Most interesting is the positive spin from CNBC. Bouncing back? Finding their footing?

As they say, “Don’t p on me and tell me it’s raining…”

Highlights below:

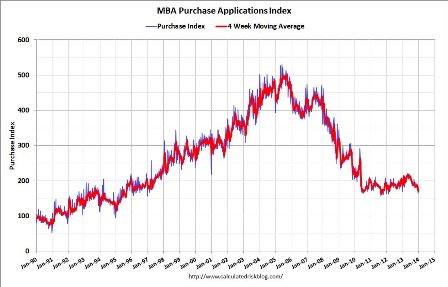

Mortgage refinances bounce back as rates settle

By Diana Olick

January 8 (CNBC) — A sharp surge in interest rates caused mortgage refinances to plummet two weeks ago, but they are now finding their footing again.

Applications to refinance rose 5 percent last week after falling 9 percent the previous week, according to a seasonally adjusted measure by the Mortgage Bankers Association. They are still down 69 percent from a year ago, as mortgage rates are now up well over a full percentage point from January of 2013.

The average rate on a conforming 30-year fixed loan hit 4.72 percent two weeks ago, after the Federal Reserve announced it would slowly curtail its purchases of mortgage-backed bonds. That rate stayed put last week, causing more borrowers to come back to the refinance market.

The average rate for a jumbo loan is once again below that of conforming at 4.66 percent, as lenders and investors in that market are growing more confident and competitive. They are also not faced with high guarantee fees from Fannie Mae and Freddie Mac.

Applications for a mortgage to purchase a home, however, did not bounce back, falling one percent on week.

“Mortgage application activity remained weak over the holiday period, with purchase applications almost twenty percent lower than at the same time last year,” said Mike Fratantoni, chief economist for the Mortgage Bankers Association. “Other economic data is reflecting a strengthening economy, so this weakness is likely due to a combination of the increase in rates and still tight credit.”

Credit availability was little changed over the past month, according to another MBA report. Investors are continuing to fine-tune credit scores and loan-to-value formulas and debt-to-income measures in order to comply with new rules from the Consumer Financial Protection Bureau; those rules go into effect at the end of this week.

Full size image