Weakness continues:

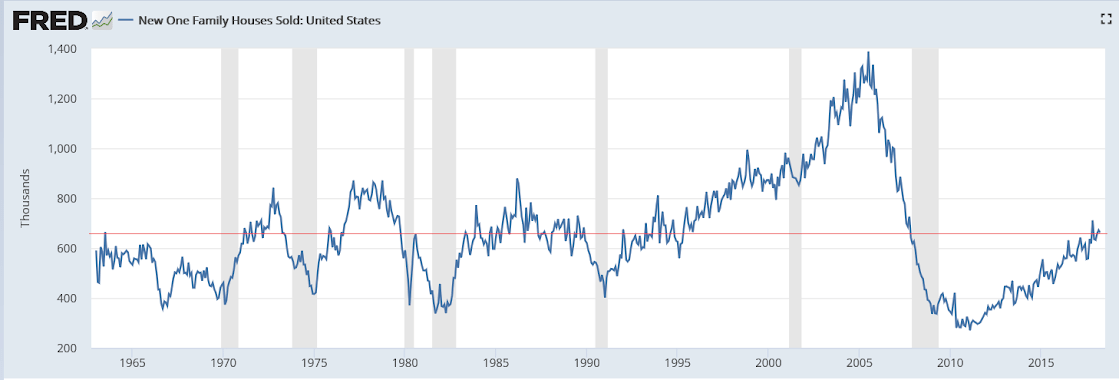

Housing, while growing modestly, remains very depressed historically:

Highlights

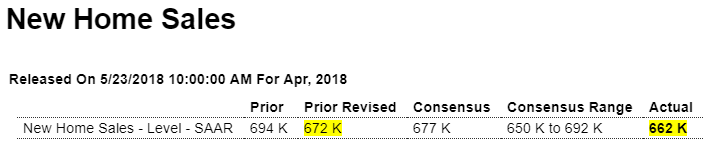

Month after month the new home sales report shows its volatility behind which, however, slight strength is evident. Sales in April came in 15,000 short of Econoday’s consensus, at a 662,000 annualized rate with revisions pulling down the prior two months by a total of 30,000. Yet compared to the prior report, when sales beat expectations by 64,000 and when upward revisions added 81,000, today’s report doesn’t reverse what is still an upward slope for new homes.

Yet details are mixed. Price discounting may be underway as the median fell a very steep 6.9 percent in the month to $312,400 for a year-on-year gain of only 0.4 percent. Relative to sales, which are up 11.6 percent year-on-year, prices look like they have room to climb. Supply data are also a concern. New homes on the market rose only 2,000 to 300,000 with supply relative to sales also moving only marginally higher, to 5.4 months from 5.3 months.

Until supply begins to build at a better pace, sales of new home homes will lack acceleration. Residential investment, where new home sales are a major piece, proved flat in the first quarter though improvement in the second quarter, however limited, does look like it’s underway. Watch tomorrow for existing home sales which have been flat and which are expected to remain so.

This chart is not population adjusted:

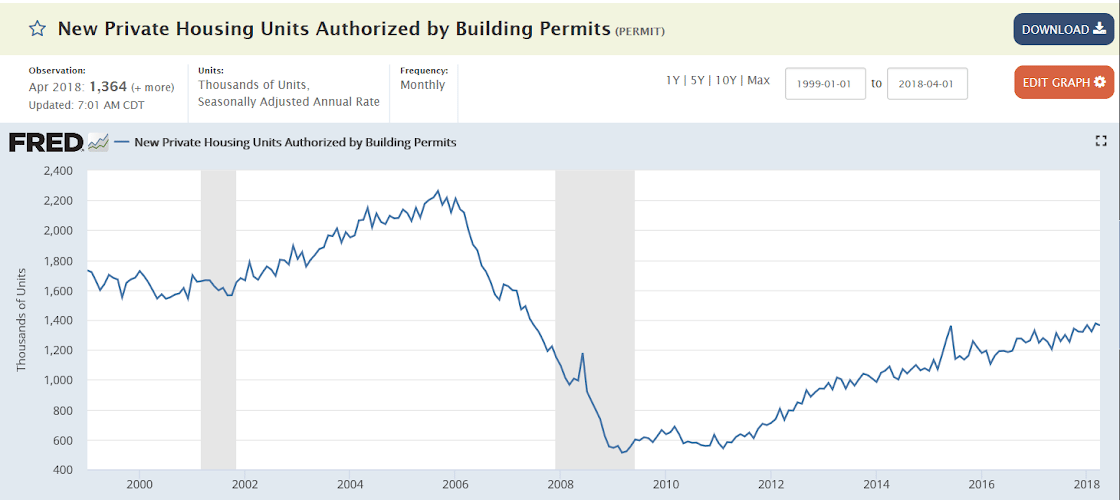

Permits are also growing very modestly and remain historically depressed. Again, this is not population adjusted:

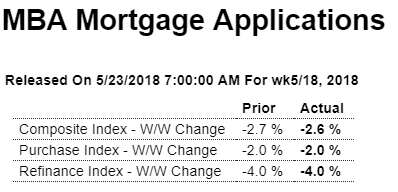

This has also been historically depressed this cycle;

https://asia.nikkei.com/Economy/China-curbs-infrastructure-spending-as-local-debt-climbs

China curbs infrastructure spending as local debt climbs

BEIJING — China is slamming the brakes on infrastructure investment to reel in soaring local debt, but the move is certain to hurt regions reliant on public works projects, widening the country’s already stark economic gaps.

Infrastructure spending in the January-April period rose 12.4% on the year, 0.6 percentage point lower than the growth marked in the three months ended March, data from China’s National Bureau of Statistics shows. The seemingly strong growth appears less impressive when put in context. The annual increase has been around 20% in recent years. In 2017, when the Communist Party held its twice-a-decade congress, the figure was 19%.

Overall fixed asset investment expanded just 7% in the January-April period, the slowest since 6.3% in 1999.