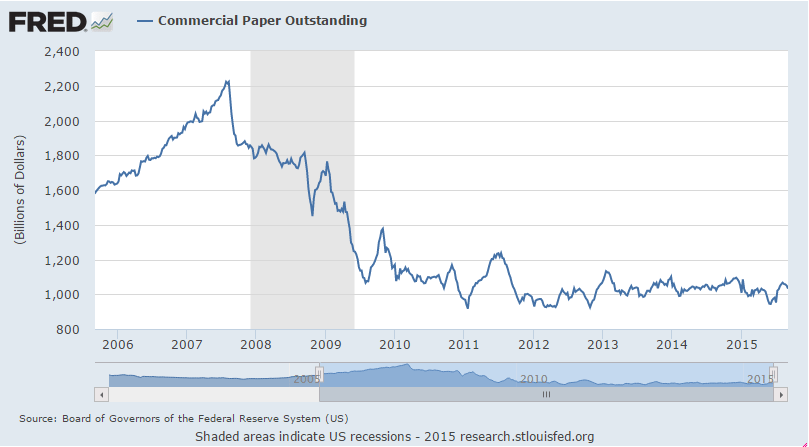

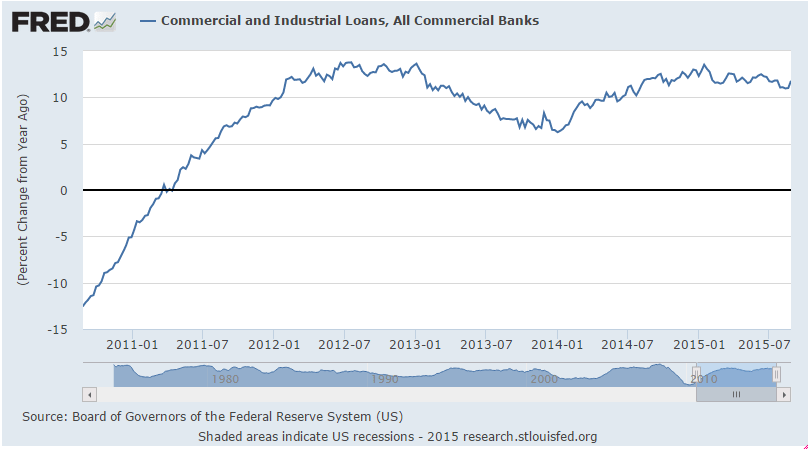

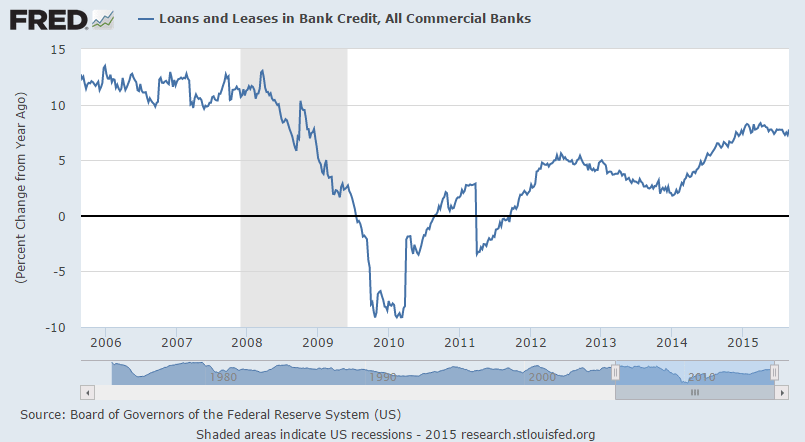

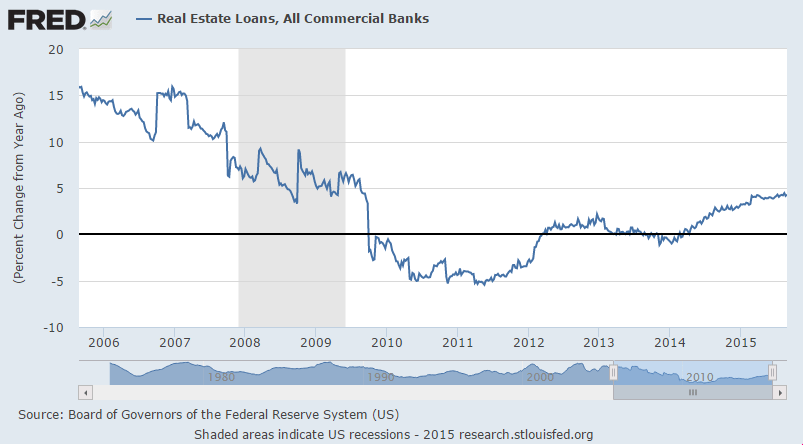

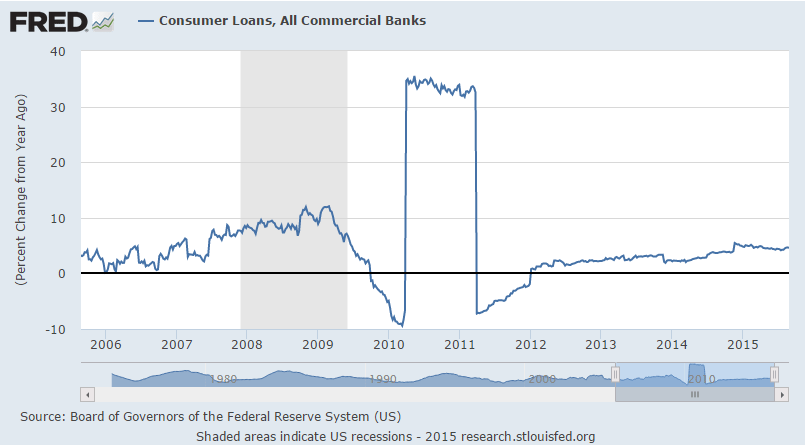

Commercial paper nudges down a bit, bank loans up a bit, so not much happening on balance:

BLS Jobs Situation Disappointing in August 2015. Growth Rate of Employment Continues to Slow.

By Steven Hansen

The BLS jobs report headlines from the establishment survey was disappointing. The unadjusted data shows growth is at the lowest levels since the Great Recession. Hey, if the kids were not going back to school (teachers being hired) – this report would have been a disaster.

Rail Week Ending 29 August 2015: Shows a Decline for the Month of August

Week 34 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic expanded year-over-year, which accounts for approximately half of movements. but weekly railcar counts continued in contraction. Total rail traffic for the month of August declined 0.8 %.

28 August 2015: ECRI’s WLI Growth Index Slides Deeper Into Contraction

ECRI’s WLI Growth Index which forecasts economic growth six months forward – slid further into negative territory. This index had spent 28 weeks in negative territory then 15 weeks in positive territory – and now is in its third week in negative territory. ECRI also released their inflation index this week.

Saudi confirms price cutting strategy:

U.S. Oil-Production Decline to Accelerate: Saudi Aramco Chairman

By Brian Wingfield

(Bloomberg) — U.S. crude production will decline before global oil markets recover, Saudi Aramco Chairman Khalid Al-Falih said.

“We expect the decline from the U.S. to accelerate as we go forward” because many rigs have already been demobilized, Al-Falih, who is also his nation’s health minister, said today at the U.S.-Saudi Investment Forum in Washington. “A re-balancing is taking place as we speak.”

Officials from Saudi Arabia, the world’s largest oil exporter, are visiting the U.S. as King Salman meets with President Barack Obama at the White House to discuss issues ranging from regional security to energy. Global oil prices have declined by more than 50 percent within the last year as world supply has exceeded demand, triggering thousands of job losses in the energy sector.

The Organization of the Petroleum Exporting Countries, of which Saudi Arabia is the largest producer, said in a report Aug. 31 it’s willing to talk to other nations about achieving a “fair” price in global markets.

The U.S. Energy Information Administration, the Energy Department’s statistical arm, projects domestic production to decline to 8.8 million barrels a day by next August before recovering later in 2016. U.S. production in June was about 9.3 million barrels a day, according to the EIA.

Al-Falih said he’s concerned that low prices may undercut investment in the oil industry, leading to future shortages. It’s “inevitable that oil markets will recover,” he said. “We’ve already started seeing pickup in demand globally,” Al-Falih said.

Saudi Arabia is better positioned to deal with the downturn in prices because it has created budgetary buffers and accumulated international reserves to shield it from an oil-price decline, Finance Minister Ibrahim Al-Assaf said at the investment forum.

“Our strategy has proven to be the right one,” he said.