As previously discussed, and relayed to the finance minister in Greece, there is no reason to assume the ECB will cut off liquidity to Greek banks.

First, those banks are private institutions, and regulated and supervised by the ECB, who has deemed them ‘solvent’ and ‘adequately capitalized’ and therefore eligible for liquidity support as members in good standing.

Think of it this way, if NY went rogue, would the Fed cut off Citibank?

ECB extends liquity for Greek banks: Report

Seems the last thing the Fed wants to do now is engineer higher mtg rates and set back the anemic housing markets.

Sort of like Bernanke did just before housing turned south and has yet to recover…

Federal Reserve minutes indicate no rush to raise interest rates

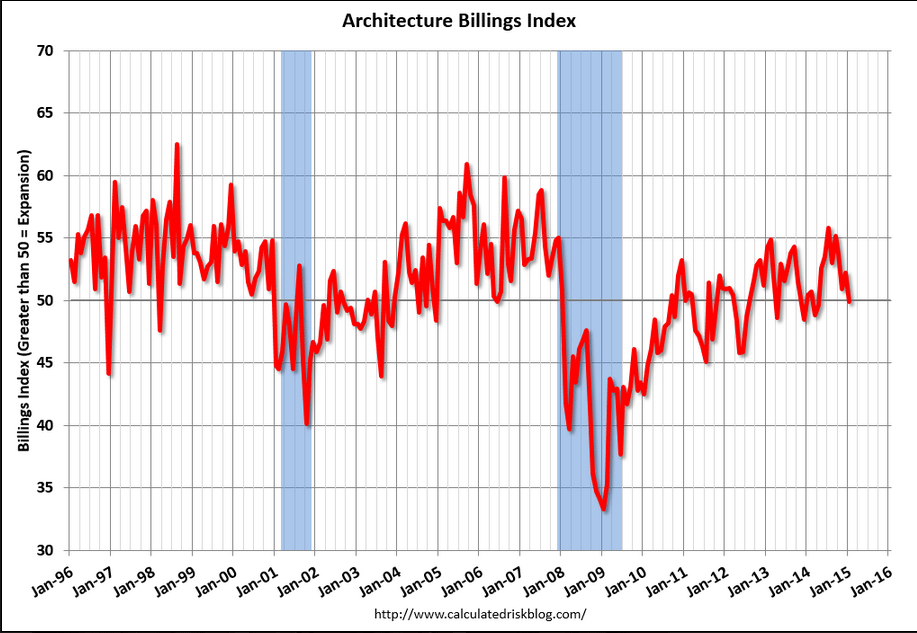

Below 50, not good: