Looks like the Saudi gift to the US economy might have been short lived?

No telling what they are up to…

Looks like the Saudi gift to the US economy might have been short lived?

No telling what they are up to…

Saudi production up a tad for July.

With the Saudis posting prices and letting their clients buy all they want at the posted prices, this shows marginal global net demand has yet to fall off, and, in fact increased a bit.

And, if Saudi excess capacity isn’t as high as the 12.5 million bpd reported a relatively small supply disruption could result in an immediate spike in price.

This was about to be seriously disruptive:

Norway intervenes to avert oil industry closure

By Mia Shanley and Dmitry Zhdannikov

July 9 (Reuters) — Norway’s government ordered on Monday a last-minute settlement in a dispute between striking oil workers and employers in a move to alleviate market fears over a full closure of its oil industry and a steep cut in Europe’s supplies.

The strike over pensions had kept crude prices on the boil with analysts expecting far quicker action by the government to stop the oil industry from locking out all offshore staff from their workplaces from midnight (2200 GMT) on Monday.

Oil markets breathed a sigh of relief on news of the intervention and crude prices dropped in early Asian trade.

Under Norwegian law, the government can force the striking workers back to duty and has done so in the past to protect the industry on which much of the country’s economy depends.

But it was slow to intervene in the latest dispute, which was in its third week, and did so on Monday only minutes before the start of the lockout, citing potential economic consequences.

“I had to make this decision to protect Norway’s vital interests. It wasn’t an easy choice, but I had to do it,” Labour Minister Hanne Bjurstroem told Reuters after meeting with the trade unions and the Norwegian oil industry association (OLF).

A full closure of output in Norway – the world’s No. 8 oil exporter – would have cut off more than 2 million barrels of oil, natural gas liquids (NGL) and condensate per day.

But the minister said her main concern was the potential cut in gas supplies. Norway is the world’s second-biggest gas exporter by pipeline, with the majority of supplies going to Britain, the Netherlands France and Germany.

“This could have had serious consequences for the trust in Norway as a credible supplier,” she added.

The oil and gas industry makes up about one-fifth of Norway’s $417 billion economy.

Leif Sande, leader of the largest labour union Industri Energi, representing more than half of 7,000 offshore workers, said workers would return to work immediately.

“It’s very sad. The strike is over,” he told journalists.

The dispute has raised eyebrows in Norway, where oil and gas workers are already the world’s best paid, raking in an average $180,000 a year. Offshore workers clock 16 weeks a year but cite tough conditions for their call for early retirement at 62.

The oil industry had refused to budge.

“I am very happy that the minister chose to end a conflict that has cost Norway and the oil companies large sums,” said Gro Braekken, leader of the OLF.

The OLF said the 16-day strike came at a cost of some 3.1 billion Norwegian crowns ($509 million).

The next step is compulsory arbitration to define a new wage agreement.

“With this decision we can see that whenever the oil industry says jump, the government listens,” Hilde Marit Rysst, leader of union SAFE, told Reuters. “We will never leave this issue – it is completely unthinkable to stop fighting for those who are worn out at 62.”

She said unions would push their issues at the next suitable opportunity.

Norway is keen to retain its image as a reliable supplier of energy, but analysts have said the Labour-led coalition government was slow to intervene as it faces general elections in a year, and labour unions are important partners.

On Monday, Labour Minister Bjurstroem said she believed the lockout was not necessary and the oil industry will have to take responsibility.

About 10 percent of the 7,000 offshore workers have been on strike since June 24.

Brent crude dropped more than $1 to below $99 per barrel in early Asian trade on Tuesday on news of the intervention, after surging to above $101 on supply fears in the previous session.

The strike had choked off some 13 percent of Norway’s oil production and 4 percent of its gas output.

State-controlled Statoil, which operates the affected fields, said it would resume production immediately and would be back at full capacity by the end of the week.

The last lockout in the offshore sector occurred in 1986, shutting down production on the Norwegian continental shelf completely, and lasted for three weeks before the government intervened. In 2004, the center-conservative government stepped in to avert a lockout. ($1 = 6.0881 Norwegian crowns)

This could send crude up to whatever price it takes to immediately reduce world consumption by the amount of the cutbacks.

In addition to the additional anticipated Iranian cutbacks.

Releasing strategic reserves could contain prices until production resumed.

Norway Oil Industry Calls Lockout to End Strike

By Vegard Botterli and Nerijus Adomaitis

July 5 (Reuters) — Norway’s oil industry moved to lock out all offshore workers on the Norwegian continental shelf on Thursday, aiming to get the government involved and put an end to a near two-week strike that has hit crude exports and helped push up prices.

While a lockout would mean a complete shutdown of oil and gas production in Norway, the world’s eighth-biggest crude exporter, analysts expected the government to intervene, end the strike and prevent a full closure.

“The conflict is deadlocked, and the demands are unreasonable … Unfortunately, we see no other course than to notify a lockout,” the Norwegian oil industry association (OLF) said in a statement.

Some 6,515 workers covered by offshore pay agreements will be locked out from their workplaces with effect from July 10.

The strike, which began June 24, has already slowed crude exports, cut Norway’s oil production by around 13 percent and its gas output by around 4 percent. News of the lockout sent Brent crude futures up to as high as $102.34 a barrel. They were trading at $101.03 at 1458 GMT.

“The likelihood is that the strike will end sooner than expected,” Commerzbank analyst Carsten Fritsch said.

State-controlled Statoil said the lockout would cause a production shortfall for the company of around 1.2 million barrels of oil equivalent (boe) per day and 520 million Norwegian crowns ($86.6 million) in lost revenues per day.

The Norwegian government declined to say whether it would intervene but called the lockout legitimate.

“A lockout is still a part of the legal strike. We are continuing to follow the situation closely,” Gro Oerset, senior adviser at the labour ministry, told Reuters.

Several North Sea oil traders on Thursday were in agreement in expecting the strike to end soon.

“It seems like Statoil is trying to get the government to settle it,” said one.

INTERVENTION?

The government has the authority to force an end to strikes if it believes that safety is being compromised or vital national interests could be harmed and has done so in the past to protect Norway’s image as a reliable energy exporter.

Analysts expect the government to intervene. In 2004, it intervened one day after the oil industry called a lockout.

“A repeat is likely, and if not there will be some SPR (Strategic Petroleum Reserve) release, but the most likely outcome is now a Norway government intervention,” Switzerland-based Petromatrix energy consultancy said in a note.

The Labour-led coalition government has been reluctant to intervene as it faces general elections in a year, and labour unions are important partners.

“I can’t imagine they can accept that the entire production on the Norwegian shelf is shut down for even a minute,” SAFE trade union leader Hilde-Marit Rysst told Reuters.

No new talks are planned between the parties, the state mediator said.

The International Energy Agency said on Thursday it was monitoring the summer oil supply situation very closely.

“We really hope that the sides can reach an agreement by Monday night in order to avoid a prolonged and more widespread outage,” IEA executive Maria van der Hoeven said in a webcast.

EXPORTS SLOWED

The strike initially shut production at the Oseberg and Heidrun fields. Oseberg in particular is significant for oil prices, because it is part of the North Sea Brent benchmark used as the basis for many of the world’s trades.

Oil traders said on Thursday the loading of Oseberg cargoes would be delayed by at least a few days in July, although exact loading dates were unclear because Statoil has not issued a revised July export programme.

An Oseberg cargo scheduled to load on July 1-3 has yet to do so, a source familiar with the matter said. The delay, as reported by Reuters on Monday, was the first sign of an impact of the strike on exports.

An August export plan for Oseberg was expected to be released on Friday, but trade sources said this would not appear until production resumed.

In an apparent expectation of business as usual, however, Statoil on Thursday issued an August loading programme for oil from its Troll field, scheduling a normal export rate. A trading source provided a copy of the loading plan.

Wage talks broke down on June 24 after the OLF refused to negotiate an early retirement scheme for the sector’s 7,000 workers. A second attempt at reaching a deal ended unsuccessfully on Wednesday over pensions.

Hays Oil & Gas said in a recent report Norwegian oil and gas workers were the best paid in the world, followed by Australia, Brunei and the Netherlands. They earn more than twice the average salary of all countries surveyed and more than double workers in Britain.

Harsh working conditions mean that offshore workers, in particular, are among the best paid industrial workers in Norway. Their 12-hour shifts last for two weeks and are followed by four weeks of leave, making for a total of 16 weeks of work a year, excluding overtime.

But the main sticking point for unions is an early retirement age for offshore workers of 62, below the standard 67. Top executives at Statoil are currently eligible for retirement at 62.

The OLF has argued their demands are not in line with government pension reforms.

In May Norway produced 1.6 million barrels of oil per day, and 8.9 billion cubic metres of gas in total.

Interesting dynamic at work.

Saudis set a spread vs other grades.

But there is a ‘market spread’ that reflects ‘quality’.

So if they set their spread too low, demand for Saudi crude is higher than otherwise, which causes prices to fall for the other producers as they always sell all of their output at ‘market prices’. That is, a ‘too tight’ price spread puts downward pressure on prices.

Likewise, if the Saudis set their spread ‘too wide’, that increases demand for the other producers who are all at full capacity, and therefore drives up prices. So a ‘too wide’ spread puts upward pressure on crude prices.

And, with ‘market spreads’ continuously fluctuating, any given spread set by the Saudis can shift between bullish to bearish at any time.

Very clever, those Saudis!

July 4 (Bloomberg) — Saudi Arabian Oil Co., the world’s largest crude exporter, raised the differentials used to set official selling prices for August of its main grades to Asia, and boosted them for Medium and Heavy crudes to the U.S.

The state-owned producer, known as Saudi Aramco, increased the premium for Arab Light crude to buyers in Asia by 70 cents a barrel to $2.05 more than the average of Oman and Dubai grades, the company said in an e-mailed statement today.

Aramco raised the Arab Extra Light crude formula for Asia by 50 cents a barrel to a $2.70 premium to the average of the Oman and Dubai grades. The company set differentials for Medium and Heavy crudes to the U.S. at narrower discounts for August loadings against the Argus Sour Crude Index, the benchmark Aramco uses for sales there.

The company raised the price for Arab Light from the Egyptian port of Sidi Kerir, two people with the knowledge of the matter said, declining to be identified as the information is confidential.

Saudi Arabia and other Persian Gulf oil producers sell most of their crude under long-term contracts to refiners. Most of the Gulf region’s state oil companies price their oil at a premium or discount to a benchmark.

The following table shows differentials for the regions into which Aramco sells crude in relation to benchmark prices, the month-on-month change and the degrees of gravity as defined by the American Petroleum Institute. Prices are in U.S. dollars a barrel.

Saudis post price and then sell whatever quantity their buyers want at their posted prices. That means their output fluctuates with net global demand.

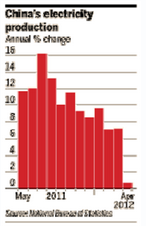

So this chart shows there’s been no drop in net global demand. And why the Saudis decided to cut price recently remains a mystery to all be a privileged few.

If Iran cuts back further this month, only the Saudis have the capacity to replace it, and if, as some believe, they don’t actually have excess capacity, control of price on the upside will be lost.

Meanwhile, the Seaway pipeline seems to be (irregularly) eliminating the WTI discount.

Looks to me like demand for their crude, at their posted prices, is still very strong. And as of approximately June 1 Iran is cutting back another 500,000 barrels per day or so, which changes this balance as of that date.

So yes, there are lots of cross currents- new supply, inventory jugglings of various sorts, etc.

But bottom line remains the net ‘call’ on Saudi crude, and what the Saudis want to charge for it.

That is, every day we either pay their price or let inventories run off or shut the lights off for a few hours.

>

> (email exchange)

>

> Attached is an interesting article from the FT discussing the investment slowdown in China.

> While the official picture remains one of a gradual slowdown, more anecdotal data on

> electricity production and bank loans suggests that the slowdown is much more severe – this

> is likely to negatively impact the EM and the Asian suppliers to China such as Australia and

> Korea.

>

Full article: China Investment Boom Starts to Unravel

As swing producer/price setter, they call the tune. But what they say publicly isn’t always what they do privately. I had thought they may be holding Brent at 120 and letting WTI converge to it as the new pipeline scheduled to begin May 15 worked to equalize prices. But it’s certainly possible they could converge at a lower price, if the Saudis so choose.

Oil a ‘Little Bit High,’ Saudi Arabia’s Al-Naimi Says

By Jacob Adelman and Yuji Okada

May 8 (Bloomberg) — Saudi Arabia is storing as much as 80 million barrels of crude to boost supplies amid international prices that are “still a little bit high,” according to the country’s oil minister Ali al-Naimi.

The nation, the world’s largest oil exporter, has set aside supplies “on shore in Saudi Arabia, in pipelines, in tanks,” al-Naimi said in Tokyo today before board meetings of state- owned Saudi Arabian Oil Co., of which he is chairman.

This could be it- watch for WTI crude to converge to Brent.

My guess is that WTI rises to meet Brent at around 120+

The pipeline was scheduled to open June 1.

This moves it up to May 15th or so.

NYMEX-US crude rises on US pipeline reversal plan

By Randy Fabi

April 1 (Reuters) — U.S. crude oil prices rose above $103 a barrel on Tuesday in response to news that a plan to drain off a glut of oil from the Midwest could be implemented two weeks ahead of schedule.

FUNDAMENTALS

* NYMEX crude for May edged up 28 cents to $103.20 a barrel by 2306 GMT, adding to a 10 cent gain the previous session.

* Enterprise Product Partners and Enbridge plan to reverse the flow of the Seaway oil pipeline by mid-May pending regulatory approval, allowing the line to start draining the glut of crude from the U.S. Midwest two weeks ahead of schedule.

* Iran is ready to resolve all nuclear issues in the next round of talks with world powers if the West starts lifting sanctions, its foreign minister said on Monday.

* U.S. commercial crude stockpiles were forecast to have risen 1.6 million barrels last week after data showed the largest three-week build in more than three years due to higher imports, a preliminary Reuters poll showed on Monday. The American Petroleum Institute will release its report later on Tuesday.