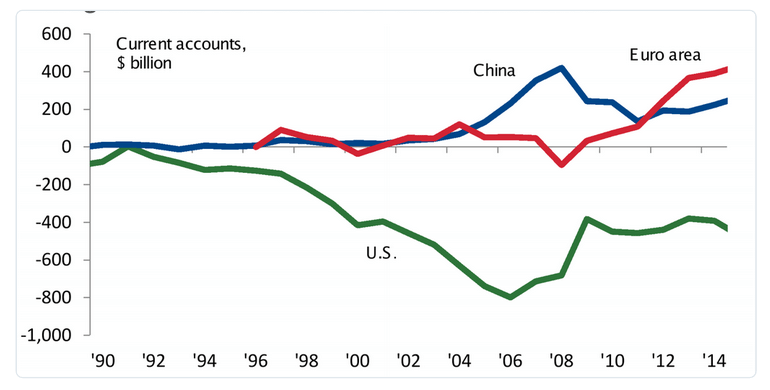

Seems trade flows and ‘inflation’ continue make the euro fundamentally stronger even as portfolios shifting due to ECB rhetoric keep it under pressure. Should the shifting run its course, I would not be surprised dramatic appreciation.

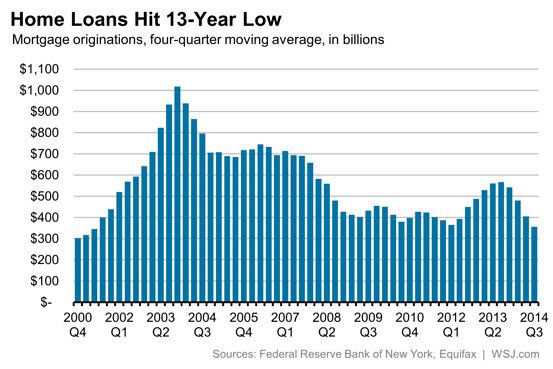

New figures released by the Federal Reserve Bank of New York on Tuesday show that mortgage lending is running at its lowest level in 13 years, with 2014 on pace to be the weakest for new loans since 2000.

Q3 GDP revised up a bit, year over year still low and down a bit, profits low and down a bit, and there is growing evidence the suspect sources of growth- govt and exports and inventories- that added about 2% are reversing: