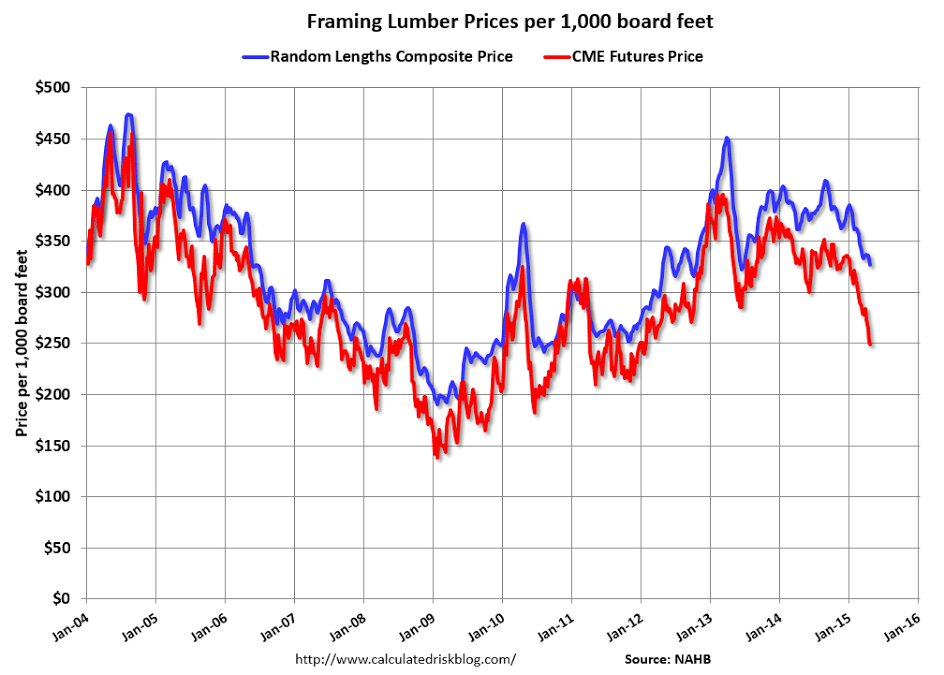

From Calculated Risk:

Right now Random Lengths prices are down about 11% from a year ago, and CME futures are down around 25% year-over-year.

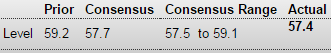

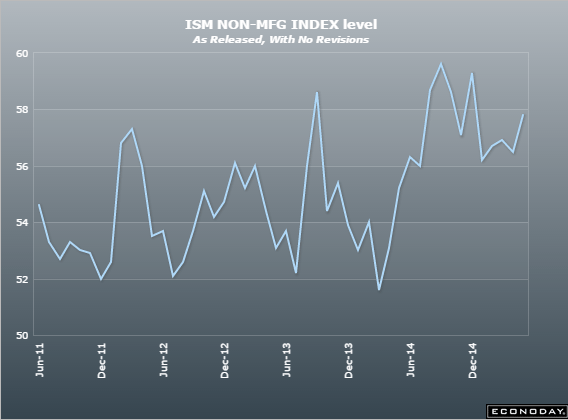

Stll positive but more recent numbers coming in worse than expected:

Great Britain : PMI Construction

Highlights

Business activity in UK construction slowed unexpectedly quickly last month. At 54.2 the sector PMI was 3.6 points short of its March outturn and at its weakest level since June 2013. However, the April print was still well above the 50 growth mark and its decline was probably at least in part due to supply shortages.

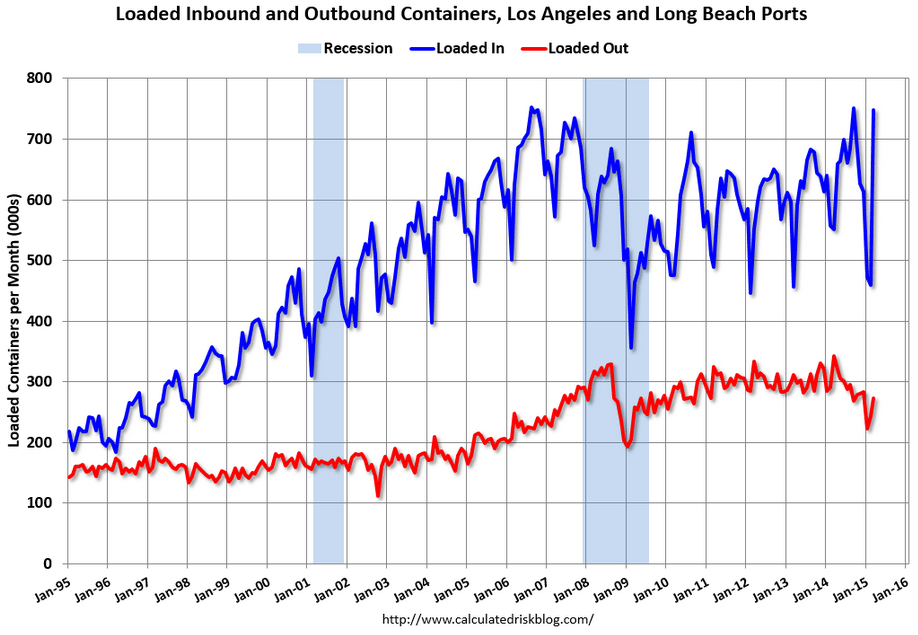

Note: West Coast port traffic increased sharply in March following the resolution of the labor issue in February. The workers were catching up with all the ships anchored in the harbor (now gone).

Both imports and exports rebounded in March, but imports rebounded more – and were up 36% year-over-year – whereas exports were down 20% year-over-year.

This suggests more imports from Asia in March, and also suggests the trade deficit was significantly higher in March than in February.

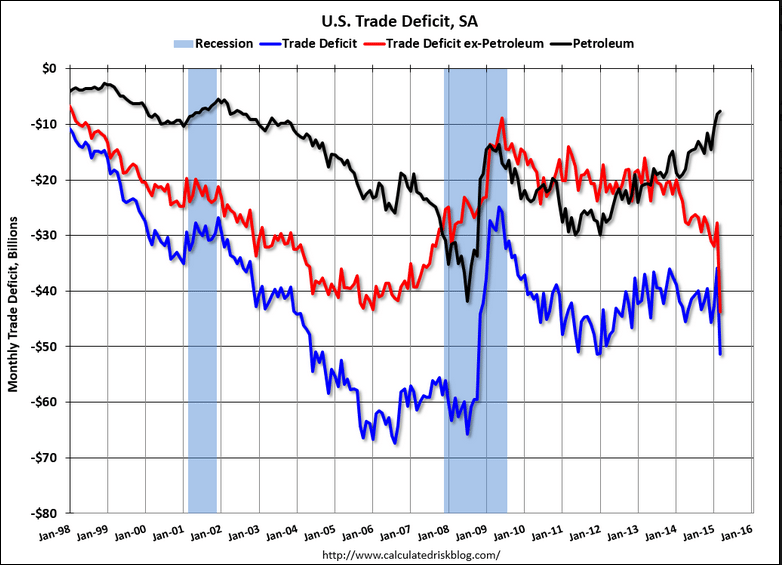

Well below expectations, hearing Q1 being revised down .5%, as Americans spend their gas savings on other imports from China and Japan. ;) And the growing US trade deficit/EU current account surplus fundamentally supports the euro vs the dollar.

United States : International Trade

Highlights

First-quarter GDP, barely above zero at plus 0.2 percent, may move into the negative column on revision following a much higher-than-expected March trade deficit of $51.4 billion, the largest since October 2008. The unwinding of the port strike on the West Coast, which was resolved mid-month March, played a major role in the data especially evident in imports which surged $17.1 billion in the month as backlogs at the ports were cleared. Imports of consumer goods, especially cell phones, were especially heavy. Exports, led by aircraft, also rose but only $1.6 billion. The total goods gap in the month was $70.6 billion which is the highest since August 2008.

The gap in petroleum trade, at $7.7 billion vs February’s $8.2 billion, wasn’t a major factor in the March data as the drop in prices was offset by a rise in volumes. By country, the gap with China widened to $31.2 vs $22.5 billion in February and to $7.1 billion vs $4.2 billion for Japan. The OPEC gap widened slightly to $1.2 billion vs $0.7 billion.

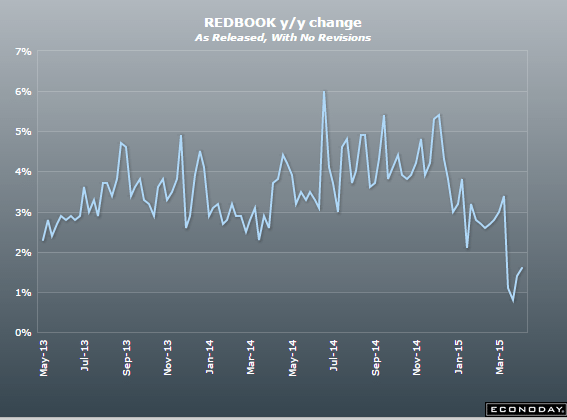

Still blaming the Easter Bunny for this:

Uptick here so still showing growth, first glimmer of hope for a positive Q2: