Can the American Wind Energy Industry Survive Without the PTC?

Production tax credit expired after 2013 (renewed for a year in 2012). This was the first year that they added a provision extending the credit to any production started before 2014, in previous years they had to be completed by the year end. This caused a jump in new projects at year’s end.

Monthly Archives: January 2014

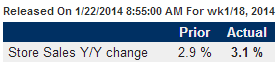

purch apps y/y and weekly retail indicator comments

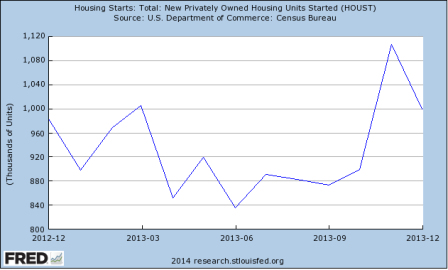

No sign of life in mortgage purchase applications this week, so still a disconnect with the November surge in housing starts. I’m guessing expiring tax credits may have moved some starts from Q1 to Q4:

Purchase applications Y/Y:

Full size image

Full size image

Highlights

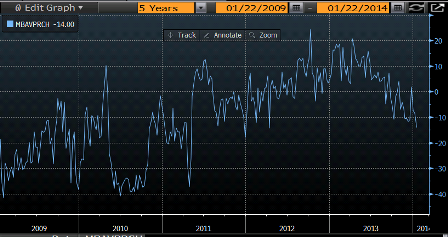

Cold weather is making for a slow start to consumer spending this year, indicated not only by weak readings in recent consumer sentiment measures but also by the weekly chain-store reports. Redbook reports a very soft plus 3.1 percent year-on-year pace for same-store sales in the January 18 week following an even more depressed plus 2.9 percent rate in the prior week. Indications from ICSC-Goldman, released earlier this morning, are even weaker.

Zip Realty

From the Zip Realty conference call yesterday:

ZipRealty Announces Preliminary 2013 Results

Lanny Baker, Chief Executive Officer and President of ZipRealty, commented, “Throughout 2013, our primary financial objective was to accelerate ZipRealty’s revenue growth while delivering positive Adjusted EBITDA for the full year. We made strong operational progress in support of those objectives during the year, however real estate sales in our markets slowed more sharply than expected during the fourth quarter, and our relative momentum was not strong enough to completely offset that change. As a result, our fourth quarter revenue was below the outlook we provided previously.”

The total value of real estate transactions in the metropolitan areas that ZipRealty serves grew by 9% year to year in the fourth quarter, compared to a 22% year to year growth rate in the first nine months of the year. The total value of ZipRealty’s real estate transactions declined by 4% year to year in the fourth quarter, compared to an 8% growth rate in the first nine months of the year.

“The results and outlook we are providing today do not match the more ambitious long-term objectives we have for ZipRealty, yet recent trends in real estate transaction activity within our owned and operated markets point to a more modest growth outlook for 2014. Consumer home search activity appears to have slowed this winter, and recent industry data shows lower pending sales and mortgage applications compared to a year ago. However, ZipRealty has increased the size of its agent force by 13% in the past year and has also released upgrades to its technology platform that are intended to aid customer acquisition and agent productivity. Meanwhile, the Powered by Zip unit continues to attract new brokerage customers and agents to its digital platform and will remain a central strategic priority in 2014 and beyond.

Q4 GDP borrowed from Q1 due to expiring tax credits?

I’ve already posted the expiring tax credits that may have brought forward housing starts. Note housing starts spiked a whopping 30% or so in Nov, falling off some in Dec but still way up from October. However purchase mtg apps remain low and maybe down 10% vs last year. And pending home sales are down. And I’ve seen no anecdotals from lenders or builders suggesting a spike in November.

And I just remembered I’m personally involved in two energy projects. In both cases we started just enough construction before year end to secure our investment tax credits which were also otherwise due to expire at year end. So I suspect these were not isolated cases, and in total contributed to the 48,000 new construction jobs in the ADP report.

So watch for the Jan housing and construction numbers to see if it turns out like I’m suspecting.

Full size image

Full size image

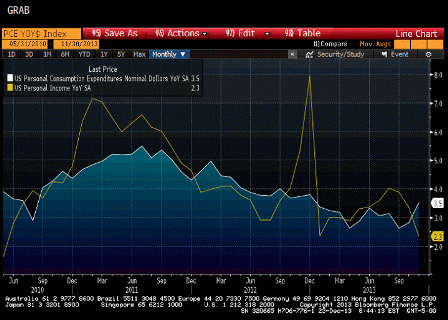

Nor is personal income growth going the right way:

Full size image

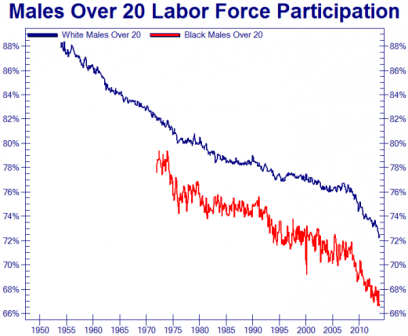

Males over 20 working – shocking when compared to the 50s

and the next thing they are going to tell us is that black males age more quickly than white males…

they would’t recognize a lack of aggregate demand if it jumped up and put everyone out of work…

Full size image

tax extensions

Was wondering what might have caused the 30% or so jump in shovels going into the ground in Nov/Dec!

Might also apply to other Q4 activity as well?

Tax Provisions Expiring in 2013

2013 Expiring Tax Provisions-Housing

These temporary taxes have been routinely extended by congress in the past. However, attempts are being made at tax reform in 2014, and these changes would either alleviate the need to continually extend these temporary provisions or eliminate them altogether. As such, these provisions may not be renewed until late 2014 if major tax reform efforts fail. This may have lead to a November jump in housing starts as consumers worried about the extension of these tax provisions

1. Determination of low-income housing credit rate for credit allocations with respect to non-federally subsidized buildings (sec. 42(b)(2))

-Amount of credit for low-income (non-subsidized) housing

2. Credit for construction of new energy efficient homes (sec. 45L(g))

3. Credit for energy efficient appliances (sec. 45M(b))

4. Discharge of indebtedness on principal residence excluded from gross income of individuals (sec. 108(a)(1)(E))

-Debt forgiveness on residences excluded from gross income

5. Premiums for mortgage insurance deductible as interest that is qualified residence interest (sec. 163(h)(3))

6. Treatment of military basic housing allowances under low-income housing credit (sec. 142(d))

Chiaciano presentation

So how well is Germany doing?

So how well is Germany doing?

German Economic Growth Fails to Gain Impetus (WSJ) Germany’s gross domestic product expanded 0.4% in 2013, following growth of 0.7% in 2012, the Federal Statistics Office said on Wednesday. The economy grew 0.5% when taking account of the number of working days each year. Based on the full-year figures, GDP increased around 0.25% in the three months through December about the same rate as the third quarter according to the statistics office, which is due to publish fourth-quarter national accounts in mid-February. Germany’s growth last year relied on domestic demand, as private consumption rose 0.9% and government spending increased 1.1%, the statistics office said. Net trade, however, reduced GDP growth, as exports the traditional driver of economic growth in Germany increased a meager 0.6%, while imports climbed 1.3%. Corporate investment was weak too, with spending on machinery and equipment down 2.2% from a year earlier.

Lagarde quote

They seem to think deflation causes weakness, rather than the other way around:

quote from Christine Lagarde, who heads the IMF “With inflation running below many central banks’ targets, we see rising risks of deflation, which could prove disastrous for the recovery. If inflation is the genie, then deflation is the ogre that must be fought decisively.”