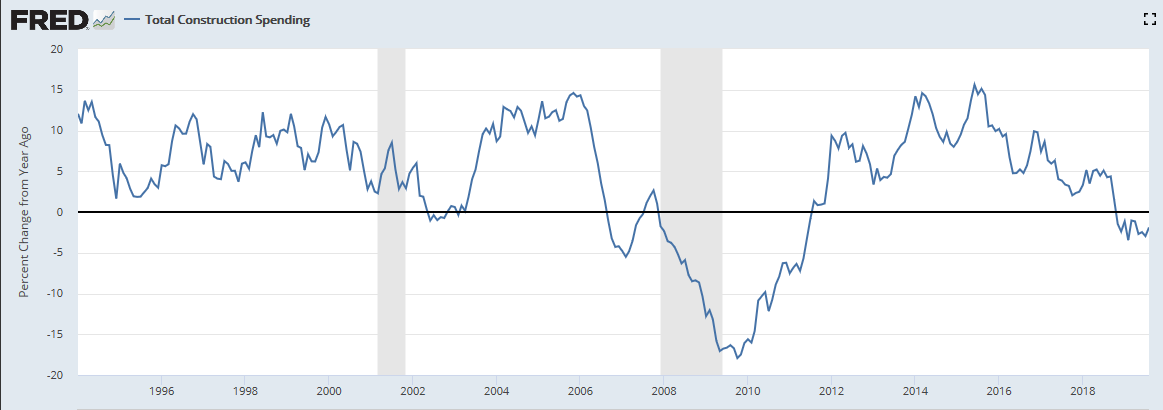

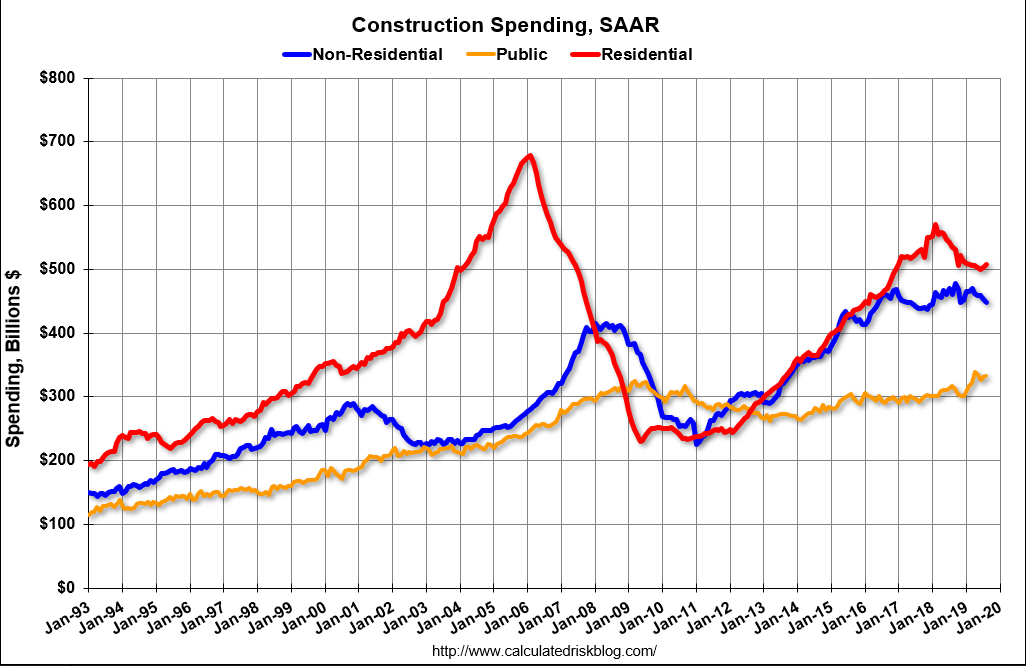

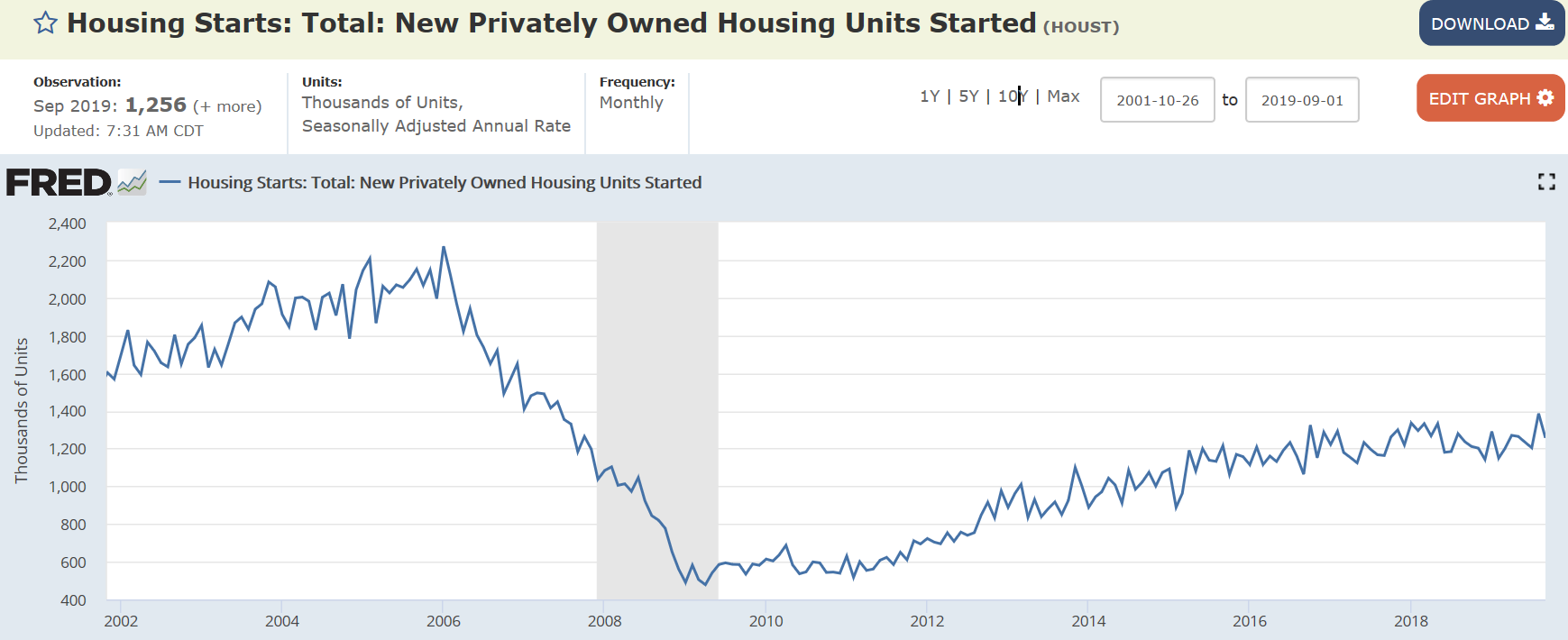

Fell back this month after last month’s spike from the drop in rates and still looking to me like it’s going nowhere from historically depressed levels, and not population adjusted:

Highlights

Upward trajectory is the theme of housing starts and permits, in data where September’s headlines don’t always tell the fundamental story. Housing starts came in at a 1.256 million annual rate in September that falls not only well short of expectations but also August which is revised higher to 1.386 million. But behind the headline is a small gain, to 918,000, for single-family starts. These pack more GDP punch per unit than multi-family starts which dropped a very sharp 28.2 percent to 338,000. The three-month average for single-family starts is up very sharply, at 901,000 for the 5th straight increase.

Permits for single-family homes are keeping pace with starts, at 882,000 in the month with this three-month average up 20,000 to 862,000 for a fourth straight increase. Total permits dipped back to 1.387 million reflecting a sharp fall in multi-units to 505,000.

Year-on-year, single-family starts are up 4.3 percent with single-family permits up 2.8 percent. These are solid positives for residential investment which, after six straight quarters of pulling GDP lower, may yet contribute positively to third-quarter GDP. But the weakness in multi-family units is a risk for residential investment with starts here down 5.1 percent on the year though permits, in what points to emerging strength and only temporary weakness for starts, up a very sharp 17.4 percent.

A negative in today’s report is decline in completions, down for single-family and multi-units in results that will limit immediate improvement for new home sales. But this report, especially the monthly gains for single-family data and the year-on-year gain for multi-unit permits, does point to the possibility that the housing sector, struggling to move higher as it has all year, may begin to contribute to economic growth.

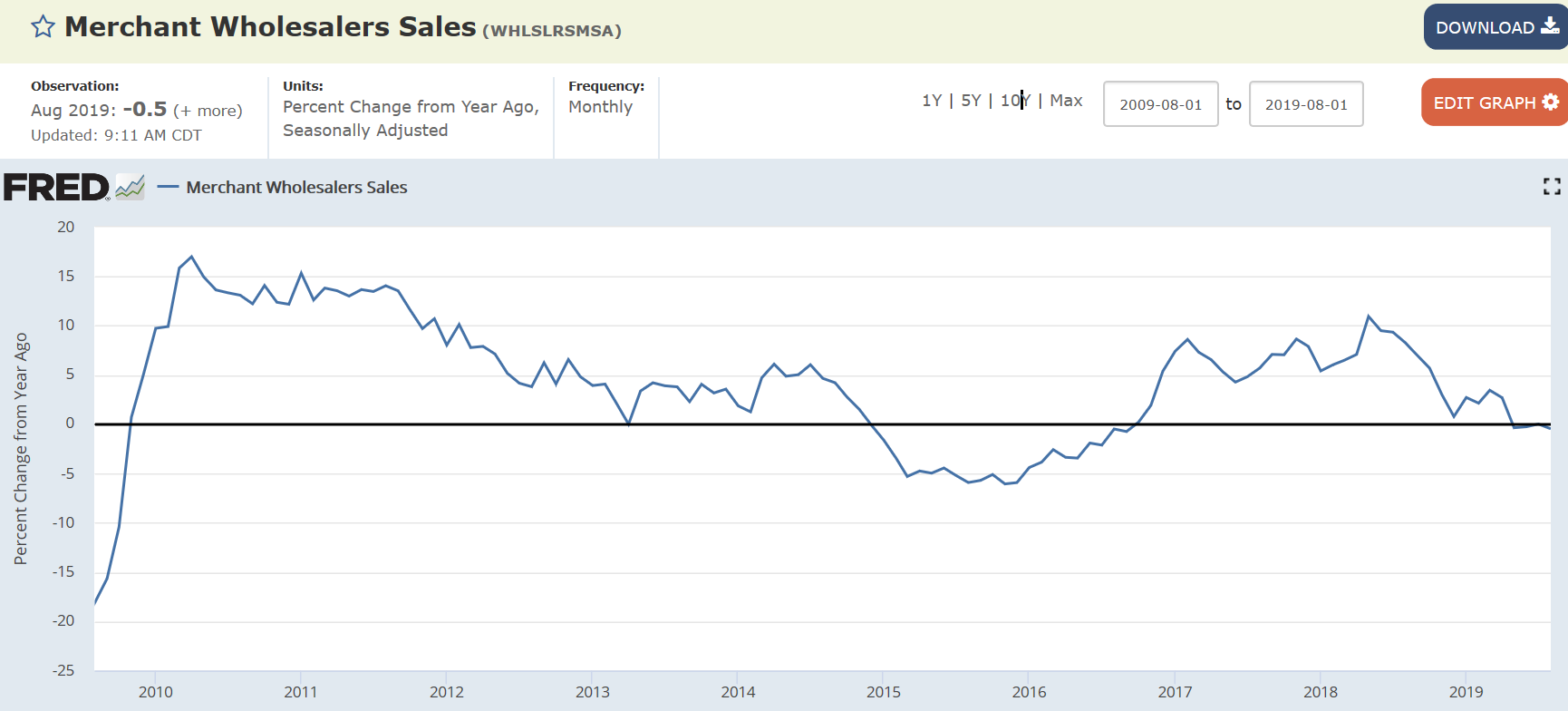

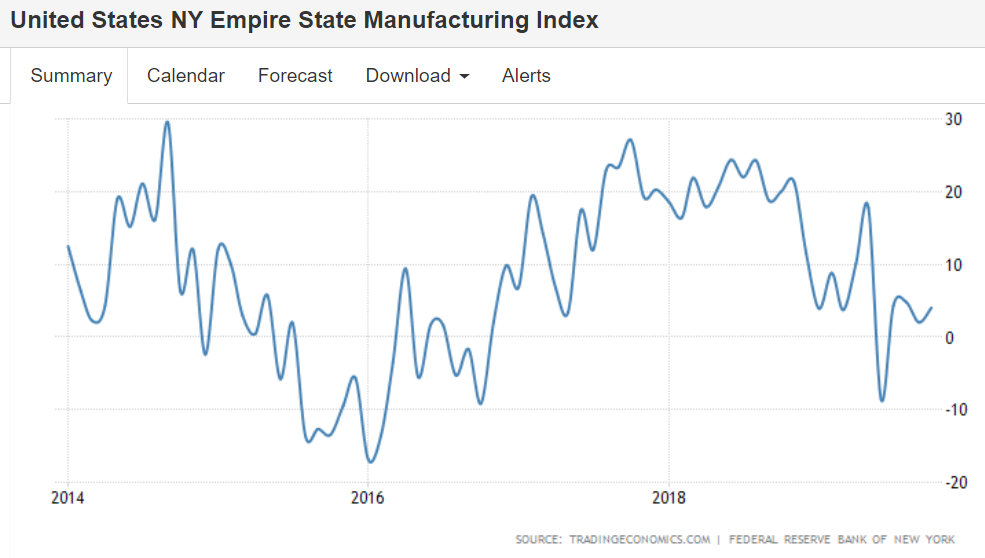

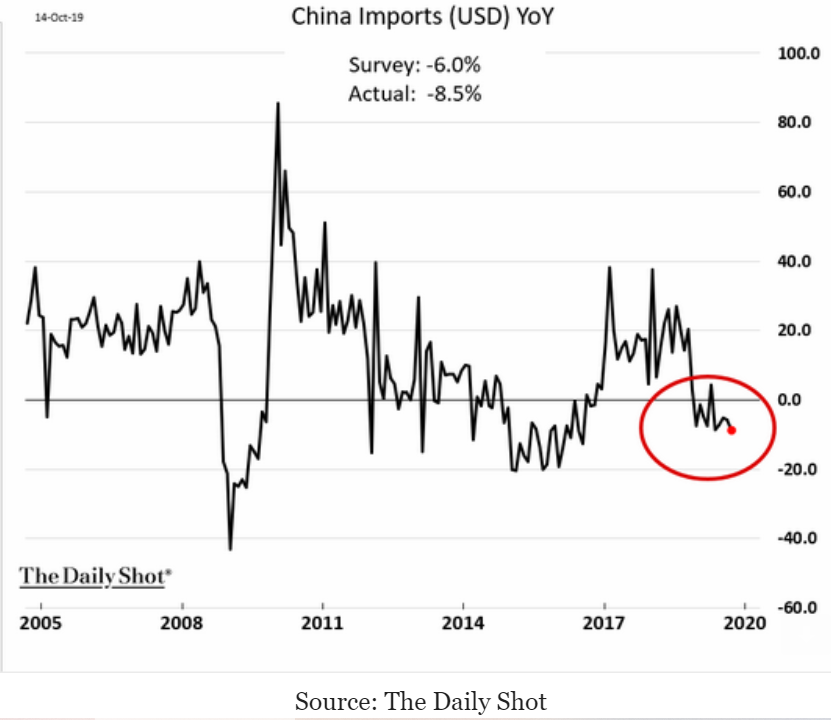

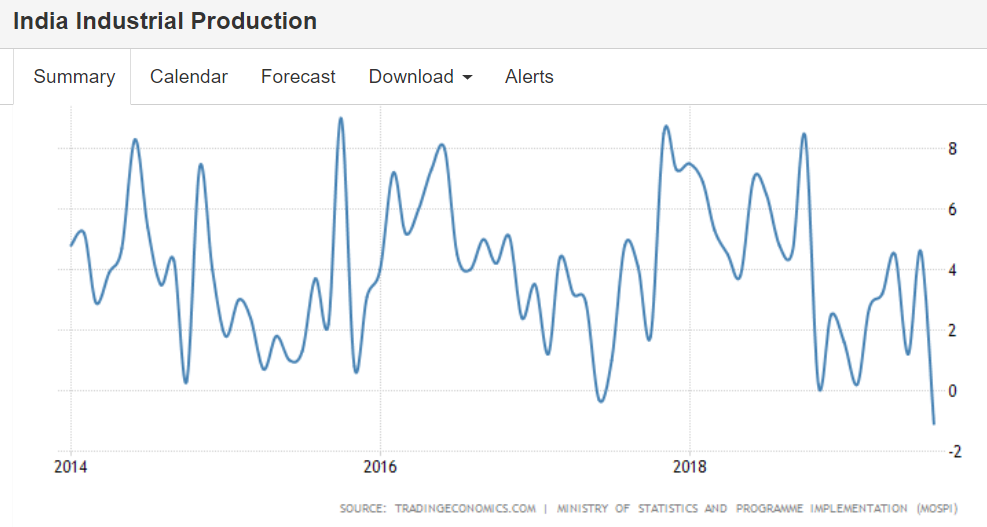

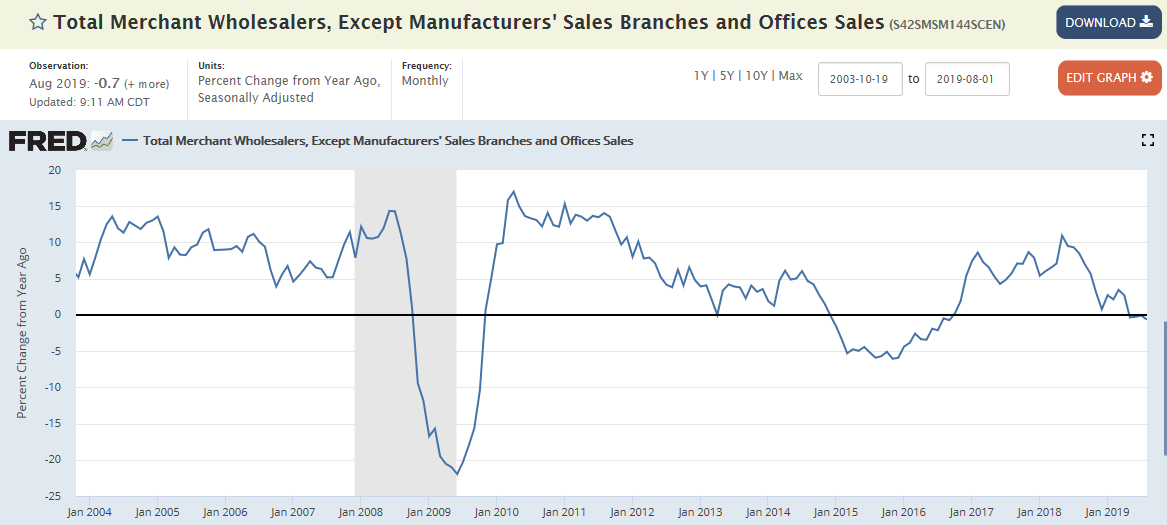

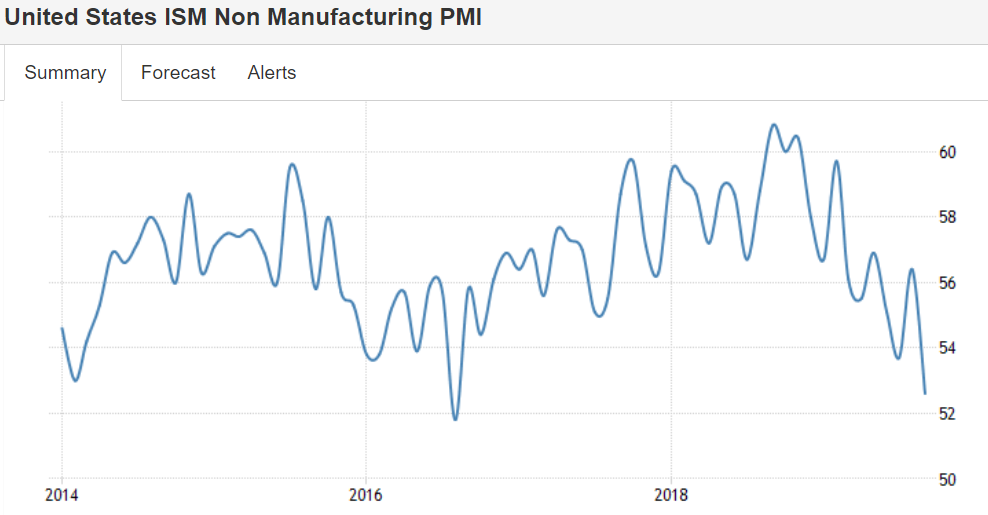

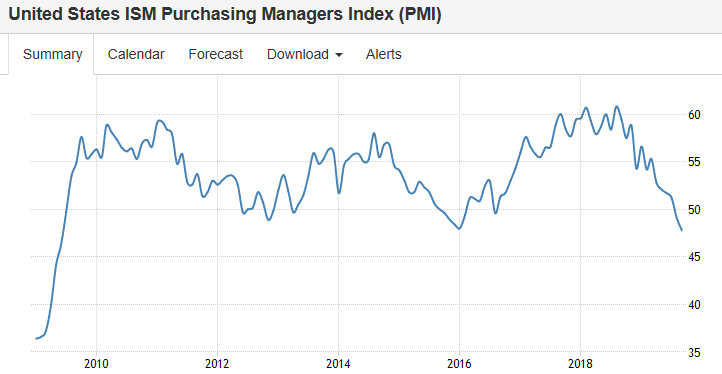

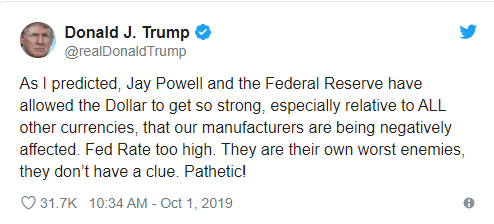

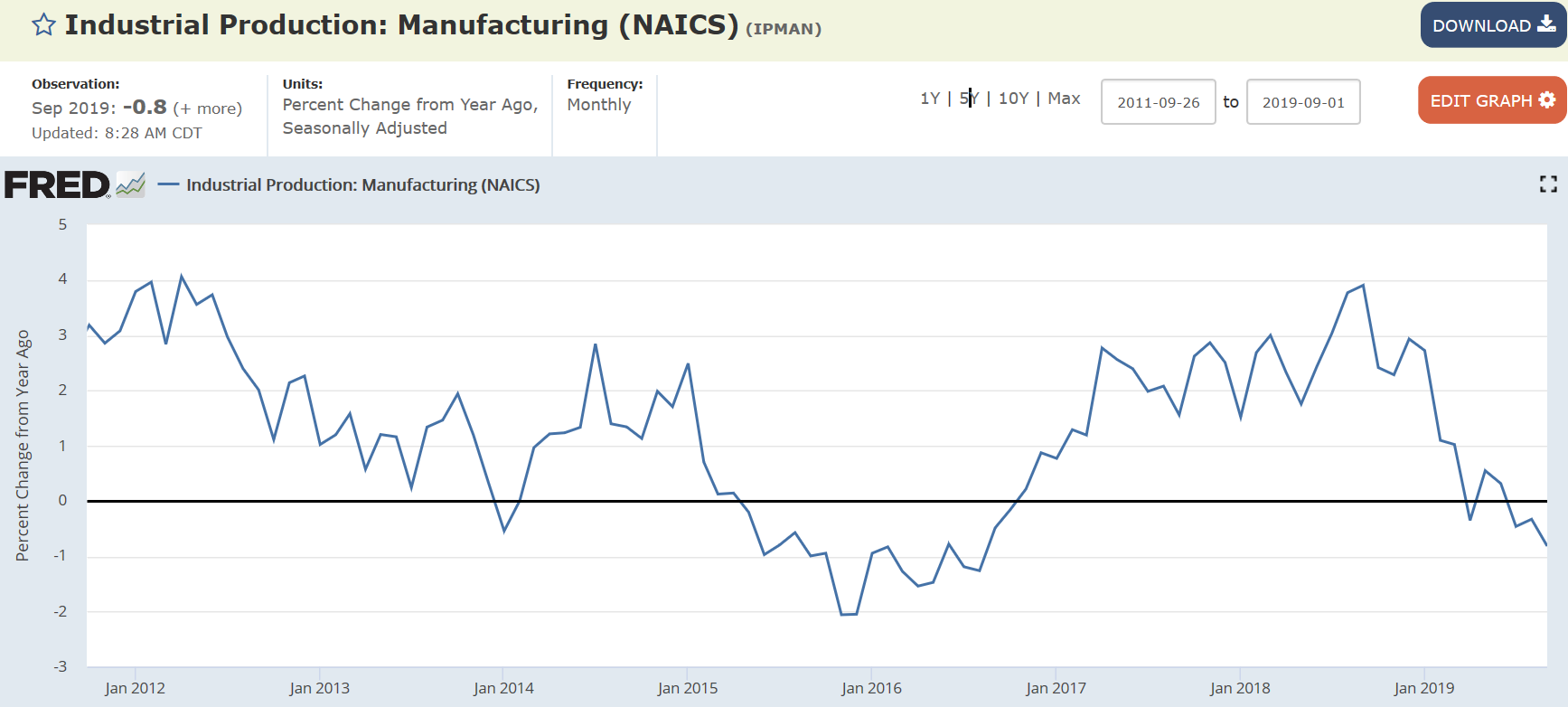

The global collapse continues:

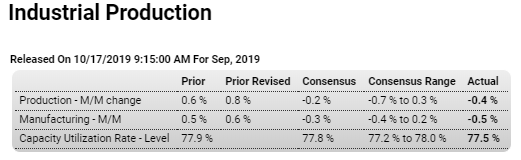

Highlights

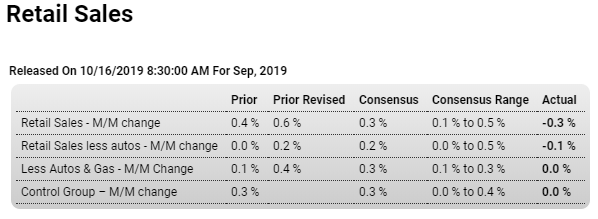

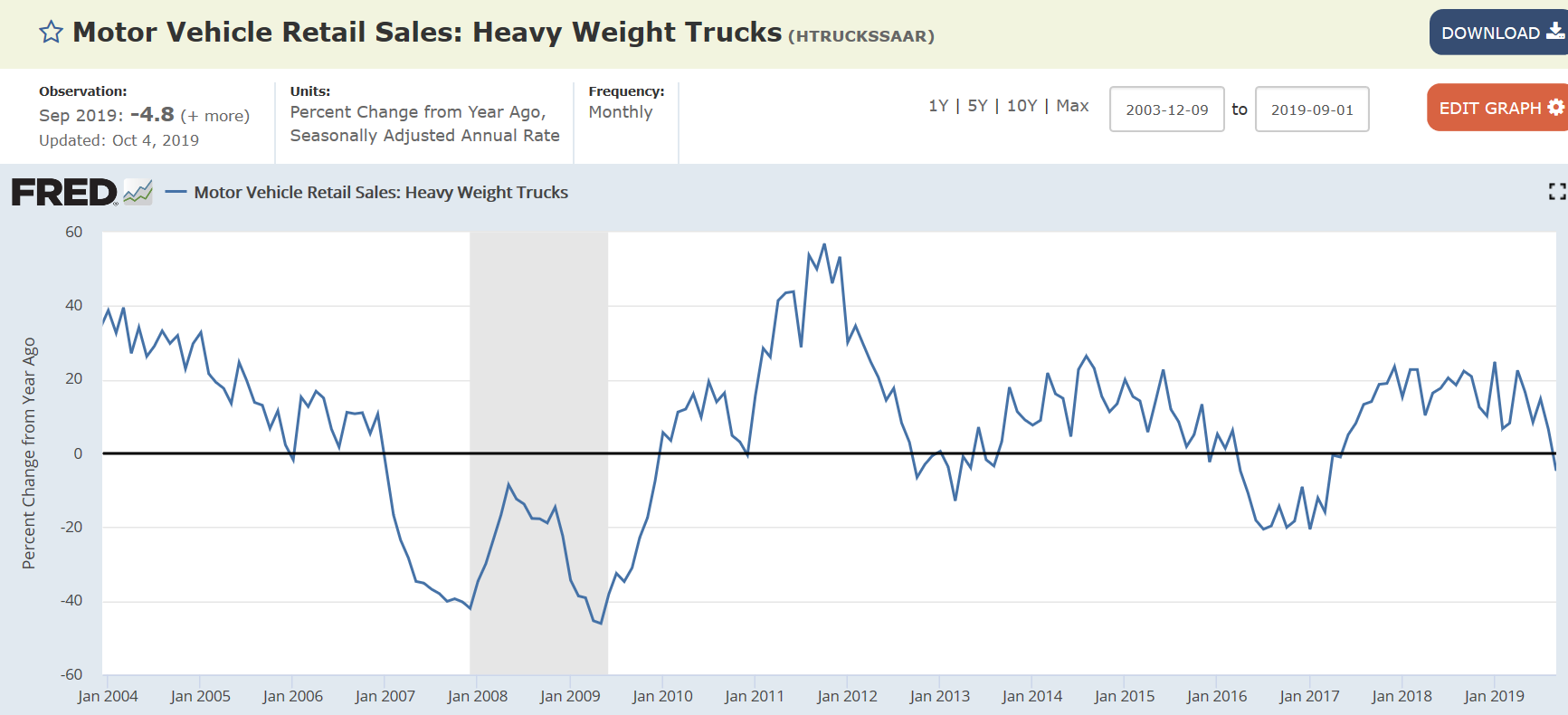

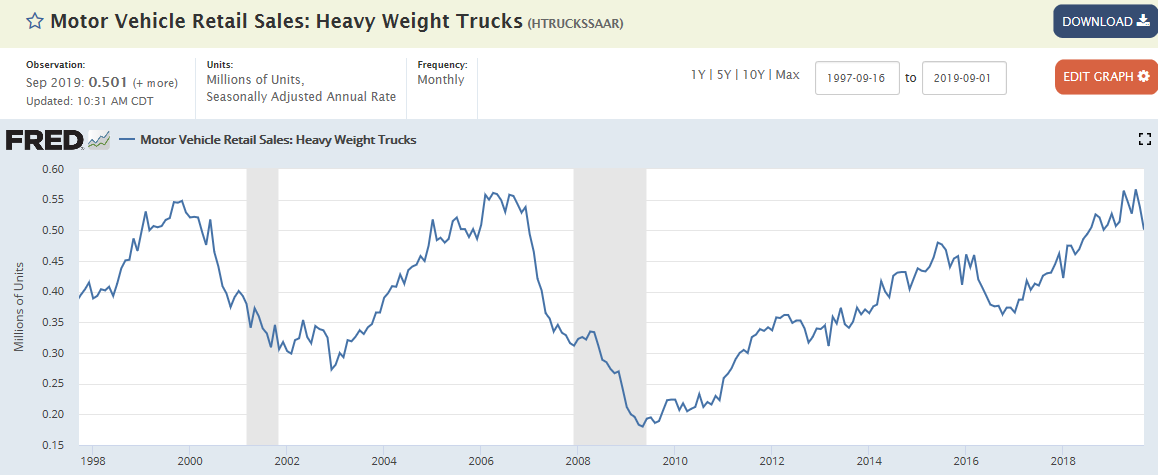

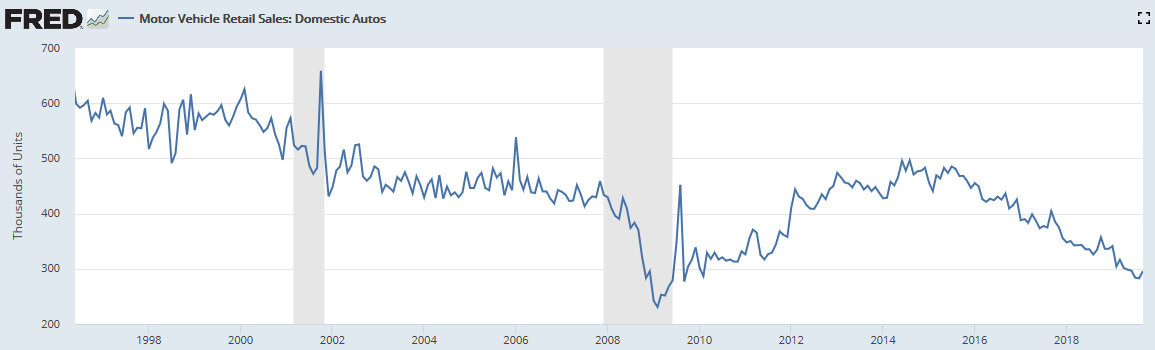

After a strong August, industrial production fell back more sharply than expected in September with year-on-year rates especially betraying the report’s generally weakening trends. Pulled down by manufacturing, industrial production fell a monthly 0.4 percent in September and double the expected contraction. Manufacturing volumes fell 0.5 percent, nearly double the expected decrease and reflecting wide declines across readings including a 4.2 percent monthly drop for motor vehicles, significantly reflecting the GM strike, and a 0.7 percent decline for business equipment.

The report’s two smaller components were mixed with utilities rising 1.4 percent in September but mining falling 1.3 percent. Mining had been enjoying two years of exceptional strength in this report but has since faded. Year-on-year, mining volumes are up a moderate 2.6 percent with utilities up 1.2 percent.

The trouble for manufacturing, which is being held down by weakening demand for US exports, is framed convincingly by 0.9 percent year-on-year contraction in this report. Vehicle production is down 5.4 percent on the year and improvement may be slow based not only the risk of an extended GM strike but also on yesterday’s retail sales report where vehicles sales were a major negative. Business equipment is another negative, down 0.8 percent on the year which won’t be giving the hawks at the FOMC much strength in their arguments to limit further rate cuts. Weakness in business equipment, the result of falling business expectations, is a central concern, if not the central concern, for monetary policy makers.

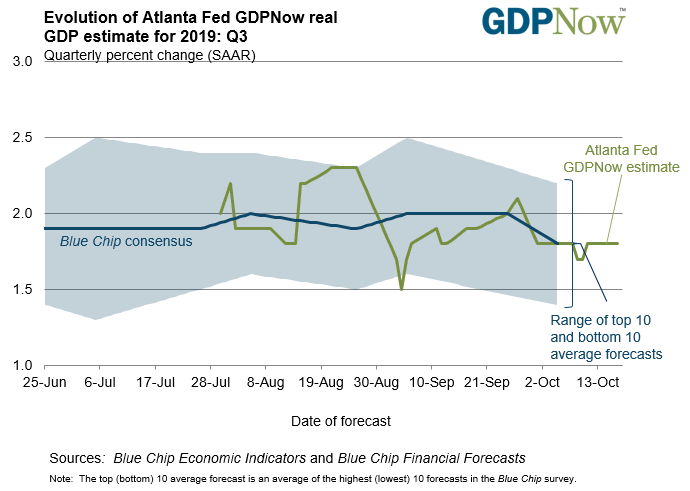

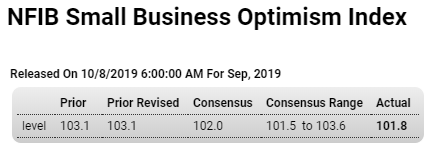

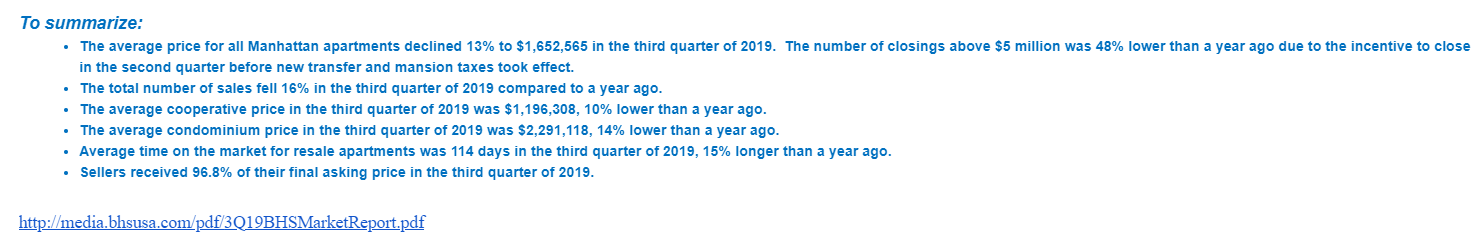

GDP continues to decelerate:

The economy probably only grew 1.5% in Q3 amid consumer weakness, CNBC tracker shows