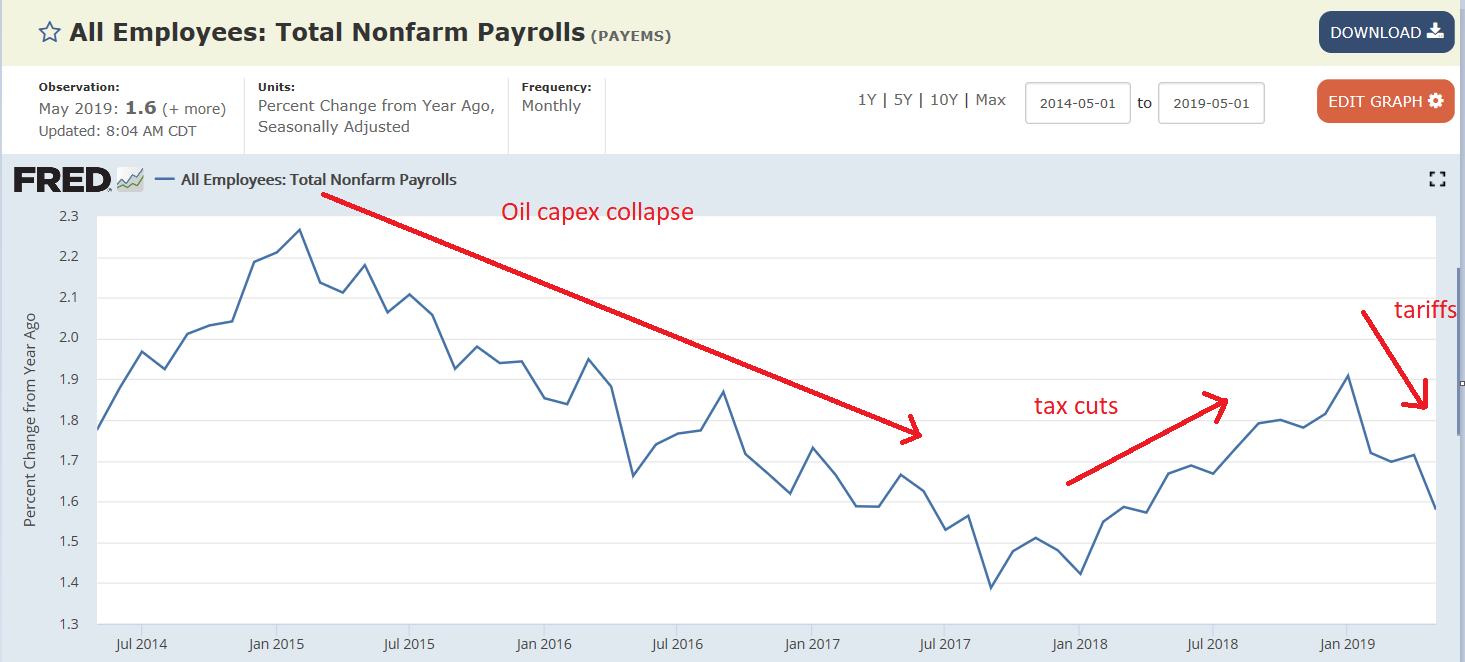

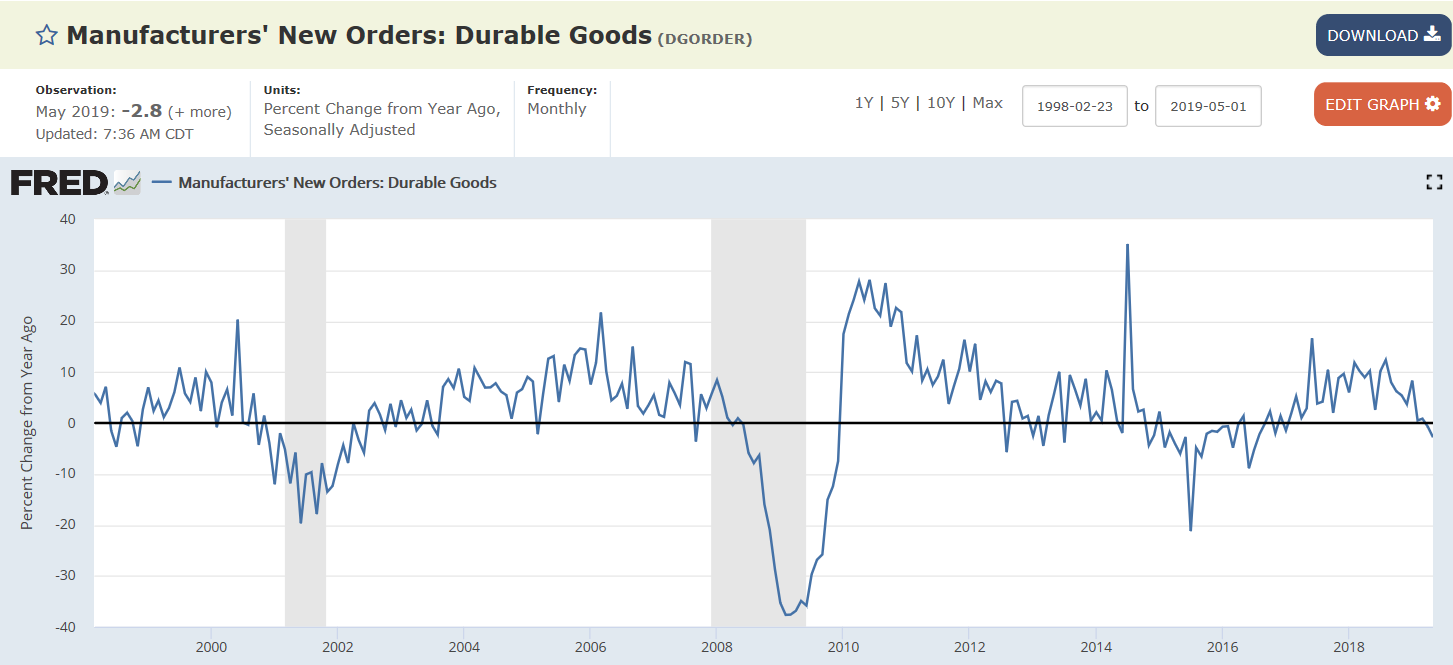

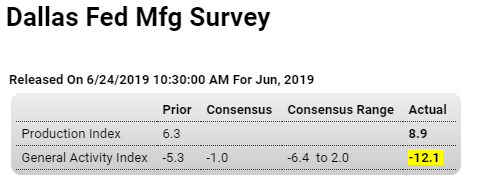

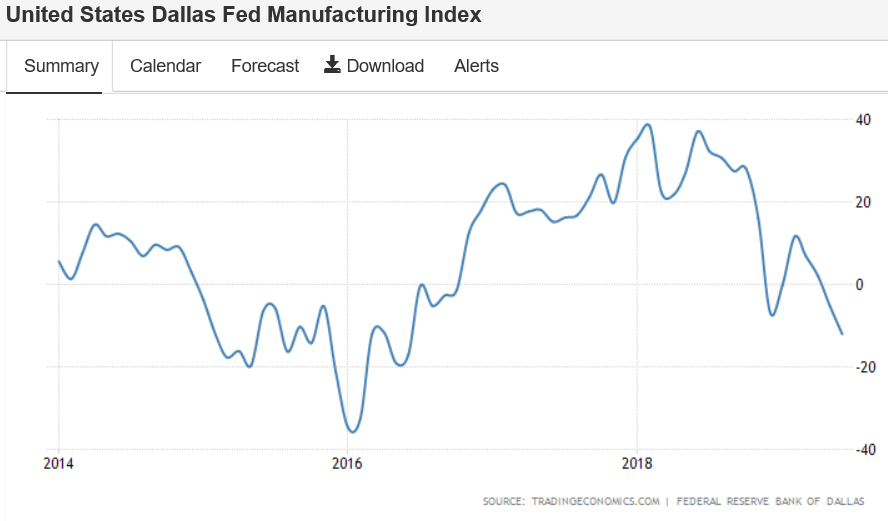

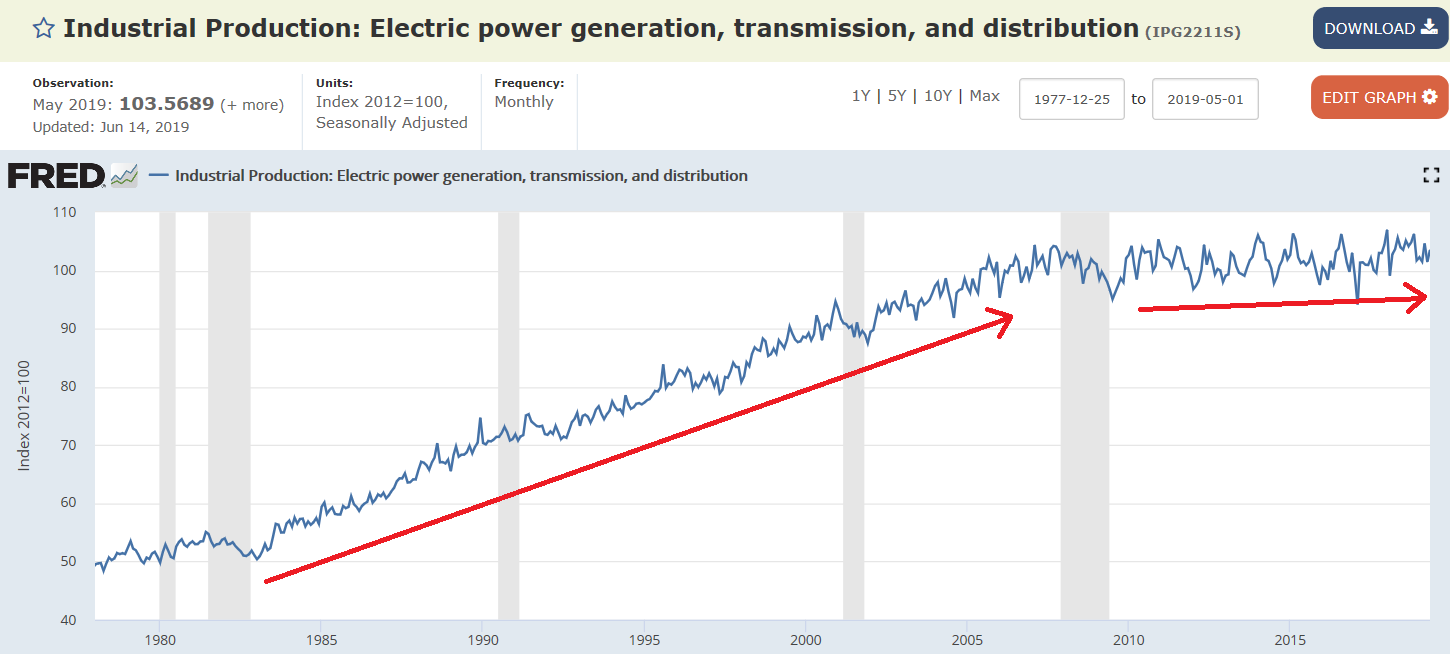

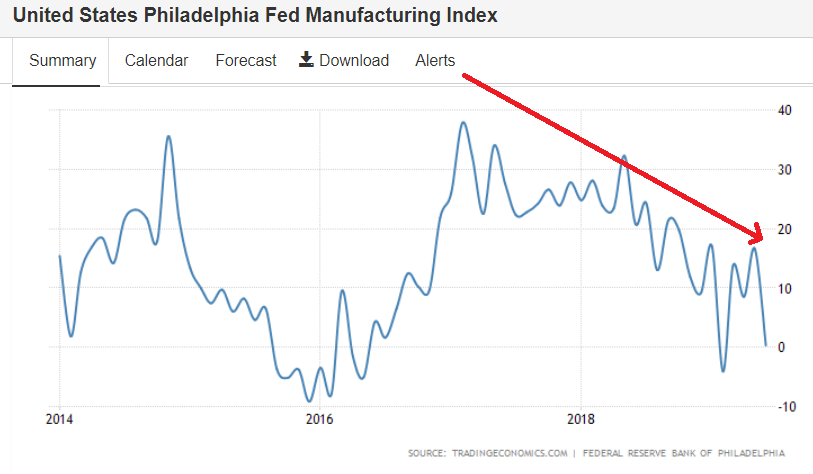

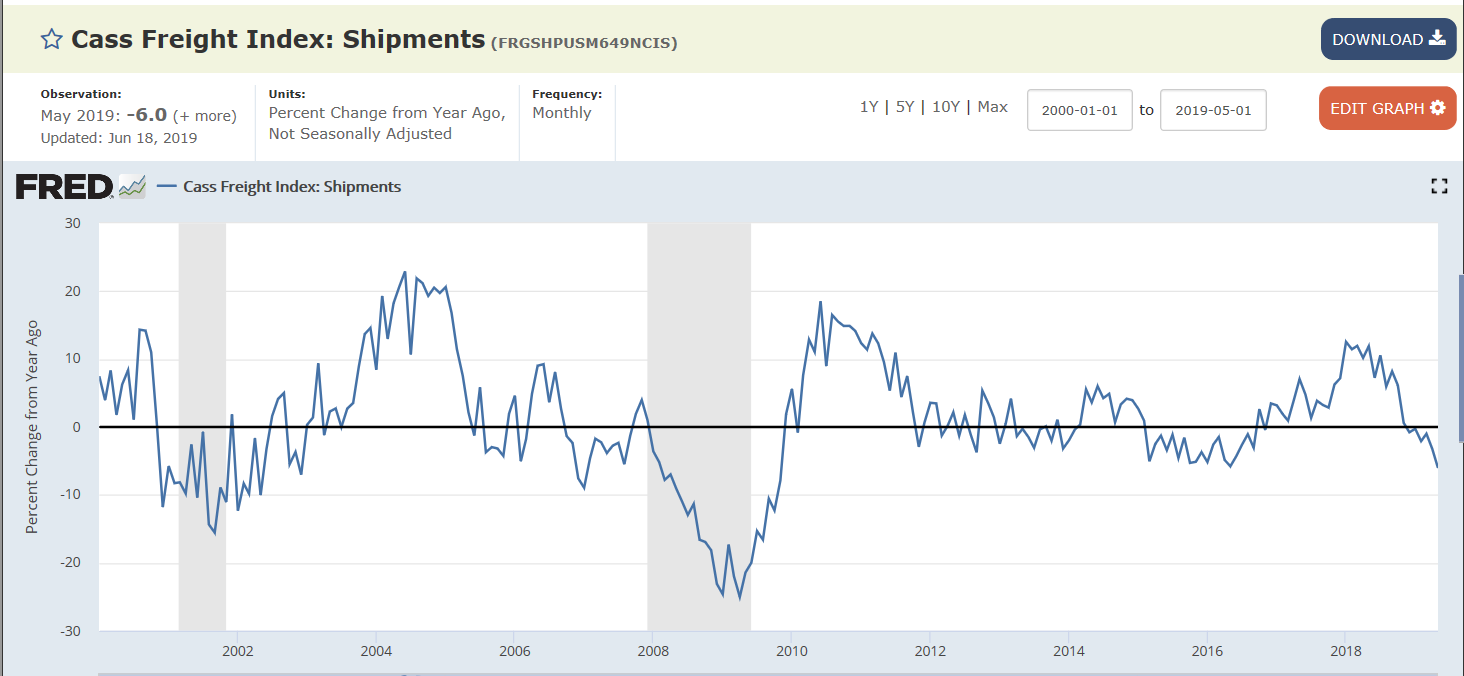

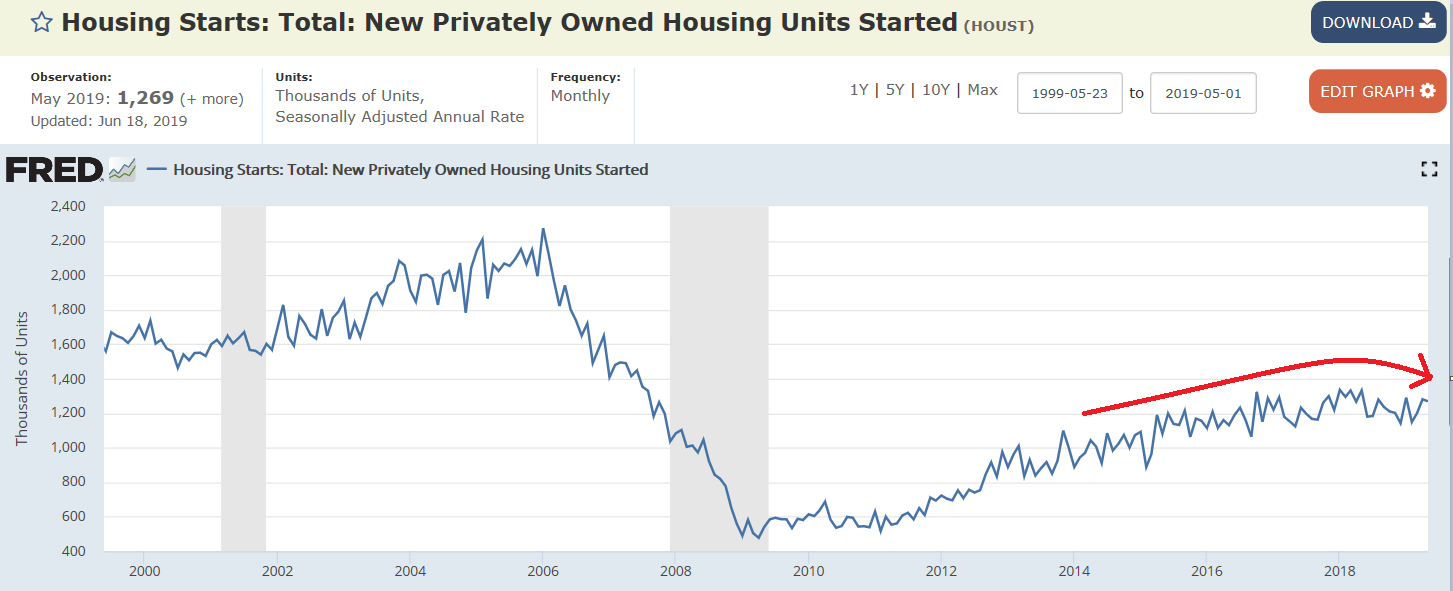

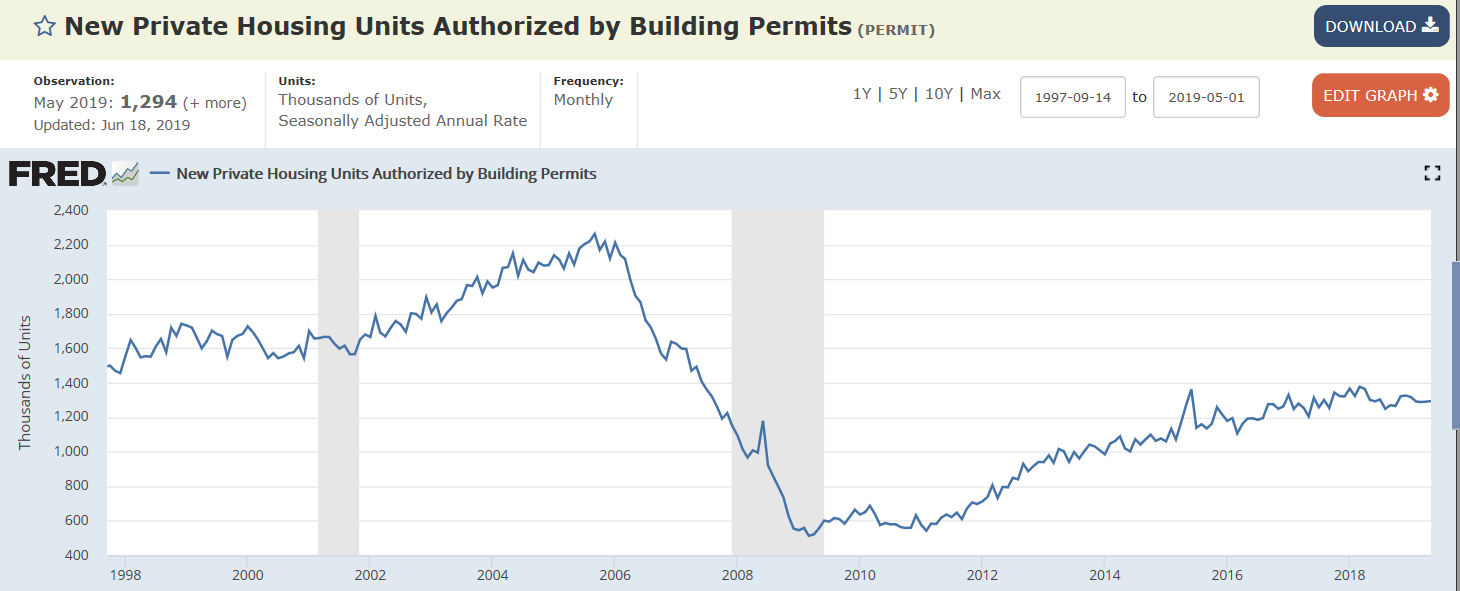

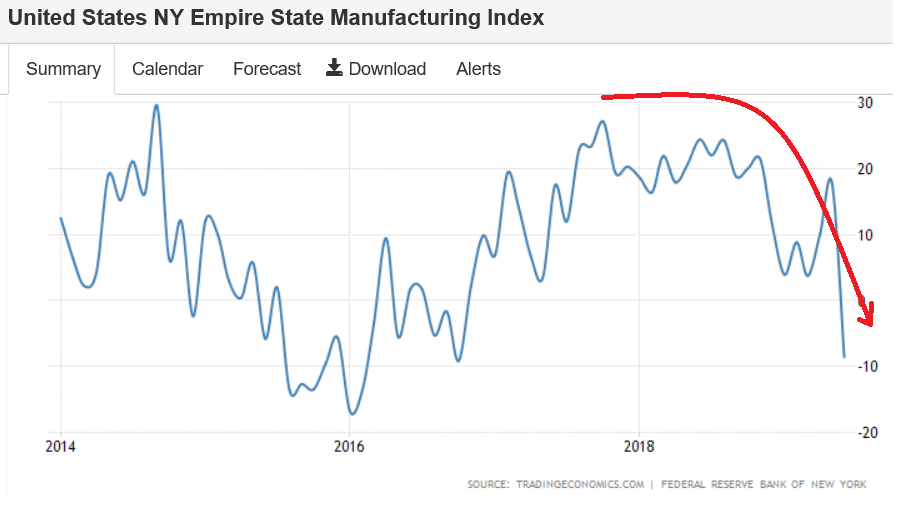

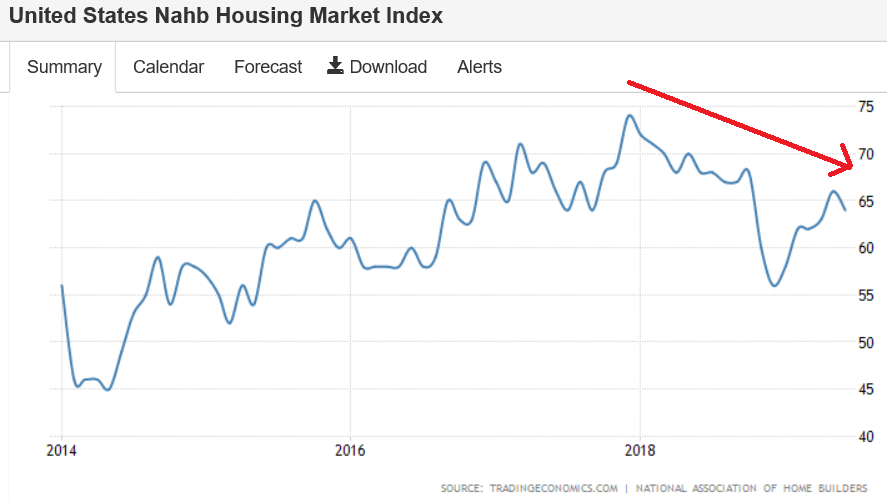

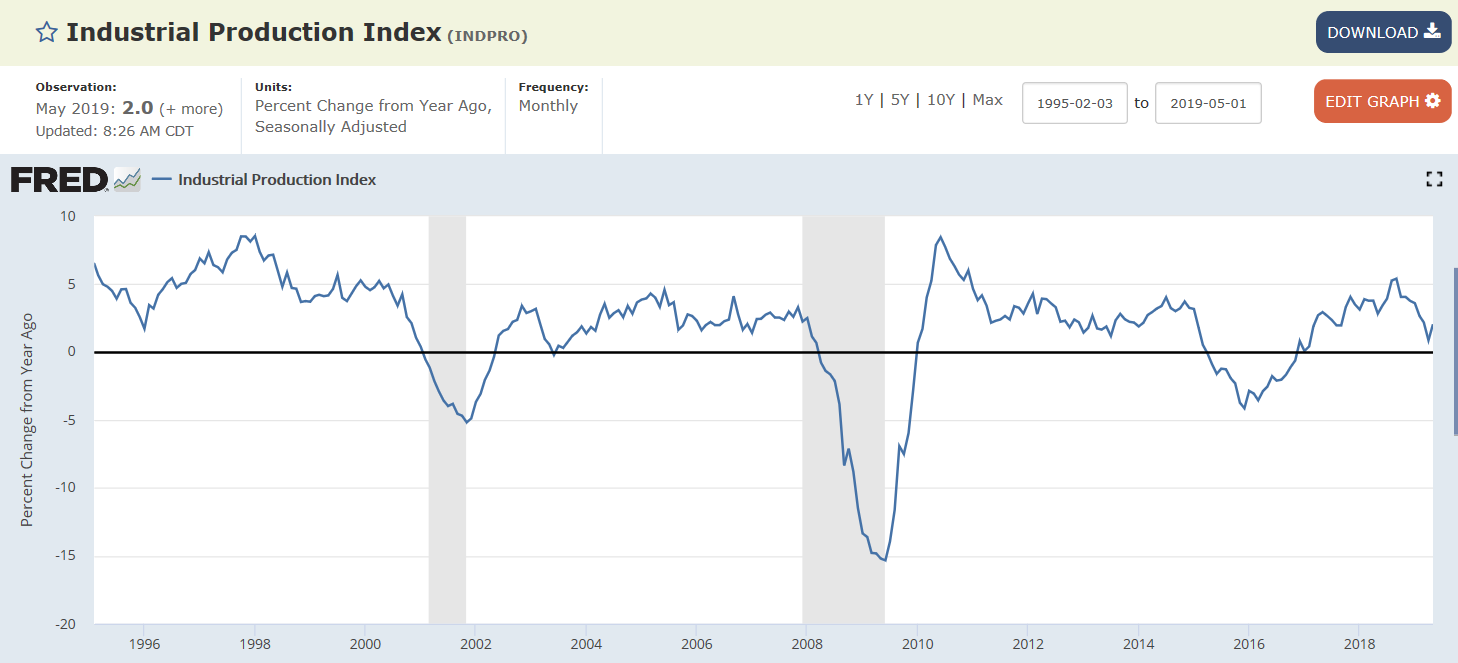

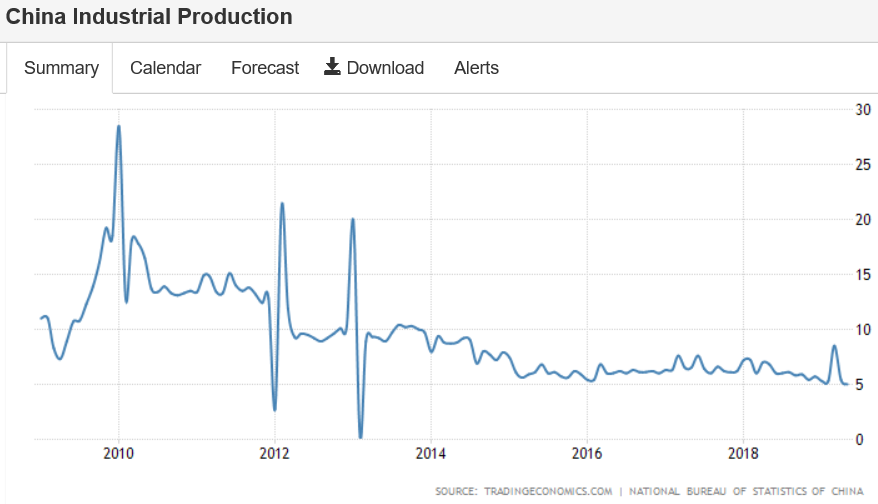

Now in contraction year over year:

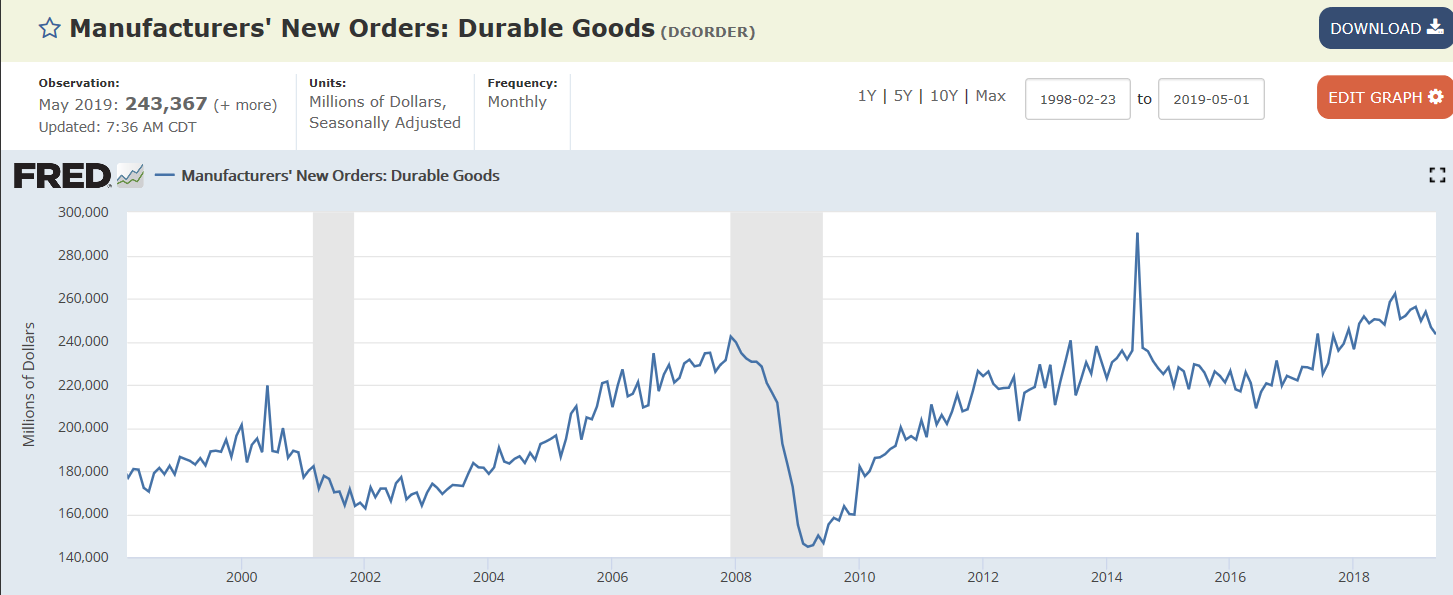

US Durable Goods Orders Drop for 2nd Month

New orders for US manufactured durable goods fell 1.3% in May, after a 2.8% plunge in April and much worse than market expectations of a 0.1% drop. Transportation equipment, down three of the last four months, was mostly responsible for the decline. Meanwhile, the so-called core capital goods orders rose 0.4%, recovering from a 1% decline in April.

Highlights

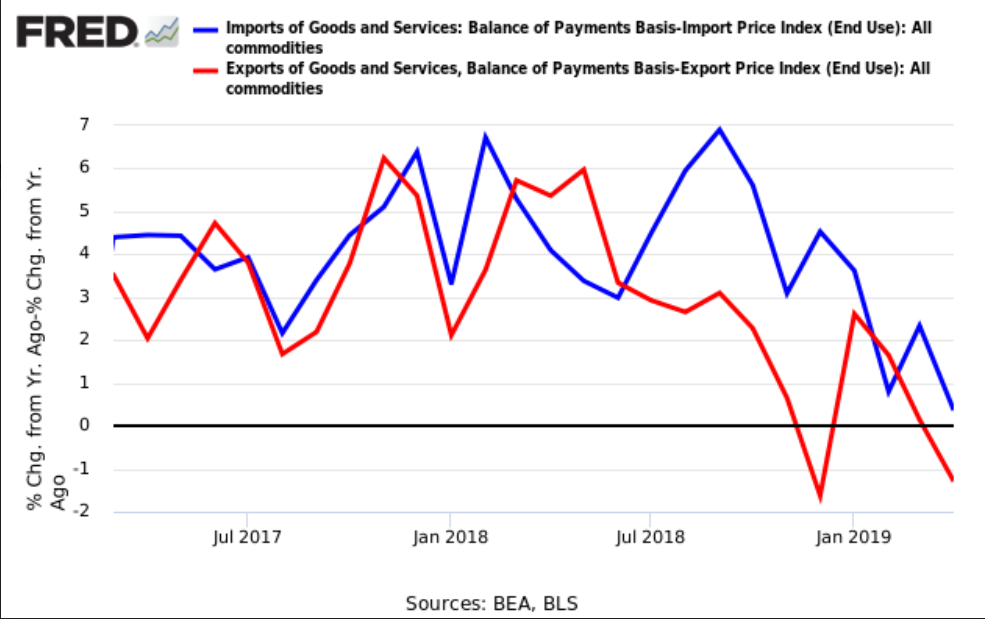

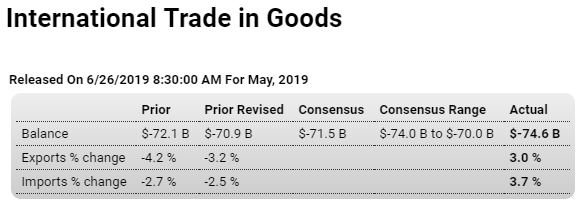

Net exports are not improving which looks to be a negative for second-quarter GDP. The US deficit in cross-border goods trade came in at a much deeper-than-expected $74.6 billion masking, however, a strong 3.0 percent rise in exports to $140.2 billion. But imports outmatched the rise with a 3.7 percent increase to $214.7 billion.

Exports of foods, feeds & beverages are a major plus for May, up 6.1 percent to $11.9 billion though year-on-year contraction is still substantial at minus 9.1 percent. Capital goods exports are also strong, up 3.5 percent to $46.3 billion with this yearly contraction at 3.8 percent. Vehicle exports rose 4.7 percent to $13.8 billion and show a 1.5 percent yearly gain.

Imports of foods fell 0.5 percent in May to $12.8 billion with all other categories, however, showing sharp increases especially vehicles at a 7.5 percent monthly gain to $33.2 billion for a yearly increase of 10.9 percent. Consumer goods imports rose 2.7 percent to $55.5 billion in the month but are down 2.4 percent on the year.

Dementia setting in?

Trump says big tech companies like Twitter are ‘all Democrats’ and purposely repressing his reach

“Twitter is just terrible, what they do. They don’t let you get the word out,” Trump tells Fox Business Network. “I’ll tell you what, they should be sued,” Trump says.

Twitter and Facebook have doubled down on efforts to remove comments and accounts suspected of hate speech as well as those thought to be bots.

“These people are all Democrats,” Trump says. “If I announced tomorrow that I’m going to become a nice liberal Democrat, I would pick up five times more followers.”

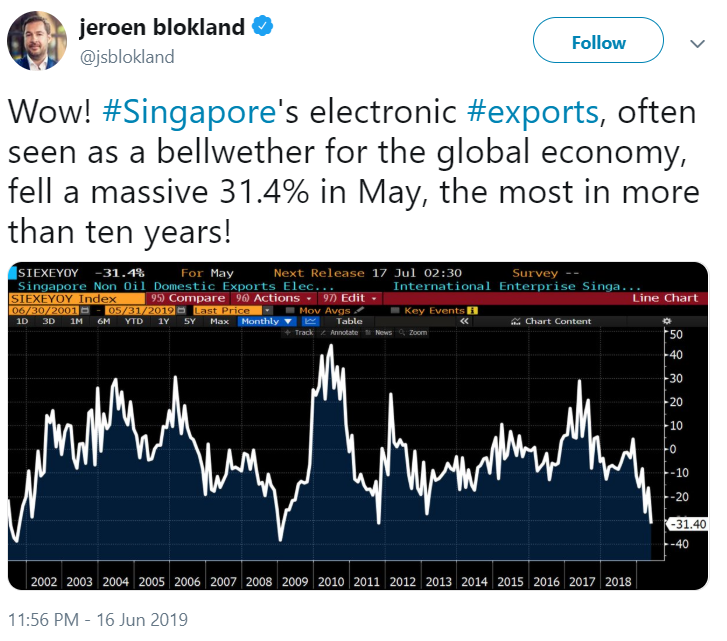

$300 billion tariff threat looming over the G-20 meeting between Trump and Xi

President Trump’s threat to impose punishing new tariffs on $300 billion in Chinese goods looms over a meeting scheduled this week between him and Chinese President Xi Jinping at the G-20 summit of world leaders.

The two are scheduled to meet Saturday, the second day of the two-day summit in Osaka, Japan.

Both leaders stand to benefit from a deal that staves off new tariffs. But hardliners in Beijing and Washington are pressing for further isolation, fueled by concerns over the two global powers’ rivalry in economic and military matters.

.

.