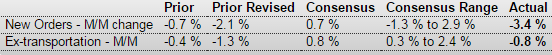

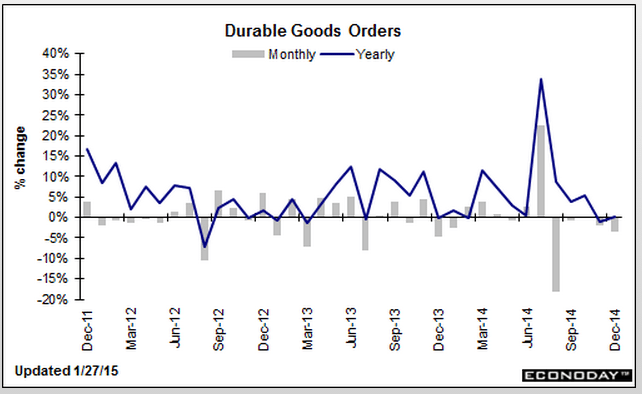

Down hard and revisions down hard as well, and year over year growth up less than 1%:

Durable Goods Orders

Highlights

Durables orders unexpectedly fell 3.4 percent in December after dropping 2.1 percent in November. Analysts projected a 0.7 percent rise.

Excluding transportation, the core slipped 0.8 in December following a decline of 1.3 percent in November. Market expectations were for a 0.8 percent boost in December. Transportation plunged a monthly 9.2 percent after dropping 3.9 percent in November. Motor vehicles rose 2.7 percent, nondefense aircraft plunged 55.5 percent, and defense aircraft fell 19.9 percent.

Outside of transportation, weakness was mixed. Industries posting gains were fabricated metals, electrical equipment, and “other.” Declines were seen in primary metals, machinery, and computers & electronics.

Nondefense capital goods orders excluding aircraft dropped 0.6 percent after a decline of 0.6 percent in November. Shipments of this series eased 0.2 percent in December after dropping 0.6 percent the month before.

Overall, manufacturing is soft. The outlook is questionable with the recently sharp boost in the value of the dollar.

Equity futures dropped very sharply on the news. However, earnings concerns also weighed on futures.

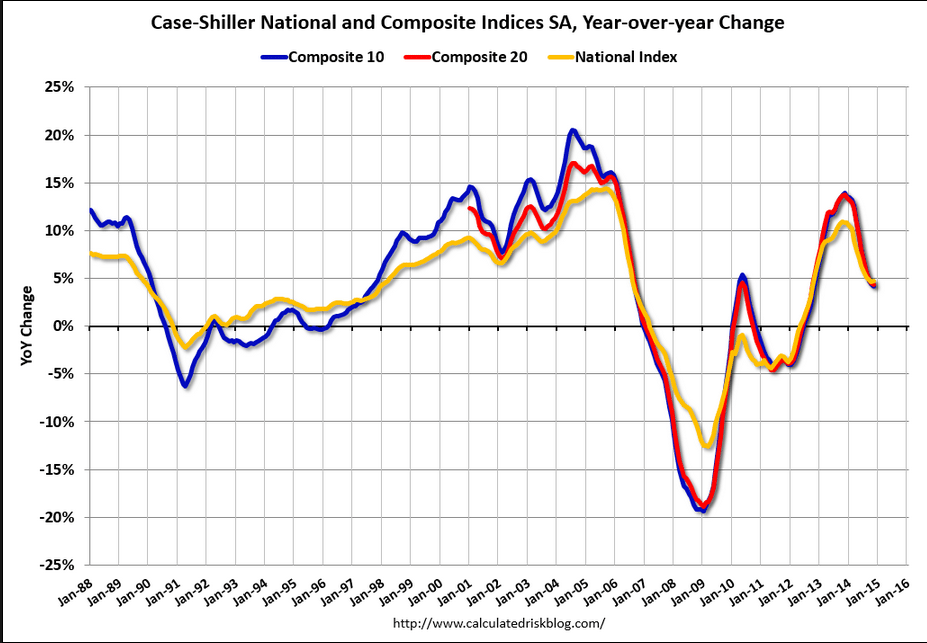

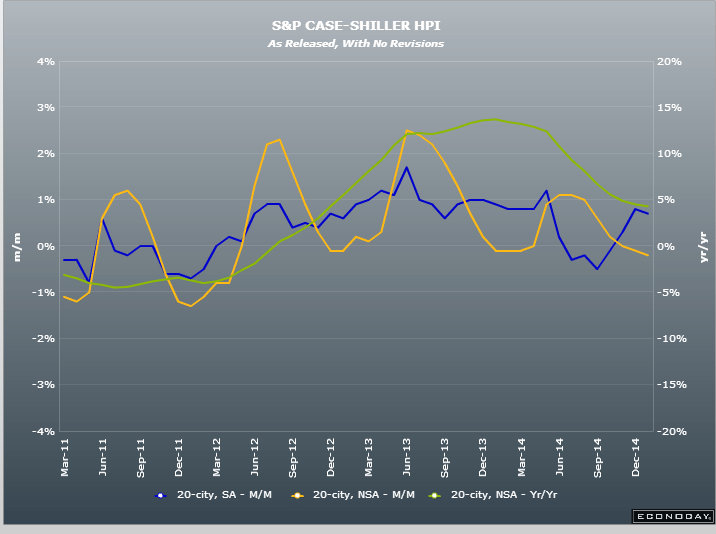

Housing still looking like it’s rolling over?

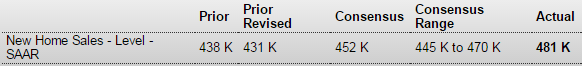

New home sales better than expected!

Consumer confidence up as well! But don’t forget this is about ‘head count’. That is, consumer confidence can be up for the hundreds of millions saving $11/week on gas, while the cutbacks from those losing high paying jobs and from capex reductions reduce the confidence of far fewer people initially, but the spending lost to the economy is far higher.

Richmond Fed- DC area doing better than Texas…

Richmond Fed Manufacturing Index

Recent History Of This Indicator

The Richmond Fed manufacturing index for December picked up to 7 from 4 in November. New orders showed relative strength, at 4 versus November’s 1, but were still on the soft side. Order backlogs, however, showed outright contraction for a second month, at minus 5 vs minus 2 in November. Shipments showed relative strength to November, at 5 vs 1, but, like new orders, were still on the soft side. A definitive sign of strength, however, came from employment which was up 3 points to a very solid 13 in a reading that points to underlying confidence among the region’s manufacturers. Price data were soft in line with declining fuel costs.

PMI Services Flash

Highlights

Growth in the nation’s service sector is accelerating but only very slightly this month based on Markit’s sample where the flash index is at 54.0 vs December’s final reading and 10-month low of 53.3 and December’s flash reading of 53.6. The report ties the gain in part to a pick up in consumer spending though new business growth this month continues to moderate and is at a new low in the 5-year history of the report. Amid the slowing, service providers in the sample continue to add to payrolls though at the slowest rate in 9 months. Growth in backlogs is at a 6-month low. Price data show only fractional pressure for inputs and only fractional pricing power for outputs.

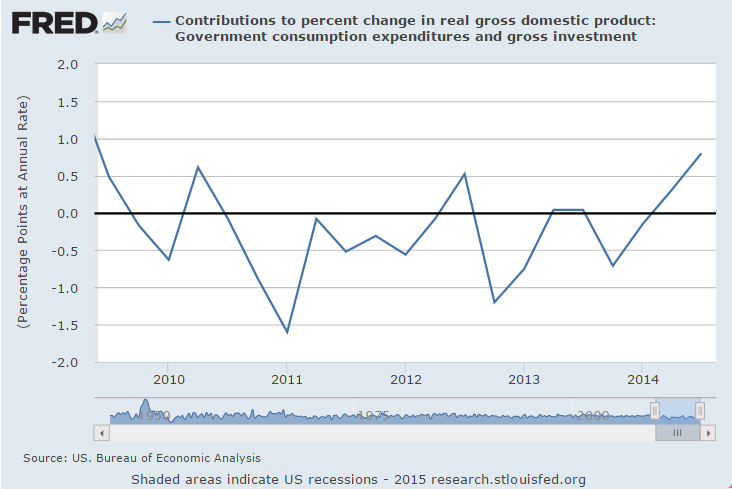

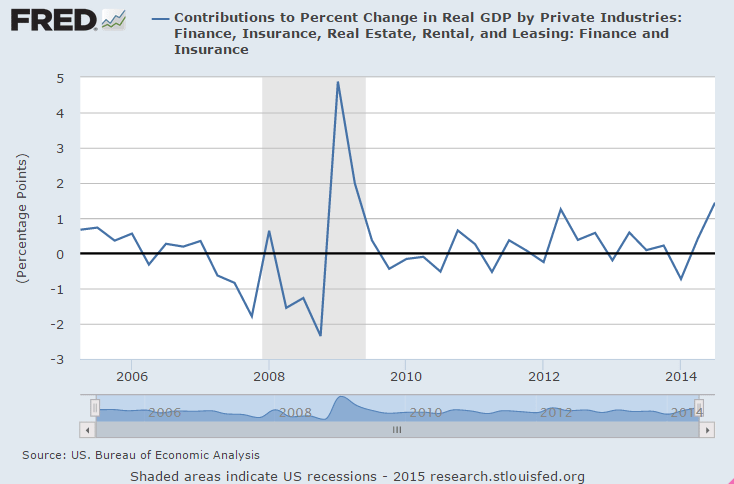

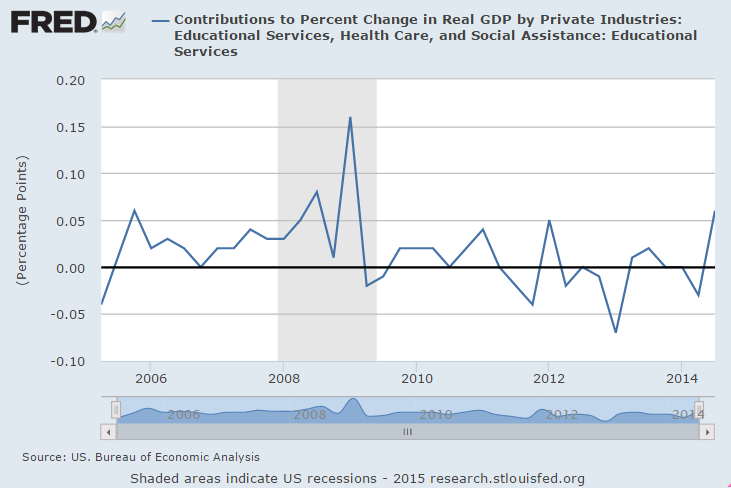

Look what spiked up in Q3, and could come down in Q4?

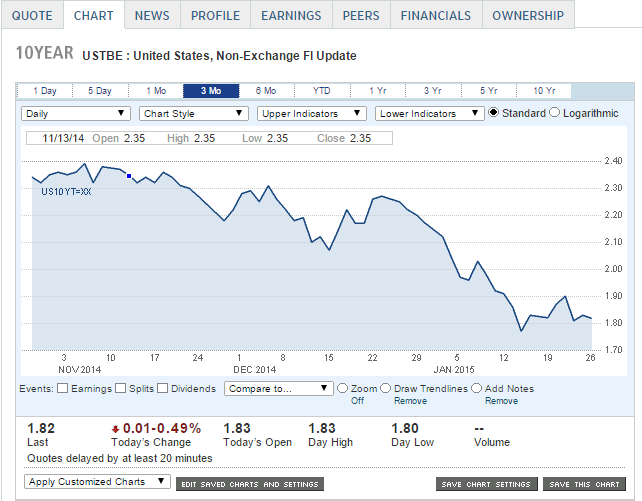

And the 10 year note is now down to 1.75%, which you could say is at odds with the Fed’s forecasts for higher rates.

Wonder who will be correct?

Norfolk Southern Revenue Slips on Coal Weakness (WSJ) Norfolk Southern Corp. profit totaled $511 million, off from $513 million in the same quarter a year earlier. Demand for electricity in the railroad’s territory fell 1% last year, executives said. The railroad’s coal revenue fell 15% to $543 million, while its coal volume declined 6%. In the fourth quarter, Norfolk Southern’s fuel-surcharge revenue declined $45 million compared with the same quarter in 2013.

Siemens Profit Hurt by Weak Economy, Oil (WSJ) Net profit in the three months to Dec. 31 fell to €1.08 billion ($1.21 billion) from €1.43 billion in the same period last year, Siemens said on Tuesday. Revenue rose 5% to €17.42 billion, helped by the euro’s weakness against major currencies. Siemens reiterated that it expects to notch up 15% growth in earnings per share in the year to end-September on unchanged revenue. Still, an 11% decline in new orders to €18.01 billion underscored the pressure Siemens is facing as customers placed fewer large orders at its mobility, wind power and renewables business as well as its process industries and drives unit. The power and gas division’s profit margin shrank to 11.3% from 18.2% in the same period last year, Siemens said.

Aso seeks swift passage of extra budget to expand economy (Kyodo) Finance Minister Taro Aso on Monday called for swift passage of the fiscal 2014 supplementary budget to eradicate prolonged deflation and allow Japan’s economy to move onto an expansionary path. “The economy remains on a moderate recovery track, but weakness can be seen in private spending and economic recovery is uneven across regions,” Aso said in a speech. “Immediate passage of the extra budget is necessary,” Aso said, pledging to spur domestic demand by bolstering local economies and supporting households — both plagued by price rises following last April’s consumption tax hike and the weaker yen.