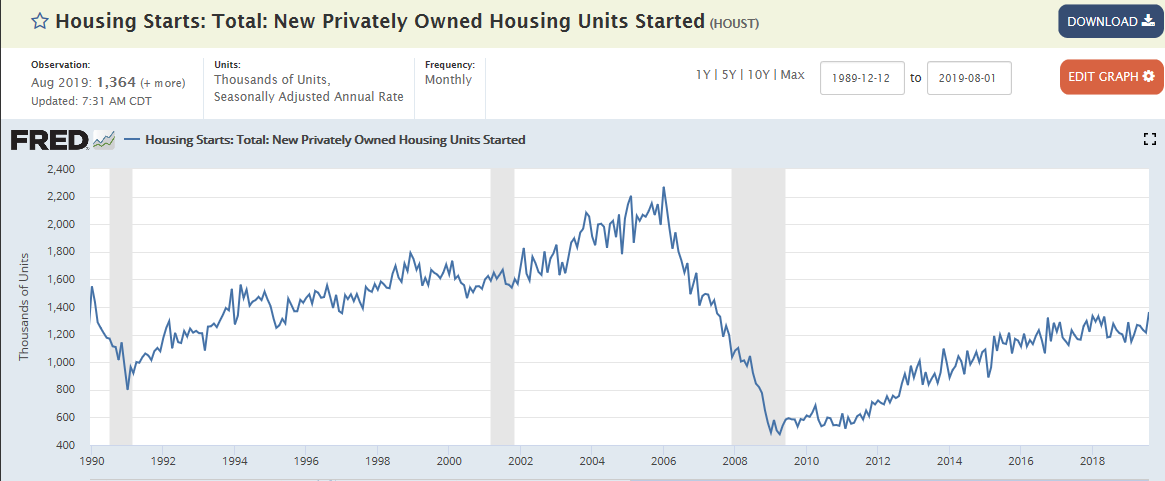

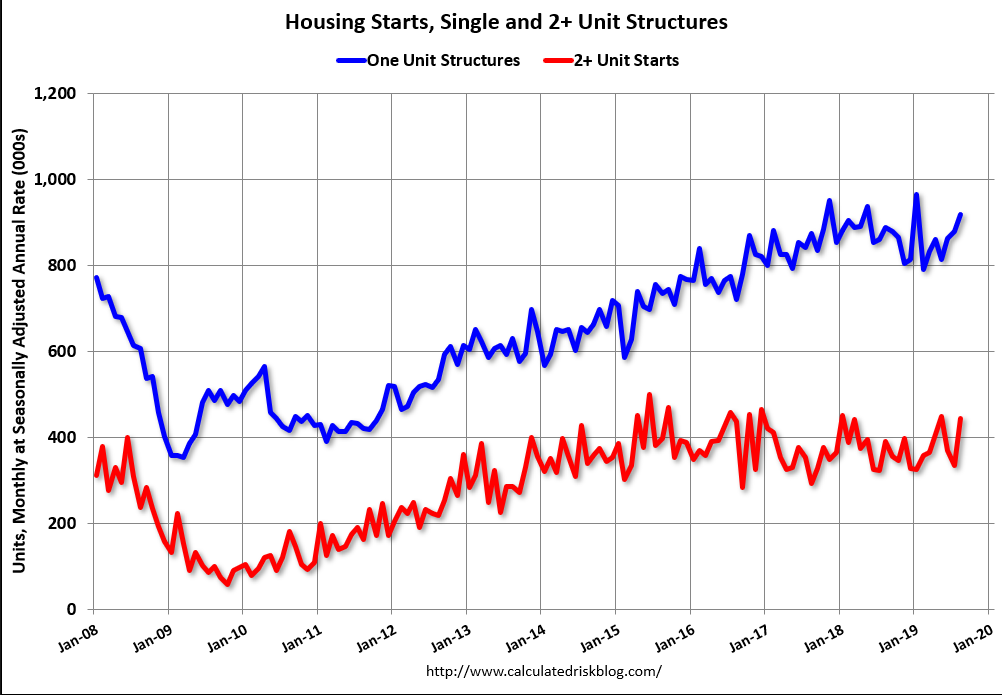

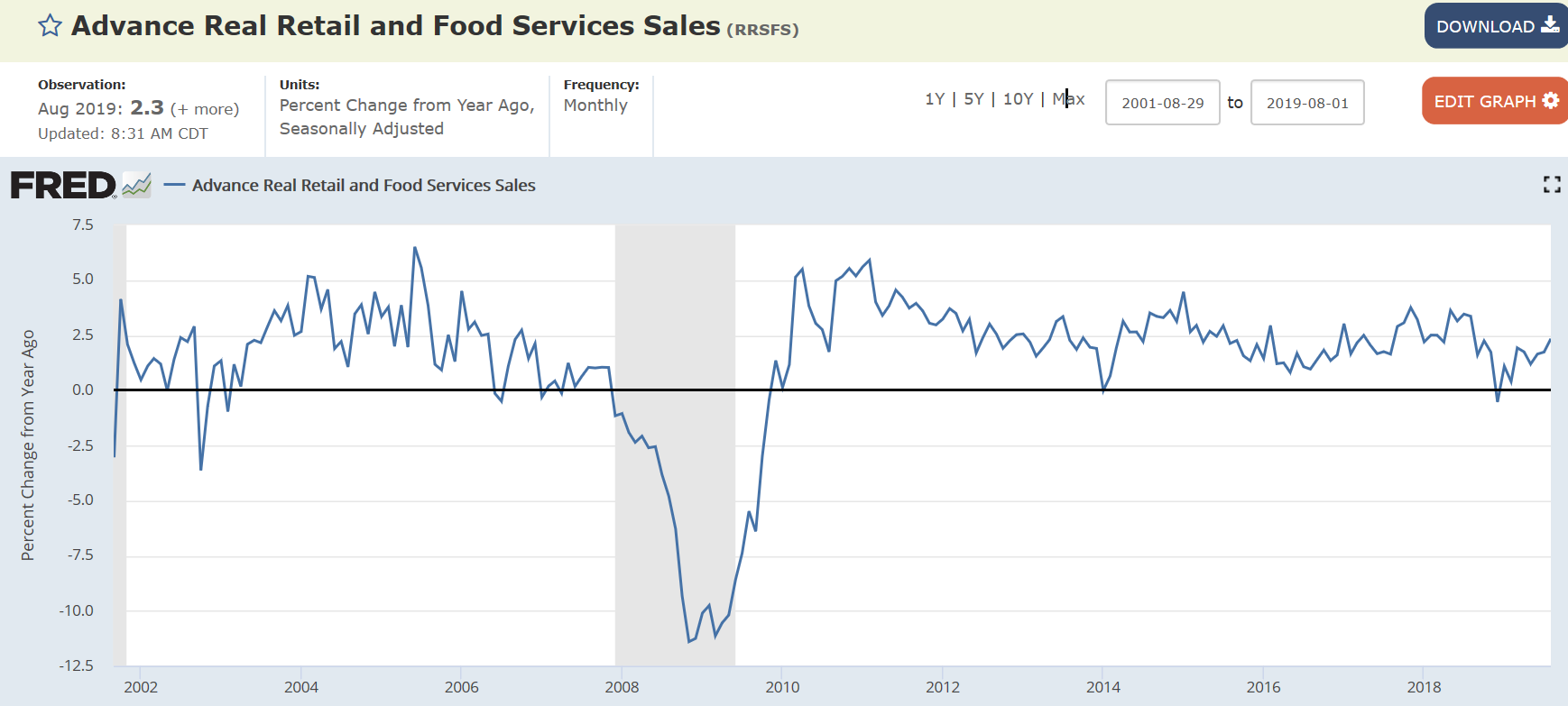

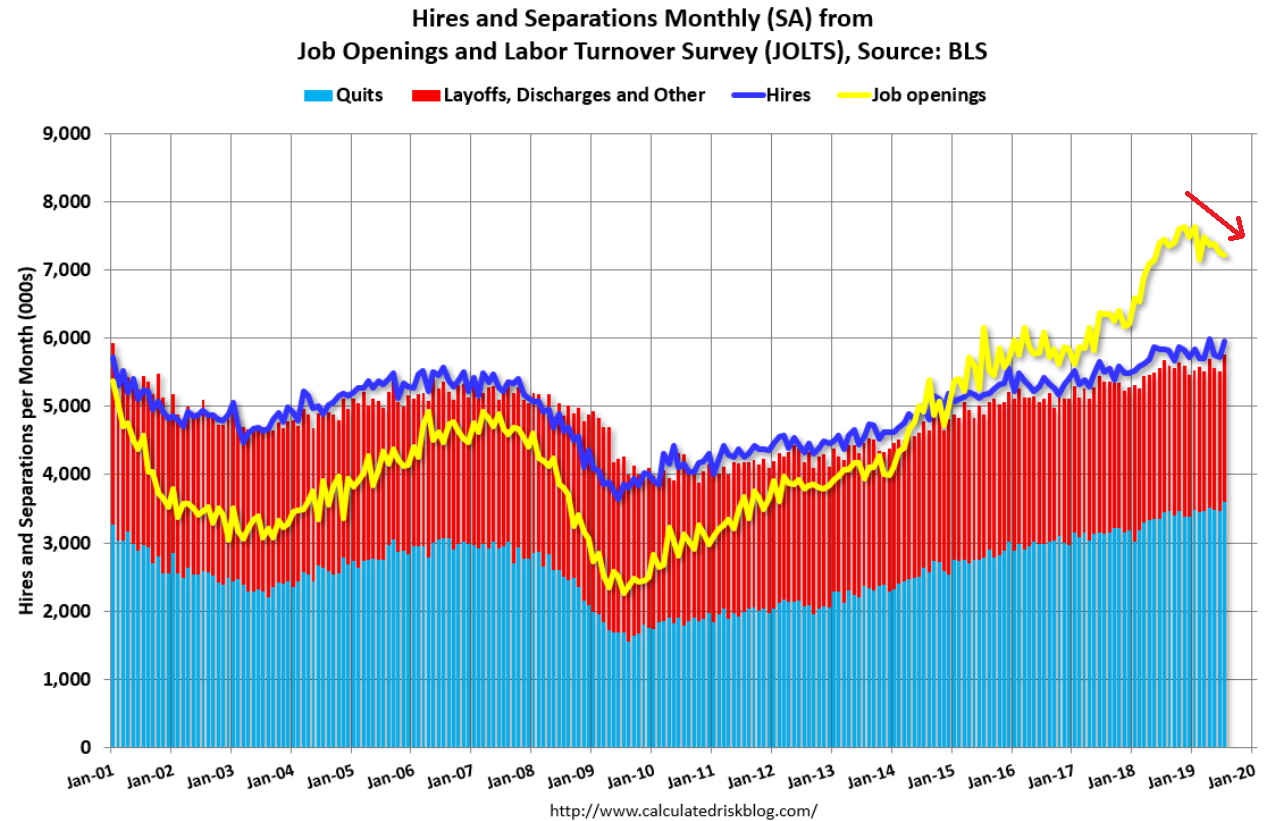

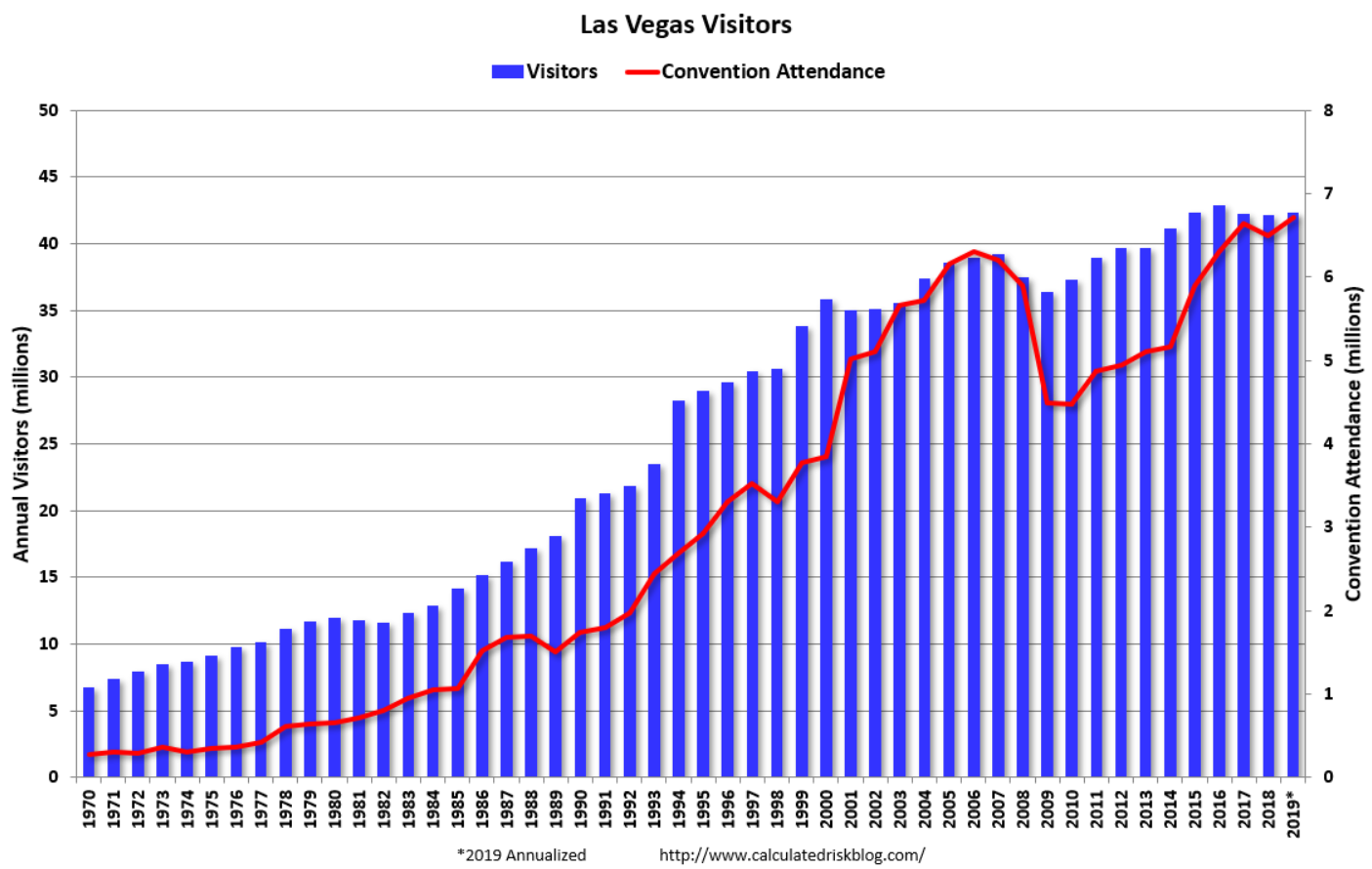

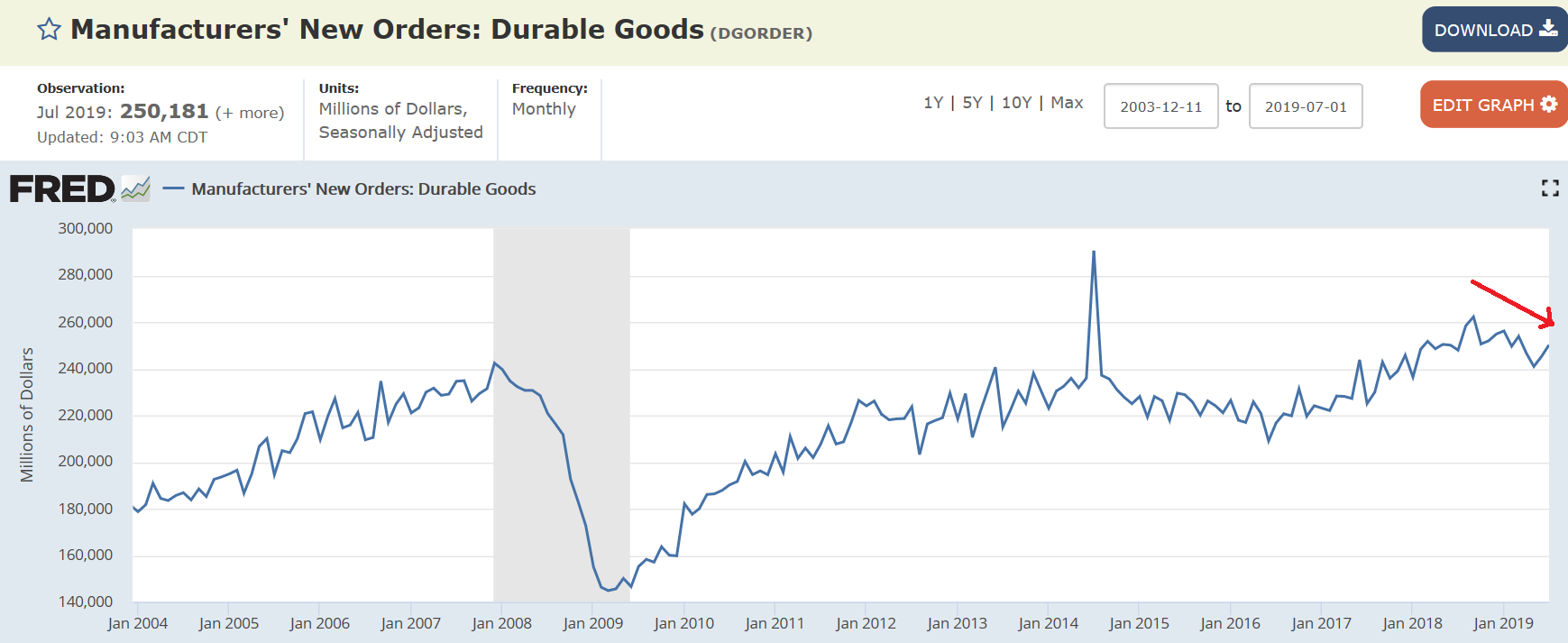

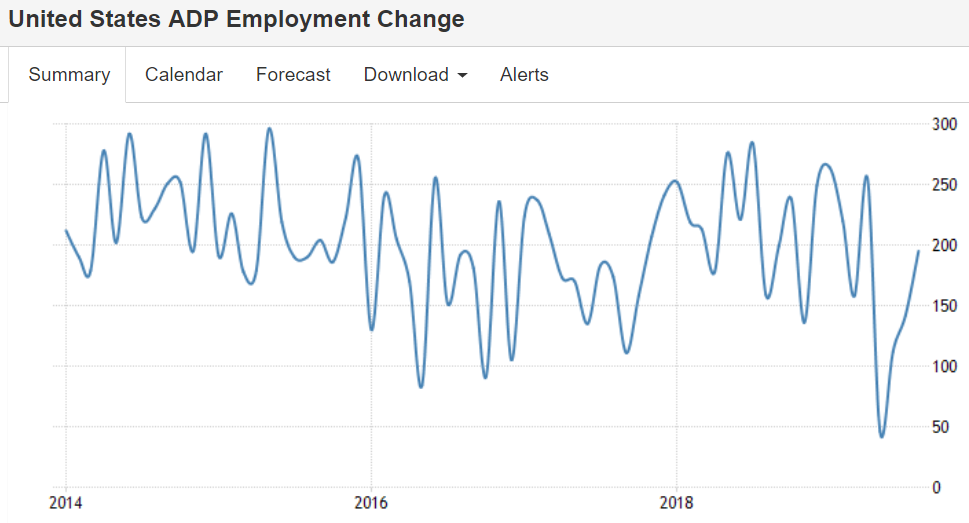

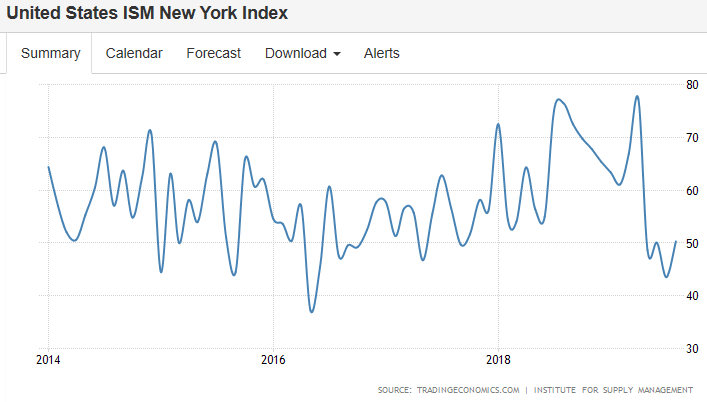

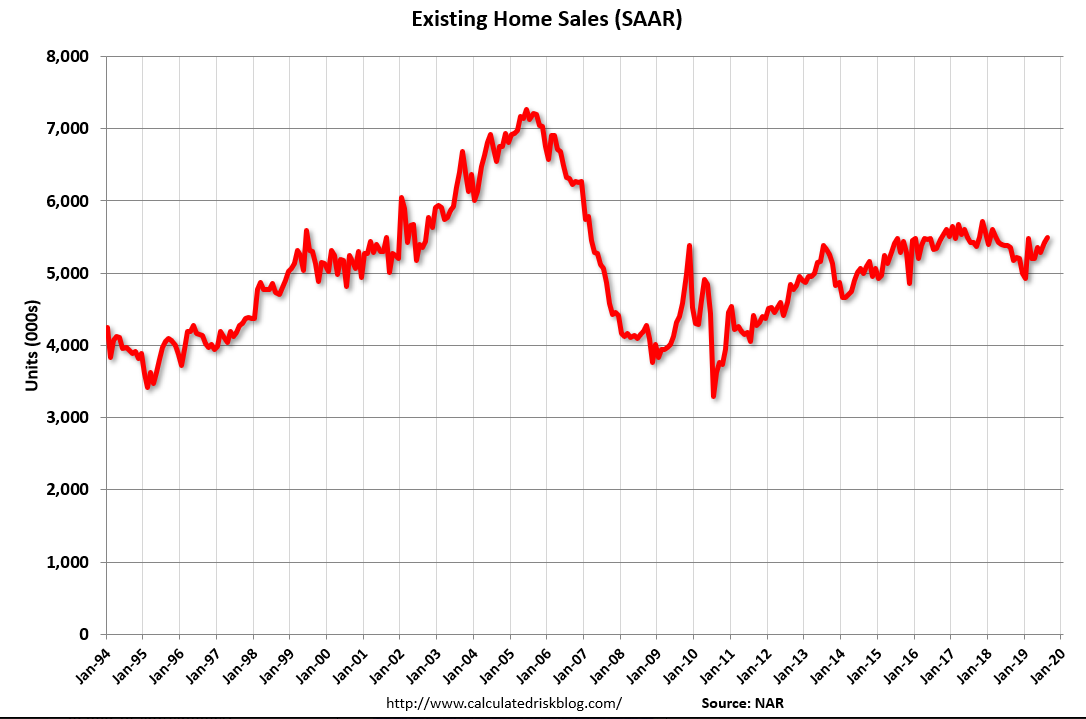

Up some for the month, but remain weak and depressed historically, especially on a per capita basis:

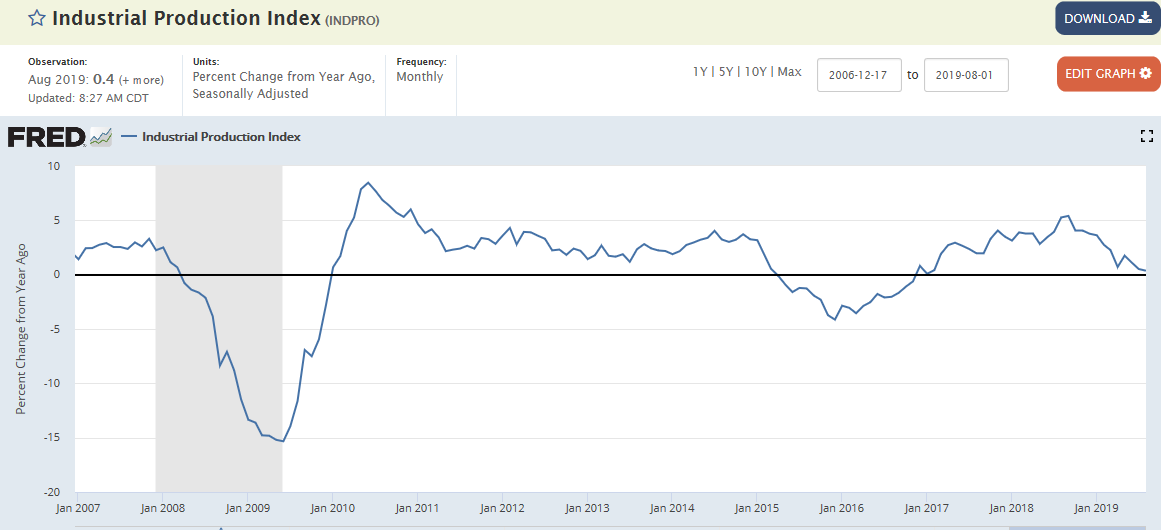

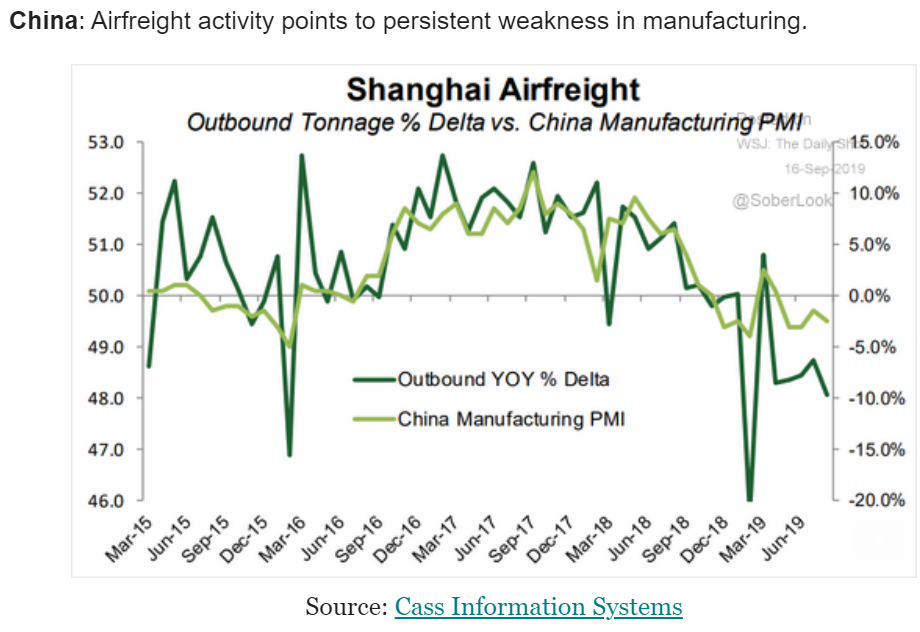

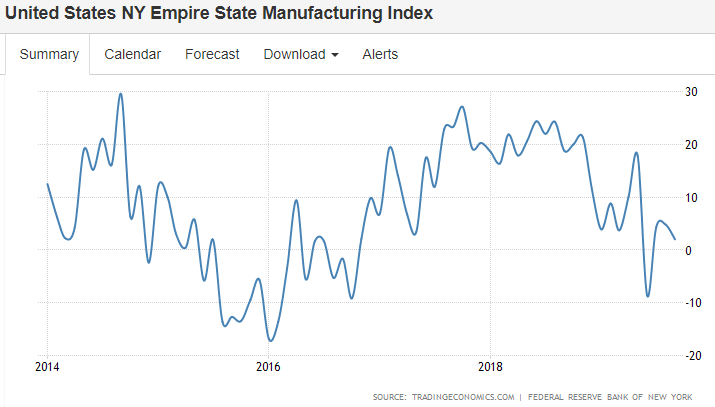

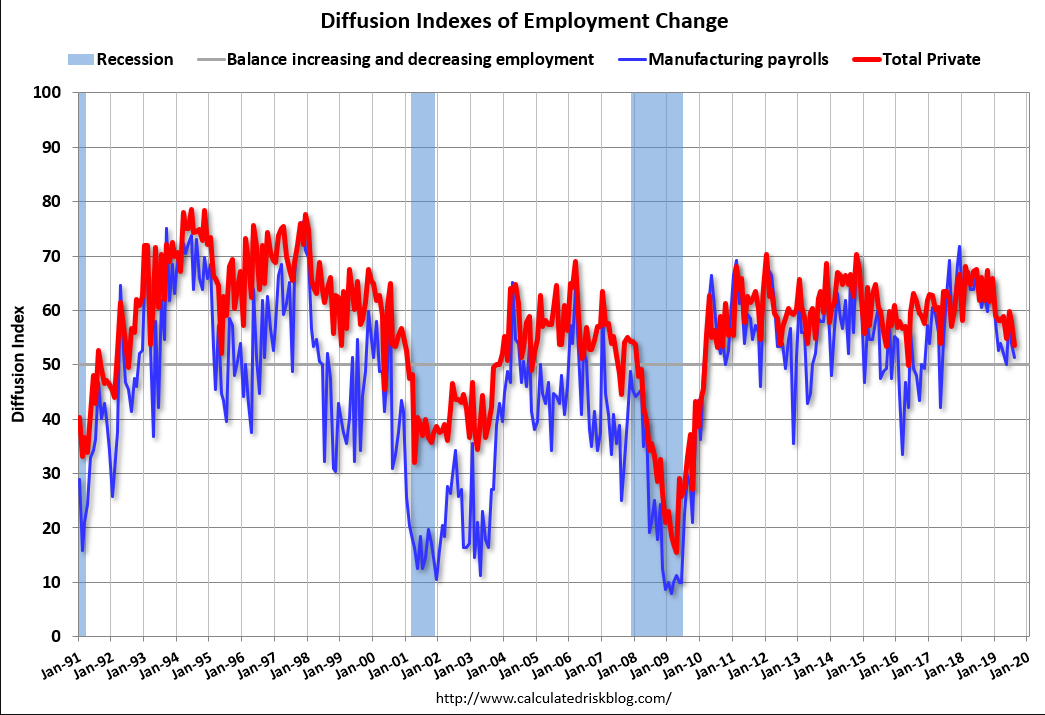

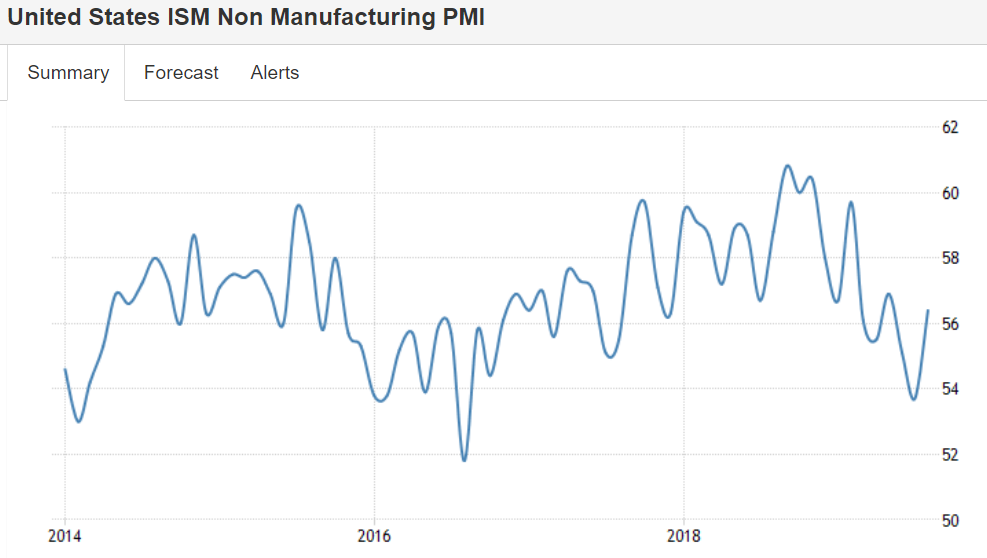

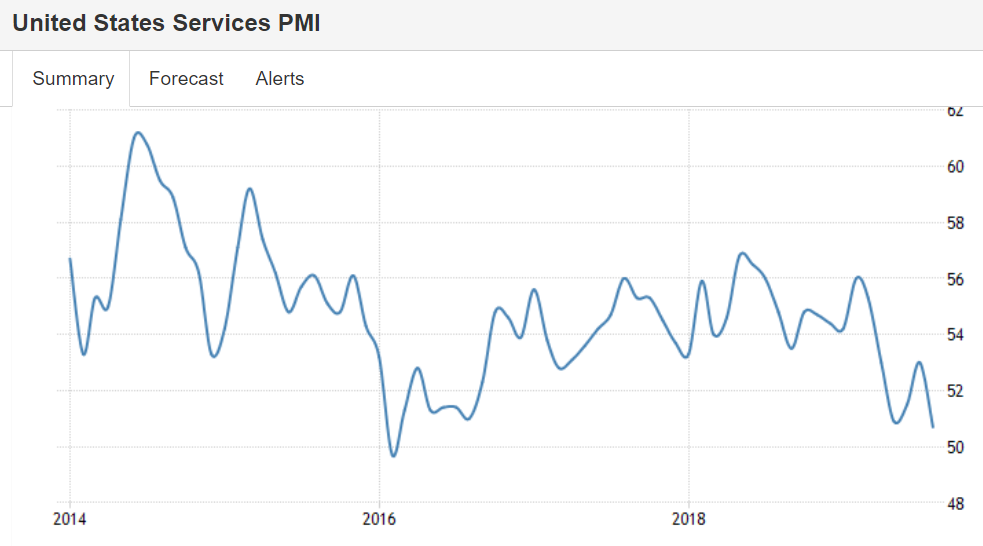

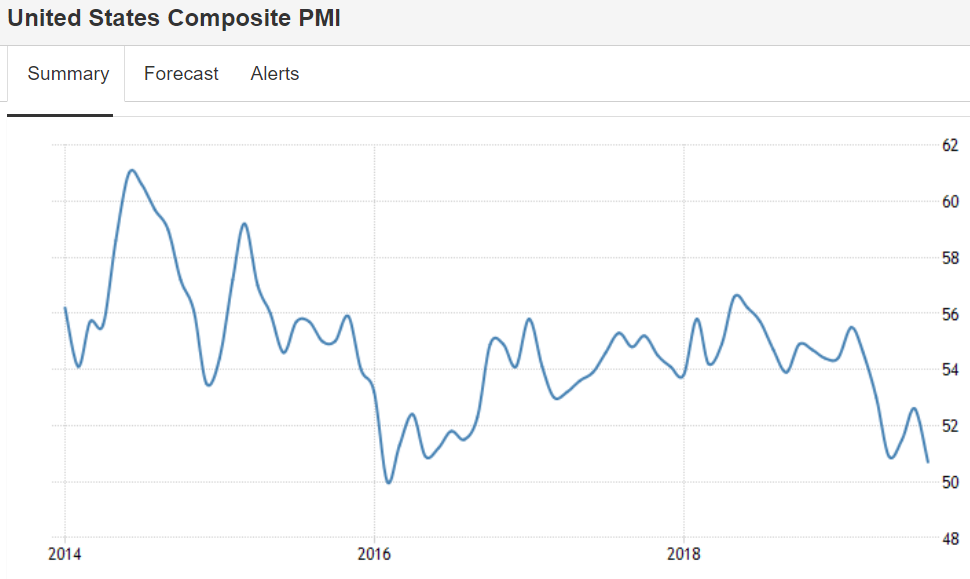

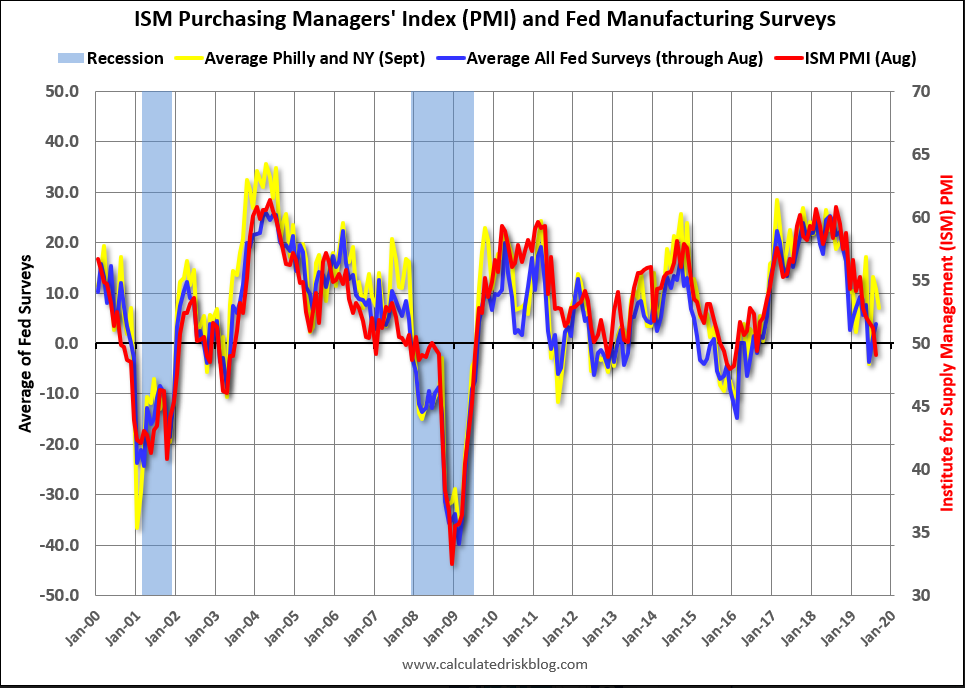

Manufacturing surveys continue to forecast weakness:

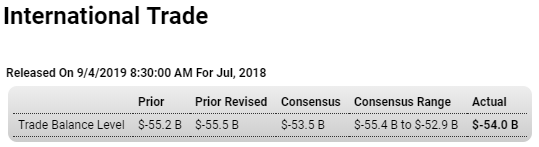

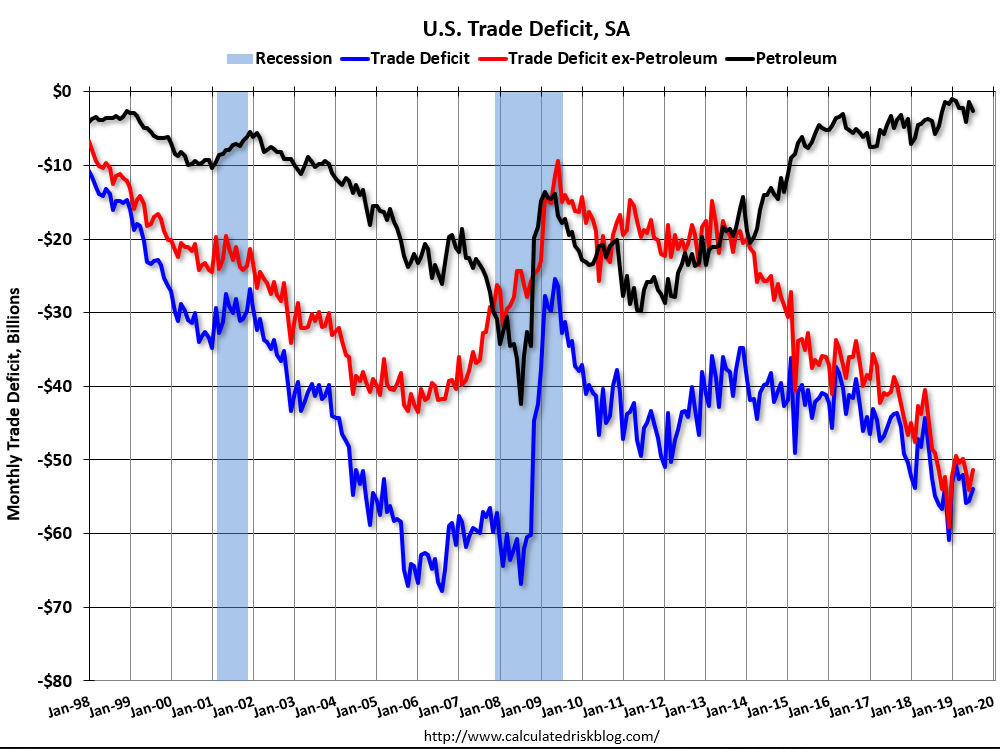

I think what he wants rate cuts because he (and most everyone else) believes that will make the dollar go down which he further believes will reduce the trade deficit and support economic growth:

And the VP isn’t far behind the big guy:

Pence says other countries should ‘emulate’ US economic policies to catch up

Vice President Mike Pence said Thursday that other countries should “emulate” US policies.

However, he also said the US should imitate the policy of other nations who keep their interest rates anchored near zero.

Looks to me like Turkey has got it right- inflation will fall and the currency firm as they cut rates. But I don’t expect it to help the economy, but instead the rate cuts will likely weaken it, begging a fiscal adjustment to support employment and output:

Erdogan Says Turkey to Soon Cut Interest Rates to Single Digits

President Recep Tayyip Erdogan said Turkey will lower interest rates to single digits soon and inflation will follow suit.

“We are lowering and will lower interest rates to single digits in the shortest period,” Erdogan said in a televised speech on Sunday. “After it falls to single digits, inflation will also slow to single digits.”

The drop in inflation after rate cuts is an apparent reference to Erdogan’s personal belief that price gains slow when the cost of borrowing is reduced. Most economists think the opposite is true.